|

시장보고서

상품코드

1873968

비디오 감시 시장 : 제공별, 소프트웨어별, 스토리지별, 시스템별, 지역별 예측(-2031년)Video Surveillance Market by Offering (Cameras, Monitors, Storage Devices, Accessories), Software (VMS, VAS), Camera (PTZ, Dome, Box & Bullet, Panoramic, Bodyworn, Fisheye), Storage (DVR, NVR, HVR, IP Storage, Direct), System - Global Forecast to 2031 |

||||||

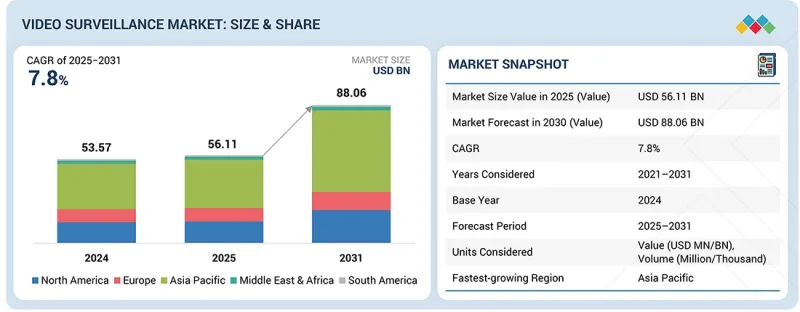

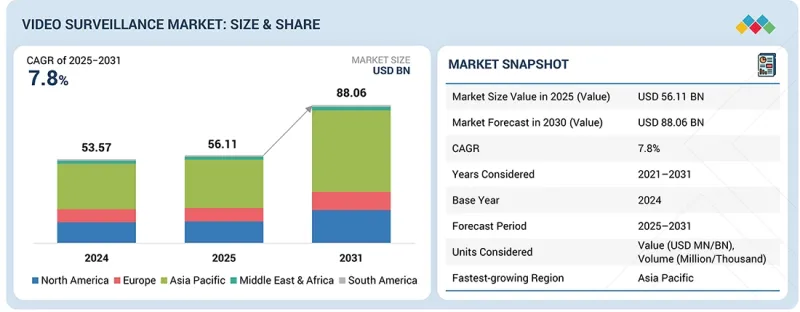

비디오 감시 시장 규모는 2025년에 561억 1,000만 달러로 평가되고, 2031년까지 880억 6,000만 달러에 이를 것으로 예상되며, 예측 기간 동안 CAGR 7.8%를 나타낼 전망입니다.

상업, 산업, 주택, 공공 등 다양한 분야에서 지능형 보안 및 감시 솔루션에 대한 수요가 증가함에 따라 비디오 감시 시장은 견조한 성장을 이루고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2021-2031년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2031년 |

| 대상 단위 | 금액(10억 달러) |

| 부문 | 제공별, 소프트웨어별, 스토리지별, 시스템별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양 및 기타 지역 |

카메라, 영상 관리 소프트웨어, 스토리지 디바이스 등의 핵심 구성 요소는 AI 구동 분석, IoT 통합, 클라우드 연결성에 의해 강화되어 실시간 감시와 위협 감지의 향상을 도모하고 있습니다. 얼굴인식, 동작분석, 원격감시 등의 신흥기술에 의해 예방적인 보안관리가 가능해지고 있습니다. 스마트시티 구상의 추진, 안전면에 대한 우려의 높아짐, IP 기반 시스템의 진보가 시장의 확대를 더욱 뒷받침해, 세계에서 지능적이고 접속된 비디오 감시 솔루션의 보급을 촉진하고 있습니다.

IP 카메라 부문은 뛰어난 이미지 해상도, 확장성 및 원격 액세스성을 제공하는 고급 네트워크 기반 모니터링 솔루션에 대한 수요 증가로 예측 기간 동안 가장 높은 CAGR을 나타낼 것으로 예측됩니다. IP 카메라는 기존 아날로그 시스템에 비해 IP 네트워크를 통한 영상 데이터 전송으로 유연성을 향상시켜 중앙 집중식 모니터링과 클라우드 IoT 플랫폼과의 원활한 통합을 가능하게 합니다. 이러한 카메라는 얼굴 인식, 움직임 감지, 행동 분석 등의 AI 구동 분석을 지원하여 조직이 보안 인텔리전스를 강화하고 사고 대응을 자동화할 수 있도록 합니다. 스마트 시티 구상, 교통 모니터링, 산업 자동화의 급속한 확대가 그 채용을 더욱 가속화하고 있습니다. 또한 IP 기반 시스템의 비용 절감과 데이터 압축 기술 및 네트워크 대역폭 효율성 향상으로 상업시설, 주택, 공공 인프라 등 다양한 용도로의 도입이 용이해졌습니다. 이러한 요인들이 결합되어 IP 카메라는 세계적으로 현대적인 지능형 비디오 감시 시스템에서 최적의 선택으로 자리매김하고 있습니다.

예측 기간 동안 상업 분야는 감시 카메라 시장에서 가장 큰 점유율을 차지할 것으로 예측됩니다. 이는 비즈니스 시설 전반에 걸친 보안 강화, 업무 효율화, 규제 준수에 대한 요구가 증가하는 배경입니다. 소매점, 기업사무실, 금융기관, 의료시설, 접객업계에서는 도난방지, 직원·고객의 활동 감시, 안전한 환경 확보를 위한 고급 감시 시스템의 도입이 확대되고 있습니다. AI를 활용한 분석 기능, 얼굴 인식 기술, 자동 경보 기능의 통합을 통해 기업은 위험을 적극적으로 관리하고 업무를 최적화할 수 있습니다. 또한 클라우드 기반 영상 관리 시스템과 원격 감시 기능의 도입 확대는 여러 거점의 실시간 액세스와 집중 관리를 지원합니다. 스마트 빌딩 인프라와 디지털 전환에 대한 투자 증가도 지능형 비디오 감시 솔루션 수요를 더욱 뒷받침하고 있으며, 비즈니스 연속성과 자산 보호를 위한 보안 기술에서 상업 부문이 주도적인 도입자로서의 지위를 확립하고 있습니다.

중국은 대규모 정부 주도 노력, 광범위한 인프라 정비, Hangzhou Hikvision Digital Technology(중국), Dahua Technology(중국), Zhejiang Uniview Technologies Co.(중국) 등 주요 국내 업체들의 강력한 존재감으로 아시아태평양 비디오 감시 시장을 주도하고 있습니다. 이 나라의 급속한 도시화와 공공안전에 대한 노력으로 스마트시티, 교통망, 중요 인프라 전반에 걸쳐 지능형 모니터링 시스템이 널리 도입되고 있습니다. AI, 빅데이터 분석, 5G 연결의 중국 리더십은 모니터링 솔루션의 기능을 더욱 강화하고 실시간 모니터링, 얼굴 인식, 행동 분석을 가능하게 합니다. 게다가 비용 효율적인 하드웨어의 현지 조달 가능성, 첨단 제조 능력 및 R&D에 대한 지속적인 투자는 국내 시장과 수출 시장 모두에서 중국의 우위를 강화하고 있습니다. 이러한 요인들이 함께 중국은 차세대 비디오 감시 기술에 있어서의 혁신과 대규모 도입의 세계적 거점으로서의 지위를 확립해, 지역 시장에서의 주도적 역할을 추진하고 있습니다.

본 보고서에서는 세계의 비디오 감시 시장에 대해 조사했으며,, 제공별, 시스템 유형별, 업계별, 지역별 동향 및 시장 진출기업프로파일 등을 정리했습니다.

자주 묻는 질문

목차

제1장 서론

제2장 주요 요약

제3장 중요 인사이트

제4장 시장 개요

- 서론

- 시장 역학

- 미충족 수요(Unmet Needs)와 공백

- 연결된 시장과 부문 간 기회

- Tier 1/2/3 기업의 전략적 움직임

제5장 업계 동향

- 서론

- Porter's Five Forces 분석

- 거시경제 전망

- 밸류체인 분석

- 생태계 분석

- 가격 분석

- 무역 분석

- 주된 컨퍼런스 및 행사(2025-2026년)

- 고객사업에 영향을 주는 동향/혼란

- 투자 및 자금조달 시나리오

- 사례 연구 분석

- 미국 관세의 영향(2025년) - 비디오 감시 시장

제6장 기술의 진보, AI에 의한 영향, 특허, 혁신, 향후 용도

- 주요 신기술

- 보완적 기술

- 인접 기술

- 기술/제품 로드맵

- 특허 분석(2015-2024년)

- AI 세대가 비디오 감시 시장에 미치는 영향

- 비디오 감시 시장에서의 AI 도입에 대한 고객의 준비 상황

제7장 고객정세와 구매행동

- 의사결정 프로세스

- 구매자의 이해관계자와 구매평가기준

- 채용 장벽과 내부 과제

- 다양한 업계의 미충족 수요(Unmet Needs)

제8장 비디오 감시 시장(제공별)

- 서론

- 하드웨어

- 소프트웨어

- 서비스

제9장 비디오 감시 시장(시스템 유형별)

- 서론

- 아날로그

- IP

- 하이브리드

제10장 비디오 감시 시장(업계별)

- 서론

- 상업

- 인프라

- 군사 및 방위

- 주택

- 공공시설

- 산업

제11장 비디오 감시 시장(지역별)

- 서론

- 북미

- 북미의 거시경제 전망

- 비디오 감시 카메라의 톱 제조업체

- 연방법 및 규제의 영향

- 미국

- 캐나다

- 멕시코

- 유럽

- 유럽의 거시 경제 전망

- 비디오 감시 카메라의 톱 제조업체

- 연방법 및 규제의 영향

- 영국

- 독일

- 프랑스

- 이탈리아

- 튀르키예

- 기타

- 러시아

- 아시아태평양

- 아시아태평양의 거시 경제 전망

- 비디오 감시 카메라의 톱 제조업체

- 연방법 및 규제의 영향

- 중국

- 일본

- 한국

- 인도

- 인도네시아

- 기타

- 기타 지역

- 기타 지역의 거시 경제 전망

- 비디오 감시 카메라의 톱 제조업체

- 연방법 및 규제의 영향

- 중동

- 아프리카

- 남미

제12장 경쟁 구도

- 서론

- 주요 참가 기업의 전략/강점(2020-2024년)

- 수익 분석(2020-2024년)

- 시장 점유율 분석(2024년)

- 기업평가와 재무지표(2024년)

- 브랜드/제품 비교

- 기업평가 매트릭스 : 주요 진입기업(2024년)

- 기업평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제13장 기업 프로파일

- 주요 진출기업

- HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.

- DAHUA TECHNOLOGY CO., LTD

- HANWHA VISION CO., LTD.

- HONEYWELL INTERNATIONAL INC.

- MOTOROLA SOLUTIONS, INC.

- AXIS COMMUNICATIONS AB.

- BOSCH SECURITY SYSTEMS GMBH

- TELEDYNE FLIR LLC

- I-PRO

- ZHEJIANG UNIVIEW TECHNOLOGIES CO., LTD.

- VIVOTEK INC.

- EAGLE EYE NETWORKS

- NEC CORPORATION

- ADT LLC

- MOBOTIX AG

- 기타 기업

- IRISITY

- NICE SPA

- CP PLUS INTERNATIONAL

- GENETEC INC.

- CORSIGHT AI

- HEXAGON AB.

- TIANDY TECHNOLOGIES CO., LTD.

- MORPHEAN SA

- VERKADA INC.

- CAMCLOUD

- IVIDEON

- THE INFINOVA GROUP

- SPOT AI, INC.

- INTELEX VISION LTD

- AMBIENT AI

제14장 조사 방법

제15장 부록

KTH 25.11.27The video surveillance market is valued at USD 56.11 billion in 2025 and is projected to reach USD 88.06 billion by 2031, registering a CAGR of 7.8% during the forecast period. The video surveillance market is experiencing robust growth as demand for intelligent security and monitoring solutions increases across various sectors, including commercial, industrial, residential, and public.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2031 |

| Base Year | 2024 |

| Forecast Period | 2025-2031 |

| Units Considered | Value (USD Billion) |

| Segments | By Offering, Software, Storage, System and Region |

| Regions covered | North America, Europe, APAC, RoW |

Core components, including cameras, video management software, and storage devices, are being enhanced with AI-driven analytics, IoT integration, and cloud connectivity to improve real-time monitoring and threat detection. Emerging technologies such as facial recognition, motion analysis, and remote surveillance are enabling proactive security management. The market's expansion is further supported by smart city initiatives, growing safety concerns, and advancements in IP-based systems, which drive the widespread adoption of intelligent and connected video surveillance solutions worldwide.

"The IP cameras segment, by camera type, is expected to grow at the highest CAGR during the forecast period."

The IP cameras segment is expected to grow at the highest CAGR during the forecast period, owing to the increasing demand for advanced, network-based surveillance solutions that offer superior image resolution, scalability, and remote accessibility. IP cameras offer enhanced flexibility compared to traditional analog systems by transmitting video data over IP networks, allowing for centralized monitoring and seamless integration with cloud and IoT platforms. These cameras support AI-driven analytics, including facial recognition, motion detection, and behavioral analysis, enabling organizations to enhance security intelligence and automate incident response. The rapid expansion of smart city initiatives, transportation monitoring, and industrial automation is further accelerating their adoption. Additionally, declining costs of IP-based systems and improvements in data compression and network bandwidth efficiency are making them more accessible across commercial, residential, and public infrastructure applications. Collectively, these factors position IP cameras as the preferred choice for modern, intelligent video surveillance deployments worldwide.

"Commercial vertical is expected to hold the largest market share in the video surveillance market."

The commercial vertical is expected to hold the largest market share in the video surveillance market during the forecast period, driven by the growing need for enhanced security, operational efficiency, and regulatory compliance across business establishments. Retail stores, corporate offices, banking institutions, healthcare facilities, and hospitality sectors are increasingly deploying advanced surveillance systems to prevent theft, monitor employee and customer activities, and ensure a safe environment. The integration of AI-powered analytics, facial recognition, and automated alerts enables businesses to proactively manage risks and optimize operations. Additionally, the rising adoption of cloud-based video management systems and remote monitoring capabilities supports real-time access and centralized control of multi-site locations. Increasing investments in smart building infrastructure and digital transformation further contribute to the demand for intelligent video surveillance solutions, positioning the commercial sector as a leading adopter of security technologies for business continuity and asset protection.

"China to dominate video surveillance market in Asia Pacific"

China dominates the video surveillance market in the Asia Pacific region due to large-scale government initiatives, extensive infrastructure development, and the strong presence of leading domestic manufacturers such as Hangzhou Hikvision Digital Technology Co., Ltd. (China), Dahua Technology Co., Ltd. (China), and Zhejiang Uniview Technologies Co. (China). The country's rapid urbanization and commitment to public safety have led to widespread deployment of intelligent surveillance systems across smart cities, transportation networks, and critical infrastructure. China's leadership in AI, big data analytics, and 5G connectivity further enhances the capabilities of surveillance solutions, enabling real-time monitoring, facial recognition, and behavioral analysis. Additionally, the local availability of cost-effective hardware, advanced manufacturing capabilities, and continuous investment in R&D strengthen China's dominance in both domestic and export markets. These factors collectively position China as a global hub for innovation and large-scale adoption of next-generation video surveillance technologies, driving its leading role in the regional market.

- By Company Type: Tier 1-25%, Tier 2-40%, and Tier 3-35%

- By Designation: Directors-32%, Managers-30%, and Others-38%

- By Region: North America-20%, Europe-40%, Asia Pacific-35%, and RoW-5%

Hangzhou Hikvision Digital Technology Co., Ltd. (China), Dahua Technology Co., Ltd. (China), Hanwha Vision Co., Ltd. (South Korea), Honeywell International Inc. (US), Motorola Solutions, Inc. (US), Axis Communications AB (Sweden), Bosch Security Systems GmbH (Germany), Teledyne FLIR LLC (US), i-PRO (Japan), Zhejiang Uniview Technologies Co. (China), VIVOTEK Inc. (Taiwan), Eagle Eye Networks (US), NEC Corporation (Japan), ADT LLC (US), and MOBOTIX AG (Germany) are some of the key players in the video surveillance market.

The study includes an in-depth competitive analysis of these key video surveillance players, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the video surveillances market by offering [hardware (cameras, monitors, storage devices, accessories), software (video management software, video analytics software), services (video surveillance-as-a-service, installation & maintenance)], by system type (analog, IP, hybrid), by vertical (commercial, infrastructure, military & defense, residential, public facilities, industrial), and by region (North America, Europe, Asia Pacific, and Rest of the World). The report's scope encompasses detailed information on the major factors, including drivers, restraints, challenges, and opportunities, that influence the growth of the video surveillance market. A thorough analysis of key industry players has provided insights into their business overview, solutions, and products, as well as key strategies, contracts, partnerships, agreements, new product launches, mergers & acquisitions, and other recent developments associated with the video surveillance market. This report provides a competitive analysis of emerging video surveillance market startups.

Reasons to buy this report

The report will help market leaders and new entrants with information on the closest approximations of the revenue numbers for the overall video surveillance market and its subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (rising adoption of edge AI to enhance data security and privacy, rise of smart city initiatives), restraints (privacy associated with cloud-based systems, high operational cost), opportunities (emergence of AI- and ML-integrated video surveillance systems, rise of smart home technologies), and challenges (cybersecurity risks, data compression issues)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the video surveillance market

- Market Development: Comprehensive information about lucrative markets-the report analyzes the video surveillance market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the video surveillance market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players in the video surveillances market, such as Hangzhou Hikvision Digital Technology Co., Ltd. (China), Dahua Technology Co., Ltd. (China), Hanwha Vision Co., Ltd. (South Korea), Honeywell International Inc. (US), Motorola Solutions, Inc. (US), Axis Communications AB (Sweden), Bosch Security Systems GmbH (Germany), Teledyne FLIR LLC (US), i-PRO (Japan), Zhejiang Uniview Technologies Co. (China), VIVOTEK Inc. (Taiwan), Eagle Eye Networks (US), NEC Corporation (Japan), ADT LLC (US), and MOBOTIX AG (Germany)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: SHARE INSIGHTS AND STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING THE MARKET

- 2.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

- 2.5 SNAPSHOT: REGIONAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN VIDEO SURVEILLANCE MARKET

- 3.2 VIDEO SURVEILLANCE MARKET IN ASIA PACIFIC, BY COUNTRY AND VERTICAL

- 3.3 VIDEO SURVEILLANCE MARKET IN ASIA PACIFIC, BY VERTICAL

- 3.4 VIDEO SURVEILLANCE MARKET, BY REGION

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Rising adoption of edge AI to enhance data security and privacy

- 4.2.1.2 Increasing crime rate and terrorism

- 4.2.1.3 Growing inclination of business owners toward VSaaS models to ensure security and prompt decision-making

- 4.2.1.4 Rise of smart city initiatives

- 4.2.2 RESTRAINTS

- 4.2.2.1 Privacy concerns associated with cloud-based systems

- 4.2.2.2 High operational costs

- 4.2.2.3 Compatibility issues due to lack of harmonized standards

- 4.2.2.4 Rising storage and management costs

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Emergence of AI- and ML-integrated video surveillance systems

- 4.2.3.2 Rapid urbanization and smart city initiatives

- 4.2.3.3 Rise of smart home technologies

- 4.2.3.4 Rising adoption of drones in aerial video surveillance applications

- 4.2.4 CHALLENGES

- 4.2.4.1 Cybersecurity risks

- 4.2.4.2 Data compression issues

- 4.2.4.3 Bandwidth and storage issues

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 UNMET NEEDS IN THE VIDEO SURVEILLANCE MARKET

- 4.3.2 WHITE SPACE OPPORTUNITIES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 INTERCONNECTED MARKETS

- 4.4.2 CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 PORTER'S FIVE FORCES ANALYSIS

- 5.2.1 THREAT OF NEW ENTRANTS

- 5.2.2 THREAT OF SUBSTITUTES

- 5.2.3 BARGAINING POWER OF SUPPLIERS

- 5.2.4 BARGAINING POWER OF BUYERS

- 5.2.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.3 MACROECONOMIC OUTLOOK

- 5.3.1 INTRODUCTION

- 5.3.2 GDP TRENDS AND FORECAST

- 5.3.3 TRENDS IN GLOBAL SEMICONDUCTOR INDUSTRY

- 5.3.4 TRENDS IN GLOBAL COMMERCIAL INDUSTRY

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND, BY VERTICAL

- 5.6.2 AVERAGE SELLING PRICE TREND, BY FORM FACTOR

- 5.6.3 AVERAGE SELLING PRICE TREND, BY REGION

- 5.6.4 INDICATIVE PRICING TREND, BY KEY PLAYER

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT SCENARIO (HS CODE 852580)

- 5.7.2 EXPORT SCENARIO (HS CODE 852580)

- 5.8 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.10 INVESTMENT AND FUNDING SCENARIO

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 GANGNEUNG CITY SURVEILLANCE SELECTS BRIEFCAM CAMERAS TO ENHANCE SAFETY

- 5.11.2 VYSTAR SELECTS HANWHA VISION CAMERAS TO PROTECT ASSETS, MEMBERS, AND EMPLOYEES

- 5.11.3 GREATER DAYTON SCHOOL ENHANCES CAMPUS SAFETY AND EFFICIENCY THROUGH MOTOROLA SOLUTIONS' AVIGILON CAMERAS

- 5.11.4 COMMERCIAL GARDEN COMPLEX M AVENUE IN MARRAKECH RELIES ON ADVANCED UNIVIEW SECURITY SYSTEM TO ALLEVIATE RISKS

- 5.11.5 IPSWICH CITY COUNCIL DEPLOYS GENTECH'S VMS SOLUTION TO REDUCE CRIME RATE

- 5.11.6 CHUKCHANSI GOLD CASINO AND RESORT ENHANCES STAFF AND GUEST SECURITY BY EMPLOYING PELCO'S VIDEO SURVEILLANCE SYSTEM

- 5.11.7 SENTINEL MONITORING IMPLEMENTS SCYLLA'S FALSE ALARM FILTERING SYSTEM TO FOCUS ON REAL SECURITY THREATS

- 5.12 IMPACT OF 2025 US TARIFFS-VIDEO SURVEILLANCE MARKET

- 5.12.1 INTRODUCTION

- 5.12.2 KEY TARIFF RATES

- 5.12.3 PRICE IMPACT ANALYSIS

- 5.12.4 IMPACT ON COUNTRIES/REGIONS

- 5.12.4.1 US

- 5.12.4.2 Europe

- 5.12.4.3 Asia Pacific

- 5.12.5 IMPACT ON VERTICALS

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 CLOUD COMPUTING

- 6.1.2 VIDEO ANALYTICS

- 6.1.3 EDGE COMPUTING

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 ACCESS CONTROL SYSTEMS

- 6.2.2 CYBERSECURITY SOLUTIONS

- 6.2.3 BIG DATA ANALYTICS

- 6.3 ADJACENT TECHNOLOGIES

- 6.3.1 DRONES AND AERIAL SURVEILLANCE

- 6.3.2 BIOMETRIC SYSTEMS

- 6.3.3 BUILDING MANAGEMENT SYSTEMS

- 6.4 TECHNOLOGY/PRODUCT ROADMAP

- 6.4.1 SHORT-TERM (2025-2027): AI-ENABLED ARCHITECTURE OPTIMIZATION AND CLOUD INTEGRATION

- 6.4.2 MID-TERM (2027-2030): HETEROGENEOUS INTEGRATION & DESIGN ECOSYSTEM EXPANSION

- 6.4.3 LONG-TERM (2030-2035+): UNIVERSAL RECONFIGURABLE COMPUTING AND SYSTEM-LEVEL CONVERGENCE

- 6.5 PATENT ANALYSIS, 2015-2024

- 6.6 IMPACT OF GEN AI ON VIDEO SURVEILLANCE MARKET

- 6.6.1 TOP USE CASES AND MARKET POTENTIAL

- 6.6.2 BEST PRACTICES IN VIDEO SURVEILLANCE MARKET

- 6.6.3 CASE STUDIES OF AI IMPLEMENTATION IN VIDEO SURVEILLANCE MARKET

- 6.6.4 INTERCONNECTED ADJACENT ECOSYSTEMS AND IMPACT ON MARKET PLAYERS

- 6.7 CLIENTS' READINESS TO ADOPT AI IN VIDEO SURVEILLANCE MARKET

- 6.7.1 INTRODUCTION

- 6.7.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.7.3 STANDARDS

- 6.7.4 GOVERNMENT REGULATIONS

- 6.7.5 CERTIFICATIONS

7 CUSTOMER LANDSCAPE & BUYER BEHAVIOUR

- 7.1 DECISION-MAKING PROCESS

- 7.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 7.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 7.2.2 BUYING CRITERIA

- 7.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 7.4 UNMET NEEDS FROM VARIOUS VERTICALS

8 VIDEO SURVEILLANCE MARKET, BY OFFERING

- 8.1 INTRODUCTION

- 8.2 HARDWARE

- 8.2.1 CAMERAS

- 8.2.1.1 Camera components

- 8.2.1.1.1 Image sensors

- 8.2.1.1.1.1 Complementary metal-oxide-semiconductor

- 8.2.1.1.1.2 Charge-coupled device

- 8.2.1.1.2 Lenses

- 8.2.1.1.2.1 Fixed

- 8.2.1.1.2.2 Varifocal

- 8.2.1.1.3 Image processing circuitry

- 8.2.1.1.1 Image sensors

- 8.2.1.2 Cameras market, by type

- 8.2.1.2.1 Analog cameras

- 8.2.1.2.1.1 Simple setup and maintenance with minimal technical expertise required to propel market

- 8.2.1.2.2 IP cameras

- 8.2.1.2.2.1 Reliance on IP cameras to capture high-definition and megapixel images to drive market

- 8.2.1.2.1 Analog cameras

- 8.2.1.3 Cameras market, by connectivity

- 8.2.1.3.1 Wired

- 8.2.1.3.1.1 Stable and reliable video transmission with minimal signal interference risk

- 8.2.1.3.2 Wireless

- 8.2.1.3.2.1 Remote access and monitoring from any location to support market growth

- 8.2.1.3.1 Wired

- 8.2.1.4 Cameras market, by form factor

- 8.2.1.4.1 Dome

- 8.2.1.4.1.1 Discreet design suitable for indoor environments and high-traffic areas to drive market growth

- 8.2.1.4.2 PTZ

- 8.2.1.4.2.1 Wide-area coverage with pan, tilt, and zoom functionality to accelerate segmental growth

- 8.2.1.4.3 Box & Bullet

- 8.2.1.4.3.1 High optical performance and ability to work with fixed or varifocal lenses to foster market growth

- 8.2.1.4.4 Panoramic

- 8.2.1.4.4.1 Capability to detect blind spots and ensure maximum security to fuel segmental growth

- 8.2.1.4.5 Fisheye

- 8.2.1.4.5.1 Ultra-wide-angle lenses capturing hemispherical images to contribute to market growth

- 8.2.1.4.6 Body-worn

- 8.2.1.4.6.1 Real-time video and audio recording for incident documentation

- 8.2.1.4.1 Dome

- 8.2.1.5 Cameras market, by resolution

- 8.2.1.5.1 0.3-1.0 MP

- 8.2.1.5.1.1 Cost-effective solutions for basic monitoring needs to contribute to market growth

- 8.2.1.5.2 1.1-2.9 MP

- 8.2.1.5.2.1 Balanced resolution and storage efficiency to contribute to market growth

- 8.2.1.5.3 3.0-5.0 MP

- 8.2.1.5.3.1 High-detail imaging for accurate identification to contribute to market growth

- 8.2.1.5.4 >5.0 MP

- 8.2.1.5.4.1 Need to enhance security and operational efficiency to accelerate demand for >5.0 MP cameras

- 8.2.1.5.1 0.3-1.0 MP

- 8.2.1.6 Cameras market, by channel partner

- 8.2.1.6.1 Distributors

- 8.2.1.6.1.1 Efficient logistics and timely product delivery are driving market growth

- 8.2.1.6.2 Direct to installers or system integrators

- 8.2.1.6.2.1 High focus on building strong customer relationships to boost segmental growth

- 8.2.1.6.3 Direct to end users

- 8.2.1.6.3.1 Expertise in customized system design and integration to contribute towards market demand

- 8.2.1.6.1 Distributors

- 8.2.1.1 Camera components

- 8.2.2 MONITORS

- 8.2.2.1 Up to 20 inches

- 8.2.2.1.1 Use of cost-effective surveillance monitors in control rooms to fuel market growth

- 8.2.2.2 More than 20 inches

- 8.2.2.2.1 Better visibility and high-resolution display to accelerate segmental growth

- 8.2.2.1 Up to 20 inches

- 8.2.3 STORAGE DEVICES

- 8.2.3.1 Digital video recorders (DVRs)

- 8.2.3.1.1 Good image quality, integration with multiple camera systems

- 8.2.3.2 Network video recorders

- 8.2.3.2.1 High-definition recording and playback, remote access, support for easy expansion

- 8.2.3.3 Hybrid video recorders

- 8.2.3.3.1 Combined benefits of DVRs and NVRs to support adoption

- 8.2.3.4 IP storage area networks

- 8.2.3.4.1 Enhanced data management and advanced video analysis

- 8.2.3.5 Direct-attached storage devices

- 8.2.3.5.1 Fast access to stored video and cost-effectiveness

- 8.2.3.6 Network-attached storage devices

- 8.2.3.6.1 Simplified data handling, centralized storage, and better security

- 8.2.3.1 Digital video recorders (DVRs)

- 8.2.4 ACCESSORIES

- 8.2.4.1 Cables

- 8.2.4.1.1 Reliable and high-quality signal transfer, ensuring uninterrupted video feeds to boost demand

- 8.2.4.2 Encoders

- 8.2.4.2.1 Capability to integrate analog systems with digital networks to contribute to segmental growth

- 8.2.4.1 Cables

- 8.2.1 CAMERAS

- 8.3 SOFTWARE

- 8.3.1 SOFTWARE MARKET, BY TYPE

- 8.3.1.1 Video management software

- 8.3.1.1.1 Non-AI-based

- 8.3.1.1.1.1 Cost-effective solution for small-scale or less complex environments to foster market growth

- 8.3.1.1.2 AI-based

- 8.3.1.1.2.1 Growing adoption in smart cities and large infrastructure projects to boost demand

- 8.3.1.1.1 Non-AI-based

- 8.3.1.2 Video analytics software

- 8.3.1.2.1 Video content analysis

- 8.3.1.2.1.1 Real-time alerts for unauthorized access, improving security response, driving growth

- 8.3.1.2.2 AI-driven video analytics

- 8.3.1.2.2.1 Adoption of AI analytics to reduce manual monitoring and enhance accuracy to fuel market growth

- 8.3.1.2.2.2 Analytics at edge

- 8.3.1.2.2.3 Analytics at server

- 8.3.1.2.2.4 AI-driven video analytics use cases

- 8.3.1.2.2.4.1 Industrial safety surveillance

- 8.3.1.2.2.4.2 Industrial temperature monitoring

- 8.3.1.2.2.4.3 Anomaly detection and behavior analysis

- 8.3.1.2.2.4.4 Facial recognition/person search

- 8.3.1.2.2.4.5 Object detection and tracking

- 8.3.1.2.2.4.6 Intrusion detection and perimeter protection

- 8.3.1.2.2.4.7 Smoke and fire detection

- 8.3.1.2.2.4.8 Traffic flow analysis and accident detection

- 8.3.1.2.2.4.9 False alarm filtering

- 8.3.1.2.2.4.10 Wireless video surveillance

- 8.3.1.2.2.4.11 Vehicle identification and number plate recognition

- 8.3.1.2.1 Video content analysis

- 8.3.1.1 Video management software

- 8.3.2 SOFTWARE MARKET, BY DEPLOYMENT MODE

- 8.3.2.1 On-premises

- 8.3.2.1.1 Full control over data security and compliance to propel market

- 8.3.2.2 Cloud-based

- 8.3.2.2.1 Flexible and scalable solutions enabling multi-location surveillance adoption to accelerate market growth

- 8.3.2.1 On-premises

- 8.3.1 SOFTWARE MARKET, BY TYPE

- 8.4 SERVICES

- 8.4.1 VSAAS

- 8.4.1.1 VSaaS market, by technology

- 8.4.1.1.1 AI-enabled VSaaS

- 8.4.1.1.1.1 Rising integration of AI and machine learning in security systems to augment segmental growth

- 8.4.1.1.2 Non-AI video surveillance as a service (VSaaS)

- 8.4.1.1.2.1 Rising demand for cost-effective and scalable cloud-based surveillance solutions to fuel market growth

- 8.4.1.1.1 AI-enabled VSaaS

- 8.4.1.2 VSaaS market, by type

- 8.4.1.2.1 Hosted

- 8.4.1.2.1.1 Availability of low-cost subscription plans to spike demand

- 8.4.1.2.2 Managed

- 8.4.1.2.2.1 Reduced operational costs to create growth opportunities to support market growth

- 8.4.1.2.3 Hybrid

- 8.4.1.2.3.1 Data security, remote access, flexibility, and scalability to boost demand

- 8.4.1.2.1 Hosted

- 8.4.1.1 VSaaS market, by technology

- 8.4.2 INSTALLATION & MAINTENANCE

- 8.4.2.1 Growing demand for professional installation services to ensure system reliability

- 8.4.1 VSAAS

9 VIDEO SURVEILLANCE MARKET, BY SYSTEM TYPE

- 9.1 INTRODUCTION

- 9.2 ANALOG

- 9.2.1 RISING SECURITY CONCERNS IN SMALL ENTERPRISES AND RESIDENTIAL AREAS TO SUPPORT MARKET GROWTH

- 9.3 IP

- 9.3.1 ADOPTION OF AI AND CLOUD-BASED ANALYTICS SOLUTIONS TO DRIVE MARKET DEMAND

- 9.4 HYBRID

- 9.4.1 RISING NEED FOR COST-EFFICIENT MIGRATION FROM ANALOG TO DIGITAL TO DRIVE MARKET DEMAND

10 VIDEO SURVEILLANCE MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- 10.2 COMMERCIAL

- 10.2.1 RETAIL STORES & MALLS

- 10.2.1.1 Need for loss prevention and improved operational efficiency in stores to accelerate segmental growth

- 10.2.2 ENTERPRISES & DATA CENTERS

- 10.2.2.1 Growing adoption of surveillance cameras to safeguard critical assets to support market growth

- 10.2.3 BANKING & FINANCE BUILDINGS

- 10.2.3.1 Rising concerns over ATM fraud and internal theft prevention contribute to segmental growth

- 10.2.4 HOSPITALITY CENTERS

- 10.2.4.1 Rising need to prevent theft, vandalism, and unauthorized area access to accelerate demand

- 10.2.5 WAREHOUSES

- 10.2.5.1 Increasing use of smart cameras for operational efficiency and automation to boost demand

- 10.2.1 RETAIL STORES & MALLS

- 10.3 INFRASTRUCTURE

- 10.3.1 TRANSPORTATION

- 10.3.1.1 Automated toll collection and license plate recognition adoption to contribute to growth

- 10.3.2 SMART CITY

- 10.3.2.1 Traffic management and parking optimization requirements to foster market growth

- 10.3.3 UTILITIES

- 10.3.3.1 Renewable energy facility expansion and distributed asset monitoring to support growth

- 10.3.1 TRANSPORTATION

- 10.4 MILITARY & DEFENSE

- 10.4.1 PRISON & CORRECTION FACILITIES

- 10.4.1.1 Prison overcrowding and increased security risk management to drive market demand

- 10.4.2 BORDER SURVEILLANCE

- 10.4.2.1 National security priorities and illegal immigration concerns to drive market demand

- 10.4.3 COASTAL SURVEILLANCE

- 10.4.3.1 Maritime terrorism and piracy threats to support coastal deployment growth

- 10.4.4 LAW ENFORCEMENT

- 10.4.4.1 Officer safety enhancement during tactical operations to support deployment growth

- 10.4.1 PRISON & CORRECTION FACILITIES

- 10.5 RESIDENTIAL

- 10.5.1 ELEVATING NEED FOR ADVANCED SURVEILLANCE SYSTEMS AND RISE OF SMART HOMES TO SPUR DEMAND

- 10.6 PUBLIC FACILITIES

- 10.6.1 HEALTHCARE BUILDINGS

- 10.6.1.1 Increasing workplace violence against healthcare workers to drive market demand

- 10.6.2 EDUCATIONAL BUILDINGS

- 10.6.2.1 Government grant funding for K-12 security improvements to support deployment growth

- 10.6.3 GOVERNMENT BUILDINGS

- 10.6.3.1 Escalating need to monitor access points and public areas to propel market

- 10.6.4 RELIGIOUS BUILDINGS

- 10.6.4.1 Rising hate crimes and violence against religious minorities to drive demand

- 10.6.1 HEALTHCARE BUILDINGS

- 10.7 INDUSTRIAL

- 10.7.1 MANUFACTURING FACILITIES

- 10.7.1.1 Intellectual property protection and supply chain security to drive market demand

- 10.7.2 CONSTRUCTION SITES

- 10.7.2.1 Liability protection from workplace injuries and accidents to support deployment growth

- 10.7.1 MANUFACTURING FACILITIES

11 VIDEO SURVEILLANCE MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 TOP VIDEO SURVEILLANCE CAMERA MANUFACTURERS

- 11.2.3 INFLUENCE OF FEDERAL LAWS AND REGULATIONS

- 11.2.3.1 Key laws and regulations related to video surveillance in US

- 11.2.3.2 Key laws and regulations related to video surveillance in Canada

- 11.2.3.3 Key laws and regulations related to video surveillance in Mexico

- 11.2.4 US

- 11.2.4.1 Growing adoption of AI and facial recognition in surveillance to drive market

- 11.2.5 CANADA

- 11.2.5.1 Government funding for smart city and surveillance infrastructure projects to fuel market growth

- 11.2.6 MEXICO

- 11.2.6.1 Large-scale government initiatives for urban safety and crime reduction to boost demand

- 11.2.6.2 Drivers for video surveillance market

- 11.2.6.3 Opportunities for video surveillance market

- 11.2.6.4 Key companies and their products in video surveillance market

- 11.2.6.5 Recommendations

- 11.2.6.6 Product & vertical trends

- 11.2.6.7 List of suppliers/integrators in video surveillance market

- 11.2.6.8 Impact of state-related laws on companies operating in video surveillance market

- 11.2.6.9 Video analytics penetration

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 TOP VIDEO SURVEILLANCE CAMERA MANUFACTURERS

- 11.3.3 INFLUENCE OF FEDERAL LAWS AND REGULATIONS

- 11.3.3.1 Key laws and regulations related to video surveillance

- 11.3.4 UK

- 11.3.4.1 Growing adoption of AI and machine learning in surveillance systems to support market growth

- 11.3.5 GERMANY

- 11.3.5.1 Rising use of thermal and PTZ cameras for critical monitoring to propel market growth

- 11.3.6 FRANCE

- 11.3.6.1 Rising adoption of intelligent video analytics for security and operations to contribute to market growth

- 11.3.7 ITALY

- 11.3.7.1 Increasing adoption of AI-powered security solutions to enhance crime prevention

- 11.3.8 TURKEY

- 11.3.8.1 Increasing collaboration between local and international technology firms to foster market growth

- 11.3.8.2 Drivers for video surveillance market

- 11.3.8.3 Opportunities for video surveillance market

- 11.3.8.4 Key companies and their products in video surveillance market

- 11.3.8.5 Recommendations

- 11.3.8.6 Trends accelerating market growth

- 11.3.8.7 List of suppliers/integrators in video surveillance market

- 11.3.8.8 Impact of state-related laws on companies operating in video surveillance market

- 11.3.8.9 Key standards and certifications

- 11.3.8.10 Video analytics penetration

- 11.3.9 REST OF EUROPE

- 11.4 RUSSIA

- 11.4.1 GOVERNMENT-LED INVESTMENTS AND INITIATIVES TO DRIVE MARKET GROWTH

- 11.4.2 MACROECONOMIC OUTLOOK FOR RUSSIA

- 11.4.3 DRIVERS FOR VIDEO SURVEILLANCE MARKET

- 11.4.4 OPPORTUNITIES FOR VIDEO SURVEILLANCE MARKET

- 11.4.5 KEY COMPANIES AND THEIR PRODUCTS IN VIDEO SURVEILLANCE MARKET

- 11.4.6 RECOMMENDATIONS

- 11.4.7 TRENDS ACCELERATING MARKET GROWTH

- 11.4.8 LIST OF SUPPLIERS/INTEGRATORS IN VIDEO SURVEILLANCE MARKET

- 11.4.9 IMPACT OF STATE-RELATED LAWS ON COMPANIES OPERATING IN VIDEO SURVEILLANCE MARKET

- 11.4.9.1 Key standards and certifications

- 11.4.9.2 Video analytics penetration

- 11.5 ASIA PACIFIC

- 11.5.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.5.2 TOP VIDEO SURVEILLANCE CAMERA MANUFACTURERS

- 11.5.3 INFLUENCE OF FEDERAL LAWS AND REGULATIONS

- 11.5.3.1 Key laws and regulations related to video surveillance in China

- 11.5.3.2 Key laws and regulations related to video surveillance in South Korea

- 11.5.3.3 Key laws and regulations related to video surveillance in Japan

- 11.5.3.4 Key laws and regulations related to video surveillance in India

- 11.5.3.5 Key laws and regulations related to video surveillance in Australia

- 11.5.3.6 Key laws and regulations related to video surveillance in Singapore

- 11.5.3.7 Key laws and regulations related to video surveillance in Malaysia

- 11.5.3.8 Key laws and regulations related to video surveillance in Thailand

- 11.5.3.9 Key laws and regulations related to video surveillance in Hong Kong

- 11.5.3.10 Key laws and regulations related to video surveillance in Indonesia

- 11.5.4 CHINA

- 11.5.4.1 Integration of artificial intelligence and facial recognition technologies to fuel market growth

- 11.5.5 JAPAN

- 11.5.5.1 Growing adoption of centralized surveillance in logistics and warehousing to accelerate market growth

- 11.5.6 SOUTH KOREA

- 11.5.6.1 Rapid deployment of 5G networks enabling real-time data transmission to support market growth

- 11.5.7 INDIA

- 11.5.7.1 Government initiatives under Smart Cities Mission and Digital India programs to fuel market growth

- 11.5.8 INDONESIA

- 11.5.8.1 Development of cloud-native platforms supporting real-time surveillance analytics to fuel market growth

- 11.5.9 REST OF ASIA PACIFIC

- 11.6 REST OF THE WORLD

- 11.6.1 MACROECONOMIC OUTLOOK FOR ROW

- 11.6.2 TOP VIDEO SURVEILLANCE CAMERA MANUFACTURERS

- 11.6.3 INFLUENCE OF FEDERAL LAWS AND REGULATIONS

- 11.6.3.1 Key laws and regulations related to video surveillance in Middle East

- 11.6.3.2 Key laws and regulations related to video surveillance in Africa

- 11.6.3.3 Key laws and regulations related to video surveillance in South America

- 11.6.4 MIDDLE EAST

- 11.6.4.1 Strategic partnerships and data center expansions to support market growth

- 11.6.4.2 Drivers for video surveillance market

- 11.6.4.3 Opportunities for video surveillance market

- 11.6.4.4 Key companies and their products in video surveillance market

- 11.6.4.5 Recommendations

- 11.6.4.6 Trends accelerating market growth

- 11.6.4.7 List of suppliers/integrators in video surveillance market

- 11.6.4.8 Influence of laws and regulations on industry

- 11.6.4.9 Key standards and certifications

- 11.6.4.10 Video analytics penetration

- 11.6.4.11 GCC countries

- 11.6.4.12 Rest of Middle East

- 11.6.5 AFRICA

- 11.6.5.1 North Africa

- 11.6.5.1.1 Preparations for 2030 FIFA World Cup boosting surveillance technology adoption

- 11.6.5.2 South Africa

- 11.6.5.2.1 Growing presence of global surveillance technology providers to fuel market growth

- 11.6.5.3 Rest of Africa

- 11.6.5.3.1 Rapid urbanization and population growth, driving security requirements

- 11.6.5.1 North Africa

- 11.6.6 SOUTH AMERICA

- 11.6.6.1 Drivers for video surveillance market in South America

- 11.6.6.2 Opportunities for video surveillance market in South America

- 11.6.6.3 Key companies and their products in video surveillance market in South America

- 11.6.6.4 Recommendations

- 11.6.6.5 Trends accelerating market growth

- 11.6.6.6 List of suppliers/integrators in video surveillance market in South America

- 11.6.6.7 South America: Influence of laws and regulations on industry

- 11.6.6.8 Key standards and certifications

- 11.6.6.9 Video analytics penetration

- 11.6.6.10 Brazil

- 11.6.6.10.1 Surging demand for advanced security solutions in retail, infrastructure, and residential sectors to accelerate market growth

- 11.6.6.11 Argentina

- 11.6.6.11.1 Strategic collaborations between international and domestic security providers to support market growth

- 11.6.6.12 Rest of South America

- 11.6.6.12.1 Growing use of intelligent video analytics in retail and commercial sectors to drive market growth

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 12.6 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Offering footprint

- 12.7.5.4 System type footprint

- 12.7.5.5 Vertical footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

- 12.9.3.1 Expansions

- 12.9.4 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Services/Solutions offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 DAHUA TECHNOLOGY CO., LTD

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Services/Solutions offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Deals

- 13.1.2.3.3 Other developments

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 HANWHA VISION CO., LTD.

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Services/Solutions offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.3.3 Expansions

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 HONEYWELL INTERNATIONAL INC.

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Services/Solutions offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 MOTOROLA SOLUTIONS, INC.

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Services/Solutions offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches

- 13.1.5.3.2 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 AXIS COMMUNICATIONS AB.

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Services/Solutions offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches

- 13.1.6.3.2 Deals

- 13.1.6.3.3 Other developments

- 13.1.7 BOSCH SECURITY SYSTEMS GMBH

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Services/Solutions offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches

- 13.1.8 TELEDYNE FLIR LLC

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Services/Solutions offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches

- 13.1.8.3.2 Deals

- 13.1.9 I-PRO

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Services/Solutions offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Product launches

- 13.1.9.3.2 Deals

- 13.1.10 ZHEJIANG UNIVIEW TECHNOLOGIES CO., LTD.

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Services/Solutions offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Product launches

- 13.1.11 VIVOTEK INC.

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Services/Solutions offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Product launches

- 13.1.12 EAGLE EYE NETWORKS

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Services/Solutions offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Product launches

- 13.1.12.3.2 Expansions

- 13.1.13 NEC CORPORATION

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Services/Solutions offered

- 13.1.14 ADT LLC

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Services/Solutions offered

- 13.1.14.3 Recent developments

- 13.1.14.3.1 Product launches

- 13.1.15 MOBOTIX AG

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Services/Solutions offered

- 13.1.15.3 Recent developments

- 13.1.15.3.1 Product launches

- 13.1.15.3.2 Deals

- 13.1.1 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.

- 13.2 OTHER PLAYERS

- 13.2.1 IRISITY

- 13.2.2 NICE S.P.A.

- 13.2.3 CP PLUS INTERNATIONAL

- 13.2.4 GENETEC INC.

- 13.2.5 CORSIGHT AI

- 13.2.6 HEXAGON AB.

- 13.2.7 TIANDY TECHNOLOGIES CO., LTD.

- 13.2.8 MORPHEAN SA

- 13.2.9 VERKADA INC.

- 13.2.10 CAMCLOUD

- 13.2.11 IVIDEON

- 13.2.12 THE INFINOVA GROUP

- 13.2.13 SPOT AI, INC.

- 13.2.14 INTELEX VISION LTD

- 13.2.15 AMBIENT AI

14 RESEARCH METHODOLOGY

- 14.1 RESEARCH DATA

- 14.1.1 SECONDARY AND PRIMARY RESEARCH

- 14.1.2 SECONDARY DATA

- 14.1.2.1 Major secondary sources

- 14.1.2.2 Key data from secondary sources

- 14.1.3 PRIMARY DATA

- 14.1.3.1 Intended participants in primary interviews

- 14.1.3.2 Key primary interview participants

- 14.1.3.3 Breakdown of primaries

- 14.1.3.4 Key data from primary sources

- 14.1.3.5 Key industry insights

- 14.2 MARKET SIZE ESTIMATION METHODOLOGY

- 14.2.1 BOTTOM-UP APPROACH

- 14.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 14.2.2 TOP-DOWN APPROACH

- 14.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 14.2.1 BOTTOM-UP APPROACH

- 14.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 14.4 RESEARCH ASSUMPTIONS

- 14.5 RESEARCH LIMITATIONS

- 14.6 RISK ANALYSIS

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS