|

시장보고서

상품코드

1891242

바이러스 벡터 및 플라스미드 DNA 제조 시장(제7판) - 업계 동향과 세계 예측(-2035년) - 사업 규모별, 제조 벡터별, 응용 분야별, 치료 영역별, 제조업체별, 지역별Viral Vector and Plasmid DNA Manufacturing Market (7th Edition): Industry Trends and Global Forecasts, till 2035 - Distribution by Scale of Operation, Vector Manufactured, Application Area, Therapeutic Area, Manufacturer and Geographical Regions |

||||||

바이러스 벡터 및 플라스미드 DNA 제조 시장

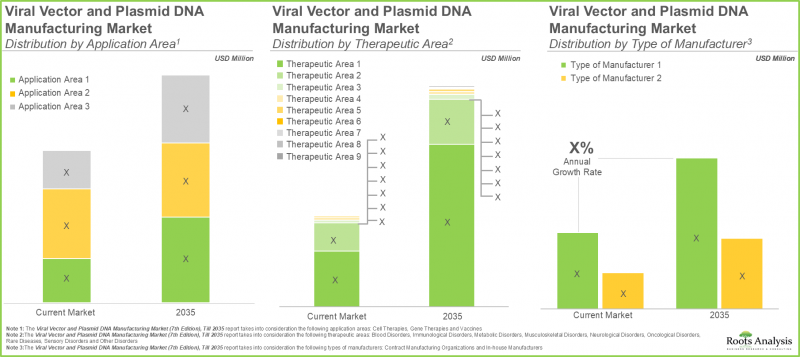

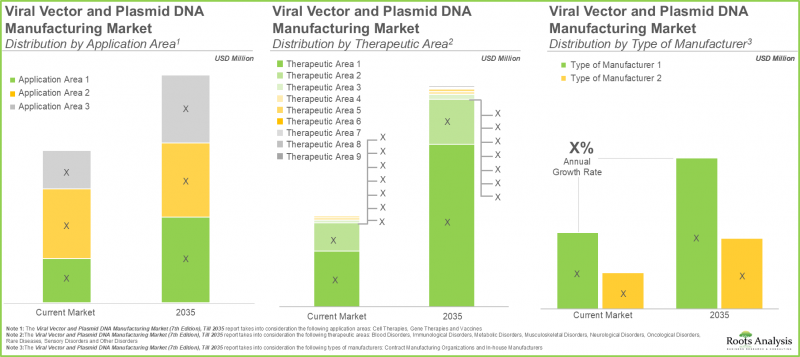

세계의 바이러스 벡터 및 플라스미드 DNA 제조 시장 규모는 2035년까지의 예측 기간에 CAGR 9.87%로 성장하며, 현재 8억 4,300만 달러에서 2035년까지 21억 6,100만 달러에 달할 것으로 추정되고 있습니다.

바이러스 벡터 및 플라스미드 DNA 제조 시장

시장 규모 및 기회 분석은 다음 매개 변수를 기반으로 세분화됩니다.

사업 규모

- 전임상 단계

- 임상

- 상업

적용 분야

- 세포치료

- 유전자 치료

- 백신

제조 벡터 유형

- AAV 벡터

- 아데노바이러스 벡터

- 렌치 바이러스 벡터

- 레트로 바이러스 벡터

- 비바이러스 벡터

- 기타

치료 영역

- 종양 질환

- 희귀질환

- 면역질환

- 신경질환

- 감각 장애

- 대사성 질환

- 혈액 질환

- 근골격계 질환

- 감염성 질환

- 안과 질환

- 기타

제조업체 유형

- 자체 제조 업체

- 수탁제조기관

지역적 지역

- 북미

- 유럽

- 아시아태평양

- 중동 및 북아프리카

- 라틴아메리카

바이러스 벡터 및 플라스미드 DNA 제조 시장 - 성장 및 동향

바이러스성 및 비바이러스성 벡터는 표적 세포에 유전물질을 전달하기 위한 필수적인 수단으로, 현대 세포 및 유전자 치료의 기초를 구성하고 있습니다. 최근 바이러스성 벡터를 이용한 약 30개의 치료법이 전 세계에서 규제 당국의 승인을 받았으며, 미국에서는 현재 500개 이상의 후보물질이 임상시험 단계에 있습니다. 승인 건수 증가와 지속적인 연구로 인해 바이러스 벡터의 대량 생산에 대한 요구가 증가하고 있습니다. 그러나 이 분야는 면역원성 위험과 바이러스 벡터 분석의 복잡성 등 많은 문제에 직면해 있습니다. 이러한 문제를 해결하기 위해 개발자들은 보다 안전하고 확장성이 높은 대안으로 비바이러스 벡터의 가능성을 점차 모색하고 있습니다.

벡터 수요 증가에 대응하기 위해 업계에서는 다양한 프로세스 개선이 추진되고 있습니다. 특히 코닝생명과학은 가스 투과성 필름 기술을 활용한 HYPERStack과 CellSTACKs와 같은 고밀도 세포배양 시스템을 개발하여 벡터 수율 향상을 실현했습니다. 또한 워크플로우 효율화, 수작업 감소, 생산 일정 단축을 위한 자동화 시스템도 도입하고 있습니다. 이러한 기술 혁신을 통해 전 세계에서 효율적이고 신뢰할 수 있는 경제적인 벡터 생산의 기반이 마련되고 있습니다.

바이러스 벡터 및 플라스미드 DNA 제조 시장 보고서에 따르면 현재 전 세계 산업 및 비산업 분야의 300개 이상의 기업이 세포치료제, 유전자치료제, 벡터 기반 백신 파이프라인을 지원하기 위한 노력에 참여하고 있습니다. 이 분야의 확장은 투자, 전략적 제휴, 시설 확장을 통해 더욱 촉진되고 있으며, 생산 과제에 대한 확고한 의지를 보여주고 있습니다. 이러한 발전은 바이러스성 및 비바이러스성 벡터의 생산이 크게 성장하여 향후 유전자 치료의 물결에 필수적인 기여자가 될 것임을 시사합니다.

바이러스 벡터 및 플라스미드 DNA 제조 시장 - 주요 연구 결과

이 보고서는 세계 바이러스 벡터 및 플라스미드 DNA 제조 시장의 현황을 상세하게 분석하고 업계의 잠재적인 성장 기회를 파악합니다. 보고서의 주요 내용은 다음과 같습니다.

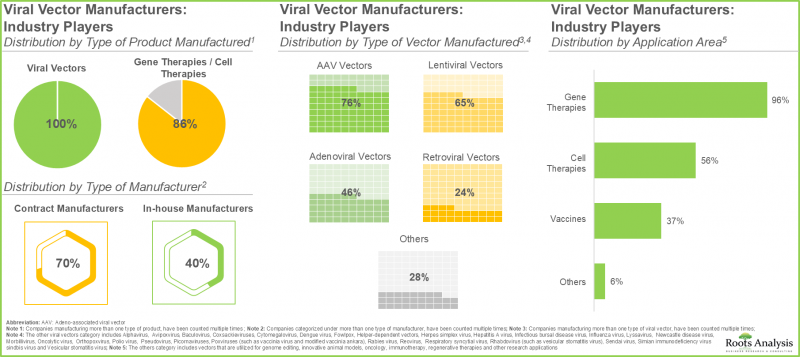

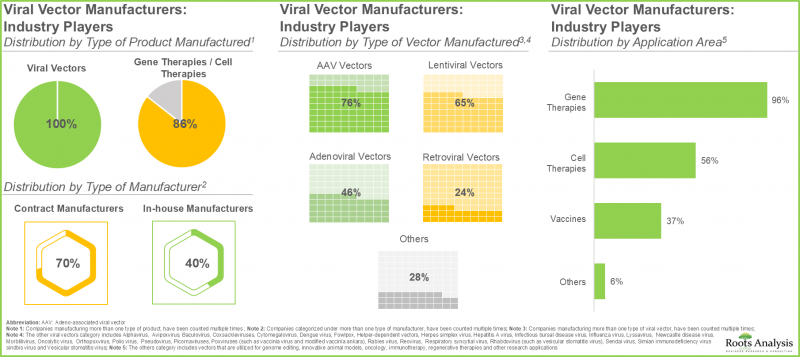

- 현재 130개 이상의 업계 관계자들이 자체 요구 사항 및/또는 위탁 서비스 계약을 위해 다양한 유형의 바이러스 벡터를 생산할 수 있는 역량을 보유하고 있다고 주장하고 있습니다.

- 현재 바이러스 벡터 제조 시장 시장 상황에서는 약 70%가 위탁 생산업체이며, 그 중 약 20%의 기업이 모든 유형의 바이러스 벡터를 생산할 수 있는 능력을 보유하고 있습니다.

- 이 분야 기업의 약 50%는 전임상, 임상, 상업의 세 가지 규모 모두에서 운영할 수 있는 역량을 갖추고 있습니다.

- 당사는 전 세계 다양한 벡터 제조업체들이 설립한 시설의 위치를 매핑했습니다. 특히 유럽은 바이러스성 및 비바이러스성 벡터 제조의 주요 거점으로 부상하고 있습니다.

- 비업계 종사자의 약 85%가 AAV 벡터 생산에 종사하고 있으며, 약 80%의 조직이 유전자 치료용 벡터 생산에 집중하고 있습니다.

- 대부분의 기술(43%)은 신경질환 치료용 벡터 생산에 활용되고 있으며, 종양질환 치료용(30%)이 그 뒤를 잇고 있습니다.

- 현재, 다양한 진출기업에 의해 150개에 가까운 확장이 이루어지고 있으며, 벡터 기반 세포 및 유전자 치료 분야에 대한 관심과 투자가 증가하고 있음을 알 수 있습니다.

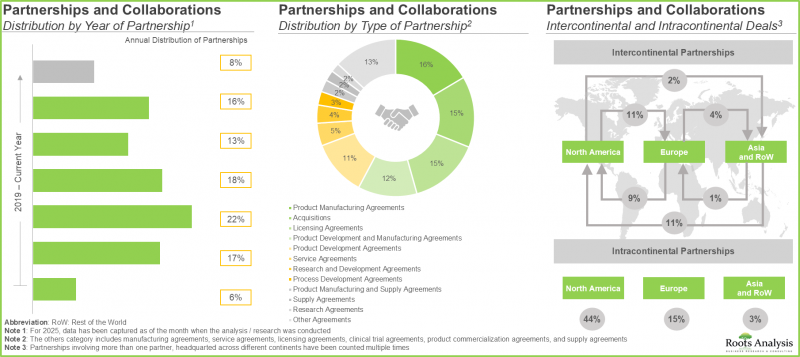

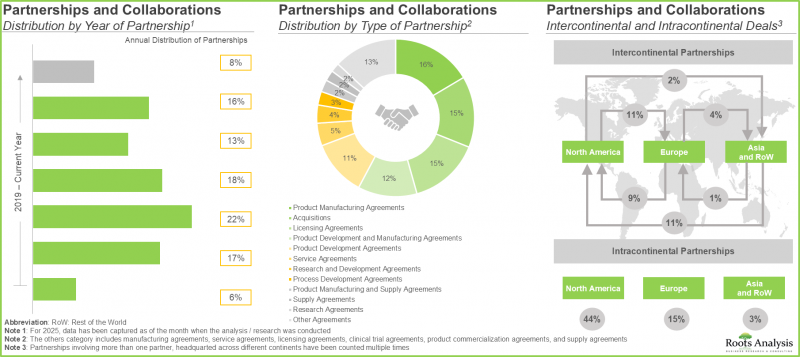

- 이 분야에 대한 관심 증가는 국내외 이해관계자들이 참여하는 최근 체결된 수많은 제휴 계약에도 반영되어 있습니다.

- 효율성을 높이고 제조 공정을 최적화하기 위해 여러 벡터 및 유전자 치료제 혁신 기업이 벡터 및 유전자 치료제 제조업체와 전략적 제휴를 맺을 것으로 예측됩니다.

- 전 세계 유전자 치료 및 벡터 생산 능력의 65% 이상이 바이러스 벡터 생산에 사용되고 있으며, 바이러스 벡터 생산 능력의 약 55%는 북미 시설에 설치되어 있습니다.

- 개발의 다양한 단계에서 평가되고 있는 여러 유형의 벡터가 있다는 점을 고려하면, 향후 10년간 이러한 벡터에 대한 수요는 크게 증가할 것으로 예측됩니다.

- 벡터 제조 분야와 관련된 전반적인 기회는 CAGR 9.87%를 보일 것으로 예측되며, 그 성장은 사업 규모, 벡터 유형, 지역적 지역에 따라 다양하게 분산될 것으로 예측됩니다.

- 장기적으로는 60% 이상 시장 점유율을 차지하고 있는 종양 질환에 대한 벡터 기반 치료제가 이 시장의 성장을 촉진할 것으로 예측됩니다.

바이러스 벡터 및 플라스미드 DNA 제조 시장 - 주요 부문

임상 부문이 바이러스 벡터 및 플라스미드 DNA 제조 시장에서 가장 큰 매출 점유율을 차지하고 있습니다.

본 시장은 전임상, 임상, 상업 등 다양한 사업 규모로 분류됩니다. 바이러스 벡터 및 플라스미드 DNA 생산 시장 분석에 따르면 올해 임상 부문이 더 높은 시장 점유율(50%)을 차지했습니다. 이는 현재 진행 중인 수많은 유전자 및 세포치료제 임상시험의 높은 수요에 기인합니다. 특히 상업 단계 부문은 예측 기간 중 13%의 연평균 복합 성장률(CAGR)로 상당한 성장률을 보일 것으로 예측됩니다. 이는 세포-유전자치료 분야의 발전으로 대부분의 치료법이 후기 개발 단계에 있으며, 단기간에 시장 진입이 가능할 것으로 예상되기 때문입니다.

렌티 바이러스 벡터 부문이 바이러스 벡터 및 플라스미드 DNA 제조 시장에서 가장 큰 점유율을 차지함.

생산되는 벡터 유형별로 전체 시장은 AAV 벡터, 아데노바이러스 벡터, 렌티바이러스 벡터, 레트로바이러스 벡터, 비바이러스 벡터, 기타 벡터로 구성되어 있습니다. 올해 렌치 바이러스 벡터 부문이 25%의 높은 시장 점유율을 차지하고 있습니다. 현재 렌티 바이러스 벡터를 기반으로 한 여러 유전자 치료 및 세포 치료는 임상 개발의 후기 단계에 있습니다. 또한 예측 기간 중 AAV 벡터 시장 점유율은 CAGR 13%로 성장하여 큰 폭으로 증가할 것으로 예측됩니다. 이는 다양한 세포 유형에 대한 효율적인 형질전환과 대량의 DNA를 전달할 수 있는 능력 등 AAV 벡터가 제공하는 장점에 기인합니다.

유전자 치료는 바이러스 벡터 및 플라스미드 DNA 생산 시장의 대부분을 차지할 것으로 예측됩니다.

응용 분야별로 전체 시장은 세포치료제, 유전자치료제, 백신으로 분류됩니다. 현재 유전자 치료 분야에서 사용되는 벡터가 가장 큰 시장 점유율(49%)을 차지하고 있습니다. 이는 여러 적응증에 대해 승인된 유전자 치료제의 수가 증가함에 따라 고품질 벡터 생산에 대한 수요가 크게 증가하고 있기 때문입니다. 또한 예측 기간 중 CAGR 11%로 성장하여 세포치료제 제조에 사용되는 벡터의 점유율이 크게 증가할 것으로 예측됩니다. 이러한 추세는 현재 임상시험 단계에 있는 치료법이 증가하고 있기 때문입니다.

종양 질환 분야가 바이러스 벡터 및 플라스미드 DNA 제조 시장에서 가장 큰 점유율을 차지하고 있습니다.

바이러스 벡터 및 플라스미드 DNA 생산 시장 예측에 따르면 올해 종양 질환 치료용 벡터 기반 요법이 가장 큰 시장 점유율(47%)을 차지할 것으로 예측됩니다. 이는 전 세계에서 이 질환의 발병률이 증가하고 있기 때문입니다. 또한 안과 질환 치료를 위한 벡터 기반 요법은 예측 기간 중 31%의 연평균 복합 성장률(CAGR)을 보일 것으로 예측됩니다. 이는 안질환에 대한 세포치료제와 유전자치료제의 승인 건수가 증가하고 있기 때문입니다.

수탁제조 부문이 바이러스 벡터 및 플라스미드 DNA 생산 시장을 독점할 것으로 예측됩니다.

이 부문에서는 수탁제조, 자체 생산 등 다양한 유형의 제조업체 시장 분포를 파악할 수 있습니다. 현재 수탁제조 부문(57%)이 시장을 장악하고 있으며, 예측 기간 중 더 높은 CAGR(11%)로 성장할 것으로 예측됩니다. 이러한 추세는 수탁제조(CMO)이 확장성과 유연성을 제공함으로써 변화하는 제조 수요에 신속하게 대응하고 증가하는 생산 수요를 처리할 수 있는 능력에 기인합니다.

아시아태평양 및 중동 및 북아프리카이 바이러스 벡터 및 플라스미드 DNA 제조 시장 성장을 주도할 것으로 전망됩니다.

현재 북미(54%)가 가장 큰 시장 점유율을 차지하고 있습니다. 이는 북미의 첨단화된 의료 시스템과 연구 환경 덕분입니다. 한편, 아시아태평양 및 중동 및 북아프리카 시장은 예측 기간 중 각각 11%의 비교적 높은 CAGR로 확대될 것으로 예측됩니다. 이는 신경질환, 유전질환, 희귀질환 등 만성질환의 유병률 증가와 효율적이고 고도화된 치료법에 대한 수요 증가에 기인합니다.

바이러스 벡터 및 플라스미드 DNA 제조 시장의 대표적인 진출기업

- Advanced BioScience Laboratories

- AGC Biologics

- Aldevron

- Celonic

- Catalent Biologics

- Charles River Laboratories

- Novartis

- Oxford BioMedica

바이러스 벡터 및 플라스미드 DNA 제조 시장 - 조사 범위

- 시장 규모 및 기회 분석 : 이 보고서는 바이러스 벡터 및 플라스미드 DNA 생산 시장에 대해(A) 사업 규모,(B) 생산 벡터 유형,(C) 응용 분야,(D) 치료 분야,(E) 제조업체 유형,(F) 지역적 지역 등 주요 시장 부문에 초점을 맞춘 상세한 분석 정보를 제공합니다. 분석이 수록되어 있습니다.

- 시장 상황 1:(A) 설립 연도,(B) 기업 규모,(C) 본사 소재지,(D) 제조 제품 유형,(E) 제조 시설 위치,(F) 제조업체 유형,(G) 사업 규모,(H) 응용 분야 등 여러 관련 매개 변수를 기반으로 한 바이러스 벡터 및 플라스미드 DNA 제조 시장에 대한 상세한 평가.

- 시장 상황 2: 플라스미드 DNA 및 유전자치료제 제조 산업 진출기업에 대해(A) 설립연도,(B) 기업 규모,(C) 본사 소재지,(D) 제조 제품 유형,(E) 사업 규모,(F) 응용 분야 등 여러 관련 매개 변수를 기반으로 한 상세 평가.

- 시장 상황 3: 바이러스성, 비바이러스성 및 기타 신규 벡터 및 유전자 치료제 제조에 종사하는 비산업계 진입기업에 대한 상세한 평가. 관련 매개 변수를 기반으로(A) 설립 연도,(B) 벡터 제조 시설 위치,(C) 제조업체 유형,(D) 사업 규모,(E) 제조 벡터 유형,(F) 응용 분야.

- 기술 동향 : 본 시장에 진출한 기업이 제공/개발하는 기술에 대해(A) 기술 유형,(B) 기술 목적,(C) 규모,(D) 벡터 유형,(E) 적용 분야를 기준으로 상세하게 분석합니다.

- 기업 경쟁력 분석 : 벡터 및 유전자 치료제 제조에 종사하는 주요 기업에 대한 종합적인 경쟁력 분석. 구체적으로(A) 공급력,(B) 제조력,(C) 서비스력 등의 요소를 검증합니다.

- 기업 개요: 북미, 유럽, 아시아태평양에 기반을 둔 바이러스 벡터 및 플라스미드 DNA 제조 시장에 현재 참여하고 있는 주요 기업의 상세한 프로파일. 특히(A) 설립연도,(B) 본사 소재지,(C) 제품 포트폴리오,(D) 제조시설,(E) 최근 동향,(F) 미래 전망에 초점을 맞추었습니다.

- 제휴/협력관계: 유전자치료, 비바이러스 벡터 및 바이러스 벡터 제조 시장에서 구축된 제휴/협력관계에 대해(A)제휴 시작연도,(B)제휴 형태,(C)제휴처 유형,(D)가장 활발한 진출기업 등 다양한 관련 파라미터를 기반으로 한 인사이트 분석을 제공합니다.

- 최근 확장: 바이러스 벡터 및 비바이러스 벡터 제조 관련 각 기업의 역량 강화를 위한 최근 확장에 대해(A) 확장 시행 연도,(B) 확장 유형,(C) 벡터 유형,(D) 응용 분야,(E) 확장 지역 등 여러 매개 변수를 기준으로 분석합니다.

- 전략적 파트너 분석 : 벡터 및 유전자치료제 제조업체의 잠재적 전략적 파트너(벡터 기반 치료제 개발 기업과 벡터 정제 제품 개발 기업 비교)를(A) 개발 기업의 강점,(B) 제품 강점,(C) 벡터 유형,(D) 치료 영역,(E) 파이프라인 강점 등 여러 가지 매개변수로 평가 등 여러 매개변수를 기반으로 평가하는 인사이트 분석.

- 신흥 벡터: 유전자 변형을 수반하는 치료제 개발을 위해 현재 연구 중인 다른 바이러스성/비바이러스성 유전자 도입 접근법의 신흥 동향에 대해 자세히 살펴봅니다.

- 주요 인사이트: 플라스미드 DNA 및 바이러스 벡터 제조 분야의 현대 시장 동향을 관련 매개 변수(벡터 유형, 사업 규모, 제조업체 유형),(벡터 유형 및 조직 유형),(본사 위치 및 주요 벡터 제조 기지의 지역적 위치)를 기반으로 강조된 인사이트으로 풍부한 분석.

- 원가 분석 : 벡터 가격 책정에 영향을 미칠 수 있는 다양한 요인을 분석하고, 제품 개발자/제조업체가 벡터 가격을 결정할 때 채택할 수 있는 다양한 모델/접근법을 특성화합니다.

- GO/NO-GO 분석 프레임워크: 바이러스성 및 비바이러스성 벡터 제조기업이 자사 제품을 자체 생산할 것인지, CMO(수탁제조기관)의 서비스를 이용할 것인지를 결정할 때 고려해야 할 다양한 요인을 강조한 인사이트 있는 GO/NO-GO 분석 프레임워크입니다.

- Portre's Five Forces 분석 : 유전자 치료, 비바이러스성 벡터, 바이러스성 벡터 제조 시장에 존재하는 5가지 경쟁 요인을 정성적으로 분석합니다. 구체적으로는(A) 신규 시장 진출기업의 위협,(B) 의약품 개발자의 협상력,(C) 벡터 및 유전자치료제 제조업체의 협상력,(D) 대체기술의 위협,(E) 기존 경쟁사 간 경쟁압력 등이 있습니다.

- 생산능력 분석 : 공개된 정보 및 1차 및 2차 조사를 통해 얻은 지식을 바탕으로 업계 관계자의 벡터 제조 설비의 총 설치 용량을 추정합니다. 본 분석에서는 기업 규모(소형, 중형, 대형), 본사 소재지(지역별: 북미, 유럽, 아시아태평양, 기타 지역), 제조시설 소재지별 세계 생산능력 분포도 확인할 수 있습니다.

- 수요 분석 : 바이러스성 및 비바이러스성 벡터에 대한 현재 및 미래 수요를 추정하기 위한 상세한 분석입니다. 여기에는(A) 대상 환자군,(B) 투여 빈도,(C) 투여 강도 등 다양한 관련 파라미터를 기반으로 시판 중인 유전자치료제 및 벡터 기반 치료제를 평가하는 임상시험이 포함됩니다.

- 시장 영향 분석 : 유전자 치료제, 비바이러스성 벡터, 바이러스성 벡터 제조 시장의 성장에 영향을 미칠 수 있는 요인에 대한 상세한 분석입니다. 또한(A) 주요 촉진요인,(B) 잠재적 제약 요인,(C) 새로운 기회,(D) 기존 과제 파악 및 분석도 포함됩니다.

목차

제1장 서문

제2장 조사 방법

제3장 시장 역학

제4장 거시경제 지표

- 챕터 개요

- 시장 역학

제5장 개요

제6장 서론

- 챕터 개요

- 바이러스성 및 비바이러스성 유전자 도입 기술

- 유전자변형 치료에 사용되는 바이러스 벡터

- 바이러스 벡터 유형

- 비바이러스 벡터 유형

- 비바이러스 벡터를 이용한 유전자 전달

- 바이러스 벡터와 비바이러스 벡터의 응용

- 벡터 개발·제조에서 현재의 동향

- 벡터 제조

- 향후 전망

제7장 바이러스 벡터 제조업체(업계 참여 기업) : 시장 구도

- 챕터 개요

- 바이러스 벡터 및 유전자 치료 제조업체 : 시장 구도

제8장 플라스미드 DNA 제조업체(업계 참여 기업) : 시장 구도

- 챕터 개요

- 플라스미드 DNA 및 유전자 치료 제조업체 : 시장 구도

제9장 바이러스 벡터 및 플라스미드 DNA 제조업체(비명계 참여 기업) : 시장 구도

- 챕터 개요

- 바이러스 벡터 및 플라스미드 DNA 제조업체(비명계 참여 기업) : 시장 구도

제10장 벡터 제조 기술의 전망

제11장 기업 경쟁력 분석

- 챕터 개요

- 조사 방법과 주요 파라미터

- 바이러스 벡터 제조업체 : 기업 경쟁력 분석

- 플라스미드 DNA 제조업체 : 기업 경쟁력 분석

제12장 북미에 기반을 둔 벡터 제조업체

- 챕터 개요

- 주요 참여 기업

- Advanced BioScience Laboratories

- Catalent Biologics

- Charles River Laboratories

- Thermo Fisher Scientific

- VectorBuilder

- 기타 주요 참여 기업

- AGC Biologics

- Aldevron

- Matica Biotechnology

- Resilience

제13장 유럽에 기반을 둔 벡터 제조업체

- 챕터 개요

- 주요 참여 기업

- Lonza

- Touchlight

- 기타 주요 참여 기업

- BioNTech Innovative Manufacturing Service(a subsidiary of BioNTech)

- Biovian

- Celonic

- Centre for Process Innovation

- CEVEC Pharmaceuticals

- NorthX Biologics

- Novartis

- Oxford BioMedica

- Sanofi

제14장 아시아태평양에 기반을 둔 벡터 제조업체

제15장 아시아태평양의 벡터 제조업체

- 챕터 개요

- 주요 참여 기업

- CoJourney

- Esco Aster

- Wuxi AppTec

- 기타 주요 참여 기업

- Altruist Biotechnology

- Jiangsu Puxin Biopharmaceutical

- Nikon CeLL innovation

제16장 Porter's Five Forces 분석

- 챕터 개요

- 조사 방법과 전제

- 주요 파라미터

- 결론

제17장 파트너십과 협업

제18장 최근 확장

- 챕터 개요

- 확장 유형

- 벡터 제조 : 최근 확장

제19장 전략적 파트너 분석

제20장 신규 벡터

제21장 중요 인사이트

제22장 원가분석

- 챕터 개요

- 바이러스 벡터 및 플라스미드 DNA 기반 치료의 고가격에 기여하는 요인

- 바이러스 벡터 및 플라스미드 DNA 기반 치료법 : 가격 모델

- 결론

제23장 아웃소싱 : GO/NO-GO 프레임워크

제24장 용량 분석

제25장 수요 분석

- 챕터 개요

- 전제와 조사 방법

- 2035년까지 바이러스 벡터와 플라스미드 DNA의 세계 수요

- 2035년까지 바이러스 벡터 및 플라스미드 DNA의 세계 임상 수요

- 2035년까지 바이러스 벡터와 플라스미드 DNA의 세계 상업 수요

- 수요와 공급 분석

제26장 시장 영향 분석 : 촉진요인, 억제요인, 기회, 과제

제27장 세계의 벡터 제조 시장

제28장 벡터 제조업 시장(사업 규모별)

제29장 벡터 제조 시장(제조 벡터 유형별)

제30장 벡터 제조 시장(응용 분야별)

제31장 벡터 제조 시장(치료 영역별)

제32장 벡터 제조 시장(제조업체별)

제33장 벡터 제조업 시장(지역별)

제34장 시장 기회 분석 : 북미

제35장 시장 기회 분석 : 유럽

제36장 시장 기회 분석 : 아시아태평양

제37장 시장 기회 분석 : 중동·북아프리카

제38장 시장 기회 분석 : 라틴아메리카

제39장 조사 분석

제40장 결론

제41장 이그제큐티브 인사이트

제42장 부록 I : 표 데이터

제43장 부록 II : 기업 및 조직 리스트

KSA 25.12.29Viral Vector and Plasmid DNA Manufacturing Market

As per Roots Analysis, the global viral vector and plasmid DNA manufacturing market is estimated to grow from USD 843 million in the current year to USD 2,161 million by 2035, at a CAGR of 9.87% during the forecast period, till 2035.

Viral Vector and Plasmid DNA Manufacturing Market

The market sizing and opportunity analysis has been segmented across the following parameters:

Scale of Operation

- Preclinical

- Clinical

- Commercial

Application Area

- Cell Therapies

- Gene Therapies

- Vaccines

Type of Vector Manufactured

- AAV Vectors

- Adenoviral Vectors

- Lentiviral Vectors

- Retroviral Vectors

- Non-viral Vectors

- Other Vectors

Therapeutic Area

- Oncological Disorders

- Rare Disorders

- Immunological Disorders

- Neurological Disorders

- Sensory Disorders

- Metabolic Disorders

- Blood Disorders

- Musculoskeletal Disorders

- Infectious Diseases

- Ophthalmic Disorders

- Other Disorders

Type of Manufacturer

- In-house Manufacturers

- Contract Manufacturing Organizations

Geographical Regions

- North America

- Europe

- Asia-Pacific

- Middle East and North Africa

- Latin America

Viral Vector and Plasmid DNA Manufacturing Market: Growth and Trends

Viral and non-viral vectors have become essential instruments for transferring genetic material into target cells, constituting the foundation of contemporary cell and gene therapies. In recent years,, approximately 30 therapies utilizing viral vectors have gained global regulatory approval, with more than 500 candidates currently in clinical trials in the US. The increase in approvals and continuing research has driven the need for extensive viral vector production. Nonetheless, this field encounters numerous challenges, such as risks of immunogenicity and the intricate character of viral vector analysis. To address these challenges, developers are progressively investigating the possibilities of non-viral vectors as more secure and scalable options.

To satisfy the increasing need for vectors, the sector has launched various process improvements. Interestingly, Corning Life Sciences has created high-density cell culture systems, such as HYPERStack and CellSTACKs, which utilize gas-permeable film technology to improve vector yields. The firm has additionally launched automation systems to enhance workflows, decrease manual involvement, and speed up production schedules. These advancements in technology have generated momentum for more efficient, reliable, and economical vector production globally.

Currently, more than 300 players from both industry and non-industry sectors worldwide are engaged in efforts to back the growing pipeline of cell therapies, gene therapies, and vector-based vaccines, according to the viral vectors and plasmid DNA manufacturing market report. The expansion in this sector is additionally driven by investments, strategic partnerships, and facility expansions, demonstrating a solid dedication to addressing production challenges. These advancements indicate that manufacturing for both viral and non-viral vectors is set for significant growth, positioning them as essential contributors to the upcoming wave of genetic therapies.

Viral Vector and Plasmid DNA Manufacturing Market: Key Insights

The report delves into the current state of the global viral vector and plasmid DNA manufacturing market and identifies potential growth opportunities within industry. Some key findings from the report include:

- Presently, over 130 industry players claim to have the necessary capabilities to manufacture different types of viral vectors for in-house requirements and / or contract service engagements.

- The current viral vector manufacturing market landscape features the presence of around 70% contract manufacturers; among these, about 20% players have capability to manufacture all types of viral vectors.

- Close to 50% of the companies in this domain have the capability to operate across all three scales of operation, namely preclinical, clinical and commercial.

- We have mapped the locations of facilities established by different vector manufacturers worldwide; notably, Europe emerged as the prominent viral and non-viral vector manufacturing hub.

- Around 85% of the non-industry players are engaged in the manufacturing of AAV vectors; further, close to 80% of the organizations are focused on manufacturing vectors for gene therapy applications.

- Majority (43%) of the technologies are being utilized for manufacturing vectors that can be used for the treatment of neurological disorders, followed by oncological disorders (30%).

- Presently, close to 150 expansions have been undertaken by various players, underscoring the growing interest and investment in the vector-based cell and gene therapy domain.

- The rising interest in this domain is also reflected by the number of partnerships that have been inked in the recent past, involving both international and local stakeholders.

- In order to increase efficiency and optimize the manufacturing processes, several vector and gene therapy innovators are anticipated to forge strategic alliances with vector and gene therapy manufacturers.

- Over 65% of the global installed gene therapy and vector manufacturing capacity is dedicated to viral vector manufacturing; ~55% of viral vector manufacturing capacity is installed in the facilities located in North America.

- Given that there are several types of vectors being evaluated across various stages of development, the demand for such vectors is anticipated to rise significantly over the next decade.

- The overall opportunity associated with vector manufacturing domain is anticipated to grow at the CAGR of 9.87%; it is likely to be well distributed across different, scales of operation, types of vectors and geographical regions.

- Over the long term, vector-based therapies for oncological disorders, which hold more than 60% market share are expected to drive the growth of this market.

Viral Vector and Plasmid DNA Manufacturing Market: Key Segments

Clinical Segment Occupies the Highest Revenue Share in the Viral Vector and Plasmid DNA Manufacturing Market

The market is segmented across various scales of operation such as preclinical, clinical and commercial. As per viral vector and plasmid DNA manufacturing market analysis, in the current year, the clinical segment occupies the higher market share (50%). This is a result of the high demand from numerous ongoing gene and cell therapy clinical trials. It is worth mentioning that the commercial stage segment is likely to witness a significant growth rate with a CAGR of 13% during the forecast period. This results from the advancing cell and gene therapy field, where the majority of therapies are in later development stages and are expected to enter the market in short-term.

Lentiviral Vector Segment Holds the Largest Viral Vector and Plasmid DNA Manufacturing Market Share

In terms of the type of vector manufactured, the overall market includes AAV vectors, adenoviral vectors, lentiviral vectors, retroviral vectors, non-viral vectors and other vectors. In the current year, lentiviral vector segment occupies the higher market share (25%). Several lentiviral vector based gene therapies and cell therapies are currently in the late stage of clinical development. Further, the market is likely to witness a substantial increase in the share of AAV vectors market share, growing at a CAGR of 13% during the forecast period. This is ascribed to advantages offered by AAV vectors, such as efficient transduction of various cell types and their ability to deliver large amounts of DNA.

Gene Therapy is Likely to Capture Majority of the Viral Vector and Plasmid DNA Manufacturing Market Share

Based on application area, the overall marker includes cell therapy, gene therapy and vaccine. Currently, vectors that are used in gene therapy segments occupy the highest market share (49%). This is due to the rising number of approved gene therapies for multiple indications, which has substantially increased the demand for high-quality vector production. Further, the market is likely to witness a substantial increase in the share of vectors that are used for cell therapy manufacturing, growing at a CAGR of 11% during the forecast period. This trend is due to an increasing number of therapies that are currently in clinical trials.

Oncological Disorders Segment Holds the Largest Viral Vector and Plasmid DNA Manufacturing Market Share

As per viral vector and plasmid DNA manufacturing market forecast, in the current year, vector-based therapies for the treatment of oncological disorders occupy the highest market share (47%), due to the growing incidence of such disorders across the globe. Further, vector-based therapies for the treatment of ophthalmic disorders are likely to grow at a CAGR of 31% during the forecast period. This is because of the growing number of approvals for cell and gene therapies for eye disorders.

Contract Manufacturing Segment is Likely to Dominate the Viral Vector and Plasmid DNA Manufacturing Market

This segment highlights the distribution of market across various types of manufacturers, such as contract manufacturing and in-house manufacturing. Currently, contract manufacturer segment (57%) is likely to dominate the market and is expected to grow at a higher CAGR (11%) during the forecast period. This trend arises from the ability of CMOs to provide scalability and flexibility, allowing them to quickly adjust to evolving manufacturing needs and handle increasing production demands.

Asia-Pacific and Middle East and North Africa is Likely to Propel the Growth of the Viral Vector and Plasmid DNA Manufacturing Market

Currently, North America (54%) captures the highest market share. This results from the developed healthcare system and research environment in North America. In contrast, the Asia-Pacific, and Middle East and North Africa markets are expected to expand at a comparatively higher CAGR of 11% each, during the forecast period. This is attributed to the growing prevalence of chronic conditions such as neurological conditions, genetic conditions, and rare illnesses and the heightened need for efficient and sophisticated treatments.

Primary Research Overview

Discussions with multiple stakeholders in this domain influenced the opinions and insights presented in this study. The market report includes transcripts of the following other third-party discussions:

- Chief Executive Officer, mid-sized company, Netherlands

- Chief Executive Officer and Chief Scientific Officer, small company, Germany

- Former Executive and Scientific Director, small company, Belgium

- Co-Founder and President, mid-sized company, France

- Former Director, Netherlands-based company

- Director, Massachusetts-based organization

- Former Scientific Director, France-based organization

- Former Managing Director, small company, Japan

- Scientific Director, small company, US

- Key Account Management, mid-sized company, Germany

- Head of Project Management, small company, Germany

- Director of Business Development, small company, US

- ATMP Key Account Manager, France-based organization

- Chief Scientific Officer, small company, France

- Director of Marketing and Technical Support, mid-sized company, France

- Head of Communications, mid-sized company, Spain

- Independent Consultant

Example Players in the Viral Vector and Plasmid DNA Manufacturing Market

- Advanced BioScience Laboratories

- AGC Biologics

- Aldevron

- Celonic

- Catalent Biologics

- Charles River Laboratories

- Novartis

- Oxford BioMedica

Viral Vector and Plasmid DNA Manufacturing Market: Research Coverage

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the viral vector and plasmid DNA manufacturing market, focusing on key market segments, including [A] scale of operation, [B] type of vector manufactured, [C] application area, [D] therapeutic area, [E] type of manufacturer and [F] geographical regions.

- Market Landscape 1: A detailed assessment of the viral vector and plasmid DNA manufacturing market based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] type of product manufactured, [E] location of manufacturing facility, [F] type of manufacturer, [G] scale of operation, and [H] application area.

- Market Landscape 2: A detailed assessment of the industry players engaged in manufacturing plasmid DNA and gene therapies based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] type of product manufactured, [E] scale of operation, and [F] application area.

- Market Landscape 3: A detailed assessment of the non-industry players engaged in the manufacturing of viral, non viral and other novel types of vectors and gene therapies, based on relevant parameters such as [A] year of establishment, [B] location of vector manufacturing facility, [C] type of manufacturer, [D] scale of operation, [E] type of vector manufactured and [F] application area.

- Technology Landscape: An in-depth analysis of the technologies offered / developed by the companies engaged in this market, based on the [A] type of technology, [B] purpose of technology, [C] scale of, [D] type of vector, and [E] application area.

- Company Competitiveness Analysis: A comprehensive competitive analysis of key players engaged in manufacturing vectors and gene therapies, examining factors, such as [A] supplier strength [B] manufacturing strength and [C] service strength.

- Company Profiles: In-depth profiles of prominent players based in regions, namely North America, Europe and Asia-Pacific that are currently involved in the viral vector and plasmid DNA manufacturing market, focusing on [A] year of establishment, [B] location of headquarters, [C] product portfolio, [D] manufacturing facilities, [E] recent developments and [F] an informed future outlook.

- Partnerships and Collaborations An insightful analysis of the partnerships and collaborations established in gene therapy, non viral vector and viral vector manufacturing market based on various relevant parameters, including [A] year of partnership, [B] type of partnership, [C] type of partner and [D] most active players.

- Recent Expansions: An analysis of the recent expansions undertaken by various companies in order to augment their respective capabilities related to viral vector and non viral vector manufacturing, based on several parameters, such as [A] year of expansion, [B] type of expansion, [C] type of vector, [D] application area and [E] geographical location of the expansion.

- Strategic Partner Analysis: An insightful analysis evaluating the potential strategic partners (comparing vector based therapy developers and vector purification product developers) for vector and gene therapy product manufacturers, based on several parameters, such as [A] developer strength, [B] product strength, [C] type of vector, [D] therapeutic area and [E] pipeline strength.

- Emerging Vectors: An elaborate discussion on the emerging trends of other viral / non viral gene delivery approaches that are currently in research for the development of therapies involving genetic modification.

- Key Insights: An insightful analysis, highlighting the contemporary market trends in the plasmid DNA and viral vector manufacturing domain, based on relevant parameters, such as (type of vector, scale of operation and type of manufacturer), (type of vector and type of organization) and (location of headquarters and geographical location of key vector manufacturing hubs).

- Cost Price Analysis: An analysis of various factors that are likely to influence the pricing of vectors, featuring different models / approaches that may be adopted by product developers / manufacturers in order to decide the prices of their proprietary vectors.

- Go / No-Go Framework Analysis: An insightful go / no-go framework analysis, highlighting various factors that needs to be considered by viral vector and non viral vector manufacturing companies while deciding whether to manufacture their respective products in-house or engage the services of a CMO.

- Porter's Five Forces Analysis: A qualitative analysis, highlighting the five competitive forces prevalent in gene therapy, non viral vector and viral vector manufacturing market, including [A] threats for new entrants, [B] bargaining power of drug developers, [C] bargaining power of vector and gene therapy manufacturers, [D] threats of substitute technologies and [E] rivalry among existing competitors.

- Capacity Analysis: An estimate of the overall, installed vector manufacturing capacity of industry players based on the information available in the public domain, and insights generated from both secondary and primary research. The analysis also highlights the distribution of global capacity by company size (small, mid-sized and large), location of headquarters (region) (North America, Europe, Asia Pacific and the rest of the world) and location of manufacturing facility.

- Demand Analysis: An in-depth analysis to estimate the current and future demand for viral vectors and non viral vectors, taking into consideration the marketed gene therapies and clinical studies evaluating vector-based therapies, based on various relevant parameters, such as [A] target patient population, [B] dosing frequency and [C] dose strength.

- Market Impact Analysis: An in-depth analysis of the factors that can impact the growth of gene therapy, non viral vector and viral vector manufacturing market. It also features identification and analysis of [A] key drivers, [B] potential restraints, [C] emerging opportunities, and [D] existing challenges.

Key Questions Answered in this Report

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What is the current global capacity of developers?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Key Market Insights

- 1.3. Scope of the Report

- 1.4. Key Questions Answered

- 1.5. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.2.1. Market Landscape and Market Trends

- 2.2.2. Market Forecast and Opportunity Analysis

- 2.2.3. Comparative Analysis

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Types of Primary Research

- 2.4.2.1.1. Qualitative Research

- 2.4.2.1.2. Quantitative Research

- 2.4.2.1.3. Hybrid Approach

- 2.4.2.2. Advantages of Primary Research

- 2.4.2.3. Techniques for Primary Research

- 2.4.2.3.1. Interviews

- 2.4.2.3.2. Surveys

- 2.4.2.3.3. Focus Groups

- 2.4.2.3.4. Observational Research

- 2.4.2.3.5. Social Media Interactions

- 2.4.2.4. Key Opinion Leaders Considered in Primary Research

- 2.4.2.4.1. Company Executives (CXOs)

- 2.4.2.4.2. Board of Directors

- 2.4.2.4.3. Company Presidents and Vice Presidents

- 2.4.2.4.4. Research and Development Heads

- 2.4.2.4.5. Technical Experts

- 2.4.2.4.6. Subject Matter Experts

- 2.4.2.4.7. Scientists

- 2.4.2.4.8. Doctors and Other Healthcare Providers

- 2.4.2.5. Ethics and Integrity

- 2.4.2.5.1. Research Ethics

- 2.4.2.5.2. Data Integrity

- 2.4.2.1. Types of Primary Research

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

- 2.5. Robust Quality Control

3. MARKET DYNAMICS

- 3.1. Chapter Overview

- 3.2. Forecast Methodology

- 3.2.1. Top-down Approach

- 3.2.2. Bottom-up Approach

- 3.2.3. Hybrid Approach

- 3.3. Market Assessment Framework

- 3.3.1. Total Addressable Market (TAM)

- 3.3.2. Serviceable Addressable Market (SAM)

- 3.3.3. Serviceable Obtainable Market (SOM)

- 3.3.4. Currently Acquired Market (CAM)

- 3.4. Forecasting Tools and Techniques

- 3.4.1. Qualitative Forecasting

- 3.4.2. Correlation

- 3.4.3. Regression

- 3.4.4. Extrapolation

- 3.4.5. Convergence

- 3.4.6. Sensitivity Analysis

- 3.4.7. Scenario Planning

- 3.4.8. Data Visualization

- 3.4.9. Time Series Analysis

- 3.4.10. Forecast Error Analysis

- 3.5. Key Considerations

- 3.5.1. Demographics

- 3.5.2. Government Regulations

- 3.5.3. Reimbursement Scenarios

- 3.5.4. Market Access

- 3.5.5. Supply Chain

- 3.5.6. Industry Consolidation

- 3.5.7. Pandemic / Unforeseen Disruptions Impact

- 3.6. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Major Currencies Affecting the Market

- 4.2.2.2. Factors Affecting Currency Fluctuations

- 4.2.2.3. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Currency Exchange Rate

- 4.2.3.1. Impact of Foreign Exchange Rate Volatility on the Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.4.2. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.8.3. Trade Policies

- 4.2.8.4. Strategies for Mitigating the Risks Associated with Trade Barriers

- 4.2.8.5. Impact of Trade Barriers on the Market

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. Stock Market Performance

- 4.2.11.7. Cross Border Dynamics

- 4.2.1. Time Period

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Viral and Non-Viral Gene Transfer Techniques

- 6.3. Viral Vectors Used in Genetically Modified Therapies

- 6.4. Types of Viral Vectors

- 6.4.1. Adeno-associated Viral Vectors

- 6.4.1.1. Overview

- 6.4.1.2. Design and Manufacturing

- 6.4.1.3. Advantages

- 6.4.1.4. Limitations

- 6.4.2. Adenoviral Vectors

- 6.4.2.1. Overview

- 6.4.2.2. Design and Manufacturing

- 6.4.2.3. Advantages

- 6.4.2.4. Limitations

- 6.4.3. Lentiviral Vectors

- 6.4.3.1. Overview

- 6.4.3.2. Design and Manufacturing

- 6.4.3.3. Advantages

- 6.4.3.4. Limitations

- 6.4.4. Retroviral Vectors

- 6.4.4.1. Overview

- 6.4.4.2. Design and Manufacturing

- 6.4.4.3. Advantages

- 6.4.4.4. Limitations

- 6.4.5. Other Viral Vectors

- 6.4.5.1. Alphavirus

- 6.4.5.2. Foamy Virus

- 6.4.5.3. Herpes Simplex Virus

- 6.4.5.4. Sendai Virus

- 6.4.5.5. Simian Virus

- 6.4.5.6. Vaccinia Virus

- 6.4.5.7. Chimeric Viral Vectors

- 6.4.1. Adeno-associated Viral Vectors

- 6.5. Types of Non-Viral Vectors

- 6.5.1. Plasmid DNA

- 6.5.2. Liposomes, Lipoplexes and Polyplexes

- 6.5.3. Oligonucleotides

- 6.5.4. Other Non-Viral Vectors

- 6.6. Gene Delivery using Non-Viral Vectors

- 6.6.1. Biolistic Methods

- 6.6.2. Electroporation

- 6.6.3. Receptor Mediated Gene Delivery

- 6.6.4. Gene Activated Matrix (GAM)

- 6.7. Applications of Viral and Non-Viral Vectors

- 6.7.1. Cell and Gene Therapy

- 6.7.2. Vaccine

- 6.8. Current / Ongoing Trends in Vector Development / Manufacturing

- 6.8.1. Vector Engineering

- 6.8.2. Cargo Engineering

- 6.9. Vector Manufacturing

- 6.9.1. Types of Vector Manufacturers

- 6.9.2. Viral Vector Manufacturing Processes

- 6.9.2.1. Vector Production

- 6.9.2.2. Adherent and Suspension Cultures

- 6.9.2.3. Unit Process Versus Multiple Parallel Processes

- 6.9.2.4. Cell Culture Systems for Production of Viral Vectors

- 6.9.2.4.1. Small Scale / Laboratory Scale Cell Culture Systems

- 6.9.2.4.2. Large Scale Cell Culture Systems

- 6.9.2.4.2.1. Stirred Tank Reactor Systems

- 6.9.2.4.2.2. Fixed Bed Reactors / Packed Bed Reactors

- 6.9.2.4.2.3. Wave Bioreactor Systems

- 6.9.2.5. Serum-Containing versus Serum-Free Media

- 6.9.3. Bioprocessing of Viral Vectors

- 6.9.3.1. AAV Vector Production

- 6.9.3.2. Adenoviral Vector Production

- 6.9.3.3. Lentiviral Vector Production

- 6.9.3.4. Y -Retroviral Vector Production

- 6.9.4. Key Challenges Associated with Vector Manufacturing

- 6.10. Future Perspectives

7. VIRAL VECTOR MANUFACTURERS (INDUSTRY PLAYERS): MARKET LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Viral Vector and Gene Therapy Manufacturers: Overall Market Landscape

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Location of Headquarters

- 7.2.4. Analysis by Type of Product Manufactured

- 7.2.5. Analysis by Type of Manufacturer

- 7.2.6. Analysis by Scale of Operation

- 7.2.7. Analysis by Type of Viral Vector Manufactured

- 7.2.8. Analysis by Application Area

8. PLASMID DNA MANUFACTURERS (INDUSTRY PLAYERS): MARKET LANDSCAPE

- 8.1. Chapter Overview

- 8.2. Plasmid DNA and Gene Therapy Manufacturers: Overall Market Landscape

- 8.2.1. Analysis by Year of Establishment

- 8.2.2. Analysis by Company Size

- 8.2.3. Analysis by Location of Headquarters

- 8.2.4. Analysis by Type of Company

- 8.2.5. Analysis by Type of Venture

- 8.2.6. Analysis by Type of Services Offered

- 8.2.7. Analysis by Type of Plasmid DNA Manufactured

- 8.2.8. Analysis by Grade of Plasmid DNA Manufactured

- 8.2.9. Analysis by Cell Bank

- 8.2.10. Analysis by Scale of Operation

- 8.2.11. Analysis by Application Area

- 8.2.12. Analysis by Viral Vector Used

- 8.2.13. Analysis by Type of Vaccine Developed

- 8.2.14. Analysis by Number of Facilities

9. VIRAL VECTOR AND PLASMID DNA MANUFACTURERS (NON-INDUSTRY PLAYERS): MARKET LANDSCAPE

- 9.1. Chapter Overview

- 9.2. Viral Vector and Plasmid DNA Manufacturers (Non-Industry Players): Overall Market Landscape

- 9.2.1. Analysis by Year of Establishment

- 9.2.2. Analysis by Company Size

- 9.2.3. Analysis by Location of Headquarters

- 9.2.4. Analysis by Type of Vector

- 9.2.5. Analysis by Scale of Operation

- 9.2.6. Analysis by Type of Manufacturer

- 9.2.7. Analysis by Application Area

10. VECTOR MANUFACTURING TECHNOLOGIES LANDSCAPE

- 10.1. Chapter Overview

- 10.2. Vector Manufacturing Technologies: Overall Market Landscape

- 10.2.1. Analysis by Type of Technology

- 10.2.2. Analysis by Purpose of Technology

- 10.2.3. Analysis by Scale of Operation

- 10.2.4. Analysis by Type of Vector

- 10.2.5. Analysis by Application Area

- 10.2.6. Most Active Players: Analysis by Number of Technologies

11. COMPANY COOMPETITIVENESS ANALYSIS

- 11.1. Chapter Overview

- 11.2. Methodology and Key Parameters

- 11.3. Viral Vector Manufacturers: Company Competitiveness Analysis

- 11.3.1. Players based in North America

- 11.3.2. Players based in Europe

- 11.3.3. Players based in Asia-Pacific and Rest of the World

- 11.4. Plasmid DNA Manufacturers: Company Competitiveness Analysis

- 11.4.1. Players based in North America

- 11.4.2. Players based in Europe

- 11.4.3. Players based in Asia-Pacific and Rest of the World

12. VECTOR MANUFACTURERS BASED IN NORTH AMERICA

- 12.1. Chapter Overview

- 12.2. Key Players

- 12.2.1. Advanced BioScience Laboratories

- 12.2.1.1. Company Overview

- 12.2.1.2. Vector Manufacturing Portfolio

- 12.2.1.3. Recent Developments and Future Outlook

- 12.2.2. Catalent Biologics

- 12.2.2.1. Company Overview

- 12.2.2.2. Financial Information

- 12.2.2.3. Vector Manufacturing Portfolio

- 12.2.2.4. Recent Developments and Future Outlook

- 12.2.3. Charles River Laboratories

- 12.2.3.1. Company Overview

- 12.2.3.2. Financial Information

- 12.2.3.3. Vector Manufacturing Portfolio

- 12.2.3.4. Recent Developments and Future Outlook

- 12.2.4. Thermo Fisher Scientific

- 12.2.4.1. Company Overview

- 12.2.4.2. Financial Information

- 12.2.4.3. Vector Manufacturing Portfolio

- 12.2.4.4. Recent Development and Future Outlook

- 12.2.5. VectorBuilder

- 12.2.5.1. Company Overview

- 12.2.5.2. Financial Information

- 12.2.5.3. Vector Manufacturing Portfolio

- 12.2.5.4. Recent Developments and Future Outlook

- 12.2.1. Advanced BioScience Laboratories

- 12.3. Other Key Players

- 12.3.1. AGC Biologics

- 12.3.1.1. Company Overview

- 12.3.1.2. Vector Manufacturing Portfolio

- 12.3.2. Aldevron

- 12.3.2.1. Company Overview

- 12.3.2.2. Vector Manufacturing Portfolio

- 12.3.3. Matica Biotechnology

- 12.3.3.1. Company Overview

- 12.3.3.2. Vector Manufacturing Portfolio

- 12.3.4. Resilience

- 12.3.4.1. Company Overview

- 12.3.4.2. Vector Manufacturing Portfolio

- 12.3.1. AGC Biologics

13. VECTOR MANUFACTURERS BASED IN EUROPE

- 13.1. Chapter Overview

- 13.2. Key Players

- 13.2.1. Lonza

- 13.2.1.1. Company Overview

- 13.2.1.2. Financial Information

- 13.2.1.3. Vector Manufacturing Portfolio

- 13.2.1.4. Recent Developments and Future Outlook

- 13.2.2. Touchlight

- 13.2.2.1. Company Overview

- 13.2.2.2. Vector Manufacturing Portfolio

- 13.2.2.3. Recent Developments and Future Outlook

- 13.2.1. Lonza

- 13.3. Other Key Players

- 13.3.1. BioNTech Innovative Manufacturing Service (a subsidiary of BioNTech)

- 13.3.1.1. Company Overview

- 13.3.1.2. Vector Manufacturing Portfolio

- 13.3.2. Biovian

- 13.3.2.1. Company Overview

- 13.3.2.2. Vector Manufacturing Portfolio

- 13.3.3. Celonic

- 13.3.3.1. Company Overview

- 13.3.3.2. Vector Manufacturing Portfolio

- 13.3.4. Centre for Process Innovation

- 13.3.4.1. Company Overview

- 13.3.4.2. Vector Manufacturing Portfolio

- 13.3.5. CEVEC Pharmaceuticals

- 13.3.5.1. Company Overview

- 13.3.5.2. Vector Manufacturing Portfolio

- 13.3.6. NorthX Biologics

- 13.3.6.1. Company Overview

- 13.3.6.2. Vector Manufacturing Portfolio

- 13.3.7. Novartis

- 13.3.7.1. Company Overview

- 13.3.7.2. Vector Manufacturing Portfolio

- 13.3.8. Oxford BioMedica

- 13.3.8.1. Company Overview

- 13.3.8.2. Vector Manufacturing Portfolio

- 13.3.9. Sanofi

- 13.3.9.1. Company Overview

- 13.3.9.2. Vector Manufacturing Portfolio

- 13.3.1. BioNTech Innovative Manufacturing Service (a subsidiary of BioNTech)

14. VECTOR MANUFACTURERS BASED IN ASIA-PACIFIC

15. VECTOR MANUFACTURERS IN ASIA-PACIFIC

- 15.1. Chapter Overview

- 15.2. Key Players

- 15.2.1. CoJourney

- 15.2.1.1. Company Overview

- 15.2.1.2. Vector Manufacturing Portfolio

- 15.2.1.3. Recent Developments and Future Outlook

- 15.2.2. Esco Aster

- 15.2.2.1. Company Overview

- 15.2.2.2. Vector Manufacturing Portfolio

- 15.2.2.3. Recent Developments and Future Outlook

- 15.2.3. Wuxi AppTec

- 15.2.3.1. Company Overview

- 15.2.3.2. Financial Information

- 15.2.3.3. Vector Manufacturing Portfolio

- 15.2.3.4. Recent Developments and Future Outlook

- 15.2.1. CoJourney

- 15.3. Other Key Players

- 15.3.1. Altruist Biotechnology

- 15.3.1.1. Company Overview

- 15.3.1.2. Vector Manufacturing Portfolio

- 15.3.2. Jiangsu Puxin Biopharmaceutical

- 15.3.2.1. Company Overview

- 15.3.2.2. Vector Manufacturing Portfolio

- 15.3.3. Nikon CeLL innovation

- 15.3.3.1. Company Overview

- 15.3.3.2. Vector Manufacturing Portfolio

- 15.3.1. Altruist Biotechnology

16. PORTER'S FIVE FORCES ANALYSIS

- 16.1. Chapter Overview

- 16.2. Methodology and Assumptions

- 16.3. Key Parameters

- 16.3.1. Threats of New Entrants

- 16.3.2. Bargaining Power of Suppliers

- 16.3.3. Bargaining Power of Buyers

- 16.3.4. Threats of Substitute Products

- 16.3.5. Rivalry Among Existing Competitors

- 16.4. Concluding Remarks

17. PARTNERSHIPS AND COLLAORATIONS

- 17.1. Chapter Overview

- 17.2. Partnership Models

- 17.3. Vector Manufacturing: Partnerships and Collaborations

- 17.3.1. Analysis by Year of Partnership

- 17.3.2. Analysis by Type of Partnership

- 17.3.3. Analysis by Scale of Operation

- 17.3.4. Analysis by Type of Vector Manufactured

- 17.3.5. Analysis by Therapeutic Area

- 17.3.6. Analysis by Application Area

- 17.3.7. Most Active Players: Analysis by Number of Partnerships

- 17.3.8. Analysis by Geography

- 17.3.8.1. Local and International Agreements

- 17.3.8.2. Intercontinental and Intracontinental Agreements

18. RECENT EXPANSIONS

- 18.1. Chapter Overview

- 18.2. Type of Expansions

- 18.3. Vector Manufacturing: Recent Expansions

- 18.3.1. Analysis by Year of Expansion

- 18.3.2. Analysis by Type of Expansion

- 18.3.3. Analysis by Year and Type of Expansion

- 18.3.4. Most Active Players: Analysis by Number of Expansions

- 18.3.5. Most Active Players: Analysis by Amount Invested

- 18.3.6. Analysis by Type of Manufacturing Facility

- 18.3.7. Analysis by Scale of Operation

- 18.3.8. Analysis by Type of Vector Manufactured

- 18.3.9. Analysis by Application Area

- 18.3.10. Analysis by Geography

- 18.3.10.1. Intercontinental and Intracontinental Expansions

- 18.3.10.2. Analysis by Location of Expansion

19. STRATEGIC PARTNER ANAYSIS

- 19.1. Chapter Overview

- 19.2. Methodology and Key Parameters

- 19.3. Strategic Partner Analysis: Viral Vector based Therapy Developers

- 19.3.1. Opportunity for AAV Vector based Therapy Developers

- 19.3.1.1. Most Likely Partners

- 19.3.1.2. Likely Partners

- 19.3.1.3. Less Likely Partners

- 19.3.1.4. Least Likely Partners

- 19.3.2. Opportunity for Adenoviral Vector based Therapy Developers

- 19.3.2.1. Most Likely Partners

- 19.3.2.2. Likely Partners

- 19.3.2.3. Less Likely Partners

- 19.3.2.4. Least Likely Partners

- 19.3.3. Opportunity for Lentiviral Vector based Therapy Developers

- 19.3.3.1. Most Likely Partners

- 19.3.3.2. Likely Partners

- 19.3.3.3. Less Likely Partners

- 19.3.3.4. Least Likely Partners

- 19.3.4. Opportunity for Retroviral Vector based Therapy Developers

- 19.3.4.1. Most Likely Partners

- 19.3.4.2. Likely Partners

- 19.3.4.3. Less Likely Partners

- 19.3.4.4. Least Likely Partners

- 19.3.5. Opportunity for Other Viral Vector based Therapy Developers

- 19.3.5.1. Most Likely Partners

- 19.3.5.2. Likely Partners

- 19.3.5.3. Less Likely Partners

- 19.3.5.4. Least Likely Partners

- 19.3.1. Opportunity for AAV Vector based Therapy Developers

20. EMERGING VECTORS

- 20.1. Chapter Overview

- 20.1.1. Alphavirus based Vectors

- 20.1.2. Anc80 based Vectors

- 20.1.3. Bifidobacterium longum based Vectors

- 20.1.4. Cytomegalovirus based Vectors

- 20.1.5. Listeria monocytogenes based Vectors

- 20.1.6. Minicircle DNA based Vectors

- 20.1.7. Myxoma Virus based Vectors

- 20.1.8. Self-Complementary Vectors

- 20.1.9. Sendai Virus based Vectors

- 20.1.10. Sleeping Beauty Transposons

- 20.1.11. Vaccinia Virus and Modified Vaccinia Ankara based Vectors

- 20.1.12. Chimeric Viral Vectors

21. KEY INSIGHTS

- 21.1. Chapter Overview

- 21.2. Vector and Gene Therapy Manufacturers: Key Insights

- 21.2.1. Analysis by Type of Manufacturer, Type of Vector Manufactured and Scale of Operation

- 21.2.2. Analysis by Type of Vector Manufactured and Company Size

- 21.2.3. Analysis by Type of Organization and Geography

- 21.2.3.1. Contract Manufacturing Organizations

- 21.2.3.2. In-House Manufacturers

- 21.2.3.3. In-House and Contract Manufacturing Organizations

- 21.2.4. Analysis by Type of Vector Manufactured and Location of Headquarters

- 21.2.4.1. AAV Vector Manufacturers

- 21.2.4.2. Adenoviral Vector Manufacturers

- 21.2.4.3. Lentiviral Vector Manufacturers

- 21.2.4.4. Retroviral Vector Manufacturers

- 21.2.4.5. Plasmid DNA Manufacturers

22. COST PRICE ANALYSIS

- 22.1. Chapter Overview

- 22.2. Factors Contributing to High Price of Viral Vector and Plasmid DNA based Therapies

- 22.3. Viral Vector and Plasmid DNA based Therapies: Pricing Models

- 22.3.1. Pricing Models Based on Expert Opinions

- 22.3.2. Pricing Models Based on Manufacturing Cost

- 22.3.2.1. Pricing Models Based on Technology Used

- 22.3.2.2. Pricing Models Based on Scale of Operation

- 22.3.2.3. Pricing Models Based on Type of Client

- 22.3.3. Prices of Different Types of Vectors

- 22.4. Concluding Remarks

23. OUTSOURCING: GO / NO-GO FRAMEWORK

- 23.1. Chapter Overview

- 23.2. Outsourcing: Go / No-Go Framework

- 23.3. Vector Manufacturing Outsourcing: Go / No-Go Framework

- 23.3.1. Key Parameters and Assumptions

- 23.3.2. Methodology

- 23.3.3. Results and Interpretations

- 23.3.3.1. Outsourcing: Go / No-Go Framework for Small Companies

- 23.3.3.2. Outsourcing: Go / No-Go Framework for Mid-Sized Companies

- 23.3.3.3. Outsourcing: Go / No-Go Framework for Large Companies

24. CAPACITY ANALYSIS

- 24.1. Chapter Overview

- 24.2. Methodology and Key Assumptions

- 24.3. Viral Vector and Plasmid DNA Manufacturing: Global Installed Capacity

- 24.4. Viral Vector Manufacturing: Global Installed Capacity

- 24.4.1. Analysis by Company Size

- 24.4.2. Analysis by Scale of Operation

- 24.4.3. Analysis by Location of Headquarters (Region)

- 24.4.4. Analysis by Location of Manufacturing Facility

- 24.5. Plasmid DNA Manufacturing: Global Installed Capacity

- 24.5.1. Analysis by Company Size

- 24.5.2. Analysis by Scale of Operation

- 24.5.3. Analysis by Location of Headquarters (Region)

- 24.5.4. Analysis by Location of Manufacturing Facility

25. DEMAND ANALYSIS

- 25.1. Chapter Overview

- 25.2. Assumptions and Methodology

- 25.3. Global Demand for Viral Vectors and Plasmid DNA, Till 2035

- 25.4. Global Clinical Demand for Viral Vectors and Plasmid DNA, Till 2035

- 25.4.1. Analysis by Type of Vector

- 25.4.2. Analysis by Type of Therapy

- 25.4.3. Analysis by Therapeutic Area

- 25.4.4. Analysis by Geography

- 25.5. Global Commercial Demand for Viral Vectors and Plasmid DNA, Till 2035

- 25.5.1. Analysis by Type of Vector

- 25.5.2. Analysis by Type of Therapy

- 25.5.3. Analysis by Therapeutic Area

- 25.5.4. Analysis by Geography

- 25.6. Demand and Supply Analysis

26. MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 26.1. Chapter Overview

- 26.2. Market Drivers

- 26.3. Market Restraints

- 26.4. Market Opportunities

- 26.5. Market Challenges

27. GLOBAL VECTOR MANUFACTURING MARKET

- 27.1. Chapter Overview

- 27.2. Key Assumptions and Methodology

- 27.3. Global Vector Manufacturing Market, Historical Trends (2018-2022) and Forecasted Estimates (2023-2035)

- 27.3.1. Scenario Analysis

- 27.3.1.1. Conservative Scenario

- 27.3.1.2. Optimistic Scenario

- 27.3.1. Scenario Analysis

- 27.4. Key Market Segmentations

28. VECTOR MANUFACTURING MARKET, BY SCALE OF OPERATION

- 28.1. Chapter Overview

- 28.2. Key Assumptions and Methodology

- 28.3. Vector Manufacturing Market: Distribution by Scale of Operation

- 28.3.1. Preclinical Scale: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 28.3.2. Clinical Scale: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 28.3.3. Commercial Scale: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 28.4. Data Triangulation and Validation

29. VECTOR MANUFACTURING MARKET, BY TYPE OF VECTOR MANUFACTURED

- 29.1. Chapter Overview

- 29.2. Key Assumptions and Methodology

- 29.3. Vector Manufacturing Market: Distribution by Type of Vector

- 29.3.1. AAV Vectors: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 29.3.2. Adenoviral Vectors: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 29.3.3. Lentiviral Vectors: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 29.3.4. Retroviral Vectors: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 29.3.5. Non-Viral Vectors: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 29.3.6. Other Vectors: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 29.4. Data Triangulation and Validation

30. VECTOR MANUFACTURING MARKET, BY APPLICATION AREA

- 30.1. Chapter Overview

- 30.2. Key Assumptions and Methodology

- 30.3. Vector Manufacturing Market: Distribution by Application Area

- 30.3.1. Cell Therapy: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 30.3.2. Gene Therapy: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 30.3.3. Vaccines: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 30.4. Data Triangulation and Validation

31. VECTOR MANUFACTURING MARKET, BY THERAPEUTIC AREA

- 31.1. Chapter Overview

- 31.2. Key Assumptions and Methodology

- 31.3. Vector Manufacturing Market: Distribution by Therapeutic Area

- 31.3.1. Oncological Disorders: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 31.3.2. Rare Disorders: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 31.3.3. Immunological Disorders: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 31.3.4. Neurological Disorders: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 31.3.5. Sensory Disorders: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 31.3.6. Metabolic Disorders: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 31.3.7. Blood Disorders: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 31.3.8. Musculoskeletal Disorders: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 31.3.9. Infectious Diseases: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 31.3.10. Ophthalmic Disorders: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 31.3.11. Other Disorders: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 31.4. Data Triangulation and Validation

32. VECTOR MANUFACTURING MARKET, BY TYPE OF MANUFACTURER

- 32.1. Chapter Overview

- 32.2. Key Assumptions and Methodology

- 32.3. Vector Manufacturing Market: Distribution by Type of Manufacturer

- 32.3.1. In-house Manufacturers: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 32.3.2. Contract Manufacturing Organizations: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 32.4. Data Triangulation and Validation

33. VECTOR MANUFACTURING MARKET, BY GEOGRAPHICAL REGION

- 33.1. Chapter Overview

- 33.2. Key Assumptions and Methodology

- 33.3. Vector Manufacturing Market: Distribution by Geographical Region

- 33.3.1. North America: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 33.3.2. Europe: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 33.3.3. Asia-Pacific: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 33.3.4. Middle East and North Africa: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 33.3.5. Latin America and Rest of the World: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 33.4. Data Triangulation and Validation

34. MARKET OPPORTUNITY ANALYSIS: NORTH AMERICA

- 34.1. Vector Manufacturing Market in North America: Distribution by Scale of Operation

- 34.1.1. Vector Manufacturing Market in North America for Preclinical, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.1.2. Vector Manufacturing Market in North America for Clinical, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.1.3. Vector Manufacturing Market in North America for Commercial, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.2. Vector Manufacturing Market in North America: Distribution by Type of Vector Manufactured

- 34.2.1. Vector Manufacturing Market in North America for AAV Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.2.2. Vector Manufacturing Market in North America for Adenoviral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.2.3. Vector Manufacturing Market in North America for Lentiviral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.2.4. Vector Manufacturing Market in North America for Retroviral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.2.5. Vector Manufacturing Market in North America for Non-Viral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.2.6. Vector Manufacturing Market in North America for Other Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.3. Vector Manufacturing Market in North America: Distribution by Application Area

- 34.3.1. Vector Manufacturing Market in North America for Cell Therapy, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.3.2. Vector Manufacturing Market in North America for Gene Therapy, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.3.3. Vector Manufacturing Market in North America for Vaccines, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.4. Vector Manufacturing Market in North America: Distribution by Therapeutic Area

- 34.4.1. Vector Manufacturing Market in North America for Oncological Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.4.2. Vector Manufacturing Market in North America for Rare Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.4.3. Vector Manufacturing Market in North America for Immunological Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.4.4. Vector Manufacturing Market in North America for Neurological Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.4.5. Vector Manufacturing Market in North America for Sensory Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.4.6. Vector Manufacturing Market in North America for Metabolic Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.4.7. Vector Manufacturing Market in North America for Blood Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.4.8. Vector Manufacturing Market in North America for Musculoskeletal Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.4.9. Vector Manufacturing Market in North America for Infectious Diseases, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.4.10. Vector Manufacturing Market in North America for Ophthalmic Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.4.11. Vector Manufacturing Market in North America for Other Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.5. Vector Manufacturing Market in North America: Distribution by Type of Manufacturer

- 34.5.1. Vector Manufacturing Market in North America for In-house Manufacturer, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.5.2. Vector Manufacturing Market in North America for Contract Manufacturers, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

35. MARKET OPPORTUNITY ANALYSIS: EUROPE

- 35.1. Vector Manufacturing Market in Europe: Distribution by Scale of Operation

- 35.1.1. Vector Manufacturing Market in Europe for Preclinical, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.1.2. Vector Manufacturing Market in Europe for Clinical, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.1.3. Vector Manufacturing Market in Europe for Commercial, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.2. Vector Manufacturing Market in Europe: Distribution by Type of Vector Manufactured

- 35.2.1. Vector Manufacturing Market in Europe for AAV Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.2.2. Vector Manufacturing Market in Europe for Adenoviral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.2.3. Vector Manufacturing Market in Europe for Lentiviral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.2.4. Vector Manufacturing Market in Europe for Retroviral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.2.5. Vector Manufacturing Market in Europe for Non-Viral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.2.6. Vector Manufacturing Market in Europe for Other Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.3. Vector Manufacturing Market in Europe: Distribution by Application Area

- 35.3.1. Vector Manufacturing Market in Europe for Cell Therapy, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.3.2. Vector Manufacturing Market in Europe for Gene Therapy, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.3.3. Vector Manufacturing Market in Europe for Vaccines, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.4. Vector Manufacturing Market in Europe: Distribution by Therapeutic Area

- 35.4.1. Vector Manufacturing Market in Europe for Oncological Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.4.2. Vector Manufacturing Market in Europe for Rare Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.4.3. Vector Manufacturing Market in Europe for Immunological Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.4.4. Vector Manufacturing Market in Europe for Neurological Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.4.5. Vector Manufacturing Market in Europe for Sensory Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.4.6. Vector Manufacturing Market in Europe for Metabolic Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.4.7. Vector Manufacturing Market in Europe for Blood Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.4.8. Vector Manufacturing Market in Europe for Musculoskeletal Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.4.9. Vector Manufacturing Market in Europe for Infectious Diseases, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.4.10. Vector Manufacturing Market in Europe for Ophthalmic Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.4.11. Vector Manufacturing Market in Europe for Other Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.5. Vector Manufacturing Market in Europe: Distribution by Type of Manufacturer

- 35.5.1. Vector Manufacturing Market in Europe for In-house Manufacturer, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.5.2. Vector Manufacturing Market in Europe for Contract Manufacturers, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

36. MARKET OPPORTUNITY ANALYSIS: ASIA-PACIFIC

- 36.1. Vector Manufacturing Market in Asia-Pacific: Distribution by Scale of Operation

- 36.1.1. Vector Manufacturing Market in Asia-Pacific for Preclinical, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.1.2. Vector Manufacturing Market in Asia-Pacific for Clinical, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.1.3. Vector Manufacturing Market in Asia-Pacific for Commercial, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.2. Vector Manufacturing Market in Asia-Pacific: Distribution by Type of Vector Manufactured

- 36.2.1. Vector Manufacturing Market in Asia-Pacific for AAV Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.2.2. Vector Manufacturing Market in Asia-Pacific for Adenoviral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.2.3. Vector Manufacturing Market in Asia-Pacific for Lentiviral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.2.4. Vector Manufacturing Market in Asia-Pacific for Retroviral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.2.5. Vector Manufacturing Market in Asia-Pacific for Non-Viral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.2.6. Vector Manufacturing Market in Asia-Pacific for Other Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.3. Vector Manufacturing Market in Asia-Pacific: Distribution by Application Area

- 36.3.1. Vector Manufacturing Market in Asia-Pacific for Cell Therapy, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.3.2. Vector Manufacturing Market in Asia-Pacific for Gene Therapy, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.3.3. Vector Manufacturing Market in Asia-Pacific for Vaccines, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.4. Vector Manufacturing Market in Asia-Pacific: Distribution by Therapeutic Area

- 36.4.1. Vector Manufacturing Market in Asia-Pacific for Oncological Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.4.2. Vector Manufacturing Market in Asia-Pacific for Rare Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.4.3. Vector Manufacturing Market in Asia-Pacific for Immunological Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.4.4. Vector Manufacturing Market in Asia-Pacific for Neurological Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.4.5. Vector Manufacturing Market in Asia-Pacific for Sensory Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.4.6. Vector Manufacturing Market in Asia-Pacific for Metabolic Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.4.7. Vector Manufacturing Market in Asia-Pacific for Blood Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.4.8. Vector Manufacturing Market in Asia-Pacific for Musculoskeletal Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.4.9. Vector Manufacturing Market in Asia-Pacific for Infectious Diseases, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.4.10. Vector Manufacturing Market in Asia-Pacific for Ophthalmic Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.4.11. Vector Manufacturing Market in Asia-Pacific for Other Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.5. Vector Manufacturing Market in Asia-Pacific: Distribution by Type of Manufacturer

- 36.5.1. Vector Manufacturing Market in Asia-Pacific for In-house Manufacturer, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.5.2. Vector Manufacturing Market in Asia-Pacific for Contract Manufacturers, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

37. MARKET OPPORTUNITY ANALYSIS: MIDDLE EAST AND NORTH AFRICA

- 37.1. Vector Manufacturing Market in Middle East and North Africa: Distribution by Scale of Operation

- 37.1.1. Vector Manufacturing Market in Middle East and North Africa for Preclinical, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.1.2. Vector Manufacturing Market in Middle East and North Africa for Clinical, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.1.3. Vector Manufacturing Market in Middle East and North Africa for Commercial, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.2. Vector Manufacturing Market in Middle East and North Africa: Distribution by Type of Vector Manufactured

- 37.2.1. Vector Manufacturing Market in Middle East and North Africa for AAV Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.2.2. Vector Manufacturing Market in Middle East and North Africa for Adenoviral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.2.3. Vector Manufacturing Market in Middle East and North Africa for Lentiviral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.2.4. Vector Manufacturing Market in Middle East and North Africa for Retroviral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.2.5. Vector Manufacturing Market in Middle East and North Africa for Non-Viral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.2.6. Vector Manufacturing Market in Middle East and North Africa for Other Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.3. Vector Manufacturing Market in Middle East and North Africa: Distribution by Application Area

- 37.3.1. Vector Manufacturing Market in Middle East and North Africa for Cell Therapy, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.3.2. Vector Manufacturing Market in Middle East and North Africa for Gene Therapy, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.3.3. Vector Manufacturing Market in Middle East and North Africa for Vaccines, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.4. Vector Manufacturing Market in Middle East and North Africa: Distribution by Therapeutic Area

- 37.4.1. Vector Manufacturing Market in Middle East and North Africa for Oncological Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.4.2. Vector Manufacturing Market in Middle East and North Africa for Rare Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.4.3. Vector Manufacturing Market in Middle East and North Africa for Immunological Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.4.4. Vector Manufacturing Market in Middle East and North Africa for Neurological Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.4.5. Vector Manufacturing Market in Middle East and North Africa for Sensory Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.4.6. Vector Manufacturing Market in Middle East and North Africa for Metabolic Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.4.7. Vector Manufacturing Market in Middle East and North Africa for Blood Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.4.8. Vector Manufacturing Market in Middle East and North Africa for Musculoskeletal Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.4.9. Vector Manufacturing Market in Middle East and North Africa for Infectious Diseases, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.4.10. Vector Manufacturing Market in Middle East and North Africa for Ophthalmic Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.4.11. Vector Manufacturing Market in Middle East and North Africa for Other Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.5. Vector Manufacturing Market in Middle East and North Africa: Distribution by Type of Manufacturer

- 37.5.1. Vector Manufacturing Market in Middle East and North Africa for In-house Manufacturer, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.5.2. Vector Manufacturing Market in Middle East and North Africa for Contract Manufacturers, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

38. MARKET OPPORTUNITY ANALYSIS: LATIN AMERICA

- 38.1. Vector Manufacturing Market in Latin America: Distribution by Scale of Operation

- 38.1.1. Vector Manufacturing Market in Latin America for Preclinical, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 38.1.2. Vector Manufacturing Market in Latin America for Clinical, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 38.1.3. Vector Manufacturing Market in Latin America for Commercial, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 38.2. Vector Manufacturing Market in Latin America: Distribution by Type of Vector Manufactured

- 38.2.1. Vector Manufacturing Market in Latin America for AAV Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 38.2.2. Vector Manufacturing Market in Latin America for Adenoviral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 38.2.3. Vector Manufacturing Market in Latin America for Lentiviral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 38.2.4. Vector Manufacturing Market in Latin America for Retroviral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 38.2.5. Vector Manufacturing Market in Latin America for Non-Viral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 38.2.6. Vector Manufacturing Market in Latin America for Other Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 38.3. Vector Manufacturing Market in Latin America: Distribution by Application Area

- 38.3.1. Vector Manufacturing Market in Latin America for Cell Therapy, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)