|

시장보고서

상품코드

1801925

파워 스포츠 애프터마켓 시장 규모 : 차량별, 추진별, 용도별, 판매 채널별, 구성요소별, 예측(2025-2034년)Powersports Aftermarket Size - By Vehicle, By Propulsion, By Application, By Sales Channel, By Component, Growth Forecast, 2025 - 2034 |

||||||

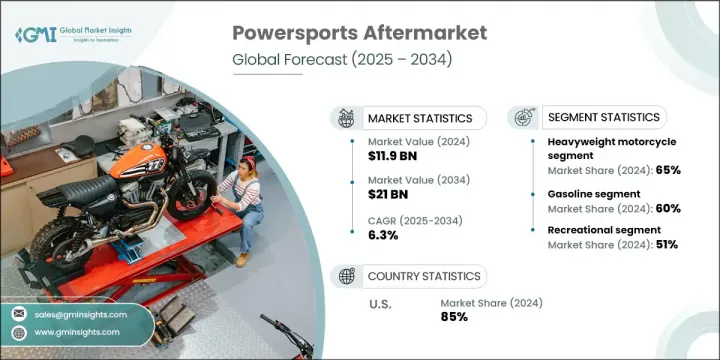

세계 파워 스포츠 애프터마켓의 2024년 시장 규모는 119억 달러에 달했고, CAGR 6.3%로 성장하여 2034년에는 210억 달러에 이를 것으로 추정됩니다.

이 상승 동향은 아웃도어나 레크리에이션 활동에 대한 관심 증가와 더불어 차량 성능 기술의 진화와 전기 및 하이브리드 엔진 탑재 모델의 존재감 증가에 의해 형성되고 있습니다. 모험적인 라이프스타일을 도입하는 소비자가 늘어남에 따라 애프터마켓 부품, 액세서리, 성능 업그레이드에 대한 수요도 증가하고 있습니다. 최근 몇 년 동안 디지털 플랫폼이 업계 상황을 재구성하는 데 기여하고 있으며, 더 많은 라이더가 업그레이드, 개조 및 수리 키트를 온라인으로 구입했습니다. 소비자 행동의 변화는 전자상거래의 성장을 뒷받침하고 있으며, 특히 집에 있으면서 커스터마이즈 된 솔루션을 요구하는 사용자가 늘고 있습니다. 아웃도어 체험에 관련된 포스트 및 팬데믹의 기운은 파워 스포츠 자동차의 보급에 크게 공헌해, 전체적인 수요에 박차를 가하고 있습니다. 시장 각 사는 고객의 편의성과 만족도를 높이기 위해 제품 라인업 확충과 원활한 디지털 서비스를 통해 대응하고 있습니다.

2024년에는 중량급 모터사이클 카테고리가 65%의 점유율을 차지했고 2034년까지 연평균 복합 성장률(CAGR) 7%로 성장할 것으로 예측됩니다. 이러한 모터사이클은 보통 750cc 이상이며 맞춤형, 내구성 투어링, 장기 소유 가치를 선호하는 라이더들에게 지지됩니다. 견고한 설계와 툴링 성능으로 인해 업그레이드된 서스펜션, 러기지 시스템, 성능 배기, 조명 강화 등 애프터마켓 부품에 대한 투자가 증가하는 경우가 많습니다. 이 부문의 라이더는 일반적으로 성능과 개성화에 열성적이기 때문에 중량급 모터사이클을 둘러싼 애프터마켓의 생태계는 특히 강력하게 유지됩니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작금액 | 119억 달러 |

| 예측 금액 | 210억 달러 |

| CAGR | 6.3% |

2024년 가솔린차 점유율은 60%를 차지했으며, 2034년까지 연평균 복합 성장률(CAGR)은 7%를 나타낼 것으로 전망됩니다. 가솔린은 널리 이용 가능하며 토크 출력이 높고 항속 거리가 길기 때문에 오프로드 및 원격지에서 사용하기에 이상적인 연료로 계속 선택되고 있습니다. 이 부문에는 ATV, 모터사이클, 유틸리티 터레인 차량 및 기타 성능 기계가 포함되어 있으며, 이들은 종종 마모와 손상을 겪기 때문에 교체 부품 및 업그레이드 키트에 대한 수요가 지속됩니다. 가솔린 엔진의 탄력성과 신뢰성으로 인해 사용자는 개선과 장기 유지 보수에 대한 투자를 계속하고 있습니다.

미국 파워스포츠 애프터마켓의 점유율은 85%로 2024년에는 47억 2,000만 달러에 이르렀습니다. 미국의 파워 스포츠 애프터마켓은 소비자의 강한 지지, 확립된 소유 패턴, 깊은 뿌리를 둔 오프로드 문화로 번창하고 있습니다. 소매 채널, 딜러 및 서비스 센터의 견고한 네트워크는 애프터마켓 제품에 대한 액세스를 용이하게 하고 전자상거래의 보급이 소비자에게 직접 판매를 지원합니다. BRP, 폴라리스, 야마하, 혼다와 같은 유명 브랜드의 존재와 RevZilla나 Rocky Mountain ATV/MC와 같은 디지털 선진 플랫폼이 결합되어 미국 시장의 지위와 소비자의 기호의 변화에 대한 대응력을 계속 강화하고 있습니다.

세계 파워 스포츠 애프터마켓의 주요 기업으로는 반스 앤 하인즈(VANCE&HINES), BRP, K&N 엔지니어링, 폴라리스(Polaris), 아크틱 캣(Arctic Cat), 데이코 인코포레이티드(Dayco Incorporated), S&S 사이클 등 입니다. 파워스포츠 애프터마켓을 전개하는 기업은 디지털 전환에 중점을 두고, 전자상거래 도달범위를 확대하고, 개인화된 구매체험을 제공합니다. 제품의 다양화도 핵심 전략의 하나로, 각 브랜드는 특정 차종과 라이더의 취향에 맞는 혁신적인 부품과 액세서리를 발표하고 있습니다. OEM과의 전략적 제휴는 브랜드 인지도를 높이고 유통망을 확대하는 데 도움이 됩니다. R&D 투자는 제품의 내구성, 성능 및 진화하는 배기 가스 규제 준수를 개선하는 것을 목표로 합니다. 많은 기업들이 데이터 분석과 CRM 플랫폼을 활용하여 고객의 행동을 이해하고 타겟팅된 마케팅을 전개하고 있습니다.

목차

제1장 조사 방법

- 시장의 범위와 정의

- 조사 디자인

- 조사 접근

- 데이터 수집 방법

- 데이터 마이닝 소스

- 세계

- 지역/국가

- 기본 추정과 계산

- 기준연도 계산

- 시장 예측의 주요 동향

- 1차 조사와 검증

- 1차 정보

- 예측 모델

- 조사의 전제와 한계

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 이익률 분석

- 비용 구조

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 혁신

- 업계에 미치는 영향요인

- 성장 촉진요인

- 세계의 야외 레크리에이션과 어드벤처 투어리즘 증가

- 젊은이의 ATV, UTV, 스노모빌, 오토바이 소유가 급증

- 차량 커스터마이즈 수요 증가

- 북미와 유럽에서 개인의 가처분 소득 증가

- 업계의 잠재적 위험 및 과제

- 격렬한 가격 경쟁을 수반하는 세분화된 시장

- 지역을 넘는 다양하고 복잡한 규제 준수

- 시장 기회

- 전동 파워 스포츠 차량 애프터마켓 확대

- 온라인 및 모바일 맞춤형 서비스 성장

- 신흥 시장에서의 파워 스포츠의 보급 확대

- 스마트 연결 액세서리 통합

- 성장 촉진요인

- 규제 상황

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- Porter's Five Forces 분석

- PESTEL 분석

- 기술과 혁신의 상황

- 현재의 기술 동향

- 신흥기술

- 특허 분석

- 유통채널의 진화와 옴니채널 전략

- 종래의 딜러 네트워크의 변화

- 독립계 소매업체와 전문점의 동향

- 온라인 마켓플레이스 통합과 소비자 직접 판매 모델

- 창고 및 배송 센터의 최적화

- 소비자 행동과 구매 패턴 분석

- DIY vs. 프로에 의한 설치의 취향

- 브랜드 충성도와 OEM과 애프터마켓의 취향

- 계절 구매 패턴과 재고 사이클

- 가격 감도와 가치 인식 분석

- 가격 전략의 진화와 가치 제안 분석

- 디지털 변혁과 전자상거래의 통합

- 온라인 판매 플랫폼 개발 및 시장 침투

- 디지털 카탈로그 및 제품 구성 시스템

- 모바일 상거래 및 앱 기반 주문 솔루션

- 증강현실과 가상 피팅 기술

- 제품 혁신과 성능 향상 동향

- 퍼포먼스 향상 기술과 시장 도입

- 스마트 기술 통합 및 연결 액세서리

- 경량 소재와 고급 제조 기술

- 커스터마이즈와 개인화 기술의 동향

- 가격 동향

- 지역별

- 차량별

- 생산 통계

- 생산 거점

- 소비 거점

- 수출과 수입

- 코스트 내역 분석

- 지속가능성과 환경 측면

- 지속가능한 관행

- 폐기물 감축 전략

- 생산에 있어서의 에너지 효율

- 환경 친화적인 노력

- 탄소발자국의 고려

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

- 주요 발전

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확장계획과 자금조달

제5장 시장 추정 및 예측 : 차량별, 2021년-2034년

- 주요 동향

- 사이드 바이 사이드 차량

- 전지형 차량

- 헤비급 모터싸이클

- 수상 오토바이

- 스노모빌

제6장 시장 추정 및 예측 : 추진별, 2021년-2034년

- 주요 동향

- 가솔린

- 디젤

- 전기

제7장 시장 추정 및 예측 : 용도별, 2021년-2034년

- 주요 동향

- 레크리에이션

- 유틸리티

- 상업

- 스포츠

- 건설

- 방어

제8장 시장 추정 및 예측 : 판매 채널별, 2021년-2034년

- 주요 동향

- 온라인

- 오프라인

제9장 시장 추정 및 예측 : 구성요소별, 2021년-2034년

- 주요 동향

- 서스펜션 & 브레이크 부품

- 배기 시스템

- 타이어와 휠

- 바디 파츠와 프레임

- 배터리와 전기제품

- 기타

제10장 시장 추정 및 예측 : 지역별, 2021년-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 필리핀

- 인도네시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제11장 기업 프로파일

- 세계기업

- Akrapovic doo

- BRP

- Continental

- Fox Factory

- Honda Powersports

- Kawasaki Motors

- Magura GmbH

- Polaris

- Suzuki Motor

- Yamaha Motor

- 지역 기업

- Acerbis SpA

- All Balls Racing

- Kimpex

- Mitas Tires

- Motovan

- Polisport Group

- ProX Racing Parts

- SBS Friction A/S

- TM Designworks

- Twin Air

- 신흥기업

- Baja Designs

- Cycra Performance Plastics

- FMF Racing

- IMS Products

- Racetech Products

- Renegade Powersports

- Scorpion Exhausts

- Tusk Racing

- Vortex Racing

- ZETA USA

The Global Powersports Aftermarket was valued at USD 11.9 billion in 2024 and is estimated to grow at a CAGR of 6.3% to reach USD 21 billion by 2034. This upward trend is shaped by rising interest in outdoor and recreational activities, alongside the evolution of vehicle performance technologies and the increasing presence of electric and hybrid-powered models. As more consumers embrace adventure lifestyles, the demand for aftermarket parts, accessories, and performance upgrades continues to rise. In recent years, digital platforms have helped reshape the industry landscape, with more riders purchasing upgrades, modifications, and repair kits online. Shifts in consumer behavior are also driving e-commerce growth, especially among users looking for customized solutions from the comfort of home. The post-pandemic momentum around outdoor experiences contributed significantly to the adoption of powersport vehicles, fueling demand across the board. Market players are adapting with expanded product offerings and seamless digital services that elevate customer convenience and satisfaction.

In 2024, the heavyweight motorcycle category held a 65% share and is projected to grow at a CAGR of 7% through 2034. These motorcycles-typically over 750cc-are favored by riders who prioritize customization, endurance touring, and long-term ownership value. Their robust design and touring capabilities often drive higher investment in aftermarket parts such as upgraded suspensions, luggage systems, performance exhausts, and lighting enhancements. Because riders of this segment are typically more enthusiastic about performance and personalization, the aftermarket ecosystem surrounding heavyweight bikes remains particularly strong.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.9 Billion |

| Forecast Value | $21 Billion |

| CAGR | 6.3% |

Gasoline-powered vehicles held 60% share in 2024, with growth anticipated at 7% CAGR through 2034. Gasoline continues to be the fuel of choice due to its widespread availability, high torque output, and extended range-factors that make these vehicles ideal for off-road and remote usage. This segment includes ATVs, motorcycles, utility terrain vehicles, and other performance machines, which often experience significant wear and tear, resulting in sustained demand for replacement components and upgrade kits. The resilience and reliability of gasoline engines ensure that users continue to invest in enhancements and long-term maintenance.

United States Powersports Aftermarket held 85% share and generated USD 4.72 billion in 2024. The US powersports aftermarket thrives on strong consumer adoption, established ownership patterns, and a deeply rooted off-road culture. Its robust network of retail channels, dealerships, and service centers makes aftermarket products easily accessible, while widespread adoption of e-commerce supports direct-to-consumer sales. The presence of notable brands like BRP, Polaris, Yamaha, and Honda, combined with digital-forward platforms such as RevZilla and Rocky Mountain ATV/MC, continues to strengthen the US market's position and responsiveness to shifting consumer preferences.

Leading companies in the Global Powersports Aftermarket include VANCE & HINES, BRP, K&N Engineering, Polaris, Arctic Cat, Dayco Incorporated, and S&S Cycle. Companies operating in the powersports aftermarket are focusing heavily on digital transformation, expanding their e-commerce reach, and offering personalized buying experiences. Product diversification is another core strategy, with brands introducing innovative parts and accessories tailored to specific vehicle types and rider preferences. Strategic collaborations with OEMs help boost brand visibility and expand distribution networks. Investments in R&D are targeted at improving product durability, performance, and compliance with evolving emission standards. Many players are leveraging data analytics and CRM platforms to understand customer behavior and deliver targeted marketing.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Propulsion

- 2.2.4 Application

- 2.2.5 Sales channel

- 2.2.6 Component

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in global outdoor recreation and adventure tourism

- 3.2.1.2 Surge in ATV, UTV, snowmobile, and motorcycle ownership among youth

- 3.2.1.3 Increase in demand for vehicle customization

- 3.2.1.4 Rising disposable income of individuals in North America and Europe

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Fragmented market with intense price competition

- 3.2.2.2 Diverse and complex regulatory compliance across regions

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of electric powersports vehicles aftermarket

- 3.2.3.2 Growth in online and mobile customization services

- 3.2.3.3 Rising powersports adoption in emerging markets

- 3.2.3.4 Integration of smart connected accessories

- 3.2.1 Growth drivers

- 3.3 Regulatory landscape

- 3.3.1 North America

- 3.3.2 Europe

- 3.3.3 Asia Pacific

- 3.3.4 Latin America

- 3.3.5 Middle East & Africa

- 3.4 Porter’s analysis

- 3.5 PESTEL analysis

- 3.6 Technology and Innovation landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Patent analysis

- 3.8 Distribution channel evolution and omnichannel strategies

- 3.8.1 Traditional dealer network transformation

- 3.8.2 Independent retailer and specialty shop dynamics

- 3.8.3 Online marketplace integration and direct-to-consumer models

- 3.8.4 Warehouse and distribution center optimization

- 3.9 Consumer behavior and purchase pattern analysis

- 3.9.1 DIY vs. Professional installation preferences

- 3.9.2 Brand loyalty and OEM vs. Aftermarket preferences

- 3.9.3 Seasonal purchase patterns and inventory cycles

- 3.9.4 Price sensitivity and value perception analysis

- 3.10 Pricing strategy evolution and value proposition analysis

- 3.11 Digital transformation and e-commerce integration

- 3.11.1 Online sales platform development and market penetration

- 3.11.2 Digital catalog and product configuration systems

- 3.11.3 Mobile commerce and app-based ordering solutions

- 3.11.4 Augmented reality and virtual fitting technologies

- 3.12 Product innovation and performance enhancement trends

- 3.12.1 Performance upgrade technologies and market adoption

- 3.12.2 Smart technology integration and connected accessories

- 3.12.3 Lightweight materials and advanced manufacturing

- 3.12.4 Customization and personalization technology trends

- 3.13 Price trends

- 3.13.1 By region

- 3.13.2 By Vehicle

- 3.14 Production statistics

- 3.14.1 Production hubs

- 3.14.2 Consumption hubs

- 3.14.3 Export and import

- 3.15 Cost breakdown analysis

- 3.16 Sustainability and environmental aspects

- 3.16.1 Sustainable practices

- 3.16.2 Waste reduction strategies

- 3.16.3 Energy efficiency in production

- 3.16.4 Eco-friendly Initiatives

- 3.16.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.1.1 Side by side vehicle

- 5.1.2 All-terrain vehicle

- 5.1.3 Heavyweight motorcycle

- 5.1.4 Personal watercrafts

- 5.1.5 Snowmobile

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Gasoline

- 6.3 Diesel

- 6.4 Electric

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Recreational

- 7.3 Utility

- 7.4 Commercial

- 7.5 Sports

- 7.6 Construction

- 7.7 Defense

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Online

- 8.3 Offline

Chapter 9 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Suspension & Brake Parts

- 9.3 Exhaust Systems

- 9.4 Tires & Wheels

- 9.5 Body Parts & Frames

- 9.6 Batteries & Electricals

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Philippines

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Akrapovic d.o.o.

- 11.1.2 BRP

- 11.1.3 Continental

- 11.1.4 Fox Factory

- 11.1.5 Honda Powersports

- 11.1.6 Kawasaki Motors

- 11.1.7 Magura GmbH

- 11.1.8 Polaris

- 11.1.9 Suzuki Motor

- 11.1.10 Yamaha Motor

- 11.2 Regional Players

- 11.2.1 Acerbis S.p.A

- 11.2.2 All Balls Racing

- 11.2.3 Kimpex

- 11.2.4 Mitas Tires

- 11.2.5 Motovan

- 11.2.6 Polisport Group

- 11.2.7 ProX Racing Parts

- 11.2.8 SBS Friction A/S

- 11.2.9 TM Designworks

- 11.2.10 Twin Air

- 11.3 Emerging Players

- 11.3.1 Baja Designs

- 11.3.2 Cycra Performance Plastics

- 11.3.3 FMF Racing

- 11.3.4 IMS Products

- 11.3.5 Racetech Products

- 11.3.6 Renegade Powersports

- 11.3.7 Scorpion Exhausts

- 11.3.8 Tusk Racing

- 11.3.9 Vortex Racing

- 11.3.10 ZETA USA