|

시장보고서

상품코드

1684687

커넥티드카 기술 시장 기회, 성장 촉진 요인, 산업 동향 분석, 예측(2025-2034년)Connected Vehicle Technology Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

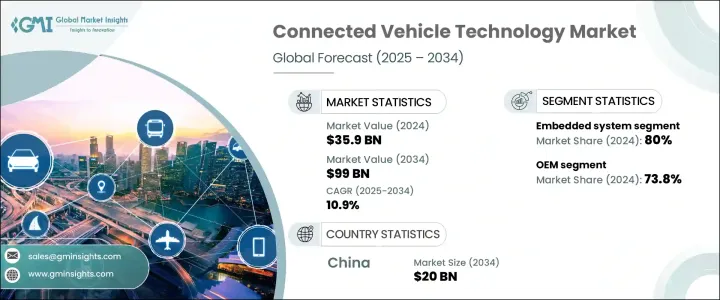

커넥티드카 기술 세계 시장은 2024년에 359억 달러로 평가되었으며, 2025년부터 2034년에 걸쳐 CAGR 10.9%로 성장할 것으로 예상됩니다.

이러한 성장의 원동력은 디지털 솔루션의 급속한 보급과 더 똑똑하고 안전하며 효율적인 교통수단에 대한 수요 증가입니다. 이 성장에는 자동차의 안전기능에 대한 감세와 자동차 구입에 대한 보조금 등 정부의 우대조치가 뒷받침되고 있어 소비자와 제조업체 양쪽이 최첨단의 자동차 기술을 도입하게 되어 있습니다. 커넥티비티는 현대 자동차 설계에 필수적인 요소가 되었으며, 자동차 제조업체는 첨단 텔레매틱스, 인포테인먼트 및 안전 시스템을 모델에 통합하는 데 주력하고 있습니다. 기술이 지속적으로 진화함에 따라 인공지능, 5G 네트워크, 클라우드 기반 플랫폼의 사용이 확대되고 V2X(Vehicle-to-Everything) 통신이 강화되어 전반적인 운전 경험이 향상되고 보다 높은 안전 기준이 확보되고 있습니다.

전기차나 자율주행차의 인기가 높아지고 있는 것도 시장 확대를 뒷받침하고 있습니다. 이러한 자동차는 내비게이션, 진단 및 원격 모니터링을 위해 임베디드 시스템에 크게 의존하기 때문입니다. 자동차 제조업체는 사이버 보안을 유지하면서 연결을 강화하는 안전하고 고성능의 디지털 솔루션을 개발하기 위해 기술 기업과의 협력 관계를 강화하고 있습니다. 소비자의 기대는 자동차 내에서 개인화된 완벽한 디지털 경험으로 이동하고 있으며 자동차 제조업체의 혁신을 더욱 강화하고 있습니다. OTA(Over-the-Air) 업데이트가 시작됨에 따라 자동차 제조업체는 구매 후 카의 기능을 강화하고 최신 소프트웨어 개선을 지속적으로 반영할 수 있습니다. 이러한 추세로 인해 커넥티드카 기술은 옵션이 아니라 필수품이 되어 세계의 보급이 가속화되고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 359억 달러 |

| 예측 금액 | 990억 달러 |

| CAGR | 10.9% |

커넥티드카 기술 시장은 주로 V2X 통신과 임베디드 시스템으로 나뉩니다. 임베디드 시스템은 제조 공정에서 카에 직접 통합되기 때문에 2024년에 가장 큰 점유율을 차지했습니다. 이러한 시스템은 텔레매틱스, 인포테인먼트, 네비게이션 솔루션을 포함하여 사용자 경험을 향상시키고 카 성능을 향상시키고 실시간 데이터 교환을 가능하게 합니다. 자율주행의 추진에 따라 ADAS(선진운전지원시스템)와 예지보전 솔루션을 지원하는 임베디드 시스템의 중요성은 더욱 커지고 있습니다. 자동차 제조업체는 AI 주도의 애널리틱스를 활용해 성능을 최적화해, 교통 안전성을 높이고 있어, 임베디드 시스템은 커넥티드·비클의 에코시스템의 핵심이 되고 있습니다.

커넥티드카 기술은 OEM(상대 브랜드 제조)과 애프터마켓의 2가지 주요 부문에서 이용되고 있습니다. 2024년에는 OEM 부문이 73.8%라는 압도적인 시장 점유율을 차지했으며, 이는 업계가 공장 설치형 커넥티비티 솔루션에 강력하게 주력하고 있음을 반영합니다. 제조업체는 텔레매틱스와 V2X 통신 기능을 신차에 통합하여 원활한 디지털 통합에 대한 소비자 수요 증가에 대응하고 있습니다. 이러한 직접적인 통합은 카의 안전성을 높이고 성능을 최적화하며 운전 효율을 향상시키기 위해 OEM을 시장 성장의 주요 촉진요인으로 자리매김하고 있습니다. 스마트 제조와 클라우드 기반 플랫폼에 투자하는 자동차 제조업체가 늘어남에 따라 커넥티드 모빌리티의 미래를 형성하는 OEM의 역할은 계속 확대되고 있습니다.

중국의 커넥티드카 기술 시장은 적극적인 마케팅 캠페인, 자동차 판매 증가, 하이테크 자동차 기능에 대한 소비자의 강한 의욕에 견인되어 2034년까지 200억 달러의 매출을 올릴 것으로 예상됩니다. 배출량 감축과 스마트 교통 솔루션의 추진에 임하는 동국의 자세도 채용을 가속화하고 있습니다. 아시아태평양은 전체적으로 급속한 시장 확대를 목표로 하고 있으며, 정부 및 자동차 업계의 리더들이 이 분야에서의 디지털 전환을 적극적으로 추진하고 있습니다. 북미도 첨단 커넥티비티 기능에 대한 소비자의 관심이 높아짐에 따라 비슷한 기세를 보이고 있습니다. 현재는 통합된 디지털 솔루션을 탑재한 자동차를 우선적으로 구매하는 자동차 구매자가 증가하고 있으며, 커넥티드카 기술이 자동차 산업의 장래에 있어서 핵심적인 요소임을 확고히 하고 있습니다.

목차

제1장 조사 방법과 조사 범위

- 조사 디자인

- 조사 접근

- 데이터 수집 방법

- 기본 추정과 계산

- 기준연도의 산출

- 시장추계의 주요 동향

- 예측 모델

- 1차 조사와 검증

- 1차 정보

- 데이터 마이닝 소스

- 시장 정의

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 자동차 OEM

- 기술 제공업체

- 통신 사업자

- 플랫폼 개발 기업

- 최종 사용자

- 공급자의 상황

- 이익률 분석

- 커넥티드카 기술의 이용 사례

- 기술과 혁신의 전망

- 주요 뉴스와 대처

- 규제 상황

- 영향요인

- 성장 촉진요인

- 안전 기능에 대한 수요 증가

- 5G 커넥티비티의 진보

- AI와 머신러닝의 통합

- 정부에 의한 규제와 인센티브 확대

- 업계의 잠재적 위험 및 과제

- 데이터 프라이버시 및 보안에 대한 우려

- 도입 비용의 높이

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략 전망 매트릭스

제5장 시장 추정 및 예측 : 기술별, 2021년-2034년

- 주요 동향

- V2X 통신

- 임베디드 시스템

제6장 시장 추정 및 예측 : 카별, 2021년-2034년

- 주요 동향

- 승용차

- 해치백

- 세단

- SUV차

- 상용차

- 소형 상용차(LCV)

- 대형 상용차(HCV)

- 전기자동차(EV)

제7장 시장 추정 및 예측 : 용도별, 2021년-2034년

- 주요 동향

- 자율주행

- 모빌리티 아즈아 서비스(MaaS)

- 인포테인먼트

- 플릿 관리

- 안전과 보안

- 카 진단 및 유지보수

제8장 시장 추정 및 예측 : 최종 용도별, 2021년-2034년

- 주요 동향

- OEM

- 애프터마켓

제9장 시장 추정 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 스페인

- 이탈리아

- 러시아

- 북유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 뉴질랜드

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- UAE

- 남아프리카

- 사우디아라비아

제10장 기업 프로파일

- Aptiv

- Atos

- AWS

- Bosch

- Cisco

- Continental

- Denso

- Ericsson

- Harman(Samsung Electronics)

- IBM

- Infineon Technologies

- Intel

- Microsoft

- Mobileye

- NXP Semiconductors

- Orange

- Qualcomm

- Telenor

- Verizon

- Vodafone

The Global Connected Vehicle Technology Market, valued at USD 35.9 billion in 2024, is set to expand at a CAGR of 10.9% between 2025 and 2034. The growth is driven by the rapid adoption of digital solutions and the increasing demand for smarter, safer, and more efficient transportation. This growth is fueled by government incentives such as tax breaks on vehicle safety features and subsidies for car purchases, which encourage both consumers and manufacturers to embrace cutting-edge automotive technologies. Connectivity has become an essential aspect of modern vehicle design, with automakers focusing on integrating advanced telematics, infotainment, and safety systems into their models. As technology continues to evolve, the growing use of artificial intelligence, 5G networks, and cloud-based platforms is enhancing vehicle-to-everything (V2X) communication, improving overall driving experiences, and ensuring higher safety standards.

The rising popularity of electric and autonomous vehicles is also propelling market expansion, as these vehicles rely heavily on embedded systems for navigation, diagnostics, and remote monitoring. Automakers are increasingly collaborating with technology companies to develop secure, high-performance digital solutions that enhance connectivity while maintaining cybersecurity. Consumer expectations are shifting towards personalized, seamless digital experiences within their vehicles, further pushing manufacturers to innovate. With the rise of over-the-air (OTA) updates, car manufacturers can now enhance vehicle functionality post-purchase, keeping cars up to date with the latest software improvements. This trend is making connected vehicle technology a necessity rather than an option, accelerating its adoption worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $35.9 Billion |

| Forecast Value | $99 Billion |

| CAGR | 10.9% |

The market for connected vehicle technology is primarily divided into V2X communication and embedded systems. Embedded systems commanded the largest share in 2024 due to their direct integration into vehicles during the manufacturing process. These systems include telematics, infotainment, and navigation solutions that improve user experience, enhance vehicle performance, and enable real-time data exchange. With the push toward autonomous driving, embedded systems are becoming even more critical, supporting advanced driver-assistance systems (ADAS) and predictive maintenance solutions. Automakers are leveraging AI-driven analytics to optimize performance and increase road safety, making embedded systems the backbone of the connected vehicle ecosystem.

Connected vehicle technology is utilized by two major segments: original equipment manufacturers (OEMs) and the aftermarket. In 2024, the OEM segment held a commanding 73.8% market share, reflecting the industry's strong focus on factory-installed connectivity solutions. Manufacturers are embedding telematics and V2X communication capabilities into new vehicles, addressing growing consumer demands for seamless digital integration. This direct integration enhances vehicle safety, optimizes performance, and improves driving efficiency, positioning OEMs as the primary drivers of market growth. As more automakers invest in smart manufacturing and cloud-based platforms, the role of OEMs in shaping the future of connected mobility continues to expand.

China connected vehicle technology market is on track to generate USD 20 billion by 2034, driven by aggressive marketing campaigns, increasing vehicle sales, and a strong consumer appetite for high-tech automotive features. The country's commitment to reducing emissions and advancing smart transportation solutions is also accelerating adoption. The Asia-Pacific region as a whole is witnessing rapid market expansion, with governments and automotive leaders actively promoting digital transformation in the sector. North America is experiencing similar momentum as consumer interest in advanced connectivity features grows. A rising number of car buyers now prioritize vehicles equipped with integrated digital solutions, solidifying connected vehicle technology as a core component of the automotive industry's future.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Automotive OEMs

- 3.1.2 Technology providers

- 3.1.3 Telecommunication companies

- 3.1.4 Platform developers

- 3.1.5 End users

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Use cases of connected vehicle technology

- 3.5 Technology & innovation landscape

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Increasing demand for safety features

- 3.8.1.2 Advancements in 5G connectivity

- 3.8.1.3 Integration of AI and machine learning

- 3.8.1.4 Growing government regulations and incentives

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Data privacy and security concerns

- 3.8.2.2 High cost of implementation

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology, 2021-2034, ($Bn)

- 5.1 Key trends

- 5.2 V2X communication

- 5.3 Embedded system

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021-2034, ($Bn)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicle

- 6.3.1 Light Commercial Vehicles (LCVs)

- 6.3.2 Heavy Commercial Vehicles (HCVs)

- 6.4 Electric Vehicles (EVs)

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034, ($Bn)

- 7.1 Key trends

- 7.2 Autonomous driving

- 7.3 Mobility as a Service (MaaS)

- 7.4 Infotainment

- 7.5 Fleet management

- 7.6 Safety and security

- 7.7 Vehicle diagnostics and maintenance

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034, ($Bn)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Aptiv

- 10.2 Atos

- 10.3 AWS

- 10.4 Bosch

- 10.5 Cisco

- 10.6 Continental

- 10.7 Denso

- 10.8 Ericsson

- 10.9 Harman (Samsung Electronics)

- 10.10 IBM

- 10.11 Infineon Technologies

- 10.12 Intel

- 10.13 Microsoft

- 10.14 Mobileye

- 10.15 NXP Semiconductors

- 10.16 Orange

- 10.17 Qualcomm

- 10.18 Telenor

- 10.19 Verizon

- 10.20 Vodafone