|

시장보고서

상품코드

1692589

재창조된 수소 경제 : 재료 및 하드웨어 시장, 기술(2025-2045년)The Hydrogen Economy Reinvented: Materials and Hardware Markets, Technology 2025-2045 |

||||||

이길 수 없다면 함께하세요.

이제 수소가 전기화를 파괴하려는 헛된 시도가 아니라 전기화를 강화하는 방향으로 전환될 때 대규모의 새로운 시장을 확보할 수 있다는 사실을 깨닫게 되었습니다. 예를 들어, 전력망을 위한 핵융합 발전으로 성공할 수 있습니다. 실제로 일부 설계에서는 직접 전력을 생산할 수 있습니다. 대형 선박의 전기 구동 장치의 전원이 될 수 있습니다. 핵융합 발전에 대한 투자는 급증하고 있으며, 2035년 이후 상업화를 위해 매년 100억 달러 이상의 투자가 예상되고 있습니다. 한편, 발전 비용이 낮으면 태양광 발전에 군배가 올라가지만, 소금 동굴에서의 통상의 수소 저장은 계절마다 발생하는 저장의 요구에 대해 톱 러너입니다. 사실, 현대의 전략적 석유 비축에 해당하는 것은 지하 동굴에 훨씬 오래 저장되는 그린 수소일 수 있습니다. 게다가, 화학 원료로서 그린 수소의 이용을 확대할 가능성도 상당히 많고, 이러한 선택은 모두 수소를 가정이나 자동차에 파이프로 공급하는 이전의 파멸적인 시도보다 훨씬 현실적입니다.

본 보고서에서는 재창조된 수소 경제 동향을 조사하여 수소 경제의 지금까지의 경위와 과제, 수소의 제조·저장기술, 재료개발의 동향, LDES(장기에너지저장)과 수소, 수소핵융합, 화학원료로서의 수소 등 수소 경제의 새로운 기회 분석, 향후 전망 등을 정리했습니다.

목차

제1장 주요 요약·총론

- 본 보고서의 목적

- 조사 방법

- 산업용 수소에 관한 일반적인 총론과 SWOT 평가

- 총론 : 전력망용 수소 : SWOT 평가를 통한 핵융합 발전

- 총론 : 전력망용 수소 : SWOT 평가를 통한 장기 에너지 저장(LDES)

- 총론 : 화학 공급 원료로서의 그린 수소

- 총론 : 육상, 해상, 항공을 통한 수소 자동차

- 전력망 지원(핵융합, LDES), 화학 공급 원료, 틈새 연료를 위한 라인이 포함된 수소 경제 개혁 로드맵

- 시장 예측(2025-2045년) : 27항목

- 수소시장

- 수소 하드웨어 시장

- LDES 시장 : 기술 카테고리별

- LDES 시장

- LDES 시장(2025-2045년)

제2장 수소 개요 : 사업 기회와 관련된 소재

- 개요

- 본 장의 내용

- 수소 경제의 목표와 우선순위 변화

- 재창조된 수소 경제를 지원하는 이니셔티브의 예

- 비즈니스 기회로서의 수소에 대한 기본 사항

- 수소 경제의 첫 번째 개념이 실패하는 이유

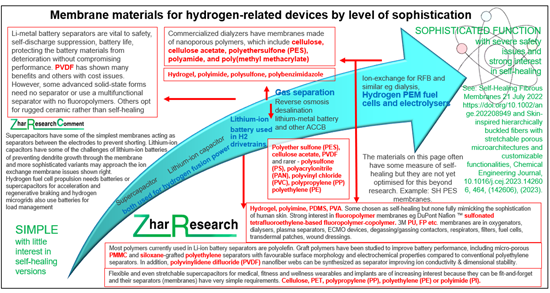

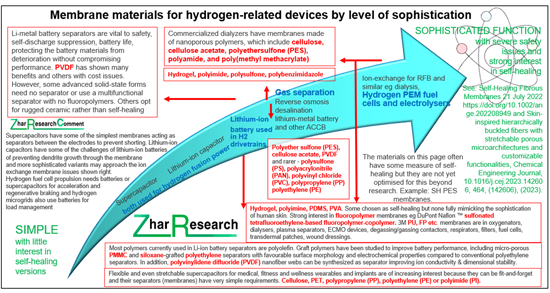

- 정교성 수준별 멤브레인 재료

제3장 수소 제조·저장 기술과 재료의 혁신

- 개요

- 수소 제조

- 수소의 운송, 저장 방법과 재료

제4장 전력망 : 수소 장기 에너지 저장(LDES)

- 개요

- 화학 중간체 LDES의 스위트 스폿

- LDES에 있어서 수소와 메탄 및 암모니아의 비교

- 수소 LDES 리더 : Calistoga Resiliency Centre USA

- 계산에 의하면, 최장기의 LDES에서는 수소가 승리하는 것이 판명

- 광업 대기업은 신중하게 많은 옵션을 진행하고 있다

- 건물 및 기타 소규모 장소

- LDES 수소 저장 기술

- LDES의 수소 저장 파라미터 평가

- LDES에 있어서의 수소, 메탄, 암모니아의 SWOT 평가

제5장 전력망 : 수소로부터의 핵융합 발전

- 핵융합의 기초 : 후보 반응과 특수 재료의 가능성

- 핵융합 그리드 전력의 가능성에 관한 SWOT 평가

- 실제 핵분열 발전 시스템과 계획 중 핵융합 발전 시스템의 비교

- 핵융합로의 동작 원리와 재료의 방사선 손상

- 관성 한정 핵융합

- 핵융합 발전을 위한 자기 한정 옵션

- 관심과 투자의 급증: 선택되는 기술과 그 이유

- 수소핵융합발전장치의 제조를 경쟁하는 민간핵융합기업의 분석

- 주요 핵융합 발전기업 : 국가별 수상 융합 발전사, 다양한 성능 기준, 자금 지원

- 핵융합 발전의 가장 빠른 공급일

제6장 화학, 철강, 식품 제조에 있어서의 수소 원료 반응물 및 중간체

- 개요 : 비료 및 시멘트, 연료, 식품, 탄소 나노튜브의 화학 물질용 수소

- 시멘트와 콘크리트의 탈탄소화

- 석유 정제 및 화학 공학에서 수소

- 비료 생산에 있어서의 수소 이용 : 암모니아 루트와 전망

- 수소에 의한 철강 제조의 탈탄소화의 조사와 전망(2025년)

- 지속가능한 연료 및 화학물질 생산을 위한 이산화탄소의 수소화

제7장 완전한 전기가 불충분하거나 실행 불가능한 틈새 연료 : 일부 항공우주, 선박, 열차, 온로드, 오프로드 차량, 마이크로그리드

- 개요

- 수소버스와 노면전차 : 작은 점유율과 전망

- 수소 트럭

- 지게차를 포함한 자재관리 및 건설 차량

- 채굴 차량

- 농업용 차량

- 군용 차량

- 열차

- 보트 및 선박

- 항공기용 수소 : SAF와 순수소의 대처, 조사, 평가(-2025년)

- 수소 마이크로그리드와 조사(2025년)

- 수소 열전병급 발전의 새로운 발명

Summary

The hydrogen economy reinvented will call for many new high-added-value materials and devices. A report is now available on just this. It is Zhar Research, "The Hydrogen Economy Reinvented: Materials and Hardware Markets, Technology 2025-2045".

If you cannot beat them then join them

It is now realised that hydrogen will have large new markets when it is redirected to enhance electrification, not pitched as a futile attempt to destroy electrification. For instance, it can succeed as fusion power for electricity grids. Indeed, it some designs, it will directly produce electricity. That may power the electric drives of large ships. Investment in fusion power is rocketing, with over $10 billion yearly in prospect for commercialisation, mostly 2035 and beyond, and much of this spent on specialist materials. Meanwhile, as solar wins for lowest cost electricity generation, regular hydrogen in salt caverns is front-runner for seasonal storage needs arising. Indeed, the modern equivalent of strategic oil reserves may be green hydrogen stored in underground caverns for much longer. In addition, there is considerable potential to grow the use of green hydrogen as a chemical feedstock, all of these options being far more realistic than the earlier doomed attempts to pipe hydrogen into our homes and cars.

Big reversals: different opportunities

Learn how there are big reversals here. Fusion power will need tiny amounts of hydrogen but at massively high prices for the deuterium and tritium isotopes. It will need highly sophisticated, high-priced materials, mostly inorganic. The volume demand for regular hydrogen will heavily involve chemical intermediary and fuel blends rather than the original idea of pure hydrogen everywhere. Because of its fundamental properties, we shall minimise the distribution of hydrogen, not maximise it.

Your new addressable markets

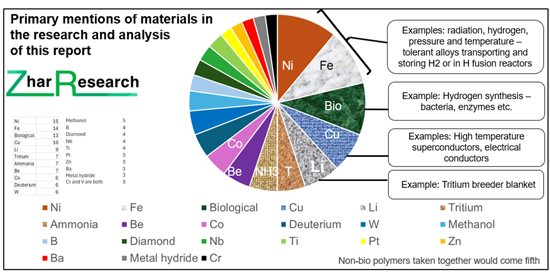

The commercially-oriented, 340-page report starts with a 50-page Executive Summary and Conclusions sufficient in itself for those in a hurry. Here are 51 key conclusions, 27 forecast lines, roadmap in three lines by year 2025-2045, three SWOT appraisals and many lucid new infographics making it easy to grasp your new opportunities. Among the new needs, learn why nickel, iron, copper and lithium-based materials are so prominent alongside biological materials. What are the many types of sophisticated membranes now needed?

Which chemistries?

Why are chemistries of B, Ba, Be, Co, Nb, Pt, V, Zn and, to a lesser extent, Ir, La, Mn, Zr important? Which organics and why, including many membrane composites emerging? Many 2025 research papers and latest industrial advances are analysed throughout the report.

Chapter 2. "Introduction to hydrogen: business opportunities and materials involved" takes 44 pages to cover actual and potential uses of green hydrogen, hydrogen isotopes and their primary uses, actual and targetted, and evidence that the industry is starting to pivot towards different objectives. Many of the resulting, different, hardware needs are introduced here.

Production is changing

The 46 pages of Chapter 3. "Hydrogen production and storage technologies and materials reinvented" concern regular hydrogen, particularly green hydrogen, reasons for current strong investment in hydrogen production and hydrogen hubs, ten hydrogen production methods and their materials then specifically electrolyser technologies compared, materials opportunities emerging. See new focus on geologic "natural" hydrogen, solar hydrogen panels, bio-fermentation and hydrogen made where it is needed. Will there be over-production of green hydrogen due to cost and other factors? Understand hydrogen storage materials: addressing life, size, weight, leakage and safety issues. What hydrogen transport and storage methods, materials, challenges are your opportunities? One particularly important aspect then gets its own chapter.

Electricity grids come center stage

Chapter 4. "Electricity grids: Hydrogen Long Duration Energy Storage LDES" (54 pages). Mostly underground in salt caverns, this will mainly involve massive surplus wind and solar power making green hydrogen with storage then subsequent discharge (GWh divided by GW) of three months or more. Again the coverage is both up-to-date and critical with 2025 research and honest, numerate presentation of the serious conversion efficiency, leakage and other issues for you to solve.

Hydrogen fusion power

It is deeply significant that proof of principle has recently been repeatedly demonstrated with generation of electricity by hydrogen fusion and many amply-funded private companies are promising to demonstrate it providing grid electricity well within the 2025-2045 timeframe. Chapter 5. "Electricity grids: Nuclear fusion power from hydrogen" (57 pages) critically inspects a profusion of 2025 research and industrial advances in this, particularly surfacing your exciting equipment and materials opportunities. Specialist steels, lithium breeder blankets, diamond hydrogen targets, high temperature superconductors pinching hydrogen plasma, deuterium, tritium and helium3 and are examples that are potentially highly profitable.

Growth in use as chemical reactant

Chapter 6. "Hydrogen feedstock reactant and intermediary in chemical, steel, food manufacture" (28 pages) sees growth in this substantial existing use of hydrogen as a chemical feedstock but this situation is complex. For example, there will be more green hydrogen use to make ammonia notably to make fertilizer. However, on a 20-year timeframe, farming is increasingly going indoors with aquaponics, hydroponics and cell culture needing little fertilizer -sometimes 95% less. Use in steelmaking is likely to be a largely new market and more hydrogen will be used in oil refineries until they are hit by a decline in number due to electrification of homes and vehicles. Over-arching all this is adoption of green hydrogen in place of dirtier forms and to make higher value materials such as carbon nanotubes. All is explained and predicted in this chapter, including relevance of hydrogen to cement decarbonisation.

Hydrogen as a niche fuel

Chapter 7. "Niche fuel where full electrification is inadequate or impracticable:

some aerospace, ships, trains, on-road, off-road vehicles, microgrids" in 40 pages addresses what remains after the original dream is abandoned - battery-electric vehicles and electricity equipment in our homes being much simpler, safer, more affordable and longer-lived. We find that industrial heating, off-road vehicles, trains and ships are among the niches that may adopt some hydrogen solutions but affordable MW-level mining vehicle and ship batteries and faster improvement of battery-electric powertrains are a threat, including very fast charging. Hydrogen adoption niches will sometimes be aided by being a marginally costed part of a hydrogen ecosystem because total cost of ownership is a major impediment in stand-alone transport and microgrid systems.

CAPTION: Primary mentions of valuable materials in the Zhar Research report, "The Hydrogen Economy Reinvented: Materials and Hardware Markets, Technology 2025-2045". Elements named refer to use as metal, alloy or compound.

CAPTION: Membrane materials for hydrogen-related devices by level of sophistication

Source: Zhar Research report, "The Hydrogen Economy Reinvented: Materials and Hardware Markets, Technology 2025-2045" .

Table of Contents

1. Executive summary and conclusions

- 1.1. Purpose of this report

- 1.2. Methodology of this analysis

- 1.3 25 General conclusions and SWOT appraisal of industrial hydrogen

- 1.4. Conclusions: hydrogen for electricity grids: fusion power with SWOT appraisal

- 1.5. Conclusions: hydrogen for electricity grids: Long Duration Energy Storage LDES with SWOT appraisal

- 1.6. Conclusions: green hydrogen as a chemical feedstock

- 1.7. Conclusions: hydrogen vehicles by land, water and air

- 1.8. Roadmap for reinvented hydrogen economy 2025-2045 with lines for electricity grid support (fusion, LDES), chemical feedstock and niche fuel

- 1.9. Market forecasts 2025-2045 in 27 lines

- 1.9.1. Hydrogen market million tonnes 2025-2045 in seven lines, table, graphs

- 1.9.2. Hydrogen hardware market $ billion 2025-2045 in 8 lines, table, graphs

- 1.9.3. LDES market in 9 technology categories $ billion 2025-2045, 9 lines table, graphs

- 1.9.4. LDES total value market showing beyond-grid gaining share 2025-2045

- 1.9.5. Total LDES value market percent in three size categories 2025-2045 table, graphs

2. Introduction to hydrogen: business opportunities and materials involved

- 2.1. Overview

- 2.2. Coverage in this chapter

- 2.3. The hydrogen economy objectives and how priorities are changing

- 2.3.1. Many actual and potential uses of green hydrogen

- 2.3.2. Lessons of history and new objectives for 2025-2045

- 2.3.3. How the hydrogen economy idea is being reinvented to reflect new realities

- 2.3.4. Reinvention to leverage strengths leads to different beneficiaries

- 2.3.5. New realities: how the hydrogen economy objective is being reinvented

- 2.3.6. The most promising uses of green hydrogen 2025-2045

- 2.3.7 2024-5 research advances

- 2.4. Examples of initiatives supporting the reinvented hydrogen economy

- 2.4.1. Steel, ammonia, hydrogen hubs not based on everyday fuel making, fusion power

- 2.4.2. Private fusion companies and governments race into hydrogen fusion power

- 2.5. Basics of hydrogen as your business opportunity

- 2.5.1. SWOT appraisal of hydrogen

- 2.5.2. Hydrogen isotopes and their primary uses actual and targetted

- 2.5.3. Comparison of regular hydrogen (protium) with other fuels and with deuterium and tritium forms of hydrogen

- 2.5.4. Parameters for on-board hydrogen storage vs gasoline

- 2.6. Why the first concept of a hydrogen economy is failing

- 2.6.1. Some emerging realities driving reinvention of the hydrogen economy idea

- 2.6.2. How hydrogen is not the leading prospect for decarbonisation

- 2.6.3. How a battery competes with hydrogen tank + fuel cell

- 2.6.4. Why hydrogen for mainstream heating is fundamentally more complex and expensive than electrification

- 2.6.5. Why hydrogen is not "the new mainstream oil or gas fuel" 2025-2045 but niches remain

- 2.7. Membrane materials by level of sophistication

3. Hydrogen production and storage technologies and materials reinvented

- 3.1. Overview

- 3.2 Hydrogen production

- 3.2.1. Strong investment in hydrogen production and hydrogen hubs

- 3.2.2. Hydrogen production choices using color coding

- 3.2.3. Eleven hydrogen production methods and their materials compared

- 3.2.4. Electrolyser technologies compared

- 3.2.5. Materials opportunities emerging

- 3.2.6. New focus on - geologic "natural" hydrogen, solar hydrogen panels, bio-fermentation

- 3.2.7. Examples of hydrogen made where it is needed - a new emphasis

- 3.2.8. Will there be over-production of green hydrogen due to cost and other factors?

- 3.3. Hydrogen transport and storage methods and materials

- 3.3.1. The challenges

- 3.3.2. Five types of hydrogen and intermediary for storage compared

- 3.3.3. Hydrogen storage materials: addressing life, size, weight, leakage and safety issues

4. Electricity grids: Hydrogen Long Duration Energy Storage LDES

- 4.1. Overview

- 4.1.1. Approach

- 4.1.2. Optimisation and priorities

- 4.1.3. Hydrogen grid storage: the UK as an example of contention

- 4.1.4. Wide spread of parameters means interpretation should be cautious

- 4.2. Sweet spot for chemical intermediary LDES

- 4.2.1. Best applications

- 4.3.2. New research on salt caverns, subsea and other options for large scale hydrogen storage

- 4.3.3. New research on complex mechanisms for hydrogen loss

- 4.3.4. N4w research on hydrogen leakage causing global warming

- 4.3.5. New research combining grid hydrogen storage with other storage: hybrid systems

- 4.4. Hydrogen compared to methane and ammonia for LDES

- 4.5. Hydrogen LDES leader: Calistoga Resiliency Centre USA 48-hour hydrogen LDES

- 4.6. Calculations finding that hydrogen will win for longest term LDES

- 4.7. Mining giants prudently progress many options

- 4.8. Buildings and other small locations

- 4.8.1. Rationale

- 4.8.2. Hydrogen storage offered for houses in Italy and Germany

- 4.9. Technologies for LDES hydrogen storage

- 4.9.1. Overview

- 4.9.2. Choices of underground storage for LDES hydrogen

- 4.9.3. Hydrogen interconnectors for electrical energy transmission and storage

- 4.9.4. Review of 15 projects that use hydrogen as energy storage in a power system

- 4.10. Parameter appraisal of hydrogen storage for LDES

- 4.11. SWOT appraisal of hydrogen, methane, ammonia for LDES

5. Electricity grids: Nuclear fusion power from hydrogen

- 5.1. Fusion basics: candidate reactions and specialist materials opportunities

- 5.1.1. Candidate hydrogen fusion reactions

- 5.1.2. Development objectives are fusion ignition then net power gain

- 5.1.3. Materials opportunities: liquids, solids, gases and plasma

- 5.3. SWOT appraisal of the potential of fusion grid power

- 5.4. Comparison of actual fission and planned fusion power systems

- 5.5. Operating principles of fusion reactors and radiation damage of the materials

- 5.5.1. Candidate designs

- 5.5.2. Radiation and plasma damage of the materials: research in 2025 and future needs

- 5.6. Inertial Confinement Fusion

- 5.6.1. Laser-based inertial confinement fusion (LICF) laser designs

- 5.6.2. Fusion target opportunities

- 5.6.3. Lawrence Livermore National Laboratories LLNL National Ignition Facility NIF

- 5.6.4. Other inertial confinement developers and the special case of Helion

- 5.7. Magnetic confinement options for fusion power

- 5.7.1. General

- 5.7.2. Heating

- 5.7.3. Electricity production

- 5.7.4. Tokamak and Z-Pinch: JET, ITER and others

- 5.7.5. Toroidal magnetic confinement machine material opportunities

- 5.7.6. Research in 2025 on toroidal and allied fusion power hardware

- 5.7.7. Stellarators and their research in 2025

- 5.7.8. Inside-out magnetic confinement: OpenStar levitated dipole fusion reactor

- 5.8. Sudden surge in interest and investment: which technology and why

- 5.9. Analysis of private fusion companies racing to make hydrogen fusion electricity generators

- 5.10. Winning fusion power companies by country, various performance criteria, funding

- 5.10.1. Analysis by location, operating principles, funding of private companies

- 5.10.2. Winning technologies in approaching or achieving fusion ignition

- 5.11. Earliest dates for fusion electricity being delivered

6. Hydrogen feedstock reactant and intermediary in chemical, steel, food manufacture

- 6.1. Overview: hydrogen for chemicals from fertiliser and cement, fuels, foods, carbon nanotubes

- 6.1.1. Current situation

- 6.1.2. Growth ahead making higher value materials such as carbon nanotubes

- 6.1.3. Europe takes the lead in decarbonising industrial hydrogen: 2025 initiatives

- 6.2. Cement and concrete decarbonisation

- 6.2.1. The challenge and the place of hydrogen

- 6.2.2. First net zero concrete placement using synthetic limestone aggregate

- 6.2.3. Use of hydrogen for cement and concrete decarbonisation

- 6.2.4. Appraisal of examples, latest research and intentions for hydrogen in cement manufacture

- 6.2.5 24 of the companies and primary countries involved

- 6.3. Hydrogen in oil refineries and chemical engineering

- 6.3.1. Rationale

- 6.3.2. Current examples of hydrogen in the oil and gas industry

- 6.3.3. Key applications and prospects

- 6.4. Hydrogen use in fertiliser production 2025-2045, the ammonia route and prospects

- 6.5. Decarbonising steel making with hydrogen and its 2025 research and prospects

- 6.6. Hydrogenation of carbon dioxide for sustainable fuel and chemical production: 2025 research

7. Niche fuel where full electrification is inadequate or impracticable: some aerospace, ships, trains, on-road, off-road vehicles, microgrids

- 7.1. Overview:

- 7.1.1. General situation through 2025 and coverage in this chapter

- 7.1.2. Why hydrogen prospects are greater for very large vehicles

- 7.1.3. Hydrogen as a hybrid solution for vehicles land, water and air

- 7.2. Hydrogen bus and tram minority share and prospects

- 7.3. Hydrogen trucks

- 7.4. Material handling and construction vehicles including forklift trucks

- 7.5. Mining vehicles

- 7.6. Agricultural vehicles

- 7.7. Military vehicles

- 7.8. Trains

- 7.9. Boats and ships

- 7.9.1. Overview

- 7.9.2. Progress towards energy independent ships without hydrogen

- 7.9.3. Hydrogen options as ship fuel loaded or made on-board including planned Energy Observer 2 ship

- 7.9.4. International Maritime Organisation forecasts, actions, view of hydrogen as ship fuel

- 7.9.5. Hydrogen ships and boats: practical experience through 2025

- 7.9.6. Research progress in 2025

- 7.10. Hydrogen for aircraft: SAF and pure hydrogen initiative, research, appraisal through 2025

- 7.10.1. Current situation

- 7.10.2. Sustainable Aviation Fuel SAF involving hydrogen

- 7.10.3. Pure hydrogen aviation

- 7.10.4. Research in 2025 on hydrogen aviation materials and issues

- 7.10.5. Enthusiasm meets decline in interest

- 7.11. Hydrogen microgrids and their 2025 research

- 7.12. Hydrogen combined heat and power reinvented