|

시장보고서

상품코드

1548194

6G 통신 유전체, 열재료, 투명 재료 : 시장과 기술(2025-2045년)6G Communications Dielectric, Thermal and Transparent Materials: Markets, Technology 2025-2045 |

||||||

무선통신의 각 세대는 전송 주파수를 높여 성능을 향상시키고 있으며, 6G에서는 광대역 갭 반도체와 특히 유전체가 요구됩니다. 예를 들어 신호를 전송하는 릴레이는 유연한 유전체 기판 위에 상변화 유전체로 튜닝된 메타표면이 될 것이며, 6G에서는 광유전체를 이용한 무선 원적외선 전송으로 진화할 것입니다.

새 세대를 거듭할수록 더 많은 열을 발생시키는 인프라가 채택됨에 따라 냉각이 중요해지고, 특히 유전체를 기반으로 한 새로운 고체 냉각이 주목받고 있습니다. 또한 인프라 및 클라이언트 장비의 자체 전원 공급을 위해 WBG 및 유전체를 사용하는 열전 및 광전 전력을 채택합니다. 하드웨어는 점점 더 투명해지고, 수용하기 쉬워지고, 성능도 향상되고 있습니다. 큰 기회는 유전체, 초광대역 UWBG 반도체, 열 재료, 투명성과 같은 주제에서 찾을 수 있습니다.

| 장 구성 : | 8장 |

| SWOT 평가 : | 16항목 |

| 예측 라인 : | 30 라인 |

| 인포그램 : | 67개 |

| 기업 수 : | 107사 |

| 페이지 수 : | 432 페이지 |

6G 통신 유전체·열재료·투명 재료의 기술과 시장을 조사했으며, 6G 유전체·열재료·투명 재료의 중요성, 주요 재료 R&D 동향, 기술 로드맵, 주요 재료 시장 규모 추이·예측, 6G 부가가치 재료와 디바이스 제조 기술에 종사하는 중소기업 등을 정리하여 전해드립니다.

목차

제1장 개요·결론 : 2025-2045년 로드맵·예측 라인

제2장 서론

- 개요, 초점, 상황 인포그램

- 6G 단계 1은 단계적으로 진행

- 6G 제2단계는 혼란스러우며 매우 어려워진다.

- 많은 광학 기능의 중요성을 나타내는 6G 재료의 요구와 툴 키트

- 보완적인 6G 주파수의 선택

- 6G 재구성 가능 지능형 표면 RIS의 진화

- 6G RIS SWOT 평가

- 6G 기지국의 진화

- 6G용 자재·기기 제조업체의 예

제3장 6G 열관리 재료와 용도

- 개요, 온도 제어 과제, 향후 기술 툴 키트

- 6G 통신 열재료 기회의 SWOT 평가

- 6G 열전도 재료의 수요 증가에 의해 새로운 혁신이 요구 : 시장 갭

- 열과제를 해결할 때 고려해야 할 중요한 점

- 새로운 열전도성 폴리머와 복합재료 : 2024년 진척 상황

- 2025-2045년에 출현하는 열재료 옵션 : 메타매트리얼, 하이드로겔, 에어로겔, 이오노겔, 열분해 흑연

- 열관리 구조

제4장 유전체, 열전도재, 투명 재료를 사용한 6G용 고체 냉각

- 개요

- 11의 주요 결론

- 솔리드 스테이트 냉각의 정의와 필요성

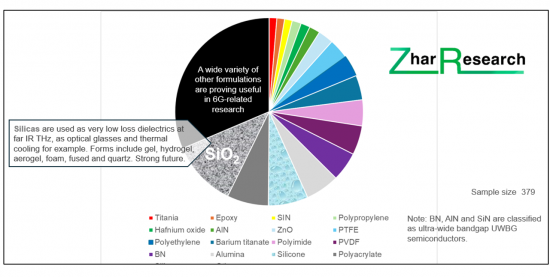

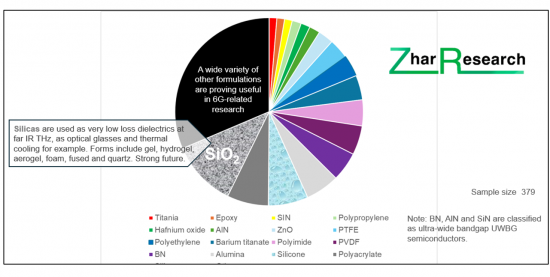

- 최근 연구 발표 211건에서 향후 고체 냉각에 가장 필요하게 되는 화합물이 분명해졌다.

- 12 솔리드 스테이트 냉각 동작 원리를 10 기능별로 비교

- 토픽별 및 기술 성숙도별 고체 냉각 연구 파이프라인

- 신규 고체 냉각의 핵심

- 고체 냉각과 가열 방지 기능과 형식

- 열전도 재료 및 기타 냉각의 미래

- 실리콘 열전도 재료의 SWOT 평가

- 솔리드 스테이트 냉각 전반의 SWOT 평가와 2024년에 대폭적인 진보가 보고되는 7개의 신버전

- 2024년 6G 칩, 레이저, 기지국 빌딩의 다기능 용도용 열전온도 제어 재료

- 냉각 기술의 주목도와 성숙도 3개 곡선 : 2025년, 2035년, 2045년

제5장 비가시성이 수용과 성능 문제를 해결 : 투명 패시브 반사 어레이와 올 라운드 STAR RIS

- 2024년의 개요와 사례

- 2024-5년 6G 전송 처리면의 투명화 상황

- 시각적으로 투명 또는 불투명하게 할 수 있는 6G빔 처리면의 옵션

- 투명한 IRS와 RIS는 거의 어디에라도 갈 수 있다.

- 투명 패시브 지능형 반사면 IRS : Meta Nanoweb-R Sekisui

- 광학적으로 투명하고 투과성 있는 밀리미터파 및 테라헤르츠 RIS

- 동시 투과·반사형 STAR RIS

- STAR RIS SWOT 평가

- 기타 연구논문 : 2024년

- 기타 연구논문 : 2023년

제6장 6G 통신의 메타매트리얼 기초, 트랜스미션, 에너지 회수 등

- 개요와 잠재적인 용도, 2024년의 진보

- 인포그램 : 5G와 6G에서 메타매트리얼의 위치설정

- 6G로 검토되고 있는 전자 메타매트리얼 클래스

- 5G 및 6G 통신용 메타매트리얼 반사 어레이와 RIS

- 2024년의 주요 진보를 포함한 메타매트리얼 패턴과 재료

- 6G RIS 윈도우를 포함한 2 기능 메타표면를 포함한 초곡면

- 메타표면 6G 에너지수확기술 : 2024년 눈부신 연구의 진보

- 2024년에 7개의 진보를 이루는 6G용 조정 가능 메타매트리얼

- GHz, THz, 적외선, 가시광선 메타매트리얼의 많은 새로운 용도가 투자 리스크를 경감

- 메타매트리얼과 메타표면의 SWOT 평가

- 메타매트리얼 전체의 장기적 전망

제7장 6G 0.3THz로부터 가시광선 6G 트랜스미션을 위한 유전체, 광학 재료, 반도체

- 유전체의 정의, 6G 유용성, 리스크 회피, 2024년 이후 연구 진전의 예

- 고유전율 및 저유전율 6G 저손실 재료의 탐구

- 6G용 중요한 유전체 배합의 등장

- 6G 옵트로닉스용 상변화 유전체, LCD 및 대체품

- 테라헤르츠 도파 케이블 및 소형 유닛

- 6G용 근적외선 광섬유의 미래

제8장 6G 부가가치 재료와 디바이스 제조 기술에 종사하는 중소기업

- AALTO HAPS(영국·독일·프랑스)

- Echodyne(미국)

- Evolv Technology(미국)

- Fractal Antenna Systems(미국)

- Greenerwave(프랑스)

- iQLP(미국)

- Kymeta Corp.(미국)

- LATYS Intelligence(캐나다)

- Meta Materials(캐나다)

- Metacept Systems(미국)

- Metawave(미국)

- Pivotal Commware(미국)

- SensorMetrix(미국)

- Teraview(미국)

Summary

Time for a report on 6G dielectrics, thermal and transparent materials. Why? Each generation of wireless communication increases performance by increasing transmission frequency. With 6G, that demands wide bandgap WBG semiconductors and particularly dielectrics. For example, the relay passing on the signal becomes a metasurface tuned with phase change dielectric on a flexible dielectric substrate as one option. 6G will evolve to add wireless far infrared transmission using optical dielectrics.

Every new generation employs more infrastructure generating more heat so cooling comes center stage, notably the new solid-state cooling based on dielectrics, and self-powering of infrastructure and client devices employs thermoelectrics and photovoltaics using WBG and dielectrics. Hardware increasingly becomes transparent to be acceptable (invisible facade overlayers, smart windows) and better performing (360-degree reconfigurable intelligent surfaces). Your big opportunity pivots to the overlapping topics of dielectrics, ultra-wide bandgap UWBG semiconductors, thermal materials and transparency and only this report covers them all. Vitally, it analyses the flood of advances in 2024, forecasting 2025-2045 because so much has changed recently.

Commercially oriented, the report has:

| Chapters: | 8 |

| SWOT appraisals: | 16 |

| Forecast lines: | 30 |

| Infograms: | 67 |

| Companies: | 107 |

| Pages: | 432 |

"6G Communications Dielectric, Thermal and Transparent Materials : Markets, Technology 2025-2045" starts with an Executive Summary and Conclusions clearly pulling everything together for those with limited time. Those 26 pages are mainly lucid new infograms, the 13 key conclusions and 2025-2045 roadmaps. The 30 forecast lines then add pages as both tables and graphs. The 41-page Introduction gives a thorough background to 6G hardware with SWOT appraisals and introduces some 2024 research.

Flood of 2024 research analysed

Then come two large chapters on your thermal materials and device opportunities in the light of breakthroughs in 2024 with a large amount of 2024 research analysed. Chapter 3 "6G thermal management materials and applications" (94 pages) presents the overall thermal picture, with the latest view of needs matched to the latest toolkit. That includes new thermally conductive polymers and composites, thermal metamaterial, hydrogel, aerogel, ionogel, pyrolytic graphite and graphene for both 6G infrastructure and client devices. There is even deep coverage of thermal systems you may wish to supply.

6G cooling becomes a large opportunity

Cooling emerges as the major thermal requirement due to 6G infrastructure making more heat and requiring client devices to manage heat in smaller formats. Indeed, emerging markets are in hotter places such as India and global warming also contributes to the 6G cooling problem. Conventional vapor compression cooling heats cities by up to several degrees and is not fit-and-forget so attention turns to solid state cooling for 6G merging with its hosts such as high-rise buildings and loitering stratospheric drones.

Consequently, a dedicated Chapter 4, "Solid state cooling for 6G using dielectric, thermal and transparent materials" (35 pages) analyses this favourite for infrastructure and client devices on the 20-year view. See eleven primary conclusions, most needed compounds for future solid-state cooling in 211 recent research announcements and twelve solid-state cooling operating principles compared by 10 capabilities. The research pipeline of solid-state cooling by topic vs technology readiness level is presented in three new maturity curves 2025, 2035, 2045. Thermal interface materials, thermoelectric, caloric, passive daytime radiative and other cooling principles are covered. Interestingly, your ultra-WBG materials such as SiN, AlN, BN and dielectrics such as silicas and aluminas are here need for cooling but later identified for many other 6G uses as well. It is found that solid state cooling suitable for 6G mainly needs inorganics whereas the other needs addressed in the report mainly need identified polymers.

Invisibility

Invisible 6G infrastructure will be more acceptable and functional from solar drones at 20km to satellites and transparent materials and devices, two major types being covered in Chapter 5, "Invisibility solves acceptance and performance problems: Transparent passive reflect-arrays and all-round STAR RIS", its 32 pages including two SWOT appraisals and a large amount of research progress in 2024.

Dielectric multifunctional metamaterials

Chapter 6, "Metamaterial basics, transmission, energy harvesting and more for 6G communications" takes 20 pages the assess a large amount of 2024 advance and give a SWOT appraisal. Understand why 6G demands progress from metal patterning on epoxy laminate to flexible, transparent, self-cleaning - even all dielectric - metamaterials for making 6G photovoltaics follow the sun and keep cool and for handling THz, near IR and visible light. See the remarkable research progress in 2024 achieving just that and also making electricity from movement, useful in 6G client devices.

Optical transmission materials and devices emerging

Then comes a large Chapter 7, "Dielectrics, optical materials, semiconductors for 6G 0.3THz to visible light 6G transmission" at 109 pages. Mostly dielectrics, it also includes ultra-wide gap semiconductors coming in and the flood of new research progress on all these topics. Overall, the important performance parameters are identified and, for dielectrics, a very detailed look at permittivities and dissipation factors DF for 20 dielectric families at the higher 6G frequencies. Matched against needs, it reveals that the emerging market for dielectrics with intermediate DF, low permittivity such as polyimides will be large, that for low DF, low permittivity such as porous silicas will be significant but there will also be a market for high permittivity, low DF such as hafnium oxide. What about Fluoropolymers (PBVE, PTFE, PVDF), epsilon near zero materials, THz and optical tuning materials? It is all here with a host of 2024 research advances and latest views.

Partners and acquisitions

To save time, you will need partners and acquisitions, mostly small companies, so the final Chapter 8, "Some small companies involved in 6G added value material and device manufacturing technologies" in 40 pages, profiles 14 for you to consider.

An important takeaway from, "6G Communications Dielectric, Thermal and Transparent Materials : Markets, Technology 2025-2045" is that the most successful materials in research for 6G thermal, dielectric and transparent applications have exceptionally varied morphologies, formats and applications in the preferred solid-state phase and are useful in many new composites. Overall, they are fairly-evenly divided between inorganics and organics with a trend to multifunctional smart materials using both.

Caption: Thermal, dielectric, UWBG materials of interest for 6G: latest research priorities. Source: Simplified image from Zhar Research report, "6G Communications Dielectric, Thermal and Transparent Materials : Markets, Technology 2025-2045".

Table of Contents

1. Executive Summary and Conclusions with roadmaps and forecast lines 2025-2045

- 1.1. Purpose of this report

- 1.2. Methodology of this analysis

- 1.3. Key conclusions: What will drive 6G success, landscape infogram

- 1.4. 6G hardware vanishing acceptable, affordable: implications, opportunities

- 1.5. Key conclusions: 6G materials generally

- 1.6. Key conclusions: thermal materials for 6G with four infograms

- 1.7. Key conclusions: dielectrics for 6G with five infograms

- 1.8. Organisations developing 6G hardware and likely purchasers of 6G added value materials

- 1.9. Technology roadmaps 2025-2045 and market forecast lines 2025-2045

- 1.9.1. Assumptions

- 1.9.2. Roadmaps of 6G materials and hardware 2025-2045

- 1.10. Market forecasts for 6G dielectric and thermal materials 2025-2045: tables with graphs

- 1.10.1. Dielectric materials market for 6G $ billion 2024-2045

- 1.10.2. Low loss materials for 6G area million square meters 2024-2045

- 1.10.3. Low loss materials for 6G value market % by frequency in two categories 2029-2045

- 1.10.4. Dielectric and thermal materials for 6G value market % by location 2029-2045

- 1.10.5. Thermal management material and structure for 6G Communications infrastructure and client devices $ billion 2025-2045

- 1.10.6. 5G vs 6G thermal interface material market $ billion 2024-2045

- 1.11. Background forecasts 2025-2045: tables with graphs

- 1.11.1. Market for 6G vs 5G base stations units millions yearly 2024-2045

- 1.11.2. Market for 6G base stations market value $bn if successful 2025-2045

- 1.11.3. 6G RIS value market $ billion: active and three semi-passive categories 2029-2045

- 1.11.4. 6G fully passive transparent metamaterial reflect-array market $ billion 2029-2045

- 1.11.5. 6G infrastructure/ client device market for materials manipulating IR and visible light: four categories $ billion 2029-2045

- 1.11.6. 6G infrastructure and device market for materials manipulating IR and visible light $ billion 2029-2045

- 1.11.7. Smartphone billion units sold globally 2023-2045 if 6G is successful

2. Introduction

- 2.1. Overview, reason for focus of this report and landscape infograms

- 2.1.1. Overview

- 2.1.2. Importance of dielectric, thermal and transparent materials and devices for 6G

- 2.1.3. Infograms: Planned 6G hardware deployment by land, water, air

- 2.2. 6G Phase One will be incremental

- 2.2.1. Overview

- 2.2.2. New needs, 5G inadequacies, massive overlap 4G, 5G, 6G

- 2.3. 6G Phase Two will be disruptive and extremely difficult

- 2.3.1. Overview

- 2.3.2. Some objectives of 6G mostly not achievable at start

- 2.3.3. View of a Japanese MNO heavily involved in hardware

- 2.3.4. ITU proposals and 3GPP initiatives also go far beyond what is achievable at start

- 2.3.5. Ultimate objectives and perceptions of those most heavily investing in 6G

- 2.4. Some 6G material needs and toolkit showing importance of many optical functions

- 2.5. Choosing complementary 6G frequencies

- 2.5.1. Overview

- 2.5.2. How attenuation in air by frequency and type 0.1THz to visible is complementary

- 2.5.3. Infogram: The Terahertz Gap and optics demands 6G RIS tuning materials and devices different from 5G

- 2.5.4. Spectrum for 6G Phase One and Two in context of current general use of spectrum

- 2.5.5. Essential frequencies for 6G success and some hardware resulting

- 2.6. Evolution of 6G reconfigurable intelligent surfaces RIS

- 2.6.1. Multifunctional and using many optical technologies

- 2.6.2. Infogram: RIS specificity, tuning criteria, physical principles, activation options

- 2.6.3. 6G RIS tuning material benefits and challenges compared

- 2.6.4. RIS will become zero energy devices and they will enable ZED client devices

- 2.6.5. Examples of 2024 research advances with far infrared THz RIS

- 2.6.6 6G RIS SWOT appraisal

- 2.7. Evolution of 6G base stations

- 2.7.1. Trend to use more optical technology

- 2.7.2. 6G Self-powered ultra-massive UM-MIMO base station design

- 2.8. Examples of manufacturers of 6G materials and equipment

- 2.8.1. Across the landscape infogram

- 2.8.2. Mapped across the globe

3. 6G thermal management materials and applications

- 3.1. Overview, temperature control challenges, future technology toolkit

- 3.2. SWOT appraisal of 6G Communications thermal material opportunities

- 3.3. Greater need for thermal materials in 6G demands more innovation: Gaps in the market

- 3.4. Important considerations when solving thermal challenges

- 3.5. New thermally conductive polymers and composites: 2024 progress

- 3.6. Thermal material options emerging 2025-2045: metamaterial, hydrogel, aerogel, ionogel, pyrolytic graphite

- 3.6.1. Thermal metamaterial with 11 advances in 2024

- 3.6.2. Thermal hydrogels including many advances in 2024

- 3.6.3. Ionogels for 6G applications: advances in 2024

- 3.6.5. Graphene-based thermal materials and structures including 2024 progress

- 3.7. Heat management structures

4. Solid state cooling for 6G using dielectric, thermal and transparent materials

- 4.1. Overview

- 4.2. Eleven primary conclusions

- 4.3. Definition and need for solid-state cooling

- 4.4. The most needed compounds for future solid-state cooling in 211 recent research announcements

- 4.5. Twelve solid-state cooling operating principles compared by 10 capabilities

- 4.6. Research pipeline of solid-state cooling by topic vs technology readiness level

- 4.7. Heart of emerging solid-state cooling

- 4.8. Function and format of solid-state cooling and prevention of heating

- 4.9. The future of thermal interface materials and other cooling by thermal conduction

- 4.10. SWOT appraisal for silicone thermal conduction materials

- 4.11. SWOT appraisals of solid-state cooling in general and seven emerging versions with radical advances reported in 2024

- 4.12. Thermoelectric temperature control materials for 6G chips, lasers, multifunctional use in base station buildings in 2024

- 4.13. Attention vs maturity of cooling technologies 3 curves 2025, 2035, 2045

- 4.14. Further reading

5. Invisibility solves acceptance and performance problems: Transparent passive reflect-arrays and all-round STAR RIS

- 5.1. Overview and examples in 2024

- 5.2. Situation with transparent 6G transmission-handling surfaces in 2024-5

- 5.3. Options for 6G beam-handling surfaces that can be visually transparent or opaque

- 5.4. Transparent IRS and RIS can go almost anywhere

- 5.5. Transparent passive intelligent reflecting surface IRS: Meta Nanoweb-R Sekisui

- 5.6. Optically transparent and transmissive mmWave and THz RIS

- 5.6.1. Overview

- 5.6.2. NTT DOCOMO transparent RIS

- 5.6.3. Cornell University RIS prototype and later work elsewhere

- 5.7. Simultaneous transmissive and reflective STAR RIS

- 5.7.1. Overview

- 5.7.2. STAR-RIS optimisation

- 5.7.3. STAR-RIS-ISAC integrated sensing and communication system

- 5.7.4. TAIS Transparent Amplifying Intelligent Surface and SWIPT active STAR-RIS

- 5.7.5. STAR-RIS with energy harvesting and adaptive power

- 5.7.6. Potential STAR-RIS applications including MIMO and security

- 5.8. STAR RIS SWOT appraisal

- 5.9. Other research papers analysed from 2024

- 5.10. Other research papers analysed from 2023

6. Metamaterial basics, transmission, energy harvesting and more for 6G communications

- 6.1. Overview and potential uses and some advances in 2024

- 6.2. Infogram: The place of metamaterials in 5G and 6G

- 6.3. Classes of electromagnetic metamaterial considered for 6G

- 6.4. Metamaterial reflect-arrays and RIS for 5G and 6G Communications

- 6.5. Metamaterial patterns and materials including major advances in 2024

- 6.6. Hypersurfaces including bifunctional metasurfaces including 6G RIS windows that cool

- 6.7. Metasurface 6G energy harvesting: Impressive research advances in 2024

- 6.8. Tunable metamaterials for 6G with seven advances in 2024

- 6.9. Many emerging applications of GHz, THz, infrared and visible light metamaterials derisking investment

- 6.10. SWOT appraisal of metamaterials and metasurfaces

- 6.11. The long-term picture of metamaterials overall

7. Dielectrics, optical materials, semiconductors for 6G 0.3THz to visible light 6G transmission

- 7.1. Dielectric definition, 6G usefulness, derisking, examples of research progress from 2024

- 7.1.1. Overview, important parameters, some latest examples and Zhar Research appraisal

- 7.1.2. Different dielectrics from 5G to 6G: better parameters, lower costs, larger areas

- 7.1.3. Important parameters for 6G dielectrics at device, board, package and RIS level: 5 infograms

- 7.1.4. Advances in 2024 and earlier with Zhar Research overall conclusions

- 7.1.5. SWOT appraisal of low-loss dielectrics for 6G infrastructure and client devices

- 7.1.6. Examples of new dielectrics being derisked by potential use both in 6G and other applications

- 7.2. The quest for high and low permittivity 6G low loss materials

- 7.2.1. Basic mechanisms affecting THz permittivity are challenging at 6G frequencies

- 7.2.2. Permittivity 0.1-1THz for 20 low loss compounds simplified

- 7.2.3. Dissipation factor optimisation across THz frequency for 20 material families

- 7.2.6. Special cases Epsilon Near Zero ENZ, silicon, phase change, electro-sensitive

- 7.2.4. THz dissipation factor variation for 20 material families: the detail

- 7.2.5. Compromises depending on format, physical properties and application

- 7.2.6. Special cases Epsilon Near Zero ENZ, silicon, phase change, electro-sensitive

- 7.3. Important dielectric formulations emerging for 6G including advances in 2024

- 7.3.1. Alumina including sapphire

- 7.3.2. Fluoropolymers PBVE, PTFE, PVDF

- 7.3.3. Polyimides

- 7.3.4. Polyphenylene ether and its polystyrene blends, polyphenylene oxide

- 7.3.5. Polypropylenes and their composites

- 7.3.6. Silica and its composites including quartz

- 7.4. Phase change dielectrics, liquid crystal and alternatives for 6G optronics

- 7.4.1. Overview

- 7.4.2. Status of 11 semiconductor and active layer candidates

- 7.4.3. Liquid crystal adopting many more 6G optronic roles: advantages, challenges

- 7.4.4. Vanadium dioxide adopting many more 6G optronic roles: advantages, challenges

- 7.5. Terahertz waveguide cables and small units

- 7.5.1. Need, and state of play

- 7.5.2. Advances in THz waveguides in 2025 (pre-publication), 2024 and 2023

- 7.5.3. Design and materials of 6G waveguide cables including fluoropolymers and polypropylenes

- 7.5.4 THz waveguides from InAs, GaP, sapphire etc. for boosting emitters, sensing etc.

- 7.5.5. Manufacturing polymer THz cable in long reels

- 7.5.6. THz waveguide gratings etched on metal-wires

- 7.5.7. SWOT appraisal of terahertz cable waveguides in 6G systems

- 7.6. Future near IR fiber optics for 6G

- 7.6.1. 5G experience

- 7.6.2. Fundamental types

- 7.6.3. Vulnerability of fiber optic cable: Serious attacks occurring

- 7.6.4. Limiting use of the fiber and its electronics to save cost

- 7.6.5. Fiber optic cable design and materials

- 7.6.6. SWOT appraisal of fiber optics in 6G system design

8. Some small companies involved in 6G added value material and device manufacturing technologies

- 8.1. AALTO HAPS UK, Germany, France

- 8.2. Echodyne USA

- 8.3. Evolv Technology USA

- 8.4. Fractal Antenna Systems USA

- 8.5. Greenerwave France

- 8.6. iQLP USA

- 8.7. Kymeta Corp. USA

- 8.8. LATYS Intelligence Canada

- 8.9. Meta Materials Canada

- 8.10. Metacept Systems USA

- 8.11. Metawave USA

- 8.12. Pivotal Commware USA

- 8.13. SensorMetrix USA

- 8.14. Teraview USA