|

시장보고서

상품코드

1750294

커넥티드카 서비스 시장 : 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Connected Vehicle Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

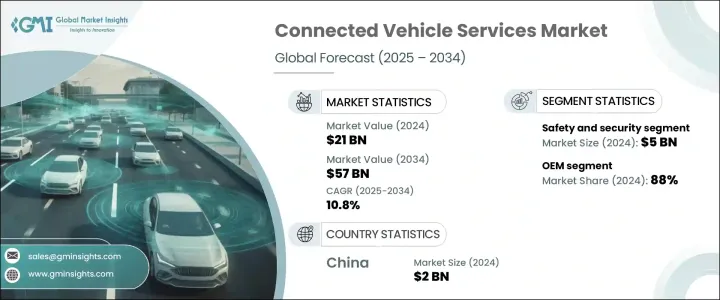

세계의 커넥티드카 서비스 시장 규모는 2024년 210억 달러에 달했고, CAGR 10.8%로 성장해 2034년까지 570억 달러에 이를 것으로 추정됩니다.

이 성장의 원동력은 기존 자동차에서 소프트웨어 정의 자동차로의 전환이 진행되고 자동차 서비스의 개발, 제공, 수익화 방법이 크게 변화하고 있다는 것입니다. 기존 자동차와 달리 최신 자동차는 구매 후 실시간 업데이트 및 주문형 서비스를 가능하게 하는 적응 가능한 소프트웨어 플랫폼을 중심으로 설계되었습니다. 이 역동적인 설계를 통해 제조업체는 원격 진단, 운전 지원, 시스템 업그레이드 등의 기능을 무선 업데이트로 도입하여 고객 만족도와 서비스 범위를 모두 향상시킬 수 있습니다. 결과적으로 커넥티드카 서비스는 보다 스마트하고 반응성이 뛰어나 안전한 이동성 솔루션에 대한 수요가 증가함에 따라 자동차 개발 전략의 기본 요소가 되었습니다.

소비자는 자동차에 안전성과 편의성을 확보하면서 운전 경험을 향상시키는 연결 기능을 더욱 기대할 수 있게 되었습니다. 지속적으로 기능을 업데이트하고 개인화된 서비스를 제공하는 능력은 자동차를 디지털 플랫폼으로 바꾸고 구독 기반 서비스 모델을 뒷받침하고 있습니다. 등을 통해 사용자 경험을 강화하는 데 주력하고 있습니다. 자동차가 AI와 IoT 기술을 계속 통합하고 있는 가운데, 확장 가능한 텔레매틱스와 강력한 클라우드 기능을 제공하는 주요 기업은 선도하는 입장에 있습니다. 제도의 진화로 서비스 제공 모델이 재구성되고 있으며, 국제 기준을 충족하는 인프라와 컴플라이언스 태세를 갖춘 기업이 유리해지고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 210억 달러 |

| 예측 금액 | 570억 달러 |

| CAGR | 10.8% |

서비스별로 보면 시장은 원격조작, 안전 및 보안, 내비게이션 및 인포테인먼트, 운전 지원, 차량 관리, 그 밖에 나뉘어집니다. 이들은 인지된 차량 안전성과 실제 차량 안전성 모두에 크게 기여하고 있습니다. 이 서비스는 개인 사용자뿐만 아니라 차량 추적, 운전자 행동 분석, 위험 평가를 위해 실시간 모니터링에 의존하는 함대 운영자와 보험 회사에서도 평가되고 있습니다.

커넥티드카 서비스 시장은 최종 용도별로 OEM 시장과 애프터마켓 시장으로 분류됩니다. 소비자는 신뢰할 수 있는 제조업체가 제공하는 커넥티드 서비스가 차량에 사전 설치되어 있다면 이를 이용하는 경향이 강합니다.

자동차 커넥티비티는 일반적으로 임베디드, 테더링 유형, 통합형으로 분류됩니다. 이 기능을 제공하여 원격 진단, OTA 업데이트, 예지 보전과 같은 기능을 원활하게 제공할 수 있으므로 OEM과 차량 관리자 모두 중앙 집중식 제어와 외부 독립적인 일관된 사용자 경험을 제공할 수 있습니다.

차량 유형별로 볼 때 시장은 승용차, 상용차, 이륜차, 오프로드 차량으로 구분됩니다. 자동차 제조업체는 서비스의 번들과 디지털 강화를 주요 차별화 요인으로 우선시하고 있습니다.

지역별로는 아시아태평양이 2024년에 35% 이상의 최대 시장 점유율을 차지하고 있으며, 중국이 20억 달러의 추정액으로 크게 공헌하고 있습니다. 이 지역 제조업체는 스마트 모빌리티에 대한 수요 증가에 대응하기 위해 자동차의 디지털 기능 강화에 주력하고 있습니다.

커넥티드카 서비스 시장을 형성하는 주요 기업으로는 AT&T, Bosch, BMW, Continental, General Motors, Ford, Geotab, HERE Technologies, Harman International, Verizon Connect 등이 있습니다. 이러한 기업은 첨단 텔레매틱스, 클라우드 인프라, 서비스 기반 모델을 활용하여 진화하는 소비자 수요에 부응하는 동시에 시장 전체에서 컴플라이언스 및 데이터 보안 과제를 추진하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 자동차 제조업체

- 자동차 기술 제공업체

- 클라우드 및 IT 서비스 제공업체

- 최종 용도

- 이익률 분석

- 트럼프 정권에 의한 관세에 대한 영향

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원재료)

- 주요 원재료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(원재료)

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 기술과 혁신의 상황

- 특허 분석

- 주요 뉴스와 대처

- 이용 사례

- 보험

- 공유 모빌리티

- 플릿 관리

- 기타

- 톱 커넥티드카 서비스

- 규제 상황

- 영향요인

- 성장 촉진요인

- 소프트웨어 정의 차량으로의 전환

- 4G/5G 및 V2X 접속의 확장

- 차내 안전성, 편리성, 효율성에 대한 수요 증가

- 플릿 관리와 상용 텔레매틱스

- 업계의 잠재적 위험 및 과제

- 사이버 보안 및 데이터 프라이버시의 위험

- 기술 통합에 드는 고비용

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

제5장 시장 추계 및 예측 : 서비스별, 2021-2034년

- 주요 동향

- 안전 및 보안

- 원격 조작

- 네비게이션 인포테인먼트

- 차량 관리

- 운전 지원

- 기타

제6장 시장 추계 및 예측 : 커넥티비티별, 2021-2034년

- 주요 동향

- 임베디드형

- 테더링형

- 통합형

제7장 시장 추계 및 예측 : 차량별, 2021-2034년

- 주요 동향

- 승용차

- 세단

- SUV

- 해치백

- 상용차

- 소형 상용차

- 중형 상용차

- 대형 상용차

- 이륜차 및 삼륜차

- 오프로드 차량

제8장 시장 추계 및 예측 : 최종 용도별, 2021-2034년

- 주요 동향

- OEM

- 애프터마켓

제9장 시장 추계 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 북유럽 국가

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 남아프리카

- 사우디아라비아

제10장 기업 프로파일

- AT&T

- BMW

- Bosch

- Continental

- Ford

- General Motors

- Geotab

- Harman

- HERE Technologies

- Hyundai

- Ituran

- Nissan

- Octo Telematics

- Qualcomm

- Sierra Wireless

- SiriusXM Connected Vehicle Services

- Tesla

- Toyota

- Verizon Connect

- Volkswagen

- Zubie

The Global Connected Vehicle Services Market was valued at USD 21 billion in 2024 and is estimated to grow at a CAGR of 10.8% to reach USD 57 billion by 2034. This growth is driven by the increasing transition from traditional vehicles to software-defined vehicles, which has significantly reshaped how automotive services are developed, offered, and monetized. Unlike conventional vehicles, modern vehicles are designed around adaptable software platforms that enable real-time updates and on-demand services even after purchase. This dynamic architecture allows manufacturers to introduce features like remote diagnostics, driver assistance, and system upgrades through over-the-air updates, enhancing both customer satisfaction and service scope. As a result, connected vehicle services have become a fundamental component of automotive development strategies, driven by rising demand for smarter, more responsive, and safer mobility solutions.

Consumers are increasingly expecting their vehicles to offer built-in connectivity features that improve the driving experience while ensuring safety and convenience. This demand shift is compelling automakers to integrate services like infotainment, safety alerts, navigation, and remote controls directly into new models. The ability to continuously update features and provide personalized services is turning vehicles into digital platforms, encouraging subscription-based service models. Manufacturers are now focusing on enhancing user experiences through predictive maintenance alerts, usage tracking, and voice-assisted commands. As vehicles continue to integrate AI and IoT technologies, companies offering scalable telematics and strong cloud capabilities are well-positioned to lead. In addition, evolving global regulations around data privacy, cybersecurity, and vehicular safety are reshaping service delivery models, favoring firms with the infrastructure and compliance readiness to meet international standards. The shift toward service-based offerings is setting the stage for long-term customer engagement and ongoing revenue generation in the automotive ecosystem.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $21 Billion |

| Forecast Value | $57 Billion |

| CAGR | 10.8% |

In terms of services, the market is divided into remote operations, safety and security, navigation and infotainment, driver assistance, vehicle management, and others. The safety and security segment led the market in 2024, generating approximately USD 5 billion and capturing over 25% of the total market share. Consumers place high importance on real-time features like emergency alerts, crash detection, theft prevention, and roadside assistance, which contribute significantly to both perceived and actual vehicle safety. These services are valued not only by individual users but also by fleet operators and insurers, who rely on real-time monitoring for vehicle tracking, driver behavior analysis, and risk assessment. These features often drive customer preference and brand loyalty by providing peace of mind.

By end use, the connected vehicle services market is classified into OEM and aftermarket segments. The OEM segment dominated the landscape in 2024, holding nearly 88% of the overall market share. Automakers are increasingly embedding hardware and software at the production stage to deliver integrated services such as navigation, diagnostics, and remote access capabilities. Consumers are more inclined to use connected services when they come pre-installed in the vehicle from a trusted manufacturer. OEMs benefit from full control over the service infrastructure, allowing them to offer updates, collect data, and roll out new features independently, which enhances monetization potential and strengthens customer relationships.

Connectivity in vehicles is typically categorized as embedded, tethered, or integrated. Among these, embedded connectivity led the market in 2024. These systems are favored for their ability to provide continuous internet access via built-in SIM cards and modems, enabling uninterrupted service delivery. Features such as remote diagnostics, OTA updates, and predictive maintenance can be delivered seamlessly, improving the ownership experience. OEMs and fleet managers alike prefer embedded systems for their centralized control and ability to provide a consistent user experience without external dependencies.

By vehicle type, the market is segmented into passenger vehicles, commercial vehicles, two- and three-wheelers, and off-highway vehicles. Passenger vehicles led the market in 2024 due to high global sales volume. As the majority of new vehicles are now equipped with connected systems, the demand for integrated services has expanded significantly. Consumers expect advanced features like safety notifications, driver profiles, and mobile device integration to become standard, which pushes automakers to prioritize service bundling and digital enhancements as key differentiators. These digital offerings are becoming essential to modern automotive marketing strategies and customer retention efforts.

Regionally, Asia Pacific held the largest market share of over 35% in 2024, with China contributing significantly at an estimated value of USD 2 billion. The region benefits from strong production capabilities and high consumer readiness for connected and intelligent automotive technologies. Manufacturers in the region are focusing on enhancing the digital capabilities of their vehicles to cater to growing demands for smart mobility. The infrastructure in Asia Pacific, especially with robust 4G and 5G networks, supports real-time data exchange required for connected services, including cloud processing, OTA updates, and location-based functions.

Key companies shaping the connected vehicle services market include AT&T, Bosch, BMW, Continental, General Motors, Ford, Geotab, HERE Technologies, Harman International, and Verizon Connect. These players are leveraging advanced telematics, cloud infrastructure, and service-based models to meet evolving consumer demands while addressing compliance and data security challenges across markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Automotive manufacturers

- 3.2.2 Automotive technology providers

- 3.2.3 Cloud and IT Service providers

- 3.2.4 End use

- 3.3 Profit margin analysis

- 3.4 Impact of Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on industry

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.2.1.1 Price volatility in key materials

- 3.4.2.1.2 Supply chain restructuring

- 3.4.2.1.3 Production cost implications

- 3.4.2.2 Demand-side impact (selling price)

- 3.4.2.2.1 Price transmission to end markets

- 3.4.2.2.2 Market share dynamics

- 3.4.2.2.3 Consumer response patterns

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.4.3 Policy engagement

- 3.4.5 Outlook & future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Use cases

- 3.8.1 Insurance

- 3.8.2 Shared mobility

- 3.8.3 Fleet management

- 3.8.4 Others

- 3.9 Top connected vehicles services

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Shift toward software-defined vehicles

- 3.11.1.2 Expansion of 4G/5G and V2X connectivity

- 3.11.1.3 Increasing demand for in-vehicle safety, convenience and efficiency

- 3.11.1.4 Fleet management and commercial telematics

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 Cybersecurity and data privacy risks

- 3.11.2.2 High cost of technology integration

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Service, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Safety and security

- 5.3 Remote operations

- 5.4 Navigation and infotainment

- 5.5 Vehicle management

- 5.6 Driver assistance

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Connectivity, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Embedded

- 6.3 Tethered

- 6.4 Integrated

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Passenger vehicle

- 7.2.1 Sedan

- 7.2.2 SUV

- 7.2.3 Hatchback

- 7.3 Commercial vehicle

- 7.3.1 LCV

- 7.3.2 MCV

- 7.3.3 HCV

- 7.4 Two and three wheelers

- 7.5 Off-highway vehicles

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 AT&T

- 10.2 BMW

- 10.3 Bosch

- 10.4 Continental

- 10.5 Ford

- 10.6 General Motors

- 10.7 Geotab

- 10.8 Harman

- 10.9 HERE Technologies

- 10.10 Hyundai

- 10.11 Ituran

- 10.12 Nissan

- 10.13 Octo Telematics

- 10.14 Qualcomm

- 10.15 Sierra Wireless

- 10.16 SiriusXM Connected Vehicle Services

- 10.17 Tesla

- 10.18 Toyota

- 10.19 Verizon Connect

- 10.20 Volkswagen

- 10.21 Zubie