|

시장보고서

상품코드

1771302

만성 통증 치료 시장 : 업계 동향 및 예측 - 적응증별, 분자 유형별, 작용기전별, 주요 지역별Chronic Pain Treatment Market: Industry Trends and Global Forecasts - Distribution by Type of Indication, Type of Molecule, Mechanism of Action and Key Geographical Regions |

||||||

세계의 만성 통증 치료 시장 : 개요

세계의 만성 통증 치료 시장 규모는 올해 73억 달러에 달했습니다. 이 시장은 예측 기간 동안 유리한 CAGR로 성장할 것으로 예측되고 있습니다.

시장 세분화 및 기회 분석은 다음 매개변수로 세분화됩니다.

적응증별

- 만성 요통

- 요추신경근증

- 편두통

- 골관절염

- 신경장애성 통증

분자 유형별

- 저분자

- 생물학적 제형

작용기전별

- CGRP 억제제

- COX/NGF 억제제

- TRPV1 수용체 길항제

- 채널 차단제

- 기타

주요 지역별

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 북아프리카

세계의 만성 통증 치료 시장 : 성장 및 동향

만성 통증은 기초 질환에 대한 심리 생리 학적 반응으로, 6개월 이상 지속되며 일반적으로 다양한 치료 접근법에 반응하지 않습니다. 세계적으로 15억 명 이상이 이러한 고통을 겪고 있는 것으로 추산되고 있다는 것은 특필할 만합니다. 특기할 만한 것은 오피오이드가 중등도에서 심한 통증에 대해 가장 일반적으로 사용되는 약리학적 치료제라는 것입니다. 이는 오피오이드의 작용 발현이 빠르고 즉효성이 높기 때문입니다. 그러나 오피오이드는 행복감을 일으킬 수 있고, 종종 오용이나 중독을 일으킵니다. 게다가 오락 목적의 사용이 늘어난 것도 오피오이드 의존 문제에 크게 기여하고 있습니다. 실제로 CDC 국립보건통계센터의 2024년 보고에 따르면 미국에서는 처방된 오피오이드 오용 결과 54,743명이 사망했습니다. 오피오이드 위기의 심각성으로 인해 제약회사들은 만성 통증 관리를 위한 비중독성 및 비마약성 치료제나 진통제 개발에 주력하고 있습니다.

오피오이드와는 대조적으로 비오피오이드 약물은 뇌의 수용체를 표적으로 하지 않기 때문에 중독성이 없습니다. 비오피오이드계 약제는 상해나 감염 부위에서 시클로옥시게나제(COX) 효소를 저해함으로써 프로스타글란딘의 생성을 저해하고 상해조직이나 질환조직에 직접 작용합니다. 이 메커니즘에 의해 말초 신경계 내에서의 페인미디에이터의 형성이 억제됩니다. 또한 다양한 통증 관리 장치는 약물 기반 치료의 필요성을 크게 감소시키거나 불필요하게 만드는 것으로 나타났습니다.

세계의 만성 통증 치료 시장 : 주요 인사이트

이 보고서는 세계의 만성 통증 치료 시장의 현재 상태를 조사하고 잠재적 성장 기회를 확인합니다. 주요 조사결과는 다음과 같습니다.

- 승인된 약은 적고, 임상 및 전임상 단계의 후보약이 몇 가지 있기 때문에 비오피오이드계 통증 관리 솔루션 시장은 눈부신 페이스로 성장하고 있습니다.

- 다양한 작용기전을 가진 파이프라인 후보의 대부분(45% 이상)은 개발 초기 단계에 있으며, 약물 전달은 경구 경로가 계속 선호되고 있습니다.

- 강력한 초기 단계와 전임상 단계의 파이프라인이 있기 때문에 업계는 새로운 생물학적 표적을 이용한 비오피오이드 대체약에 대한 현재의 미충족 요구에 대응할 가능성이 높습니다.

- TRPV1 수용체를 표적으로 한 임상 단계의 수용체 작용제가 몇 가지 있습니다. 시판되고 있는 약제의 대부분은 항염증제와 칼슘 길항제입니다.

- 주목해야 할 것은 만성 통증 관리를 위한 비오피오이드의 대부분(-45%)이 경구 투여라는 것입니다.

- 파이프라인은 이온 채널을 쉽게 차단하고 통증을 증식시키는 수용체에 길항함으로써 이익을 얻고 있으며, 선진 단계와 전임상 단계 모두에서 많은 저분자를 제공합니다.

- 시간이 지남에 따라 장치를 이용한 통증 관리 솔루션도 마약과 치료를 대체할 수 있는 선택 가능한 옵션으로 등장했습니다.

- 우리는 다양한 통증 완화 기술을 기반으로 다양한 장치를 식별하고 통증을 완화하기 위해 신체에 묻거나 표면적으로 적용할 수 있습니다

- 통증을 느끼는 부위에 특화하는 것으로, 경쟁 우위에 서는 기기도 많이 있습니다. 그러한 기기의 예로는 액티 패치, 바이오 빔 940, 케어 테크 IV 등이 있습니다.

- 친숙한 사용자 인터페이스를 갖춘 웨어러블 기기(25%)나 핸드헬드 기기(20%)는 폭넓은 고객층에 채용될 가능성이 높습니다.

- 시장에는 복수의 자극계 기기가 존재하지만, 차세대 기기는 통증 완화를 위한 혁신적이고 침습성이 낮은 메커니즘에 초점을 맞추었습니다.

- 경쟁 우위를 얻기 위해 제조업체는 각 제품 포트폴리오에 고급 기능을 통합하는 데 주력하고 있습니다.

- 투자자가 만성 통증에 대한 비오피오이드 대체약의 많은 장점과 장래성을 인식했기 때문에 각사는 다액의 자금을 조달하고 있습니다.

- Centrexion Therapeutics, Hydra Bioscience, NeurogesX, Vapogenix 등입니다.

- 투자의 대부분은 이해관계자가 벤처캐피탈의 다양한 라운드를 통해서 조달한 것으로, 주로 벤처캐피탈의 시리즈 B에서 행해졌습니다.

- 여러 투자자가 비오피오이드약 개발자의 이니셔티브를 지원하고 있으며, 이 영역에서는 NIH에서만 거액의 자금이 수여되고 있습니다.

- 만성 통증 치료제 분야에 대한 관심이 높아짐에 따라 장비 제공업체와 기타 이해 관계자간에 여러 파트너십이 확립되어 있습니다. 특기할 만한 것은 제휴의 대부분(25% 이상)이 상업화 계약이었다는 것입니다.

- 여러 후기 단계의 분자가 장래에 판매 승인을 취득하기 때문에 시장은 큰 페이스로 성장할 가능성이 높습니다.

만성 통증 치료 시장의 진출기업 예

- Stimwave

- BlueWind Medical

- Omron Healthcare

- Cefaly Technologies

- Prizm Medical

- PainPod

- Neurometrix

- Chattem

- Silk'n Therapy

- ElectroMedical Technologies

이 보고서는 세계의 만성 통증 치료 시장에 대해 조사했으며, 시장 개요와 함께 적응증별, 분자 유형별, 작용기전별 동향, 지역별 동향 및 시장 진출기업 프로파일 등의 정보를 제공합니다.

목차

제1장 서문

제2장 주요 요약

제3장 서문

- 통증의 정의

- 통증의 분류

- 급성 통증

- 만성 통증

- 통증 관리

- 장래의 전망

제4장 만성 통증 관리 : 미충족 요구 분석

- 장의 개요

- 미충족 요구 분석

제5장 파이프라인 검토 : 시판약 및 개발 약

- 장의 개요

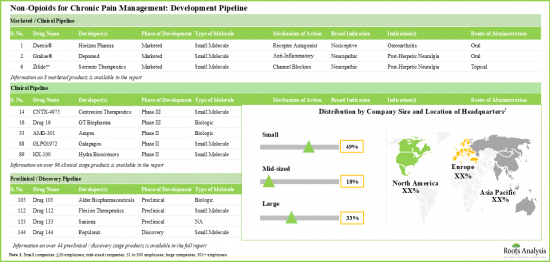

- 만성 통증 관리를 위한 비오피오이드 약물 : 출시 및 개발 파이프라인

- 만성 통증 관리를 위한 비오피오이드 약물 : 파이프라인 분석

제6장 시판 제품의 라이프 사이클 관리 전략

- 서문

- 제품 프로파일 : Duexis(R)(Horizon Pharma)

- 제품 프로파일 : Gralise(R)(Depomed)

- 제품 프로파일 : Horizant(R)(Arbor Pharmaceuticals)

- 제품 프로파일 : Vimovo(R)(AstraZeneca 및 Pozen)

제7장 약제 프로파일 : 후기 단계의 분자

- 장의 개요

- 약제 프로파일 : Aimovig(TM)/Erenumab

- 약제 프로파일 : Analgecine

- 약제 프로파일 : Atogepant/AGN 241689/MK 8031

- 약제 프로파일 : Civamide/Civanex/Zucapsaicin

- 약제 프로파일 : CNTX-4975

- 약제 프로파일 : Eptinezumab/ALD403

- 약제 프로파일 : Fasinumab

- 약제 프로파일 : Fremanezumab

- 약제 프로파일 : Galcanezumab/LY2951742

- 약제 프로파일 : Lasmiditan/COL-144

- 약제 프로파일 : Mirogabalin/DS-5565

- 약제 프로파일 : MPC-06-ID

- 약제 프로파일 : Neridronate

- 약제 프로파일 : NTM-001

- 약제 프로파일 : NTM-002

- 약제 프로파일 : Perampanel(E2007)

- 약제 프로파일 : POSIMIR(SABER-Bupivacaine)

- 약제 프로파일 : Ralfinamide

- 약제 프로파일 : SP-102

- 약제 프로파일 : T-121

- 약제 프로파일 : Tanezumab

- 약제 프로파일 : Tetrodotoxin /TTX

- 약제 프로파일 : Ubrogepant /MK-1602

- 약제 프로파일 : YHD1119/PREGABALIN

제8장 만성 통증 관리 장치 : 시장 상황

- 장의 개요

- 통증 관리 장치 : 데이터베이스

- 통증 관리 장치 : 데이터베이스 분석

제9장 디바이스 경쟁력 분석 및 프로파일

- 장의 개요

- 조사 방법

- 임플란트

- 웨어러블

- 기타

제10장 파트너십 및 협업

- 장의 개요

- 파트너십 모델

- 만성 통증 관리를 위한 비오피오이드 약물 및 장치 : 최근 파트너십 및 협력

제11장 자금 조달 및 투자 분석

- 장의 개요

- 자금 조달의 유형

- 만성 통증 관리를 위한 비오피오이드 약물 : 자금 조달 및 투자 분석

- 결론

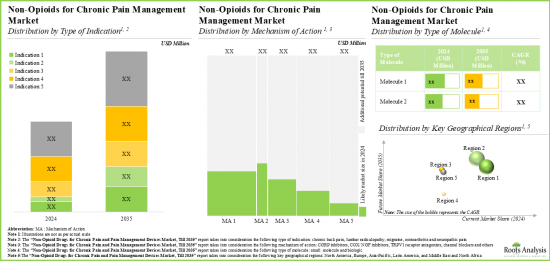

제12장 시장 예측 및 기회 분석

- 장의 개요

- 주요 전제

- 예측 조사 방법

- 만성 통증 관리 시장에 있어서의 비오피오이드 약의 전체적 추이(2018년-)

- 비오피오이드 약 시장 : 치료 영역별

- 비오피오이드 약 시장 : 분자 유형별

- 비오피오이드 약 시장 : 작용기전별

- 비오피오이드 약 시장 : 지역별

- 비오피오이드 의약품 시장 : 제품별 매출 예측

- Qutenza(R)(Accorda Therapeutics)

- Vimovo(R)(Horizon Pharma)

- Duexis(R)(Horizon Pharma)

- Gralise(R)(Depomed)

- Horizant(R)(Arbor Pharmaceuticals))

- Zilretta(R)(Flexion Therapeutics)

- Ztlido(TM)(Sorrento Therapeutics)

- Aimovig(TM)(Amgen)

- Fremanezumab(Teva Pharmaceuticals)

- Galcanezumab(Eli Lilly)

- Mirogabalin(DS-5565)(Daiichi Sankyo)

- YHD1119(Yuhan corporation)

- GLA5PR(GL PharmTech)

- Eptinezumab(Alder Biopharmaceuticals)

- ALLOD-2(Allodynic Therapeutics)

- PainBrake(R)(GT Biopharma)

- Neridronate(Grunenthal)

- Fasinumab(Regeneron Pharmaceuticals)

- SP-102(Semnur Pharmaceuticals)

- CNTX-4975(Centrexion Therapeutics)

- MPC-06-ID(Mesoblast)

- Tanezumab

- 통증 관리 디바이스 시장 전체(2018년-)

- 통증 관리 디바이스 시장 : 지역별

- 통증 관리 디바이스 시장 : 디바이스 유형별

- 통증 관리 디바이스 시장 : 작용기전별

제13장 결론

- 오피오이드 위기는 규제 약물의 남용별 다수의 사망자를 내고, 의약품 개발 기업은 대체적인 통증 관리 솔루션의 개발에 적극적으로 임하고 있습니다.

- 비오피오이드 치료제 시장은 다양한 만성 질환의 치료제 후보의 강력한 파이프라인에 의해 특징지어집니다.

- 만성 통증을 특징으로 하는 다양한 임상 증상의 관리에도, 다양한 혁신적인 디바이스가 이용 가능합니다.

- 파트너십 활동 증가와 다양한 투자자의 재정 지원은 미래의 큰 가능성을 시사하고 있습니다.

- 언멧 요구가 존재하기 때문에 시장은 가까운 미래에 꾸준히 성장할 것으로 예측됩니다.

제14장 주요 인사이트

제15장 부록 I

제16장 부록 II

AJY 25.07.21GLOBAL CHRONIC PAIN TREATMENT MARKET: OVERVIEW

As per Roots Analysis, the global chronic pain treatment market valued at USD 7.3 billion in the current year is anticipated to grow at a lucrative CAGR during the forecast period.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Indication

- Chronic Back Pain

- Lumbar Radiculopathy

- Migraine

- Osteoarthritis

- Neuropathic Pain

Type of Molecule

- Small Molecule

- Biologic

Mechanism of Action

- CGRP Inhibitors

- COX/ NGF Inhibitors

- TRPV1 Receptor Antagonists

- Channel Blockers

- Others

Key Geographical Regions

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and North Africa

GLOBAL CHRONIC PAIN TREATMENT MARKET: GROWTH AND TRENDS

Chronic pain is a psychophysiological response to an underlying medical condition that persists for more than six months and typically does not respond to various treatment approaches. It is worth mentioning that as per the estimates over 1.5 billion people worldwide experience this form of pain. Notably, opioids remain among the most commonly used pharmacological treatments for moderate to severe pain. This can be attributed to their rapid onset of action and high effectiveness in providing immediate relief. However, opioids can induce feelings of euphoria, which often leads to misuse and addiction. Further, increased recreational use has significantly contributed to the problem of opioid dependency. In fact, according to a 2024 report by CDC's National Center for Health Statistics, 54,743 people died in the United States as a result of misuse of prescribed opioids. The severity of the opioid crisis has driven pharmaceutical companies to focus on developing non-addictive, non-narcotic therapeutics and analgesics for the management of chronic pain.

In contrast to opioids, non-opioid medications do not target brain receptors and are therefore non-addictive. These drugs act directly on injured or diseased tissues, specifically by blocking the production of prostaglandins through inhibition of the cyclooxygenase (COX) enzyme at the site of injury or infection. This mechanism reduces the formation of pain mediators within the peripheral nervous system. Furthermore, a variety of pain management devices have been shown to significantly decrease or even eliminate the need for drug-based treatments.

GLOBAL CHRONIC PAIN TREATMENT MARKET: KEY INSIGHTS

The report delves into the current state of global chronic pain treatment market and identifies potential growth opportunities within industry. Some key findings from the report include:

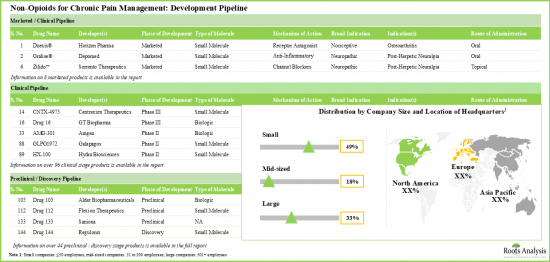

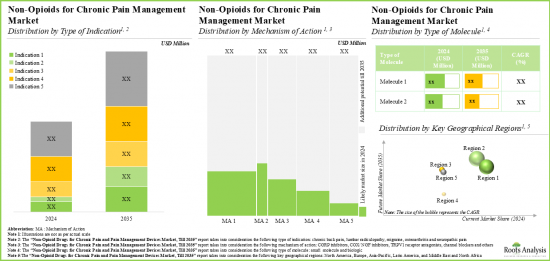

- With few approved drugs and several clinical / preclinical candidates, the market for non-opioid pain management solutions is growing at a commendable pace.

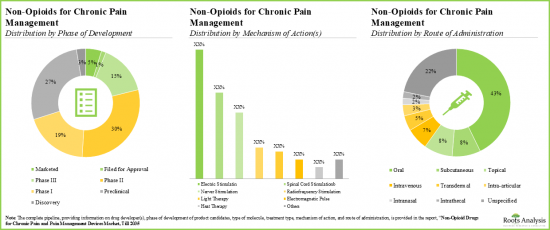

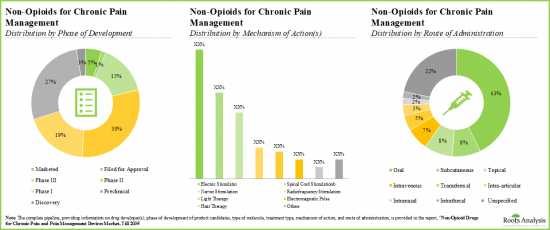

- Majority (>45%) of the pipeline candidates, having diverse mechanisms of action, are in the early stages of development; the oral route continues to be the preferred mode of drug delivery.

- Given a strong early-stage and preclinical pipeline, the industry is likely to address the current unmet need for non-opioid alternatives with novel biological targets.

- There are several clinical stage receptor agonists designed to target the TRPV1 receptor. Most of the marketed drugs are anti-inflammatory agents and calcium channel blockers.

- Notably, majority (~45%) of the non-opioids for chronic pain management are administered through oral route of administration.

- Benefited by easily blocking ion-channels and antagonizing pain proliferating receptors, the pipeline offers many small molecules in both advanced and preclinical stages.

- Over time, several device-based pain management solutions have also emerged as viable alternatives to narcotic drugs / therapies.

- We identified various devices, based on diverse pain relief technologies, which can be either implanted or superficially applied on the body to provide relief from pain.

- Numerous devices have a competitive advantage by focusing on the pain sensation area; examples of such devices include ActiPatch, BioBeam 940, CareTec IV.

- With friendly user interface, wearable (25%) and hand-held devices (20%) are likely to be adopted by a wide customer base; examples include ElectroCore and Interx Technologies.

- Although the market is characterized with multiple stimulation-based devices, next generation devices focus on innovative and less invasive mechanisms for pain relief.

- In pursuit of gaining a competitive edge, manufacturers are focusing on the integration of advanced features in their respective product portfolios.

- Companies have raised significant amounts in financing as investors have realized numerous benefits and future potential for non-opioid alternatives to chronic pain.

- Investments in various companies have fostered innovation in this domain; examples include Centrexion Therapeutics, Hydra Bioscience, NeurogesX and Vapogenix.

- The significant share of investments was raised by stakeholders through various rounds of venture capital funding, primarily in venture series B.

- Multiple investors have supported the initiatives of non-opioid drug developers; huge amount has been awarded only by NIH in the domain.

- With the growing interest in the field of chronic pain therapeutics, several partnerships have been established between device providers and other stakeholders. Notably, most (>25%) of the partnerships were commercialization agreements.

- Prevalent trends indicate that the market is likely to grow at a significant pace as multiple late-stage molecules receive marketing approval in the foreseen future.

Example Players in the Chronic Pain Treatment Market

- Stimwave

- BlueWind Medical

- Omron Healthcare

- Cefaly Technologies

- Prizm Medical

- PainPod

- Neurometrix

- Chattem

- Silk'n Therapy

- ElectroMedical Technologies

PRIMARY RESEARCH OVERVIEW

The opinions and insights presented in this study were influenced by discussions conducted with multiple stakeholders. The research report features detailed transcripts of interviews conducted with the following industry stakeholders:

- Chief Executive Officer, Company A

- Chief Advocacy Officer, Company B

- Chief Executive Officer, Company C

- Director of Clinical Affairs and New Markets, Company D

GLOBAL CHRONIC PAIN TREATMENT MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global chronic pain treatment market, focusing on key market segments, including [A] type of indication, [B] type of molecule, [C] mechanism of action and [D] key geographical regions.

- Drugs Market Landscape: A comprehensive evaluation of drugs being developed for the treatment of chronic pain, considering various parameters, such as [A] information on their respective developer(s), [B] phase of development, [C] type of molecule, [D] indication, [E] mechanism of action and [F] route of administration.

- Pipeline Review of Marketed and Development Drugs: A detailed analysis of product pipeline and developer companies, highlighting [A] a mirror analysis depicting the relative popularity of different disease indications based on the number of molecules available / under development for each indication and the number of companies involved, [B] a comprehensive analysis of the various industry players involved in chronic pain treatment market, distributed on the basis of location of headquarters and company size, [C] a detailed analysis highlighting the distribution of marketed and pipeline molecules based on their respective mechanisms of action, and [D] an analysis highlighting the distribution of molecules on the basis of stage of development, route of administration and treatment type.

- Unmet Need Analysis: A comprehensive evaluation of the key unmet needs across chronic pain, highlighting insights generated from data sourced from [A] patient blogs, [B] recent scientific publications, [C] social media posts and [D] the views of key opinion leaders expressed on various online platforms.

- Lifecycle Management Strategies for Marketed Products: A detailed discussion on the lifecycle management strategies that describes how various companies are using different methods to prolong patent age and, thereby, expand marketing exclusivity in order to exploit the revenue generation potential of their proprietary products.

- Drug Profiles: In-depth profiles of drugs that are in phase III of clinical development, focusing on [A] information on developer companies, [B] type of molecule, [C] mechanism of action, [D] current status of development, [E] route of administration, [F] information on clinical trials and [G] key developments (if available).

- Chronic Pain Management Devices Market Landscape: A comprehensive evaluation of various devices that are being developed for chronic pain management, considering various parameters, such as [A] information on developer(s), [B] mechanism of action, [C] site of application on the body, [D] modality of the device, [E] treatment requirements and [F] type of device.

- Device Competitiveness Analysis and Profiles: A comprehensive device competitive analysis highlighting the most important products by examining factors, such as [A] modality of device, [B] treatment requirement, [C] type of device and [D] supplier power. Furthermore, in-depth profiles of devices that emerged as relatively superior, focusing on [A] details on the developer, [B] approval year, [C] mechanism of action, [D] key features and [E] key developments.

- Partnerships and Collaborations: An insightful analysis of the deals inked by stakeholders in the chronic pain treatment market, based on several parameters, such as [A] year of partnership, [B] type of partnership, [C] quarterly trends, [D] most active players (in terms of the number of partnerships signed) and [E] geography.

- Funding and Investments: An insightful analysis of investments made at various stages of product development, based on various relevant parameters, such as [A] types of funding, [B] amount invested, [C] most active players and [D] most active investors.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Scope of the Report

- 1.2. Research Methodology

- 1.2.1. Research Assumptions

- 1.2.2. Project Methodology

- 1.2.3. Forecast Methodology

- 1.2.4. Robust Quality Control

- 1.2.5. Key Considerations

- 1.2.5.1. Demographics

- 1.2.5.2. Economic Factors

- 1.2.5.3. Government Regulations

- 1.2.5.4. Supply Chain

- 1.2.5.5. COVID Impact / Related Factors

- 1.2.5.6. Market Access

- 1.2.5.7. Healthcare Policies

- 1.2.5.8. Industry Consolidation

- 1.3 Key Questions Answered

- 1.4. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

- 3.1. Definition of Pain

- 3.2. Classification of Pain

- 3.2.1. Acute Pain

- 3.2.2. Chronic Pain

- 3.2.2.1. Classification of Chronic Pain

- 3.2.2.2. Chronic Pain and Mental Health

- 3.3. Pain Management

- 3.3.1. Therapeutics for Pain Management

- 3.3.2. Devices for Pain Management

- 3.3.3. Other Therapeutic Modalities and Interventions for Pain Management

- 3.4. Future Prospects

4. CHRONIC PAIN MANAGEMENT: UNMET NEED ANALYSIS

- 4.1. Chapter Overview

- 4.2. Unmet Need Analysis

- 4.2.1. Introduction

- 4.2.2. Patient Blogs

- 4.2.2.1. Methodology

- 4.2.2.2. Key Insights

- 4.2.3. Published Literature

- 4.2.3.1. Methodology

- 4.2.3.2. Key Insights

- 4.2.4. Social Media Platforms

- 4.2.4.1. Methodology

- 4.2.4.2. Key Insights

- 4.2.5. Expert Opinions

- 4.2.5.1. Jeffrey Curtis, MD, University of Alabama

- 4.2.5.2. Stephan Silberstein, MD, Jefferson University Hospital

- 4.2.5.3. Jeffrey Gudin, MD, Englewood Hospital and Medical Center

- 4.2.5.4. Kevin Zacharoff, MD, SUNY Stonybrook School of Medicine

- 4.2.5.5. Philip J Mease, MD, University of Washington School of Medicine

- 4.2.5.6. John D Reveille, MD, McGovern Medical School

- 4.2.5.7. Christopher R McCurdy, PhD, University of Florida

- 4.2.6. Concluding Remarks: Key Unmet Needs in Chronic Pain Management

5. PIPELINE REVIEW: MARKETED AND DEVELOPMENT DRUGS

- 5.1. Chapter Overview

- 5.2. Non-Opioid Drugs for Chronic Pain Management: Marketed and Development Pipeline

- 5.3. Non-Opioid Drugs for Chronic Pain Management: Pipeline Analysis

- 5.3.1. Analysis by Phase of Development

- 5.3.2. Analysis by Type of Molecule

- 5.3.3. Analysis by Mechanism of Action

- 5.3.4. Analysis by Route of Administration

- 5.3.5. Analysis by Target Therapeutic Indication(s)

- 5.3.6. Analysis by Size of Employee Base of Developer

- 5.3.7. Pipeline Analysis: Leading Players

- 5.3.8. Developer Logo Landscape: Distribution by Size and Location

- 5.3.9. Mirror Analysis: Distribution by Type of Indication, Number of Molecules and Manufacturer

- 5.3.10. Heptagon Representation: Distribution by Target Disease Indication and Phase of Development

- 5.3.11. Funnel Analysis: Distribution by Target Disease Indications, Route of Administration and Phase of Development

6. LIFECYCLE MANAGEMENT STRATEGIES FOR MARKETED PRODUCTS

- 6.1. Introduction

- 6.2. Product Profile: Duexis(R) (Horizon Pharma)

- 6.2.1. Overview

- 6.2.2. Mechanism of Action

- 6.2.3. Life Cycle Management Strategies

- 6.2.3.1. Strategic Pricing

- 6.2.3.2. Geographical Expansion

- 6.2.3.3. Indication Expansion

- 6.2.3.4. Extension of Patent Exclusivity

- 6.2.3.5. Authorized Generics

- 6.2.3.6. Awareness Campaigns

- 6.2.4. Partnerships and Collaborations

- 6.2.4.1. Mallinckrodt

- 6.2.4.2. Gru nenthal

- 6.3. Product Profile: Gralise(R) (Depomed)

- 6.3.1. Overview

- 6.3.2. Mechanism of Action

- 6.3.3. Life Cycle Management Strategies

- 6.3.3.1. New Dose Strength

- 6.3.4. Legal Defense

- 6.3.4.1. Authorized Generics

- 6.3.5. Partnerships and Collaborations

- 6.3.5.1. Actavis

- 6.3.5.2. Abbott

- 6.4. Product Profile: Horizant(R) (Arbor Pharmaceuticals)

- 6.4.1. Overview

- 6.4.2. Mechanism of Action

- 6.4.3. Life Cycle Management Strategies

- 6.4.3.1. Extension of Patent Exclusivity

- 6.4.3.2. Indication Expansion

- 6.4.4. New Dose Strength

- 6.4.5. Partnerships and Collaborations

- 6.4.5.1. GlaxoSmithKline

- 6.4.5.2. Arbor Pharmaceutical

- 6.5. Product Profile: Vimovo(R) (AstraZeneca and Pozen)

- 6.5.1. Overview

- 6.5.2. Mechanism of Action

- 6.5.3. Life Cycle Management Strategies

- 6.5.3.1. Pricing

- 6.5.3.2. Geographical Expansion

- 6.5.4. Legal Defense

- 6.5.5. Partnerships and Collaborations

- 6.5.5.1. AstraZeneca

- 6.5.5.2. Horizon Pharma

7. DRUG PROFILES: LATE-STAGE MOLECULES

- 7.1. Chapter Overview

- 7.2. Drug Profile: Aimovig(TM) / Erenumab

- 7.3. Drug Profile: Analgecine

- 7.4. Drug Profile: Atogepant / AGN 241689 / MK 8031

- 7.5. Drug Profile: Civamide / Civanex / Zucapsaicin

- 7.6. Drug Profile: CNTX-4975

- 7.7. Drug Profile: Eptinezumab / ALD403

- 7.8. Drug Profile: Fasinumab

- 7.9. Drug Profile: Fremanezumab

- 7.10. Drug Profile: Galcanezumab / LY2951742

- 7.11. Drug Profile: Lasmiditan / COL-144

- 7.12. Drug Profile: Mirogabalin / DS-5565

- 7.13. Drug Profile: MPC-06-ID

- 7.14. Drug Profile: Neridronate

- 7.15. Drug Profile: NTM-001

- 7.16. Drug Profile: NTM-002

- 7.17. Drug Profile: Perampanel (E2007)

- 7.18. Drug Profile: POSIMIR (SABER-Bupivacaine)

- 7.19. Drug Profile: Ralfinamide

- 7.20. Drug Profile: SP-102

- 7.21. Drug Profile: T-121

- 7.22. Drug Profile: Tanezumab

- 7.23. Drug Profile: Tetrodotoxin / TTX

- 7.24. Drug Profile: Ubrogepant / MK-1602

- 7.25. Drug Profile: YHD1119 / PREGABALIN

8. CHRONIC PAIN MANAGEMENT DEVICES: MARKET LANDSCAPE

- 8.1. Chapter Overview

- 8.2. Devices for Pain Management: Database

- 8.3. Devices for Pain Management: Database Analysis

- 8.3.1. Analysis by Type of Devices

- 8.3.2. Analysis by Mechanism of Action

- 8.3.3. Analysis by Modality of Device

- 8.3.4. Analysis by Site of Application on Body

- 8.3.5. Analysis by Convenience of Use

- 8.3.6. Analysis by Location of Developer(s)

- 8.3.7. Analysis by Company Size

9. DEVICE COMPETITIVENESS ANALYSIS AND PROFILES

- 9.1. Chapter Overview

- 9.2. Methodology

- 9.3. Implants

- 9.3.1. Assumptions, Limitations and Key Evaluable Parameters

- 9.3.2. Device Competitive Analysis for Implants: Results

- 9.3.3. Device Profiles

- 9.3.3.1. Freedom SCS System (Stimwave)

- 9.3.3.2. VIVENDI(TM) (BlueWind Medical)

- 9.4. Wearables

- 9.4.1. Assumptions, Limitations and Parameters Evaluated

- 9.4.2. Device Competitive Analysis for Wearables: Results

- 9.4.3. Device Profiles

- 9.4.3.1. Avail Wireless (Omron Healthcare)

- 9.4.3.2. Cefaly (Cefaly Technologies)

- 9.4.3.3. Electro-Mesh Garments (Prizm Medical)

- 9.4.3.4. Micro-Z (Prizm Medical)

- 9.4.3.5. PainPod MI (PainPod)

- 9.4.3.6. PainPod XPV (PainPod)

- 9.4.3.7. Quell Relief (Neurometrix)

- 9.4.3.8. SENSUS(R) Pain Management System (Neurometrix)

- 9.4.3.9. Smart Relief Back (Chattem)

- 9.5. Other Devices

- 9.5.1. Assumptions, Limitations and Parameters Evaluated

- 9.5.2. Devices Competitive Analysis for Other Devices: Results

- 9.5.3. Device Profiles

- 9.5.3.1. Silk'n Relief (Silk'n Therapy)

- 9.5.3.2. The Wellness Pro(TM) Plus (ElectroMedical Technologies)

10. PARTNERSHIPS AND COLLABORATIONS

- 10.1. Chapter Overview

- 10.2. Partnership Models

- 10.3. Non-Opioid Drugs and Devices for Chronic Pain Management: Recent Partnerships and Collaborations

- 10.3.1. Analysis by Year of Agreement

- 10.3.2. Analysis by Quarterly Trends

- 10.3.3. Analysis by Type of Partnership

- 10.3.4. Analysis by Most Active Players

- 10.3.5. Analysis by Geographical Activity

11. FUNDING AND INVESTMENT ANALYSIS

- 11.1. Chapter Overview

- 11.2. Types of Funding

- 11.3. Non-Opioid Drugs for Chronic Pain Management: Funding and Investment Analysis

- 11.3.1. Analysis by Cumulative Number of Funding Instances

- 11.3.2. Analysis by Cumulative Amount Invested

- 11.3.3. Analysis by Type of Funding

- 11.3.4. Analysis by Most Active Players

- 11.3.5. Analysis by Most Active Investors

- 11.4. Concluding Remarks

12. MARKET FORECAST AND OPPORTUNITY ANALYSIS

- 12.1. Chapter Overview

- 12.2. Key Assumptions

- 12.3. Forecast Methodology

- 12.4. Overall Non-Opioids Drugs for Chronic Pain Management Market, Since 2018

- 12.4.1. Non-Opioid Drugs Market: Distribution by Therapeutic Area

- 12.4.2. Non-Opioid Drugs Market: Distribution by Molecule Type

- 12.4.3. Non-Opioid Drugs Market: Distribution by Mechanism of Action

- 12.4.4. Non-Opioid Drugs Market: Distribution by Geography

- 12.5. Non-Opioid Drugs Market: Product-Wise Sales Forecasts

- 12.5.1. Qutenza(R) (Accorda Therapeutics)

- 12.5.1.1. Drug Overview and Target Patient Population

- 12.5.1.2. Sales Forecast

- 12.5.2. Vimovo(R) (Horizon Pharma)

- 12.5.2.1. Drug Overview and Target Patient Population

- 12.5.2.2. Sales Forecast

- 12.5.3. Duexis(R) (Horizon Pharma)

- 12.5.3.1. Drug Overview and Target Patient Population

- 12.5.3.2. Sales Forecast

- 12.5.4. Gralise(R) (Depomed)

- 12.5.4.1. Drug Overview and Target Patient Population

- 12.5.4.2. Sales Forecast

- 12.5.5. Horizant(R) (Arbor Pharmaceuticals)

- 12.5.5.1. Drug Overview and Target Patient Population

- 12.5.5.2. Sales Forecast

- 12.5.6. Zilretta(R) (Flexion Therapeutics)

- 12.5.6.1. Drug Overview and Target Patient Population

- 12.5.6.2. Sales Forecast

- 12.5.7. Ztlido(TM) (Sorrento Therapeutics)

- 12.5.7.1. Drug Overview and Target Patient Population

- 12.5.7.2. Sales Forecast

- 12.5.8. Aimovig(TM) (Amgen)

- 12.5.8.1. Drug Overview and Target Patient Population

- 12.5.8.2. Sales Forecast

- 12.5.9. Fremanezumab (Teva Pharmaceuticals)

- 12.5.9.1. Drug Overview and Target Patient Population

- 12.5.9.2. Sales Forecast

- 12.5.10. Galcanezumab (Eli Lilly)

- 12.5.10.1. Drug Overview and Target Patient Population

- 12.5.10.2. Sales Forecast

- 12.5.11. Mirogabalin (DS-5565) (Daiichi Sankyo)

- 12.5.11.1. Drug Overview and Target Patient Population

- 12.5.11.2. Sales Forecast

- 12.5.12. YHD1119 (Yuhan corporation)

- 12.5.12.1. Drug Overview and Target Patient Population

- 12.5.12.2. Sales Forecast

- 12.5.13. GLA5PR (GL PharmTech)

- 12.5.13.1. Drug Overview and Target Patient Population

- 12.5.13.2. Sales Forecast

- 12.5.14. Eptinezumab (Alder Biopharmaceuticals)

- 12.5.14.1. Drug Overview and Target Patient Population

- 12.5.14.2. Sales Forecast

- 12.5.15. ALLOD-2 (Allodynic Therapeutics)

- 12.5.15.1. Drug Overview and Target Patient Population

- 12.5.15.2. Sales Forecast

- 12.5.16. PainBrake(R) (GT Biopharma)

- 12.5.16.1. Drug Overview and Target Patient Population

- 12.5.16.2. Sales Forecast

- 12.5.17. Neridronate (Grunenthal)

- 12.5.17.1. Drug Overview and Target Patient Population

- 12.5.17.2. Sales Forecast

- 12.5.18. Fasinumab (Regeneron Pharmaceuticals)

- 12.5.18.1. Drug Overview and Target Patient Population

- 12.5.18.2. Sales Forecast

- 12.5.19. SP-102 (Semnur Pharmaceuticals)

- 12.5.19.1. Drug Overview and Target Patient Population

- 12.5.19.2. Sales Forecast

- 12.5.20. CNTX-4975 (Centrexion Therapeutics)

- 12.5.20.1. Drug Overview and Target Patient Population

- 12.5.20.2. Sales Forecast

- 12.5.21. MPC-06-ID (Mesoblast)

- 12.5.21.1. Drug Overview and Target Patient Population

- 12.5.21.2. Sales Forecast

- 12.5.22. Tanezumab

- 12.5.22.1. Drug Overview and Target Patient Population

- 12.5.22.2. Sales Forecast

- 12.5.1. Qutenza(R) (Accorda Therapeutics)

- 12.6. Overall Pain Management Devices Market, Since 2018

- 12.6.1. Pain Management Devices Market: Distribution by Geography

- 12.6.2. Pain Management Devices Market: Distribution by Type of Device

- 12.6.3. Pain Management Devices Market: Distribution by Mechanism of Action

13. CONCLUSION

- 13.1. The Opioid Crisis is Responsible for a Number of Fatalities Due to the Abuse of Controlled Substances; Drug Developers are Actively Attempting to Develop Alternative Pain Management Solutions

- 13.2. The Non-Opioid Therapeutics Market is Characterized by a Robust Pipeline of Candidate Drugs Being Developed for a Variety of Chronic Clinical Conditions

- 13.3. A Variety of Innovative Devices are also Available for the Management of Various Clinical Conditions Characterized by Chronic Pain

- 13.4. Increasing Partnership Activity and Financial Support from Various Investors are Indicative of Lucrative Future Potential

- 13.5. Given the Existing Unmet Needs, the Market is Anticipated to Grow at a Steady Pace in the Foreseen Future

14. EXECUTIVE INSIGHTS

- 14.1. Chapter Overview

- 14.2. Chief Executive Officer, Company A

- 14.3. Chief Advocacy Officer, Company B

- 14.4. Chief Executive Officer, Company C

- 14.5. Director of Clinical Affairs and New Markets, Company D