|

시장보고서

상품코드

1816011

착유 자동화 시장 예측(-2030년) : 오퍼링별, 농장 규모별, 가축별, 용도별, 최종 용도별, 지역별Milking Automation Market by Offering (Hardware, Software, Services), Farm Size (Small, Medium, Large, Industrial), Livestock (Dairy Cattle, Sheep, Goat), End Use, Application, and Region - Global Forecast to 2030 |

||||||

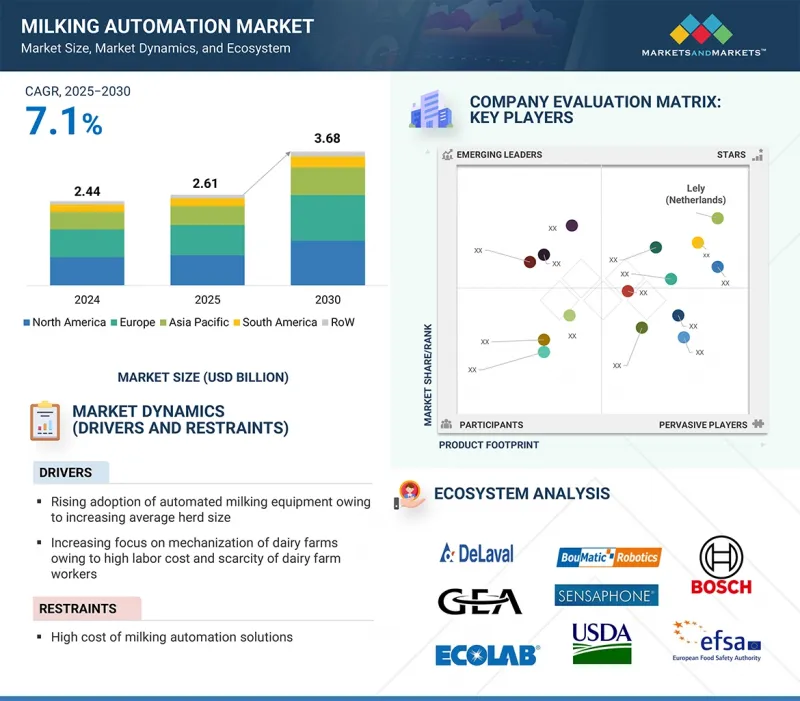

세계의 착유 자동화 시장 규모는 2025년에는 26억 1,000만 달러로 추정되며, 예측 기간 중 CAGR은 7.1%로 전망되고 있으며, 2030년에는 36억 8,000만 달러에 달할 것으로 예측됩니다.

세계 낙농 생산자들은 서유럽, 북미, 오세아니아, 동아시아 일부 지역에서 노동력 부족과 인건비 상승으로 어려움을 겪고 있습니다. 자동화는 숙련된 착유 노동자에 대한 의존도를 낮추는 동시에 제조업체가 처리 능력을 예측하고 하루 작업 시간을 늘릴 수 있게 해줍니다. 둘째, 목장 통합은 특히 신흥 시장에서 농장당 평균 착유두수를 증가시켜 모듈식 자동화 시스템에 대한 투자를 정당화하는 데 도움이 될 수 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상연도 | 2023-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 대상 유닛 | 금액(달러) 및 수량(대) |

| 부문별 | 오퍼링별, 농장 규모별, 가축별, 용도별, 최종 용도별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 남미, 기타 지역 |

체세포수 수준, 잔류물 검사, 추적성 등 품질 및 규정 준수에 대한 요구는 농장의 절차를 표준화하고 세분화된 데이터를 생성하는 시스템에 대한 투자를 촉진하고 있습니다. 이러한 강력한 니즈와 함께 자동화 시스템 도입을 촉진하는 소프트한 니즈도 있습니다. 소의 편안함 향상, 로봇 시스템의 유연한 타이밍, 젊은 농장주 세대를 위한 데이터베이스 목장 관리 모델 등입니다.

젖소는 전 세계에서 설치된 착유 자동화 설비의 대부분을 차지하고 있으며, 2030년까지 젖소 착유 자동화 시장의 경제적 진원지가 될 것으로 예측됩니다. 젖소의 생산 생태(높은 일당 생산량, 하루 2-3회 착유 스케줄, 연중 분만 스케줄)는 노동 강도를 낮추고, 일관된 루틴을 제공하며, 대규모의 고품질 우유를 유지하는 자동화의 ROI 사례를 쉽게 이해할 수 있게 합니다. 낙농장 규모에 관계없이 자동 착유 팔러(병렬, 헤링본, 래피드 엑시트, 대형 로터리), 로봇 착유 시스템(싱글 및 멀티 박스), 자동 클러스터 제거, 인라인 센서(전도도, 유량, 혈액/색상, SCC/LDH), 자동 유두 전처리, 자동 ID 및 도면 작성, 스프레이 및 스프레이, 자동 ID 및 도면 작성, 통합 목장 관리 플랫폼 등의 기술 스택이 있습니다. 보다 기술적으로 진보된 도입 기업에서는 활동/발정 센서, 유두/유방 식별을 위한 머신 비전, 가변속 진공 펌프 및 우유 펌프와 연동된 예지보전을 채택하고 있습니다.

산업 농장 부문(500두 이상)은 2025-2030년까지 어느 부문보다 빠르게 성장할 것으로 예측됩니다. 이는 주로 유제품 산업의 통합 추세가 강화되고, 중소형 농장이 현대화되거나 대규모 농장에 흡수되는 경향이 강해졌기 때문입니다. 산업형 농장은 규모와 효율을 중시하고 안정적인 생산량을 늘리는 데 중점을 둔 경영이기 때문에 로봇 착유 시스템이나 대형 로터리식 자동 유축기를 포함한 전자동 착유 시스템에 가장 적합한 후보입니다. 산업형 낙농장은 노동력 부족이 심각하고, 높은 인건비와 맞물려 착유 자동화를 위한 이러한 시스템 도입은 효율성의 문제가 아니라 필수 불가결한 요소로 작용할 것입니다. 또한 산업형 낙농장은 중규모/소규모 낙농장보다 첨단 농업 기술을 도입할 수 있는 더 나은 자금 조달 방법이나 정부 보조금을 이용할 수 있는 가능성이 높으며, 이러한 시스템을 도입하기 위한 진입 장벽을 훨씬 낮출 수 있습니다.

산업 농장의 완전 자동 착유 시스템의 기술 발전과 함께 데이터베이스 목장 관리 및 추적 가능성에 대한 수요가 증가하고 있습니다. 소떼의 규모가 500두가 넘으면 수작업으로 관리할 수 없게 됩니다. 그러나 착유 자동화와 목장 건강관리, 유질관리, 정밀급이 기술을 결합하면 모두 부가가치를 제공할 수 있습니다. 또한 산업 농장은 규제 당국과 소매업체로부터 더 높은 동물 복지와 우유 위생에 대한 요구를 받고 있으며, 이는 자동화에 대한 추가 투자 동기가 될 것으로 예측됩니다.

착유 자동화는 2025-2030년까지 아시아태평양에서 가장 빠르게 성장할 것으로 예측됩니다. 아시아태평양의 농업, 특히 낙농업은 중국, 인도 등 인구가 많은 국가의 우유 소비 수요 증가, 가처분 소득 증가, 많은 정부의 농업 현대화 시도로 인해 빠르게 변화하고 있습니다. 아시아태평양의 낙농장은 전통적으로 세분화되고 노동력에 의존해 왔지만, 구조적 변화에 따라 많은 낙농장이 대규모의 전문적으로 관리되는 낙농장으로 변모하고 있습니다. 특히 농촌의 노동력 부족이 두드러지고, 농장주들이 착유 자동화를 통한 생산성 향상과 복지 향상 가능성을 이해하면서 착유 자동화 시장이 형성되고 있습니다. 1,000두 이상의 메가 낙농에 많은 투자를 하고 있는 중국과 같은 국가가 로봇 착유와 로터리 착유 채택의 최전선에 서게 될 것으로 보입니다.

세계의 착유 자동화 시장에 대해 조사했으며, 오퍼링별, 농장 규모별, 가축별, 용도별, 최종 용도별, 지역별 동향 및 시장에 참여하는 기업의 개요 등을 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 개요

제4장 주요 인사이트

제5장 시장 개요

- 서론

- 거시경제 지표

- 시장 역학

- 생성형 AI/AI가 착유 자동화 시장에 미치는 영향

제6장 업계 동향

- 서론

- 고객 비즈니스에 영향을 미치는 동향

- 가격 분석

- 밸류체인 분석

- 에코시스템

- 기술 분석

- 특허 분석

- 무역 분석

- 2025-2026년의 주요 컨퍼런스와 이벤트

- 규제 상황

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 투자와 자금조달 시나리오

- 사례 연구 분석

- 착유 자동화 시장에 대한 관세의 영향

제7장 착유 자동화 시장(오퍼링별)

- 서론

- 하드웨어

- 소프트웨어

- 서비스

제8장 착유 자동화 시장(농장 규모별)

- 서론

- 소규모

- 중규모

- 대규모

- 산업 규모

제9장 착유 자동화 시장(가축별)

- 서론

- 젖소

- 염소

- 양

제10장 착유 자동화 시장(용도별)

- 서론

- 착유·수량 모니터링

- 동물 건강·품질 감시

- 자동 청소·위생 관리

- 농장 데이터·의사결정 지원

제11장 착유 자동화 시장(최종 용도별)

- 서론

- 상업 낙농장

- 연구·실증 농장

- 협동조합 및 계약 시설

제12장 착유 자동화 시장(지역별)

- 서론

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 덴마크

- 네덜란드

- 벨기에

- 오스트리아

- 기타

- 아시아태평양

- 중국

- 일본

- 인도

- 호주와 뉴질랜드

- 기타

- 남미

- 아르헨티나

- 브라질

- 기타

- 기타 지역

- 아프리카

- 중동

- 튀르키예

제13장 경쟁 구도

- 개요

- 주요 참여 기업의 전략/강점

- 매출 분석, 2020-2024년

- 시장 점유율 분석, 2024년

- 기업 평가와 재무 지표

- 브랜드/제품 비교

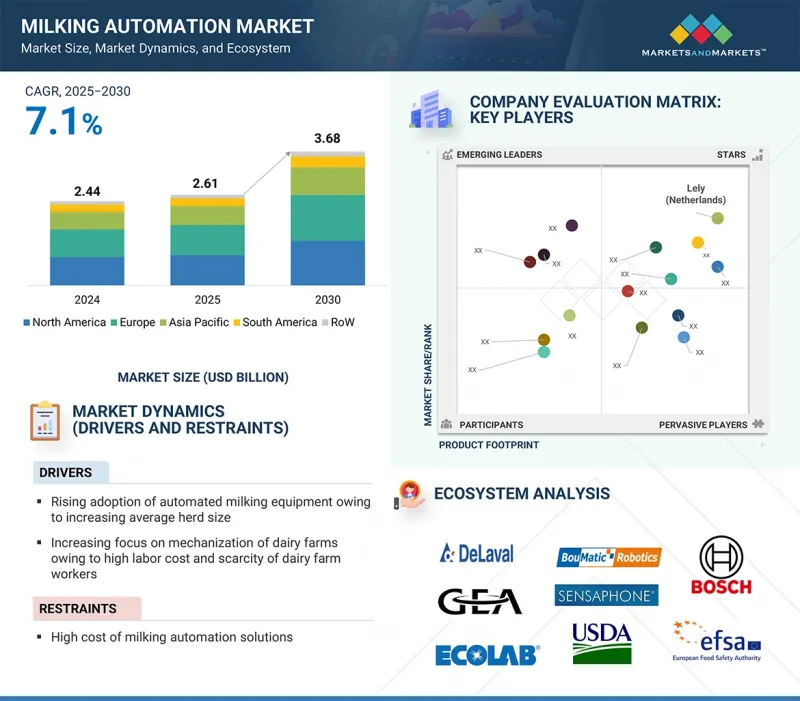

- 기업 평가 매트릭스 : 주요 참여 기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 경쟁 시나리오와 동향

제14장 기업 개요

- 주요 참여 기업

- DELAVAL

- GEA GROUP AG

- LELY

- NEDAP LIVESTOCK MANAGEMENT

- BOUMATIC

- FULLWOOD JOZ

- SYSTEM HAPPEL GMBH

- AMS GALAXY USA

- WAIKATO MILKING SYSTEMS

- DAIRYMASTER

- AFIMILK LTD.

- SHANGHAI RUIKE MACHINERY EQUIPMENT

- DAVIESWAY PTY LTD.

- HOKOFARM GROUP

- MILKPLAN

- 기타 기업

- PROMPT DAIRYTECH

- YUYAO YUHAI LIVESTOCK MACHINERY TECHNOLOGY CO. LTD.

- VANSUN TECHNOLOGIES PRIVATE LIMITED

- SEZER AGRICULTURE AND MILKING TECHNOLOGIES

- BEIJING KINGPENG GLOBAL HUSBANDRY TECHNOLOGY CO., LTD.

- ADF MILKING LTD.

- MIROBOT

- MILKWELL MILKING SYSTEMS

- CONNECTERRA B.V.

- ARCNUT ENGINEERS

제15장 인접 시장과 관련 시장

제16장 부록

KSA 25.09.25The global market for milking automation is estimated to be USD 2.61 billion in 2025 and is projected to reach USD 3.68 billion by 2030, at a CAGR of 7.1% during the forecast period. Global dairy producers are wrestling with labor shortages and rising labor costs in Western Europe, North America, Oceania, and parts of East Asia. Automation lowers reliance on skilled milking labor while allowing manufacturers to predict throughput and increase daily operational windows. Second, herd consolidation drives the average cows-per-farm higher, particularly in developed markets, and helps justify a modular automated system investment.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) and Volume (Units) |

| Segments | By Offering, End Use, Livestock, Farm Size, Application, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and Rest of the World (RoW) |

Quality and compliance needs-somatic cell count levels, residue testing, traceability-lead farms to invest in systems that help standardize procedures and generate high-granularity data. Along with these stronger needs, there are softer needs that still drive adoption of automated systems: increased cow comfort, flexible timing for robotic systems, and data-based herd management models for the younger farm operator generation.

"The dairy cattle livestock segment is projected to register a significant CAGR during the forecast period."

Dairy cattle represent the majority of all installed milking automation across the globe, and they will continue to be the economic epicenter of the market through 2030. The production biology of the species (high daily yield, two to three daily milking schedules, all year calving schedule) makes a straightforward ROI case for automation that lowers labor intensity, provides consistent routines, and maintains high quality of milk at scale. Across farm sizes, the technology stack includes automatic milking parlors (parallel, herringbone, rapid-exit, and large rotaries), robotic milking systems (single- and multi-box), automatic cluster removal, inline sensors (conductivity, flow, blood/color, SCC/LDH), automated teat prep and spray, auto-ID and drafting, and an integrated herd management platform. More technically advanced adopters layer activity/rumination sensors, machine vision for teat/udder identification, and predictive maintenance linked to variable-speed vacuum and milk pumps.

"Industrial farm size is projected to grow at a significant CAGR in the farm size segment during the forecast period."

The industrial farms segment (500+ cows) is projected to grow faster than any segment from 2025 to 2030. This is primarily due to the dairy industry's growing consolidation trend, with small and mid-sized farms modernizing or being absorbed into larger farms. Industrial farms are operations that focus on operating at scale and efficiency and producing consistent output, which makes them the best candidates for fully automated milking systems, including robotic milking systems and large rotary automatic parlors. Industrial farms have a significant labor shortage, and coupled with high labor costs, installing these systems to automate milking will be a necessity and not an issue of efficiency. Additionally, industrial farms are likely to have access to better financing options and government subsidies for the adoption of advanced agricultural technologies than mid-sized/small farms, making the reduction in entry barriers for adoption of those systems far easier.

Alongside the technological advances of fully automated milking systems in industrial farms is the growing demand for data-driven herd management and traceability. When you have herd sizes above 500 cows, the task of manual management is simply impossible. However, technologies that combine milking automation with herd health management, milk quality management, and precision feeding can all provide added value. In addition, industrial farms are being pushed by regulators and retailers for higher animal welfare and milk hygiene, which is hoped will provide motivation for more investment in automation.

Asia Pacific is projected to account for growth at a notably high CAGR.

Milking automation is anticipated to grow most rapidly in the Asia Pacific (APAC) region between 2025 and 2030. APAC agriculture, particularly dairy, is rapidly transforming, with increasing demand for milk consumption in populous countries like China and India, rising disposable incomes, and many governments trying to modernize agriculture. APAC dairy farms have traditionally been fragmented and dependent on labor, but with structural changes, many farms are converting into large-scale, professionally managed dairy farms. This is creating a market for milking automation, especially as rural labor shortages become more prominent, and as farm owners understand the productive potential and welfare improvements that result from milking automation. Countries like China, which are investing heavily in mega-dairies exceeding 1,000 cows, will be at the forefront of robotic and rotary milking adoption.

In-depth interviews have been conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the milking automation market:

- By Company Type: Tier 1 - 25%, Tier 2 - 45%, and Tier 3 - 30%

- By Designation: CXOs - 20%, Managers - 50%, Executives - 30%

- By Region: North America - 25%, Europe - 30%, Asia Pacific - 20%, South America - 15%, and Rest of the World - 10%

Prominent companies in the market include DeLaval (Sweden), Afimilk Ltd. (Israel), GEA Group (Germany), Nedap N.V. (Netherlands), Allflex Livestock Intelligence (US), BouMatic (US), Waikato Milking Systems (New Zealand), Dairymaster (Ireland), and BECO Dairy Automation Inc. (US).

Other players include Milkplan (Greece), Lely (Netherlands), Fullwood JOZ (UK), AMS Galaxy USA (US), miRobot (Israel), MilkWell Milking Systems (UK), Connecterra B.V. (Netherlands), Prompt Dairy Tech (India), ADF Milking Ltd. (UK), Stellapps (India), Daviesway Pty Ltd. (Australia), and SAC Group (Denmark).

Research Coverage

This research report categorizes the milking automation market by Offering (hardware, software, services) end-use (commercial dairy farms, cooperative & contracted milking facilities, research and demonstration farms), livestock (dairy cattle, sheep, goat), farm size (small-scale farms, mid-sized farms, large farms, industrial-scale farms), application (milk extraction & yield monitoring, animal health & quality monitoring, automated cleaning and sanitation, farm data & decision support), and Region (North America, Europe, Asia Pacific, South America, and Rest of the World). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the market. A thorough analysis of the key industry players has been done to provide insights into their business overview, services, key strategies, contracts, partnerships, agreements, new service launches, mergers and acquisitions, and recent developments associated with the milking automation market. This report covers a competitive analysis of upcoming startups in the milking automation market ecosystem. Industry-specific trends such as technology analysis, ecosystem and market mapping, patent analysis, and regulatory landscape, among others, are also covered in the study.

Reasons to buy this report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall milking automation and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (rising adoption of automated milking equipment owing to increasing average herd size), restraints (high cost of milking automation solutions), opportunities (encountering global warming and environmental issues with automation), and challenges (risks associated with automated milking systems) influencing the growth of the milking automation market

- New Product Launch/Innovation: Detailed insights into research & development activities and new product launches in the milking automation market

- Market Development: Comprehensive information about lucrative markets-the report analyzes the milking automation across varied regions

- Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the milking automation market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, brand/product comparison, and product food prints of leading players such as DeLaval (Sweden), Afimilk Ltd. (Israel), GEA Group (Germany), Nedap N.V. (Netherlands), Allflex Livestock Intelligence (US), BouMatic (US), Waikato Milking Systems (New Zealand), Dairymaster (Ireland), and BECO Dairy Automation Inc. (US), and other players in the milking automation market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.5.1 CURRENCY/VALUE UNIT

- 1.5.2 VOLUME UNIT

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key insights from industry experts

- 2.1.2.3 Breakdown of primary profiles

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 SUPPLY-SIDE ANALYSIS

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR KEY PLAYERS IN MILKING AUTOMATION MARKET

- 4.2 ASIA PACIFIC: MILKING AUTOMATION MARKET, BY OFFERING AND COUNTRY

- 4.3 MILKING AUTOMATION MARKET, BY OFFERING AND REGION

- 4.4 MILKING AUTOMATION MARKET: SHARE OF MAJOR REGIONAL SUBMARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 RAPID DIGITALIZATION

- 5.2.2 IMPLEMENTATION OF IOT- AND AI-ENABLED DEVICES FOR LIVESTOCK MONITORING

- 5.3 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Better herd management with superior quality of milk

- 5.3.1.2 Labor scarcity and rising labor costs: Primary economic triggers for automation in dairy farms

- 5.3.1.3 Technology convergence (IoT, sensors, AI) and rise of Data-as-a-Service

- 5.3.1.4 Rising herd size, farm consolidation, and financing innovations

- 5.3.2 RESTRAINTS

- 5.3.2.1 High cost associated with initial investments

- 5.3.2.2 Lack of technical knowledge among farmers

- 5.3.2.3 Infrastructure limitations & unequal regional development slow adoption

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Increasing adoption of livestock monitoring technology in developing countries

- 5.3.3.2 Expansion into emerging dairy markets with untapped potential

- 5.3.4 CHALLENGES

- 5.3.4.1 Regulatory control on livestock industry to reduce disease outbreaks

- 5.3.4.2 Compatibility problems between old farm infrastructure and modern automated systems delay adoption

- 5.3.1 DRIVERS

- 5.4 IMPACT OF GENERATIVE AI/AI ON MILKING AUTOMATION MARKET

- 5.4.1 USE OF GEN AI IN MILKING AUTOMATION MARKET

- 5.4.2 CASE STUDY ANALYSIS

- 5.4.2.1 Lely's AI-enhanced robotic milking systems

- 5.4.2.2 GEA's smart farm advisory platform with Gen AI

- 5.4.2.3 DeLaval's AI-powered predictive maintenance and herd management

- 5.4.3 IMPACT OF AI ON MILKING AUTOMATION MARKET

- 5.4.4 IMPACT OF GEN AI ON ADJACENT ECOSYSTEMS

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS IMPACTING CUSTOMER BUSINESS

- 6.3 PRICING ANALYSIS

- 6.3.1 AVERAGE SELLING PRICE TREND OF OFFERING, BY KEY PLAYER

- 6.3.2 AVERAGE SELLING PRICE TREND, BY REGION

- 6.4 VALUE CHAIN ANALYSIS

- 6.4.1 R&D AND TECHNOLOGY DEVELOPMENT

- 6.4.2 COMPONENT MANUFACTURING AND ASSEMBLY

- 6.4.3 SYSTEM INTEGRATION AND FARM INSTALLATION

- 6.4.4 QUALITY CONTROL AND REGULATORY COMPLIANCE

- 6.4.5 DISTRIBUTION AND MARKETING

- 6.4.6 END USE AND PRODUCT INTEGRATION

- 6.5 ECOSYSTEM

- 6.5.1 SUPPLY SIDE

- 6.5.2 DEMAND SIDE

- 6.6 TECHNOLOGY ANALYSIS

- 6.6.1 KEY TECHNOLOGIES

- 6.6.1.1 Computer vision & AI-based udder recognition

- 6.6.1.2 Robotic teat cleaning & disinfection units

- 6.6.2 COMPLEMENTARY TECHNOLOGIES

- 6.6.2.1 Cow wearables with biometric monitoring

- 6.6.2.2 Autonomous barn robots

- 6.6.3 ADJACENT TECHNOLOGIES

- 6.6.3.1 Digital twin technology for dairy farms

- 6.6.3.2 5G and IoT-enabled smart barn integration

- 6.6.1 KEY TECHNOLOGIES

- 6.7 PATENT ANALYSIS

- 6.8 TRADE ANALYSIS

- 6.8.1 IMPORT SCENARIO OF HS CODE 8434

- 6.8.2 EXPORT SCENARIO OF HS CODE 8434

- 6.9 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.10 REGULATORY LANDSCAPE

- 6.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.10.2 REGULATORY FRAMEWORK

- 6.10.2.1 North America

- 6.10.2.2 Australia

- 6.10.2.3 Europe

- 6.10.2.4 Standards

- 6.11 PORTER'S FIVE FORCES ANALYSIS

- 6.11.1 THREAT OF NEW ENTRANTS

- 6.11.2 THREAT OF SUBSTITUTES

- 6.11.3 BARGAINING POWER OF SUPPLIERS

- 6.11.4 BARGAINING POWER OF BUYERS

- 6.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.12.2 BUYING CRITERIA

- 6.13 INVESTMENT AND FUNDING SCENARIO

- 6.14 CASE STUDY ANALYSIS

- 6.14.1 DELAVAL: ROBOTIC MILKING SYSTEM IN SWEDEN

- 6.14.2 GEA GERMANY: LARGE-SCALE AUTOMATED MILKING PARLOR

- 6.15 TARIFF IMPACT ON MILKING AUTOMATION MARKET

- 6.15.1 INTRODUCTION

- 6.15.2 KEY TARIFF RATES

- 6.15.3 DISRUPTION MILKING AUTOMATION

- 6.15.4 PRICE IMPACT ANALYSIS

- 6.15.5 KEY IMPACTS ON VARIOUS REGIONS

- 6.15.5.1 US

- 6.15.5.2 Europe

- 6.15.5.3 Asia Pacific

- 6.15.6 END-USE INDUSTRY-LEVEL IMPACT

7 MILKING AUTOMATION MARKET, BY OFFERING

- 7.1 INTRODUCTION

- 7.2 HARDWARE

- 7.2.1 LABOR SHORTAGES AND DEMAND FOR EFFICIENCY TO DRIVE RAPID ADOPTION OF HARDWARE-BASED AUTOMATED MILKING SOLUTIONS

- 7.2.2 FULLY AUTOMATED ROBOTIC MILKING SYSTEMS

- 7.2.2.1 Data-driven herd management and precision livestock monitoring to accelerate adoption of robotic milking systems

- 7.2.2.2 Systems

- 7.2.2.2.1 Single-box systems

- 7.2.2.2.2 Multi-box systems

- 7.2.2.3 Components

- 7.2.2.3.1 Robotic arms

- 7.2.2.3.2 Teat cups & liners

- 7.2.2.3.3 Sensors

- 7.2.2.3.4 Cow trafficking systems

- 7.2.3 AUTOMATIC MILKING PARLORS

- 7.2.3.1 Growing herd sizes and need for throughput efficiency to fuel expansion of automated milking parlors globally

- 7.2.3.2 Systems

- 7.2.3.2.1 Rotary parlors

- 7.2.3.2.2 Parallel parlors

- 7.2.3.2.3 Herringbone parlors

- 7.2.3.3 Components

- 7.2.3.3.1 Milk controllers

- 7.2.3.3.2 Milk quality controllers

- 7.2.4 SEMI-AUTOMATIC MILKING PARLORS

- 7.2.4.1 Affordability and transitional adoption encourage small and mid-sized farms to adopt semi-automated milking systems

- 7.2.4.2 Systems

- 7.2.4.2.1 Manual milking with data support

- 7.2.4.2.2 Assisted systems with sensors

- 7.2.4.3 Components

- 7.2.4.3.1 Milking clusters & vacuum systems

- 7.2.4.3.2 Automatic detachers & controllers

- 7.2.4.3.3 Basic cow monitoring sensors

- 7.3 SOFTWARE

- 7.3.1 AI-POWERED ANALYTICS AND IOT CONNECTIVITY TO PROPEL GROWTH OF ADVANCED DAIRY MANAGEMENT SOFTWARE SOLUTIONS

- 7.3.2 FARM & HERD MANAGEMENT

- 7.3.2.1 Growing focus on animal welfare and productivity to drive adoption of digital herd management software

- 7.3.3 DATA ANALYTICS & CLOUD DASHBOARD

- 7.3.3.1 Rise in demand for real-time monitoring and predictive insights to accelerate adoption of cloud-based dairy analytics platforms

- 7.3.4 ERP/FARM IOT INTEGRATION

- 7.3.4.1 Integration of IoT devices with ERP platforms to enhance efficiency and transparency in modern dairy operations

- 7.4 SERVICES

- 7.4.1 GROWING COMPLEXITY OF AUTOMATED SYSTEMS TO BOOST DEMAND FOR INSTALLATION, MAINTENANCE, AND TRAINING SERVICES

8 MILKING AUTOMATION MARKET, BY FARM SIZE

- 8.1 INTRODUCTION

- 8.2 SMALL

- 8.2.1 NEED FOR MINIMAL AUTOMATION AS HERD SIZE IS SMALLER

- 8.3 MEDIUM

- 8.3.1 NUMBER OF MEDIUM-SIZED FARMS TO SIGNIFICANTLY INCREASE IN COMING DECADE

- 8.4 LARGE

- 8.4.1 HIGH RETURN ON INVESTMENTS AND REDUCED LABOR COSTS TO DRIVE USE IN LARGE FARMS

- 8.5 INDUSTRIAL

- 8.5.1 PRIORITIZING AUTOMATION FOR CONSISTENCY, TRACEABILITY, AND COMPLIANCE WITH STRINGENT GLOBAL FOOD SAFETY STANDARDS

9 MILKING AUTOMATION MARKET, BY LIVESTOCK

- 9.1 INTRODUCTION

- 9.2 DAIRY CATTLE

- 9.2.1 LARGE-SCALE EFFICIENCY AND LABOR OPTIMIZATION TO DRIVE MARKET

- 9.3 GOAT

- 9.3.1 RISE IN DEMAND FOR SPECIALTY DAIRY PRODUCTS TO DRIVE MARKET FOR GOAT MILK PRODUCTION

- 9.4 SHEEP

- 9.4.1 GROWTH OF ARTISANAL AND FUNCTIONAL DAIRY MARKETS DRIVES DEMAND FOR SHEEP MILK

10 MILKING AUTOMATION MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 MILK EXTRACTION & YIELD MONITORING

- 10.2.1 RISE IN GLOBAL DAIRY DEMAND TO NECESSITATE PRECISION-DRIVEN YIELD MONITORING AND EFFICIENT AUTOMATED MILK EXTRACTION TECHNOLOGIES

- 10.3 ANIMAL HEALTH & QUALITY MONITORING

- 10.3.1 STRINGENT WELFARE REGULATIONS AND CONSUMER DEMAND TO DRIVE GROWTH OF ANIMAL HEALTH MONITORING IN DAIRY AUTOMATION

- 10.4 AUTOMATED CLEANING & SANITATION

- 10.4.1 GROWING FOCUS ON HYGIENE AND BIOSECURITY TO ACCELERATE ADOPTION OF AUTOMATED CLEANING AND SANITATION SYSTEMS

- 10.5 FARM DATA & DECISION SUPPORT

- 10.5.1 ARTIFICIAL INTELLIGENCE AND IOT INTEGRATION ACCELERATE GROWTH OF FARM DATA & DECISION-SUPPORT APPLICATIONS

11 MILKING AUTOMATION MARKET, BY END USE

- 11.1 INTRODUCTION

- 11.2 COMMERCIAL DAIRY FARMS

- 11.2.1 LARGE HERD MANAGEMENT EFFICIENCY TO DEMAND SCALE-DRIVEN AUTOMATION FOR COST SAVINGS AND SUSTAINABLE PRODUCTIVITY

- 11.3 RESEARCH & DEMONSTRATION FARMS

- 11.3.1 INNOVATION HUBS TO SHOWCASE AUTOMATION BENEFITS, ACCELERATING ADOPTION THROUGH VALIDATION, TRAINING, AND TECHNOLOGY TRANSFER OPPORTUNITIES

- 11.4 COOPERATIVE & CONTRACTED FACILITIES

- 11.4.1 ENABLING SMALLER FARMERS' ACCESS TO AUTOMATION THROUGH POOLED RESOURCES AND SHARED INFRASTRUCTURE MODELS

12 MILKING AUTOMATION MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 US

- 12.2.1.1 Growing labor costs and rising labor shortages in dairy sector to fuel market

- 12.2.2 CANADA

- 12.2.2.1 Increase in demand for domestically produced dairy products to offer lucrative growth opportunities to players

- 12.2.3 MEXICO

- 12.2.3.1 Growing cattle imports from US to drive market in Mexico

- 12.2.1 US

- 12.3 EUROPE

- 12.3.1 GERMANY

- 12.3.1.1 Large dairy cattle population and government initiatives for sustainable agriculture to drive market

- 12.3.2 UK

- 12.3.2.1 Increase in R&D activities pertaining to dairy cattle to drive opportunities in UK

- 12.3.3 FRANCE

- 12.3.3.1 Rise in number of farms with expanding average herd size to accelerate demand in France

- 12.3.4 ITALY

- 12.3.4.1 Continuous consolidation of dairy farms and rise in average dairy herd size to create substantial opportunities in Italy

- 12.3.5 SPAIN

- 12.3.5.1 Shortage of dairy laborers and surge in demand for dairy products to fuel market in Spain

- 12.3.6 DENMARK

- 12.3.6.1 Increase in herd size to drive market growth in Denmark

- 12.3.7 NETHERLANDS

- 12.3.7.1 Presence of large number of milking machine manufacturers in Netherlands

- 12.3.8 BELGIUM

- 12.3.8.1 Farm consolidation, aging farmer demographics, labor shortages to drive automation adoption in Belgium

- 12.3.9 AUSTRIA

- 12.3.9.1 High organic milk share, sustainability policies, advanced dairy infrastructure, and focus on animal welfare to support milking automation

- 12.3.10 REST OF EUROPE

- 12.3.1 GERMANY

- 12.4 ASIA PACIFIC

- 12.4.1 CHINA

- 12.4.1.1 Increased consolidation of small farms to accelerate demand in China

- 12.4.2 JAPAN

- 12.4.2.1 Shortage of labor, with increasing aging labor population, to fuel growth in Japan

- 12.4.3 INDIA

- 12.4.3.1 Emergence of commercial farms with modern technologies to offer growth opportunities

- 12.4.4 AUSTRALIA & NEW ZEALAND

- 12.4.4.1 Low dependency on manual labor to boost demand in Australia & New Zealand

- 12.4.5 REST OF ASIA PACIFIC

- 12.4.1 CHINA

- 12.5 SOUTH AMERICA

- 12.5.1 ARGENTINA

- 12.5.1.1 Large cattle population to accelerate livestock identification, monitoring, and demand for tracking devices in Argentina

- 12.5.2 BRAZIL

- 12.5.2.1 Rapid adoption of precision livestock farming technology by commercial farmers to drive market in Brazil

- 12.5.3 REST OF SOUTH AMERICA

- 12.5.1 ARGENTINA

- 12.6 REST OF THE WORLD (ROW)

- 12.6.1 AFRICA

- 12.6.1.1 Growing investments from governments to improve livestock sector in Africa

- 12.6.2 MIDDLE EAST

- 12.6.2.1 Large farmlands to facilitate demand for smart agriculture in Middle East

- 12.6.3 TURKEY

- 12.6.3.1 Rising consolidation of small dairy farms into large ones in Turkey

- 12.6.1 AFRICA

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 REVENUE ANALYSIS, 2020-2024

- 13.4 MARKET SHARE ANALYSIS, 2024

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.5.1 COMPANY VALUATION

- 13.5.2 FINANCIAL METRICS

- 13.6 BRAND/PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS

- 13.7.5.1 Company footprint

- 13.7.5.2 Regional footprint

- 13.7.5.3 Application footprint

- 13.7.5.4 Livestock footprint

- 13.7.5.5 Offering footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.9 COMPETITIVE SCENARIO AND TRENDS

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

- 13.9.4 OTHER DEVELOPMENTS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 DELAVAL

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.3.2 Deals

- 14.1.1.3.3 Other developments

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths/Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 GEA GROUP AG

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches

- 14.1.2.3.2 Deals

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths/Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 LELY

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches

- 14.1.3.3.2 Deals

- 14.1.3.3.3 Expansions

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths/Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 NEDAP LIVESTOCK MANAGEMENT

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Deals

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths/right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 BOUMATIC

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches

- 14.1.5.3.2 Deals

- 14.1.5.4 MnM View

- 14.1.5.4.1 Key strengths/Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 FULLWOOD JOZ

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches

- 14.1.6.3.2 Deals

- 14.1.7 SYSTEM HAPPEL GMBH

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.8 AMS GALAXY USA

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Product launches

- 14.1.9 WAIKATO MILKING SYSTEMS

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product launches

- 14.1.9.3.2 Deals

- 14.1.10 DAIRYMASTER

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.11 AFIMILK LTD.

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Product launches

- 14.1.11.3.2 Deals

- 14.1.11.3.3 Expansions

- 14.1.12 SHANGHAI RUIKE MACHINERY EQUIPMENT

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Solutions/Services offered

- 14.1.13 DAVIESWAY PTY LTD.

- 14.1.13.1 Business overview

- 14.1.13.2 Products/Solutions/Services offered

- 14.1.14 HOKOFARM GROUP

- 14.1.14.1 Business overview

- 14.1.14.2 Products/Solutions/Services offered

- 14.1.15 MILKPLAN

- 14.1.15.1 Business overview

- 14.1.15.2 Products/Solutions/Services offered

- 14.1.1 DELAVAL

- 14.2 OTHER PLAYERS

- 14.2.1 PROMPT DAIRYTECH

- 14.2.1.1 Business overview

- 14.2.1.2 Products/Solutions/Services offered

- 14.2.2 YUYAO YUHAI LIVESTOCK MACHINERY TECHNOLOGY CO. LTD.

- 14.2.2.1 Business overview

- 14.2.2.2 Products/Solutions/Services offered

- 14.2.3 VANSUN TECHNOLOGIES PRIVATE LIMITED

- 14.2.3.1 Business overview

- 14.2.3.2 Products/Solutions/Services offered

- 14.2.4 SEZER AGRICULTURE AND MILKING TECHNOLOGIES

- 14.2.4.1 Business overview

- 14.2.4.2 Products/Solutions/Services offered

- 14.2.5 BEIJING KINGPENG GLOBAL HUSBANDRY TECHNOLOGY CO., LTD.

- 14.2.5.1 Business overview

- 14.2.5.2 Products/Solutions/Services offered

- 14.2.6 ADF MILKING LTD.

- 14.2.7 MIROBOT

- 14.2.8 MILKWELL MILKING SYSTEMS

- 14.2.9 CONNECTERRA B.V.

- 14.2.10 ARCNUT ENGINEERS

- 14.2.1 PROMPT DAIRYTECH

15 ADJACENT AND RELATED MARKETS

- 15.1 INTRODUCTION

- 15.2 LIMITATIONS

- 15.3 MILKING ROBOTS MARKET

- 15.3.1 MARKET DEFINITION

- 15.3.2 MARKET OVERVIEW

- 15.4 PRECISION LIVESTOCK FARMING MARKET

- 15.4.1 MARKET DEFINITION

- 15.4.2 MARKET OVERVIEW

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS