|

시장보고서

상품코드

1829982

당뇨병 관리 기기 시장 : 제품 유형별, 질환 유형별, 환자 치료 시설별, 지역별 - 예측(-2030년)Diabetes Care Devices Market by Product Type (Blood Glucose Monitoring (CGM), Insulin Delivery Devices (Insulin Pumps (Tethered), Insulin Pens, Pen Needles), Application) Disease Type (Type 1, Type 2), End User (Homecare/Self) - Global Forecast to 2030 |

||||||

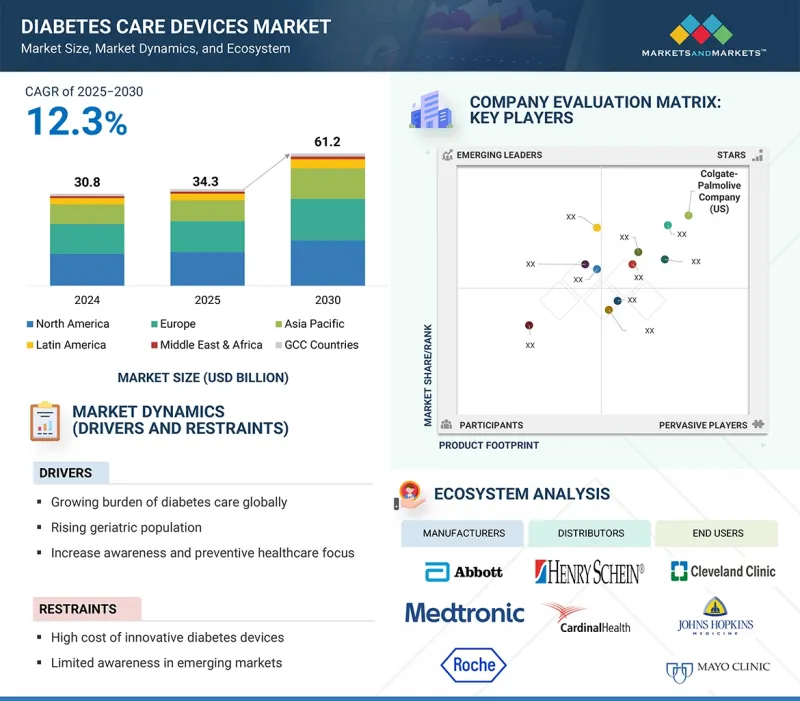

세계의 당뇨병 관리 기기 시장 규모는 예측 기간 중에 12.3%의 연평균 복합 성장률(CAGR)로 확대되어 2025년 343억 달러에서 2030년에는 612억 달러에 이를 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(10억 달러) |

| 부문 | 제품 유형별, 질환 유형별, 환자 치료 시설별, 지역별 |

| 대상 지역 | 북미, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

앉아있는 생활습관, 비만, 식습관 변화 등으로 인한 당뇨병 유병률 증가로 인해 당뇨병 치료를 위한 효과적인 모니터링 및 관리 도구에 대한 수요가 크게 증가하고 있습니다. 2형 당뇨병과 그 합병증에 취약한 노인 인구 증가로 인해 혈당 모니터링 기기에 대한 수요가 더욱 증가하고 있습니다. 또한, 예방적 건강관리에 대한 인식이 높아지고 강조되면서 조기 진단 및 자가 관리 도구가 장려되고 가정용 기기의 사용이 확대되고 있습니다. 기술의 발전은 환자와 의료 서비스 제공업체 모두에게 이러한 기기를 더욱 매력적으로 만들고 있습니다.

더 넓은 시장에서의 채택은 장비의 높은 비용과 특정 시장에서의 낮은 소비자 수용성 및 순응도에 의해 제한될 수 있습니다.

세계 당뇨병 관리 기기 시장은 혈당 모니터링 시스템, 인슐린 전달 장치, 당뇨병 관리 모바일 애플리케이션의 세 가지 주요 부문으로 나뉩니다. 혈당 모니터링 시스템 분야는 강력한 기능적 장점과 의료 지원으로 인해 가장 큰 시장 점유율을 차지하고 있습니다. 이러한 장치는 정확한 실시간 추적을 제공하여 합병증을 예방하는 데 도움이 됩니다. 당뇨병 유병률 증가, 의사의 추천, 스마트폰과의 통합과 같은 기술 혁신은 가정에서의 도입 설정을 더욱 증가시킬 것입니다.

세계 당뇨병 관리 기기 시장은 환자 치료 시설, 자가/재택치료, 병원/당뇨병 전문 클리닉으로 구분됩니다. 이 중 셀프/홈 헬스케어 분야가 가장 큰 시장 점유율을 차지할 것으로 예측됩니다. 편리하고 비용 효율적인 장비에 대한 수요 증가가 이 분야의 성장을 주도하고 있습니다. 많은 사람들이 지속혈당측정기 등 자가혈당측정기에 의존하고 있으며, 이는 임상 진찰의 필요성을 줄여줍니다. 예방 의료에 대한 인식 증가, 휴대용 및 커넥티드 기술의 발전, 2형 당뇨병에 취약한 노인 인구 증가는 셀프/홈케어 기기에 대한 수요 증가에 박차를 가하고 있습니다.

이 우위는 주로 앉아있는 행동, 식습관, 비만 증가 등 생활습관 관련 위험 요인으로 인해 2형 당뇨병이 인구에 만연해 있기 때문입니다. 고칼로리 음식, 가공식품, 운동 부족으로 인한 비만 증가가 급속한 성장의 주요 요인입니다. 도시화와 현대화로 인해 일상적인 운동량은 더욱 감소하고 패스트푸드에 대한 접근성이 증가하면서 선진국과 개발도상국 모두에서 비만율이 증가하고 있습니다. 또한, 당뇨병은 노화와 밀접한 관련이 있는 질환으로 고령일수록 발병하기 쉬우며, 세계 인구가 고령화됨에 따라 유병률도 당연히 계속 증가하고 있습니다.

당뇨병 환자의 급증과 고급 당뇨병 치료에 대한 수요 증가는 아시아태평양의 당뇨병 치료 장비에 대한 강력한 수요를 촉진하고 있습니다. 또한, 당뇨병 치료 제품의 세계 리더로서 첨단 제제 및 디지털 통합형 당뇨병 관리 기기를 출시하여 아시아태평양에서의 입지를 넓히고 있습니다.

세계의 당뇨병 관리 기기 시장에 대해 조사했으며, 제품 유형별/질환 유형별/환자 치료 시설별/지역별 동향, 시장 진출기업 프로파일 등의 정보를 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 프리미엄 인사이트

제5장 시장 개요

- 서론

- 시장 역학

- 업계 동향

- 기술 분석

- 가격 분석

- 생태계 분석

- 상환 시나리오 분석

- 밸류체인 분석

- Porter의 Five Forces 분석

- 주요 이해관계자와 구입 기준

- 무역 분석

- 규제 분석

- 특허 분석

- 2025-2026년 주요 컨퍼런스 및 이벤트

- 인접 시장 분석

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 미충족 요구/최종사용자 기대

- 당뇨병 관리 기기 시장 AI/생성형 AI의 영향

- 사례 연구 분석

- 투자 및 자금조달 시나리오

- 2025년 미국 관세가 당뇨병 관리 기기 시장에 미치는 영향

제6장 당뇨병 관리 기기 시장(제품 유형별)

- 서론

- 혈당 모니터링 시스템

- 인슐린 전달 기기

- 당뇨병 관리 모바일 애플리케이션

제7장 당뇨병 관리 기기 시장(질환 유형별)

- 서론

- 1형 당뇨병

- 2형 당뇨병

제8장 당뇨병 관리 기기 시장(환자 치료 시설 별)

- 서론

- 셀프/재택치료

- 병원 및 당뇨병 전문 클리닉

제9장 당뇨병 관리 기기 시장(지역별)

- 서론

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타

- 라틴아메리카

- 라틴아메리카의 거시경제 전망

- 브라질

- 멕시코

- 기타

- 중동 및 아프리카

- 당뇨병 관리 조기진단과 혈당 컨트롤 의식 향상이 시장 성장을 지지

- 중동 및 아프리카의 거시경제 전망

- GCC 국가

- 당뇨병 이환율 상승과 1인당 헬스케어 상승이 시장을 촉진

- GCC 국가 거시경제 전망

제10장 경쟁 구도

- 서론

- 주요 시장 진출기업의 전략/강점

- 매출 분석, 2020년-2024년

- 시장 점유율 분석, 2024년

- 기업 평가 매트릭스 : 주요 시장 진출기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 기업 평가와 재무 지표

- 브랜드 및 제품 비교

- 주요 기업 연구개발비

- 경쟁 시나리오

제11장 기업 개요

- 주요 시장 진출기업

- F. HOFFMAN-LA ROCHE LTD.

- ABBOTT

- DEXCOM, INC.

- MEDTRONIC

- B. BRAUN SE

- EMBECTA CORP.

- NIPRO

- SENSEONICS

- YPSOMED

- I-SENS, INC.

- TANDEM DIABETES CARE, INC.

- INSULET CORPORATION

- ACON LABORATORIES, INC.

- ARKRAY, INC.

- TERUMO CORPORATION

- 기타 기업

- SINOCARE

- AGAMATRIX

- LIFESCAN IP HOLDINGS, LLC

- SD BIOSENSOR, INC.

- DEBIOTECH S.A.

- SUNGSHIM MEDICAL CO., LTD.

- SOOIL DEVELOPMENTS CO., LTD.

- HINDUSTAN SYRINGES & MEDICAL DEVICES LTD.

- MICROGENE DIAGNOSTIC SYSTEMS(P) LTD.

- ROSSMAX INTERNATIONAL LTD.

제12장 부록

LSH 25.10.15The global diabetes care devices market is projected to reach 61.2 billion in 2030 from USD 34.3 billion in 2025, at a CAGR of 12.3% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product Type, Disease Type, Patient Care Settings, and Region |

| Regions covered | Europe, North America, Asia Pacific, Latin America, Middle East, and Africa |

The rising prevalence of diabetes, driven by sedentary lifestyles, obesity, and changes in dietary habits, is significantly increasing the demand for effective monitoring and management tools for diabetes care. The growing geriatric population, which is more susceptible to type 2 diabetes and its complications, further boosts the demand for glucose monitoring devices. Additionally, increased awareness and a greater focus on preventive healthcare are encouraging early diagnosis and self-management tools, which are enhancing the use of home-based devices. Technological advancements also make these devices more appealing to both patients and healthcare providers.

Wider market adoption may be limited by the high cost of devices and, in certain markets, low consumer acceptance or adherence.

By product type, the blood glucose monitoring segment is expected to account for the largest share of the global diabetes care devices market.

The global diabetes care devices market is divided into three main segments: blood glucose monitoring systems, insulin delivery devices, and diabetes management mobile applications. The blood glucose monitoring system segment holds the largest market share due to its strong functional advantages and medical support. These devices provide accurate real-time tracking, which helps prevent complications. Rising diabetes prevalence, physician recommendations, and innovations like smartphone integration further increase home adoption settings.

By patient care settings, the self/home healthcare segment is expected to account for the largest share of the global diabetes care devices market.

The global diabetes care devices market is segmented by patient care settings into the following categories: self/home healthcare and hospitals & diabetes specialty clinics. Among these, the self/home healthcare segment is expected to hold the largest market share. The increasing demand for convenient, cost-effective devices is driving growth in this area. Many people rely on self-testing devices, such as continuous blood glucose monitors, which reduce the need for clinical visits. Rising awareness of preventive care, advancements in both portable and connected technologies, and an increasing geriatric population, which is more susceptible to type 2 diabetes, are fueling the growth in demand for self/homecare devices.

By disease type, the type 2 diabetes segment is expected to account for the largest share of the global diabetes care devices market.

This dominance is mainly driven by lifestyle-related risk factors such as sedentary behavior, dietary habits, and increasing obesity, which make type 2 diabetes more prevalent in the population. The rise in obesity, fueled by high-calorie diets, processed foods, and physical inactivity, is the primary contributor to its rapid growth. Urbanization and modernization have further reduced daily physical activity while increasing access to fast food, leading to rising rates across both developed and developing countries. The disease is also strongly age-related, with older adults being more susceptible, and as global populations age, the prevalence naturally continues to rise.

The diabetes care devices market in the Asia Pacific is expected to grow at the highest CAGR during the forecast period.

The rapid rise in diabetes cases and the increasing demand for advanced diabetes care are driving a strong need for diabetes care devices in the Asia Pacific region. Additionally, global leaders in diabetes care products are expanding their footprint in the Asia Pacific by launching advanced formulations and digitally integrated diabetes care devices.

A breakdown of the primary participants (supply side) for the diabetes care devices market referred to in this report is provided below:

- By Company Type: Tier 1 (30%), Tier 2 (35%), and Tier 3 (35%)

- By Designation: C-level Executives (20%), Directors (35%), and Others (45%)

- By Region: North America (30%), Europe (25%), Asia Pacific (20%), Latin America (20%), Middle East & Africa (2%), GCC Countries (3%)

Prominent players in the diabetes care devices market include F. Hoffmann Roche Ltd (Switzerland), Abbott Laboratories (US), Medtronic (Ireland), Dexcom (US), Insulet Corporation (US), B Braun Se (Germany), Embecta Corp (US), Nipro (Japan), Senseonics (US), Ypsomed (Switzerland), i-Sens, Inc (South Korea), Tandem Diabetes Care, Inc (US), ACON LABORATORIES, INC (US), ARKRAY, INC(Japan), Terumo Corporation (Japan), Sinocare Inc (Japan), Waveform Diabetes (AgaMatrix) (US), Lifescan IP Holdings (US), SD Biosensor, Inc (South Korea), DeBiotech SA. (Switzerland), Sungshim Medical Co, Ltd (South Korea), Sooil Developments Co., Ltd (South Korea), Hindustan syringes and medical devices (India), Microgene Diagnostic Systems Pvt Ltd (India), Rossmax International Ltd (Taiwan)

Research Coverage

The report provides an analysis of the diabetes care devices market, focusing on estimating the market size and potential for future growth across various segments, including distribution channels, regions, indications, and product types. Additionally, the report features a competitive analysis of the key players in the market, detailing their company profiles, product and service offerings, recent developments, and key market insights strategies.

Reasons to Buy the Report

The report offers valuable insights for both market leaders and new entrants in the diabetes care devices industry, providing estimated revenue figures for the entire market and its subsegments. It helps stakeholders understand the competitive landscape, allowing them to better position their businesses and develop effective go-to-market strategies. Additionally, the report emphasizes key market drivers, restraints, challenges, and opportunities, assisting stakeholders in assessing the current state of the market.

This report provides insights into the following pointers:

- Analysis of key drivers (growing burden of diabetes care globally, rising geriatric population, increasing awareness and preventive healthcare focus, technological advancements), restraints (high cost of innovative diabetes devices, limited awareness in emerging markets), opportunities (enhanced diabetes management with advanced patient-implantable CGM devices) and challenges (limited sensor durability leading to repeated and costly replacements, high cost and socio-economic disparities in access to devices).

- Market Penetration: This report provides detailed information on the product portfolios offered by major players in the global diabetes care devices market. It covers various segments, including product types, patient care settings, and regions.

- Product Enhancement/Innovation: Comprehensive details about new product launches and anticipated trends in the global diabetes care devices market.

- Market Development: Thorough knowledge and analysis of the profitable rising markets by product types, patient care settings, disease type, and regions.

- Market Diversification: Comprehensive information about newly launched products and services, expanding markets, current advancements, and investments in the global diabetes care devices market.

- Competitive Assessment: Thorough evaluation of the market shares, growth plans, offerings of products and services, and capacities of the major competitors in the global diabetes care devices market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

- 1.5.1 REFINEMENTS IN SCOPE

- 1.5.2 COVERAGE OF NEW PLAYERS

- 1.5.3 ADDITION OF SEGMENTS

- 1.5.4 UPDATED MARKET DEVELOPMENTS OF PROFILED PLAYERS

- 1.5.5 UPDATED FINANCIAL INFORMATION/PRODUCT PORTFOLIOS OF PLAYERS

- 1.5.6 UPDATED GEOGRAPHIC ANALYSIS

- 1.5.7 IMPACT OF AI

- 1.5.8 IMPACT OF US TARIFF

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key sources of secondary data

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary sources

- 2.1.2.2 Key objectives of primary research

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 REVENUE SHARE ANALYSIS

- 2.2.2 BOTTOM-UP APPROACH (SUPPLY-SIDE ANALYSIS)

- 2.2.3 COMPANY PRESENTATIONS & PRIMARY INTERVIEWS

- 2.2.4 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 MARKET SHARE ESTIMATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.6.1 SCOPE-RELATED LIMITATIONS

- 2.6.2 METHODOLOGY-RELATED LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 DIABETES CARE DEVICES MARKET OVERVIEW

- 4.2 ASIA PACIFIC: DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE AND COUNTRY (2024)

- 4.3 DIABETES CARE DEVICES MARKET: GEOGRAPHICAL MIX

- 4.4 DIABETES CARE DEVICES MARKET: REGIONAL MIX

- 4.5 DIABETES CARE DEVICES MARKET: DEVELOPED VS. EMERGING MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surging global diabetes patient population requiring continuous care

- 5.2.1.2 Rapidly growing geriatric population

- 5.2.1.3 Increasing efforts toward public awareness and preventive healthcare

- 5.2.1.4 Rapid technological advancements in diabetes care

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of advanced diabetes care devices

- 5.2.2.2 Limited awareness in emerging healthcare markets

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Enhanced diabetes management with advanced patient-implantable continuous glucose monitoring devices

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited sensor durability with repeated and costly replacements

- 5.2.4.2 High cost and socio-economic disparities in access to diabetes care devices

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 RISING ADOPTION OF DIGITAL HEALTH SOLUTIONS AND TELEMEDICINE INTEGRATION IN DIABETES CARE

- 5.3.2 ACCELERATING SHIFT TOWARD HOME-BASED, PATIENT-CENTRIC, AND SELF-MANAGED DIABETES CARE

- 5.4 TECHNOLOGY ANALYSIS

- 5.4.1 KEY TECHNOLOGIES

- 5.4.1.1 Implantable sensors

- 5.4.1.2 Smart automated insulin pumps

- 5.4.2 COMPLEMENTARY TECHNOLOGIES

- 5.4.2.1 Telehealth services

- 5.4.3 ADJACENT TECHNOLOGIES

- 5.4.3.1 Cutting-edge and smartphone-enabled diabetes self-management technologies

- 5.4.1 KEY TECHNOLOGIES

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND OF DIABETES CARE DEVICES, BY KEY PLAYER, 2022-2024

- 5.5.2 AVERAGE SELLING PRICE TREND OF DIABETES CARE DEVICES, BY REGION, 2022-2024

- 5.6 ECOSYSTEM ANALYSIS

- 5.6.1 ROLE IN ECOSYSTEM

- 5.7 REIMBURSEMENT SCENARIO ANALYSIS

- 5.8 VALUE CHAIN ANALYSIS

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.9.2 BARGAINING POWER OF SUPPLIERS

- 5.9.3 BARGAINING POWER OF BUYERS

- 5.9.4 THREAT OF SUBSTITUTES

- 5.9.5 THREAT OF NEW ENTRANTS

- 5.10 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 KEY BUYING CRITERIA

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT DATA FOR HS CODE 9027, 2020-2024

- 5.11.2 EXPORT DATA FOR HS CODE 9027, 2020-2024

- 5.12 REGULATORY ANALYSIS

- 5.12.1 REGULATORY FRAMEWORK

- 5.12.1.1 North America

- 5.12.1.1.1 US

- 5.12.1.1.2 Canada

- 5.12.1.2 Europe

- 5.12.1.3 Asia Pacific

- 5.12.1.3.1 China

- 5.12.1.3.2 Japan

- 5.12.1.3.3 India

- 5.12.1.4 Latin America

- 5.12.1.4.1 Brazil

- 5.12.1.4.2 Mexico

- 5.12.1.5 Middle East

- 5.12.1.6 Africa

- 5.12.1.1 North America

- 5.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES AND OTHER ORGANIZATIONS

- 5.12.1 REGULATORY FRAMEWORK

- 5.13 PATENT ANALYSIS

- 5.13.1 PATENT PUBLICATION TRENDS FOR DIABETES CARE DEVICES MARKET

- 5.13.2 JURISDICTION ANALYSIS: TOP APPLICANTS FOR PATENTS IN DIABETES CARE DEVICES

- 5.13.3 LIST OF MAJOR PATENTS

- 5.14 KEY CONFERENCES & EVENTS, 2025-2026

- 5.15 ADJACENT MARKET ANALYSIS

- 5.16 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.17 UNMET NEEDS/END-USER EXPECTATIONS

- 5.17.1 UNMET NEEDS

- 5.17.2 END-USER EXPECTATIONS

- 5.18 IMPACT OF AI/GEN AI IN DIABETES CARE DEVICES MARKET

- 5.19 CASE STUDY ANALYSIS

- 5.19.1 LONG-TERM GLUCOSE MONITORING FOR SENSITIVE SKIN PATIENTS USING SENSEONICS' EVERSENSE E3 IMPLANTABLE SENSORS

- 5.19.2 ENHANCING PATIENT ADHERENCE AND GLYCEMIC CONTROL USING ABBOTT'S FREESTYLE LIBRE 2 CGM

- 5.19.3 MEDTRONIC MINIMED INSULIN PUMP TO ENHANCE GLUCOSE CONTROL AND IMPROVE DAILY MANAGEMENT FOR PEOPLE WITH DIABETES

- 5.20 INVESTMENT & FUNDING SCENARIO

- 5.21 IMPACT OF 2025 US TARIFF ON DIABETES CARE DEVICES MARKET

- 5.21.1 INTRODUCTION

- 5.21.2 KEY TARIFF RATES

- 5.21.3 PRICE IMPACT ANALYSIS

- 5.21.4 IMPACT ON END-USE INDUSTRIES

6 DIABETES CARE DEVICES MARKET, BY PRODUCT TYPE

- 6.1 INTRODUCTION

- 6.2 BLOOD GLUCOSE MONITORING SYSTEMS

- 6.2.1 SELF-MONITORING BLOOD GLUCOSE SYSTEMS

- 6.2.1.1 Need for self-monitoring in type 1 and type 2 diabetes management to propel market growth

- 6.2.2 CONTINUOUS GLUCOSE MONITORING SYSTEMS

- 6.2.2.1 Technological advancements in continuous glucose monitoring systems to track trends and enhance diabetes management

- 6.2.3 TEST STRIPS/TEST PAPERS

- 6.2.3.1 Shift toward non-invasive methods for blood glucose monitoring to restrain market growth

- 6.2.4 LANCETS/LANCING DEVICES

- 6.2.4.1 Need for infection and accidental pricking to increase popularity of safety lancets/lancing devices

- 6.2.1 SELF-MONITORING BLOOD GLUCOSE SYSTEMS

- 6.3 INSULIN DELIVERY DEVICES

- 6.3.1 INSULIN PUMPS & ACCESSORIES

- 6.3.1.1 Tethered pumps

- 6.3.1.1.1 Increase in collaborations and partnerships among companies to develop integrated insulin systems

- 6.3.1.2 Tubeless insulin pumps

- 6.3.1.2.1 Use of artificial intelligence to replace traditional vial-syringe combinations with tubeless pumps

- 6.3.1.1 Tethered pumps

- 6.3.2 INSULIN PENS

- 6.3.2.1 Reusable insulin pens

- 6.3.2.1.1 Technology innovations and cost-effectiveness to boost market growth

- 6.3.2.2 Disposable insulin pens

- 6.3.2.2.1 Ease of use, accurate dose measurement, and built-in cartridges to propel segment growth

- 6.3.2.1 Reusable insulin pens

- 6.3.3 PEN NEEDLES

- 6.3.3.1 Reduced chances of infection and accidental pricking to augment market growth

- 6.3.4 INSULIN SYRINGES & NEEDLES

- 6.3.4.1 Safety concerns and need for affordable alternatives to limit market growth

- 6.3.5 OTHER INSULIN DELIVERY DEVICES

- 6.3.1 INSULIN PUMPS & ACCESSORIES

- 6.4 DIABETES MANAGEMENT MOBILE APPLICATIONS

- 6.4.1 INCREASING PREVALENCE OF DIABETES AND RISING ADOPTION OF BLOOD GLUCOSE TRACKING APPLICATIONS TO DRIVE MARKET

7 DIABETES CARE DEVICES MARKET, BY DISEASE TYPE

- 7.1 INTRODUCTION

- 7.2 TYPE 1 DIABETES

- 7.2.1 CHRONIC NATURE OF TYPE 1 DIABETES AND NEED FOR IMPROVED DIAGNOSIS TO AID MARKET GROWTH

- 7.3 TYPE 2 DIABETES

- 7.3.1 RISING BURDEN OF TYPE 2 DIABETES TO INCREASE NEED FOR SCALABLE CARE DEVICE SOLUTIONS

8 DIABETES CARE DEVICES MARKET, BY PATIENT CARE SETTINGS

- 8.1 INTRODUCTION

- 8.2 SELF/HOME HEALTHCARE

- 8.2.1 INCREASING AFFORDABILITY OF SELF-MONITORING SYSTEMS AND INSULIN DELIVERY DEVICES TO FUEL PREFERENCE

- 8.3 HOSPITALS & DIABETES SPECIALTY CLINICS

- 8.3.1 RISING DEMAND FOR POINT-OF-CARE TESTING IN HOSPITALS TO BOOST MARKET GROWTH

9 DIABETES CARE DEVICES MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 US to dominate North American diabetes care devices market during forecast period

- 9.2.3 CANADA

- 9.2.3.1 High prevalence of diabetes and supportive government disease management initiatives to spur market growth

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Advanced healthcare infrastructure to drive adoption of innovative diabetes care devices

- 9.3.3 UK

- 9.3.3.1 Increased government support and improved research funding to propel market growth

- 9.3.4 FRANCE

- 9.3.4.1 Substantial national spending on diabetes management and robust healthcare infrastructure to aid market growth

- 9.3.5 ITALY

- 9.3.5.1 High diabetes-related mortality and increased public investment to augment market growth

- 9.3.6 SPAIN

- 9.3.6.1 Minimal co-payments and full reimbursement to drive market

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 Huge diabetic population and high government healthcare spending to spur market growth

- 9.4.3 JAPAN

- 9.4.3.1 Increased geriatric population and supportive healthcare policies to support market growth

- 9.4.4 INDIA

- 9.4.4.1 Rise in diabetes cases and affordable local manufacturing to fuel diabetes care devices demand

- 9.4.5 AUSTRALIA

- 9.4.5.1 Comprehensive government-backed initiatives and subsidies to support market growth

- 9.4.6 SOUTH KOREA

- 9.4.6.1 Rise in diabetes cases and strong government healthcare support to boost market growth

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.5.2 BRAZIL

- 9.5.2.1 Increasing adoption of advanced diabetes monitoring and management solutions to aid market growth

- 9.5.3 MEXICO

- 9.5.3.1 Supportive regulatory frameworks and high burden of diabetes to propel market growth

- 9.5.4 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 INCREASING AWARENESS OF EARLY DIAGNOSIS AND GLYCEMIC CONTROL FOR DIABETES MANAGEMENT TO FAVOR MARKET GROWTH

- 9.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 9.7 GCC COUNTRIES

- 9.7.1 RISE IN DIABETES PREVALENCE AND HIGH PER CAPITA HEALTHCARE EXPENDITURE TO DRIVE MARKET

- 9.7.2 MACROECONOMIC OUTLOOK FOR GCC COUNTRIES

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN DIABETES CARE DEVICES MARKET

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Region footprint

- 10.5.5.3 Product type footprint

- 10.5.5.4 Patient care settings footprint

- 10.5.5.5 Disease type footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SMEs

- 10.6.5.2 Competitive benchmarking of key startups/SMEs

- 10.7 COMPANY VALUATION & FINANCIAL METRICS

- 10.7.1 FINANCIAL METRICS

- 10.7.2 COMPANY VALUATION

- 10.8 BRAND/PRODUCT COMPARISON

- 10.9 R&D EXPENDITURE OF KEY PLAYERS

- 10.10 COMPETITIVE SCENARIO

- 10.10.1 PRODUCT LAUNCHES AND APPROVALS

- 10.10.2 DEALS

- 10.10.3 EXPANSIONS

- 10.10.4 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 F. HOFFMAN-LA ROCHE LTD.

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches & approvals

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Expansions

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses & competitive threats

- 11.1.2 ABBOTT

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches & approvals

- 11.1.2.3.2 Deals

- 11.1.2.3.3 Expansions

- 11.1.2.3.4 Other developments

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses & competitive threats

- 11.1.3 DEXCOM, INC.

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches & approvals

- 11.1.3.3.2 Deals

- 11.1.3.3.3 Expansions

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses & competitive threats

- 11.1.4 MEDTRONIC

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches & approvals

- 11.1.4.3.2 Deals

- 11.1.4.3.3 Expansions

- 11.1.4.3.4 Other developments

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses & competitive threats

- 11.1.5 B. BRAUN SE

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions offered

- 11.1.5.3 MnM view

- 11.1.5.3.1 Right to win

- 11.1.5.3.2 Strategic choices

- 11.1.5.3.3 Weaknesses & competitive threats

- 11.1.6 EMBECTA CORP.

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product approvals

- 11.1.6.3.2 Deals

- 11.1.6.3.3 Expansions

- 11.1.6.3.4 Other developments

- 11.1.7 NIPRO

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Expansions

- 11.1.8 SENSEONICS

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product launches & approvals

- 11.1.8.3.2 Deals

- 11.1.8.3.3 Other developments

- 11.1.9 YPSOMED

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches & approvals

- 11.1.9.3.2 Deals

- 11.1.9.3.3 Expansions

- 11.1.9.3.4 Other developments

- 11.1.10 I-SENS, INC.

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product approvals

- 11.1.10.3.2 Deals

- 11.1.11 TANDEM DIABETES CARE, INC.

- 11.1.11.1 Business overview

- 11.1.11.2 Products/Solutions offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Product launches & approvals

- 11.1.11.3.2 Deals

- 11.1.12 INSULET CORPORATION

- 11.1.12.1 Business overview

- 11.1.12.2 Products/Solutions offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Product launches & approvals

- 11.1.12.3.2 Deals

- 11.1.12.3.3 Expansions

- 11.1.12.3.4 Other developments

- 11.1.13 ACON LABORATORIES, INC.

- 11.1.13.1 Business overview

- 11.1.13.2 Products/Solutions offered

- 11.1.14 ARKRAY, INC.

- 11.1.14.1 Business overview

- 11.1.14.2 Products/Solutions offered

- 11.1.14.3 Recent developments

- 11.1.14.3.1 Product launches

- 11.1.15 TERUMO CORPORATION

- 11.1.15.1 Business overview

- 11.1.15.2 Products/Solutions offered

- 11.1.15.3 Recent developments

- 11.1.15.3.1 Product launches

- 11.1.15.3.2 Deals

- 11.1.15.3.3 Expansions

- 11.1.15.3.4 Other developments

- 11.1.1 F. HOFFMAN-LA ROCHE LTD.

- 11.2 OTHER PLAYERS

- 11.2.1 SINOCARE

- 11.2.2 AGAMATRIX

- 11.2.3 LIFESCAN IP HOLDINGS, LLC

- 11.2.4 SD BIOSENSOR, INC.

- 11.2.5 DEBIOTECH S.A.

- 11.2.6 SUNGSHIM MEDICAL CO., LTD.

- 11.2.7 SOOIL DEVELOPMENTS CO., LTD.

- 11.2.8 HINDUSTAN SYRINGES & MEDICAL DEVICES LTD.

- 11.2.9 MICROGENE DIAGNOSTIC SYSTEMS (P) LTD.

- 11.2.10 ROSSMAX INTERNATIONAL LTD.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS