|

시장보고서

상품코드

1833291

커넥티드 오토바이 시장 : 이륜차 유형별, 하드웨어 유형별, 추진 유형별, 네트워크 유형별, 최종사용자별, 용도별, 지역별 - 예측(-2032년)Connected Motorcycle Market by Two-wheeler Type, Hardware Type, Propulsion Type, Network Type, End User, Application, and Region - Global Forecast to 2032 |

||||||

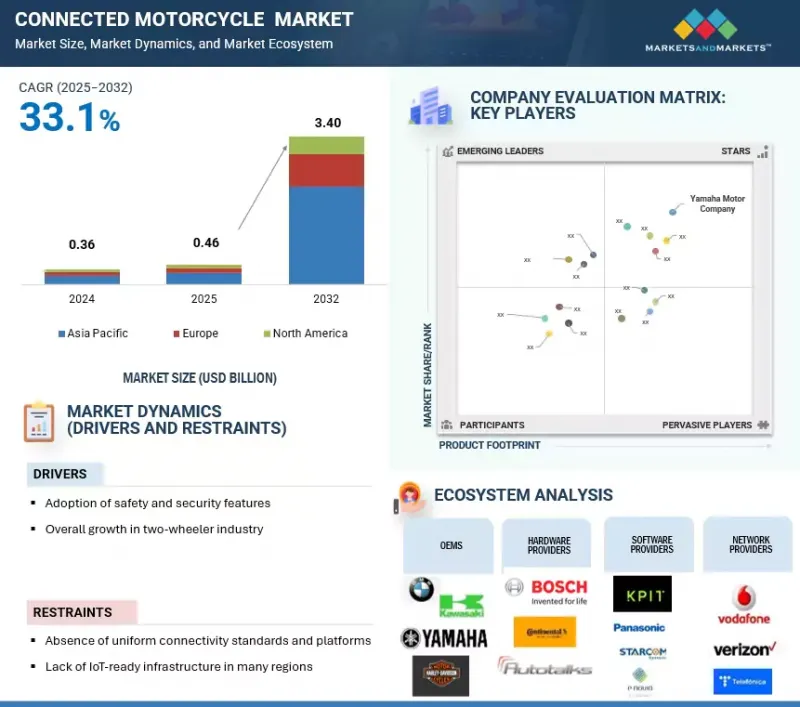

세계의 커넥티드 오토바이 시장 규모는 2025년 4억 6,000만 달러에서 2032년까지 34억 달러에 이르고, 예측 기간에 CAGR 33.1%의 성장이 전망됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2032년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2032년 |

| 단위 | 100만 달러 |

| 부문 | 이륜차 유형, 하드웨어 유형, 추진 유형, 네트워크 유형, 최종사용자, 용도, 지역 |

| 대상 지역 | 아시아태평양, 유럽, 북미 |

커넥티드 바이크 시장은 빠르게 성장하고 있으며, 안전과 보안 기능이 보급을 주도하고 있습니다. 사고율 증가, 유럽에서 CEN/TS 17249에 따른 eCall 의무화 등 규제 강화, 보험사의 인센티브 증가로 인해 eCall, 도난 차량 추적, 지오펜싱, 라이더 지원 경고 등의 기능이 오토바이 OEM 전략의 중심이 되고 있습니다. 프리미엄 모델뿐만 아니라 중급 차량 및 차량 운영자들도 라이더 보호, 자산 보안 및 운영 가동 시간을 개선하기 위해 이러한 시스템을 통합하고 있습니다. IoT, V2X, 4G/5G의 발전에 힘입어 안전 관련 커넥티드 서비스가 커넥티드 바이크 시장에서 가장 큰 수익 기여를 할 것으로 예측됩니다.

"안전 및 보안 부문이 예측 기간 동안 가장 큰 점유율을 차지할 것으로 예측됩니다."

용도별로는 안전 및 보안 부문이 예측 기간 동안 가장 큰 점유율을 차지할 것으로 예측됩니다. 교통 위험에 대한 라이더의 인식 증가, 이륜차 모빌리티의 안전 강화를 위한 정부 규제, 커넥티드 비상 대응 기능의 급속한 발전이 이 부문의 성장을 가속하고 있습니다. Yamaha Motor Company, BMW Group, Harley Davidson 등 주요 OEM은 eCall, 충돌 감지, 도난 추적 등의 안전 보안 기능을 표준으로 제공합니다. 아시아태평양은 여전히 이 부문의 성장 동력이며, 적극적인 도시화와 규제 강화에 힘입어 2024년 6억 3,600만 달러에서 2032년 7억 2,950만 달러로 급증할 것으로 예측됩니다.

내비게이션 부문은 2032년까지 9억 1,750만 달러(CAGR 29.6%)에 달할 것으로 예상되며, OEM들은 턴바이턴 안내, 교통 경보, 경로 최적화 등의 서비스 채택이 증가함에 따라 사망 사고와 도난을 즉각적으로 측정 가능한 형태로 감소시킬 수 있는 안전 기능에 대한 투자를 우선시하고 있습니다. 안전 기능에 대한 투자를 우선시하고 있습니다. 안전 보안 기능은 신흥 시장의 저렴한 통근용 자전거부터 선진국 시장의 프리미엄 투어링 모델까지 모든 계층의 자전거에 제공되고 있으며, 커넥티드 바이크 생태계의 기초로서 안전 보안이 강화되고 있습니다.

"ICE 부문이 예측 기간 동안 크게 성장할 것으로 예측됩니다."

추진 유형별로는 ICE 부문이 예측 기간 동안 크게 성장할 것으로 예측됩니다. 전 세계 커넥티드 ICE 모델 출하량은 2025년 525만 대에서 2032년까지 약 2,315만 대로 증가하여 연평균 23.6%의 높은 성장률을 나타낼 것으로 예측됩니다. 아시아태평양이 ICE 부문의 급격한 판매 증가를 주도하고 있으며, 연간 ICE 판매량은 2025년 451만 대에서 2032년까지 2,130만 대 이상으로 증가할 것으로 예측됩니다. 이는 거대한 통근용 자전거 사용자층, 저렴한 가격의 텔레매틱스 패키지, 강화된 안전 표준으로 인해 연결성 통합을 촉진하는 안전 표준에 힘입은 것입니다. 또한, 유럽과 북미도 이 증가에 기여하고 있습니다. 통신사의 데이터 요금제 묶음 상품이 저가화 되고, 보험사들이 사용량 기반 보험료 플랜을 도입하면서 ICE의 기세는 더욱 강화될 것으로 보입니다. 전기화는 배터리 비용의 하락과 무공해 구역의 혜택을 받겠지만, ICE 바이크가 많은 수의 가동과 저렴한 가격으로 인해 적어도 향후 10년간은 커넥티드 이륜차에서 ICE 바이크가 큰 점유율을 차지할 것으로 예측됩니다.

"아시아태평양은 예측 기간 동안 커넥티드 이륜차 시장의 주요 지역이 될 것으로 예측됩니다."

아시아태평양은 거대한 이륜차 사용자 기반, 수많은 통근 차량, 가속화되는 디지털 인프라 구축에 힘입어 가장 빠르게 성장하는 커넥티드 바이크 시장이 될 것으로 예측됩니다. 이 지역의 커넥티드 이륜차 연간 판매량은 2025년 약 707만 대에서 2032년까지 약 2,913만 대로 급증할 것으로 예상되며, 예측 기간 동안 CAGR은 22.4%로 활발하게 성장할 것으로 전망됩니다. 아시아태평양 시장 성장률은 북미와 유럽의 성장률을 크게 상회하고 있습니다.

세계의 커넥티드 바이크(Connected Bike) 시장에 대해 조사 분석했으며, 주요 촉진요인과 저해요인, 경쟁 구도, 향후 동향 등의 정보를 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

- 커넥티드 오토바이 시장 기업에 있어서 매력적인 기회

- 커넥티드 오토바이 시장 : 이륜차 유형별

- 커넥티드 오토바이 시장 : 하드웨어별

- 커넥티드 오토바이 시장 : 추진 유형별

- 커넥티드 오토바이 시장 : 네트워크 유형별

- 커넥티드 오토바이 시장 : 최종사용자별

- 커넥티드 오토바이 시장 : 용도별

- 커넥티드 오토바이 시장 : 지역별

제5장 시장 개요

- 서론

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 커넥티드 오토바이 시장 : 시장 역학의 영향

제6장 산업 동향

- 고객의 비즈니스에 영향을 미치는 동향과 혼란

- 생태계 분석

- 공급망 분석

- 하드웨어 프로바이더

- 소프트웨어 프로바이더

- 서비스 플랫폼 프로바이더

- 네트워크 프로바이더

- OEM

- 최종사용자

- 투자 및 자금조달 시나리오

- 주요 이해관계자와 구입 기준

- 주요 컨퍼런스 및 이벤트(2025년-2026년)

- OEM 접속 서비스

- 비즈니스 모델

- 구독 기반 접속성 서비스

- BaaS(Battery-as-a-Service)와 스와핑 모델

- 종량 빌링 제 플랫폼

- 데이터 수익화

- 이륜차 산업 성장 기회

- 세계의 오토바이와 스쿠터 판매

- 유럽

- 아시아태평양

- 북미

- ICE차와 전기자동차 판매(2025년·2032년)

- 커넥티드 기술 보급률(2025년·2032년)

- 사례 연구 분석

제7장 기술, 특허, 디지털, AI 채택을 통한 전략적 파괴

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 특허 분석

- AI/생성형 AI의 영향

제8장 지속가능성과 규제 상황

- 규제 상황

- 규제기관, 정부기관 및 기타 조직 리스트

- 규제 구조

제9장 커넥티드 오토바이 시장 : 이륜차 유형별

- 서론

- 오토바이

- 스쿠터 및 모페드

- 중요 인사이트

제10장 커넥티드 오토바이 시장 : 하드웨어별

- 서론

- 임베디드

- 통합

- 중요 인사이트

제11장 커넥티드 오토바이 시장 : 추진 유형별

- 서론

- ICE

- 전기

- 중요 인사이트

제12장 커넥티드 오토바이 시장 : 네트워크 유형별

- 서론

- 3G/4G

- 5G

- 기타

- 중요 인사이트

제13장 커넥티드 오토바이 시장 : 최종사용자별

- 서론

- 개인

- 상업

- 중요 인사이트

제14장 커넥티드 오토바이 시장 : 용도별

- 서론

- 세이프티 및 보안

- 내비게이션

- 차량 건강 및 진단

- 기타 용도

- 중요 인사이트

제15장 커넥티드 오토바이 시장 : 지역별

- 서론

- 아시아태평양

- 거시경제 전망

- 중국

- 인도

- 일본

- 필리핀

- 인도네시아

- 베트남

- 태국

- 기타 아시아태평양

- 유럽

- 거시경제 전망

- 프랑스

- 독일

- 이탈리아

- 스페인

- 영국

- 기타 유럽

- 북미

- 거시경제 전망

- 미국

- 캐나다

- 멕시코

제16장 경쟁 구도

- 개요

- 주요 시장 진출기업의 전략/강점

- 시장 점유율 분석(2024년)

- 주요 기업의 매출 분석

- 기업 평가와 재무 지표

- 브랜드 비교

- 기업 평가 매트릭스 : 주요 기업(OEM)(2024년)

- 기업 평가 매트릭스 : 주요 기업(기술 제공업체)(2024년)

- 경쟁 시나리오

제17장 기업 개요

- 주요 기업(OEM)

- YAMAHA MOTOR CO., LTD.

- KAWASAKI MOTORS CORP.

- SUZUKI MOTOR CORPORATION

- HARLEY-DAVIDSON

- BMW AG

- 주요 기업 : 하드웨어 프로바이더

- BOSCH LIMITED

- CONTINENTAL AG

- AUTOTALKS

- PANASONIC CORPORATION

- SIEMENS

- 주요 기업 : 소프트웨어 프로바이더

- STARCOM SYSTEMS LLC

- COMODULE OU

- KPIT TECHNOLOGIES LTD

- ITURAN GLOBAL

- E-NOVIA S.P.A

- 주요 기업 : 서비스 플랫폼 프로바이더

- IBM

- AMAZON

- GOOGLE LLC

- APPLE INC.

- DXC TECHNOLOGY COMPANY

- 주요 기업 : 네트워크 프로바이더

- VODAFONE GROUP

- VERIZON

- TELEFONICA S.A.

- AERIS

- CHINA TELECOM GLOBAL LIMITED

- 기타 주요 기업

- HERO MOTOCORP LTD

- HONDA MOTOR CO., LTD.

- TRIUMPH MOTORCYCLES

- TVS MOTORS COMPANY

- KEEWAY

- ROYAL ENFIELD

- KTM AG

- DUCATI MOTOR HOLDING S.P.A

- IAV

- FACOMSA

- HARMAN INTERNATIONAL

- TOMTOM INTERNATIONAL BV

- NVIDIA CORPORATION

- AIRTEL INDIA

- QUALCOMM TECHNOLOGIES, INC.

- NXP SEMICONDUCTORS

- 주요 스타트업, 신규 참여 기업

- ZERO MOTORCYCLES, INC.

- TORK MOTORS

- TE CONNECTIVITY

- EMBIEN TECHNOLOGIES INDIA PVT LTD.

- CALIMOTO GMBH

- NAVINFO

- INDIAN MOTORCYCLE INTERNATIONAL, LLC

- THE FLOOW LIMITED

- TELTONIKA

- PARKOFON INC. DBA SHEEVA.AI

- SIBROS TECHNOLOGIES INC.

- TWILIO INC.

- COSMO CONNECTED

- CONCIRRUS LTD

- RIDE VISION

- AMODO

- BLUARMOR

- COBI.BIKE

- SENA TECHNOLOGIES INC.

- YADEA TECHNOLOGY GROUP CO., LTD.

- BAJAJ AUTO LTD.

- NIU INTERNATIONAL

- PIAGGIO & C. SPA

- KYMCO

- ATHER ENERGY

- OLA ELECTRIC MOBILITY LTD

제18장 MARKETSANDMARKETS의 제안

- 아시아태평양은 단기적으로 중점 지역이 된다

- 아시아태평양은 장기적으로 가장 급성장하는 시장이 된다

- 저가격 오토바이 커넥티드 기능은 제조업체에 있어서 중요 초점이 될 가능성이 있다

- 커넥티드 오토바이 시장 성장을 가속시키는 기술 진보

- 원활한 솔루션 제공을 향한 커넥티드 오토바이 에코시스템 기업간 파트너십

- 결론

제19장 부록

LSH 25.10.17The global connected motorcycle market is projected to reach USD 3.40 billion by 2032, growing from USD 0.46 billion in 2025 at a CAGR of 33.1% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million) |

| Segments | Two-wheeler Type, Hardware Type, Propulsion Type, Network Type, End User, Application, and Region |

| Regions covered | Asia Pacific, Europe, and North America |

The connected motorcycle market is rapidly expanding, with safety and security features leading to adoption. Rising accident rates, regulatory pushes such as CEN/TS 17249-compliant eCall mandate in Europe, and growing insurer incentives are making features like eCall, stolen vehicle tracking, geo-fencing, and rider assistance alerts central to two-wheeler OEM strategies. Besides premium models, mid-range and fleet operators increasingly integrate these systems to improve rider protection, asset security, and operational uptime. Backed by IoT, V2X, and 4G/5G advances, safety-related connected services are expected to remain the largest revenue contributor in the connected motorcycle market.

"The safety & security segment is projected to capture the largest share during the forecast period."

By application, the safety & security segment is projected to account for the largest share during the forecast period. The growing rider awareness about road hazards, government regulations for safer two-wheeler mobility, and rapid advances in connected emergency response features drive the segment's growth. Major OEMs like Yamaha Motor Company, BMW Group, and Harley Davidson provide safety & security features, such as eCall, crash detection, and theft tracking as standard in their product offerings. Asia Pacific remains the segment's growth engine, with safety and security revenues projected to jump from USD 63.6 million in 2024 to USD 729.5 million in 2032, helped by aggressive urbanization and supportive regulations.

While the navigation segment is projected to reach USD 917.5 million by 2032 (29.6% CAGR), due to increased adoption of services like turn-by-turn guidance, traffic alerts, and route optimization, OEMs are prioritizing investments in safety functions that deliver immediate, measurable reductions in fatalities and theft. Safety and security features are being provided across all tiers of motorcycles, from affordable commuter bikes in emerging markets to premium touring models in developed markets, reinforcing safety and security as the basic layer of connected-motorcycle ecosystems.

"The ICE segment is projected to achieve significant growth during the forecast period."

By propulsion type, the ICE segment is projected to achieve significant growth during the forecast period. Global shipments of connected ICE models are forecast to rise from 5.25 million units in 2025 to roughly 23.15 million units by 2032, registering a robust 23.6% CAGR. Asia Pacific underpins this surge of sales in the ICE segment, and annual ICE volumes in Asia Pacific will climb from 4.51 million units in 2025 to more than 21.30 million units by 2032, driven by a massive commuter-bike base, affordable telematics packages, and tightening safety mandates that encourage factory-fitted connectivity. Europe and North America also contribute to this rise. Widespread low data-plan prices bundled by telecom operators, and insurers' uptake of usage-based premiums plans further reinforce ICE momentum. Although electrification benefits from falling battery costs and zero-emission zones, the sheer installed base and continuing affordability of ICE motorcycles ensure they will command a significant share of connected two-wheeler volumes for at least the next decade.

"Asia Pacific is projected to be the dominant region for the connected motorcycle market during the forecast period."

Asia Pacific is projected to be the fastest-growing connected motorcycle market, supported by a massive two-wheeler user base, many commuters, and accelerating digital infrastructure rollouts. Annual connected two-wheeler sales in the region are forecast to leap from about 7.07 million units in 2025 to nearly 29.13 million units by 2032, translating to a vigorous 22.4% CAGR during the forecast period. The market growth in Asia Pacific is well ahead of the growth rates projected in North America and Europe.

This momentum is underpinned by government safety mandates, affordable 4G/5G data plans, and OEM strategies that bundle turn-by-turn navigation, e-call, and theft tracking on even entry-level models. China, India, and Southeast Asian nations lead the surge as urban congestion fuels the demand for smarter commuting solutions and last-mile delivery fleets.

Regulatory mandates, such as India's AIS-140 telematics standard and Indonesia's push for connected EV scooters, create a fertile environment for large-scale deployments of connected motorcycle technology. With OEMs investing in cloud-based service platforms and over-the-air update frameworks, Asia Pacific's ecosystem is set to outpace all other regions, cementing its status as the primary growth engine for connected motorcycles over the coming decade.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: OEMS: 74%, Hardware & Software Providers: 26%

- By Designation: Directors: 15%, C-Level Executives: 33%, Others: 52%

- By Region: Asia Pacific: 60%, Europe: 15%, and North America: 25%

Major players dominating the connected motorcycle market include Honda (Japan), Yamaha (Japan), BMW Motorrad (Germany), and Harley-Davidson (US). These companies are expanding their portfolios to strengthen their connected motorcycle market position.

Research Coverage:

The report covers the connected motorcycle market by two-wheeler type (motorcycle, scooter/moped), hardware type (embedded, integrated), propulsion type (ICE, electric), network type (3G/4G, 5G, and other network types), end user (private, commercial), application (safety & security, navigation, vehicle health & diagnostics, infotainment & communication, and other applications), and region (Asia Pacific, Europe, and North America). The report also covers the competitive landscape and company profiles of significant connected motorcycle market players. The study further includes an in-depth competitive analysis of the key market players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

- The report will help market leaders/new entrants with information on the closest approximations of revenue numbers for the connected motorcycle market and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights, enabling them to position their businesses better and plan suitable go-to-market strategies.

- The report will help stakeholders understand the market pulse and provide information on key market drivers, restraints, challenges, and opportunities.

- The report will help stakeholders understand the current and future pricing trends of the connected motorcycle market.

The report provides insight into the following pointers:

- Market Dynamics: Analysis of key drivers (adoption of safety & security features and growth in the two-wheeler industry), restraints (absence of connected standards & uniform platform and lack of IoT-enabled infrastructure), opportunities (growing communication technology & network innovations and integration of payment services), and challenges (cybersecurity vulnerabilities and software maintenance & OTA challenges)

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the connected motorcycle market

- Market Development: Comprehensive information about lucrative markets across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the connected motorcycle market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and service offerings of leading players, namely Honda (Japan), Yamaha (Japan), BMW Motorrad (Germany), Harley Davidson (US), among others

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNIT CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interview participants

- 2.1.2.2 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CONNECTED MOTORCYCLE MARKET

- 4.2 CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE

- 4.3 CONNECTED MOTORCYCLE MARKET, BY HARDWARE

- 4.4 CONNECTED MOTORCYCLE MARKET, BY PROPULSION TYPE

- 4.5 CONNECTED MOTORCYCLE MARKET, BY NETWORK TYPE

- 4.6 CONNECTED MOTORCYCLE MARKET, BY END USER

- 4.7 CONNECTED MOTORCYCLE MARKET, BY APPLICATION

- 4.8 CONNECTED MOTORCYCLE MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Demand for safety and security features in motorcycles

- 5.2.1.2 Growth in two-wheeler industry

- 5.2.1.3 Need for advanced connected features in two-wheelers

- 5.2.2 RESTRAINTS

- 5.2.2.1 Absence of connected standards and uniform platforms

- 5.2.2.2 Lack of IoT-enabled infrastructure

- 5.2.2.3 Lack of connectivity in small cities and outskirts

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Adoption of CAN & Ethernet-based architecture

- 5.2.3.2 Real-time cloud integration for fleets

- 5.2.3.3 Integration of payment services

- 5.2.3.4 Advancements in IoT, connected technology, and real-time diagnostics

- 5.2.3.5 Advancements in communication and networking technology

- 5.2.4 CHALLENGES

- 5.2.4.1 Cybersecurity vulnerabilities

- 5.2.4.2 Software maintenance & OTA challenges

- 5.2.5 CONNECTED MOTORCYCLE MARKET: IMPACT OF MARKET DYNAMICS

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.2 ECOSYSTEM ANALYSIS

- 6.3 SUPPLY CHAIN ANALYSIS

- 6.3.1 HARDWARE PROVIDERS

- 6.3.2 SOFTWARE PROVIDERS

- 6.3.3 SERVICE PLATFORM PROVIDERS

- 6.3.4 NETWORK PROVIDERS

- 6.3.5 OEMS

- 6.3.6 END USERS

- 6.4 INVESTMENT & FUNDING SCENARIO

- 6.5 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.5.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.5.2 BUYING CRITERIA

- 6.6 KEY CONFERENCES & EVENTS, 2025-2026

- 6.6.1 KEY CONFERENCES & EVENTS, 2025-2026

- 6.7 OEM-CONNECTED SERVICE OFFERINGS

- 6.8 BUSINESS MODELS

- 6.8.1 SUBSCRIPTION-BASED CONNECTIVITY SERVICES

- 6.8.2 BATTERY-AS-A-SERVICE (BAAS) AND SWAPPING MODEL

- 6.8.3 PAY-PER-USE PLATFORMS

- 6.8.4 DATA MONETIZATION

- 6.9 GROWTH OPPORTUNITIES IN TWO-WHEELER INDUSTRY

- 6.10 GLOBAL MOTORCYCLE AND SCOOTER SALES

- 6.10.1 EUROPE

- 6.10.2 ASIA PACIFIC

- 6.10.3 NORTH AMERICA

- 6.11 ICE AND ELECTRIC VEHICLE SALES, 2025 VS. 2032

- 6.12 CONNECTED TECHNOLOGY PENETRATION, 2025 VS. 2032

- 6.13 CASE STUDY ANALYSIS

- 6.13.1 EUROPEAN OEM DEPLOYED SIBROS' DEEP CONNECTED PLATFORM (DCP) TO OFFER EXCEPTIONAL OFF-ROADING EXPERIENCE TO CUSTOMERS

- 6.13.2 ZERO MOTORCYCLES DEPLOYED T42'S HELIOS PLATFORM AND ESEYE'S ANYNET+ ESIMS TO CAPTURE AND ANALYZE HIGH-QUALITY REAL-TIME DATA FROM EVERY ECU IN ITS FLEET

- 6.13.3 ATHER PARTNERED WITH GOOGLE CLOUD TO REDEFINE URBAN MOBILITY IN INDIA'S DYNAMIC ECONOMY

7 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTIONS

- 7.1 TECHNOLOGY ANALYSIS

- 7.1.1 KEY TECHNOLOGIES

- 7.1.1.1 Embedded telematics systems

- 7.1.1.2 ECU and sensor integration

- 7.1.1.3 Advanced rider assistance system (ARAS)

- 7.1.2 COMPLEMENTARY TECHNOLOGIES

- 7.1.2.1 Smartphone connectivity platforms

- 7.1.2.2 Human machine interface (HMI) systems

- 7.1.2.3 Navigation and geo-fencing modules

- 7.1.2.4 Integration of smart helmets with wearables

- 7.1.3 ADJACENT TECHNOLOGIES

- 7.1.3.1 Over-the-air (OTA) update systems

- 7.1.3.2 Battery management systems (BMS) for connected EVs

- 7.1.3.3 Predictive maintenance

- 7.1.1 KEY TECHNOLOGIES

- 7.2 PATENT ANALYSIS

- 7.3 IMPACT OF AI/GEN AI

8 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 8.1 REGULATORY LANDSCAPE

- 8.1.1 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 8.1.2 REGULATORY FRAMEWORK

- 8.1.2.1 Canada

- 8.1.2.2 US

- 8.1.2.3 European Union

- 8.1.2.3.1 General Data Protection Regulation (GDPR)

9 CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE

- 9.1 INTRODUCTION

- 9.2 MOTORCYCLE

- 9.2.1 RISING DEMAND FOR CONNECTED MOTORCYCLES AMONG MIDDLE-CLASS TO DRIVE MARKET

- 9.3 SCOOTER/MOPED

- 9.3.1 POPULARITY OF SCOOTERS/MOPEDS BECAUSE OF THEIR SIMPLE FEATURES TO DRIVE MARKET

- 9.4 KEY PRIMARY INSIGHTS

10 CONNECTED MOTORCYCLE MARKET, BY HARDWARE

- 10.1 INTRODUCTION

- 10.2 EMBEDDED

- 10.2.1 EMBEDDED SYSTEM HAS BUILT-IN SIM CARD AND DOES NOT NEED SMARTPHONE TO OPERATE

- 10.3 INTEGRATED

- 10.3.1 INTEGRATED CONNECTIVITY COMBINES FUNCTIONS TO PROVIDE RIDERS WITH VITAL DIGITAL DISPLAY

- 10.4 KEY PRIMARY INSIGHTS

11 CONNECTED MOTORCYCLE MARKET, BY PROPULSION TYPE

- 11.1 INTRODUCTION

- 11.1.1 MODEL NAMES OF POPULAR CONNECTED ICE AND ELECTRIC MOTORCYCLES

- 11.2 ICE

- 11.2.1 < 125 CC

- 11.2.1.1 Rising need for motorcycles for daily commuting to boost demand

- 11.2.2 125-300 CC

- 11.2.2.1 Need for balance of cost savings and performance to drive market

- 11.2.3 > 300 CC

- 11.2.3.1 Demand for performance-oriented motorcycle models to drive market

- 11.2.1 < 125 CC

- 11.3 ELECTRIC

- 11.3.1 < 3 KW

- 11.3.1.1 Demand for connected motorcycles for frequent city rides to boost market

- 11.3.2 3-7 KW

- 11.3.2.1 Demand for two-wheelers offering better performance to boost market

- 11.3.3 > 7 KW

- 11.3.3.1 Increasing demand for premium models to boost market

- 11.3.1 < 3 KW

- 11.4 KEY PRIMARY INSIGHTS

12 CONNECTED MOTORCYCLE MARKET, BY NETWORK TYPE

- 12.1 INTRODUCTION

- 12.2 3G/4G

- 12.2.1 DEMAND FOR LIVE TRACKING, NAVIGATION, AND OTHER ADVANCED FEATURES TO BOOST MARKET

- 12.3 5G

- 12.3.1 FOCUS OF CUSTOMERS ON IMPROVED CONNECTIVITY TO DRIVE PREFERENCE

- 12.4 OTHERS

- 12.5 KEY PRIMARY INSIGHTS

13 CONNECTED MOTORCYCLE MARKET, BY END USER

- 13.1 INTRODUCTION

- 13.1.1 COMPANIES PROVIDING RIDE-HAILING SERVICES ON MOTORCYCLES

- 13.2 PRIVATE

- 13.2.1 FOCUS OF COMPANIES ON GRANTING ENHANCED SAFETY TO CONSUMERS TO SPUR DEMAND

- 13.3 COMMERCIAL

- 13.3.1 INCREASING USE OF CONNECTED MOTORCYCLES FOR COMMERCIAL USE TO BOOST GROWTH

- 13.4 KEY PRIMARY INSIGHTS

14 CONNECTED MOTORCYCLE MARKET, BY APPLICATION

- 14.1 INTRODUCTION

- 14.2 SAFETY & SECURITY

- 14.2.1 INCREASED EMPHASIS ON SAFETY AND SECURITY DURING COMMUTE TO DRIVE MARKET

- 14.2.2 ECALL & BCALL

- 14.2.3 GEO-FENCING

- 14.2.4 ADVANCED RIDER ASSISTANCE SYSTEMS (ARAS)

- 14.2.5 RIDER BEHAVIOR MONITORING

- 14.3 NAVIGATION

- 14.3.1 INCREASING POPULARITY OF CONNECTED FEATURES FOR NAVIGATION PURPOSES TO DRIVE DEMAND

- 14.3.2 TURN-BY-TURN NAVIGATION

- 14.3.3 REAL-TIME TRAFFIC UPDATES

- 14.3.4 TRIP PLANNING & ROUTE SHARING

- 14.3.5 PARKING ASSISTANCE & LOCATOR

- 14.4 VEHICLE HEALTH & DIAGNOSTICS

- 14.4.1 EMPHASIS ON MAINTAINING HEALTH OF TWO-WHEELERS TO DRIVE MARKET

- 14.4.2 PREDICTIVE MAINTENANCE ALERTS

- 14.4.3 BATTERY MANAGEMENT SYSTEM (FOR EVS)

- 14.4.4 REMOTE DIAGNOSTICS

- 14.4.5 INFOTAINMENT & COMMUNICATION

- 14.4.5.1 Smartphone connectivity

- 14.4.5.2 Music/Media streaming and voice assistants

- 14.4.5.3 Ride telemetry & performance analytics

- 14.4.5.4 Helmet connectivity

- 14.5 OTHER APPLICATIONS

- 14.5.1 OTA SOFTWARE UPDATES

- 14.5.2 REMOTE FEATURE UNLOCKS/SUBSCRIPTION UPGRADES

- 14.5.3 CHARGING STATION LOCATOR

- 14.5.4 REMOTE LOCK/UNLOCK (FOR SHARED BIKES)

- 14.6 KEY PRIMARY INSIGHTS

15 CONNECTED MOTORCYCLE MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 ASIA PACIFIC

- 15.2.1 MACROECONOMIC OUTLOOK

- 15.2.2 CHINA

- 15.2.2.1 Vast two-wheeler base and strong manufacturing system to drive market

- 15.2.3 INDIA

- 15.2.3.1 Rising demand for connected features to boost market

- 15.2.4 JAPAN

- 15.2.4.1 Rising population of people preferring two-wheelers to drive market

- 15.2.5 PHILIPPINES

- 15.2.5.1 Growing urban mobility challenges to boost market

- 15.2.6 INDONESIA

- 15.2.6.1 Increased adoption of connected motorcycles to boost market

- 15.2.7 VIETNAM

- 15.2.7.1 Drive for innovation among local manufacturers to boost market

- 15.2.8 THAILAND

- 15.2.8.1 Vast consumer base for two-wheelers to spur demand

- 15.2.9 REST OF ASIA PACIFIC

- 15.3 EUROPE

- 15.3.1 MACROECONOMIC OUTLOOK

- 15.3.2 FRANCE

- 15.3.2.1 Intense regulatory pressure and urban mobility needs to boost demand

- 15.3.3 GERMANY

- 15.3.3.1 Strong presence of tier-1 players to drive demand

- 15.3.4 ITALY

- 15.3.4.1 Presence of major OEMs to boost demand for advanced connected motorcycles

- 15.3.5 SPAIN

- 15.3.5.1 People's heavy reliance on motorcycles and scooters to boost market

- 15.3.6 UK

- 15.3.6.1 People's focus on premium products to boost market

- 15.3.7 REST OF EUROPE

- 15.4 NORTH AMERICA

- 15.4.1 MACROECONOMIC OUTLOOK

- 15.4.2 US

- 15.4.2.1 Presence of major manufacturers to boost demand

- 15.4.3 CANADA

- 15.4.3.1 Strong push by government for road safety and electrification policies to boost market

- 15.4.4 MEXICO

- 15.4.4.1 Urban congestion and rising fuel prices to boost market

16 COMPETITIVE LANDSCAPE

- 16.1 OVERVIEW

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 16.3 MARKET SHARE ANALYSIS, 2024

- 16.4 REVENUE ANALYSIS OF KEY PLAYERS

- 16.5 COMPANY VALUATION AND FINANCIAL METRICS

- 16.5.1 COMPANY VALUATION

- 16.5.2 FINANCIAL METRICS

- 16.6 BRAND COMPARISON

- 16.7 COMPANY EVALUATION MATRIX: KEY PLAYERS (OEMS), 2024

- 16.7.1 STARS

- 16.7.2 EMERGING LEADERS

- 16.7.3 PARTICIPANTS

- 16.7.4 PERVASIVE PLAYERS

- 16.7.5 COMPANY FOOTPRINT: KEY PLAYERS (OEMS), 2024

- 16.7.5.1 Company footprint

- 16.7.5.2 Hardware footprint

- 16.7.5.3 Region footprint

- 16.8 COMPANY EVALUATION MATRIX: KEY PLAYERS (TECHNOLOGY PROVIDERS), 2024

- 16.8.1 STARS

- 16.8.2 EMERGING LEADERS

- 16.8.3 PERVASIVE PLAYERS

- 16.8.4 PARTICIPANTS

- 16.8.5 COMPANY FOOTPRINT: KEY PLAYERS (TECHNOLOGY PROVIDERS) 2024

- 16.8.5.1 Company footprint

- 16.8.5.2 Hardware footprint

- 16.8.5.3 Region footprint

- 16.9 COMPETITIVE SCENARIO

- 16.9.1 PRODUCT LAUNCHES

- 16.9.2 DEALS

- 16.9.3 OTHER DEVELOPMENTS

17 COMPANY PROFILES

- 17.1 KEY PLAYERS (OEMS)

- 17.1.1 YAMAHA MOTOR CO., LTD.

- 17.1.1.1 Business overview

- 17.1.1.2 Products offered

- 17.1.1.3 Recent developments

- 17.1.1.4 MnM view

- 17.1.1.4.1 Key strengths/Right to Win

- 17.1.1.4.2 Strategic choices

- 17.1.1.4.3 Weaknesses & competitive threats

- 17.1.2 KAWASAKI MOTORS CORP.

- 17.1.2.1 Business overview

- 17.1.2.2 Products offered

- 17.1.2.3 Recent developments

- 17.1.2.4 MnM view

- 17.1.2.4.1 Key strengths/Right to win

- 17.1.2.4.2 Strategic choices

- 17.1.2.4.3 Weaknesses & competitive threats

- 17.1.3 SUZUKI MOTOR CORPORATION

- 17.1.3.1 Business overview

- 17.1.3.2 Products offered

- 17.1.3.3 Recent developments

- 17.1.3.4 MnM view

- 17.1.3.4.1 Key strengths/Right to win

- 17.1.3.4.2 Strategic choices

- 17.1.3.4.3 Weaknesses & competitive threats

- 17.1.4 HARLEY-DAVIDSON

- 17.1.4.1 Business overview

- 17.1.4.2 Products offered

- 17.1.4.3 Recent developments

- 17.1.4.4 MnM view

- 17.1.4.4.1 Key strengths/Right to win

- 17.1.4.4.2 Strategic choices

- 17.1.4.4.3 Weaknesses & competitive threats

- 17.1.5 BMW AG

- 17.1.5.1 Business overview

- 17.1.5.2 Products offered

- 17.1.5.3 Recent developments

- 17.1.5.4 MnM view

- 17.1.5.4.1 Key strengths/Right to win

- 17.1.5.4.2 Strategic choices

- 17.1.5.4.3 Weaknesses & competitive threats

- 17.1.1 YAMAHA MOTOR CO., LTD.

- 17.2 KEY PLAYERS: HARDWARE PROVIDERS

- 17.2.1 BOSCH LIMITED

- 17.2.1.1 Business overview

- 17.2.1.2 Products offered

- 17.2.1.3 Recent developments

- 17.2.1.4 MnM view

- 17.2.1.4.1 Key strengths/Right to win

- 17.2.1.4.2 Strategic choices

- 17.2.1.4.3 Weaknesses & competitive threats

- 17.2.2 CONTINENTAL AG

- 17.2.2.1 Business overview

- 17.2.2.2 Products offered

- 17.2.2.3 Recent developments

- 17.2.2.4 MnM view

- 17.2.2.4.1 Key strengths/Right to win

- 17.2.2.4.2 Strategic choices

- 17.2.2.4.3 Weaknesses & competitive threats

- 17.2.3 AUTOTALKS

- 17.2.3.1 Business overview

- 17.2.3.2 Products offered

- 17.2.3.3 Recent developments

- 17.2.3.4 MnM view

- 17.2.3.4.1 Key strengths/Right to win

- 17.2.3.4.2 Strategic choices

- 17.2.3.4.3 Weaknesses & competitive threats

- 17.2.4 PANASONIC CORPORATION

- 17.2.4.1 Business overview

- 17.2.4.2 Products offered

- 17.2.4.3 Recent developments

- 17.2.4.4 MnM view

- 17.2.4.4.1 Key strengths/Right to win

- 17.2.4.4.2 Strategic choices

- 17.2.4.4.3 Weaknesses & competitive threats

- 17.2.5 SIEMENS

- 17.2.5.1 Business overview

- 17.2.5.2 Products offered

- 17.2.5.3 Recent developments

- 17.2.5.4 MnM view

- 17.2.5.4.1 Key strengths/Right to win

- 17.2.5.4.2 Strategic choices

- 17.2.5.4.3 Weaknesses & competitive threats

- 17.2.1 BOSCH LIMITED

- 17.3 KEY PLAYERS: SOFTWARE PROVIDERS

- 17.3.1 STARCOM SYSTEMS LLC

- 17.3.1.1 Business overview

- 17.3.1.2 Products offered

- 17.3.1.3 MnM view

- 17.3.1.3.1 Key strengths/Right to win

- 17.3.1.3.2 Strategic choices

- 17.3.1.3.3 Weaknesses & competitive threats

- 17.3.2 COMODULE OU

- 17.3.2.1 Business overview

- 17.3.2.2 Products offered

- 17.3.2.3 Recent developments

- 17.3.2.4 MnM view

- 17.3.2.4.1 Key strengths/Right to win

- 17.3.2.4.2 Strategic choices

- 17.3.2.4.3 Weaknesses & competitive threats

- 17.3.3 KPIT TECHNOLOGIES LTD

- 17.3.3.1 Business overview

- 17.3.3.2 Products offered

- 17.3.3.3 Recent developments

- 17.3.3.4 MnM view

- 17.3.3.4.1 Key strengths/Right to win

- 17.3.3.4.2 Strategic choices

- 17.3.3.4.3 Weaknesses & competitive threats

- 17.3.4 ITURAN GLOBAL

- 17.3.4.1 Business overview

- 17.3.4.2 Products offered

- 17.3.4.3 MnM view

- 17.3.4.3.1 Key strengths/Right to win

- 17.3.4.3.2 Strategic choices made

- 17.3.4.3.3 Weaknesses & competitive threats

- 17.3.5 E-NOVIA S.P.A

- 17.3.5.1 Business overview

- 17.3.5.2 Products offered

- 17.3.5.3 Recent developments

- 17.3.5.4 MnM view

- 17.3.5.4.1 Key strengths/Right to win

- 17.3.5.4.2 Strategic choices

- 17.3.5.4.3 Weaknesses & competitive threats

- 17.3.1 STARCOM SYSTEMS LLC

- 17.4 KEY PLAYERS: SERVICE PLATFORM PROVIDERS

- 17.4.1 IBM

- 17.4.1.1 Business overview

- 17.4.1.2 Products offered

- 17.4.1.3 Recent developments

- 17.4.1.4 MnM view

- 17.4.1.4.1 Key strengths/Right to win

- 17.4.1.4.2 Strategic choices

- 17.4.1.4.3 Weaknesses & competitive threats

- 17.4.2 AMAZON

- 17.4.2.1 Business overview

- 17.4.2.2 Products offered

- 17.4.2.3 Recent developments

- 17.4.2.4 MnM view

- 17.4.2.4.1 Key strengths/Right to win

- 17.4.2.4.2 Strategic choices

- 17.4.2.4.3 Weaknesses & competitive threats

- 17.4.3 GOOGLE LLC

- 17.4.3.1 Business overview

- 17.4.3.2 Products offered

- 17.4.3.3 Recent developments

- 17.4.3.4 MnM view

- 17.4.3.4.1 Key strengths/Right to win

- 17.4.3.4.2 Strategic choices

- 17.4.3.4.3 Weaknesses & competitive threats

- 17.4.4 APPLE INC.

- 17.4.4.1 Business overview

- 17.4.4.2 Products offered

- 17.4.4.3 Recent developments

- 17.4.4.4 MnM view

- 17.4.4.4.1 Key strengths/Right to win

- 17.4.4.4.2 Strategic choices

- 17.4.4.4.3 Weaknesses & competitive threats

- 17.4.5 DXC TECHNOLOGY COMPANY

- 17.4.5.1 Business overview

- 17.4.5.2 Products offered

- 17.4.5.3 Recent developments

- 17.4.5.4 MnM view

- 17.4.5.4.1 Key strengths/Right to win

- 17.4.5.4.2 Strategic choices

- 17.4.5.4.3 Weaknesses & competitive threats

- 17.4.1 IBM

- 17.5 KEY PLAYERS: NETWORK PROVIDERS

- 17.5.1 VODAFONE GROUP

- 17.5.1.1 Business overview

- 17.5.1.2 Products offered

- 17.5.1.3 Recent developments

- 17.5.1.4 MnM view

- 17.5.1.4.1 Key strengths/Right to win

- 17.5.1.4.2 Strategic choices

- 17.5.1.4.3 Weaknesses & competitive threats

- 17.5.2 VERIZON

- 17.5.2.1 Business overview

- 17.5.2.2 Products offered

- 17.5.2.3 Recent developments

- 17.5.2.4 MnM view

- 17.5.2.4.1 Key strengths/Right to win

- 17.5.2.4.2 Strategic choices

- 17.5.2.4.3 Weaknesses & competitive threats

- 17.5.3 TELEFONICA S.A.

- 17.5.3.1 Business overview

- 17.5.3.2 Products offered

- 17.5.3.3 Recent developments

- 17.5.3.4 MnM view

- 17.5.3.4.1 Key strengths/Right to win

- 17.5.3.4.2 Strategic choices

- 17.5.3.4.3 Weaknesses & competitive threats

- 17.5.4 AERIS

- 17.5.4.1 Business overview

- 17.5.4.2 Products offered

- 17.5.4.3 Recent developments

- 17.5.4.4 MnM view

- 17.5.4.4.1 Key strengths/Right to win

- 17.5.4.4.2 Strategic choices

- 17.5.4.4.3 Weaknesses & competitive threats

- 17.5.5 CHINA TELECOM GLOBAL LIMITED

- 17.5.5.1 Business overview

- 17.5.5.2 Products offered

- 17.5.5.3 Recent developments

- 17.5.5.4 MnM view

- 17.5.5.4.1 Key strengths/Right to win

- 17.5.5.4.2 Strategic choices

- 17.5.5.4.3 Weaknesses & competitive threats

- 17.5.1 VODAFONE GROUP

- 17.6 OTHER KEY PLAYERS

- 17.6.1 HERO MOTOCORP LTD

- 17.6.2 HONDA MOTOR CO., LTD.

- 17.6.3 TRIUMPH MOTORCYCLES

- 17.6.4 TVS MOTORS COMPANY

- 17.6.5 KEEWAY

- 17.6.6 ROYAL ENFIELD

- 17.6.7 KTM AG

- 17.6.8 DUCATI MOTOR HOLDING S.P.A

- 17.6.9 IAV

- 17.6.10 FACOMSA

- 17.6.11 HARMAN INTERNATIONAL

- 17.6.12 TOMTOM INTERNATIONAL BV

- 17.6.13 NVIDIA CORPORATION

- 17.6.14 AIRTEL INDIA

- 17.6.15 QUALCOMM TECHNOLOGIES, INC.

- 17.6.16 NXP SEMICONDUCTORS

- 17.7 KEY STARTUPS AND NEW ENTRANTS

- 17.7.1 ZERO MOTORCYCLES, INC.

- 17.7.2 TORK MOTORS

- 17.7.3 TE CONNECTIVITY

- 17.7.4 EMBIEN TECHNOLOGIES INDIA PVT LTD.

- 17.7.5 CALIMOTO GMBH

- 17.7.6 NAVINFO

- 17.7.7 INDIAN MOTORCYCLE INTERNATIONAL, LLC

- 17.7.8 THE FLOOW LIMITED

- 17.7.9 TELTONIKA

- 17.7.10 PARKOFON INC. DBA SHEEVA.AI

- 17.7.11 SIBROS TECHNOLOGIES INC.

- 17.7.12 TWILIO INC.

- 17.7.13 COSMO CONNECTED

- 17.7.14 CONCIRRUS LTD

- 17.7.15 RIDE VISION

- 17.7.16 AMODO

- 17.7.17 BLUARMOR

- 17.7.18 COBI.BIKE

- 17.7.19 SENA TECHNOLOGIES INC.

- 17.7.20 YADEA TECHNOLOGY GROUP CO., LTD.

- 17.7.21 BAJAJ AUTO LTD.

- 17.7.22 NIU INTERNATIONAL

- 17.7.23 PIAGGIO & C. SPA

- 17.7.24 KYMCO

- 17.7.25 ATHER ENERGY

- 17.7.26 OLA ELECTRIC MOBILITY LTD

18 RECOMMENDATIONS BY MARKETSANDMARKETS

- 18.1 ASIA PACIFIC TO BE KEY FOCUS REGION IN SHORT TERM

- 18.2 ASIA PACIFIC TO BE FASTEST-GROWING MARKET IN LONG TERM

- 18.3 CONNECTED FEATURES IN BUDGET-FRIENDLY MOTORCYCLES CAN BE KEY FOCUS FOR MANUFACTURERS

- 18.4 TECHNOLOGICAL ADVANCEMENTS TO HELP SPEED UP CONNECTED MOTORCYCLE MARKET GROWTH

- 18.5 PARTNERSHIPS AMONG CONNECTED MOTORCYCLE ECOSYSTEM PLAYERS FOR SEAMLESS SOLUTION OFFERING

- 18.6 CONCLUSION

19 APPENDIX

- 19.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 19.2 DISCUSSION GUIDE

- 19.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.4 CUSTOMIZATION OPTIONS

- 19.5 RELATED REPORTS

- 19.6 AUTHOR DETAILS