|

시장보고서

상품코드

1797779

발효조 및 숙성 장비 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Fermenters and Aging Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

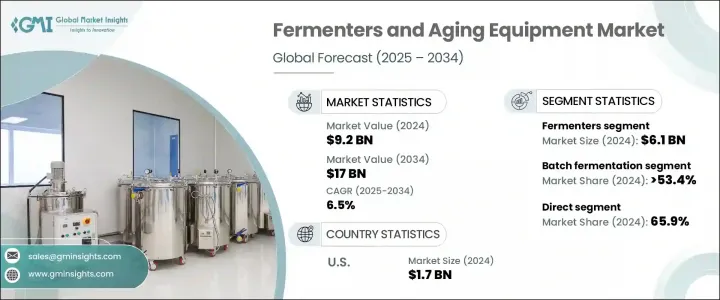

세계의 발효조 및 숙성 장비 시장 규모는 2024년에 92억 달러로 평가되었고, CAGR 6.5%를 나타내 2034년에는 170억 달러에 이를 것으로 추정되고 있습니다.

이 시장 성장의 원동력은 발효와 숙성 과정에 의존하는 여러 산업에 걸친 수요 증가입니다. 최첨단 발효 시스템에 대한 요구는 생물제제, 단일클론항체, 백신 등 수요가 높아지고 있는 바이오의약품 분야의 진보가 주요 요인이 되어 높아지고 있습니다. 건강 관리에 대한 세계 투자 확대와 만성 질환의 급증은 효율적이고 오염되지 않은 발효 과정에 대한 추가 주력을 촉진하고 있습니다.

자동화 시스템이나 일회용 발효조 등의 기술의 채용에 의해 오퍼레이션이 합리화되어, 생산 성과가 향상하고 있습니다. 이와 병행하여, 식품 및 식품 산업은 고품질의 자연 가공 제품의 인기 덕분에 장비의 노후화를 계속 추진하고 있습니다. 지속가능성과 자연식품 가공에 대한 관심도 커다란 촉매이며, 다양한 제조 셋업에 발효와 숙성 기술을 모두 통합할 것을 촉구하고 있습니다. APAC 등의 신흥경제권도 현대발효조술의 전개를 지원하는 산업화의 진전과 인프라의 개선에 의해 중요한 역할을 하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 92억 달러 |

| 예측 금액 | 170억 달러 |

| CAGR | 6.5% |

발효조는 여러 산업 분야에서 널리 사용되고 있기 때문에 시장 전체를 계속 지배하고 있습니다. 이러한 시스템은 생물학적 제제, 효소, 치료 화합물, 발효 식품의 생산에 필수적인 미생물 및 세포 배양 배양에 중요한 역할을 합니다. 그 용도는 일반적으로 범위가 제한되는 에이징 장치와 비교할 때 훨씬 광범위합니다. 정밀하고 확장 가능한 생산에 대한 수요가 증가함에 따라 제조업체는 차세대 발효조 개발에 적극적으로 투자하고 있습니다. 이러한 시스템에는 향상된 모니터링, 자동화, 내오염성 등의 기능이 내장되어 있습니다. 보다 높은 효율성과 적응성을 가능하게 하는 이러한 혁신은 특히 제품의 일관성과 순도가 중요한 분야에서 생산자가 시장의 요구에 신속하게 대응할 수 있도록 합니다.

2024년에는 배치 발효 부문이 53.4%의 점유율을 차지했으며, 2034년까지 연평균 복합 성장률(CAGR)은 7.3%를 나타낼 것으로 예측됩니다. 이 발효 방법은 조작의 간편성과 광범위한 적응성 때문에 바이오 의약품 산업과 식품 산업 모두에서 가장 선호되고 있습니다. 배치 처리는 성분의 첨가, 처리 및 제거를 제어된 환경에서 수행할 수 있어 다양한 제품 카테고리에 이상적인 간단한 설정을 제공합니다. 이 기술은 정밀도, 유연성 및 깨끗한 처리가 최우선으로 되는 중소규모 생산에 특히 적합합니다. 연속 생산과 대규모 생산과 같은 복잡성 없이 세밀한 모니터링이 필요한 고가치 제품의 제조를 지원합니다.

미국의 발효조 및 숙성 장비 시장은 67.7%의 점유율을 차지했으며 2024년에는 17억 달러를 창출했습니다. 이 나라의 이점은 고급 의약품 제조 환경, 정교한 연구시설, 강력한 공급업체 네트워크로 인해 발생합니다. 생물 제제와 개인화 치료 시장이 급속히 발전함에 따라 대규모 제조업체와 개발 위탁 기관 모두에서 보다 정교한 발효 솔루션에 대한 관심이 높아지고 있습니다. 미국은 의약품 생산과 혁신을 향상시키기 위한 공공 부문과 민간부문의 지속적인 투자의 혜택을 계속 받고 있습니다.

Thermo Fisher Scientific, Alfa Laval AB, Sartorius AG, Merck KGaA(MilliporeSigma), GEA Group AG 등 주요 시장 선수들은 전략적 노력을 통해 경쟁 구도를 적극적으로 형성하고 있습니다. 이러한 기업들은 바이오프로세스와 식품업계의 진화하는 요구에 대응하는 보다 스마트하고 모듈화된 확장 가능한 시스템을 도입하기 위한 연구개발을 우선하고 있습니다. 또한 각 지역의 제조 거점, 현지화된 서비스 센터, 전략적인수를 통해 세계적인 발자취를 확대하고 있습니다. 학술기관이나 바이오의약품기업과의 제휴는 이들 기업이 시장의 변화를 선점하고 신기술을 신속하게 시험·전개하는 데 도움이 되고 있습니다. 제품 성능 향상, 자동화 진전, 통합 디지털 솔루션 제공으로 이 기업들은 시장에서의 입지를 강화하고 유연하고 효율적인 가공 기술에 대한 수요에 부응하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 이익률

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 업계에 미치는 영향요인

- 성장 촉진요인

- 바이오의약품 수요 증가

- 식품 및 음료 업계의 성장

- 기술적 진보

- 업계의 잠재적 위험 및 과제

- 고액의 자본 투자

- 운영 및 유지 보수의 복잡성

- 기회

- 성장 촉진요인

- 성장 가능성 분석

- 향후 시장 동향

- 기술과 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 가격 동향

- 지역별

- 기기유형별

- 규제 상황

- 표준 및 컴플라이언스 요건

- 지역 규제 틀

- 인증기준

- 무역 통계(HS코드-84199090)

- 주요 수입국

- 주요 수출국

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 지역별

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 주요 발전

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확장 계획

제5장 시장 추계·예측 : 기기종별(2021-2034년)

- 주요 동향

- 발효조

- 수중 발효조(예: 교반조)

- 고체 발효조

- 혐기성 발효조

- 호기성 발효조

- 노화 장비

- 숙성 탱크(예 : 스테인리스 스틸, 오크, 플라스틱)

- 배럴(예 : 오크 배럴, 하이브리드 배럴)

- 보틀링 및 2차 숙성 시스템

- 셀러 에이징 유닛

제6장 시장 추계·예측 : 조작별(2021-2034년)

- 주요 동향

- 배치 발효

- 피드 배치 발효

- 연속 발효

제7장 시장 추계·예측 : 구조 재료별(2021-2034년)

- 주요 동향

- 스테인레스 스틸

- 유리

- 플라스틱/폴리머

- 콘크리트(와인/사이다 숙성용)

- 목재(주로 숙성용)

제8장 시장 추계·예측 : 자동화 레벨별(2021-2034년)

- 주요 동향

- 매뉴얼

- 반자동

- 전자동

제9장 시장 추계·예측 : 용도별(2021-2034년)

- 주요 동향

- 식음료

- 제약

- 생명공학

- 영양보조식품

- 화장품 및 퍼스널케어

제10장 시장 추계·예측 : 유통 채널별(2021-2034년)

- 주요 동향

- 직접

- 간접

제11장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 남아프리카

- 사우디아라비아

제12장 기업 프로파일

- Alfa Laval

- Applikon Biotechnology

- Bioengineering

- Bucher Vaslin

- Danaher Corporation

- Eppendorf

- GEA Group

- Merck

- Paul Mueller Company

- Sartorius

- STS Canada

- Tetra Pak

- Thermo Fisher Scientific

- Ziemann Holvrieka

- JVNW

The Global Fermenters and Aging Equipment Market was valued at USD 9.2 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 17 billion by 2034. This market growth is fueled by the increasing demand across multiple industries that rely on fermentation and aging processes. The need for cutting-edge fermentation systems is rising, driven largely by advancements in the biopharmaceutical sector, where biologics, monoclonal antibodies, and vaccines are seeing heightened demand. Growing investments in healthcare globally and a surge in chronic disease prevalence are prompting further focus on efficient and contamination-free fermentation processes.

The adoption of technologies such as automated systems and single-use fermenters has streamlined operations and improved production outcomes. Alongside, the food and beverage industry continue to push growth in aging equipment, thanks to the popularity of high-quality, naturally processed products. Interest in sustainability and natural food processing is another major catalyst, encouraging the integration of both fermentation and aging technologies across various manufacturing setups. Emerging economies in regions such as APAC are also playing a key role due to increased industrialization and infrastructure improvements that support the deployment of modern fermentation technologies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.2 Billion |

| Forecast Value | $17 Billion |

| CAGR | 6.5% |

Fermenters continue to dominate the overall market, owing to their wide-ranging usage across several industrial verticals. These systems play a crucial role in cultivating microorganisms and cell cultures essential for producing biologics, enzymes, therapeutic compounds, and fermented food items. Their applications are far more extensive when compared to aging equipment, which is generally more limited in scope. As demand for precision-driven and scalable production intensifies, manufacturers are actively investing in the development of next-generation fermenters. These systems incorporate features such as enhanced monitoring, automation, and contamination resistance. By enabling higher efficiency and adaptability, these innovations are making it easier for producers to respond quickly to market needs, especially in sectors where product consistency and purity are critical.

In 2024, the batch fermentation segment held a 53.4% share and is projected to grow at a CAGR of 7.3% through 2034. This fermentation method remains the most preferred across both biopharma and food industries because of its operational simplicity and broad adaptability. Batch processing allows ingredients to be added, processed, and removed in a controlled environment, offering a straightforward setup ideal for a variety of product categories. This technique is particularly well-suited to small- to medium-scale production runs, where precision, flexibility, and clean processing are paramount. It supports the manufacturing of high-value products that require detailed oversight without the complications of continuous or large-scale operations.

United States Fermenters and Aging Equipment Market held a 67.7% share and generated USD 1.7 billion in 2024. The country's dominance stems from its advanced pharmaceutical manufacturing landscape, sophisticated research facilities, and strong supplier networks. A rapidly evolving market for biologics and personalized therapies is fueling interest in more advanced fermentation solutions across both large-scale manufacturers and contract development organizations. The US continues to benefit from sustained public and private sector investments aimed at improving pharmaceutical output and innovation.

Key market players, including Thermo Fisher Scientific, Alfa Laval AB, Sartorius AG, Merck KGaA (MilliporeSigma), and GEA Group AG, are actively shaping the competitive landscape through strategic efforts. These firms are prioritizing research and development to introduce smarter, modular, and scalable systems that meet the evolving needs of bioprocessing and food industries. They are also expanding their global footprint through regional manufacturing hubs, localized service centers, and strategic acquisitions. Partnerships with academic institutions and biopharma companies help these players stay ahead of market shifts and rapidly test and deploy new technologies. By enhancing product performance, increasing automation, and offering integrated digital solutions, these companies are solidifying their market positions and responding to the demand for flexible and efficient processing technologies.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.3 Data collection methods

- 1.4 Data mining sources

- 1.4.1 Global

- 1.4.2 Regional/Country

- 1.5 Base estimates and calculations

- 1.5.1 Base year calculation

- 1.5.2 Key trends for market estimation

- 1.6 Primary research and validation

- 1.6.1 Primary sources

- 1.7 Forecast model

- 1.8 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment Type

- 2.2.3 Operation

- 2.2.4 Automation Level

- 2.2.5 Material for construction

- 2.2.6 Application

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.4 Critical success factors for market players

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for biopharmaceuticals

- 3.2.1.2 Growth of food & beverage industry

- 3.2.1.3 Technological advancements

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High capital investment

- 3.2.2.2 Complexity of operation and maintenance

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation Landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By equipment type

- 3.7 Regulatory landscape

- 3.7.1 standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code - 84199090)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Equipment Type, 2021 - 2034 ($ Bn, Units)

- 5.1 Key trends

- 5.2 Fermenters

- 5.2.1 Submerged fermenters (e.g., stirred tank)

- 5.2.2 Solid-state fermenters

- 5.2.3 Anaerobic fermenters

- 5.2.4 Aerobic fermenters

- 5.3 Aging Equipment

- 5.3.1 Aging tanks (e.g., stainless steel, oak, plastic)

- 5.3.2 Barrels (e.g., oak barrels, hybrid barrels)

- 5.3.3 Bottling and secondary aging systems

- 5.3.4 Cellar aging units

Chapter 6 Market Estimates & Forecast, By Operation, 2021 - 2034 ($ Bn, Units)

- 6.1 Key trends

- 6.2 Batch fermentation

- 6.3 Fed-batch fermentation

- 6.4 Continuous fermentation

Chapter 7 Market Estimates & Forecast, By Material of Construction, 2021 - 2034 ($ Bn, Units)

- 7.1 Key trends

- 7.2 Stainless steel

- 7.3 Glass

- 7.4 Plastic/polymer

- 7.5 Concrete (for wine/cider aging)

- 7.6 Wood (primarily for aging)

Chapter 8 Market Estimates & Forecast, By Automation Level, 2021 - 2034 ($ Bn, Units)

- 8.1 Key trends

- 8.2 Manual

- 8.3 Semi-automatic

- 8.4 Fully automatic

Chapter 9 Market Estimates & Forecast, By Application 2021 - 2034 ($ Bn, Units)

- 9.1 Key trends

- 9.2 Food & beverage

- 9.3 Pharmaceuticals

- 9.4 Biotechnology

- 9.5 Nutraceuticals

- 9.6 Cosmetics & personal care

Chapter 10 Market Estimates & Forecast, By Distribution Channel 2021 - 2034 ($ Bn, Units)

- 10.1 Key trends

- 10.2 Direct

- 10.3 Indirect

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($ Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 Alfa Laval

- 12.2 Applikon Biotechnology

- 12.3 Bioengineering

- 12.4 Bucher Vaslin

- 12.5 Danaher Corporation

- 12.6 Eppendorf

- 12.7 GEA Group

- 12.8 Merck

- 12.9 Paul Mueller Company

- 12.10 Sartorius

- 12.11 STS Canada

- 12.12 Tetra Pak

- 12.13 Thermo Fisher Scientific

- 12.14 Ziemann Holvrieka

- 12.15 JVNW