|

시장보고서

상품코드

1578352

레독스 플로우 배터리 : 시장 예측 라인(23 라인), 로드맵, 기술, 제조업체(59사), 최신 연구 파이프라인(2025-2045년)Redox Flow Batteries: 23 Market Forecast Lines, Roadmaps, Technologies, 59 Manufacturers, Latest Research Pipeline 2025-2045 |

||||||

레독스 플로우 배터리(RFB)는 수십년간 황무지였던 분야에서 현재는 매우 활발한 분야가 되고 있습니다. 그 이유로는 주로 적절한 시장 요구의 부상 및 중요한 개량이 이루어지고 있는 점 등이 있습니다.

RFB의 제조업자는 2045년에 200억 달러 초과 또는 두 배의 사업 규모를 보일 것으로 예측하고 있습니다. 핵심은 초기 비용 및 LCOS와 같은 RFB의 제약을 극복하는 급속한 발전입니다. 예를 들어 미국 에너지부의 새로운 보고서에 따르면 RFB는 전력망용 장기 저장에 필요한 기준인 MWh당 50달러를 달성할 수 있는 세 가지 옵션 중 하나라고 합니다. 또한 다른 두 가지 기술은 대규모 토목 공사가 필요하지만 RFB는 그렇지 않습니다.

부활하는 솔라 마이크로그리드

또 다른 중요한 점은 10시간의 지속시간과 안전하게 쌓을 수 있는 RFB는 빠르게 성장하는 솔라 마이크로그리드 시장에서 이미 널리 구매되고 있다는 점입니다. 실제로 RFB를 통해 간헐적인 태양광에 쉽게 대응할 수 있으며, RFB는 필요에 따라 전력과 용량을 개별적으로 조정할 수 있으므로 규모의 경제를 달성할 수 있으며, RFB는 단시간 및 장시간 저장을 위해 하나의 장비로 사용할 수 있습니다.

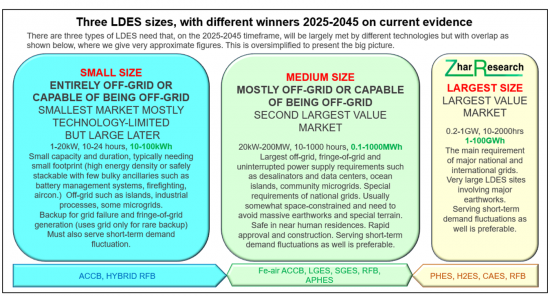

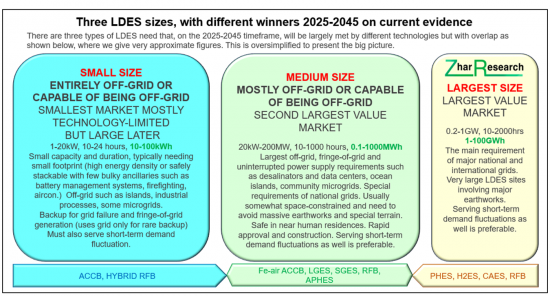

캡션 : 3개의 LDES 사이즈, 다른 승자(2025-2045년)

현재 에비던스에 기반

세계의 레독스 플로우 배터리(RFB) 시장을 조사했으며, 장시간 에너지 저장(LDES) 기술의 개요, RFB 하드웨어와 시스템 설계, 연구 파이프라인, 기술 로드맵, 그리드 내외 RFB 전망, 주요 기업의 개요 등을 정리하여 전해드립니다.

목차

제1장 개요·결론

제2장 서론

- 에너지 기초와 LCOS

- 급속한 비용 삭감으로 재생에너지에 대한 참여를 가속

- 태양에너지 발전의 승리와 간헐성의 과제

- LDES의 회피 루트

- LDES의 정의와 선택 비교

- 그리드와 그리드외의 LDES에 대한 다른 요구

- 2025년의 주요프로젝트와 주요 기술 부분집합

- LDES 장애, 대체안, 투자환경

- LDES 툴 키트

- 기술별 퍼포먼스에 관한 최신 독립 평가

- 기타 측면

제3장 RFB 설계 원칙·연구 파이프라인·독소 대체품·SWOT 평가

- 개요, 비용 분석, 발자국의 삭감, 다음 설계 과제

- 화학과 반응에 의한 RFB 유형과 파라미터 평가

- 기본적인 RFB 하드웨어와 시스템 설계

- 바나듐 RFB 설계

- 올 아이언 RFB 설계

- 철크롬 금속 배위자 설계

- 기타 금속 배위자 RFB 설계

- 수소 브롬 RFB 설계

- 유기 RFB 설계

- RFB막 설계

- RFB 연구 파이프라인

- 대처해야 할 독소 문제와 각사의 현재 성과

- SWOT 평가 : 일반 RFB

- SWOT 평가 : 고정형 저장에서의 RFB

- SWOT 평가 : 하이브리드 RFB

- SWOT 평가 : 대체품과 비교한 바나듐 RFB

제4장 59개 RFB 기업·제조업체·주요 재료 공급업체의 비교·소개

- 8 요소에 의한 비교 : 이름, 브랜드, 기술, 기술의 준비 상황, 그리드외 초점, LDES 초점, 코멘트

- 58개 RFB 기업(제조업체 48사·주요 재료/서비스 10사)의 개요·그리드외 LDES의 가능성

- Agora Energy Technologies

- Allegro Energy

- Beijing Herui Energy Storage

- Bryte Batteries Norway

- CellCube(Enerox)

- CERQ

- China CEC

- CMBlu

- Cougar Creek Technologies

- EDF bought Pivot Power

- Elestor

- ESS

- Green Energy Storage

- H2

- HBIS

- Hubei Lvdong

- Hunan Huifeng High Tech Energy

- HydraRedox

- Invinity Energy Systems

- Jolt Energy Storage Solutions

- Kemiwatt

- Korid Energy / AVESS

- Largo Inc

- LE System

- Lockheed Martin

- nanoFlowcell

- Noon Energy

- Pinflow

- Primus Power

- Prolux

- Quino Energy

- Redflow

- Redox One

- RFC Power

- Rongke Power

- Salgenx

- Shanghai Electric Energy Storage

- Shmid

- State Power Investment Corp.

- StorEn Technologies

- StorTera

- Stryten Energy

- Sumitomo Electric

- Suntien Green Energy

- Swanbarton

- VFlowTech

- Vionx Energy

- VizBlue

- VLiquid

- Voith

- Volterion

- VoltStorage

- VRB Energy

- Wattjoule Corporation

- WeView

- Wuhan NARI

- XL Batteries

- Yinfeng New Energy

- Zhiguang

제5장 LDES(장시간 에너지 저장)용 RFB

- 개요

- RFB 연구 : LDES로 축을 옮긴다.

- RFB LDES 프로젝트와 2025년까지의 계산 : 시간, 용량, 현재 이기고 있는 기술

- RFB LDES의 성과와 목표

- 승리를 초래하는 LDES 레독스 플로우 배터리 기술

- LDES 기능으로 이동할 가능성이 있는 RFB 기업 44사 : 8개 열로 비교

- 그리드외와 LDES RFB에 대한 동향의 리더

- LDES에서 RFB 경쟁상 위치를 분명히 하는 8개의 파라미터 맵

제6장 그리드외 LDES용 레독스 플로우 배터리

- 개요

- 그리드외 : 건물, 산업 프로세스, 미니그리드, 마이크로그리드, 기타

- 그리드외 발전과 관리

- 보다 장기 보관이 필요한 경향

- LDES의 필요성을 줄이는 전략과 LDES의 확대 억제

- 그리드 및 그리드외용 LDES 툴 키트

- 그리드외 발전의 시장 성장 촉진요인으로서의 LDES 제공

- 그리드외 저장의 다기능성

- LDES 비용의 과제

- 그리드 및 그리드외에서 LDES 기술의 가능성 전체상

- 그리드외 LDES가 2025-2045년에 RFB의 최대수·최대 가치 시장이 되는 이유

- 2024-2045년에 판매되는 LDES의 최대수를 지지하는 기술

Summary

Redox flow batteries are now a very active area after decades in the wilderness. That is largely because the appropriate market needs have arrived but it is increasingly reinforced by important improvements.

Essential new report

The new commercially-oriented 327-page report, "Redox Flow Batteries: 23 Market Forecast Lines, Roadmaps, Technologies, 59 Manufacturers, Latest Research Pipeline 2025-2045" predicts that these manufacturers will share over $20 billion of business in 2045, possibly double. Key is the now rapid progress in overcoming RFB limitations such as up-front cost and Levelised Cost of Storage LCOS. For example, a new US Department of Energy report finds that RFB are one of only three options able to drop to the $50/MWh it sees as necessary for long duration storage for grids. The other two technologies identified need massive earthworks: RFB does not.

Solar microgrids resurgent

Equally important, safely stackable RFB with ten hours duration (MWh divided by MW) are already widely purchased for solar microgrids, a rapidly-growing market. Indeed, coping with longer solar intermittency is easily achievable with RFB and most competition cannot keep up with that trend mainly driven by solar power taking over but also wind and their attendant intermittency. RFB has economy of scale due to separate adjustment of power and capacity as needed. RFB can perform short-and long-duration storage in one unit.

Traditional vanadium gaining business

The traditional vanadium RFB is gaining business. That is mostly for systems capable of being off-grid but some grid giants are being erected in China. An even bigger one is now planned in Europe.

Iron and other approaches slash cost and hybrids go small

Much of the effort is directed at using iron and, later, other options, to save cost. For different applications, the industry is perfecting small hybrids of RFB with one side having conventional battery structure instead of a tank of liquid. These may offer long duration in our solar buildings, where space is very tight. Eliminate the expensive ion exchange membrane? Offer 50-year life? Switch it off to store power in its liquids for a year with no leak or fade? Only the new Zhar Research report has the analysis, latest research, roadmaps and forecasts.

What the report offers

The Executive Summary and Conclusions is sufficient in itself with the new infograms, three SWOT appraisals, roadmaps and 23 forecast lines, graphs with explanations. The Introduction (30 pages) explains the context of renewable energy, Long Duration Energy Storage (most of the future RFB opportunity), its best technologies compared with many diagrams and comparison tables. Here are escape routes from needing LDES, because this report is balanced, real-world appraisal of your opportunity, not the maximised dream of a trade association. The conclusion is that LDES will not be as large a market as enthusiasts portray, but huge, nonetheless.

Chapter 3. RFB design principles, research pipeline, toxigen alternatives and SWOT appraisals (63 pages) looks closely at the different chemistries, electrolytes, membranes and so on, with infograms and tables. Understand the implications of the latest research pipeline and how to deal with matters of concern to industry such as toxicity issues. Which objectives are far off, even unrealistic?

Chapter 4. compares in eight columns then profiles 59 RFB companies, mostly manufacturers, but also some key materials providers in its 132 pages. Which four are already serious about 100 day LDES RFB, embarrassing the competition facing this very real emerging need? Chapter 5. Long Duration Energy Storage LDES RFB (28 pages) is equally detailed. It closely examines 13 relevant research advances in 2024. Parameters required, achieved and likely are revealed and explained because LDES is where the main potential of RFB now lies - from compact hybrid RFB in a building to very large RFB in a grid. Chapter 6. Redox flow batteries for LDES beyond grids (15 pages) then takes another look at this aspect because it will probably dominate value sales 2025-2045.

CAPTION: Three LDES sizes, with different winners 2025-2045

on current evidence

Table of Contents

1. Executive summary and conclusions

- 1.1. Purpose of this report

- 1.2. Methodology of this analysis

- 1.2. The different characteristics of grid utility and beyond-grid LDES 2025-2045

- 1.3. Eight primary conclusions: RFB markets and industry with ten infograms

- 1.4. 19 primary conclusions concerning RFB technologies

- 1.4.1. The 19 conclusions

- 1.4.2. Research pipeline analysis: 108 papers from 2022-2024

- 1.4.3. Seven RFB parameters in volume sales, vanadium vs other 2025-2045

- 1.5. 48 RFB manufacturers compared in 8 columns: name, brand, technology, tech. readiness, beyond grid focus, LDES focus, comment

- 1.6. Pie charts of active material and country of RFB manufacturers

- 1.7. SWOT appraisal of regular RFB

- 1.8. SWOT appraisal of hybrid RFB

- 1.9. SWOT appraisal of vanadium RFB against alternatives

- 1.10. RFB roadmap by market and by technology 2025-2045

- 1.11. Long Duration Energy Storage LDES roadmap 2025-2045

- 1.12. Market forecasts in 23 lines

- 1.12.1. RFB global value market grid vs beyond-grid 2025-2045 table, graph, explanation

- 1.12.2. RFB global value market short term and LDES 2025-2045 table, graph, explanation

- 1.12.3. Vanadium vs iron vs other RFB value market % 2025-2045 table, graph, explanation

- 1.12.4. Vanadium loses RFB share but rises elsewhere

- 1.12.5. Regional share of RFB value market in four regions 2025-2045

- 1.12.6. LDES value market $ billion in 9 technology categories with explanation 2025-2045

- 1.12.7. LDES total value market showing beyond-grid gaining share 2025-2045

2. Introduction

- 2.1. Energy fundamentals and LCOS

- 2.2. Racing into renewables with rapid cost reduction

- 2.3. Solar winning and the intermittency challenge

- 2.4. Escape routes from LDES

- 2.4.1. General situation

- 2.4.2. Reduction of LDES need by unrelated actions

- 2.4.3. Many options to deliberately reduce the need for LDES

- 2.5. LDES definitions and choices compared

- 2.6. The very different needs for grid vs beyond-grid LDES 2025-2045

- 2.7. Leading projects in 2025 showing leading technology subsets

- 2.8. LDES impediments, alternatives and investment climate

- 2.9. LDES toolkit

- 2.9.1. Overview

- 2.9.2. LDES choices compared

- 2.10. Latest independent assessments of performance by technology

- 2.12. Other aspects

3. RFB design principles, research pipeline, toxigen alternatives and SWOT appraisals

- 3.1. Overview, cost analysis, footprint reduction and next design challenges

- 3.1.1. General

- 3.1.2. Cost issues, cost breakdown and potential improvement

- 3.1.3. Footprint reduction

- 3.2. Types of RFB by chemistry and reaction with parameter appraisal

- 3.3. Basic RFB hardware and system design

- 3.4. Vanadium RFB design

- 3.5. All-iron RFB design

- 3.6. Iron Chromium metal ligand design

- 3.7. Other metal ligand RFB design

- 3.8. Hydrogen-bromine RFB design

- 3.9. Organic RFB design

- 3.10. RFB membrane design

- 3.10.1. Issues

- 3.10.2. Membrane difficulty levels and materials used and proposed

- 3.10.3. Recent RFB membrane research

- 3.11. RFB research pipeline

- 3.11.1. Overview

- 3.11.2. Extreme promises

- 3.11.3. Research pipeline analysis: 108 papers from 2022 to 2024

- 3.11.4. Iron-based electrolyte RFB research 2024

- 3.11.5. Vanadium electrolyte RFB research

- 3.11.6. Organic electrolyte RFB research

- 3.11.7. Zinc electrolyte RFB research

- 3.11.8. General and other metals RFB research

- 3.11.9. Manganese-based RFB research

- 3.12. Toxigen issues to tackle and current achievements by company

- 3.13. SWOT appraisal of regular RFB

- 3.14. SWOT appraisal of RFB for stationary storage

- 3.15. SWOT appraisal of hybrid RFB

- 3.16. SWOT appraisal of vanadium RFB against alternatives

4. 59 RFB companies, manufacturers, key materials providers compared and profiled in 132 pages

- 4.1. 58 RFB companies compared in 8 columns: name, brand, technology, tech. readiness, beyond grid focus, LDES focus, comment

- 4.2. Profiles of 58 RFB companies (48 manufacturers, 10 in key materials/ services) in 130 pages with appraisal for beyond-grid LDES potential

- Agora Energy Technologies

- Allegro Energy

- Beijing Herui Energy Storage

- Bryte Batteries Norway

- CellCube (Enerox)

- CERQ

- China CEC

- CMBlu

- Cougar Creek Technologies

- EDF bought Pivot Power

- Elestor

- ESS

- Green Energy Storage

- H2

- HBIS

- Hubei Lvdong

- Hunan Huifeng High Tech Energy

- HydraRedox

- Invinity Energy Systems

- Jolt Energy Storage Solutions

- Kemiwatt

- Korid Energy / AVESS

- Largo Inc

- LE System

- Lockheed Martin

- nanoFlowcell

- Noon Energy

- Pinflow

- Primus Power

- Prolux

- Quino Energy

- Redflow

- Redox One

- RFC Power

- Rongke Power

- Salgenx

- Shanghai Electric Energy Storage

- Shmid

- State Power Investment Corp.

- StorEn Technologies

- StorTera

- Stryten Energy

- Sumitomo Electric

- Suntien Green Energy

- Swanbarton

- VFlowTech

- Vionx Energy

- VizBlue

- VLiquid

- Voith

- Volterion

- VoltStorage

- VRB Energy

- Wattjoule Corporation

- WeView

- Wuhan NARI

- XL Batteries

- Yinfeng New Energy

- Zhiguang

5. Long Duration Energy Storage LDES RFB

- 5.1. Overview

- 5.1.1. Definition

- 5.1.2. Very different LDES needs for grid vs beyond-grid

- 5.1.3. RFB capability in the LDES world

- 5.1.4. Duration vs power of LDES technologies not needing major earthworks compared with others in 2025

- 5.2. RFB research pivoting to LDES

- 5.2.1. Overview of research

- 5.2.2. 13 important RFB research advances in 2024 relevant to LDES

- 5.3. RFB LDES projects and calculations to 2025: hours, capacity, currently winning technology

- 5.4. RFB LDES achievements and aspirations 2025-2045

- 5.5. Winning LDES redox flow battery technologies 2025-2045

- 5.7 44 RFB companies likely to move to LDES capability compared in 8 columns

- 5.8. Leaders in the trends to beyond-grid and LDES RFB

- 5.9. Eight parameter maps revealing RFB competitive position in LDES

6. Redox flow batteries for LDES beyond grids

- 6.1. Overview

- 6.2. Beyond-grid: buildings, industrial processes, minigrids, microgrids, other

- 6.3. Beyond-grid electricity production and management

- 6.4. The trend to needing longer duration storage

- 6.5. Strategies for reducing LDES need can limit escalation of LDES

- 6.6. LDES toolkit for grid and beyond-grid

- 6.7. Market drivers of beyond-grid electricity generation notably providing LDES

- 6.8. Multifunctional nature of beyond-grid storage

- 6.9. LDES cost challenge

- 6.10. Big picture of LDES technology potential for grid and beyond-grid

- 6.11. Why beyond-grid LDES will become the largest number and value market for RFB 2025-2045

- 6.12. Technologies for largest number of LDES sold 2024-2045