|

시장보고서

상품코드

1706271

핵융합 발전 및 기타 플라즈마 엔지니어링 재료 및 하드웨어의 기회 : 시장(2025-2045년)Nuclear Fusion Power and Other Plasma Engineering Materials and Hardware Opportunities: Markets 2025-2045 |

||||||

'핵융합 체조 선수'로서의 붕소:

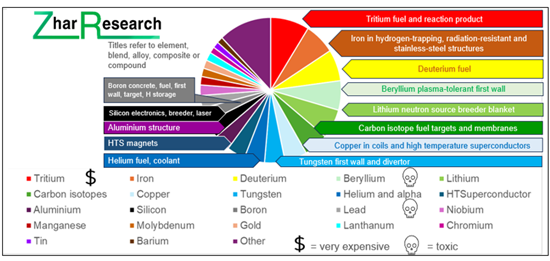

붕소는 의료에서 항공우주에 이르기까지 핵융합 외에도 폭넓게 응용되고 있으며, 개발 비용의 리스크는 감소될 것입니다. 예를 들어, 고온 초전도체, 고출력 레이저, 텅스텐, 구리, 실리콘, 리튬, 철, 탄소 동위원소 등이 있으며, 이들은 합금, 화합물, 나노기술을 이용한 형태 등 다양한 형태로 사용되고 있습니다. 왜 붕소 기반 재료가 '핵융합의 체조 선수'라고 불리는 이유는 무엇일까요? 그것은 핵융합 장치에서 매우 많은 중요한 용도의 기반이 되기 때문입니다. 또한, 희토류(희토류 원소), 유기 고분자 및 기타 많은 재료들도 마찬가지로 주목받고 있습니다.

투자의 홍수, 미래를 내다보며:

현재 핵융합 개발 기업들은 빠르게 증가하는 막대한 자금을 고부가가치 재료와 구조물에 투자하고 있습니다. 핵융합 발전 및 관련 신흥 응용 분야가 더욱 발전하면 플라즈마 기술, 레이저, 극저온(극저온) 등의 기술이 거대한 하드웨어 시장을 개척할 수 있을 것으로 예상됩니다. 이 보고서에서는 유망한 응용 분야, 잠재적 파트너, 경쟁사, 그리고 2025년부터 2045년까지의 로드맵과 시장 예측을 포함하고 있습니다.

목차

제1장 주요 요약 및 결론

- 본 보고서의 목적

- 분석 방법

- 일반적인 결론(7개 항목)

- 재료 및 하드웨어에 관한 결론(11개 항목)

- 2025년 연구·개발자 우선사항에 근거한 주요 23종 재료 및 하드웨어 기회

- 플라즈마 관련 재료 및 하드웨어 기회

- 핵융합 밸류체인 막재료와 관련 기기 첨단화 수준별 정리

- 민간 핵융합 기업에 대한 투자 동향에 관한 3개 결론

- 핵융합 그리드 전력의 잠재력에 대한 SWOT 평가

- 잠재적인 소스 그리드 전기로서의 자기 감금 융합의 SWOT 평가

- 잠재적인 소스 그리드 전기로서의 관성 감금 융합의 SWOT 평가

- 핵융합 및 관련 시스템 재료/하드웨어 기술과 시장 로드맵

- 22개 항목의 시장 예측과 그래프(2025-2045년)

제2장 재생에너지, 재구축 된 수소 경제, 타산업 핵융합 발전과 기타 플라즈마 공학

- 개요

- 수소 경제 : 잘못된 스타트, 재구축, 수소 융합에 대한 기대

- 민간 핵융합 기업과 정부 : 수소 융합 발전에 겨루어 참여

- 핵융합 발전에 대한 대규모 정부 투자

- 수소 동위체의 주요 용도

- 일반 수소(프로튬)와 기타 연료, 중수소 및 삼중수소 형태 수소와의 특성 비교

- 수소 : 전력화 파트너이며, 대체 수단이기도 하다

- 실제 핵분열 발전 시스템과 계획중인 핵융합 발전 시스템 비교

- 핵융합에 의한 그리드 전력 공급 최고 속도 실현 예측 시기

- 중수소를 이용한 기타 융합 및 플라즈마 공학 용도

제3장 핵융합 기초와 고부가 가치 재료 기회 구체적인 예

- 개요

- 후보 연료, 반응, 원자로 작동 원리 및 설계

- 핵융합 발전 주요 마일스톤, 장비 소형화가 진행되는 이유, 대표적인 기업예

- 재료 기회 전체상 : 액체·고체·기체·플라즈마

- 핵융합노시설용 강철 및 기타 철계 합금 배합과 구조 설계

- 수소 탱크용 재료 및 화학적 수소 저장 재료

- 핵융합 밸류체인 막재료와 관련 기기 첨단화 수준별 정리

제4장 자기 감금 핵융합 발전 : 재료와 하드웨어 기회

- 개요

- 잠재적 소스 그리드 전기로서의 자기 감금 융합의 SWOT 평가

- 핵융합 전력을 위한 자기 감금 기하학적 구조

- 플라즈마에 인접한 재료 기회

- 자석 기술 진전

- 히트 싱크/열전달 및 냉각재 기술 혁신

- . 2025년 다이버터 재료 연구 및 새로운 ITER 설치

- 플라즈마 가열 시스템 및 로보틱스 진전

- 핵융합용 전력 시스템과 발전 시스템

- tokamak나 Z-Pinch 하드웨어 기회 예 : JET, ITER 등

- 2025년 토로이달형 및 관련하는 핵융합 발전 하드웨어 연구

- 인사이드 아웃형 자기 감금

제5장 관성 잠금과 자기 관성 핵융합 발전 : 재료와 하드웨어의 가능성

- 개요

- 그리드 전력으로서의 관성 잠금 핵융합 : SWOT 분석

- 레이저 기반 관성 잠금 핵융합 레이저 설계

- 융합 타겟 기회(연료 펠릿 등)

- Lawrence Livermore National Laboratories(LLNL) National Ignition Facility(NIF)

- 중국이 앞서나가고 있는가?(국제적인 경쟁 구도)

- 기타 관성 및 자기 관성 감금 개발자

제6장 변화하는 투자 초점, 주목해야 할 기업. 하드웨어 및 재료

- 관심과 투자 급증 : 어느 기술이 왜?

- 민간기업에에 대한 투자

- 투자자 의향과 거래 : 기술별

- 세계의 대처

- 수소 핵융합 발전 장비 제조를 겨루는 민간 핵융합 기업 분석

- 국가별 유력 핵융합 기업 : 각종 퍼포먼스 기준과 자금조달 상황에 의한 평가

- 정부 투자와 민간투자 핵융합 발전 입지와 기술 우위성

- 투자를 유치하는 중요 열쇠가 되는 재료와 하드웨어

- 고부가 가치 재료가 빈번히 언급되고 있는 예 : 인기와 핵융합에서의 구체적인 용도 소개

제7장 핵융합 발전을 넘은 핵융합 기술 재료 가능성

- 개요

- 핵융합 추진 우주선을 위해 제안된 원리

- 정전기 관성 감금 핵융합의 발전, 2025년 목표 용도

- 핵융합과 그 이후를 위한 중성자 소스: 2025년 연구

- 핵융합을 넘어선 자이로트론 기술 스핀오프: 지열 시추 등

- 고온 초전도체(HTS) 핵융합 이외에서의 이용 가능성

Summary

Good news. The quest for fusion power is opening up many opportunities for your high added value materials and hardware. Thoroughly analysing your opportunities is the new commercially-oriented 218-page Zhar Research report, "Nuclear Fusion and Other Plasma Engineering Materials and Hardware Opportunities: Markets 2025-2045". Whether your skills lie in metallurgy, composites or chemistry based on the many elements it examines, this report details your road ahead.

Boron the gymnast

Learn how your development costs are derisked by these materials having many other applications beyond fusion power from medical to aerospace. Examples include high temperature superconductors, high power lasers, tungsten, copper, silicon, lithium, iron, carbon isotopes, many in forms varying from alloys to compounds and nano technology. Why is boron-based material the gymnast of fusion, being the basis of so many vital uses in fusion machines? See how rare earths, organic polymers and many other materials are also in the frame.

Flood of investment, see the future

Fusion developers now have massive, rapidly-rising funding to spend on your essential added value materials and structures. Further success in fusion power or allied emerging applications means that these plasma, laser, cryogenic and other technologies will open up huge hardware markets. Winning applications, potential partners and competitors are identified with 2025-2045 roadmaps and forecasts.

Comprehensive report

The 35 page "Executive summary and conclusions" is sufficient in itself with 21 key conclusions, 3 SWOT appraisals, 2025-2045 roadmaps both for technology and for markets and 22 forecast lines as graphs and tables. New infograms make it all easy to absorb in a short time. 23 key materials and hardware opportunities from 2025 research and company initiatives are prioritised.

Pivoting to a hydrogen economy reinvented

Then comes context and options in Chapter 2. "Fusion power and other plasma engineering in the context of renewable energy, the hydrogen economy reinvented and other industry" (30 pages). Learn the significance of the hydrogen isotopes. Understand why the original idea of a hydrogen economy based on fuel for your car and house is doomed. We are pivoting to a reinvented hydrogen economy mostly based on fusion grid power, making basic chemicals and aerospace and ship propulsion because they have far greater chance of success, though nothing is guaranteed.

Derisk your investment

Then come four chapters detailing your opportunities in fusion and allied plasma engineering, with particular emphasis on 2025 research and breakthroughs. The report ends with a chapter on the other emerging markets needing the same or similar materials, often well before any possible success with fusion for electricity generation. This derisks your investment.

Size reduction and other priorities

Chapter 3. "Basics of fusion and examples of its high-value materials opportunities" (39 pages) presents the detail including candidate fuels, reactions, reactor operating principles and designs, with much 2025 research, most notably deuterium, tritium, alpha particle and neutron-related. See candidate operating principles and designs of fusion power reactors and understand the changing views on winning technologies and changing relative achievements, plans and the most important milestones ahead. Why is size reduction now a strong focus even if the materials achieving this are expensive? Here is the big picture of materials opportunities, encompassing liquids, solids, gases and plasma.

Materials surviving a perfect storm

See how fusion subsystems present many added burdens for materials, withstanding chemical, heat, radiation, hydrogen embrittlement and plasma damage. Here is appraisal of the research in 2025 that leads you to candidate materials solving identified future needs. Examples explained include many different steels and membranes, mostly using advanced polymers.

Better materials urgently needed

Chapter 4. "Magnetic confinement fusion power: materials and hardware opportunities" (50 pages) concerns the fusion power option receiving the most public and private investment. Materials focus here particularly includes complex multi-wall structures for tokamaks and stellarators and identified derivatives. These formulations variously withstand or magnetically contain plasma, breed fuel, multiply neutrons, remove heat, block radiation. Can you rescue this industry from its lethally toxic and dangerously chemically-reactive materials? Metals, alloys, composites, compounds or what? High added value also comes from wall-conditioning, multipurpose blanket materials. Massive power supplies, "divertors" and other giant subsystems are needed. Why are- stellarators - gaining more attention and what are their materials? Inside-out magnetic confinement, levitated dipole, reverse triangulation and other approaches and needs? It is all here.

The 25 close-packed pages of Chapter 5. "Inertial confinement and magneto-inertial fusion power: materials and hardware opportunities" concerns the second most important fusion power option in investment and number of participants. It is the only one that has demonstrated "ignition" so far. See why it is now getting more attention as smaller, higher-power lasers, analysed here, arrive and China builds a massive facility 50% bigger than the American one. On the other hand, hybrid magneto-inertial options promise direct production of electricity but it is wrong to think of this as no-neutrons/ no-radioactivity. Which problems are your materials opportunities in magnetic confinement fusion? Colliding plasmas or projectiles instead of lasers?

Changing investment focus

Chapter 6. "Changing Investment focus, companies, hardware and materials to watch" (10 pages) explains the sudden surge in interest and investment: which technology and why. Detail is presented on investment in private companies, investor intentions and deals by technology. See how this is now a global effort. Here is analysis of private fusion companies racing to make hydrogen fusion electricity generators, winning fusion power companies by country, various performance criteria and funding. What are the winning fusion power locations and technologies for government vs private investments? What are significant key enabling materials and hardware attracting investment from analysis of 214 recent advances?

Profusion of opportunities

Those seeking investment may whisper it quietly but there is a possibility of fusion power not being commercialised in the 2025-2045 timeframe. Contrast allied technologies such as high temperature superconductors in medical scanners that are already commercialised with many more applications soon. The report therefore closes with Chapter 7. "Materials opportunities in fusion technologies beyond fusion power generation" (14 pages). Learn how spacecraft will not just drift after lift-off but use fusion power continuously and which options are emerging for this. Electrostatic inertial confinement fusion is not promising for generating electricity but see other advances and targetted uses for it from 2025. See plasma neutron sources for beyond fusion, with 2025 research. Gyrotron technology, not mainstream for power, can spin off beyond fusion for geothermal drilling and other uses. See detail on this high-profile new development and also the remarkable scope for high temperature superconductors beyond fusion.

Latest information and views

Fusion is now a fast-moving subject, so old information is useless. Most of the report, "Nuclear Fusion Power and Other Plasma Engineering Materials and Hardware Opportunities: Markets 2025-2045" interprets advances in 2025 and it is constantly updated so you only get the latest. It is your essential reading for your materials and hardware opportunities with realistic appraisal of timescales.

CAPTION: Simplified version of image in the report, "Nuclear Fusion Power and Other Plasma Engineering Materials and Hardware Opportunities: Markets 2025-2045", giving priority by number of primary mentions of high added-value materials and uses in the large amount of research and other activity analysed, with examples of applications.

Table of Contents

1. Executive summary and conclusions

- 1.1. Purpose of this report

- 1.2. Methodology of this analysis

- 1.3. Seven general conclusions

- 1.4. Eleven conclusions concerning materials and hardware

- 1.5. 23 key materials and hardware opportunities from 2025 research and developers prioritised

- 1.6. Materials and hardware opportunities adjacent to the plasma

- 1.7. Membrane materials in the fusion value chain and related devices by level of sophistication

- 1.8. Three conclusions: Investment trends in private fusion companies

- 1.9. SWOT appraisal of the potential of fusion grid power

- 1.10. SWOT appraisal of magnetic confinement fusion as a potential source grid electricity

- 1.11. SWOT appraisal of inertial confinement fusion as a potential source grid electricity

- 1.12. Fusion and allied systems, materials and hardware roadmap for technology vs market 2025-2045

- 1.13. Market forecasts in 22 lines, graphs 2025-2045

- 1.13.1. Specialist materials and assemblies for fusion power including experiments: market inorganic vs organic $ billion 2025-2045

- 1.13.2. Hydrogen hardware market: fusion reactors + 7 lines $ billion 2025-2045, table, graphs

- 1.13.3. Number of companies seeking to make fusion reactors 2025-2045

- 1.13.4. Fusion machine energy output trend with and without ignition

- 1.13.5. Hydrogen market million tonnes 2025-2045 in seven lines, table, graphs

2. Fusion power and other plasma engineering in the context of renewable energy, the hydrogen economy reinvented and other industry

- 2.1. Overview

- 2.2. Hydrogen economy: a false start, reinvention and the promise of hydrogen fusion

- 2.2.1. The big picture

- 2.2.2. Lessons of history and new objectives for 2025-2045

- 2.2.3. Materials for the hydrogen economy reinvented

- 2.2.4. Supporting information

- 2.3. Private fusion companies and governments race into hydrogen fusion power

- 2.4. Major government investment in fusion power

- 2.5. Hydrogen isotopes and their primary uses actual and targetted

- 2.6. Comparison of properties of regular hydrogen (protium) with other fuels and with the deuterium and tritium forms of hydrogen

- 2.7. Hydrogen is both partner and alternative to electrification

- 2.8. Comparison of actual fission and planned fusion power systems

- 2.9. Earliest dates for fusion grid electricity being delivered

- 2.10. Other fusion and plasma engineering and other uses for deuterium

3. Basics of fusion and examples of its high-value materials opportunities

- 3.1. Overview

- 3.2. Candidate fuels, reactions, reactor operating principles and designs

- 3.2.1. Candidate fusion fuels and reactions with 2025 research

- 3.2.2. Deuterium-related fusion research advances in 2025

- 3.2.3. Tritium-related fusion research advances in 2025

- 3.2.4. Alpha particle-related fusion research advances in 2025

- 3.2.5. Neutron-related fusion research advances in 2025

- 3.2.6. Candidate operating principles and designs of fusion power reactors

- 3.2.7. Changing views on winning technologies and changing relative achievements and plans

- 3.3. Milestones, reasons for size reduction and examples of companies for fusion power

- 3.4. Big picture of materials opportunities : liquids, solids, gases and plasma

- 3.4.1. Materials are a primary challenge to fusion power: premium pricing opportunities

- 3.4.2. Fusion subsystems present many added burdens for materials

- 3.4.3. Radiation and plasma damage of the materials: research in 2025 and future needs

- 3.4.4. Some candidate materials reflecting various of these needs

- 3.5. Steel and other iron-based alloy formulations and structures for fusion reactor facilities

- 3.5.1. Steels for general fusion facility structures, radiative environments with 2025 research

- 3.5.2. Resisting hydrogen embrittlement

- 3.5.3. Welding and other structural optimisation with 2025 research

- 3.6. Hydrogen tank materials and chemical hydrogen storage materials

- 3.6.1. Hydrogen tank materials

- 3.6.2. Hydrogen leakage causing global warming: research in 2025

- 3.7. Membrane materials in the fusion value chain and related devices by level of sophistication

4. Magnetic confinement fusion power: materials and hardware opportunities

- 4.1. Overview

- 4.2. SWOT appraisal of magnetic confinement fusion as a potential source grid electricity

- 4.3. Magnetic confinement geometries for fusion power

- 4.4. Materials opportunities adjacent to the plasma

- 4.4.1. Multilayer wall and proximate structures

- 4.4.2. Wall conditioning materials advances through 2025

- 4.4.3. Multifunctional blanket materials research in 2025

- 4.5. Magnet advances

- 4.6. Heat sink/ heat transfer, coolant materials advances

- 4.7. Divertor materials research in 2025 and the new ITER installation

- 4.8. Plasma heating systems and robotics

- 4.9. Fusion power supplies and electricity generation systems

- 4.9.1. Power generation from fusion reactors

- 4.9.2. Power supply to fusion reactors

- 4.10. Examples of tokamak and Z-Pinch hardware opportunities: JET, ITER and others

- 4.11. Research in 2025 on toroidal and allied fusion power hardware

- 4.11.1. General

- 4.11.2. Stellarators and their materials research in 2025

- 4.12. Inside-out magnetic confinement:

- 4.12.1. OpenStar levitated dipole fusion reactor

- 4.12.2. Reverse triangulation

5. Inertial confinement and magneto-inertial fusion power: materials and hardware opportunities

- 5.1. Overview

- 5.2. SWOT appraisal of inertial confinement fusion as a potential source grid electricity

- 5.3. Laser-based inertial confinement fusion (LICF) laser designs

- 5.3.1. Neodymium glass lasers

- 5.3.2. Ultraviolet lasers

- 5.3.3. Quantum cascade lasers

- 5.4. Fusion target opportunities

- 5.4.1. HUB project targets

- 5.4.2. NIF project targets

- 5.4.3. Fundamentals of target operation

- 5.5. Lawrence Livermore National Laboratories LLNL National Ignition Facility NIF

- 5.6. China pulling ahead?

- 5.7. Other inertial and magneto-inertial confinement developers

- 5.7.1. General picture

- 5.7.2. Helion and its key materials and devices

- 5.7.3. Electrostatic inertial confinement fusion advances in 2025

6. Changing Investment focus, companies, hardware and materials to watch

- 6.1. Sudden surge in interest and investment: which technology and why

- 6.2. Investment in private companies

- 6.3. Investor intentions and deals by technology

- 6.4. Global effort

- 6.5. Analysis of private fusion companies racing to make hydrogen fusion electricity generators

- 6.6. Winning fusion power companies by country, various performance criteria, funding

- 6.6. Winning fusion power locations and technologies for government vs private investments

- 6.7. Significant key enabling materials and hardware attracting investment

- 6.8. Primary mentions of high added-value materials indicating popularity with examples of fusion uses

7. Materials opportunities in fusion technologies beyond fusion power generation

- 7.1. Overview

- 7.2. Principles proposed for fusion-propelled spacecraft

- 7.3. Electrostatic inertial confinement fusion advances, targeted uses in 2025

- 7.4. Neutron sources for fusion and beyond: 2025 research

- 7.5. Gyrotron technology spinoff beyond fusion: geothermal drilling, other

- 7.5.1. Principle of operation

- 7.5.2. Geothermal drilling, material processing, other

- 7.5.3. Recent research

- 7.5.4. Gyrotron materials and designs

- 7.6. High temperature superconductors beyond fusion