|

시장보고서

상품코드

1850269

동물 유전학 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Animal Genetics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

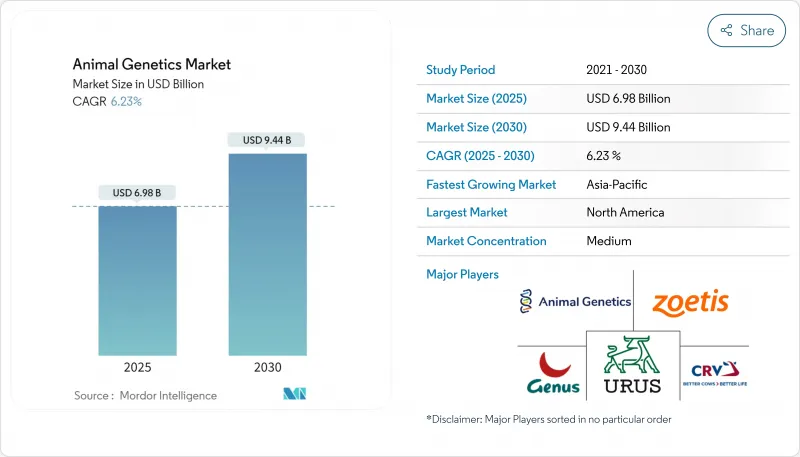

동물 유전학 시장 규모는 2025년에 69억 8,000만 달러로 평가되었고, 예측 기간(2025-2030년)의 CAGR은 6.23%를 나타낼 것으로 예측되며, 2030년에는 94억 4,000만 달러로 성장할 전망입니다.

이러한 건전한 성장세는 고품질 동물성 단백질에 대한 지속적인 수요, 유전체학 도구 활용 확대, 그리고 유전체 선택과 전통적 축산 방식을 결합한 정밀 육종의 부상을 반영합니다. 북미는 선진 연구실, 지원적 규제 환경, 인공수정 및 유전체 검사 조기 도입으로 연구 주기가 짧고 상업적 활용도가 높아 여전히 최대 지역 기여자로 자리매김하고 있습니다. 아시아태평양 지역은 가축 군집 확대, 정부 생산성 지원 정책, 접근 비용을 낮추는 국내 유전자형 분석 센터 네트워크 확대로 빠르게 추격 중입니다. 제품별로는 생축이 여전히 주요 수익원이지만, 물류·냉동 보존·디지털 주문 시스템이 개선되면서 유전자 재료(특히 냉동 정액 및 배아)가 더 빠른 성장을 기록하고 있습니다. 기술 경쟁은 입증된 경제성으로 인해 인공수정에 집중되고 있으며, CRISPR 및 관련 유전자 편집 도구는 규제 경로가 명확해짐에 따라 실험 단계에서 상업적 규모로 전환되고 있습니다. 최종 사용자 수요는 수의학 클리닉으로 이동 중이며, 여기서 유전적 진단은 가축과 반려동물 모두에게 일상화되고 있습니다.

세계의 동물유전학 시장 동향 및 인사이트

고수익, 질병 저항성 가축 품종에 대한 수요 증가

식량 체계에 대한 압박이 심화되면서 유전적 질병 저항성이 핵심 생산성 요인으로 부상했습니다. 마커 보조 선별 기술은 이제 저항성 유전자 위치를 신속하게 특정하며, CRISPR로 생성된 PRRS 저항성 돼지는 정밀 편집이 어떻게 비용이 많이 드는 발병을 억제할 수 있는지 보여줍니다. 구매자들은 항생제 무첨가 라벨을 선호하여 내성 특성을 명확한 가격 프리미엄으로 전환하고 있습니다. 육종 기업들은 내성 마커를 성장 및 효율성 특성과 결합하여 대응하고 있으며, 정부는 항생제 사용을 줄이는 프로젝트에 보조금을 지원하고 있습니다. 밀집된 농장 클러스터에 노출된 아시아태평양 지역 생산자들은 내성을 위험 보험으로 간주하여 검증된 유전학에 대한 지역 수요를 촉진하고 있습니다.

첨단 유전자 기술 채택 증가

시퀀싱 비용 하락과 고처리량 SNP 어레이는 중간 규모 생산자들에게도 유전체 검사를 가능하게 했습니다. 통합 예측 모델은 이제 유전체, 성능, 환경 기록을 결합하여 사료 효율성, 내열성, 메탄 저감 특성에 대한 선별을 가능하게 합니다. 예를 들어 낙농 프로그램은 영양소 흡수 효율을 높여 사료 비용과 배출량을 낮추기 위해 반추위 미생물군집 관련 SNP 패널을 활용합니다. 유럽과 북미의 공공-민간 파트너십은 기준 개체군을 공동 자금 지원하여 유전적 이득을 지속시키는 장기적 데이터 흐름을 보장합니다.

유전체 시퀀싱 비용 부담으로 도입 제한

시퀀싱 비용은 낮아졌으나 초기 장비 투자와 샘플당 비용이 여전히 소규모 농가의 진입 장벽으로 작용합니다. 유전적 이득이 현금화되는 속도가 느린 육우 기업들은 신중한 도입 태도를 보입니다. 생산량 기반 가격 책정 방식과 정부 보조금이 일부 비용을 상쇄하지만 접근성은 여전히 불균등합니다. 이러한 격차는 산업형 농장과 가족 농장 간 성능 차이를 확대시킬 위험이 있어, 정책 입안자들이 공동 실험실 시설과 단계별 서비스 패키지 도입을 모색하도록 촉진하고 있습니다.

부문 분석

2024년 동물 유전학 시장의 62.54%를 차지한 생체 동물 부문은 검증된 생산 실적을 보유한 검증된 수소, 수퇘지, 수양 및 번식용 가축에 상업적 구매자들이 지속적으로 프리미엄을 부여하는 현상을 반영합니다. 사육자들은 엘리트 종축의 가격이 종종 50,000달러를 초과하는 것을 정당화하기 위해 농장 내 성능 테스트, 쇼 서킷 가시성 및 디지털 혈통 플랫폼에 투자합니다. 무역은 국경 간 이동을 간소화하는 개선된 물류 및 검역 허브의 혜택을 받습니다.

유전 물질은 절대적 가치는 작지만, 냉동 보존 기술이 운송 위험을 낮추고 디지털화된 주문 포털이 글로벌 구매자를 다양한 유전자원 재고와 연결함에 따라 6.98%의 연평균 성장률(CAGR)로 더 빠르게 확장됩니다. 배아 유리화 기술은 해동 후 생존율을 90% 이상 달성하며, 생우 수입 없이 신속한 유전적 도약을 원하는 신흥 시장 낙농가들 사이에서 활용도가 확대되고 있습니다. 정액은 경제성으로 여전히 물량 주도권을 유지하지만, 프리미엄 배아 및 DNA 라이브러리가 고마진 틈새 시장을 창출하고 있습니다. 최종 제품의 다양성과 배송 유연성은 유전자 자원이 2030년까지 전체 동물 유전학 시장 성장률을 상회할 수 있는 기반을 마련합니다.

유전자형 및 성능 검사는 2024년 동물 유전학 시장 매출의 48.15%를 차지했습니다. 이 서비스는 우유 생산량, 도체 품질, 사료 전환율, 내성 형질에 대한 세분화된 데이터를 수집한 후 DNA 마커와 통합하여 선발 지수를 정교화합니다. 클라우드 기반 대시보드는 이제 생산자에게 실시간 벤치마킹을 제공하여 번식 주기마다 반복적인 개선을 촉진합니다. 통합 돼지 및 가금류 사육 시설의 수요는 사료 효율성에서 발생하는 작은 이득이 수백만 마리의 가축에 걸쳐 누적되기 때문에 높은 물량을 유지합니다.

DNA 타입 분석 및 혈통 검사는 샘플당 시퀀싱 비용의 급격한 하락과 시료를 중앙 실험실로 익일 배송하는 휴대용 채취 키트의 보급으로 인해 연평균 복합 성장률(CAGR) 7.01%로 성장할 것으로 전망됩니다. 반려동물 병원의 샘플 비중이 증가하고 있으나, 가축 업체들도 혈통 주장 검증 및 품종별 건강 프로그램 준수 강화를 위해 혈통 패널을 활용합니다. DNA 타입 분석과 형질 검사를 결합한 패키지는 실험실이 부가가치 분석 서비스를 추가 판매하는 데 도움을 주어 동물 유전학 시장 내 입지를 강화합니다.

지역 분석

북미는 2024년 동물 유전학 시장 점유율의 37.34%를 차지하며 최대 지역으로 유지되었습니다. 현대적인 실험실 인프라, 숙련된 AI 기술자 기반, 그리고 수용적인 규제 태도가 도입을 강화하고 있습니다. FDA의 2025년 유전자 편집 돼지고기 승인은 식품 공급망에서 정밀 사육에 대한 수용이 증가하고 있음을 시사합니다. 미국 농무부(USDA) 전망에 따르면 2034년까지 쇠고기, 돼지고기, 육계 생산량이 각각 11.1%, 10.0%, 11.5% 증가할 것으로 예상되어 지역 전반에 걸친 우수한 유전학 수요를 뒷받침합니다. 대학들의 연구도 추가 동력을 제공합니다. 소 미생물군에서 발견된 소형 CRISPR 단백질인 SubCas9는 오프타겟 위험을 줄이면서 더 정밀한 유전자 편집을 가능케 할 전망입니다.

아시아태평양 지역은 2030년까지 연평균 7.75%의 가장 빠른 성장률을 기록할 전망입니다. 중국은 자국 품종용 국가 유전체 칩을 도입하고, 인도는 젖소 개체당 생산량 증대를 위해 성별 선택 정액을 장려합니다. 가처분 소득 증가와 식습관 변화로 육류·계란·유제품 수요가 확대되며, 생산 증대와 수입 감축을 위한 유전자 개량 투자도 촉진됩니다. 유전체학 분야의 공공-민간 협력으로 검사 비용이 낮아져 중규모 농장도 참여할 수 있게 되었습니다. 이러한 노력들이 종합적으로 예측 기간 동안 매년 해당 지역의 동물 유전학 시장 점유율을 끌어올릴 전망입니다.

유럽은 사육자 전략을 형성하는 엄격한 복지 및 지속가능성 규범을 기반으로 상당한 위치를 차지하고 있습니다. 특히 돼지와 가금류 계통에서 생산성과 동물 복지를 결합한 균형 잡힌 선발 지수에 중점을 두고 있습니다. 남미는 풍부한 목초지 자원을 지속적으로 수익화하고 있으며, 브라질과 아르헨티나에서는 내열성과 무각 특성을 위한 유전자 편집 소의 도입이 활발히 진행 중입니다. 중동 및 아프리카 일부 지역은 규모는 작지만 가혹한 기후와 제한된 사료 공급에 대응하기 위해 유전체학을 활용하고 있습니다. 일본과 아르헨티나에서 특정 유전자 편집 가축이 비유전자변형(non-GMO)으로 인정받는 등 규제 명확성은 다른 관할권에 영감을 주고 유전자 제품의 국경 간 교역을 원활하게 할 수 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 고수익, 질병 저항성 가축 품종에 대한 수요

- 대규모 생산 및 고품질 품종을 위한 첨단 유전 기술의 확산

- 북미 소 인공수정에서의 성별 선별 정액 기술의 급속한 도입

- 도시 시장에서 반려동물 유전자 검사의 성장

- 중국 및 베트남에서 아프리카 돼지 열병(ASF) 이후 정부 보조금 지원 하에 진행된 돼지 사육군 재건

- 유유럽에서 A2A2 B-카제인을 목표로 한 낙농 유전학 프로그램 확대

- 시장 성장 억제요인

- 도입을 제한하는 높은 유전체 시퀀싱 비용

- 육종 협동조합 내 숙련된 유전학자 부족

- 국경 간 유전자원 거래에 대한 생물안전성 제한

- CRISPR 유전자 편집에 관한 EU의 윤리적 및 규제적 장애물

- 공급망 분석

- 규제 전망

- 기술의 전망

- Porter's Five Forces

- 공급기업의 협상력

- 구매자의 협상력

- 대체품의 위협

- 신규 참가업체의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측

- 제품 유형별

- 동물

- 소

- 돼지

- 가금

- 개

- 말

- 수산 양식종

- 기타

- 유전 물질

- 정액

- 배아

- DNA 및 기타 유전 자원

- 동물

- 검사 서비스 유형별

- 유전성 질환 검사

- 유전적 특성 및 성능 검사

- DNA형 판정 및 친자 확인 검사

- 기타 전문 검사

- 기술별

- 인공수정(AI)

- 배아 이식(ET)

- 마커 보조 및 유전체 선택

- CRISPR 및 유전자 편집

- 기타 보조생식기술

- 최종 사용자별

- 육종 회사 및 협회

- 축산농가/농장

- 동물병원 및 전문클리닉

- 연구 및 학술기관

- 기타

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 호주

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Genus PLC

- Hendrix Genetics BV

- Zoetis Inc.

- Topigs Norsvin

- Cobb-Vantress Inc.

- Aviagen Group

- CRV Holding BV

- Select Sires Inc.

- STgenetics

- Semex Alliance

- Alta Genetics Inc.

- Neogen Corporation

- ABS Global Inc.

- Genex Co-operative Inc.

- Grimaud Groupe

- Eurogene AI Services

- Sexing Technologies

- Envigo RMS LLC

- Bovine Elite LLC

- Nugenomics Ltd.

제7장 시장 기회와 장래의 전망

HBR 25.11.19The Animal Genetics Market size is estimated at USD 6.98 billion in 2025, and is expected to reach USD 9.44 billion by 2030, at a CAGR of 6.23% during the forecast period (2025-2030).

This healthy pace reflects sustained demand for high-quality animal protein, wider use of genomic tools, and the rise of precision breeding that blends genomic selection with conventional husbandry. North America remains the largest regional contributor as advanced laboratories, supportive regulation, and early adoption of artificial insemination and genomic testing keep research cycles short and commercial uptake high. Asia-Pacific is catching up fast, supported by expanding herds, government productivity schemes, and a widening network of in-country genotyping centers that lower access costs. Product-wise, live animals still represent the primary revenue stream, yet genetic material-especially frozen semen and embryos-records quicker growth as logistics, cryopreservation, and digital ordering improve. Technology competition centers on artificial insemination for its proven economics, while CRISPR and related gene-editing tools are moving from experimental to commercial scale as regulatory paths clarify. End-user demand is shifting toward veterinary clinics, where genetic diagnostics are becoming routine for both livestock and companion animals

Global Animal Genetics Market Trends and Insights

Demand for high-yielding disease-resistant livestock breeds

Intensifying pressure on food systems has made genetic disease resistance a core productivity lever. Marker-assisted selection now pinpoints resistance loci quickly, and CRISPR-generated PRRS-resistant pigs demonstrate how precision edits can curb costly outbreaks. Buyers also reward antibiotic-free labels, turning resistance traits into clear price premiums. Breeding firms respond by bundling resistance markers with growth and efficiency traits, while governments channel grants toward projects that cut antimicrobial use. Asia-Pacific producers, exposed to dense farm clusters, view resistance as risk insurance, driving regional demand for verified genetics.

Increased adoption of advanced genetic technologies

Falling sequencing costs and high-throughput SNP arrays have opened genomic testing to mid-scale producers. Integrated prediction models now combine genomic, performance, and environmental records, allowing selection for feed efficiency, heat tolerance, and methane mitigation. Dairy programs, for instance, use rumen microbiome-linked SNP panels to raise nutrient absorption efficiency, lowering feed costs and emissions. Public-private partnerships in Europe and North America co-fund reference populations, ensuring long-term data flow that sustains genetic gain.

High cost of genomic sequencing limiting adoption

While sequencing has become cheaper, upfront equipment outlays and per-sample fees still deter smallholders. Beef enterprises, where genetic gains translate more slowly into cash, adopt cautiously. Output-based pricing schemes and state subsidies partially offset costs, yet access remains uneven. This disparity risks widening performance gaps between industrial players and family farms, nudging policy makers to explore shared lab facilities and tiered service packages.

Other drivers and restraints analyzed in the detailed report include:

- Rapid adoption of sexed-semen technology

- Growth of companion-animal genetic testing

- Shortage of skilled geneticists in breeding co-ops

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The live animal segment generated 62.54% of the animal genetics market in 2024, reflecting the persistent premium that commercial buyers place on proven bulls, boars, rams, and breeding stock with validated production records. Breeders invest in on-farm performance testing, show circuit visibility, and digital pedigree platforms to justify animal prices that often exceed USD 50,000 for elite sires. The trade benefits from improved logistics and quarantine hubs that simplify cross-border movement.

Genetic material, though smaller in absolute value, expands faster at a 6.98% CAGR as cryopreservation advances lower shipment risk and digitized ordering portals connect global buyers to diverse germplasm inventories. Embryo vitrification now achieves post-thaw viability above 90%, widening usage among emerging-market dairies that want rapid genetic leaps without importing live cattle. Semen remains the volume leader for its affordability, but premium embryos and DNA libraries create higher-margin niches. End-product diversity and delivery flexibility position genetic material to outpace overall animal genetics market growth through 2030.

Genetic trait-and-performance testing produced 48.15% of animal genetics market revenue in 2024. The service captures granular data on milk yield, carcass quality, feed conversion, and resilience traits, then integrates them with DNA markers to refine selection indices. Cloud-based dashboards now deliver real-time benchmarking to producers, encouraging iterative improvements each breeding cycle. Demand from integrated pork and poultry operations keeps volume high because small gains in feed efficiency compound across millions of head.

DNA typing and parentage testing, forecast at 7.01% CAGR, benefits from plummeting per-sample sequencing costs and the spread of handheld collection kits that mail specimens to central labs overnight. Companion-animal clinics account for a rising share of samples, but livestock players also employ parentage panels to verify pedigree claims and enforce breed-specific health program compliance. Packages that bundle DNA typing with trait testing help laboratories upsell value-added analytics, strengthening their position within the animal genetics market.

The Animal Genetics Market Report Segments by Animals (Poultry, Porcine, and More), by Animal Genetic Testing Services (DNA Typing, Genetic Trait Tests, and More), by Technology (Artificial Insemination (AI), Embryo Transfer (ET) and More), by End User (Breeding Companies, Livestock Producers/Farms and More) and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America remained the largest region, accounting for 37.34% of the animal genetics market share in 2024. Modern laboratory infrastructure, a seasoned AI technician base, and an accommodating regulatory stance reinforce adoption. The FDA's 2025 approval of gene-edited pork signals growing acceptance of precision breeding in the food chain. USDA outlooks project beef, pork, and broiler production to climb 11.1%, 10.0%, and 11.5% respectively by 2034, reinforcing region-wide demand for superior genetics. Universities add further momentum; SubCas9, a compact CRISPR protein discovered in bovine microbiota, promises more targeted edits with fewer off-target risks.

Asia-Pacific is on course for the fastest 7.75% CAGR through 2030. China rolls out national genomic chips for local breeds, while India promotes sexed semen to lift dairy yield per cow. Rising disposable incomes and shifting diets expand demand for meat, eggs, and dairy, prompting investment in genetic upgrades to boost output and cut imports. Public-private partnerships in genomics lower test prices, helping mid-sized farms participate. These efforts collectively push the region's weight in the animal genetics market upward each year of the forecast period.

Europe holds a sizeable position anchored by stringent welfare and sustainability norms that shape breeder strategies. Emphasis lies on balanced selection indices that pair productivity with animal well-being, especially in swine and poultry lines. South America continues to monetize strong pasture resources; Brazil and Argentina see brisk uptake of gene-edited cattle for heat tolerance and hornlessness traits. The Middle East and parts of Africa, though smaller, explore genomics to counter harsh climates and limited feed supplies. Regulatory clarity in Japan and Argentina-where certain gene-edited livestock qualify as non-GMO-could inspire other jurisdictions and smooth cross-border trade in genetic products.

- Genus

- Hendrix Genetics

- Zoetis

- Topigs Norsvin

- Cobb-Vantress Inc.

- Aviagen Group

- CRV Holding BV

- Select Sires

- STgenetics

- Semex Alliance

- Alta Genetics

- Neogen

- ABS Global Inc.

- Genex Co-operative Inc.

- Grimaud Groupe

- Eurogene AI Services

- Sexing Technologies

- Envigo RMS LLC

- Bovine Elite

- Nugenomics Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Demand for high-yielding disease-resistant livestock breeds

- 4.2.2 Increased Adoption of Advanced Genetic Technologies for Large-scale Production and Quality Breeds

- 4.2.3 Rapid adoption of sexed-semen technology in North American bovine AI

- 4.2.4 Growth of companion-animal genetic testing in urban markets

- 4.2.5 Government-subsidized swine herd rebuilding post-ASF in China & Vietnam

- 4.2.6 Expansion of dairy genetics programs targeting A2A2 B-casein in Europe

- 4.3 Market Restraints

- 4.3.1 High cost of genomic sequencing limiting adoption

- 4.3.2 Shortage of skilled geneticists in breeding co-ops

- 4.3.3 Biosecurity restrictions on cross-border germplasm trade

- 4.3.4 EU ethical & regulatory hurdles for CRISPR gene-edited

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of Substitutes

- 4.7.4 Threat of New Entrants

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product Type (Value)

- 5.1.1 Animal

- 5.1.1.1 Bovine

- 5.1.1.2 Porcine

- 5.1.1.3 Poultry

- 5.1.1.4 Canine

- 5.1.1.5 Equine

- 5.1.1.6 Aquaculture Species

- 5.1.1.7 Others

- 5.1.2 Genetic Material

- 5.1.2.1 Semen

- 5.1.2.2 Embryo

- 5.1.2.3 DNA & Other Germplasm

- 5.1.1 Animal

- 5.2 By Testing Service Type (Value)

- 5.2.1 Genetic Disease Testing

- 5.2.2 Genetic Trait & Performance Testing

- 5.2.3 DNA Typing & Parentage Testing

- 5.2.4 Other Specialised Tests

- 5.3 By Technology (Value)

- 5.3.1 Artificial Insemination (AI)

- 5.3.2 Embryo Transfer (ET)

- 5.3.3 Marker-Assisted & Genomic Selection

- 5.3.4 CRISPR & Gene Editing

- 5.3.5 Other Assisted-Reproduction Technologies

- 5.4 By End User (Value)

- 5.4.1 Breeding Companies & Associations

- 5.4.2 Livestock Producers / Farms

- 5.4.3 Veterinary Hospitals & Specialty Clinics

- 5.4.4 Research & Academic Institutes

- 5.4.5 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Genus PLC

- 6.4.2 Hendrix Genetics BV

- 6.4.3 Zoetis Inc.

- 6.4.4 Topigs Norsvin

- 6.4.5 Cobb-Vantress Inc.

- 6.4.6 Aviagen Group

- 6.4.7 CRV Holding BV

- 6.4.8 Select Sires Inc.

- 6.4.9 STgenetics

- 6.4.10 Semex Alliance

- 6.4.11 Alta Genetics Inc.

- 6.4.12 Neogen Corporation

- 6.4.13 ABS Global Inc.

- 6.4.14 Genex Co-operative Inc.

- 6.4.15 Grimaud Groupe

- 6.4.16 Eurogene AI Services

- 6.4.17 Sexing Technologies

- 6.4.18 Envigo RMS LLC

- 6.4.19 Bovine Elite LLC

- 6.4.20 Nugenomics Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment