|

시장보고서

상품코드

1690060

MRAM : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)MRAM - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

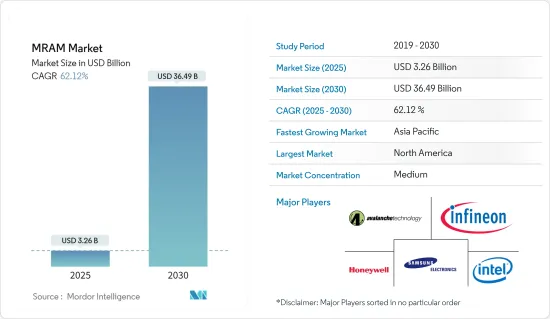

MRAM 시장 규모는 2025년 32억 6,000만 달러에 이르고 시장 추정·예측 기간(2025-2030년)의 CAGR은 62.12%를 나타내 2030년에는 364억 9,000만 달러에 달할 것으로 예상됩니다.

산업 전반의 디지털화 채택 증가, 컴퓨팅 기술의 기술 진보, 사물 인터넷(IoT), 스마트 로봇 세계의 급속한 시장 개척, 스마트폰, TV, 스마트 웨어러블, 컴퓨터, 드론 등의 전자기기 투자 증가가 향후 시장 수요를 끌어올릴 수 있습니다.

주요 하이라이트

- 컴퓨터의 급속한 도입으로 산업, 상업, 자동차, 방어 시스템에서 저비용, 소형, 전력 효율이 높은 랜덤 액세스 메모리 기술에 대한 요구가 과거 10년 동안 높아지고 있습니다.

- 차세대 리드 액세스 메모리의 연구 개발에 대한 투자가 확대됨으로써 새로운 제품 용도의 기회가 탄생하여 시장의 성장에 박차가 걸릴 가능성이 있습니다.

- 스마트폰의 세계 보급에 의해 제조업체 각사는 기동 시간을 단축해, 메모리 공간을 확대해 고성능을 실현하는 선진적인 RAM의 개발을 뒷받침하고 있습니다.

- COVID-19의 발생은 스마트폰 산업에 악영향을 미쳤지만, 집 대기용 서버와 PC 메모리 수요에 박차를 가했음에도 불구하고 2020-2021년에는 다소 회복되었습니다. 클라우드 컴퓨팅, AI, IoT 등 중요한 메가 동향에 견인해 메모리 시장은 지난 10년간 경이적인 성장을 이루었습니다.

- 인텔에 따르면 가상화된 데스크톱 인프라와 가상화된 스토리지 솔루션의 요구가 커짐에 따라 데이터센터의 스토리지 및 메모리 제품에 대한 수요가 증가하고 있습니다. 재택 근무 증가 추세와 COVID-19 팬데믹시의 디지털 자원의 이용 증가에 의해 이 2개의 용도 유형의 스토리지와 메모리 기능을 강화해, 고속화할 필요성이 높아졌습니다.

MRAM 시장 동향

소비자 일렉트로닉스가 크게 성장할 가능성

- 소비자용 전자기기는 기술의 진보, IoT의 침투, 4G와 5G 기술의 출현, 메모리 용량과 전력 효율을 높이기 위한 각종 디바이스의 기술 혁신에 의해 큰 성장을 이룰 수 있습니다. 스마트폰, 노트북, 스마트 웨어러블, 디지털 카메라는 가처분 소득 증가와 스마트 기기 보급 대수 증가로 인기가 높아질 것으로 예상됩니다.

- 스마트폰의 세계 보급에 의해 제조업체 각사는 기동 시간을 단축해, 메모리 용량을 늘려 고성능을 실현하는 선진적인 RAM을 개발하게 되었습니다. 이 시장에서는 향후 동 시장에서 주도적 지위를 획득하기 위해 독립형 또는 임베디드 MRAM의 개발과 양산에 주력하는 주요 진출기업이 증가하고 있습니다.

- 예를 들어 최근 삼성은 최초의 업무용 임베디드 MRAM의 양산을 시작했습니다.

- 기존과 신흥의 임베디드 메모리 기술 중에서도 STT MRAM은 지속성, 저소비 전력, 고속성, 고내구성을 겸비하고 있으며, 저소비 전력 마이크로컨트롤러, 웨어러블 기기, 게임 기기, IoT 기기에 이상적이기 때문에 매우 유망합니다.

북미가 큰 시장 점유율을 차지할 가능성

- 북미는 예측기간 중 MRAM 시장의 성장이 예상됩니다.

- MRAM 기술은 극단적인 온도 범위에서도 견고하고 신뢰성이 높기 때문에 자동차 부문의 메모리 제품에 대한 수요가 높아지고 있습니다.

- MRAM 기술은 보다 높은 감도, 정밀도, 노이즈 저감을 갖춘 차세대 센서를 제공하기 위해 의료기기에도 구현되어 있습니다.

- 데이터 통신, 데이터 보존, 데이터 마이닝 기술을 통합하기 위해 의료기기에 IoT 디바이스가 급속히 채용되어 인위적 실수를 줄이기 위해 RFID(Radio-Frequency) Identification) 장치는 감마선을 견딜 수 있도록 MRAM과 통합되어 있습니다.

- COVID-19의 대유행은 세계의 대부분의 산업에도 영향을 주었습니다. 지역 소독, 온도 모니터링, COVID-19 환자에게 식품 및 의약품을 전달하는 지원 로봇의 채용이 증가했습니다. Dynamics의 로봇인 스팟은 감염된 환자의 치료를 지원함으로써 Boston Dynamics의 의료 종사자를 도와주고 있습니다.

MRAM 산업 개요

MRAM 시장은 경쟁이 치열해지고 있습니다. 향상시키기 위해 전략적인 공동 이니셔티브를 활용하고 있습니다.

- 2022년 1월 - 첨단 반도체 기술의 세계 리더인 Samsung Electronics는 MRAM(자기저항 랜덤 액세스 메모리)에 의한 세계 최초의 인메모리 컴퓨팅을 실증했습니다. Electronics 주조 사업과 반도체 R&D 센터와 공동으로 Samsung 첨단 기술 실험실(SAIT)이 실시했습니다.

- 2022년 5월 - Everspin은 산업용 IoT 및 임베디드 시스템을 위한 새로운 제품인 비휘발성 메모리 솔루션인 EMxxLX xSPI MRAM을 출시했습니다. NOR/NAND 플래시를 대체하는 제품으로서 8MB-64MB의 집적도, 최대 400MB/초의 고속 R/W 데이터 전송 속도를 고객에게 제공하는 것을 목적으로 하고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업의 매력 - Porter's Five Forces 분석

- 신규 참가업체의 위협

- 소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

- 밸류체인 분석

- COVID-19의 산업에 대한 영향 평가

제5장 시장 역학

- 시장 성장 촉진요인

- 전자기기의 소형화 수요 증가

- RFID 태그에서 MRAM 사용 증가

- 시장의 과제

- 전자기장 문제를 수반하는 높은 설계 비용

제6장 시장 세분화

- 유형

- 토글 MRAM

- 스핀 전달 토크 MRAM

- 제공

- 독립형

- 임베디드

- 용도

- 소비자 일렉트로닉스

- 로봇 공학

- 엔터프라이즈 스토리지

- 자동차

- 항공우주 및 방위

- 기타

- 지역

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

제7장 경쟁 구도

- 기업 프로파일

- Avalanche Technology Inc.

- NVE Corporation

- Qualcomm Incorporated

- Crocus Nano Electronics LLC

- Everspin Technologies Inc.

- HFC Semiconductor Corporation

- Tower Semiconductor

- Honeywell International Inc.

- Infineon Technologies AG

- Intel Corporation

- Samsung Electronics Co. Ltd

- Spin Transfer Technologies

- Numem

제8장 투자 분석

제9장 시장의 미래

KTH 25.05.09The MRAM Market size is estimated at USD 3.26 billion in 2025, and is expected to reach USD 36.49 billion by 2030, at a CAGR of 62.12% during the forecast period (2025-2030).

Increasing adoption of digitalization across the industry, technological advancement of computing technologies, Internet of Things (IoT) and rapid development of smart robots across the world, and rising investment in electronic devices such as smartphones, televisions, smart wearables, computers, and drones, may boost the market demand in the future.

Key Highlights

- The need for low-cost, small-size, power-efficient random-access memory technology grew in the past decade in industrial, commercial, automotive, and defense systems due to the rapid implementation of computers. MRAMs can withstand high radiation, operate in extreme temperature conditions, and are tamper-resistant, making them fit for military and industrial applications.

- Growing investments in the research and development of next-generation read access memory may open provide opportunities to new product applications and fuel the market's growth.

- The global adoption of smartphones has encouraged manufacturers to develop advanced RAM that could reduce the boot-up time and enhance memory space to offer high performance. The number of key players in the market has grown, focusing on developing and mass-producing MRAM either in stand-alone or embedded design to gain a leading position in the market in the future.

- Despite the COVID-19 outbreak, which negatively impacted the smartphone industries but spurred demand for server and PC memory for stay-at-home activities, the year 2020-2021 was expected to see recovery. Driven by important megatrends such as cloud computing, AI, and the IoT, the memory market experienced extraordinary growth in the past decade.

- According to Intel, the increased need for virtualized desktop infrastructure and virtualized storage solutions is driving the demand for its storage and memory products in data centers. The need to enhance and accelerate storage and memory capabilities for the two application types grew due to the rising trend of work-from-home and the increased usage of digital resources during the COVID-19 pandemic.

Magneto Resistive RAM (MRAM) Market Trends

Consumer Electronics May Experience Significant Growth

- Consumer electronics may experience significant growth due to technological advancements, penetration of IoT, the emergence of 4G and 5G technologies, and innovation in various devices to increase memory capacity and power efficiency. Smartphones, laptops, smart wearables, and digital cameras are expected to gain popularity due to increased disposable income and the rising adoption of smart devices.

- Global adoption of smartphones has encouraged manufacturers to develop advanced RAM that could reduce the boot-up time and enhance the memory space to offer high performance. The number of key players in the market has grown, focusing on developing and mass-producing MRAM either in stand-alone or embedded design to gain a leading position in the market in the future.

- For instance, recently, Samsung has started mass producing its first commercial embedded magnetic RAM (eMRAM). As eMRAM does not require an erase cycle before writing data, it is 1,000 times faster than eFlash with lower voltage, providing a promising opportunity for its implementation in an upcoming smartphone.

- Among the established and emerging embedded memory technologies, STT MRAM is very promising, as it offers a combination of persistence, low power consumption, high speed, and high endurance, ideal for low-power microcontrollers wearables and gaming and IoT devices.

North America May Hold a Significant Market Share

- North America is projected to experience growth in the magneto-resistive RAM market during the forecast period. Large, small, and medium enterprises are moving toward cloud-based services to reduce the costs related to technology infrastructure and streamline operations. This contemporary shift is boosting the growth of data centers with lower power consumption and encouraging MRAM implementation as it does not require refreshing and allows low-power states.

- As MRAM technology is robust and reliable over extreme temperature ranges, its demand for memory products in the automotive sector is increasing. Everspin provided a 4MB MRAM chip (MR2A16AMYS35) to BMV for its superbike. It is also used in various automotive applications, such as engine control units, advanced transmission control in-car data logs, and multimedia systems for in-car entertainment.

- MRAM technology is also implemented in medical devices to provide next-generation sensors with higher sensitivity, accuracy, and noise reduction. These sensors are used for non-invasive diagnostic testing of blood, body fluids, and tissue for medical conditions, including diabetes and hypoxia.

- The rapid adoption of IoT devices in medical devices to integrate technology for data communication, data storage, and data mining is helping reduce human errors. Therefore, radio-frequency identification (RFID) devices are integrated with MRAM to withstand gamma radiation. An increased number of chronic disease cases in North America are also fueling the growth of the market. According to a report, chronic diseases are among the most prevalent and costly health conditions in the United States, and nearly half (approximately 45%, or 133 million) of the American population suffer from at least one chronic disease.

- The COVID-19 pandemic also affected most industries worldwide. However, it boosted the growth of robots, drones, and other automated machines used to fight the virus. The outbreak led to an increasing adoption of assistive robots in hospitals and testing facilities to disinfect hospitals and residential areas, monitor temperature, and deliver food and medicines to COVID -19 patients. It also relieved hospital staff from non-essential tasks and helped limit the spread of the virus. For instance, Spot, a robot by Boston Dynamics, helps Boston's healthcare workers by providing assistance in treating infected patients. Boston Dynamics also announced its plans to expand the use of its robots to other hospitals.

Magneto Resistive RAM (MRAM) Industry Overview

The magneto resistive RAM (MRAM) market is competitive. The major players with a prominent market share are focusing on expanding their customer base across foreign countries. These companies are leveraging strategic collaborative initiatives to increase their market share and profitability. However, with technological advancements and product innovations, mid-size to smaller companies are increasing their market presence by securing new contracts and tapping new markets.

- January 2022 - Samsung Electronics, a world leader in advanced semiconductor technology, demonstrated the world's first in-memory computing based on MRAM (Magneto-resistive Random Access Memory). The research was carried out by the Samsung Advanced Institute of Technology (SAIT) in collaboration with the Samsung Electronics Foundry Business and Semiconductor R&D Center. In line with this technological development, Samsung aims to merge memory and system semiconductors for next-generation artificial intelligence (AI) chips, along with strengthening its market position.

- May 2022 - Everspin launched its new product, the EMxxLX xSPI MRAM, a non-volatile memory solution, for applications in industrial IoT and embedded systems. It aims to provide its customers with an alternative to SPI NOR/NAND flash, along with densities ranging between 8MB and 64MB and much faster R/W data rates of up to 400MB/s.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Miniaturization of Electronic Devices

- 5.1.2 Increased Use of MRAM in RFID Tags

- 5.2 Market Challenges

- 5.2.1 High Design Cost with Electromagnetic Interface Problems

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 Toggle MRAM

- 6.1.2 Spin-transfer Torque MRAM

- 6.2 Offering

- 6.2.1 Stand-alone

- 6.2.2 Embedded

- 6.3 Application

- 6.3.1 Consumer Electronics

- 6.3.2 Robotics

- 6.3.3 Enterprise Storage

- 6.3.4 Automotive

- 6.3.5 Aerospace and Defense

- 6.3.6 Other Applications

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Avalanche Technology Inc.

- 7.1.2 NVE Corporation

- 7.1.3 Qualcomm Incorporated

- 7.1.4 Crocus Nano Electronics LLC

- 7.1.5 Everspin Technologies Inc.

- 7.1.6 HFC Semiconductor Corporation

- 7.1.7 Tower Semiconductor

- 7.1.8 Honeywell International Inc.

- 7.1.9 Infineon Technologies AG

- 7.1.10 Intel Corporation

- 7.1.11 Samsung Electronics Co. Ltd

- 7.1.12 Spin Transfer Technologies

- 7.1.13 Numem