|

시장보고서

상품코드

1883075

귀금속 시장(-2035년) : 귀금속별, 용도별, 최종 사용자별, 지역별, 업계 동향 및 예측Precious Metal Market, Till 2035: Distribution by Type of Precious Metal, Type of Application, Type of End-User, and Geographical Regions: Industry Trends and Global Forecasts |

||||||

귀금속 시장 개요

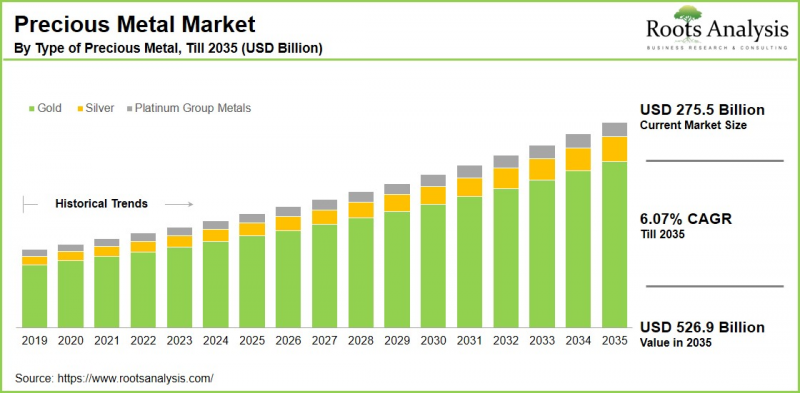

세계의 귀금속 시장 규모는 현재 2,755억 달러로 평가되었고 2035년까지 5,269억 달러에 이를 것으로 추정되며, 2035년까지의 예측 기간에 CAGR은 6.07%를 나타낼 전망입니다.

귀금속 시장 : 성장과 동향

귀금속은 자연적으로 발생하는 희귀 금속 원소로, 희소성, 아름다움 및 다양한 산업적 용도로 인해 상당한 경제적 가치를 지닙니다. 가장 널리 알려진 귀금속으로는 금, 은, 그리고 백금, 팔라듐, 로듐으로 구성된 백금군 금속(PGMs)이 있습니다. 귀금속은 항공우주, 자동차, 전자, 재생에너지 등 다양한 산업 분야에서 활용됩니다. 이 금속들은 광택, 가단성, 내식성, 우수한 전기 전도성 등 독특한 특성을 지닙니다. 흥미롭게도 전 세계 금의 약 7%가 전자 폐기물에 포함되어 있으며, 이는 전 세계적으로 가장 빠르게 증가하는 폐기물 흐름 중 하나가 되었습니다.

또한 귀금속 산업은 현재 다양한 최종 사용자의 수요 증가에 힘입어 변혁기를 겪고 있습니다. 인공지능 및 자동화를 포함한 기술 발전은 공정 최적화와 금속 추출 효율 향상을 가져올 것으로 예상됩니다. 특히 재생에너지 솔루션에 귀금속을 통합하고 첨단 폐기물 관리 방법을 도입하는 등 지속 가능한 채굴 관행은 산업의 환경적 발자국을 줄이는 데 기여할 것입니다. 결과적으로, 상기 요인들로 인해 귀금속 시장은 예측 기간 동안 상당한 성장을 보일 것으로 전망됩니다.

이 보고서는 세계의 귀금속 시장을 조사했으며, 시장 규모 추정 및 기회 분석, 경쟁 구도, 기업 프로파일 등의 정보를 제공합니다.

목차

제1장 서문

제2장 조사 방법

제3장 경제적 고려 사항, 기타 프로젝트 특유의 고려 사항

제4장 거시경제지표

제5장 주요 요약

제6장 소개

제7장 경쟁 구도

제8장 기업 프로파일

- 장의 개요

- Anglo American Platinum

- AngloGold Ashanti

- Barrick Gold

- First Quantum Minerals

- Freeport-McMoRan

- Gabriel Resources

- Gold Fields

- Impala Platinum Holdings

- Kinross Gold

- Lundin Mining

- Newcrest Mining

- Newmont

- Wheaton Precious Metals

제9장 밸류체인 분석

제10장 SWOT 분석

제11장 세계의 귀금속 시장

제12장 시장 기회 : 귀금속별

제13장 시장 기회 : 용도별

제14장 시장 기회 : 최종 사용자별

제15장 북미의 귀금속 시장 기회

제16장 유럽의 귀금속 시장 기회

제17장 아시아의 귀금속 시장 기회

제18장 중동 및 북아프리카의 귀금속 시장 기회

제21장 라틴아메리카의 귀금속 시장 기회

제20장 기타 지역의 귀금속 시장 기회

제21장 표 형식 데이터

제22장 기업 및 단체의 리스트

제23장 맞춤형 기회

제24장 Roots 구독 서비스

제25장 저자 상세

HBR 25.12.15Precious Metal Market Overview

As per Roots Analysis, the global precious metal market size is estimated to grow from USD 275.5 billion in the current year to USD 526.9 billion by 2035, at a CAGR of 6.07% during the forecast period, till 2035.

The opportunity for precious metal market has been distributed across the following segments:

Type of Precious Metal

- Gold

- Platinum Group Metal

- Silver

Type of Application

- Industrial

- Investment

- Jewelry

- Semiconductors

- Others

Type of End-User

- Aerospace

- Automotive

- Electronics

- Medical

- Oil and gas

- Others

Geographical Regions

- North America

- US

- Canada

- Mexico

- Other North American countries

- Europe

- Austria

- Belgium

- Denmark

- France

- Germany

- Ireland

- Italy

- Netherlands

- Norway

- Russia

- Spain

- Sweden

- Switzerland

- UK

- Other European countries

- Asia

- China

- India

- Japan

- Singapore

- South Korea

- Other Asian countries

- Latin America

- Brazil

- Chile

- Colombia

- Venezuela

- Other Latin American countries

- Middle East and North Africa

- Egypt

- Iran

- Iraq

- Israel

- Kuwait

- Saudi Arabia

- UAE

- Other MENA countries

- Rest of the World

- Australia

- New Zealand

- Other countries

Precious Metal Market: Growth and Trends

Precious metals are rare metallic elements that occur naturally and hold significant economic value due to their scarcity, beauty, and various industrial uses. The most commonly known precious metals include gold, silver, and the platinum group metals (PGMs), which comprise platinum, palladium, and rhodium. Precious metals are utilized in several industries, including aerospace, automotive, electronics, and renewable energy. These metals are characterized by unique properties such as luster, malleability, resistance to corrosion, and excellent electrical conductivity. Interestingly, around 7% of the world's gold is contained within electronic waste, which has become one of the fastest-growing waste streams globally.

Additionally, the precious metals industry is currently experiencing a transformative phase, fueled by rising demand from various end users. Advances in technology, including artificial intelligence and automation, are expected to optimize processes and improve the efficiency of metal extraction. Importantly, sustainable mining practices, such as integrating precious metals into renewable energy solutions and implementing advanced waste management methods, will help lessen the environmental footprint of the industry. As a result, owing to the above mentioned factors, the precious metal market is expected to grow significantly during the forecast period.

Precious Metal Market: Key Segments

Market Share by Type of Precious Metal

Based on type of precious metal, the global precious metal market is segmented into gold, platinum group metal and silver. According to our estimates, currently, the gold segment captures the majority of the market share. This growth can be linked to its dependable protection against inflation, escalating gold market trends, increased reserves held by central banks, and growing demand from retailers.

Market Share by Type of Application

Based on type of application, the global precious metal market is segmented into industrial, investment, jewelry, semiconductors and others. According to our estimates, currently, the industrial segment captures the majority of the market share, due to the increasing use of industrial applications across various sectors such as electronics, automotive production, aerospace, and healthcare.

Market Share by Type of End-User

Based on type of end-user, the global precious metal market is segmented into aerospace, automotive, electronics, medical, oils and gas and others. According to our estimates, currently, the precious metals in electronics are capturing the majority of the market share. This can be linked to the increasing need for electronic devices and components that depend on materials such as gold, silver, and platinum due to their distinct characteristics.

Market Share by Geographical Regions

Based on geographical regions, the precious metal market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and the rest of the world. According to our estimates, currently, Asia captures the majority share of the market, driven by the increasing need for electronic devices and components that depend on materials such as gold, silver, and platinum due to their distinct characteristics.

Example Players in Precious Metal Market

- Anglo American Platinum

- AngloGold Ashanti

- Barrick Gold

- First Quantum Minerals

- Freeport-McMoRan

- Gabriel Resources

- Gold Fields

- Impala Platinum Holdings

- Kinross Gold

- Lundin Mining

- Newcrest Mining

- Newmont

- Wheaton Precious Metals

Precious Metal Market: Research Coverage

The report on the precious metal market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the precious metal market, focusing on key market segments, including [A] type of precious metal, [B] type of application, [C] type of end-user, and [D] geographical regions.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the precious metal market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters and [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the precious metal market, providing details on [A] location of headquarters, [B] company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] precious metal portfolio, [J] moat analysis, [K] recent developments, and an informed future outlook.

- Megatrends: An evaluation of ongoing megatrends in the precious metal industry.

- Patent Analysis: An insightful analysis of patents filed / granted in the precious metal domain, based on relevant parameters, including [A] type of patent, [B] patent publication year, [C] patent age and [D] leading players.

- Recent Developments: An overview of the recent developments made in the precious metal market, along with analysis based on relevant parameters, including [A] year of initiative, [B] type of initiative, [C] geographical distribution and [D] most active players.

- Porter's Five Forces Analysis: An analysis of five competitive forces prevailing in the precious metal market, including threats of new entrants, bargaining power of buyers, bargaining power of suppliers, threats of substitute products and rivalry among existing competitors.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

- Value Chain Analysis: A comprehensive analysis of the value chain, providing information on the different phases and stakeholders involved in the precious metal market.

Key Questions Answered in this Report

- How many companies are currently engaged in precious metal market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Introduction

- 2.4.2.2. Types

- 2.4.2.2.1. Qualitative

- 2.4.2.2.2. Quantitative

- 2.4.2.3. Advantages

- 2.4.2.4. Techniques

- 2.4.2.4.1. Interviews

- 2.4.2.4.2. Surveys

- 2.4.2.4.3. Focus Groups

- 2.4.2.4.4. Observational Research

- 2.4.2.4.5. Social Media Interactions

- 2.4.2.5. Stakeholders

- 2.4.2.5.1. Company Executives (CXOs)

- 2.4.2.5.2. Board of Directors

- 2.4.2.5.3. Company Presidents and Vice Presidents

- 2.4.2.5.4. Key Opinion Leaders

- 2.4.2.5.5. Research and Development Heads

- 2.4.2.5.6. Technical Experts

- 2.4.2.5.7. Subject Matter Experts

- 2.4.2.5.8. Scientists

- 2.4.2.5.9. Doctors and Other Healthcare Providers

- 2.4.2.6. Ethics and Integrity

- 2.4.2.6.1. Research Ethics

- 2.4.2.6.2. Data Integrity

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Forecast Methodology

- 3.1.1. Top-Down Approach

- 3.1.2. Bottom-Up Approach

- 3.1.3. Hybrid Approach

- 3.2. Market Assessment Framework

- 3.2.1. Total Addressable Market (TAM)

- 3.2.2. Serviceable Addressable Market (SAM)

- 3.2.3. Serviceable Obtainable Market (SOM)

- 3.2.4. Currently Acquired Market (CAM)

- 3.3. Forecasting Tools and Techniques

- 3.3.1. Qualitative Forecasting

- 3.3.2. Correlation

- 3.2.3. Regression

- 3.3.4. Time Series Analysis

- 3.3.5. Extrapolation

- 3.3.6. Convergence

- 3.3.7. Forecast Error Analysis

- 3.3.8. Data Visualization

- 3.3.9. Scenario Planning

- 3.3.10. Sensitivity Analysis

- 3.4. Key Considerations

- 3.4.1. Demographics

- 3.4.2. Market Access

- 3.4.3. Reimbursement Scenarios

- 3.4.4. Industry Consolidation

- 3.5. Robust Quality Control

- 3.6. Key Market Segmentations

- 3.7 Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Overview of Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. R&D Innovation

- 4.2.11.7. Stock Market Performance

- 4.2.11.8. Supply Chain

- 4.2.11.9. Cross-Border Dynamics

- 4.2.1. Time Period

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of Precious Metal

- 6.2.1. Type of Precious Metal

- 6.2.2. Type of Application

- 6.2.3. Type of End-User

- 6.3. Future Perspective

7. COMPETITIVE LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Precious Metal: Overall Market Landscape

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Location of Headquarters

- 7.2.4. Analysis by Ownership Structure

8. COMPANY PROFILES

- 8.1. Chapter Overview

- 8.2. Anglo American Platinum *

- 8.2.1. Company Overview

- 8.2.2. Company Mission

- 8.2.3. Company Footprint

- 8.2.4. Management Team

- 8.2.5. Contact Details

- 8.2.6. Financial Performance

- 8.2.7. Operating Business Segments

- 8.2.8. Service / Product Portfolio (project specific)

- 8.2.9. MOAT Analysis

- 8.2.10. Recent Developments and Future Outlook

- 8.3. AngloGold Ashanti

- 8.4. Barrick Gold

- 8.5. First Quantum Minerals

- 8.6. Freeport-McMoRan

- 8.7. Gabriel Resources

- 8.8. Gold Fields

- 8.9. Impala Platinum Holdings

- 8.10. Kinross Gold

- 8.11. Lundin Mining

- 8.12. Newcrest Mining

- 8.13. Newmont

- 8.14. Wheaton Precious Metals

9. VALUE CHAIN ANALYSIS

10. SWOT ANALYSIS

11. GLOBAL PRECIOUS METAL MARKET

- 11.1. Chapter Overview

- 11.2. Key Assumptions and Methodology

- 11.3. Trends Disruption Impacting Market

- 11.4. Global Precious Metal Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 11.5. Multivariate Scenario Analysis

- 11.5.1. Conservative Scenario

- 11.5.2. Optimistic Scenario

- 11.6. Key Market Segmentations

12. MARKET OPPORTUNITIES BASED ON TYPE OF PRECIOUS METAL

- 12.1. Chapter Overview

- 12.2. Key Assumptions and Methodology

- 12.3. Revenue Shift Analysis

- 12.4. Market Movement Analysis

- 12.5. Penetration-Growth (P-G) Matrix

- 12.6. Precious Metal Market for Gold: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.7. Precious Metal Market for Platinum Group Metal: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.8. Precious Metal Market for Silver: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.9. Data Triangulation and Validation

13. MARKET OPPORTUNITIES BASED ON TYPE OF APPLICATION

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Methodology

- 13.3. Revenue Shift Analysis

- 13.4. Market Movement Analysis

- 13.5. Penetration-Growth (P-G) Matrix

- 13.6. Precious Metal Market for Industrial: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.7. Precious Metal Market for Investment: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.8. Precious Metal Market for Jewelry: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.9. Precious Metal Market for Semiconductor: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.10. Precious Metal Market for Other: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.11. Data Triangulation and Validation

14. MARKET OPPORTUNITIES BASED ON TYPE OF END-USER

- 14.1. Chapter Overview

- 14.2. Key Assumptions and Methodology

- 14.3. Revenue Shift Analysis

- 14.4. Market Movement Analysis

- 14.5. Penetration-Growth (P-G) Matrix

- 14.6. Precious Metal Market for Aerospace: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.7. Precious Metal Market for Automotive: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.8. Precious Metal Market for Electronics: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.9. Precious Metal Market for Medical: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.10. Precious Metal Market for Oil and Gas: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.11. Precious Metal Market for Others: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.12. Data Triangulation and Validation

15. MARKET OPPORTUNITIES FOR PRECIOUS METAL IN NORTH AMERICA

- 15.1. Chapter Overview

- 15.2. Key Assumptions and Methodology

- 15.3. Revenue Shift Analysis

- 15.4. Market Movement Analysis

- 15.5. Penetration-Growth (P-G) Matrix

- 15.6. Precious Metal Market in North America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.6.1. Precious Metal Market in the US: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.6.2. Precious Metal Market in Canada: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.6.3. Precious Metal Market in Mexico: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.6.4. Precious Metal Market in Other North American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.7. Data Triangulation and Validation

16. MARKET OPPORTUNITIES FOR PRECIOUS METAL IN EUROPE

- 16.1. Chapter Overview

- 16.2. Key Assumptions and Methodology

- 16.3. Revenue Shift Analysis

- 16.4. Market Movement Analysis

- 16.5. Penetration-Growth (P-G) Matrix

- 16.6. Precious Metal Market in Europe: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.6.1. Precious Metal Market in the Austria: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.6.2. Precious Metal Market in Belgium: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.6.3. Precious Metal Market in Denmark: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.6.4. Precious Metal Market in France: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.6.5. Precious Metal Market in Germany: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.6.6. Precious Metal Market in Ireland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.6.7. Precious Metal Market in Italy: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.6.8. Precious Metal Market in Netherlands: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.6.9. Precious Metal Market in Norway: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.6.10. Precious Metal Market in Russia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.6.11. Precious Metal Market in Spain: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.6.12. Precious Metal Market in Sweden: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.6.13. Precious Metal Market in Switzerland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.6.14. Precious Metal Market in the UK: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.6.15. Precious Metal Market in Other European Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.7. Data Triangulation and Validation

17. MARKET OPPORTUNITIES FOR PRECIOUS METAL IN ASIA

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Revenue Shift Analysis

- 17.4. Market Movement Analysis

- 17.5. Penetration-Growth (P-G) Matrix

- 17.6. Precious Metal Market in Asia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.6.1. Precious Metal Market in China: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.6.2. Precious Metal Market in India: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.6.3. Precious Metal Market in Japan: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.6.4. Precious Metal Market in Singapore: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.6.5. Precious Metal Market in South Korea: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.6.6. Precious Metal Market in Other Asian Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.7. Data Triangulation and Validation

18. MARKET OPPORTUNITIES FOR PRECIOUS METAL IN MIDDLE EAST AND NORTH AFRICA

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Revenue Shift Analysis

- 18.4. Market Movement Analysis

- 18.5. Penetration-Growth (P-G) Matrix

- 18.6. Precious Metal Market in Middle East and North Africa (MENA): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.6.1. Precious Metal Market in Egypt: Historical Trends (Since 2019) and Forecasted Estimates (Till 205)

- 18.6.2. Precious Metal Market in Iran: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.6.3. Precious Metal Market in Iraq: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.6.4. Precious Metal Market in Israel: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.6.5. Precious Metal Market in Kuwait: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.6.6. Precious Metal Market in Saudi Arabia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.6.7. Precious Metal Market in United Arab Emirates (UAE): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.6.8. Precious Metal Market in Other MENA Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.7. Data Triangulation and Validation

21. MARKET OPPORTUNITIES FOR PRECIOUS METAL IN LATIN AMERICA

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Revenue Shift Analysis

- 21.4. Market Movement Analysis

- 21.5. Penetration-Growth (P-G) Matrix

- 21.6. Precious Metal Market in Latin America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.1. Precious Metal Market in Argentina: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.2. Precious Metal Market in Brazil: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.3. Precious Metal Market in Chile: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.4. Precious Metal Market in Colombia Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.5. Precious Metal Market in Venezuela: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.6. Precious Metal Market in Other Latin American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.7. Data Triangulation and Validation

20. MARKET OPPORTUNITIES FOR PRECIOUS METAL IN REST OF THE WORLD

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Revenue Shift Analysis

- 20.4. Market Movement Analysis

- 20.5. Penetration-Growth (P-G) Matrix

- 20.6. Precious Metal Market in Rest of the World: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.1. Precious Metal Market in Australia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.2. Precious Metal Market in New Zealand: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.3. Precious Metal Market in Other Countries

- 20.7. Data Triangulation and Validation