|

시장보고서

상품코드

1812629

햅틱 기술 시장 : 피드백 유형별, 구성요소별, 업계별, 지역별 - 예측(-2030년)Haptic Technology Market by Eccentric Rotating Mass (ERM) & Linear Resonant Actuators (LRAs), Piezo Electric Actuators, Drivers & Microcontrollers, Feedback Type (Tactile, Force), Active Haptic Device, Passive Haptic Device - Global Forecast to 2030 |

||||||

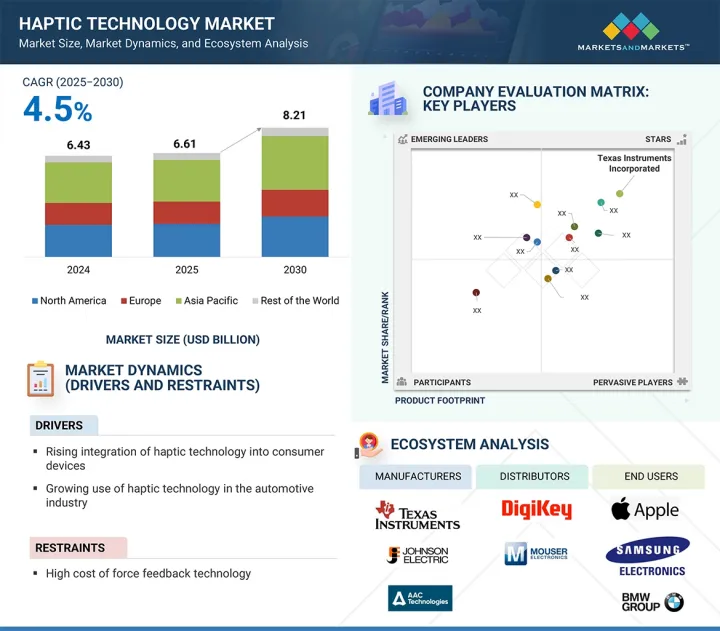

세계의 햅틱 기술 시장 규모는 2025년에 66억 1,000만 달러로 평가되었으며, 예측 기간 동안 CAGR 4.5%로 증가하여 2030년에는 82억 1,000만 달러에 달할 것으로 예측됩니다.

햅틱 기술 시장은 스마트폰, 태블릿, 웨어러블, 게임기, 차량용 인터페이스, 헬스케어 애플리케이션의 사용자 경험 향상에 대한 수요 증가에 힘입어 전 세계적으로 강력한 성장세를 보이고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(10억 달러) |

| 부문별 | 피드백 유형별, 구성요소별, 업계별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 기타 지역 |

AR, VR, XR 플랫폼의 보급은 고화질 햅틱, 에너지 효율이 높은 액추에이터 등의 기술 혁신과 맞물려 채택을 더욱 가속화하고 있습니다. 촉각 솔루션은 정확한 촉각 피드백을 제공하고, 직관적인 제어를 가능하게 하며, 몰입감을 높여 사용자 상호작용, 접근성, 안전성을 향상시키는 데 중요한 역할을 합니다. 터치스크린의 촉각 피드백, 시뮬레이션 장비의 힘 피드백, 고급 촉각 지원 인터페이스 등의 응용 분야는 여러 산업에서 널리 채택되어 세계 시장 전망을 강화하고 있습니다.

포스 부문은 자동차 안전 시스템 및 인포테인먼트 시스템, 수술 시뮬레이터 및 재활 장비의 사용 증가, 게임 및 가상 트레이닝 환경에서의 사용 증가로 인해 예측 기간 동안 두 번째로 큰 시장 규모를 차지할 것으로 예상됩니다. 자동차 분야에서 포스 피드백 기술은 촉각 조향 시스템 및 제어 패널을 통해 운전자의 인식과 제어를 강화하여 안전과 사용자 경험을 향상시킬 수 있습니다. 헬스케어 분야에서는 수술 시뮬레이터와 재활 장비에 실제와 같은 힘의 감각을 제공함으로써 의료 훈련과 재활에 중요한 역할을 하며, 정확성과 기술 개발, 환자 결과를 크게 향상시킵니다. 또한, 게임 업계와 가상훈련 업계에서는 컨트롤러, 조이스틱, 시뮬레이션 장비에 포스 피드백을 통합하여 실제와 같은 저항감과 인터랙션을 제공함으로써 몰입감과 몰입도를 높이는 움직임이 가속화되고 있습니다. 이러한 다양한 용도의 조합은 힘 피드백 시스템에 대한 지속적인 수요를 보장하며, 예측 기간 동안 햅틱 기술 시장에서 두 번째로 큰 피드백 유형으로 자리매김할 것입니다.

하드웨어 부문은 액추에이터 기술의 지속적인 발전, 컴팩트하고 에너지 효율적인 햅틱 부품에 대한 수요 증가, 가전, 자동차, 헬스케어 기기 전반에 걸쳐 햅틱 하드웨어의 통합이 증가함에 따라 예측 기간 동안 가장 높은 CAGR을 기록할 것으로 예상됩니다. 선형 공진 액추에이터(LRA), 편심 회전 질량(ERM) 모터, 피에조 액추에이터와 같은 혁신적인 액추에이터 기술의 발전으로 보다 정확하고 반응성이 높으며, 고화질의 촉각 피드백이 가능해져 여러 산업 분야에서 채택이 확대되고 있습니다. 컴팩트하고 에너지 효율적인 부품에 대한 수요 증가는 스마트폰, 웨어러블 기기, 휴대용 기기의 소형화 추세를 뒷받침하고 있으며, 제조업체는 기기 크기와 배터리 수명을 유지하면서 강력한 햅틱 성능을 구현할 수 있습니다. 또한, 가전제품, 자동차 인포테인먼트 시스템, AR/VR 컨트롤러, 수술 시뮬레이터, 산업 장비에 햅틱 하드웨어의 통합이 진행되면서 시장 침투가 확대되고 있습니다. 이러한 복합적인 요인으로 인해 하드웨어 부문은 예측 기간 동안 햅틱 기술 시장에서 가장 빠르게 성장하는 부품 카테고리로 자리매김하고 있습니다.

북미는 고급 게임 및 엔터테인먼트 경험에 대한 높은 수요, 의료 교육 및 시뮬레이션 분야에서의 햅틱 채택 증가, 자동차 기술에서의 햅틱 피드백의 빠른 통합으로 인해 예측 기간 동안 햅틱 기술 시장에서 두 번째로 높은 CAGR을 기록할 것으로 예상됩니다. 고급 게임 및 엔터테인먼트 경험에 대한 높은 수요는 VR/AR 기기, 게임기, 몰입형 액세서리의 높은 채택률로 인해 현실감과 사용자 몰입도를 높이는 햅틱 지원 제품에 대한 수요가 크게 증가하고 있습니다. 또한, 병원과 교육 센터가 수술 시뮬레이션, 진단 및 재활 과정을 개선하기 위해 햅틱 피드백을 활용하여 더 나은 결과와 기술 개발을 위해 의료 교육 및 시뮬레이션에 햅틱 기술을 채택하는 사례가 증가하고 있으며, 이는 시장 침투를 촉진하고 있습니다. 또한, 자동차 기술의 급속한 통합이 성장에 기여하고 있으며, 자동차 제조업체들은 햅틱 피드백을 인포테인먼트 시스템, 운전 보조 기능, 안전 경고에 통합하여 사용자와의 상호 작용 및 교통 안전을 강화하고 있습니다.

세계의 햅틱 기술 시장에 대해 조사했으며, 피드백 유형별, 구성요소별, 산업별, 지역별 동향, 시장 진입 기업 프로파일 등의 정보를 정리하여 전해드립니다.

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 주요 인사이트

제5장 시장 개요

- 소개

- 시장 역학

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 가격 분석

- 밸류체인 분석

- 생태계 분석

- 기술 분석

- 특허 분석

- 무역 분석

- 2025년의 주요 회의와 이벤트

- 사례 연구

- 투자와 자금 조달 시나리오

- 관세와 규제 상황

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- AI/생성형 AI가 햅틱 기술 시장에 미치는 영향

- 2025년 미국 관세가 햅틱 기술 시장에 미치는 영향

제6장 액티브 및 패시브 햅틱 디바이스

- 소개

- 액티브 햅틱 디바이스

- 패시브 햅틱 디바이스

제7장 햅틱 터치스크린 유형

- 소개

- 용량성

- 저항성

- 기타

제8장 햅틱 기술 시장(피드백 유형별)

- 소개

- 촉각

- 포스

제9장 햅틱 기술 시장(구성요소별)

- 소개

- 하드웨어

- 소프트웨어

제10장 햅틱 기술 시장(업계별)

- 소개

- 가전

- 자동차·운송

- 교육·연구

- 헬스케어

- 상업

- 기타

제11장 햅틱 기술 시장(지역별)

- 소개

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 멕시코

- 유럽

- 유럽의 거시경제 전망

- 영국

- 독일

- 프랑스

- 이탈리아

- 기타

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 중국

- 일본

- 인도

- 한국

- 기타

- 기타 지역

- 기타 지역의 거시경제 전망

- 중동

- 남미

제12장 경쟁 구도

- 개요

- 주요 진출 기업의 전략/강점, 2020-2025년

- 시장 점유율 분석, 2024년

- 매출 분석, 2020-2024년

- 기업 평가와 재무 지표

- 브랜드/제품 비교

- 기업 평가 매트릭스 : 주요 진출 기업, 2024년

- 기업 평가 매트릭스 : 스타트업 기업/중소기업, 2024년

- 경쟁 시나리오

제13장 기업 개요

- 소개

- 주요 진출 기업

- TEXAS INSTRUMENTS INCORPORATED

- JOHNSON ELECTRIC HOLDINGS LIMITED

- AAC TECHNOLOGIES

- TDK CORPORATION

- MICROCHIP TECHNOLOGY INC.

- IMMERSION

- SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC(ONSEMI)

- PRECISION MICRODRIVES

- SYNAPTICS INCORPORATED

- ULTRALEAP

- 기타 기업

- AITO BV

- ALPS ALPINE

- CIRRUS LOGIC INC.

- INFINEON TECHNOLOGIES AG

- VYBRONICS

- RENESAS ELECTRONICS CORPORATION

- HAP2U

- IMAGIS

- NIDEC CORPORATION

- MPLUS

- BOREAS TECHNOLOGIES

- ANALOG DEVICES

- ALLEGRO MICROSYSTEMS

- NOVASENTIS, INC.

- NEED-FOR-POWER MOTOR CO., LTD.

제14장 부록

KSM 25.09.25The global haptic technology market was valued at USD 6.61 billion in 2025 and is projected to reach USD 8.21 billion by 2030, at a CAGR of 4.5% during the forecast period. The haptic technology market is experiencing strong growth across regions, driven by increasing demand for enhanced user experiences in smartphones, tablets, wearables, gaming devices, automotive interfaces, and healthcare applications.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Feedback Type, Component, Vertical, and Region |

| Regions covered | North America, Europe, APAC, RoW |

The proliferation of AR, VR, and XR platforms, coupled with technological innovations such as high-definition haptics and energy-efficient actuators, is further accelerating adoption. Haptic solutions play a vital role in improving user interaction, accessibility, and safety by delivering precise tactile feedback, enabling intuitive controls, and enhancing immersion. Applications such as tactile feedback in touchscreens, force feedback in simulation devices, and advanced haptic-enabled interfaces are being widely adopted across multiple industries, strengthening the global market outlook.

"Based on feedback type, the force segment will account for the second-largest market size during the forecast period"

Force segment holds the second-largest market size during the forecast period due to its growing adoption in automotive safety and infotainment systems, increasing use in surgical simulators and rehabilitation equipment, and expanding applications in gaming and virtual training environments. In the automotive sector, force feedback technology enhances driver awareness and control through haptic-enabled steering systems and control panels, thereby improving safety and user experience. In the healthcare sector, it plays a crucial role in medical training and rehabilitation by providing realistic force sensations in surgical simulators and rehabilitation devices, which significantly improve precision, skill development, and patient outcomes. Additionally, the gaming and virtual training industries are increasingly integrating force feedback into controllers, joysticks, and simulation equipment to deliver lifelike resistance and interaction, enhancing immersion and engagement. The combination of these diverse applications ensures sustained demand for force feedback systems, securing its position as the second-largest feedback type in the haptic technology market throughout the forecast period.

"Based on component, the hardware segment is projected to register the highest CAGR during the forecast period"

The hardware segment is expected to witness the highest CAGR during the forecast period due to continuous advancements in actuator technologies, rising demand for compact and energy-efficient haptic components, and increasing integration of haptic hardware across consumer electronics, automotive, and healthcare devices. Advancements in actuator technologies, including innovations in Linear Resonant Actuators (LRA), Eccentric Rotating Mass (ERM) motors, and piezo actuators, are enabling more precise, responsive, and high-definition tactile feedback, driving adoption across multiple industries. The rising demand for compact and energy-efficient components supports the growing trend of miniaturization in smartphones, wearables, and portable devices, allowing manufacturers to deliver powerful haptic performance without compromising device size or battery life. Furthermore, the increased integration of haptic hardware in consumer electronics, automotive infotainment systems, AR/VR controllers, surgical simulators, and industrial equipment is expanding market penetration. These combined factors position the hardware segment as the fastest-growing component category in the haptic technology market during the forecast period.

" North America will register the second-highest CAGR during the forecast period"

North America is expected to witness the second-highest CAGR in the haptic technology market during the forecast period due to strong demand for advanced gaming and entertainment experiences, increasing adoption of haptics in medical training and simulation, and rapid integration of haptic feedback in automotive technologies. The strong demand for advanced gaming and entertainment experiences is driven by the high adoption of VR/AR devices, gaming consoles, and immersive accessories, which significantly increases the demand for haptic-enabled products that enhance realism and user engagement. Additionally, the increasing adoption of haptic technology in medical training and simulation is boosting market penetration, as hospitals and training centers leverage haptic feedback to improve surgical simulations, diagnostics, and rehabilitation processes, leading to better outcomes and skill development. Furthermore, rapid integration in automotive technologies is contributing to growth, with automakers incorporating haptic feedback into infotainment systems, driver-assist features, and safety alerts to enhance user interaction and road safety.

Extensive primary interviews were conducted with key industry experts in the haptic technology market to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below.

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type - Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation - Directors - 50%, Managers - 30%, and Others - 20%

- By Region - North America - 45%, Europe - 30%, Asia Pacific - 20%, and RoW - 5%

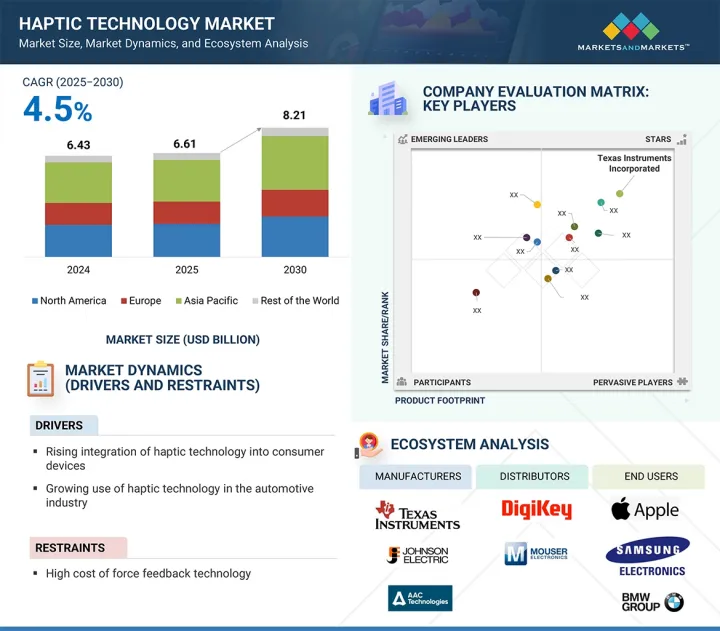

The haptic technology market is dominated by a few globally established players, such as Texas Instruments Incorporated (US), Johnson Electric Holdings Limited (China), AAC Technologies (China), TDK Corporation (Japan), Microchip Technology Inc. (US), Immersion (US), Semiconductor Components Industries, LLC (US), Precision Microdrives (UK), Synaptics Incorporated (US), Ultraleap (UK), Aito (Netherlands), ALPS ALPINE CO., LTD. (Japan), Cirrus Logic, Inc. (US), Infineon Technologies AG (Germany), and Vybronics (Vietnam).

The study includes an in-depth competitive analysis of these key players in the haptic technology market, with their company profiles, recent developments, and key market strategies.

Study Coverage:

The report segments the haptic technology market and forecasts its size by feedback type (tactile, force), by component (hardware, software), and vertical (consumer electronics, automotive & transportation, education & research, healthcare, commercial, others). It also discusses the market's drivers, restraints, opportunities, and challenges. It gives a detailed view of the market across four main regions (North America, Europe, Asia Pacific, and RoW). The report includes a value chain analysis of the key players and their competitive analysis in the haptic technology ecosystem.

Key Benefits of Buying the Report:

- Analysis of key drivers (Rising integration of haptic technology into consumer devices, Growing use of haptic technology in automotive industry, Increasing use of haptic technology in healthcare industry, Increasing adoption of haptic technology in industrial applications), restraints (High cost of force feedback technology), opportunities (Rising applications of haptic technology in aerospace & defense industry, Technological advancements in haptic technology), challenges (Technical challenges related to product design, High power consumption in haptic feedback, Leakage issues associated with pneumatic and hydraulic actuators)

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the haptic technology market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the haptic technology market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the haptic technology market

- Competitive Assessment: In-depth assessment of market shares and growth strategies of leading players, such as Texas Instruments Incorporated (US), Johnson Electric Holdings Limited (China), AAC Technologies (China), TDK Corporation (Japan), Microchip Technology Inc. (US), Immersion (US), Semiconductor Components Industries, LLC (US), Precision Microdrives (UK), Synaptics Incorporated (US), Ultraleap (UK), Aito (Netherlands), ALPS ALPINE CO., LTD. (Japan), Cirrus Logic, Inc. (US), Infineon Technologies AG (Germany), and Vybronics (Vietnam)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 List of primary interview participants

- 2.1.3.2 Breakdown of primary interviews

- 2.1.3.3 Key data from primary sources

- 2.1.3.4 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 FACTOR ANALYSIS

- 2.3.1 DEMAND-SIDE ANALYSIS

- 2.3.2 SUPPLY-SIDE ANALYSIS

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HAPTIC TECHNOLOGY MARKET

- 4.2 HAPTIC TECHNOLOGY MARKET, BY FEEDBACK TYPE

- 4.3 HAPTIC TECHNOLOGY MARKET, BY COMPONENT

- 4.4 HAPTIC TECHNOLOGY MARKET, BY VERTICAL

- 4.5 HAPTIC TECHNOLOGY MARKET, BY REGION

- 4.6 HAPTIC TECHNOLOGY MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising integration of haptic technology into consumer electronics

- 5.2.1.2 Growing adoption of haptic technology in automotive applications

- 5.2.1.3 Increasing use of haptic technology in healthcare industry

- 5.2.1.4 Surging deployment of haptic technology in industrial applications

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of force feedback haptic technology

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising applications of haptic technology in aerospace & defense industry

- 5.2.3.2 Emerging applications of haptic technology in education and robotic fields

- 5.2.4 CHALLENGES

- 5.2.4.1 Technical challenges related to product design

- 5.2.4.2 High power consumption of haptic technology-based products

- 5.2.4.3 Leakage issues associated with pneumatic and hydraulic actuators

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE OF ACTUATOR TYPES, BY KEY PLAYER, 2024

- 5.4.2 AVERAGE SELLING PRICE TREND OF ACTUATOR TYPES, BY REGION, 2021-2024

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Vibrotactile haptic feedback

- 5.7.1.2 Electroactive polymers

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Human-machine interfaces

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Motion tracking systems

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO (HS CODE 8501)

- 5.9.2 EXPORT SCENARIO (HS CODE 8501)

- 5.10 KEY CONFERENCES AND EVENTS, 2025

- 5.11 CASE STUDIES

- 5.11.1 INTEGRATION OF HAPTIC TECHNOLOGY INTO MEDICAL SIMULATORS TO SIMULATE ORTHOPEDIC AND LAPAROSCOPIC SURGERIES

- 5.11.2 DEPLOYMENT OF HAPTIC TECHNOLOGY INTO LEGACY CONSUMER ELECTRONIC DEVICES TO ENHANCE USER SATISFACTION

- 5.11.3 USE OF HAPTIC GLOVES IN INDUSTRIAL TRAINING PROGRAMS TO OFFER REALISTIC, TOUCH-SENSITIVE VIRTUAL SIMULATIONS

- 5.11.4 ADOPTION OF HAPTIC TECHNOLOGY BY REHABILITATION CENTERS TO IMPROVE MOTOR SKILLS RECOVERY

- 5.12 INVESTMENT AND FUNDING SCENARIO

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF ANALYSIS (HS CODE 8501)

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.3 KEY REGULATIONS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREATS OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF AI/GEN AI ON HAPTIC TECHNOLOGY MARKET

- 5.17 IMPACT OF 2025 US TARIFF ON HAPTIC TECHNOLOGY MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON VERTICALS

6 ACTIVE AND PASSIVE HAPTIC DEVICES

- 6.1 INTRODUCTION

- 6.2 ACTIVE HAPTIC DEVICES

- 6.3 PASSIVE HAPTIC DEVICES

7 HAPTIC TOUCH SCREEN TYPES

- 7.1 INTRODUCTION

- 7.2 CAPACITIVE

- 7.3 RESISTIVE

- 7.4 OTHERS

8 HAPTIC TECHNOLOGY MARKET, BY FEEDBACK TYPE

- 8.1 INTRODUCTION

- 8.2 TACTILE

- 8.2.1 WIDE DEPLOYMENT IN SMARTPHONES, WEARABLES, AND GAMING CONTROLLERS TO FACILITATE SEGMENTAL GROWTH

- 8.3 FORCE

- 8.3.1 ROBOTICS, AUTOMOTIVE, AND AEROSPACE APPLICATIONS TO CREATE LUCRATIVE OPPORTUNITIES

9 HAPTIC TECHNOLOGY MARKET, BY COMPONENT

- 9.1 INTRODUCTION

- 9.2 HARDWARE

- 9.2.1 ACTUATORS

- 9.2.1.1 ERM actuators & LRAs

- 9.2.1.1.1 Growing focus on device miniaturization and intuitive interface design to boost segmental growth

- 9.2.1.2 Piezoelectric actuators

- 9.2.1.2.1 Ultra-fast response times, less energy consumption, and low latency features to drive adoption

- 9.2.1.1 ERM actuators & LRAs

- 9.2.2 DRIVERS & MICROCONTROLLERS

- 9.2.2.1 Significant focus of consumer device manufacturers on enhancing user experience to fuel segmental growth

- 9.2.1 ACTUATORS

- 9.3 SOFTWARE

- 9.3.1 NEED FOR REAL-TIME RESPONSIVENESS AND MULTIMODAL SYNCHRONIZATION TO FOSTER SEGMENTAL GROWTH

10 HAPTIC TECHNOLOGY MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- 10.2 CONSUMER ELECTRONICS

- 10.2.1 ESCALATING CONSUMER DEMAND FOR IMMERSIVE EXPERIENCES AND ENHANCED TOUCHSCREEN FUNCTIONALITY TO DRIVE MARKET

- 10.3 AUTOMOTIVE & TRANSPORTATION

- 10.3.1 ELEVATING DEMAND FOR ELECTRIC AND AUTONOMOUS VEHICLES TO CREATE GROWTH OPPORTUNITIES

- 10.4 EDUCATION & RESEARCH

- 10.4.1 SURGING ADOPTION OF E-LEARNING PLATFORMS AND VIRTUAL LABORATORIES TO PROPEL MARKET

- 10.5 HEALTHCARE

- 10.5.1 INCREASING ADOPTION OF SIMULATION-BASED MEDICAL TRAINING MODULES TO FOSTER MARKET GROWTH

- 10.6 COMMERCIAL

- 10.6.1 EMPHASIS ON DELIVERING MULTI-SENSORY EXPERIENCES AS CUSTOMER RETENTION MECHANISM TO DRIVE MARKET

- 10.7 OTHER VERTICALS

11 HAPTIC TECHNOLOGY MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Advancements in XR, AI, and 5G connectivity technologies to augment market growth

- 11.2.3 CANADA

- 11.2.3.1 Government initiatives promoting digital innovation and technology-driven skill development to support market growth

- 11.2.4 MEXICO

- 11.2.4.1 Rising demand for haptic-based surgical simulators and rehabilitation devices to fuel market growth

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 UK

- 11.3.2.1 Increasing demand for haptic-enabled surgical simulators and rehabilitation devices to create growth opportunities

- 11.3.3 GERMANY

- 11.3.3.1 Rising use of haptic solutions in premium vehicles and industrial automation tools to foster market growth

- 11.3.4 FRANCE

- 11.3.4.1 Elevating demand for haptic-based surgical simulators and telemedicine solutions to foster market growth

- 11.3.5 ITALY

- 11.3.5.1 Growing implementation of Industry 4.0 practices in manufacturing to boost demand

- 11.3.6 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 CHINA

- 11.4.2.1 Rising demand for advanced consumer electronics to support market growth

- 11.4.3 JAPAN

- 11.4.3.1 Elevating requirement for immersive consumer electronics and advanced automotive systems to drive market

- 11.4.4 INDIA

- 11.4.4.1 Thriving gaming industry and increasing popularity of VR/AR-based content to fuel market growth

- 11.4.5 SOUTH KOREA

- 11.4.5.1 Significant presence of technology leaders to contribute to market growth

- 11.4.6 REST OF ASIA PACIFIC

- 11.5 ROW

- 11.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 11.5.2 MIDDLE EAST

- 11.5.2.1 GCC

- 11.5.2.1.1 Increasing smartphone penetration and rapid digital adoption to support market expansion

- 11.5.2.2 Africa and Rest of Middle East

- 11.5.2.1 GCC

- 11.5.3 SOUTH AMERICA

- 11.5.3.1 Booming e-commerce industry to create growth opportunities

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- 12.3 MARKET SHARE ANALYSIS, 2024

- 12.4 REVENUE ANALYSIS, 2020-2024

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Feedback type footprint

- 12.7.5.4 Vertical footprint

- 12.7.5.5 Component footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES PLAYERS, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of startups/SMEs

- 12.8.5.2 Competitive benchmarking of startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS

- 13.2.1 TEXAS INSTRUMENTS INCORPORATED

- 13.2.1.1 Business overview

- 13.2.1.2 Products/Solutions/Services offered

- 13.2.1.3 Recent developments

- 13.2.1.3.1 Product launches

- 13.2.1.4 MnM view

- 13.2.1.4.1 Key strengths

- 13.2.1.4.2 Strategic choices

- 13.2.1.4.3 Weaknesses and competitive threats

- 13.2.2 JOHNSON ELECTRIC HOLDINGS LIMITED

- 13.2.2.1 Business overview

- 13.2.2.2 Products/Solutions/Services offered

- 13.2.2.3 Recent developments

- 13.2.2.3.1 Product launches

- 13.2.2.4 MnM view

- 13.2.2.4.1 Key strengths

- 13.2.2.4.2 Strategic choices

- 13.2.2.4.3 Weaknesses and competitive threats

- 13.2.3 AAC TECHNOLOGIES

- 13.2.3.1 Business overview

- 13.2.3.2 Products/Solutions/Services offered

- 13.2.3.3 Recent developments

- 13.2.3.3.1 Product launches

- 13.2.3.3.2 Deals

- 13.2.3.4 MnM view

- 13.2.3.4.1 Key strengths

- 13.2.3.4.2 Strategic choices

- 13.2.3.4.3 Weaknesses and competitive threats

- 13.2.4 TDK CORPORATION

- 13.2.4.1 Business overview

- 13.2.4.2 Products/Solutions/Services offered

- 13.2.4.3 Recent developments

- 13.2.4.3.1 Product launches

- 13.2.4.3.2 Deals

- 13.2.4.4 MnM view

- 13.2.4.4.1 Key strengths

- 13.2.4.4.2 Strategic choices

- 13.2.4.4.3 Weaknesses and competitive threats

- 13.2.5 MICROCHIP TECHNOLOGY INC.

- 13.2.5.1 Business overview

- 13.2.5.2 Products/Solutions/Services offered

- 13.2.5.3 Recent developments

- 13.2.5.3.1 Product launches

- 13.2.5.3.2 Deals

- 13.2.5.4 MnM view

- 13.2.5.4.1 Key strengths

- 13.2.5.4.2 Strategic choices

- 13.2.5.4.3 Weaknesses and competitive threats

- 13.2.6 IMMERSION

- 13.2.6.1 Business overview

- 13.2.6.2 Products/Solutions/Services offered

- 13.2.6.3 Recent developments

- 13.2.6.3.1 Deals

- 13.2.7 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC (ONSEMI)

- 13.2.7.1 Business overview

- 13.2.7.2 Products/Solutions/Services offered

- 13.2.8 PRECISION MICRODRIVES

- 13.2.8.1 Business overview

- 13.2.8.2 Products/Solutions/Services offered

- 13.2.9 SYNAPTICS INCORPORATED

- 13.2.9.1 Business overview

- 13.2.9.2 Products/Solutions/Services offered

- 13.2.9.3 Recent developments

- 13.2.9.3.1 Product launches

- 13.2.9.3.2 Deals

- 13.2.10 ULTRALEAP

- 13.2.10.1 Business overview

- 13.2.10.2 Products/Solutions/Services offered

- 13.2.10.3 Recent developments

- 13.2.10.3.1 Product launches

- 13.2.10.3.2 Deals

- 13.2.1 TEXAS INSTRUMENTS INCORPORATED

- 13.3 OTHER PLAYERS

- 13.3.1 AITO BV

- 13.3.2 ALPS ALPINE

- 13.3.3 CIRRUS LOGIC INC.

- 13.3.4 INFINEON TECHNOLOGIES AG

- 13.3.5 VYBRONICS

- 13.3.6 RENESAS ELECTRONICS CORPORATION

- 13.3.7 HAP2U

- 13.3.8 IMAGIS

- 13.3.9 NIDEC CORPORATION

- 13.3.10 MPLUS

- 13.3.11 BOREAS TECHNOLOGIES

- 13.3.12 ANALOG DEVICES

- 13.3.13 ALLEGRO MICROSYSTEMS

- 13.3.14 NOVASENTIS, INC.

- 13.3.15 NEED-FOR-POWER MOTOR CO., LTD.

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS