|

시장보고서

상품코드

1699340

항바이러스제 시장 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Antiviral Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

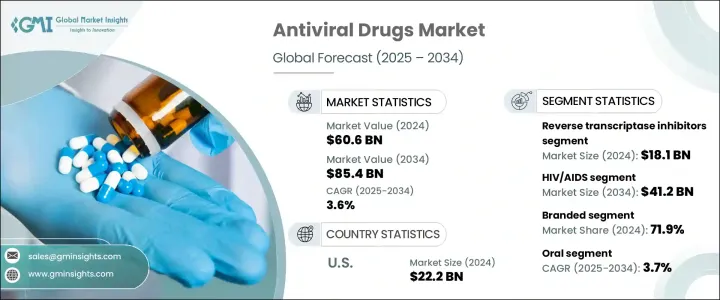

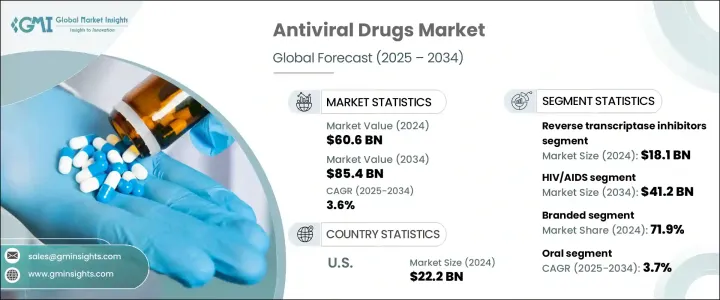

세계의 항바이러스제 시장은 2024년에 606억 달러를 기록했으며, 2025년부터 2034년에 걸쳐 CAGR 3.6%를 나타낼 전망입니다.

HIV/AIDS, B형 간염, C형 간염, 인플루엔자 등의 바이러스 감염 증례 증가가 항바이러스제 수요를 견인하고 있습니다.

항바이러스제는 바이러스 복제를 억제하고 HIV/AIDS, 간염, 인플루엔자 등의 감염증 치료에 중요한 역할을 하고 있습니다. 이러한 억제제는 항레트로바이러스 요법에서 중요한 역할을 담당하고 있으며, 뉴클레오시드계 및 비뉴클레오시드계 역전사효소 억제제가 그 보급을 견인하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 606억 달러 |

| 예측 금액 | 854억 달러 |

| CAGR | 3.6% |

적응증별로는 HIV/AIDS 분야가 시장을 독점하고 있으며, 2034년에는 412억 달러에 이를 것으로 예측되고 있습니다.

브랜드 항바이러스제는 효능과 안전성을 보장하는 엄격한 임상시험에 힘입어 2024년에는 시장의 71.9%를 차지했습니다.

2024년에는 경구 항바이러스제가 선도했고 CAGR 3.7%를 나타낼 것으로 예측됩니다.

연령층별로는 2024년에 269억 달러로 평가된 노년 부문이 2032년에는 375억 달러에 이를 것으로 예상됩니다.

병원 약국은 2024년에 시장 점유율의 46.7%를 차지했고 CAGR 3.3%를 나타낼 것으로 예측됩니다.

미국의 항바이러스제 시장은 2023년 219억 달러, 2022년 215억 달러에서 2024년에는 222억 달러에 달했습니다.

목차

제1장 조사 방법과 조사 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 업계에 미치는 영향요인

- 성장 촉진요인

- 바이러스 감염증 증가

- HIV 치료제의 출시 수 증가

- 연구개발 활동에 대한 높은 투자와 파이프라인 제품의 존재

- 고령자 인구 증가

- 업계의 잠재적 위험 및 과제

- 약제 내성의 출현

- 높은 개발 비용

- 성장 촉진요인

- 잠재성장력의 분석

- 규제 상황

- 파이프라인 분석

- 향후 시장 동향

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업 매트릭스 분석

- 기업 점유율 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

제5장 시장 추계·예측 : 약제 클래스별(2021-2034년)

- 주요 동향

- 역전사효소 억제제

- DNA 중합효소 억제제

- 프로테아제 억제제

- 뉴라미니다아제 억제제

- 기타 약제 클래스

제6장 시장 추계·예측 : 적응증별(2021-2034년)

- 주요 동향

- HIV/AIDS

- 간염

- 코로나바이러스 감염

- 단순 포진 바이러스(HSV)

- 인플루엔자

- 기타 적응증

제7장 시장 추계·예측 : 유형별(2021-2034년)

- 주요 동향

- 브랜드

- 제네릭

제8장 시장 추계·예측 : 투여 경로별(2021-2034년)

- 주요 동향

- 경구용

- 비경구용

- 국소용

- 기타 투여 경로

제9장 시장 추계·예측 : 연령층별(2021-2034년)

- 주요 동향

- 노년

- 성인

- 소아

제10장 시장 추계·예측 : 유통 채널별(2021-2034년)

- 주요 동향

- 병원 약국

- 소매 약국

- 온라인 약국

제11장 시장 예측 : 지역별 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 네덜란드

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제12장 기업 프로파일

- AbbVie

- Aurobindo Pharma Limited

- Bristol-Myers Squibb

- Cipla

- Dr. Reddy's Laboratories

- Gilead Sciences

- GlaxoSmithKline

- Janssen Pharmaceutical(Johnson & Johnson)

- Merck

- Mylan

- Pfizer

- Sun Pharmaceutical Industries

The Global Antiviral Drugs Market, estimated at USD 60.6 billion in 2024, is set to grow at a CAGR of 3.6% from 2025 to 2034. Increasing cases of viral infections, including HIV/AIDS, hepatitis B and C, and influenza, are driving demand for antiviral medications. Greater awareness, combined with government funding for drug approvals and clinical research, is fostering market growth. Companies are expanding manufacturing capacities to cater to a rising patient base, contributing to increased market penetration.

Antiviral drugs inhibit viral replication, playing a crucial role in treating infections such as HIV/AIDS, hepatitis, and influenza. The market is segmented by drug class, with reverse transcriptase inhibitors holding 29.9% of the share at USD 18.1 billion in 2024. These inhibitors are key in antiretroviral therapy, with nucleoside and non-nucleoside reverse transcriptase inhibitors driving their widespread use. Government-backed HIV treatment programs and their cost-effectiveness enhance adoption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $60.6 Billion |

| Forecast Value | $85.4 Billion |

| CAGR | 3.6% |

By indication, the HIV/AIDS segment dominates the market and is expected to reach USD 41.2 billion by 2034. A rising number of infections, along with antiretroviral therapy's long-term necessity, is fueling segment growth. Regulatory bodies are streamlining drug development, further boosting expansion.

Branded antiviral drugs accounted for 71.9% of the market in 2024, supported by rigorous clinical trials ensuring efficacy and safety. Branded drugs remain preferred for treating chronic infections due to better therapeutic outcomes. Pharmaceutical companies continue to enhance accessibility, increasing market adoption.

Oral antiviral drugs led in 2024 and are projected to grow at a 3.7% CAGR. Their ease of administration and non-invasive nature make them a preferred choice for long-term treatment. Advances in oral drug formulations are improving patient adherence and treatment effectiveness, further strengthening demand.

By age group, the geriatric segment, valued at USD 26.9 billion in 2024, is expected to reach USD 37.5 billion by 2032. An aging global population with a higher susceptibility to viral infections is driving demand. Increased use of antiviral medications and vaccines among older adults is supporting market expansion.

Hospital pharmacies captured 46.7% of the market share in 2024 and are anticipated to grow at a 3.3% CAGR. Hospitals remain the primary treatment centers for severe viral infections, ensuring easy drug accessibility. The availability of diverse antiviral formulations and the need for hospitalization in critical cases are reinforcing segment dominance.

The U.S. antiviral drugs market stood at USD 22.2 billion in 2024, up from USD 21.9 billion in 2023 and USD 21.5 billion in 2022. Growing government initiatives and rising infection rates are driving demand. Policies focused on eliminating viral diseases and intensifying prevention efforts are further strengthening market growth.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of viral infections

- 3.2.1.2 Increasing number of product launches for HIV treatment

- 3.2.1.3 High investment in R&D activities and presence of pipeline products

- 3.2.1.4 Increasing geriatric population

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Emerging drug resistance

- 3.2.2.2 High development cost

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Pipeline analysis

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Reverse transcriptase inhibitors

- 5.3 DNA polymerase inhibitors

- 5.4 Protease inhibitors

- 5.5 Neuraminidase inhibitors

- 5.6 Other drug classes

Chapter 6 Market Estimates and Forecast, By Indication, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 HIV/AIDS

- 6.3 Hepatitis

- 6.4 Coronavirus infection

- 6.5 Herpes simplex virus (HSV)

- 6.6 Influenza

- 6.7 Other indications

Chapter 7 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Branded

- 7.3 Generic

Chapter 8 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Oral

- 8.3 Parenteral

- 8.4 Topical

- 8.5 Other routes of administration

Chapter 9 Market Estimates and Forecast, By Age Group, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Geriatric

- 9.3 Adult

- 9.4 Pediatric

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Hospital pharmacies

- 10.3 Retail pharmacies

- 10.4 Online pharmacies

Chapter 11 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 AbbVie

- 12.2 Aurobindo Pharma Limited

- 12.3 Bristol-Myers Squibb

- 12.4 Cipla

- 12.5 Dr. Reddy's Laboratories

- 12.6 Gilead Sciences

- 12.7 GlaxoSmithKline

- 12.8 Janssen Pharmaceutical (Johnson & Johnson)

- 12.9 Merck

- 12.10 Mylan

- 12.11 Pfizer

- 12.12 Sun Pharmaceutical Industries