|

시장보고서

상품코드

1799624

자율 시스템 검증Verification for Autonomous Systems |

||||||

항공우주 및 국방, 자동차 및 운송, 산업 자동화 분야에서는 인간 또는 인간에 의한 제어를 자율 시스템으로 대체하는 움직임이 빠르게 진행되고 있습니다. 이러한 시스템의 안전성, 신뢰성, 컴플라이언스를 보장하기 위한 견고하고 신뢰할 수 있는 검증 솔루션의 필요성이 증가하고 있으며, 특히 사람의 개입을 최소화하거나 전혀 개입하지 않는 경우, 이는 심각한 기술적 도전이 되고 있습니다. 또한, 자율 시스템 이용 사례의 발전, 운영 설계 영역의 다양화, 국가별/지역별 규제 차이로 인해 검증 프로세스가 더욱 복잡해지고 있습니다.

기존의 검증 접근 방식은 더 이상 자율 시스템 테스트에 충분하지 않습니다. 이러한 문제에 대응하기 위해 업계는 시스템 라이프사이클 전반에 걸친 검증을 지원하는 시뮬레이션 기반의 고급 검증 솔루션으로 전환하고 있습니다. 이러한 플랫폼은 센서 데이터, 인식 알고리즘, 제어 로직을 다양하고 복잡한 시나리오 하에서 가상으로 테스트할 수 있습니다. 이러한 도구에 AI를 통합함으로써 개발자는 학습 속도 향상, 검증 워크플로우 자동화, 사실적인 환경 생성, 자율 시스템 개발의 정확성과 확장성을 향상시킬 수 있습니다.

본 보고서에서는 자율 시스템에 특화된 검증 툴의 현황을 분석하고, 주요 솔루션의 기능, 적용 분야, 시장 동향을 파악합니다. 또한, 시뮬레이션 기반 검증 기술의 새로운 동향을 밝히고, 고신뢰성 자율성을 실현하기 위한 베스트 프랙티스를 제시합니다. 또한, VDC가 실시한 'Voice of the Engineer(엔지니어의 목소리)' 설문조사를 바탕으로 한 최종 사용자에 대한 조사 결과도 포함되어 있습니다.

답변을 얻을 수 있는 질문

- 2029년까지 자율 시스템 검증 솔루션 시장 규모와 성장 속도는?

- 가장 빠르게 성장하는 산업과 지역은?

- 주요 파트너십, 인수, 표준화, 규제가 어떻게 시장을 형성하고 있는가?

- 자율 시스템의 보급이 예상되는 시장은 어디인가?

- 자율 시스템 검증을 자동화하기 위해 AI를 어떻게 활용하고 있는가?

- 자율 시스템 검증 시장을 선도하는 벤더는?

본 보고서에 수록된 조직

|

|

|

보고서 발췌

검증 및 타당성 확인 활동의 타이밍

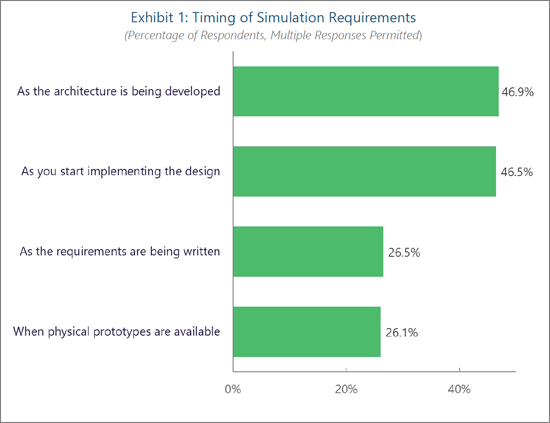

응답자들에 따르면, 많은 엔지니어링 조직들이 제품 수명주기 초기에 시뮬레이션 요구사항을 수립하기 시작했다고 합니다. 약 절반(46.9%)이 아키텍처 설계 단계에서 이러한 프로세스를 시작했으며, 거의 같은 비율인 46.5%가 설계 구현 단계에서 시작했다고 답했습니다. 이러한 초기 단계의 노력은 개발 초기에 잠재적인 문제를 식별하고 해결함으로써 후공정에서 발생하는 비용과 리스크를 크게 줄일 수 있다는 업계의 인식을 반영하고 있습니다.

반면, 초기 개념 설계 단계부터 시뮬레이션 요구사항 수립을 시작하는 조직은 적었으며, 26.5%만이 요구사항 문서 작성 시점에 시뮬레이션 요구사항 수립에 착수하는 것으로 나타났습니다. 또한, 26.1%의 조직은 물리적 프로토타입을 사용할 수 있을 때까지 프로세스를 지연시키고 있으며, 이는 변경 비용과 작업 시간을 증가시키는 경향이 있어 비효율적이라는 지적을 받고 있습니다. 이러한 결과는 개발 프로세스의 초기 단계에서 시뮬레이션을 통합하는 것이 점점 더 중요해지고 있음을 보여줍니다. 이는 첨단 자율 시스템 엔지니어링 프로그램에서 표준화되고 있는 모델 기반 설계, 시뮬레이션 기반 검증, 가상 프로토타이핑 전략과 일치합니다.

샘플 미리보기

목차

본 보고서에서 다룬 주요 질문

본 보고서의 구독 대상

본 보고서에 게재되어 있는 주요 조직 리스트

주요 요약

- 주요 조사 결과

서론

- 시장 성장 요인

- 신기술과 새로운 접근

- 과제와 시장 갭

세계 시장 개요

수직 시장

- 항공우주 및 방위

- 차량내 시스템

- CE 제품

- 산업 자동화

- 의료기기

- 운송

지역 시장

- 아메리카

- 유럽, 중동 및 아프리카

- 아시아태평양

- 자율 시스템에 관한 세계의 규제 상황

최근 시장 동향

- 인수, 제휴 및 시장 전환

- 조직 프레임워크

- Autonomous Vehicle Computing Association

- The Autoware Foundation

- CARLA

- Future Airborne Capability Environment

- Cloud Native Computing Foundation

- IEEE Robotics & Automation Society

- NASA

- SOAFEE

- 관련 규격

- RTCA/EUROCAE DO-178C

- ASAM

- EN 50128

- ISO/IEC TR 5469(2024)

- IEEE 7009-2024

- IEEE 7001-2021

- ISO/PAS 8800 및 ISO 21448

- NIST

- UL 4600

경쟁 구도

- 주요 벤더 인사이트

- Apex.AI

- Applied Intuition

- Cadence

- dSPACE

- Elektrobit(Continental)

- ETAS

- Hexagon

- MathWorks

- NVIDIA

- Siemens

- Synopsys/Ansys

- Vector Informatik

최종사용자 인사이트

- 시장의 우선 과제와 자율 시스템 검증의 중요성

- 엔지니어링 프로젝트 지연 요인

- 검증 및 밸리데이션 활동 타이밍

저자에 대해

LSH 25.11.14Inside this Report

The aerospace/defense, automotive/transportation, and industrial automation industries are increasingly using autonomous systems to replace human or human-controlled operations. The need for robust and dependable verification solutions to ensure the safety, reliability, and compliance of these solutions, especially in use cases where human intervention is minimal or nonexistent, presents a critical technical challenge. The complex verification process is compounded by the rapid advancement of autonomous use-cases, operational design domains and varying country- or region- specific regulations.

Traditional verification approaches are increasingly inadequate for the testing autonomous systems. To address these challenges, the industry is turning to advanced, simulation-based validation solutions that support verification throughout the system's lifecycle. Advanced simulation platforms are increasingly enabling virtual testing of sensor data, perception systems, and control algorithms across diverse and complex scenarios. By integrating AI into these tools, developers can accelerate training, automate validation workflows, and generate more realistic environments, enhancing the accuracy and scalability of autonomous system development.

This report explores the current landscape of verification tools tailored for autonomous systems. It analyzes the capabilities and applications of leading solutions, highlights emerging trends in simulation-based validation, and provides insights into best practices for achieving high-assurance autonomy. As part of VDC's continued efforts to engage with the technology markets we research, this report includes end user insights from VDC's "Voice of the Engineer" survey.

What Questions are Addressed?

- What is the size of the market for autonomous systems verification solutions and how fast will it grow through 2029?

- Which vertical and regional markets are growing the fastest?

- How are key partnerships, acquisitions, standards, and regulations shaping the market?

- Which markets are primed for widespread adoption of autonomous systems?

- How is Artificial Intelligence used to automate autonomous system verification?

- Which vendors are leading the autonomous system verification market?

Organizations Listed in this Report:

|

|

|

Who Should Read this Report?

- CEO or other C-level executives

- Corporate development and M&A teams

- Marketing executives

- Business development and sales leaders

- Product development and strategy leaders

- Channel management and channel strategy leaders

Executive Summary

The rapid advancement of autonomous system technologies, related multi-sensor interfaces and complex edge- case scenarios, is creating a mix of test challenges and opportunities. As systems adopt increasingly sophisticated AI algorithms for sensing and perception, decision-making and environmental adaptation, each technological advancement requires an assessment of the verification and validation (V&V) processes to ensure safety and performance. Verification is an objective set of tests that confirm that the product meets requirement's metrics, while validation seeks to demonstrate that the product meets its original intent.

Verifying the performance, safety and reliability of autonomous systems remains a fundamentally difficult problem. The complexity of multiple sensor inputs, dynamic real-world environments, AI decision-making trust, and the lack of standardized verification practices generate friction points that can potentially slow an autonomous system's time-to-market timeline and increase risk.

The aforementioned factors, along with increased regulatory oversight, recent mergers and acquisition activity and partnerships, are driving change in the traditional makeup of the software and hardware development supply chain, creating increased opportunities for companies offering verification solutions for autonomous systems.

Key Findings:

- Advanced simulation solutions are used in the verification and validation of autonomous systems, alleviating many of the limitations of real-world testing.

- Engineering organizations begin simulation verification and validation requirements early in the product lifecycle during architecture development and nearly the same proportion at design implementation.

- Merger and acquisition activity in the autonomous system verification market has led to increased consolidation among key players. This convergence of simulation and verification tool domains and functionalities has significantly enhanced platform capabilities.

- Fatal accidents involving autonomous vehicles in the U.S and China have increased regulatory scrutiny and will significantly drive demand for autonomous system verification solutions.

Report Excerpt

Timing of Verification and Validation Activities

Respondents indicate that most engineering organizations initiate simulation requirement activities early in the product lifecycle. Nearly half of respondents (46.9%) report beginning these processes as the architecture is being developed, closely followed by 46.5% who start as the design is being implemented. This early engagement reflects the industry's recognition that identifying and addressing potential issues during foundational stages can significantly reduce downstream costs and risks.

By contrast, fewer organizations initiate simulation requirements during the earliest conceptual stage, with 26.5% starting as the requirements are being written. Similarly, 26.1% delay the process until physical prototypes are available, a stage where changes are typically more expensive and time-consuming to implement. These findings underscore the growing emphasis on integrating simulation earlier in the development pipeline, aligning with model-based design, simulation-driven validation, and virtual prototyping strategies that are becoming standard in advanced autonomous engineering programs.

Sample preview

Table of Contents

What Questions are Addressed?

Who Should Read this Report?

Organizations Listed in this Report

Executive Summary

- Key Findings

Introduction

- Drivers of Market Growth

- Emerging Technologies and Approaches

- Challenges and Market Gaps

Global Market Overview

Vertical Markets

- Aerospace and Defense

- Automotive In-Vehicle

- Consumer Electronics

- Industrial Automation

- Medical Devices

- Transportation

Regional Markets

- The Americas

- Europe, the Middle East & Africa (EMEA)

- Asia-Pacific (APAC)

- MIIT Tightens AV Testing Rules After Deadly Xiaomi SU7 Crash

- Global Regulatory Landscape for Autonomous Systems

Recent Market Developments

- Acquisitions, Partnerships and Market Pivots

- Synopsys Acquires ANSYS to Create a Silicon-to-Systems Platform

- From Simulation to Industrial AI - Siemens' $10.6B Move for Altair Engineering

- Applied Intuition Expands Simulation Capabilities with Mechanical Simulation Acquisition

- Organizations and Frameworks

- Autonomous Vehicle Computing Association

- The Autoware Foundation

- CARLA

- Future Airborne Capability Environment

- Cloud Native Computing Foundation

- IEEE Robotics & Automation Society

- NASA

- SOAFEE

- Relevant Standards

- RTCA/EUROCAE DO-178C

- ASAM

- EN 50128

- ISO/IEC TR 5469 (2024)

- IEEE 7009-2024

- IEEE 7001-2021

- ISO/PAS 8800 and ISO 21448

- NIST

- UL 4600

Competitive Landscape

- Selected Vendor Insights

- Apex.AI

- Applied Intuition

- Cadence

- dSPACE

- Elektrobit (Continental)

- ETAS

- Hexagon

- MathWorks

- NVIDIA

- Siemens

- Synopsys / Ansys

- Vector Informatik

End-User Insights

- Market Priorities and the Critical Role of Autonomous Systems Verification

- Attributions of Delays in Engineering Projects

- Timing of Verification and Validation Activities

About the Authors

List of Exhibits

- Exhibit 1: Worldwide Revenue for Autonomous System Verification Solutions

- Exhibit 2: Worldwide Revenue for Autonomous System Verification Solutions, by Vertical Market

- Exhibit 3: Percentage of Worldwide Revenue for Autonomous System Verification Solutions, by Vertical Market

- Exhibit 4: Worldwide Revenue for Autonomous System Verification Solutions 2024 & 2029, by Geographic Region

- Exhibit 5: Percentage of Worldwide Revenue for Autonomous System Verification Solutions 2024 & 2029, by Geographic Region

- Exhibit 6: Worldwide Autonomous System Verification Solutions, Share by Vendor

- Exhibit 7: Technologies Automotive Respondent's Organization is Most Interested in and/or Building for Future Customers

- Exhibit 8: Attributions of Delays to Automotive Projects

- Exhibit 9: Timing of Simulation Requirements

IoT & Embedded Engineering Survey (Partial)

- Exhibit 1: Primary Role Within Company/Organization

- Exhibit 2: Respondent's Organization's Primary Industry

- Exhibit 3: Total Number of Employees at Respondent's Organization

- Exhibit 4: Primary Region of Residence

- Exhibit 5: Primary Country of Residence

- Exhibit 6: Type of Most Current or Recent Project

- Exhibit 7: Involvement with Engineering of an Embedded/Edge, Enterprise/IT, HPC, AI/ML, or Mobile/System Device or Solution

- Exhibit 8: Type of Purchase by Respondent's Organization

- Exhibit 9: Primary Industry Classification of Project

- Exhibit 10: Type of Aerospace & Defense Application for Most Recent Project

- Exhibit 11: Type of Automotive In-Vehicle Application for Most Recent Project

- Exhibit 12: Type of Communications & Networking Application for Most Recent Project

- Exhibit 13: Type of Consumer Electronics Application for Most Recent Project

- Exhibit 14: Type of Digital Security Application for Most Recent Project

- Exhibit 15: Type of Digital Signage Application for Most Recent Project

- Exhibit 16: Type of Energy and Utilities Application for Most Recent Project

- Exhibit 17: Type of Gaming Application for Most Recent Project

- Exhibit 18: Type of Industrial Automation Application for Most Recent Project

- Exhibit 19: Type of Media & Broadcasting Application for Most Recent Project

- Exhibit 20: Type of Medical Device Application for Most Current Project

- Exhibit 21: Type of Mobile Phone

- Exhibit 22: Type of Office/Business Automation Application for Most Recent Project

- Exhibit 23: Type of Transportation Application for Most Recent Project

- Exhibit 24: Type of Retail Automation Application for Most Recent Project

- Exhibit 25: Type of Non-Manufacturing/Services Application for Most Recent Project

For the full list of the 416 IoT & Embedded Technology Voice of the Engineer Survey Exhibits available with this report.