|

시장보고서

상품코드

1854898

보청기 시장 : 제품별, 난청 유형별, 환자 유형별, 기술별, 유통 채널별, 지역별 - 예측(-2030년)Hearing Aids Market by Product (Devices(RITE, BTE, Canal, ITE), Implants (Cochlear, Bone-anchored)), Type of Hearing Loss (Sensorineural, Conductive), Patient (Adults, Pediatrics), Technology (Digital, Analog), Channel & Region - Global Forecast to 2030 |

||||||

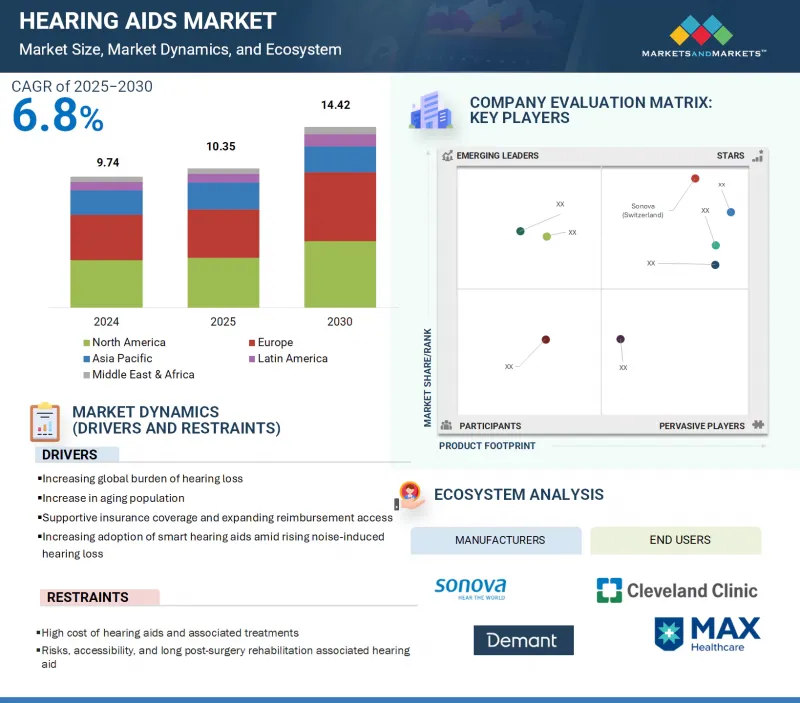

세계의 보청기 시장 규모는 2025년 103억 5,000만 달러에서 2030년에는 144억 2,000만 달러에 이를 것으로 예측되며, 예측 기간 중 연평균 복합 성장률(CAGR)은 6.8%를 나타낼 전망입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(10억 달러) |

| 부문 | 제품별, 난청 유형별, 환자 유형별, 기술별, 유통 채널별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

보청기 시장이 크게 성장한 배경에는 난청 유병률 증가, 고령화 인구 증가, 청각 관련 질환에 대한 인식이 높아지면서 보청기 시장 성장을 견인하고 있습니다.

또한, 스마트하고 사용하기 쉬운 디지털 보청기의 채택이 증가하고 있는 것도 시장 확대를 더욱 촉진할 것으로 예측됩니다.

보청기 시장은 유통 채널에 따라 구분되며, 특히 청각 및 이비인후과 병원 및 클리닉, 소매점 및 약국 매장, 온라인 플랫폼으로 분류됩니다. 2024년에는 병원 및 클리닉이 가장 큰 시장 점유율을 차지할 것으로 예측됩니다. 이들 시설은 진단, 기기 착용, 착용 후 관리 등의 종합적인 청각 건강 관리를 제공하며, 특히 진행성 난청이나 복합적인 난청을 가진 사람들에게 중요한 역할을 합니다. 이러한 시설에 대한 확고한 신뢰가 보급률을 크게 높이고 있습니다. 이비인후과나 이비인후과 병원이나 클리닉에는 보통 자격을 갖춘 전문의가 상주하고, 방음 검사 환경, 진단 장비, 수술 장비가 잘 갖추어져 있습니다. 이러한 시설에서는 비수술적 솔루션과 이식형 보청기를 한 곳에서 제공하기 때문에 환자의 경험이 보다 효율적입니다. 연구에 따르면, 언번들링 가격 모델과 같은 최적화된 임상적 프레임워크는 보청기 보급을 더욱 촉진할 것으로 보입니다. 이러한 헬스케어 환경은 정확한 진단, 전문적인 상담, 보청기 및 임플란트 보청기의 종합적인 서비스를 제공할 수 있는 능력을 갖추고 있기 때문에 시장에서 독보적인 존재로 남아있습니다.

세계 보청기 시장은 기기를 디지털 보청기와 아날로그 보청기로 분류하고 있습니다. 2024년 현재 디지털 보청기가 가장 큰 시장 점유율을 차지하고 있는 것은 음성 명료도 향상, 적응형 음성 처리 기능 등 뛰어난 기능성에 기인합니다. 이 보청기는 주변 소음을 디지털 신호로 변환하고 고급 알고리즘을 사용하여 처리함으로써 청력을 최적화하고 불필요한 배경 소음을 억제하며 기존 아날로그 보청기에는 없는 음향 피드백을 줄입니다. 디지털 보청기는 주로 병원이나 전문 보청기 시설 등 임상 현장에서 청각 전문의에 의해 처방됩니다. 최신 보청기는 대부분 무선 연결 기능을 탑재하여 원격 조정 및 다양한 음향 환경에 자동으로 적응할 수 있어 사용자의 편의성과 종합적인 사용감이 향상되었습니다. 한편, 아날로그 보청기는 시장에서 점차 그 존재감이 줄어들고 있습니다. 아날로그 보청기는 주로 저비용 환경, 특히 디지털 기술 및 피팅 서비스에 대한 접근이 제한된 중저소득 국가의 농촌 지역과 인프라가 제한된 지역에서 주로 사용됩니다.

세계 보청기 시장은 5개 주요 지역(북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카)으로 분류됩니다. 아시아태평양은 노인 인구의 급격한 증가, 이비인후과 서비스에 대한 수요 증가, 헬스케어 인프라에 대한 대규모 투자로 인해 빠르게 성장하고 있습니다. 이 지역은 업계 이해관계자들에게 큰 성장 잠재력을 가지고 있으며, 예측 기간 동안 가장 높은 CAGR을 달성할 것으로 예측됩니다. 인구 고령화에 따라 한국, 대만, 싱가포르 등의 국가에서는 난청 유병률이 증가하면서 청력 관리에 대한 수요가 증가하고 있습니다. 의료 서비스 접근성을 강화하고 병원 및 클리닉 네트워크를 확대하기 위한 정부의 이니셔티브으로 보청기가 더욱 친근하게 다가오고 있습니다. 또한, 이 지역, 특히 태국과 말레이시아에서 급성장하고 있는 의료 관광 부문은 청력 관리 솔루션의 이용 가능성과 채택 증가를 촉진하고 있습니다. 이러한 추세는 아시아태평양 전체에서 견조한 시장 성장을 유지할 것으로 예측됩니다.

세계의 보청기 시장을 조사했으며, 제품별, 난청 유형별, 환자 유형별, 기술별, 유통 채널별, 지역별 동향, 시장 진출기업 프로파일 등의 정보를 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 프리미엄 인사이트

제5장 시장 개요

- 서론

- 시장 역학

- 가격 분석

- 밸류체인 분석

- 공급망 분석

- 생태계 분석

- Porter의 Five Forces 분석

- 주요 이해관계자와 구입 기준

- 규제 분석

- 무역 분석

- 특허 분석

- 주요 컨퍼런스 및 이벤트

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 기술 분석

- 투자 및 자금조달 시나리오

- AI/생성형 AI가 보청기 시장에 미치는 영향

- 사례 연구 분석

- 보청기 시장에 대한 AI의 영향

- 미국 관세 규제가 보청기 시장에 미치는 영향

제6장 보청기 시장(제품별)

- 서론

- 보청기

- RITE 타입

- BTE 타입

- 커널 타입

- ITC 타입

- 기타

- 보청 임플란트

- 인공와우

- 뼈 고정 시스템

제7장 보청기 시장(난청 유형별)

- 서론

- 감음성 난청

- 전음성 난청

제8장 보청기 시장(환자 유형별)

- 서론

- 성인

- 소아

제9장 보청기 시장(기술별)

- 서론

- 디지털

- 아날로그

제10장 보청기 시장(유통 채널별)

- 서론

- 청각학 및 이비인후과 병원 및 클리닉

- 소매점 및 약국

- 온라인 판매

제11장 지역별 보청기 시장

- 서론

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시경제 전망

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 기타

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 중국

- 인도

- 일본

- 호주

- 기타

- 라틴아메리카

- 라틴아메리카의 거시경제 전망

- 브라질

- 멕시코

- 기타

- 중동 및 아프리카

- 중동 및 아프리카의 거시경제 전망

제12장 경쟁 구도

- 개요

- 주요 시장 진출기업의 전략/강점, 2024년

- 매출 분석, 2022년-2024년

- 시장 점유율 분석, 2024년

- 기업 평가 매트릭스 : 주요 시장 진출기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 기업 평가와 재무 지표

- 브랜드/제품 비교

- 경쟁 시나리오

제13장 기업 개요

- 주요 시장 진출기업

- SONOVA

- WSAUDIOLOGY

- DEMANT A/S

- COCHLEAR LTD.

- GN STORE NORD A/S

- STARKEY LABORATORIES, INC.

- MED-EL MEDICAL ELECTRONICS

- EARGO INC.

- RION CO., LTD.

- ZHEJIANG NUROTRON BIOTECHNOLOGY CO., LTD.

- 기타 기업

- AUDINA HEARING INSTRUMENTS, INC.

- NEUBIO AG

- HORENTEK HEARING DIAGNOSTICS

- SEBOTEK HEARING SYSTEMS, LLC

- ARPHI ELECTRONICS PRIVATE LIMITED

- IN4 TECHNOLOGY CORPORATION

- AUDICUS

- NANO HEARING AIDS

- LORECA HEARING AID

- EARLENS CORP.

- AUSTAR HEARING SCIENCE AND TECHNOLOGY(XIAMEN) CO., LTD.

- SHANGHAI LISTENT MEDICAL TECH CO., LTD.

- AUDIFON GMBH & CO. KG

- FOSHAN VOHOM TECHNOLOGY CO., LTD.

- TODOC CO., LTD.

제14장 부록

LSH 25.11.07The global hearing aids market is projected to reach USD 14.42 billion by 2030 from USD 10.35 billion in 2025, at a CAGR of 6.8% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Type of Hearing Loss, Patient Type, Technology, Distribution Channel, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

The large growth in the hearing aids market is due to the increasing prevalence of hearing loss, the rising aging population, and growing awareness of hearing-related disorders, which drive market growth. Additionally, the increasing adoption of smart and user-friendly digital hearing aids is expected to further support market expansion.

"Audiology and ENT hospitals & clinics are the leading distribution channel in the hearing aids market."

The hearing aids market is delineated by distribution channels, specifically categorized into audiology and ENT hospitals and clinics, retail and pharmacy outlets, and online platforms. In 2024, hospitals and clinics commanded the largest market share. These institutions provide a comprehensive continuum of hearing healthcare, encompassing diagnosis, device fitting, and post-fitting management, which is particularly critical for individuals with progressive or complex hearing impairments. The established trust in these facilities significantly enhances adoption rates. Audiology and ENT hospitals & clinics are typically staffed with qualified specialists and are equipped with soundproof testing environments, diagnostic apparatus, and surgical capabilities. They deliver non-surgical solutions and implantable hearing devices within a single location, streamlining the patient's experience. Research indicates that optimized clinical frameworks-such as unbundled pricing models-further facilitate increased uptake of hearing aids. These healthcare settings remain preeminent in the market due to their ability to provide precise diagnostics, professional counsel, and integrated services for hearing aids and implantable devices.

"Digital hearing commanded the largest share in the hearing aids technology market in 2024."

The global hearing aids market categorizes devices into digital and analog hearing aids. As of 2024, digital hearing aids accounted for the largest market share owing to their superior functionalities, including enhanced speech intelligibility and adaptive sound processing capabilities. These devices convert ambient noise into digital signals, which are then processed using sophisticated algorithms to optimize auditory perception, suppress unwanted background noise, and reduce acoustic feedback-features that are notably absent in traditional analog hearing aids. Digital hearing aids are predominantly prescribed by audiologists in clinical settings such as hospitals and specialized hearing care facilities. A significant number of contemporary models are equipped with wireless connectivity, allowing for remote adjustment and automatic adaptation to varying acoustic environments, thereby improving user convenience and overall experience. Meanwhile, analog hearing aids are experiencing a gradual decline in market presence; they remain primarily in use in low-cost settings, particularly in rural or infrastructure-limited regions of low- and middle-income countries, where access to digital technology and fitting services is restricted.

"Asia Pacific is expected to be the fastest-growing region of the hearing aids regional market during the study period."

The global hearing aids market is categorized into five primary regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The Asia Pacific region is witnessing rapid expansion, driven by a significant increase in the elderly demographic, heightened demand for otolaryngological services, and substantial investments in healthcare infrastructure. This region presents considerable growth potential for industry stakeholders and is anticipated to achieve the highest compound annual growth rate (CAGR) during the forecast period. As demographic aging progresses, nations such as South Korea, Taiwan, and Singapore observe a rising prevalence of hearing loss, escalating the demand for audiological care. Government initiatives aimed at enhancing healthcare access and expanding hospital and clinic networks have made hearing aids more accessible to the population. Furthermore, the region's burgeoning medical tourism sector, particularly in Thailand and Malaysia, is facilitating an increase in the availability and adoption of hearing care solutions. These trends are expected to sustain robust market growth across the Asia Pacific region.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1: 38%, Tier 2: 29%, and Tier 3: 33%

- By Designation: C Level: 27%, Director Level: 18%, and Others: 55%

- By Region: North America: 50%, Europe: 20%, Asia Pacific: 20%, Latin America: 7%, and Middle East & Africa: 3%

Note 1: Companies are classified into tiers based on their total revenue. As of 2023, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = <USD 1.00 billion.

Note 2: C-level primaries include CEOs, CFOs, COOs, and VPs.

Note 3: Other designations include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

The major players operating in the hearing aids market are Sonova (Switzerland), Demant A/S(Denmark), GN Store Nord A/S (Denmark), Cochlear Ltd. (Australia), Rion Co., Ltd. (Japan), Eargo Inc. (US), Starkey Laboratories, Inc. (US), WSAudiology (Denmark), Zhejiang Nurotron Biotechnology Co., Ltd. (China), and MED-EL Medical Electronics (Austria), among others.

Research Coverage

This report examines the hearing aids market based on product type, type of hearing loss, patient type, technology, distribution channel, and region. It also explores factors such as drivers, restraints, opportunities, and challenges that influence market growth, and provides details on the competitive landscape for market leaders. Additionally, the report analyzes micro markets concerning their growth trends. It forecasts the revenue of market segments across five major regions and their respective countries.

Reasons to Buy the Report

The report will enable established firms as well as entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them to garner a larger market share. Firms purchasing the report could use one or a combination of the strategies mentioned below to strengthen their market presence.

This report provides insights on the following pointers:

- Analysis of key drivers (increasing global burden of hearing loss, increase in aging population, supportive insurance coverage and expanding reimbursement access, increasing adoption of smart hearing aids amid rising noise-induced hearing loss), restraints (high cost of hearing aids and associated treatments, risks, accessibility, and long post-surgery rehabilitation associated with hearing aid), opportunities (high-growth potential for hearing technologies in emerging economies, integration with digital health platforms enhances hearing device care), and challenges (shortage of skilled professionals performing ENT Procedures).

- Market Penetration: Comprehensive information on the product portfolios offered by the top players in the hearing aids market

- Product Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and product launches in the hearing aids market

- Market Development: Comprehensive information on lucrative emerging regions

- Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the hearing aids market

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and products of the leading market players

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach 1: Company revenue estimation approach

- 2.2.1.2 Approach 2: Presentations of companies and primary interviews

- 2.2.1.3 Approach 3: Primary interviews

- 2.2.1.4 Growth forecast

- 2.2.1.5 CAGR projections

- 2.2.2 TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.4.1 STUDY-RELATED ASSUMPTIONS

- 2.4.2 PARAMETRIC ASSUMPTIONS

- 2.4.3 GROWTH RATE ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 HEARING AIDS MARKET OVERVIEW

- 4.2 ASIA PACIFIC: HEARING AIDS CARE MARKET SHARE, BY DISTRIBUTION CHANNEL AND COUNTRY

- 4.3 HEARING AIDS MARKET, BY KEY COUNTRY

- 4.4 HEARING AIDS MARKET, REGIONAL MIX

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increase in global burden of hearing loss

- 5.2.1.2 Increase in aging population

- 5.2.1.3 Supportive insurance coverage and expanding reimbursement access

- 5.2.1.4 Increase in adoption of smart hearing aids amid rising noise-induced hearing loss

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of hearing aids and associated treatments

- 5.2.2.2 Risks, accessibility, and long post-surgery rehabilitation associated with hearing aids

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 High-growth potential for hearing technologies in emerging economies

- 5.2.3.2 Integration with digital health platforms to enhance hearing device care

- 5.2.4 CHALLENGES

- 5.2.4.1 Shortage of skilled professionals performing ENT procedures

- 5.2.1 DRIVERS

- 5.3 PRICING ANALYSIS

- 5.3.1 AVERAGE SELLING PRICE TREND OF HEARING AID PRODUCTS, BY REGION

- 5.3.2 AVERAGE SELLING PRICE TREND OF HEARING AID PRODUCTS, BY KEY PLAYER

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- 5.7.1 THREAT OF NEW ENTRANTS

- 5.7.2 THREAT OF SUBSTITUTES

- 5.7.3 BARGAINING POWER OF BUYERS

- 5.7.4 BARGAINING POWER OF SUPPLIERS

- 5.7.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.8 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.8.2 KEY BUYING CRITERIA

- 5.9 REGULATORY ANALYSIS

- 5.9.1 REGULATORY FRAMEWORK

- 5.9.1.1 North America

- 5.9.1.1.1 US

- 5.9.1.1.2 Canada

- 5.9.1.2 Europe

- 5.9.1.3 Asia Pacific

- 5.9.1.3.1 Japan

- 5.9.1.3.2 China

- 5.9.1.3.3 India

- 5.9.1.4 Latin America

- 5.9.1.4.1 Brazil

- 5.9.1.4.2 Mexico

- 5.9.1.5 Middle East

- 5.9.1.6 Africa

- 5.9.1.1 North America

- 5.9.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.1 REGULATORY FRAMEWORK

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT DATA (HS CODE 902140)

- 5.10.2 EXPORT DATA (HS CODE 902140)

- 5.11 PATENT ANALYSIS

- 5.11.1 LIST OF MAJOR PATENTS

- 5.12 KEY CONFERENCES & EVENTS

- 5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.14 TECHNOLOGY ANALYSIS

- 5.14.1 KEY TECHNOLOGIES

- 5.14.1.1 Digital signal processing (DSP)

- 5.14.2 COMPLEMENTARY TECHNOLOGIES

- 5.14.2.1 Bimodal hearing solutions

- 5.14.3 ADJACENT TECHNOLOGIES

- 5.14.3.1 Cochlear implants & bone-anchored hearing systems

- 5.14.1 KEY TECHNOLOGIES

- 5.15 INVESTMENT & FUNDING SCENARIO

- 5.16 IMPACT OF AI/GEN AI ON COCHLEAR IMPLANTS MARKET

- 5.17 CASE STUDY ANALYSIS

- 5.17.1 ADVANCING HEARING CAPABILITY WITH INTEGRATED COCHLEAR IMPLANT AND HEARING AID TECHNOLOGY

- 5.17.2 WIDEX MOMENT EXPERIENCE: RESTORING SOUND PRECISION THROUGH ADVANCED HEARING TECHNOLOGY

- 5.17.3 NANCY E. AND BAHA SYSTEM: REDISCOVERING SOUND AFTER FIVE DECADES

- 5.18 IMPACT OF AI ON HEARING AIDS MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 MARKET POTENTIAL OF AI IN HEARING AIDS MARKET

- 5.18.3 AI USE CASES

- 5.18.4 KEY COMPANIES IMPLEMENTING AI

- 5.18.5 FUTURE OF AI IN HEARING AIDS MARKET

- 5.19 IMPACT OF US TARIFF REGULATION ON HEARING AIDS MARKET

- 5.19.1 INTRODUCTION

- 5.19.2 KEY TARIFF RATES

- 5.19.3 PRICE IMPACT ANALYSIS

- 5.19.4 KEY IMPACTS ON COUNTRY/REGION

- 5.19.4.1 North America

- 5.19.4.2 Europe

- 5.19.4.3 Asia Pacific

- 5.19.5 IMPACT ON END-USE INDUSTRIES

- 5.19.5.1 Audiology and ENT hospitals & clinics

6 HEARING AIDS MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 HEARING AID DEVICES

- 6.2.1 RECEIVER-IN-THE-EAR HEARING AIDS

- 6.2.1.1 Designed to manage mild to severe hearing loss

- 6.2.2 BEHIND-THE-EAR HEARING AIDS

- 6.2.2.1 Affordability and advancements in BTE hearing aids to drive growth

- 6.2.3 CANAL HEARING AIDS

- 6.2.3.1 Technological innovations and low visibility to drive demand for canal aids

- 6.2.4 IN-THE-EAR HEARING AIDS

- 6.2.4.1 Custom fit and advanced functionality of ITE hearing aids to drive market expansion

- 6.2.5 OTHER HEARING AID DEVICES

- 6.2.1 RECEIVER-IN-THE-EAR HEARING AIDS

- 6.3 HEARING IMPLANTS

- 6.3.1 COCHLEAR IMPLANTS

- 6.3.1.1 Cochlear implants to lead hearing implants market

- 6.3.2 BONE-ANCHORED SYSTEMS

- 6.3.2.1 Rise in adoption of bone-anchored hearing systems in single-sided deafness and conductive hearing loss

- 6.3.1 COCHLEAR IMPLANTS

7 HEARING AIDS MARKET, BY TYPE OF HEARING LOSS

- 7.1 INTRODUCTION

- 7.2 SENSORINEURAL HEARING LOSS

- 7.2.1 GROWTH OF ELDERLY POPULATION TO DRIVE SENSORINEURAL HEARING LOSS SEGMENT

- 7.3 CONDUCTIVE HEARING LOSS

- 7.3.1 TECHNOLOGICAL INNOVATIONS AND REGULATORY APPROVALS TO FUEL GROWTH OF CONDUCTIVE HEARING LOSS SEGMENT

8 HEARING AIDS MARKET, BY PATIENT TYPE

- 8.1 INTRODUCTION

- 8.2 ADULTS

- 8.2.1 HIGHER SUSCEPTIBILITY TO HEARING LOSS MAKES ADULTS KEY SEGMENT OF OVERALL PATIENT POOL

- 8.3 PEDIATRICS

- 8.3.1 TECHNOLOGICAL ADVANCEMENTS TO FUEL GROWTH OF PEDIATRIC HEARING AIDS

9 HEARING AIDS MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- 9.2 DIGITAL

- 9.2.1 PRECISION SOUND TAILORED THROUGH DIGITAL PROCESSING TO PROPEL MARKET

- 9.3 ANALOG

- 9.3.1 ANALOG: AFFORDABLE SOLUTIONS FOR BASIC HEARING NEEDS

10 HEARING AIDS MARKET, BY DISTRIBUTION CHANNEL

- 10.1 INTRODUCTION

- 10.2 AUDIOLOGY AND ENT HOSPITALS & CLINICS

- 10.2.1 EXPERT-LED CARE IN CLINICAL SETTINGS TO DRIVE HIGHER ADOPTION AND SATISFACTION

- 10.3 RETAIL & PHARMACY STORES

- 10.3.1 EXPANDING ACCESS TO HEARING CARE THROUGH CONVENIENT AND AFFORDABLE IN-STORE OPTIONS

- 10.4 ONLINE SALES

- 10.4.1 EMERGING CHANNEL OFFERING REMOTE ACCESS TO HEARING AIDS

11 HEARING AIDS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 US to lead North America's hearing aids market through 2030

- 11.2.3 CANADA

- 11.2.3.1 Targeted awareness-raising and aging trends to drive steady growth in Canada's hearing aids market

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Growth in healthcare expenditure in Germany to drive demand for advanced hearing aids

- 11.3.3 UK

- 11.3.3.1 Rise in burden of hearing loss continues to fuel market expansion in UK

- 11.3.4 FRANCE

- 11.3.4.1 Investment in R&D and technological innovation to drive market expansion in France

- 11.3.5 SPAIN

- 11.3.5.1 Rise in life expectancy and aging population to boost market growth

- 11.3.6 ITALY

- 11.3.6.1 Rise in Italy's elderly population to create further potential demand for hearing aids

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 CHINA

- 11.4.2.1 China to continue dominating Asia Pacific hearing aids market

- 11.4.3 INDIA

- 11.4.3.1 Healthcare infrastructure improvements to drive hearing aids market growth

- 11.4.4 JAPAN

- 11.4.4.1 Aging population and favorable insurance policies to support adoption in Japan

- 11.4.5 AUSTRALIA

- 11.4.5.1 Rise in geriatric population and government programs to accelerate market growth

- 11.4.6 REST OF ASIA PACIFIC

- 11.5 LATIN AMERICA

- 11.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 11.5.2 BRAZIL

- 11.5.2.1 Largest healthcare sector in region and government initiatives to drive market

- 11.5.3 MEXICO

- 11.5.3.1 Expanding hospital infrastructure to support hearing healthcare growth

- 11.5.4 REST OF LATIN AMERICA

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2024

- 12.3 REVENUE ANALYSIS, 2022-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company footprint

- 12.5.5.2 Regional footprint

- 12.5.5.3 Product footprint

- 12.5.5.4 Type of hearing loss footprint

- 12.5.5.5 Patient type footprint

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.6.5.1 Detailed list of key startups/SMEs

- 12.6.5.2 Competitive benchmarking of key startups/SMEs

- 12.7 COMPANY VALUATION AND FINANCIAL METRICS

- 12.7.1 COMPANY VALUATION

- 12.7.2 FINANCIAL METRICS

- 12.8 BRAND/PRODUCT COMPARISON

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES & APPROVALS

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

- 12.9.4 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 SONOVA

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches & approvals

- 13.1.1.3.2 Deals

- 13.1.1.3.3 Expansions

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses & competitive threats

- 13.1.2 WSAUDIOLOGY

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches & approvals

- 13.1.2.3.2 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses & competitive threats

- 13.1.3 DEMANT A/S

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches & approvals

- 13.1.3.3.2 Deals

- 13.1.3.3.3 Expansions

- 13.1.3.3.4 Other developments

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses & competitive threats

- 13.1.4 COCHLEAR LTD.

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches & approvals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses & competitive threats

- 13.1.5 GN STORE NORD A/S

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches & approvals

- 13.1.5.3.2 Deals

- 13.1.5.3.3 Other developments

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses & competitive threats

- 13.1.6 STARKEY LABORATORIES, INC.

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches & approvals

- 13.1.6.3.2 Deals

- 13.1.7 MED-EL MEDICAL ELECTRONICS

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.8 EARGO INC.

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.9 RION CO., LTD.

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.10 ZHEJIANG NUROTRON BIOTECHNOLOGY CO., LTD.

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.1 SONOVA

- 13.2 OTHER PLAYERS

- 13.2.1 AUDINA HEARING INSTRUMENTS, INC.

- 13.2.2 NEUBIO AG

- 13.2.3 HORENTEK HEARING DIAGNOSTICS

- 13.2.4 SEBOTEK HEARING SYSTEMS, LLC

- 13.2.5 ARPHI ELECTRONICS PRIVATE LIMITED

- 13.2.6 IN4 TECHNOLOGY CORPORATION

- 13.2.7 AUDICUS

- 13.2.8 NANO HEARING AIDS

- 13.2.9 LORECA HEARING AID

- 13.2.10 EARLENS CORP.

- 13.2.11 AUSTAR HEARING SCIENCE AND TECHNOLOGY (XIAMEN) CO., LTD.

- 13.2.12 SHANGHAI LISTENT MEDICAL TECH CO., LTD.

- 13.2.13 AUDIFON GMBH & CO. KG

- 13.2.14 FOSHAN VOHOM TECHNOLOGY CO., LTD.

- 13.2.15 TODOC CO., LTD.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS