|

시장보고서

상품코드

1440245

생물제제 CDMO : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Biologics CDMO - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

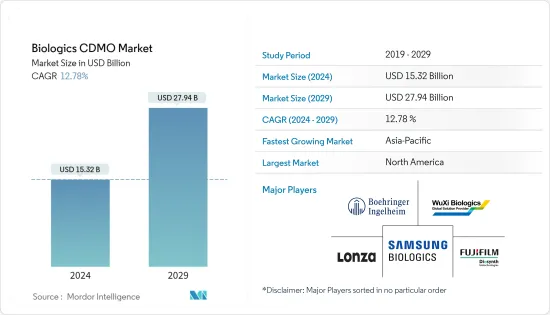

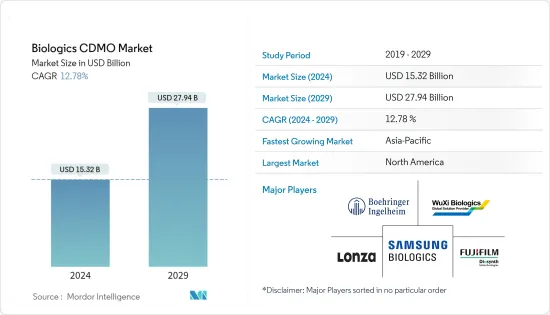

생물제제 CDMO 시장 규모는 2024년 153억 2,000만 달러에 이를 것으로 추정됩니다. 2029년까지 279억 4,000만 달러에 달할 것으로 예상되며, 예측 기간(2024-2029년) 동안 12.78%의 연평균 복합 성장률(CAGR)을 나타낼 전망입니다.

제약업계에서 아웃소싱 서비스를 고려하는 기업이 증가하고 있으며, 위탁생산 및 위탁개발 제조조직의 서비스 수요가 증가할 것으로 예상됩니다.

주요 하이라이트

- 제약 산업은 세계 경제 성장, 인구 증가 및 고령화, 신제품 출시로 인해 빠르게 성장하고 있습니다. 저분자 의약품이 여전히 시장에서 큰 비중을 차지하고 있지만, 생물학적 제제, 바이오시밀러, 세포 및 유전자 치료제와 같은 고분자는 예측 기간 동안 가장 빠른 성장을 보일 것으로 예상됩니다.

- 대분자는 부피가 작아지는 경향이 있지만, 이 부문은 빠르게 성장하고 있습니다. 오리지널 바이오 의약품, 바이오시밀러, 세포 및 유전자 치료제를 포함한 거대 분자 시장의 절대적인 성장으로 인해 시장은 2023년까지 1,330억 달러에 달할 것으로 예상됩니다. 오리지널 바이오의약품 시장 규모는 2023년까지 3,710억 달러에 달할 것으로 예상됩니다. 리잘트 헬스케어로.

- 암 치료는 생물학적 제제 시장의 성장을 주도하는 주요 요인 중 하나입니다. 더 빠른 성장이 예상됨에도 불구하고, 의약품 승인에 있어서는 소분자가 생물학적 제제를 능가하고 있습니다. 예를 들어, FDA의 의약품평가연구센터(CDER)는 2021년에 50개의 신약과 생물학적 제제를 승인했습니다. 승인된 50개의 신약과 생물학적 제제 중 33개는 저분자 의약품, 17개는 단클론 항체 및 기타 고분자 의약품입니다. 최근 몇 년동안 생물학적 제제의 승인 건수는 꾸준히 증가하고 있습니다.

- 기업은 제조업체에 부과된 규제를 준수하기 위해 추가 투자를 해야 합니다. 대신 기업은 기업 전체에 이익을 가져다주는 연구 개발 활동에 적극적으로 투자합니다. 따라서 고도로 규제 된 제조 공정은 복잡한 기술 이전 및 지적 재산권 보안 문제를 수반하여 다양한 지역에서 예상되는 시장 성장과 채택을 방해합니다.

- COVID19 팬데믹은 조사 대상 시장에서 사업을 영위하는 기업들에게 백신 제조 및 아웃소싱이 지속 가능한 수익원이 될 수 있다는 가능성을 보여주었습니다, CDMO 업체들의 성장에 유리한 환경이 조성될 것으로 기대됩니다. 예를 들어, Catalent는 60개 이상의 고객사를 위해 COVID19 백신 및 치료제 개발 가능성을 조사하기 위해 약 100개의 서로 다른 화합물을 연구하고 있습니다.

생물제제 CDMO 시장 동향

CDMO의 신기술에 대한 접근성과 실행 속도 향상으로 시장 성장 촉진

- 공급망 길이를 단축하고 리드 타임의 효율성을 개선해야 한다는 압력으로 인해 기업은 수요를 충족시키기 위해 다양한 조치를 취해야 하며, 위탁 생산은 공급망에서 실행 속도를 늦추는 주요 요인으로 작용하고 있습니다.

- 일부 의약품의 경우 수탁 제조 후 위탁 포장이 이루어지는 경우가 많습니다. 이에 따라 제약사들은 품질 테스트와 함께 수탁 제조 및 위탁 포장을 제공하는 공급업체를 찾고 있습니다. 또한 DHL과 같은 제3자물류 제공 업체는 계약 포장 서비스를 포함하여 서비스 기능을 확장하고 있습니다.

- CDMO는 첨단 기술과 전문성을 통해 시장에서 큰 견인력을 얻고 있습니다. 최신 기술 동향을 파악하는 것은 한 가지 화합물이나 제형에 특화된 틈새 CDMO에 특히 중요합니다.

- 생물제제 CDMO는 경쟁이 치열한 업계에서 성공할 가능성이 가장 높습니다. 그들은 최첨단 기술을 적극적으로 채택하고 차별화 된 기능을 구축하는 데 필요한 시간과 자본을 투자합니다. 우수한 CDMO는 유연성과 민첩성을 유지하면서 용량을 늘리기 위해 신속하게 행동합니다.

- 감염병의 확산과 새로운 치료법에 대한 수요가 증가함에 따라 첨단 기술에 대한 막대한 자본 투자가 필요한 제약 및 생명공학 기업들은 CDMO와 파트너십을 맺어 시장 성장을 더욱 촉진하고 있습니다.

북미 시장 점유율이 가장 높았음

- 북미는 미국과 캐나다라는 두 개의 주요 경제 국가로 인해 바이오 의약품 CDMO 산업의 주요 시장 중 하나입니다. 미국은 세계 주요 제약 산업의 본거지이며 시장 수익의 큰 비중을 차지하고 있습니다.

- IQVIA 휴먼 데이터 과학 연구소의 조사에 따르면, 전 세계 의료 지출은 2026년 코로나19 감염 백신을 포함해 1조 8,000억 달러에 달할 것으로 예상됩니다. 또한 이 지역은 CDMO 시장에서도 상당한 점유율을 차지하고 있습니다. Results Healthcare에 따르면, 이 지역은 CDMO 시장 점유율의 약 37%를 차지하고 있으며, 향후 몇 년동안 한 자릿수 중반의 성장률을 나타낼 것으로 예상됩니다.

- 만성질환의 높은 유병률, 인구의 고령화, 증거 기반 진료에 대한 필요성 증가는 미국에서 임상시험에 대한 높은 수요를 촉진하는 요인으로 작용하고 있습니다. 최근 몇 년동안 임상시험의 수가 학술 의료 센터에서 지역 기반 진료소, 그리고 다양한 국가의 세계 시설로 이동하는 사례가 증가하고 있습니다.

- 또한 CRO는 이 지역에서 강력한 발판을 마련하여 시장 성장에 기여하고 있습니다. QVIA Holdings Inc., Pharmaceutical Product Development LLC, PRA Health Sciences Inc. 및 Laboratory Corporation of America Holdings 등이 있습니다. 바이오벡트라(Biovectra)와 같은 기업들은 북미의 4개 cGMP 시설에서 중간체 및 원료의약품(API)의 위탁 개발 및 제조 역량을 제공하는 데 주력하고 있습니다. 최근 중국의 위탁개발생산기관(CDMO)은 미국 임상 제조시설과 10년간의 임대계약을 체결하여 생물제제 CDMO 시장의 성장을 더욱 촉진하고 있습니다.

- Emergent BioSolutions는 Vaxart, Novavax, J&J, AstraZeneca 등 코로나19 백신 개발 기업들과 다양한 CDMO 계약도 발표했습니다. FDA 승인 백신 BioThrax(탄저균 백신 흡착형) 및 Vaxchora(콜레라 백신, 생백신, 경구용)와 같은 항감염증 백신 상용화에 대한 경험과 팬데믹 대응 제조 네트워크가 코로나19 관련 계약 체결의 주요 요인으로 작용했습니다. 주요 요인으로 작용하고 있습니다. 메릴랜드주 볼티모어에 위치한 베이뷰(Bayview) 원료의약품 시설은 미국 정부와 협력하여 팬데믹에 대응하기 위해 설계 및 건설되었습니다. 새로운 첨단개발제조혁신센터(CIADM)에는 최대 4,000L 용량의 일회용 바이오리액터 시스템을 갖추고 있습니다.

생물제제 CDMO 산업 개요

바이오 의약품 CDMO 시장은 매우 집중되어 있으며, 시장의 거의 절반이 소수의 기업에 의해 지배되고 있습니다. 2021년에는 Catalent, 베링거인겔하임 그룹, 론자 그룹, 삼성바이오로직스 등 대기업이 조사 대상 시장의 30.1% 이상을 차지했습니다.

- 2022년 5월-Euroapi는 저분자 의약품 유효성분(API) 전문 CDMO입니다. 2022년 5월, 유로아피의 주식은 유로넥스트 파리 증권거래소에서 거래를 시작했습니다. 사노피는 유로아피와 장기적인 고객 관계를 구축하여 CDMO에 대한 지원을 확대하고 있으며, 1년의 락업 기간 동안 유로아피의 소수 지분 약 30%를 보유하기로 합의했습니다. ?33? year lock-up ?35? 1년의 락업 ?34? 또한 프랑스 정부 소유의 프랑스 공공 투자 은행인 EPIC Bpifrance는 사노피로부터 Euroapi의 지분 12%를 임베디드하기로 합의했습니다. ?33? EPIC Bpifrance ?35? EPIC Bpifrance ?34?

- 2022년 4월 키메론바이오는 후지필름 디오신스 바이오테크놀러지스(FDB)와 제조 계약을 체결하고 클리닉을 포함한 종양 포트폴리오를 추진한다고 발표했습니다. 키메론바이오는 원료의약품 제조 공정을 이전하고 확장하기 위한 파트너로 FUJIFILM DiosynthBiotechnologies를 선택했습니다.

- 2022년 1월 - 삼성바이오로직스는 바이오젠과 양사가 설립한 합작법인 삼성바이오에피스(Samsung Bioepis)의 바이오젠 지분 50%를 최대 23억 달러에 인수하는 계약을 체결했습니다. 삼성바이오로직스의 바이오젠 지분 전량 인수를 통해 삼성바이오에피스의 바이오시밀러 개발 역량과 향후 신약 개발 성과가 강화될 것으로 기대됩니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

- 조사 체제

- 2차 조사

- 1차 조사

- 1차 조사 접근과 주요 응답자

- 데이터 삼각측량과 통찰 생성

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 시장이 해결해야 할 과제

- 시장 기회(바이오시밀러 공동 개발과 디자이너 세포주 개념의 출현)

- 생물제제 CDMO 벤더 선택에 관한 중요 고려사항

- 비즈니스 모델 분석 - 부가가치, 유연한 생산능력 리스크 공유 및 인타임 제조

- 생물제제 CDMO(새로운 백신 개발 경쟁과 현재 생산능력에 대한 영향)에 대한 신형 COVID-19의 영향 상세한 평가

- 바이오의약품 업계 주요 동향

- 종양학, 감염증, 심혈관질환 등 다양한 유형 의 질병병 치료에서의 생물학적 제제 현재 사용에 관한 보도

제5장 시장 세분화

- 유형별

- 포유류

- 비포유류(미생물)

- 제품 유형별

- 생물제제

- 단클론항체(진단, 치료, 단백질 기반)

- 재조합 단백질

- 안티센스 및 분자 치료

- 백신

- 기타 생물제제

- 바이오시밀러

- 생물제제

- 지역별

- 북미

- 유럽

- 아시아태평양

- 중동 및 아프리카

- 라틴아메리카

제6장 경쟁 구도

- 기업 개요

- Boehringer Ingelheim Group

- Wuxi Biologics

- Samsung Biologics

- Lonza Group

- Fujifilm Diosynth Biotechnologies USA Inc.

- Toyobo Co. Limited

- Parexel International Corporation

- Icon PLC

- Binex Co. Limited

- JRS Pharma

- Rentschler Biotechnologies

- AGC Biologics

- Sandoz Biopharmaceuticals(Novartis AG)

- Catalent Inc.

- AbbVie Contract Manufacturing

제7장 벤더의 시장 점유율

제8장 투자 분석

제9장 시장 전망

LSH 24.03.14The Biologics CDMO Market size is estimated at USD 15.32 billion in 2024, and is expected to reach USD 27.94 billion by 2029, growing at a CAGR of 12.78% during the forecast period (2024-2029).

With an increasing number of companies within the pharmaceutical sector considering outsourcing services, the demand for services from contract manufacturing and contract development manufacturing organizations will rise.

Key Highlights

- The pharmaceutical industry is growing exponentially, driven by global economic growth, a growing and aging population, and new product launches. Even though small molecules continue to command a prominent share of the market, large molecules, such as biologics, biosimilars, and cell and gene therapies, are expected to witness the fastest growth over the forecast period.

- Even though volumes in large molecules tend to be smaller, the segment is growing faster. Absolute growth in the large molecules market, including originator biologics, biosimilars, and cell and gene therapies, is expected to propel the market to USD 133 billion by 2023. The market size for originator biologics is expected to reach USD 371 billion by 2023, according to Results Healthcare.

- Cancer therapies are among the primary drivers for a large portion of the growth in the biologics market. Even with the faster growth forecast, small molecules outweigh biologics regarding drug approvals. For instance, the FDA's Center for Drug Evaluation and Research (CDER) approved 50 new drugs and biological products in 2021. Of the 50 approved new drugs and biological products, 33 were small molecule drugs, and 17 were monoclonal antibodies and other big molecule drugs. The number of biologic approvals has been increasing steadily over the past few years.

- Companies need to invest additional amounts in complying with regulations imposed on the manufacturers. Instead, companies are willing to spend on R&D activities, which benefit the company overall. Hence, the highly regulated manufacturing processes, with complicated technology transfer and IP security concerns, impede the anticipated growth and adoption of the market in different regions.

- The COVID-19 pandemic indicated the potential of vaccine manufacturing and outsourcing as a sustainable revenue stream for companies operating in the market studied. Following the COVID-19 vaccine, introducing boosters is expected to create a favorable landscape for growth for CDMO vendors. For instance, Catalent has worked on nearly 100 different compounds to investigate its potential to develop COVID-19 vaccines and therapies for more than 60 customers.

Biologics Contract Development & Manufacturing Organization (CDMO) Market Trends

CDMOs' Access to New Technologies and Higher Speed of Execution Driving Market Growth

- Pressure to reduce the supply chain length and improve lead-time efficiency is forcing companies to take various measures to meet the demand, turning contract manufacturing into a major enabler in the supply chain to reduce the speed of execution.

- Often, contract manufacturing is followed by contract packaging for some pharmaceutical drugs. As a result, pharmaceutical companies seek vendors who provide contract manufacturing and contract packaging, along with quality testing. In addition, third-party logistic providers, like DHL, are extending their service capability to include contract packaging services.

- CDMOs are gaining significant market traction through advanced technology and specialized expertise. Keeping up with the latest technology trends is particularly important for niche CDMOs specializing in one compound or dosage form.

- Biopharmaceutical CDMOs are most likely to succeed in a highly competitive industry. They are willing to adopt cutting-edge technology and invest the necessary time and capital to build differentiated capabilities. The best CDMOs will move quickly to increase capacity while remaining flexible and agile.

- With the rising prevalence of infectious diseases and increased demand for novel therapies, pharma and biotech companies requiring higher capital investments for advanced technologies are forming collaborations with CDMOs, further driving the market's growth.

North America to Hold Prominent Market Share

- North America is one of the major markets for the biologics CDMO industry, owing to the presence of two major economies, namely, the United States and Canada. The United States is home to one of the major pharmaceutical industries in the world and commands a significant share of the market revenue.

- According to a study by the IQVIA Institute for Human Data Science, global medicine spending will reach USD 1.8 trillion in 2026, including COVID-19 vaccines. In addition, the region also holds a prominent share of the CDMO market. According to Results Healthcare, the region accounts for about 37% of the CDMO market share and is expected to witness growth in mid-single-digit percentage points over the coming years.

- The high prevalence of chronic diseases, the aging of the population, and the increased need for evidencebased practice are factors that have bolstered the high demand for clinical trials in the United States. In recent years, a growing number of clinical trials have shifted from academic medical centers to communitybased practices to global sites in different countries.

- Moreover, CROs have a strong foothold in the region, contributing to the market's growth. These include QVIA Holdings Inc., Pharmaceutical Product Development LLC, PRA Health Sciences Inc., and Laboratory Corporation of America Holdings. Companies such as Biovectra are also focusing on offering contract development and manufacturing capacity for intermediates and active pharmaceutical ingredients (APIs) at four cGMP facilities in North America. The Chinese contract development and manufacturing organization (CDMO) recently signed a 10-year lease deal for a clinical manufacturing facility in the United States, further helping the biologics CDMO market grow.

- Emergent BioSolutions also announced various CDMO deals with COVID-19 vaccine developers, including Vaxart, Novavax, J&J, and AstraZeneca. The company's experience in commercializing anti-infectious disease vaccines, including FDA-approved vaccines BioThrax (Anthrax Vaccine Adsorbed) and Vaxchora (Cholera Vaccine, Live, Oral), and its pandemic-ready manufacturing network are major factors in winning these deals for the COVID-19 vaccine. The company's Bayview drug substance facility in Baltimore, Maryland, was designed and built in partnership with the US government to respond to the pandemic. The new Center for Innovation in Advanced Development and Manufacturing (CIADM) has single-use bioreactor systems of up to 4,000 L.

Biologics Contract Development & Manufacturing Organization (CDMO) Industry Overview

The biologics contract development and manufacturing organization (CDMO) market is highly concentrated, with close to half of the market being dominated by a few players. In 2021, major players, such as Catalent, Boehringer Ingelheim Group, Lonza Group, and Samsung Biologics, together accounted for more than 30.1% of the market studied.

- May 2022 - Euroapi is a CDMO specializing in small-molecule active pharmaceutical ingredients (APIs). In May 2022, the company's stock began trading on the Euronext Paris stock exchange. Sanofi is extending its support for the CDMO by establishing a long-term customer relationship with Euroapi. It has agreed to hold a minority stake of approximately 30% in the CDMO for a two-year lock-up period. Furthermore, EPIC Bpifrance, a French public investment bank owned by the French government, has agreed to buy 12% of EuroAPI's shares from Sanofi.

- April 2022 - ChimeronBio announced that it had signed a manufacturing agreement with FUJIFILM DiosynthBiotechnologies (FDB) to advance its Oncology portfolio to include clinics. ChimeronBio opted for FUJIFILM DiosynthBiotechnologies as its partner for transferring and scaling its drug substance manufacturing process.

- January 2022 - Samsung Biologics signed an agreement with Biogen to acquire Biogen's 50% stake in Samsung Bioepis, a joint venture formed by the two companies, for up to USD 2.3 billion. The complete buyout of Biogen's stake by Samsung Biologics is anticipated to strengthen Samsung Bioepis' biosimilar development capabilities and future performance in new drug development.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Research Framework

- 2.2 Secondary Research

- 2.3 Primary Research

- 2.4 Primary Research Approach and Key Respondents

- 2.5 Data Triangulation and Insight Generation

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Access to New Technologies and Higher Speed of Execution Realized by CDMOs

- 4.2.2 Need for High Capital Investments to Develop Capabilities Has Led to Firms Choosing the Outsourcing Model

- 4.2.3 Lack of In-house Capacity among Emerging Drug Development Companies

- 4.3 Market Challenges

- 4.3.1 Transfer Complexities and Concerns over the Breach of IP and Patents

- 4.3.2 Capacity Issues Related to Large-molecule Drugs

- 4.4 Market Opportunities (Emergence of the Concept of Biosimilars Co-development and Designer Cell Lines)

- 4.5 Key Considerations Involved in the Selection of Biologics CDMO Vendors

- 4.6 Business Model Analysis - Value Added, Flexible Capacity Risk Sharing, and In-time Manufacturing

- 4.7 Detailed Assessment of the Impact of COVID-19 on Biologics CDMO (The Race for the Development of a New Vaccine and Impact on the Current Capacities)

- 4.8 Key Trends in Biopharmaceutical Industry

- 4.9 Coverage on the Current Use of Biologics for Different Types of Disease Treatment - Oncology, Infectious, Cardiovascular, etc.

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Mammalian

- 5.1.2 Non-mammalian (Microbial)

- 5.2 By Product Type

- 5.2.1 Biologics

- 5.2.1.1 Monoclonal (Diagnostic, Therapeutic, and Protein-based)

- 5.2.1.2 Recombinant Proteins

- 5.2.1.3 Antisense and Molecular Therapy

- 5.2.1.4 Vaccines

- 5.2.1.5 Other Biologics

- 5.2.2 Biosimilars

- 5.2.1 Biologics

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Middle-East & Africa

- 5.3.5 Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Boehringer Ingelheim Group

- 6.1.2 Wuxi Biologics

- 6.1.3 Samsung Biologics

- 6.1.4 Lonza Group

- 6.1.5 Fujifilm Diosynth Biotechnologies USA Inc.

- 6.1.6 Toyobo Co. Limited

- 6.1.7 Parexel International Corporation

- 6.1.8 Icon PLC

- 6.1.9 Binex Co. Limited

- 6.1.10 JRS Pharma

- 6.1.11 Rentschler Biotechnologies

- 6.1.12 AGC Biologics

- 6.1.13 Sandoz Biopharmaceuticals (Novartis AG)

- 6.1.14 Catalent Inc.

- 6.1.15 AbbVie Contract Manufacturing