|

시장보고서

상품코드

1826561

TSN 시장 : IEEE 유형별, 컴포넌트별, 최종 사용자별, 지역별 예측(-2030년)Time-Sensitive Networking Market by Type IEEE, Component, End User & Region - Global Forecast to 2030 |

||||||

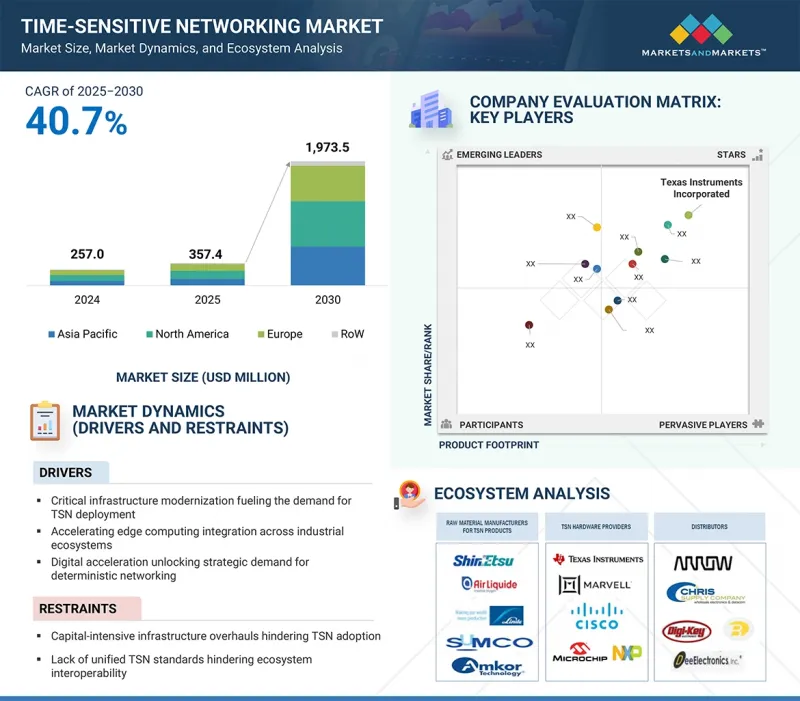

세계의 TSN 시장 규모는 2025년 3억 5,740만 달러에서 2030년까지 19억 7,350만 달러에 이를 것으로 예측되며, CAGR로 40.7%의 성장이 예상됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | IEEE 유형, 컴포넌트, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양 및 기타 지역 |

TSN 시장은 산업계가 엣지 컴퓨팅을 채택하여 대기 시간을 단축하고 응답성을 향상시키면서 크게 성장하고 있습니다. TSN은 디바이스와 에지 노드 간의 원활한 데이터 전송에 필요한 시간 결정성의 동기화된 통신을 제공합니다. 이 조합은 정확한 타이밍과 신뢰성이 요구되는 제조, 자율주행 차량, 스마트 그리드, 의료 등의 중요한 용도를 지원합니다. 에지에서 효율적이고 지연이 적은 연결을 촉진함으로써 TSN은 산업 분야의 업무 효율성, 안전성 및 확장성 향상을 지원하고 광범위한 채택과 대폭적인 시장 확대를 촉진하고 있습니다.

"IEEE 802.1AS는 예측 기간에 가장 빠르게 성장합니다."

IEEE 802.1AS는 차세대 네트워크 아키텍처의 관련성이 확대됨에 따라 TSN 표준에서 가장 빠른 속도로 성장하고 있습니다. 기존의 동기화 프로토콜과 달리 IEEE 802.1AS는 이더넷에서 고정밀 타이밍을 위해 특별히 설계되었으므로 실시간 및 비실시간 트래픽을 모두 처리하는 통합 네트워크에 이상적입니다. 이더넷 기반 시스템과 호환되므로 하드웨어를 크게 변경할 필요 없이 기존 인프라에 쉽게 통합하여 배포 비용을 절감할 수 있습니다. 또한 제어, 데이터 및 오디오/비디오 트래픽이 동일한 네트워크를 공유하는 통합 네트워킹으로의 전환은 IEEE 802.1AS에서 제공하는 시간 동기화의 필요성을 더욱 높여줍니다. IEEE 802.1AS가 제공하는 접지 마스터 클럭 선택 및 경로 지연 측정 지원은 다축 모션 컨트롤, 동기 비디오 스트리밍, 차량 네트워크와 같은 고급 이용 사례에 필수적인 높은 정확도를 보장합니다. 공급업체는 칩셋과 네트워킹 하드웨어에 802.1AS를 탑재하고 있으며, 802.1AS는 다양하고 까다로운 TSN 용도에서 신뢰할 수 있는 시간 동기화를 보장하기 위한 기본 옵션입니다.

"스위치 부문이 2024년 TSN 시장을 독점했습니다."

스위치 부문은 복잡한 네트워크 인프라 전체의 실시간 통신을 관리하는 데 핵심적인 역할을 하기 때문에 TSN 시장을 독점하고 있습니다. TSN 스위치는 시간 의존 트래픽의 우선순위 지정, 지연 최소화, 패킷 전송 동기화를 통해 시간 확실성의 데이터 전달을 가능하게 합니다. 특히 자동차, 제조, 에너지, 운송 등에서 신뢰성이 높은 저지연의 통신을 요구하는 산업이 늘어나면서 TSN 대응 스위치는 견고한 통합 네트워크 구축에 필수적이 되고 있습니다. 이 스위치는 IEEE 802.1Qbv(시간 지원 스케줄링) 및 IEEE 802.1AS(시간 동기화)와 같은 고급 TSN 표준을 지원하여 단일 네트워크에서 제어, 비디오 및 데이터 트래픽을 완벽하게 통합할 수 있습니다.

"미국이 예측 기간에 북미에서 가장 현저한 시장 점유율을 차지할 전망입니다."

미국은 강력한 기술 생태계, 주요 반도체 및 네트워크 기업의 존재, 고급 통신 표준의 조기 채택으로 북미 TSN 시장을 독점하고 있습니다. Texas Instruments, Broadcom 및 Marvell과 같은 미국에 본사를 둔 주요 기업이 TSN 솔루션의 혁신과 개발을 촉진하고 시장 성장을 가속하고 있습니다. 자동차, 항공우주, 제조, 통신에 이르는 이 나라의 견고한 산업 기반은 실시간 시간 확정성의 네트워킹을 요구하고 있으며, TSN의 전개를 가속화하고 있습니다. 게다가 연구개발에 대한 엄청난 투자, 정부 지원책, 첨단 인프라가 미국 시장 경쟁력을 더욱 높여주고 있습니다. 미국은 또한 자율주행차와 스마트 팩토리와 같은 신기술에서 수많은 조기 어댑터와 파일럿 프로젝트의 혜택을 누리고 있으며, 북미 내 TSN 분야의 리더십을 확고히 하고 있습니다.

이 보고서는 세계 TSN 시장에 대한 조사 분석을 통해 주요 촉진요인과 억제요인, 경쟁 구도, 미래 동향 등의 정보를 제공합니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요한 지견

- TSN 시장에서 기업에게 매력적인 기회

- TSN 시장 : 유형별

- TSN 시장 : 컴포넌트별

- TSN 시장 : 최종 사용자별, 지역별

- TSN 시장 : 지리별

제5장 시장 개요

- 소개

- 시장 역학

- 성장 촉진요인

- 억제요인

- 기회

- 과제

- 밸류체인 분석

- 생태계 분석

- 투자 및 자금조달 시나리오

- 가격 설정 분석

- TSN 컴포넌트의 가격대 : 주요 기업별(2024년)

- TSN 컴포넌트의 평균 판매 가격 동향(2020-2024년)

- TSN 컴포넌트의 평균 판매 가격 동향 : 지역별(2020-2024년)

- 고객사업에 영향을 주는 동향/혼란

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- 사례 연구 분석

- 무역 분석

- 수입 시나리오(HS 코드 854231)

- 수출 시나리오(HS 코드 854231)

- 특허 분석

- 주요 컨퍼런스 및 이벤트(2025-2027년)

- 관세 및 규제 상황

- 관세분석(HS코드 854231)

- 규제기관, 정부기관, 기타 조직

- 규제

- 표준

- TSN 시장에 대한 AI의 영향

- TSN 시장에 대한 2025년 미국 관세의 영향

- 소개

- 주요 관세율

- 가격의 영향 분석

- 국가/지역에 미치는 영향

- 최종 사용자에 대한 영향

제6장 TSN 시장 : 유형별

- 소개

- IEEE 802.1AS

- IEEE 802.1QBV

- IEEE 802.1CB

- IEEE 802.1QBU

- IEEE 802.1QCC

- IEEE 802.11BE

- IEEE 802.1CM

- 기타 유형

제7장 TSN 시장 : 컴포넌트별

- 소개

- 스위치

- 허브, 라우터, 게이트웨이

- 컨트롤러 및 프로세서

- 아이솔레이터 및 컨버터

제8장 TSN 시장 : 최종 사용자별

- 소개

- 공업

- 자동차

- 수송

- 석유 및 가스

- 통신 및 데이터센터

- 항공우주

- 기타 최종 사용자

제9장 시장 : 지역별

- 소개

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 멕시코

- 유럽

- 유럽의 거시 경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 북유럽

- 동유럽

- 기타 유럽

- 아시아태평양

- 아시아태평양의 거시 경제 전망

- 중국

- 일본

- 한국

- 인도

- 호주

- 인도네시아

- 말레이시아

- 태국

- 베트남

- 기타 아시아태평양

- 기타 지역

- 기타 지역의 거시 경제 전망

- 중동

- 아프리카

- 남미

제10장 경쟁 구도

- 개요

- 주요 참가 기업의 전략/강점(2021-2025년)

- 수익 분석(2020-2024년)

- 시장 점유율 분석(2024년)

- 기업 평가 및 재무 지표

- 브랜드 비교

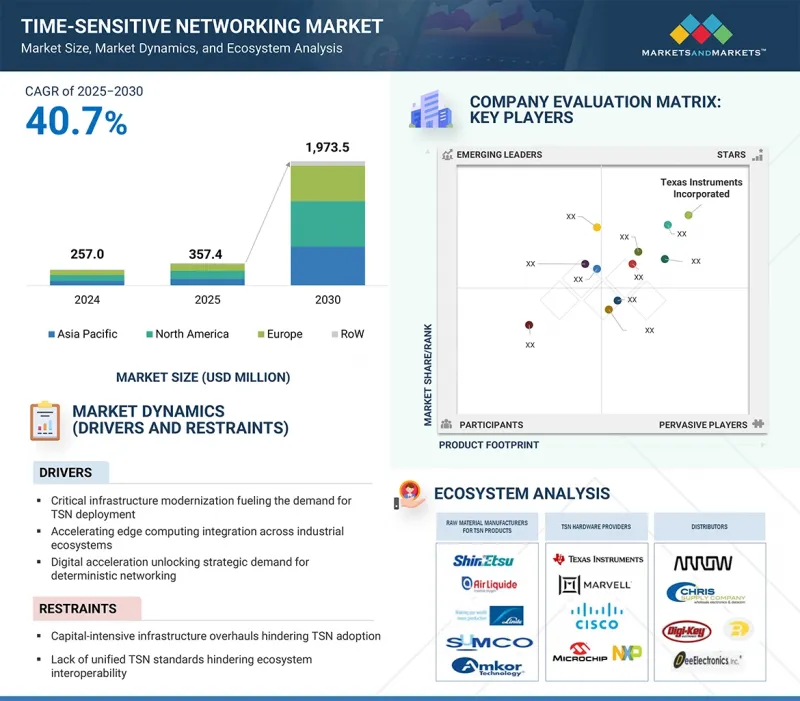

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업의 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제11장 기업 프로파일

- 주요 기업

- TEXAS INSTRUMENTS INCORPORATED

- NXP SEMICONDUCTORS

- SIEMENS

- MARVELL

- BROADCOM

- BELDEN INC.

- CISCO SYSTEMS, INC.

- MICROCHIP TECHNOLOGY INC.

- ANALOG DEVICES, INC.

- RENESAS ELECTRONICS CORPORATION

- 기타 기업

- KYLAND TECHNOLOGY CO., LTD.

- MOXA INC.

- ADVANTECH CO., LTD.

- KONTRON

- PHOENIX CONTACT

- 3ONEDATA CO., LTD.

- TAILYN TECHNOLOGIES INC.

- NOKIA

- RIBBON COMMUNICATIONS OPERATING COMPANY, INC.

- CAST

- WINSYSTEMS INC.

- SYSTEM-ON-CHIP ENGINEERING, SL

- B&R INDUSTRIAL AUTOMATION GMBH

- NATIONAL INSTRUMENTS CORPORATION

- TTTECH COMPUTERTECHNIK AG

제12장 부록

JHS 25.10.10The global time-sensitive networking market is projected to grow from USD 357.4 million in 2025 to USD 1,973.5 million by 2030, at a CAGR of 40.7%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Type IEEE, Component and Region |

| Regions covered | North America, Europe, APAC, RoW |

The time-sensitive networking market is growing significantly as industries adopt edge computing to reduce latency and improve responsiveness. TSN provides the deterministic and synchronized communication necessary for seamless data transfer between devices and edge nodes. This combination supports critical applications in manufacturing, autonomous vehicles, smart grids, and healthcare that demand precise timing and reliability. By facilitating efficient, low-latency connectivity at the edge, TSN helps industries enhance operational efficiency, safety, and scalability, driving widespread adoption and significant market expansion.

"IEEE 802.1 AS to grow at the fastest rate during the forecasted period."

IEEE 802.1AS is growing at the fastest rate among TSN standards due to its expanding relevance in next-generation network architectures. Unlike traditional synchronization protocols, IEEE 802.1AS is specifically designed for high-precision timing over Ethernet, making it ideal for converged networks handling both real-time and non-real-time traffic. Its compatibility with Ethernet-based systems allows easy integration into existing infrastructures without requiring major hardware changes, reducing deployment costs. Additionally, the move toward unified networking-where control, data, and audio/video traffic share the same network-further boosts the need for synchronized time, which IEEE 802.1AS provides. The standard's support for Grandmaster clock selection and path delay measurement ensures high accuracy, which is essential for advanced use cases like multi-axis motion control, synchronized video streaming, and vehicular networks. As vendors increasingly incorporate 802.1AS into chipsets and networking hardware, it becomes the default choice for ensuring reliable time synchronization across diverse and demanding TSN applications.

"Switch segment dominated the time-sensitive networking market in 2024."

The switch segment dominates the time-sensitive networking (TSN) market due to its central role in managing real-time communication across complex network infrastructures. TSN switches enable deterministic data delivery by prioritizing time-sensitive traffic, minimizing latency, and ensuring synchronized packet transmission. As industries increasingly demand reliable, low-latency communication-especially in automotive, manufacturing, energy, and transportation-TSN-enabled switches have become essential for building robust, converged networks. They support advanced TSN standards such as IEEE 802.1Qbv (time-aware scheduling) and IEEE 802.1AS (time synchronization), allowing seamless integration of control, video, and data traffic on a single network.

"The US is expected to hold the most prominent market share in North America during the forecast period."

The US dominates the North American time-sensitive networking (TSN) market due to its strong technological ecosystem, presence of leading semiconductor and networking companies, and early adoption of advanced communication standards. Major US-based corporations like Texas Instruments, Broadcom, and Marvell drive innovation and development of TSN solutions, fueling market growth. The country's robust industrial base-spanning automotive, aerospace, manufacturing, and telecommunications-demands real-time, deterministic networking, accelerating TSN deployment. Additionally, substantial investments in research & development, supportive government initiatives, and advanced infrastructure further enhance the US market's competitiveness. The US also benefits from a large number of early adopters and pilot projects in emerging technologies such as autonomous vehicles and smart factories, solidifying its leadership in the TSN space within North America.

In-depth interviews have been conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the time-sensitive networking marketplace.

- By Company Type: Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: C-level Executives - 45%, Directors - 35%, and Others - 20%

- By Region: North America - 45%, Europe - 25%, Asia Pacific - 20%, and RoW - 10%

The study includes an in-depth competitive analysis of these key players in the time-sensitive networking market, including their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the time-sensitive networking market by type, component, end user, and region (North America, Europe, Asia Pacific, RoW). The report covers detailed information regarding major factors influencing market growth, such as drivers, restraints, challenges, and opportunities. A thorough analysis of the key industry players has provided insights into their business overview, solutions and services, key strategies, contracts, partnerships, and agreements. Product and service launches, acquisitions, and recent developments associated with the time-sensitive networking market. This report covers a competitive analysis of upcoming startups in the time-sensitive networking market ecosystem.

Reasons to Buy This Report

The report will help market leaders and new entrants with information on the closest approximations of the revenue numbers for the time-sensitive networking market and subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (Operational efficiency pressures amplifying industrial automation adoption, Digital acceleration unlocking strategic demand for deterministic networking, Accelerating edge computing integration across industrial ecosystems, Critical infrastructure modernization fueling the demand for TSN deployment), restraints (Capital-intensive infrastructure overhauls hindering TSN adoption, Lack of unified TSN standards hindering ecosystem interoperability), opportunities (Emerging IIoT demand signals robust market potential for TSN, 5G technology accelerates TSN adoption across industries, Expanding role of TSN in shaping the future of connected and autonomous mobility), and challenges (Interoperability fragmentation as a strategic barrier to scalable time-sensitive networking deployment, Integration complexity as a barrier to seamless time-sensitive networking deployment) influencing the growth of the time-sensitive networking market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product launches in the time-sensitive networking market

- Market Development: Comprehensive information about lucrative markets with an analysis of the time-sensitive networking market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the time-sensitive networking market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the time-sensitive networking market, such as Texas Instruments Incorporated (US), NXP Semiconductors (Netherlands), Siemens (Germany), Marvell (US), and Broadcom (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 List of primary interview participants

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of primaries

- 2.2 FACTOR ANALYSIS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.3.2 TOP-DOWN APPROACH

- 2.3.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN TIME-SENSITIVE NETWORKING MARKET

- 4.2 TIME-SENSITIVE NETWORKING MARKET, BY TYPE

- 4.3 TIME-SENSITIVE NETWORKING MARKET, BY COMPONENT

- 4.4 TIME-SENSITIVE NETWORKING MARKET, BY END USER AND REGION

- 4.5 TIME-SENSITIVE NETWORKING MARKET, BY GEOGRAPHY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Accelerating adoption of automation in industrial applications

- 5.2.1.2 Surging deployment of digital solutions in industrial processes

- 5.2.1.3 Increasing use of edge computing across organizations

- 5.2.1.4 Rising focus on infrastructure modernization

- 5.2.2 RESTRAINTS

- 5.2.2.1 Requirement for high capital investment to implement TSN solutions

- 5.2.2.2 Interoperability issues due to lack of unified standards

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Elevating adoption of IIoT

- 5.2.3.2 Rollout of 5G technology

- 5.2.3.3 Growing prominence of CASE trends within automotive industry

- 5.2.4 CHALLENGES

- 5.2.4.1 Interoperability gaps and fragmentation in TSN implementations

- 5.2.4.2 Integration challenges in TSN deployment

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 INVESTMENT AND FUNDING SCENARIO

- 5.6 PRICING ANALYSIS

- 5.6.1 PRICING RANGE OF TIME-SENSITIVE NETWORKING COMPONENTS, BY KEY PLAYER, 2024

- 5.6.2 AVERAGE SELLING PRICE TREND OF TIME-SENSITIVE NETWORKING COMPONENTS, 2020-2024

- 5.6.3 AVERAGE SELLING PRICE TREND OF TIME-SENSITIVE NETWORKING COMPONENTS, BY REGION, 2020-2024

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Time synchronization protocol

- 5.8.1.2 Precision Time Protocol (PTP)

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Stream Reservation Protocol (SRP)

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Local Area Network (LAN)

- 5.8.3.2 Token Ring

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.9.2 BARGAINING POWER OF SUPPLIERS:

- 5.9.3 BARGAINING POWER OF BUYERS:

- 5.9.4 THREAT OF SUBSTITUTES

- 5.9.5 THREAT OF NEW ENTRANTS:

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 TTTECH PROVIDES STMICROELECTRONICS WITH TSN SOLUTION TO ENSURE COMPATIBILITY ACROSS INDUSTRIAL APPLICATIONS

- 5.11.2 MOXA OFFERS TSN SWITCH TO CNC MACHINERY MANUFACTURER TO ENSURE DETERMINISTIC COMMUNICATION FOR PRECISE AND RELIABLE MACHINE CONTROL

- 5.11.3 AVNU ALLIANCE COLLABORATES WITH AUDI TO INTEGRATE TSN INTO AUTOMOTIVE SYSTEMS FOR IMPROVED CAR SAFETY AND EFFICIENCY

- 5.11.4 CISCO OFFERS TSN TO ROCKWELL AUTOMATION TO ACHIEVE IMPROVED EFFICIENCY AND PRODUCTIVITY IN DISCRETE MANUFACTURING SYSTEMS

- 5.11.5 NXP IMPLEMENTS TSN IN SMART BUILDINGS FOR IMPROVED ENERGY EFFICIENCY, USER COMFORT, AND REDUCED ENERGY CONSUMPTION

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT SCENARIO (HS CODE 854231)

- 5.12.2 EXPORT SCENARIO (HS CODE 854231)

- 5.13 PATENT ANALYSIS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2027

- 5.15 TARIFF AND REGULATORY LANDSCAPE

- 5.15.1 TARIFF ANALYSIS (HS CODE 854231)

- 5.15.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.3 REGULATIONS

- 5.15.3.1 Electronic waste

- 5.15.3.2 RoHS Directive

- 5.15.3.3 Moisture sensitivity level (MSL)

- 5.15.4 STANDARDS

- 5.15.4.1 IEEE Std 802.1Q - Bridges and Bridged Networks

- 5.15.4.2 IEEE Std 802.1AB - Station and Media Access Control Connectivity Discovery

- 5.15.4.3 IEEE Std 802.1AS - Timing and Synchronization for Time-Sensitive Applications

- 5.15.4.4 IEEE Std 802.1AX - Link Aggregation

- 5.15.4.5 IEEE Std 802.1BA - Audio-Video Bridging (AVB) Systems

- 5.15.4.6 IEEE Std 802.1CB - Frame Replication and Elimination for Reliability

- 5.15.4.7 IEEE Std 802.1CM - Time-Sensitive Networking for Fronthaul

- 5.15.4.8 IEEE Std 802.1CS - Link-local Registration Protocol

- 5.16 IMPACT OF AI ON TIME-SENSITIVE NETWORKING MARKET

- 5.17 IMPACT OF 2025 US TARIFF ON TIME-SENSITIVE NETWORKING MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON END USERS

6 TIME-SENSITIVE NETWORKING MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 IEEE 802.1AS

- 6.2.1 SURGING DEMAND FOR RELIABLE AND CONVERGED ETHERNET NETWORKS ACROSS INDUSTRIES TO SUPPORT SEGMENTAL GROWTH

- 6.2.2 USE CASES

- 6.3 IEEE 802.1QBV

- 6.3.1 RISING ADOPTION OF INDUSTRY 4.0, ROBOTICS, ENERGY GRIDS, AND SMART TRANSPORTATION SYSTEMS TO FOSTER SEGMENTAL GROWTH

- 6.4 IEEE 802.1CB

- 6.4.1 PROFICIENCY IN OFFERING DETERMINISTIC AND FAULT-TOLERANT COMMUNICATION FOR SAFETY-CRITICAL AND INDUSTRIAL APPLICATIONS TO BOOST DEMAND

- 6.5 IEEE 802.1QBU

- 6.5.1 ABILITY TO OPTIMIZE NETWORK PERFORMANCE IN CLOUD COMPUTING ENVIRONMENTS TO FACILITATE ADOPTION

- 6.6 IEEE 802.1QCC

- 6.6.1 EXCELLENCE IN SIMPLIFYING NETWORK MANAGEMENT AND REDUCING ERRORS AND INCONSISTENCIES IN QOS POLICY CONFIGURATION TO DRIVE DEMAND

- 6.7 IEEE 802.11BE

- 6.7.1 ELEVATING USE OF AUGMENTED REALITY, CLOUD GAMING, 4K/8K VIDEO CONFERENCING, AND SMART HOMES TO STIMULATE SEGMENTAL GROWTH

- 6.8 IEEE 802.1CM

- 6.8.1 RAPID GLOBAL EXPANSION OF 5G NETWORKS TO CREATE OPPORTUNITIES

- 6.9 OTHER TYPES

7 TIME-SENSITIVE NETWORKING MARKET, BY COMPONENT

- 7.1 INTRODUCTION

- 7.2 SWITCHES

- 7.2.1 ABILITY TO DELIVER NANOSECOND-ACCURATE SYNCHRONIZATION FOR SEAMLESS OPERATIONS TO BOOST DEMAND

- 7.3 HUBS, ROUTERS, AND GATEWAYS

- 7.3.1 PRESSING NEED FOR INTEROPERABLE, LOW-LATENCY, AND RESILIENT NETWORK INFRASTRUCTURE TO DRIVE MARKET

- 7.4 CONTROLLERS AND PROCESSORS

- 7.4.1 RISING DEMAND FOR REAL-TIME AND INTELLIGENT NETWORKS TO SUPPORT MARKET GROWTH

- 7.5 ISOLATORS AND CONVERTERS

- 7.5.1 GROWING INCLINATION TOWARD INDUSTRY 4.0, SMART TRANSPORTATION, AND AUTOMATION TO PROPEL MARKET

8 TIME-SENSITIVE NETWORKING MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 INDUSTRIAL

- 8.2.1 ESTABLISHMENT OF SMART FACTORIES TO ACCELERATE DIGITALIZATION TO FOSTER SEGMENTAL GROWTH

- 8.3 AUTOMOTIVE

- 8.3.1 RAPID DEVELOPMENTS IN ELECTRIC VEHICLE AND AUTONOMOUS VEHICLES TO FUEL SEGMENTAL GROWTH

- 8.4 TRANSPORTATION

- 8.4.1 NEED FOR REAL-TIME DATA EXCHANGE AND SYSTEM MODULARITY TO FUEL SEGMENTAL GROWTH

- 8.5 OIL & GAS

- 8.5.1 REQUIREMENT FOR RELIABLE, ROBUST, AND HIGH-CAPACITY COMMUNICATION NETWORKS TO DRIVE MARKET

- 8.6 TELECOM & DATA CENTER

- 8.6.1 STRONG FOCUS ON REDUCING LATENCY AND EFFICIENT DATA TRAFFIC MANAGEMENT TO INCREASE ADOPTION

- 8.7 AEROSPACE

- 8.7.1 RISING ADOPTION OF AUTOMATED AND INTERCONNECTED PLATFORMS TO FACILITATE DEMAND

- 8.8 OTHER END USERS

9 REGION MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 Thriving consumer electronics sector and rapid industrial automation to accelerate market growth

- 9.2.3 CANADA

- 9.2.3.1 Significant investment in robotics, AI, and ML to support market growth

- 9.2.4 MEXICO

- 9.2.4.1 Booming semiconductor industry to create market growth opportunities

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Growing inclination of automotive sector toward electric and autonomous vehicles to boost demand

- 9.3.3 UK

- 9.3.3.1 Significant focus of aerospace companies on sustainability goals and high-precision engineering to contribute to market growth

- 9.3.4 FRANCE

- 9.3.4.1 Elevating adoption of smart and sustainable manufacturing practices to fuel market growth

- 9.3.5 ITALY

- 9.3.5.1 Strategic investment in robotics and digitally connected manufacturing to expedite market expansion

- 9.3.6 SPAIN

- 9.3.6.1 Automotive sector to contribute most to market growth

- 9.3.7 NORDICS

- 9.3.7.1 Sustainability, energy efficiency, and smart factory initiatives to propel market

- 9.3.8 EASTERN EUROPE

- 9.3.8.1 Poland

- 9.3.8.1.1 Growing adoption of industrial IoT and smart factories to favor market expansion

- 9.3.8.2 Slovakia

- 9.3.8.2.1 Escalating demand for precision electronics testing, high-speed packaging, and smart warehousing to drive market

- 9.3.8.3 Romania

- 9.3.8.3.1 Rapid digital transformation to facilitate TSN adoption

- 9.3.8.4 Ukraine

- 9.3.8.4.1 Growing applications of TSN in defense, smart manufacturing, and critical infrastructure projects to drive market

- 9.3.8.5 Hungary

- 9.3.8.5.1 Increasing investment in connected transport and automation projects to surge TSN deployment

- 9.3.8.6 Rest of Eastern Europe

- 9.3.8.1 Poland

- 9.3.9 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 Substantial focus on automating and modernizing production processes to accelerate demand

- 9.4.3 JAPAN

- 9.4.3.1 Emphasis of automotive firms on electrification, automation, and Industry 4.0 production methods to fuel market growth

- 9.4.4 SOUTH KOREA

- 9.4.4.1 Rollout of 5G networks and deployment of smart factories to support market growth

- 9.4.5 INDIA

- 9.4.5.1 Smart City and BharatNet Phase 3 initiatives to contribute to market growth

- 9.4.6 AUSTRALIA

- 9.4.6.1 Expansion of high-speed rail network to boost demand

- 9.4.7 INDONESIA

- 9.4.7.1 Rapidly growing EV ecosystem to stimulate market growth

- 9.4.8 MALAYSIA

- 9.4.8.1 Fast-growing data center market and 5G deployment to drive market

- 9.4.9 THAILAND

- 9.4.9.1 Elevating adoption of intelligent transportation systems to facilitate market growth

- 9.4.10 VIETNAM

- 9.4.10.1 Transition toward high-tech industrialization to stimulate demand

- 9.4.11 REST OF ASIA PACIFIC

- 9.5 ROW

- 9.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 9.5.2 MIDDLE EAST

- 9.5.2.1 Bahrain

- 9.5.2.1.1 Smart factory initiatives to create opportunities for market players

- 9.5.2.2 Kuwait

- 9.5.2.2.1 AI-driven smart city initiatives and rising deployment of digital technology in oil & gas to support market growth

- 9.5.2.3 Oman

- 9.5.2.3.1 Implementation of 4IR technologies in industrial sector to contribute to market growth

- 9.5.2.4 Qatar

- 9.5.2.4.1 Long-term vision for economic diversification and technological leadership to fuel market growth

- 9.5.2.5 Saudi Arabia

- 9.5.2.5.1 National initiatives emphasizing high-performance and low-latency networking to spike demand

- 9.5.2.6 UAE

- 9.5.2.6.1 Rising use of IoT and blockchain technologies to improve grid reliability to spur demand

- 9.5.2.7 Rest of Middle East

- 9.5.2.1 Bahrain

- 9.5.3 AFRICA

- 9.5.3.1 South Africa

- 9.5.3.1.1 Significant focus on modernizing industrial, urban, and digital infrastructure to create opportunities

- 9.5.3.2 Rest of Africa

- 9.5.3.1 South Africa

- 9.5.4 SOUTH AMERICA

- 9.5.4.1 Surging deployment of smart grids and rollout of 5G networks to fuel market growth

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS, 2O24

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 BRAND COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 Type footprint

- 10.7.5.4 Component footprint

- 10.7.5.5 End user footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 EXPANSIONS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 TEXAS INSTRUMENTS INCORPORATED

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Expansions

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 NXP SEMICONDUCTORS

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 SIEMENS

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 MARVELL

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 BROADCOM

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches

- 11.1.5.4 MnM view

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 BELDEN INC.

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches

- 11.1.7 CISCO SYSTEMS, INC.

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.8 MICROCHIP TECHNOLOGY INC.

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product launches

- 11.1.9 ANALOG DEVICES, INC.

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches

- 11.1.10 RENESAS ELECTRONICS CORPORATION

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product launches

- 11.1.1 TEXAS INSTRUMENTS INCORPORATED

- 11.2 OTHER PLAYERS

- 11.2.1 KYLAND TECHNOLOGY CO., LTD.

- 11.2.2 MOXA INC.

- 11.2.3 ADVANTECH CO., LTD.

- 11.2.4 KONTRON

- 11.2.5 PHOENIX CONTACT

- 11.2.6 3ONEDATA CO., LTD.

- 11.2.7 TAILYN TECHNOLOGIES INC.

- 11.2.8 NOKIA

- 11.2.9 RIBBON COMMUNICATIONS OPERATING COMPANY, INC.

- 11.2.10 CAST

- 11.2.11 WINSYSTEMS INC.

- 11.2.12 SYSTEM-ON-CHIP ENGINEERING, S.L.

- 11.2.13 B&R INDUSTRIAL AUTOMATION GMBH

- 11.2.14 NATIONAL INSTRUMENTS CORPORATION

- 11.2.15 TTTECH COMPUTERTECHNIK AG

12 APPENDIX

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS