|

시장보고서

상품코드

1821518

고무 시장(-2035년) : 고무 유형별, 용도 유형별, 기업 유형별, 등급 유형별, 유통 채널 유형별, 지역별 - 산업 동향 및 예측Rubber Market, Till 2035: Distribution by Type of Rubber, Type of Application, Type of Enterprise, Type of Grade, Type of Distribution Channel and Geographical Regions: Industry Trends and Global Forecasts |

||||||

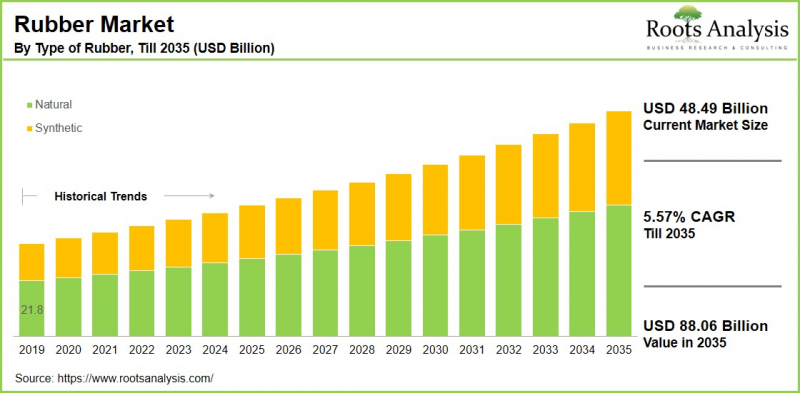

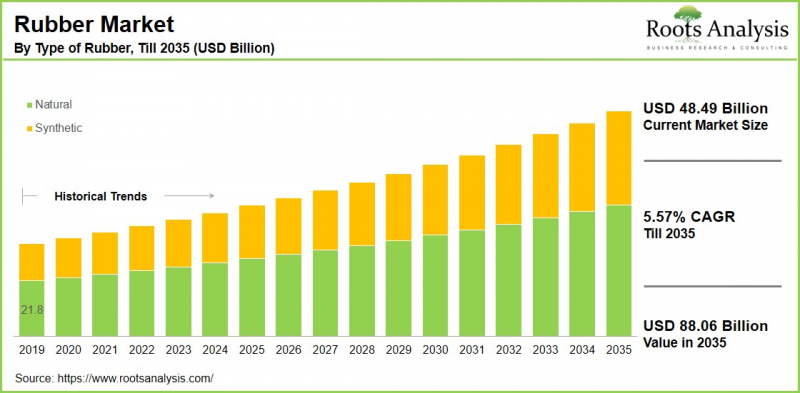

세계 고무 시장 규모는 현재 484억 9,000만 달러에서 2035년까지 880억 6,000만 달러에 달할 것으로 예상되며, 2035년까지 예측 기간 동안 CAGR 5.57% 성장할 것으로 예측됩니다.

고무 시장 : 성장과 동향

고무는 유연성, 열수축성, 내구성 등 수많은 장점을 제공하며 산업 분야에서 필수적인 역할을 하고 있습니다. 또한, 고무는 열 수축 및 내구성을 포함한 뚜렷한 기능적 탄성을 제공합니다. 고무는 크게 합성고무와 천연고무 두 가지로 나뉩니다. 천연 고무는 파라고무나무의 라텍스 수액에서 추출한 것으로, 인장 강도가 높고 마모 피로에 강합니다.

한편, 합성고무는 흔히 인공 고분자라고 불리는 합성고무는 단량체를 고분자로 중합하여 만들어집니다. 고무는 자동차, 항공우주, 전자, 해양, 에너지 부문 등 다양한 산업 분야에 적용되고 있습니다. 또한, 윤활제의 개선과 기술의 발전으로 보다 효율적이고 고성능의 고무가 개발되고 있습니다. 주목할 만한 점은 이 분야에서 지속가능성이 점점 더 강조되면서 천연 소재를 원료로 하는 바이오 고무의 추세가 두드러지고 있다는 점입니다.

이러한 변화는 뛰어난 효율을 가진 고무의 탄생으로 이어지고 있습니다. 결과적으로, 위의 요인으로 인해 세계 고무 시장은 예측 기간 동안 큰 성장을 이룰 것으로 예측됩니다.

세계의 고무 시장에 대해 조사했으며, 시장 규모 추정과 기회 분석, 경쟁 구도, 기업 프로파일 등의 정보를 전해드립니다.

목차

제1장 서문

제2장 조사 방법

제3장 경제적 고려사항, 기타 프로젝트 특유의 고려사항

제4장 거시경제 지표

제5장 주요 요약

제6장 서론

제7장 경쟁 구도

제8장 고무 시장 스타트업 에코시스템

제9장 기업 개요

- 본 장의 개요

- Arlanxeo

- Bridgestone

- Dow

- DuPont

- Enghuat Industries

- Exxon Mobile

- Goodyear Tire & Rubber

- Halcyon Agri

- Kumho Petrochemical

- Lanxess

- LG Chem

- Michelin

- Sinopec

- Southland Holdings

- Sri Trang Agro-Industry

- Sumitomo Rubber

- Tradewinds Plantation Berhad

- TSRC

- Unitex

- Vietnam Rubber

- Von Bundit

- Yokohama

제10장 밸류체인 분석

제11장 SWOT 분석

제12장 세계의 고무 시장

제13장 시장 기회 : 고무 유형별

제14장 시장 기회 : 용도 유형별

제15장 시장 기회 : 기업 유형별

제16장 시장 기회 : 등급 유형별

제17장 시장 기회 : 유통 채널 유형별

제18장 북미의 고무 시장 기회

제19장 유럽의 고무 시장 기회

제20장 아시아의 고무 시장 기회

제21장 중동 및 북아프리카(MENA)의 고무 시장 기회

제22장 라틴아메리카의 고무 시장 기회

제23장 기타 지역의 고무 시장 기회

제24장 표 형식 데이터

제25장 기업 및 단체 리스트

제26장 커스터마이즈 기회

제27장 Roots 구독 서비스

제28장 저자 상세

LSH 25.09.30Rubber Market Overview

As per Roots Analysis, the global rubber market size is estimated to grow from USD 48.49 billion in the current year to USD 88.06 billion by 2035, at a CAGR of 5.57% during the forecast period, till 2035.

The opportunity for rubber market has been distributed across the following segments:

Type of Rubber

- Natural

- Synthetic

Type of Application

- Footwear

- Industrial Goods

- Non-Tire Automotive

- Tire

- Others

Type of Enterprise

- Large

- Small and Medium Enterprise

Type of Grade

- Commercial Grade

- Food Grade

- Industrial Grade

- Medical Grade

Type of Distribution Channel

- Direct Sales

- Distributors

- Online Retail

- Specialty Stores

Geographical Regions

- North America

- US

- Canada

- Mexico

- Other North American countries

- Europe

- Austria

- Belgium

- Denmark

- France

- Germany

- Ireland

- Italy

- Netherlands

- Norway

- Russia

- Spain

- Sweden

- Switzerland

- UK

- Other European countries

- Asia

- China

- India

- Japan

- Singapore

- South Korea

- Other Asian countries

- Latin America

- Brazil

- Chile

- Colombia

- Venezuela

- Other Latin American countries

- Middle East and North Africa

- Egypt

- Iran

- Iraq

- Israel

- Kuwait

- Saudi Arabia

- UAE

- Other MENA countries

- Rest of the World

- Australia

- New Zealand

- Other countries

Rubber Market: Growth and Trends

Rubber plays an essential role in the industrial sector, providing numerous benefits such as flexibility, thermal shrinkage, and durability. Moreover, rubbers offer distinct functional elasticity that includes thermal shrinkage and durability. It can primarily be divided into two types, namely, synthetic and natural rubber. It is important to note that natural rubber comes from the latex sap of the Para rubber tree, resulting in high tensile strength and good resistance to wear fatigue.

On the other hand, synthetic rubber, often referred to as manmade polymer, is created by polymerizing monomers into polymers. Rubber finds applications in a variety of industries, such as automotive, aerospace, electronics, marine, and energy sectors. Additionally, ongoing improvements in lubricants and technological advancements are leading to the development of more efficient and higher-performing rubbers. Notably, this domain is increasingly embracing sustainability, with a trend towards bio-based rubber sourced from natural materials.

This transformation has resulted in the creation of rubbers with enhanced efficiency. As a result, owing to the above-mentioned factors, the global rubber market is expected to experience significant growth during the forecast period.

Rubber Market: Key Segments

Market Share by Type of Rubber

Based on type of rubber, the global rubber market is segmented into natural and synthetic. According to our estimates, currently, the asphalt shingles segment captures the majority of the market share. Moreover, this segment is anticipated to grow at a faster pace throughout the forecast period. Key factors driving this growth include high demand from the tire, automotive, and footwear sectors. Additionally, the constrained supply of natural rubber is likely to boost the synthetic rubber market.

Market Share by Type of Application

Based on type of application, the global rubber market is segmented into large and small and medium enterprise. According to our estimates, currently, the large enterprises capture the majority of the market share. In contrast, the small and medium enterprises are projected to grow at a higher CAGR throughout the forecast period. This can be attributed to their flexibility, creativity, concentration on specialized markets, and capacity to adjust to evolving customer demands and market dynamics.

Market Share by Type of Grade

Based on type of grade, the global rubber market is segmented into commercial grade, food grade, industrial grade and medical grade. According to our estimates, currently, the medical grade segment captures the majority of the market share. This trend can be linked to the rising healthcare requirements and advancements in medical technology.

Market Share by Type of Distribution Channel

Based on type of distribution channel, the global rubber market is segmented into direct sales, distributors, online retail and specialty stores. According to our estimates, currently, the direct sales segment captures the majority of the market share. In contrast, the online retail segment is projected to grow at a higher CAGR throughout the forecast period. This can be attributed to growing inclination toward online shopping and the digital transformation of trade.

Market Share by Geographical Regions

Based on geographical regions, the rubber market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and the rest of the world. According to our estimates, currently, Asia captures the majority share of the market, driven by the increased industrialization, robust automotive demand in countries such as China and India.

Example Players in Rubber Market

- Arlanxeo

- Bridgestone

- Dow

- DuPont

- Enghuat Industries

- Exxon Mobile

- Goodyear Tire & Rubber

- Halcyon Agri

- Kumho Petrochemical

- Lanxess

- LG Chem

- Michelin

- Sinopec

- Southland Holdings

- Sri Trang Agro-Industry

- Sumitomo Rubber

- Tradewinds Plantation Berhad

- TSRC

- Unitex

- Vietnam Rubber

- Von Bundit

- Yokohama

Rubber Market: Research Coverage

The report on the rubber market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the rubber market, focusing on key market segments, including [A] type of rubber, [B] type of application, [C] type of enterprise, [D] type of grade, [E] type of distribution channel and [F] geographical regions.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the rubber market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters and [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the rubber market, providing details on [A] location of headquarters, [B] company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] rubber portfolio, [J] moat analysis, [K] recent developments, and an informed future outlook.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

- Value Chain Analysis: A comprehensive analysis of the value chain, providing information on the different phases and stakeholders involved in the rubber market.

Key Questions Answered in this Report

- How many companies are currently engaged in rubber market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Introduction

- 2.4.2.2. Types

- 2.4.2.2.1. Qualitative

- 2.4.2.2.2. Quantitative

- 2.4.2.3. Advantages

- 2.4.2.4. Techniques

- 2.4.2.4.1. Interviews

- 2.4.2.4.2. Surveys

- 2.4.2.4.3. Focus Groups

- 2.4.2.4.4. Observational Research

- 2.4.2.4.5. Social Media Interactions

- 2.4.2.5. Stakeholders

- 2.4.2.5.1. Company Executives (CXOs)

- 2.4.2.5.2. Board of Directors

- 2.4.2.5.3. Company Presidents and Vice Presidents

- 2.4.2.5.4. Key Opinion Leaders

- 2.4.2.5.5. Research and Development Heads

- 2.4.2.5.6. Technical Experts

- 2.4.2.5.7. Subject Matter Experts

- 2.4.2.5.8. Scientists

- 2.4.2.5.9. Doctors and Other Healthcare Providers

- 2.4.2.6. Ethics and Integrity

- 2.4.2.6.1. Research Ethics

- 2.4.2.6.2. Data Integrity

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Forecast Methodology

- 3.1.1. Top-Down Approach

- 3.1.2. Bottom-Up Approach

- 3.1.3. Hybrid Approach

- 3.2. Market Assessment Framework

- 3.2.1. Total Addressable Market (TAM)

- 3.2.2. Serviceable Addressable Market (SAM)

- 3.2.3. Serviceable Obtainable Market (SOM)

- 3.2.4. Currently Acquired Market (CAM)

- 3.3. Forecasting Tools and Techniques

- 3.3.1. Qualitative Forecasting

- 3.3.2. Correlation

- 3.3.3. Regression

- 3.3.4. Time Series Analysis

- 3.3.5. Extrapolation

- 3.3.6. Convergence

- 3.3.7. Forecast Error Analysis

- 3.3.8. Data Visualization

- 3.3.9. Scenario Planning

- 3.3.10. Sensitivity Analysis

- 3.4. Key Considerations

- 3.4.1. Demographics

- 3.4.2. Market Access

- 3.4.3. Reimbursement Scenarios

- 3.4.4. Industry Consolidation

- 3.5. Robust Quality Control

- 3.6. Key Market Segmentations

- 3.7. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Overview of Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. R&D Innovation

- 4.2.11.7. Stock Market Performance

- 4.2.11.8. Supply Chain

- 4.2.11.9. Cross-Border Dynamics

- 4.2.1. Time Period

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of Rubber Market

- 6.2.1. Type of Rubber

- 6.2.2. Type of Applications

- 6.2.3. Type of Enterprise

- 6.2.4. Type of Grade

- 6.2.5. Type of Distribution Channel

- 6.3. Future Perspective

7. COMPETITIVE LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Rubber: Overall Market Landscape

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Location of Headquarters

- 7.2.4. Analysis by Ownership Structure

8. STARTUP ECOSYSTEM IN THE RUBBER MARKET

- 8.1. Rubber Market: Market Landscape of Startups

- 8.1.1. Analysis by Year of Establishment

- 8.1.2. Analysis by Company Size

- 8.1.3. Analysis by Company Size and Year of Establishment

- 8.1.4. Analysis by Location of Headquarters

- 8.1.5. Analysis by Company Size and Location of Headquarters

- 8.1.6. Analysis by Ownership Structure

- 8.2. Key Findings

9. COMPANY PROFILES

- 9.1. Chapter Overview

- 9.2. Arlanxeo *

- 9.2.1. Company Overview

- 9.2.2. Company Mission

- 9.2.3. Company Footprint

- 9.2.4. Management Team

- 9.2.5. Contact Details

- 9.2.6. Financial Performance

- 9.2.7. Operating Business Segments

- 9.2.8. Service / Product Portfolio (project specific)

- 9.2.9. MOAT Analysis

- 9.2.10. Recent Developments and Future Outlook

- 9.3. Bridgestone

- 9.4. Dow

- 9.5. DuPont

- 9.6. Enghuat Industries

- 9.7. Exxon Mobile

- 9.8. Goodyear Tire & Rubber

- 9.9. Halcyon Agri

- 9.10. Kumho Petrochemical

- 9.11. Lanxess

- 9.12. LG Chem

- 9.13. Michelin

- 9.14. Sinopec

- 9.15. Southland Holdings

- 9.16. Sri Trang Agro-Industry

- 9.17. Sumitomo Rubber

- 9.18. Tradewinds Plantation Berhad

- 9.19. TSRC

- 9.20. Unitex

- 9.21. Vietnam Rubber

- 9.22. Von Bundit

- 9.23. Yokohama

10. VALUE CHAIN ANALYSIS

11. SWOT ANALYSIS

12. GLOBAL RUBBER MARKET

- 12.1. Chapter Overview

- 12.2. Key Assumptions and Methodology

- 12.3. Trends Disruption Impacting Market

- 12.4. Global Rubber Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.5. Multivariate Scenario Analysis

- 12.5.1. Conservative Scenario

- 12.5.2. Optimistic Scenario

- 12.6. Key Market Segmentations

13. MARKET OPPORTUNITIES BASED ON TYPE OF RUBBER

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Methodology

- 13.3. Revenue Shift Analysis

- 13.4. Market Movement Analysis

- 13.5. Penetration-Growth (P-G) Matrix

- 13.6. Rubber Market for Natural: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.7. Rubber Market for Synthetic: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.8. Data Triangulation and Validation

14. MARKET OPPORTUNITIES BASED ON TYPE OF APPLICATION

- 14.1. Chapter Overview

- 14.2. Key Assumptions and Methodology

- 14.3. Revenue Shift Analysis

- 14.4. Market Movement Analysis

- 14.5. Penetration-Growth (P-G) Matrix

- 14.6. Rubber Market for Footwear: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.7. Rubber Market for Industrial Goods: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.8. Rubber Market for Non-Tire Automotive: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.9. Rubber Market for Tire: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.10. Rubber Market for Others: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.11. Data Triangulation and Validation

15. MARKET OPPORTUNITIES BASED ON TYPE OF ENTERPRISE

- 15.1. Chapter Overview

- 15.2. Key Assumptions and Methodology

- 15.3. Revenue Shift Analysis

- 15.4. Market Movement Analysis

- 15.5. Penetration-Growth (P-G) Matrix

- 15.6. Rubber Market for Large: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.7. Rubber Market for Small and Medium Enterprise: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.8. Data Triangulation and Validation

16. MARKET OPPORTUNITIES BASED ON TYPE OF GRADE

- 16.1. Chapter Overview

- 16.2. Key Assumptions and Methodology

- 16.3. Revenue Shift Analysis

- 16.4. Market Movement Analysis

- 16.5. Penetration-Growth (P-G) Matrix

- 16.6. Rubber Market for Commercial Grade: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.7. Rubber Market for Food Grade: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.8. Rubber Market for Industrial Grade: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.9. Rubber Market for Medical Grade: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.10. Data Triangulation and Validation

17. MARKET OPPORTUNITIES BASED ON TYPE OF DISTRIBUTION CHANNEL

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Revenue Shift Analysis

- 17.4. Market Movement Analysis

- 17.5. Penetration-Growth (P-G) Matrix

- 17.6. Rubber Market for Direct Sales: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.7. Rubber Market for Distributor: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.8. Rubber Market for Online Retail: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.9. Rubber Market for Specialty Stores: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.10. Data Triangulation and Validation

18. MARKET OPPORTUNITIES FOR RUBBER IN NORTH AMERICA

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Revenue Shift Analysis

- 18.4. Market Movement Analysis

- 18.5. Penetration-Growth (P-G) Matrix

- 18.6. Rubber Market in North America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.6.1. Rubber Market in the US: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.6.2. Rubber Market in Canada: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.6.3. Rubber Market in Mexico: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.6.4. Rubber Market in Other North American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.7. Data Triangulation and Validation

19. MARKET OPPORTUNITIES FOR RUBBER IN EUROPE

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Revenue Shift Analysis

- 19.4. Market Movement Analysis

- 19.5. Penetration-Growth (P-G) Matrix

- 19.6. Rubber Market in Europe: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.1. Rubber Market in Austria: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.2. Rubber Market in Belgium: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.3. Rubber Market in Denmark: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.4. Rubber Market in France: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.5. Rubber Market in Germany: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.6. Rubber Market in Ireland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.7. Rubber Market in Italy: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.8. Rubber Market in Netherlands: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.9. Rubber Market in Norway: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.10. Rubber Market in Russia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.11. Rubber Market in Spain: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.12. Rubber Market in Sweden: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.13. Rubber Market in Switzerland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.14. Rubber Market in the UK: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.15. Rubber Market in Other European Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.7. Data Triangulation and Validation

20. MARKET OPPORTUNITIES FOR RUBBER IN ASIA

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Revenue Shift Analysis

- 20.4. Market Movement Analysis

- 20.5. Penetration-Growth (P-G) Matrix

- 20.6. Rubber Market in Asia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.1. Rubber Market in China: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.2. Rubber Market in India: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.3. Rubber Market in Japan: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.4. Rubber Market in Singapore: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.5. Rubber Market in South Korea: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.6. Rubber Market in Other Asian Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.7. Data Triangulation and Validation

21. MARKET OPPORTUNITIES FOR RUBBER IN MIDDLE EAST AND NORTH AFRICA (MENA)

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Revenue Shift Analysis

- 21.4. Market Movement Analysis

- 21.5. Penetration-Growth (P-G) Matrix

- 21.6. Rubber Market in Middle East and North Africa (MENA): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.1. Rubber Market in Egypt: Historical Trends (Since 2019) and Forecasted Estimates (Till 205)

- 21.6.2. Rubber Market in Iran: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.3. Rubber Market in Iraq: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.4. Rubber Market in Israel: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.5. Rubber Market in Kuwait: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.6. Rubber Market in Saudi Arabia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.7. Rubber Market in United Arab Emirates (UAE): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.8. Rubber Market in Other MENA Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.7. Data Triangulation and Validation

22. MARKET OPPORTUNITIES FOR RUBBER IN LATIN AMERICA

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Revenue Shift Analysis

- 22.4. Market Movement Analysis

- 22.5. Penetration-Growth (P-G) Matrix

- 22.6. Rubber Market in Latin America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.1. Rubber Market in Argentina: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.2. Rubber Market in Brazil: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.3. Rubber Market in Chile: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.4. Rubber Market in Colombia Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.5. Rubber Market in Venezuela: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.6. Rubber Market in Other Latin American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.7. Data Triangulation and Validation

23. MARKET OPPORTUNITIES FOR RUBBER IN REST OF THE WORLD

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Revenue Shift Analysis

- 23.4. Market Movement Analysis

- 23.5. Penetration-Growth (P-G) Matrix

- 23.6. Rubber Market in Rest of the World: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.1. Rubber Market in Australia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.2. Rubber Market in New Zealand: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.3. Rubber Market in Other Countries

- 23.7. Data Triangulation and Validation