|

시장보고서

상품코드

1716612

철근 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Steel Rebar Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

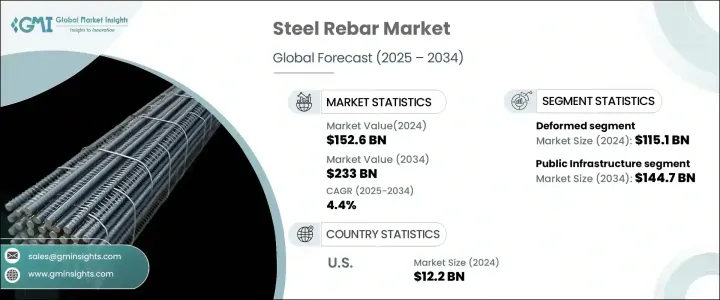

세계의 철근 시장은 2024년에 1,526억 달러에 달했고, 2025년부터 2034년에 걸쳐 CAGR 4.4%를 나타낼 것으로 예측됩니다.

이 성장의 주된 원인은 특히 신흥 경제 국가를 중심으로 한 인프라 개발에 대한 많은 투자입니다. 고강도 소재 수요가 급증하고 있습니다. 건설 활동 증가로 이어져 철근 수요를 더욱 밀어 올리고 있습니다. 철강 제조에 있어서의 기술의 진보나, 콘크리트와의 결합을 개선하는 혁신적인 철근 설계의 도입도, 내구성이 있어 탄력성이 있는 구조물의 건설을 가능하게 해, 시장의 성장에 기여하고 있습니다.

철근 시장은 주로 이형철근과 연철근의 2개로 구분됩니다. 뚜렷한 표면 패턴으로 인해 우수한 결합 특성으로 알려진 변형 철근은 2024년에 1,151억 달러의 매출을 올렸으며 2034년까지 4.4%의 연평균 성장률(CAGR)를 나타낼 것으로 예상됩니다. 이로 인해 고층 빌딩, 교량, 공업 시설 등의 대규모 인프라 프로젝트가 계속 확대되고 있는 가운데, 이형철근 수요는 계속 견조합니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 1,526억 달러 |

| 예측 금액 | 2,330억 달러 |

| CAGR | 4.4% |

용도별로는 공공 인프라 분야가 2024년 시장 점유율 61.6%를 차지했습니다. 수많은 나라가, 교통망, 공항, 교량 등의 대규모 인프라 프로젝트에 투자하고 있어 이들 모두가 구조 보강을 위해 대량의 철근을 필요로 하고 있습니다. 인프라를 구축하는 것을 목표로 하고 있습니다. 인프라 근대화에 대한 강한 초점은 정부의 지원 이니셔티브와 자금 조달과 함께 공공 인프라 프로젝트에 있어서 고품질 철근 수요를 부추기고 있습니다.

미국의 철근 시장은 2024년 122억 달러로 평가되었으며, 도로, 교량, 대중교통시스템 등 주요 인프라 건설과 유지보수 지출 증가로 꾸준한 성장이 예상됩니다. 대규모 유틸리티 및 민간 건설 프로젝트에 요구되는 엄격한 품질 기준을 충족하고 현대적인 인프라의 탄력성과 긴 수명을 보장하기 위해 시장 기업은 제품 제공 강화에 주력하고 있습니다.

목차

제1장 조사 방법과 조사 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 밸류체인에 영향을 주는 요인

- 이익률 분석

- 파괴적 혁신

- 향후 전망

- 제조업체

- 유통업체

- 공급자의 상황

- 이익률 분석

- 기술 개요

- 규제 상황

- 영향요인

- 성장 촉진요인

- 건설 및 부동산 개발 증가

- 주거의 개축과 리폼 증가

- 에너지 효율의 중시

- 도시화의 진전과 가처분 소득 증가

- 업계의 잠재적 위험 및 과제

- 원재료 비용과 가격 변동

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략 전망 매트릭스

제5장 시장 추계·예측 : 제품별(2021-2034년)

- 주요 동향

- 변형

- 마일드

제6장 시장 추계·예측 : 프로세스별(2021-2034년)

- 주요 동향

- 기본 산소제강

- 전기 아크로

제7장 시장 추계·예측 : 용도별(2021-2034년)

- 주요 동향

- 주거용 건물

- 공공 인프라

- 산업

제8장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제9장 기업 프로파일

- Acerinox SA

- ArcelorMittal

- Commercial Metals Company

- Daido Steel Co Ltd

- Gerdau S/A

- HBIS Group

- Jiangsu Shagang Group

- JSW

- NIPPON STEEL CORPORATION

- NLMK

- Nucor

- POSCO HOLDINGS INC.

- SAIL

- Steel Dynamics, Inc

- Tata Steel

The Global Steel Rebar Market reached USD 152.6 billion in 2024 and is projected to grow at a CAGR of 4.4% from 2025 to 2034. This growth is primarily driven by substantial investments in infrastructure development, particularly across emerging economies. As countries continue to modernize their transportation systems, expand urban areas, and enhance public utilities, the demand for reliable, high-strength materials such as steel rebar continues to surge. Steel rebar is essential for reinforcing concrete structures and improving their strength, stability, and longevity. Rapid urbanization and population growth have led to increased construction activities in both residential and commercial sectors, further boosting the demand for steel rebar. Moreover, government initiatives aimed at upgrading aging infrastructure and constructing sustainable buildings are creating lucrative opportunities for manufacturers. Technological advancements in steel manufacturing and the introduction of innovative rebar designs that improve bonding with concrete have also contributed to the market's growth, enabling the construction of durable and resilient structures.

The steel rebar market is segmented into two primary categories: deformed and mild steel rebar. Deformed steel rebar, known for its superior bonding properties due to its distinct surface patterns, generated USD 115.1 billion in 2024 and is projected to grow at a CAGR of 4.4% through 2034. Its enhanced adhesion to concrete minimizes slippage and significantly improves structural stability, making it the preferred choice in high-stress applications. This segment's dominance is attributed to its extensive use in the construction of reinforced concrete structures such as beams, columns, and foundations. As large-scale infrastructure projects, including high-rise buildings, bridges, and industrial facilities, continue to expand, the demand for deformed steel rebar remains robust. Additionally, the growing emphasis on sustainable construction practices and the need for earthquake-resistant structures are further amplifying the use of deformed steel rebar.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $152.6 Billion |

| Forecast Value | $233 Billion |

| CAGR | 4.4% |

In terms of application, the public infrastructure segment accounted for a 61.6% share of the market in 2024. Numerous countries are channeling investments into large-scale infrastructure projects such as transportation networks, airports, and bridges, all of which require significant quantities of steel rebar for structural reinforcement. These projects aim to create long-lasting, durable infrastructure that can withstand environmental stress and ensure public safety. The strong focus on infrastructure modernization, coupled with government-backed initiatives and funding, is fueling the demand for high-quality steel rebar in public infrastructure projects. As global economies invest heavily in expanding their urban landscapes and improving public utilities, the reliance on steel rebar to fortify critical structures continues to grow.

The U.S. steel rebar market was valued at USD 12.2 billion in 2024, with projections indicating steady growth driven by increased spending on the construction and maintenance of essential infrastructure, including roads, bridges, and public transportation systems. Government initiatives aimed at revitalizing the nation's infrastructure, combined with increased investments in building materials, are propelling the demand for steel rebar in the U.S. Market players are focusing on enhancing product offerings to meet the stringent quality standards required for large-scale public works and private construction projects, ensuring the resilience and longevity of modern infrastructure.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technological overview

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising construction and real estate development

- 3.6.1.2 Increasing home renovation and remodeling

- 3.6.1.3 Focus on energy efficiency

- 3.6.1.4 Rising urbanization and rising disposable income

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Raw material costs and price volatility

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021-2034 (USD Million) (Million Tones)

- 5.1 Key trends

- 5.2 Deformed

- 5.3 Mild

Chapter 6 Market Estimates & Forecast, By Process, 2021-2034 (USD Million) (Million Tones)

- 6.1 Key trends

- 6.2 Basic oxygen steelmaking

- 6.3 Electric arc furnace

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Million Tones)

- 7.1 Key trends

- 7.2 Residential buildings

- 7.3 Public infrastructure

- 7.4 Industrial

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Million Tones)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Acerinox S.A

- 9.2 ArcelorMittal

- 9.3 Commercial Metals Company

- 9.4 Daido Steel Co Ltd

- 9.5 Gerdau S/A

- 9.6 HBIS Group

- 9.7 Jiangsu Shagang Group

- 9.8 JSW

- 9.9 NIPPON STEEL CORPORATION

- 9.10 NLMK

- 9.11 Nucor

- 9.12 POSCO HOLDINGS INC.

- 9.13 SAIL

- 9.14 Steel Dynamics, Inc

- 9.15 Tata Steel