|

시장보고서

상품코드

1698267

자동차용 트랙션 모터 시장 : 시장 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Automotive Traction Motor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

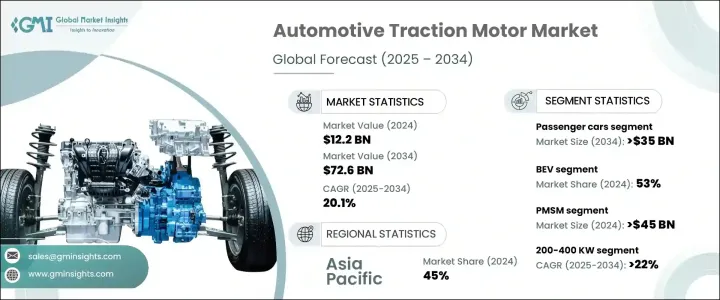

세계의 자동차용 트랙션 모터 시장은 2024년에 122억 달러로 평가되었으며, 2025-2034년 연평균 복합 성장률(CAGR) 20.1%를 나타낼 것으로 예측됩니다.

전기자동차(EV)의 생산 대수가 세계적으로 크게 증가하고 있는 것이 이 성장의 주된 요인이 되고 있습니다. 각국 정부는 디젤차에 대한 의존을 줄이고 자동차 전동화를 추진함으로써 이산화탄소 배출량 감축을 추진하고 있습니다. 소비자의 지속 가능성과 연료 절약에 대한 의식도 높아지고 있어 EV로의 이행이 더욱 가속화되고 있습니다.

파워 일렉트로닉스와 모터 제어의 기술적 진보에 의해 트랙션 모터의 효율과 성능이 향상하고 있습니다. 탄화규소(SiC) 및 질화갈륨(GaN) 반도체의 채택은 전력 효율을 높이고 에너지 손실을 최소화하며 모터 출력을 최적화합니다. 이 진보에 의해 제조사는 보다 소형이고 경량인 모터를 개발할 수 있게 되어 차량 성능의 향상으로 이어집니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 122억 달러 |

| 예측 금액 | 726억 달러 |

| CAGR | 20.1% |

자동차용 트랙션 모터 시장은 모터 유형별로 영구 자석 동기 모터(PMSM)와 AC 유도 모터로 분류됩니다. 2024년에는 PMSM이 시장을 독점하였으며, 450억 달러 이상의 수익을 창출했습니다. 이러한 모터는 경량 구조, 뛰어난 토크, 고효율 때문에 선호되며 EV 견인 시스템에 자주 사용됩니다. PMSM은 유도 모터에 비해 소비 전력이 크기 때문에 제조사는 최신 EV 설계에 포함시키는 것을 우선시하고 있습니다.

희토류 재료를 둘러싼 비용과 공급의 우려가 높아짐에 따라, 제조업체는 네오디뮴이나 디스프로슘 없이 효율적으로 기능하는 희토류 프리 PMSM을 개발하게 되었습니다. 이러한 기술 혁신에 의해 공급망이 안정되어, EV에 대한 PMSM의 채용이 퍼지고 있습니다. 이러한 설계가 계속 개선되면 더 많은 제조업체가 도입하여 시장 확대를 더욱 촉진할 것으로 예상됩니다.

또한 시장은 출력별로 200kW 미만, 200-400kW, 400kW 이상의 3개로 구분됩니다. 200-400 kW의 부문은, 2034년까지 CAGR 22% 이상의 성장이 전망되고 있습니다. 이 레인지의 고출력 트랙션 모터는 전동 SUV, 스포츠카, 상용차에서 인기가 높아지고 있습니다. 자동차 회사들은 이러한 모터를 통합하여 가속과 성능을 높이고 강력하고 효율적인 전동 드라이브 트레인에 대한 수요 증가에 대응하고 있습니다.

트럭과 버스를 포함한 전기 상용차도 고출력 트랙션 모터 수요에 박차를 가하고 있습니다. 물류 및 화물 수송은 전동화로 이행하고 있으며, 높은 토크 및 고출력 모터에 대한 요구가 높아지고 있습니다. 현재 많은 EV가 듀얼 모터에 의한 전륜구동(AWD) 시스템을 탑재하고 있어 안정성과 트랙션을 향상시키는 한편, 200-400kW 범위의 정격 출력이 필요합니다. 자동차 제조사는 차량 역학을 최적화하기 위해 이 설계를 채택하고 있으며, 고출력 트랙션 모터의 수요를 더욱 끌어올리고 있습니다.

중국, 일본, 한국, 인도 등의 국가들이 EV 인프라와 제조에 많은 투자를 하고 있으며, 아시아태평양은 여전히 EV 생산에 있어 지배적인 힘을 가지고 있습니다. 대기업 EV 제조업체의 존재와, 이 지역의 공급망, 특히 희토류 자석 생산의 진보가, 시장의 성장을 지지하고 있습니다. 세계 최대 EV 시장인 중국은 국내 수요 및 세계 수요에 모두 대응하기 위해 생산능력 확대를 지속하고 있습니다.

목차

제1장 조사 방법 및 조사 범위

- 조사 디자인

- 조사 접근

- 데이터 수집 방법

- 기본 추정 및 계산

- 기준 연도 산출

- 시장 추계 주요 동향

- 예측 모델

- 1차 조사 및 검증

- 1차 정보

- 데이터 마이닝 소스

- 시장 범위 및 정의

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 원재료 및 부품 공급자

- 자동차 제조업체

- 자동차 제조업체

- 최종 용도

- 공급자의 상황

- 이익률 분석

- 기술 혁신의 상황

- 특허 분석

- 주요 뉴스 및 대처

- 규제 상황

- 가격 동향

- 사례 연구

- 영향요인

- 성장 촉진요인

- 전기차를 촉진하는 정부의 인센티브 및 배출 감축 정책 증가

- 환경 친화적이고 에너지 효율적인 전기자동차에 대한 소비자 수요 증가

- 모터 효율의 향상에 의한 에너지 소비의 삭감 및 항속 거리의 연장

- AI 및 자율주행 기술의 채용이 증가하여 트랙션 모터 시스템의 기술 혁신 촉진

- 업계의 잠재적 위험 및 과제

- 모터에 필요한 희토류 원소 등 중요한 재료 공급망에 있어서의 제약

- 첨단 트랙션 모터 기술과 관련된 높은 개발 비용

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서문

- 기업 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략 전망 매트릭스

제5장 시장 추계 및 예측 : 자동차별(2021-2034년)

- 주요 동향

- 승용차

- 해치백

- 세단

- SUV차

- 상용차

- 소형 상용차(LCV)

- 대형 상용차(HCV)

- 이륜차

- 오프로드 자동차

제6장 시장 추계 및 예측 : 전동 드라이브 트레인별(2021-2034년)

- 주요 동향

- 배터리 전기자동차(BEV)

- 하이브리드 전기자동차(HEV)

- 플러그인 하이브리드 자동차(PHEV)

제7장 시장 추계 및 예측 : 모터별(2021-2034년)

- 주요 동향

- PMSM

- AC 인덕션

제8장 시장 추계 및 예측 : 출력별(2021-2034년)

- 주요 동향

- 200KW 미만

- 200-400 KW

- 400KW 이상

제9장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 북유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- UAE

- 남아프리카

- 사우디아라비아

제10장 기업 프로파일

- Audi

- Bosch

- Continental

- Ford

- General

- Honda

- Hyundai

- Kia

- Magna

- Magneti Marelli

- Mercedes Benz

- Mitsubishi

- Nidec

- Parker Hannifin

- PSA Group

- SAIC Motor

- Schaeffler

- Valeo

- Volkswagen

- ZF Friedrichshafen

The Global Automotive Traction Motor Market was valued at USD 12.2 billion in 2024 and is projected to grow at a CAGR of 20.1% from 2025 to 2034. A significant rise in electric vehicle (EV) production worldwide is a key driver of this growth. Governments are pushing for lower carbon emissions by reducing reliance on diesel fleets and promoting vehicle electrification. Consumers are also becoming more conscious of sustainability and fuel conservation, further accelerating the transition to EVs.

Technological advancements in power electronics and motor control are improving the efficiency and performance of traction motors. The adoption of silicon carbide (SiC) and gallium nitride (GaN) semiconductors enhances power efficiency, minimizes energy loss, and optimizes motor output. This progress allows manufacturers to develop more compact and lightweight motors, leading to better vehicle performance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.2 Billion |

| Forecast Value | $72.6 Billion |

| CAGR | 20.1% |

The automotive traction motor market is categorized by motor type into Permanent Magnet Synchronous Motors (PMSM) and AC induction motors. PMSM dominated the market in 2024, generating over USD 45 billion in revenue. These motors are preferred due to their lightweight structure, superior torque, and higher efficiency, making them a popular choice for EV traction systems. As PMSMs consume more electric energy compared to induction motors, manufacturers are prioritizing their integration into modern EV designs.

Rising costs and supply concerns surrounding rare earth materials have prompted manufacturers to develop rare-earth-free PMSMs that function efficiently without neodymium or dysprosium. These innovations are stabilizing the supply chain and facilitating broader adoption of PMSMs in EVs. As these designs continue to improve, more manufacturers are expected to implement them, further driving market expansion.

The market is also segmented by power output into three categories: less than 200 kW, 200-400 kW, and above 400 kW. The 200-400 kW segment is anticipated to grow at a CAGR of over 22% by 2034. High-output traction motors in this range are becoming increasingly popular in electric SUVs, sports cars, and commercial vehicles. Automakers are integrating these motors to enhance acceleration and performance, meeting the growing demand for powerful yet efficient electric drivetrains.

Electric commercial vehicles, including trucks and buses, are also fueling the demand for high-power traction motors. Logistics and freight transport are transitioning toward electrification, increasing the need for motors with high torque and power capacity. Many EVs are now equipped with dual-motor all-wheel-drive (AWD) systems, improving stability and traction while requiring power ratings within the 200-400 kW range. Automakers are adopting this design to optimize vehicle dynamics, further driving the demand for high-power traction motors.

Asia Pacific remains a dominant force in EV production, with countries such as China, Japan, South Korea, and India investing heavily in EV infrastructure and manufacturing. The presence of leading EV manufacturers and advancements in the regional supply chain, particularly in rare earth magnet production, are supporting market growth. China, as the world's largest EV market, continues to expand production capacity to cater to both domestic and global demand.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material & component suppliers

- 3.1.2 Manufacturers

- 3.1.3 Automotive manufacturers

- 3.1.4 End use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Price trend

- 3.9 Case studies

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Increasing government incentives and emission reduction policies promoting electric vehicles

- 3.10.1.2 Rising consumer demand for eco-friendly and energy-efficient electric vehicles

- 3.10.1.3 Advancements in motor efficiency, reducing energy consumption and extending vehicle range

- 3.10.1.4 Growing adoption of AI and autonomous technologies, driving innovation in traction motor systems

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Supply chain constraints for critical materials such as rare earth elements needed for motors

- 3.10.2.2 High development costs associated with advanced traction motor technologies

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter’s analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Passenger vehicles

- 5.2.1 Hatchback

- 5.2.2 Sedan

- 5.2.3 SUV

- 5.3 Commercial vehicles

- 5.3.1 Light Commercial Vehicles (LCV)

- 5.3.2 Heavy Commercial Vehicles (HCV)

- 5.4 Two-wheelers

- 5.5 Off-road vehicles

Chapter 6 Market Estimates & Forecast, By Electric Drivetrain, 2021 - 2034($Bn, Units)

- 6.1 Key trends

- 6.2 Battery Electric Vehicle (BEV)

- 6.3 Hybrid Electric Vehicle (HEV)

- 6.4 Plug-in Hybrid Electric Vehicle (PHEV)

Chapter 7 Market Estimates & Forecast, By Motor, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 PMSM

- 7.3 AC Induction

Chapter 8 Market Estimates & Forecast, By Power Output, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Less than 200 KW

- 8.3 200-400 KW

- 8.4 Above 400 KW

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Audi

- 10.2 Bosch

- 10.3 Continental

- 10.4 Ford

- 10.5 General

- 10.6 Honda

- 10.7 Hyundai

- 10.8 Kia

- 10.9 Magna

- 10.10 Magneti Marelli

- 10.11 Mercedes Benz

- 10.12 Mitsubishi

- 10.13 Nidec

- 10.14 Parker Hannifin

- 10.15 PSA Group

- 10.16 SAIC Motor

- 10.17 Schaeffler

- 10.18 Valeo

- 10.19 Volkswagen

- 10.20 ZF Friedrichshafen