|

시장보고서

상품코드

1859653

필드 프로그래머블 게이트 어레이(FPGA) 시장 : 컨피규레이션별, 노드 사이즈별, 기술별, 업계별, 지역별 - 예측(-2030년)Field-Programmable Gate Array (FPGA) Market by Configuration (Low-end FPGA, Mid-range FPGA, High-end FPGA), Technology (SRAM, Flash, Antifuse), Node Size (<16 nm, 20-90 nm, >90 nm), Vertical (Telecom, Data Center) and Region - Global Forecast to 2030 |

||||||

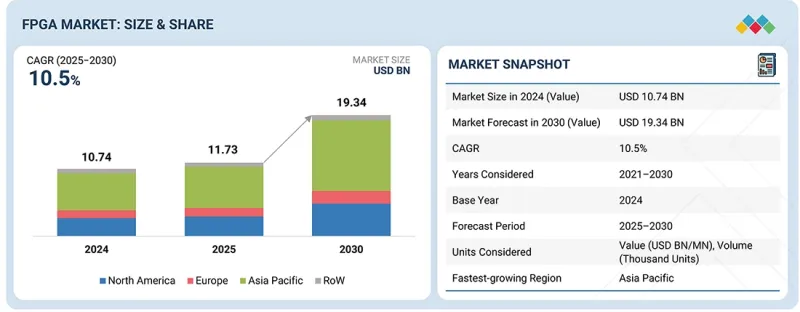

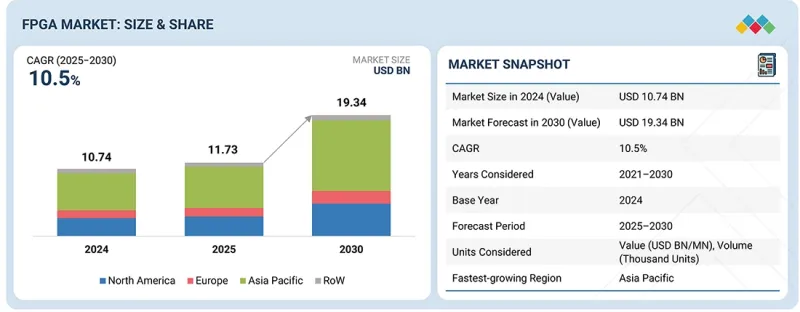

세계의 필드 프로그래머블 게이트 어레이(FPGA) 시장 규모는 10.5%의 CAGR로 확대되어 2025년 117억 3,000만 달러에서 2030년에는 193억 4,000만 달러에 달할 것으로 예측됩니다.

이 시장은 AI 기술의 광범위한 채택과 주요 산업 분야의 5G 인프라 구축으로 인해 강력한 성장세를 보이고 있습니다. AI 워크로드가 점점 더 복잡해짐에 따라, FPGA는 항공우주 및 방위, 자동차 등의 산업에서 실시간 데이터 처리, 센서 융합, 적응형 학습을 가속화하기 위해 도입되고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(10억 달러) |

| 부문별 | 컨피규레이션별, 노드 사이즈별, 기술별, 업계별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 기타 지역 |

5G 네트워크의 확장으로 광대역폭, 저지연 통신, 재구성 가능한 신호 처리를 지원하는 FPGA에 대한 수요가 증가하고 있습니다. 또한, 진화하는 표준과 프로토콜에 유연하게 대응할 수 있는 FPGA는 차세대 통신기기와 엣지 컴퓨팅 시스템에 필수적인 요소입니다. 이러한 추세에 따라 FPGA는 지능형, 고성능, 미래지향적인 디지털 인프라를 구현하는 데 중요한 역할을 담당하고 있습니다.

SRAM 기반 FPGA는 뛰어난 재구성성, 고속 성능, 복잡한 디지털 시스템에 대한 적합성으로 인해 2025년 FPGA 시장에서 가장 큰 점유율을 차지했습니다. 이 장치를 통해 설계자는 하드웨어 기능을 동적으로 재프로그래밍할 수 있어 AI 가속, 데이터센터 네트워킹, 고급 통신 등 잦은 업데이트와 설계 유연성이 요구되는 애플리케이션에 적합합니다. SRAM 기술의 지속적인 발전으로 로직 밀도 향상, 에너지 효율 개선, 보안 기능 강화가 가능해져 성능이 중요한 분야에서 우위를 점할 수 있게 되었습니다. 또한, FPGA 로직을 실시간으로 재구성하여 워크로드를 최적화하는 적응형 컴퓨팅 아키텍처의 채택이 확대되고 있으며, 차세대 컴퓨팅 및 통신 시스템에서 SRAM 기반 FPGA의 사용은 더욱 확대되고 있습니다.

데이터센터 및 컴퓨팅 분야는 AI 추론, 클라우드 가속, 고성능 컴퓨팅 워크로드에 대한 FPGA 채택 증가로 인해 FPGA 시장에서 가장 높은 CAGR을 기록할 것으로 예상됩니다. FPGA는 독보적인 병렬 처리 능력, 재구성 가능성, 전력 효율성이 뛰어나 실시간 애플리케이션의 데이터 처리량을 최적화하고 대기 시간을 줄이는 데 매우 효과적입니다. 주요 클라우드 서비스 제공업체와 하이퍼스케일 사업자들은 AI, 머신러닝, 애널리틱스 등 다양한 워크로드를 처리하기 위해 FPGA 기반 가속기를 통합하고 있습니다. 또한, 이기종 컴퓨팅 아키텍처로의 전환과 진화하는 알고리즘을 지원하는 맞춤형 하드웨어에 대한 수요 증가로 인해 대규모 컴퓨팅 인프라에 FPGA가 도입되고 있으며, 이 부문은 지속적이고 높은 성장세를 보일 것으로 예상됩니다. 높은 성장세를 보일 것으로 예상됩니다.

유럽은 탄탄한 산업 기반, 전략적 디지털 투자, 기술 주권을 향한 협력적 추진을 통해 2025년 세계 FPGA 시장에서 큰 점유율을 차지했습니다. 이 지역은 자동차 전자, 산업 자동화, 통신, 국방 분야에서 주도권을 쥐고 있으며, 재구성 가능한 컴퓨팅 솔루션에 대한 지속적인 수요를 촉진하고 있습니다. '유럽 칩법(European Chips Act)'과 '호라이즌 유럽(Horizon Europe)'에 기반한 지속적인 노력으로 반도체 설계, 제조, 고성능 컴퓨팅의 혁신을 촉진하고 FPGA 채택에 유리한 환경을 조성하고 있습니다. 2024년 4월, OPTIMA 이니셔티브는 EuroHPC JU의 일환으로 산업용을 HPC 시스템에 최적화하여 이식할 수 있는 FPGA 기반 칩 플랫폼을 개발하여 에너지 효율적 설계를 통한 프로그래머블 컴퓨팅 분야의 유럽 역량 향상에 기여하고 기여하였습니다. 또한, 유럽에서는 AI 가속, 엣지 인텔리전스, 오픈 하드웨어 아키텍처(RISC-V 등)를 중시하고 있으며, FPGA를 차세대 컴퓨팅 인프라의 핵심으로 자리매김하고 있습니다. 독일, 프랑스, 네덜란드에서는 탄탄한 R&D 생태계가 구축되어 있고, 학계와 산업계의 협력 관계도 확대되고 있어, 유럽은 첨단 FPGA 혁신 및 개발의 중요한 거점으로서 입지를 강화할 것으로 예상됩니다.

세계의 필드 프로그래머블 게이트 어레이(FPGA) 시장에 대해 조사했으며, 구성별, 노드 크기별, 기술별, 산업별, 지역별 동향, 시장 진입 기업 프로파일 등의 정보를 정리하여 전해드립니다.

자주 묻는 질문

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 주요 인사이트

제5장 시장 개요

- 소개

- 시장 역학

- 미충족 수요와 공백

- 상호 접속된 시장과 분야 횡단적인 기회

- 티어1/2/3플레이어 전략적 활동

제6장 업계 동향

- 소개

- Porter's Five Forces 분석

- 거시경제 지표

- 밸류체인 분석

- 생태계 분석

- 가격 분석

- 무역 분석

- 2025-2026년의 주요 회의와 이벤트

- 고객의 비즈니스에 영향을 미치는 동향/디스럽션

- 투자와 자금 조달 시나리오, 2021-2025년

- 사례 연구 분석

- 2025년 미국 관세의 영향

제7장 고객 상황과 구매 행동

- 의사결정 프로세스

- 주요 이해관계자와 구입 기준

- 채용 장벽과 내부 과제

- 다양한 업계로부터의 미충족 수요

제8장 규제 상황

- 소개

- 규제기관, 정부기관, 기타 조직

- 표준

- 정부 규제

제9장 기술, 특허, 디지털, AI의 도입별 전략적 파괴

- 주요 신기술

- 보완 기술

- 인접 기술

- 기술/제품 로드맵

- 특허 분석

- AI의 영향

제10장 FPGA와 EFPGA 시장 규모

- 소개

- FPGA

- EFPGA

제11장 FPGA 시장(컨피규레이션별)

- 소개

- 로우 엔드 FPGA

- 미드 레인지 FPGA

- 하이 엔드 FPGA

제12장 FPGA 시장(노드 사이즈별)

- 소개

- 16NM 이하

- 20-90NM

- 90NM 이상

제13장 FPGA 시장(기술별)

- 소개

- 정적 랜덤 액세스 메모리(SRAM)

- 플래시

- 안티퓨즈

제14장 FPGA 시장(업계별)

- 소개

- 통신

- 가전

- 테스트, 측정, 에뮬레이션

- 데이터센터와 컴퓨팅

- 군·항공우주

- 산업용

- 자동차

- 헬스케어

- 멀티미디어

- 방송

제15장 FPGA 시장(지역별)

- 소개

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 기타

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 기타

- 기타 지역

- 남미

- 걸프협력회의(GCC)

- 기타

제16장 경쟁 구도

- 개요

- 주요 진출 기업의 전략/강점, 2021-2025년

- 매출 분석, 2021-2024년

- 시장 점유율 분석, 2024년

- 기업 평가와 재무 지표

- 브랜드/제품 비교

- FPGA 기업 평가 매트릭스 : 주요 진출 기업, 2024년

- FPGA 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 경쟁 시나리오

제17장 기업 개요

- 주요 진출 기업

- ADVANCED MICRO DEVICES, INC.

- ALTERA CORPORATION

- MICROCHIP TECHNOLOGY INC.

- LATTICE SEMICONDUCTOR CORPORATION

- ACHRONIX SEMICONDUCTOR CORPORATION

- QUICKLOGIC CORPORATION

- EFINIX, INC.

- SHENZHEN PANGO MICROSYSTEMS CO., LTD.

- GOWIN SEMICONDUCTOR CORP.

- RENESAS ELECTRONICS CORPORATION

- 기타 기업

- AGM MICRO

- SHANGHAI ANLOGIC INFOTECH CO., LTD.

- HERCULES MICROELECTRONICS INC.

- XI'AN ZHIDUOJING MICROELECTRONICS CO., LTD.

- NANOXPLORE

- COLOGNE CHIP AG

- LEAFLABS, LLC

- LOGIC FRUIT TECHNOLOGIES PRIVATE LIMITED

- RAPID SILICON

- ZERO ASIC

- ADICSYS

- RAPID FLEX

- MENTA

- SARACA SOLUTIONS PRIVATE LIMITED

- BYTESNAP DESIGN

제18장 부록

KSM 25.11.17The global field-programmable gate array (FPGA) market is projected to reach USD 19.34 billion by 2030 from USD 11.73 billion in 2025 at a CAGR of 10.5%. The market is experiencing robust growth driven by the wide adoption of AI technologies and the rollout of 5G infrastructure across key industries. As AI workloads become increasingly complex, FPGAs are being deployed to accelerate real-time data processing, sensor fusion, and adaptive learning in industries such as aerospace & defense and automotive.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Configuration, Technology, Node Size, Vertical and Region |

| Regions covered | North America, Europe, APAC, RoW |

The expansion of 5G networks is fueling demand for FPGAs due to their ability to support high-bandwidth, low-latency communication and reconfigurable signal processing. Their flexibility in adapting to evolving standards and protocols makes FPGAs indispensable for next-generation telecom equipment and edge computing systems. Together, these trends are reinforcing FPGA's role as a critical enabler of intelligent, high-performance, and future-ready digital infrastructure.

"SRAM technology to hold largest market share in 2025"

SRAM-based FPGAs are expected to hold the largest share of the FPGA market in 2025, owing to their superior reconfigurability, high-speed performance, and suitability for complex digital systems. These devices allow designers to dynamically reprogram hardware functions, making them ideal for applications requiring frequent updates and design flexibility, such as AI acceleration, data center networking, and advanced telecommunications. The continued advancement of SRAM technology enables higher logic density, improved energy efficiency, and enhanced security features, reinforcing its dominance across performance-critical sectors. Moreover, the growing adoption of adaptive computing architectures, where FPGA logic is reconfigured in real time to optimize workloads, is further expanding the use of SRAM-based FPGAs in next-generation computing and communication systems.

"Data centers and computing vertical to record highest CAGR during forecast period"

The data centers and computing segment is projected to register the highest CAGR in the FPGA market, driven by the rising adoption of FPGAs for AI inference, cloud acceleration, and high-performance computing workloads. FPGAs offer unmatched parallel processing capability, reconfigurability, and power efficiency, making them highly effective in optimizing data throughput and reducing latency for real-time applications. Major cloud service providers and hyperscale operators are increasingly integrating FPGA-based accelerators to handle diverse workloads in AI, machine learning, and analytics. Additionally, the transition toward heterogeneous computing architectures and the growing demand for customizable hardware to support evolving algorithms are propelling FPGA deployment in large-scale computing infrastructures, positioning this segment for sustained high growth.

"Europe to hold significant market share for FPGA in 2025"

Europe is set to capture a significant share of the global FPGA market in 2025, driven by its strong industrial base, strategic digital investments, and a coordinated push toward technological sovereignty. The region's leadership in automotive electronics, industrial automation, telecommunications, and defense is fueling sustained demand for reconfigurable computing solutions. Ongoing initiatives under the European Chips Act and Horizon Europe are fostering innovation in semiconductor design, manufacturing, and high-performance computing, creating a favorable environment for FPGA adoption. In April 2024, the OPTIMA initiative developed an FPGA-based chip platform under the EuroHPC JU to optimize and port industrial applications onto HPC systems, helping advance Europe's capabilities in programmable computing with energy-efficient designs. Moreover, Europe's emphasis on AI acceleration, edge intelligence, and open hardware architectures (such as RISC-V) is positioning FPGAs as a core enabler of next-generation computing infrastructure. With robust R&D ecosystems in Germany, France, and the Netherlands, alongside growing collaborations between academia and industry, Europe is expected to strengthen its position as a key hub for advanced FPGA innovation and deployment.

Extensive primary interviews were conducted with key industry experts in the FPGA market to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below.

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1-40%, Tier 2-30%, and Tier 3-30%

- By Designation: C-level Executives-20%, Directors-20%, and Others-60%

- By Region: North America-30%, Asia Pacific-40%, Europe-20%, and RoW-10%

The FPGA market is dominated by a few globally established players, such as Advanced Micro Devices, Inc. (US), Altera Corporation (US), Lattice Semiconductor (US), Microchip Technology Inc. (US), Achronix Semiconductor Corporation (US), QuickLogic Corporation (US), Efinix, Inc. (US), GOWIN Semiconductor Corp. (China), Renesas Electronics Corporation (Japan), and Shenzhen Pango Microsystems Co., Ltd. (China).

The study includes an in-depth competitive analysis of these key players in the FPGA market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the FPGA market based on configuration (low-end FPGA, mid-range FPGA, high-end FPGA), node size (<=16 NM, 20-90 NM, > 90 NM), technology (SRAM, flash, antifuse), FPGA and eFPGA Market Size (FPGA, eFPGA), and vertical (telecommunications; consumer electronics; test, measurement and emulation; data centers and computing; military & aerospace; industrial; automotive; healthcare; multimedia; broadcasting). It also discusses the market's drivers, restraints, opportunities, and challenges. It gives a detailed view of the market across four main regions (North America, Europe, the Asia Pacific, and the RoW). The report includes an ecosystem analysis of key players.

Key Benefits of Buying the Report:

- Analysis of key drivers (wide adoption of AI and IoT technologies in the aerospace & defense industry, integration of FPGAs into advanced driver-assistance systems, increased deployment of data centers and high-performance computing facilities, elevated demand for FPGA hardware testing and verification services to enhance avionics system performance, accelerated demand for FPGAs to handle complex sensor data and execute AI algorithms in real time), restraints (limited availability of skilled FPGA developers, risk of data security breaches arising from hidden bugs in FPGA chips), opportunities (integration of FPGA technology into high-bandwidth devices, rollout of 5G technology, utilization of eFPGAs in military and aerospace applications), challenges (lack of standardized FPGA verification and validation techniques, extended design cycles due to complexities associated with FPGA programming)

- Service Development/Innovation: Detailed insights into upcoming technologies, research and development activities, and launches in the FPGA market

- Market Development: Comprehensive information about lucrative markets through the analysis of the FPGA market across varied regions

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the FPGA market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players, such as Advanced Micro Devices, Inc. (US), Altera Corporation (US), Lattice Semiconductor (US), Microchip Technology Inc. (US), Achronix Semiconductor Corporation (US), QuickLogic Corporation (US), Efinix, Inc. (US), GOWIN Semiconductor Corp. (China), Renesas Electronics Corporation (Japan), and Shenzhen Pango Microsystems Co., Ltd. (China)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- 3.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 3.2 KEY MARKET PARTICIPANTS: SHARE INSIGHTS AND STRATEGIC DEVELOPMENTS

- 3.3 DISRUPTIVE TRENDS SHAPING MARKET

- 3.4 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS

- 3.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FPGA MARKET

- 4.2 FPGA MARKET, BY CONFIGURATION AND NODE SIZE

- 4.3 FPGA MARKET, BY TECHNOLOGY

- 4.4 FPGA MARKET, BY VERTICAL

- 4.5 FPGA MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Wide adoption of AI and IoT technologies in aerospace & defense industry

- 5.2.1.2 Integration of FPGAs into advanced driver assistance systems

- 5.2.1.3 Increasing deployment of data centers and high-performance computing facilities

- 5.2.1.4 Growing demand for FPGA hardware testing and verification services to enhance avionics system performance

- 5.2.1.5 Growth in demand for FPGAs to handle complex sensor data and execute AI algorithms in real time

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited availability of skilled FPGA developers

- 5.2.2.2 Risk of data security breaches arising from hidden bugs in FPGA chips

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integration of FPGA technology into high-bandwidth devices

- 5.2.3.2 Rollout of 5G technology

- 5.2.3.3 Utilization of eFPGAs in military and aerospace applications

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of standardized FPGA verification and validation techniques

- 5.2.4.2 Extended design cycles due to complexities associated with FPGA programming

- 5.2.1 DRIVERS

- 5.3 UNMET NEEDS AND WHITE SPACES

- 5.3.1 UNMET NEEDS IN FPGA MARKET

- 5.3.2 WHITE SPACE OPPORTUNITIES

- 5.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 5.4.1 INTERCONNECTED MARKETS

- 5.4.2 CROSS-SECTOR OPPORTUNITIES

- 5.5 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

- 5.5.1 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 PORTER'S FIVE FORCES ANALYSIS

- 6.2.1 THREAT OF NEW ENTRANTS

- 6.2.2 THREAT OF SUBSTITUTES

- 6.2.3 BARGAINING POWER OF SUPPLIERS

- 6.2.4 BARGAINING POWER OF BUYERS

- 6.2.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.3 MACROECONOMIC INDICATORS

- 6.3.1 INTRODUCTION

- 6.3.2 GDP TRENDS AND FORECAST

- 6.3.3 TRENDS IN LOGIC SEMICONDUCTORS INDUSTRY

- 6.3.4 TRENDS IN DATA CENTER INDUSTRY

- 6.4 VALUE CHAIN ANALYSIS

- 6.5 ECOSYSTEM ANALYSIS

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE OF FPGAS OFFERED BY TOP 3 KEY PLAYERS, BY VERTICAL, 2024

- 6.6.1.1 Average selling price of low-end FPGAs offered by top 3 key players, by vertical, 2024

- 6.6.1.2 Average selling price of mid-range FPGAs offered by top 3 key players, by vertical, 2024

- 6.6.1.3 Average selling price of high-end FPGAs offered by top 2 players, by vertical, 2024

- 6.6.2 AVERAGE SELLING PRICE, BY REGION, 2021-2024

- 6.6.1 AVERAGE SELLING PRICE OF FPGAS OFFERED BY TOP 3 KEY PLAYERS, BY VERTICAL, 2024

- 6.7 TRADE ANALYSIS

- 6.7.1 IMPORT DATA (HS CODE 854239)

- 6.7.2 EXPORT SCENARIO (HS CODE 854239)

- 6.8 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 6.10 INVESTMENT AND FUNDING SCENARIO, 2021-2025

- 6.11 CASE STUDY ANALYSIS

- 6.11.1 CANOGA PERKINS ACCELERATED AI-READY PRIVATE 5G NETWORKS WITH AMD VIRTEX ULTRASCALE+ FPGAS FOR DETERMINISTIC, ULTRA-LOW-LATENCY CONNECTIVITY

- 6.11.2 MAGEWELL ENHANCED 4K MEDIA CAPTURE PERFORMANCE USING AMD ARTIX ULTRASCALE+ FPGAS

- 6.11.3 DIGIBIRD'S AUDIOVISUAL SOLUTION EQUIPPED WITH XILINX'S KINTEX SERIES FPGA

- 6.11.4 NEWTOUCH'S FOURTH-GENERATION LARGE-SCALE PROTOTYPING SYSTEM EQUIPPED WITH XILINX'S FPGA

- 6.11.5 PERSEVERANCE ROVER EMPLOYED AMD'S FPGA-BASED HARDWARE ACCELERATION FOR IMAGE PROCESSING AND NAVIGATION TASKS

- 6.11.6 TECHNICAL UNIVERSITY OF BERLIN DEVELOPED SOFTWARE-DEFINED RADIO SYSTEM USING GIDEL'S FPGA PLATFORM

- 6.11.7 FLEX AND INTEL PARTNERED TO REVOLUTIONIZE SMT PRODUCTION WITH FPGA-BASED SOLUTIONS

- 6.12 IMPACT OF 2025 US TARIFFS

- 6.12.1 KEY TARIFF RATES

- 6.12.2 PRICE IMPACT ANALYSIS

- 6.12.3 IMPACT ON VARIOUS COUNTRIES/REGIONS

- 6.12.3.1 US

- 6.12.3.2 Europe

- 6.12.3.3 Asia Pacific

- 6.12.4 IMPACT ON VERTICALS

7 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 7.1 DECISION-MAKING PROCESS

- 7.2 KEY STAKEHOLDERS AND BUYING CRITERIA

- 7.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 7.2.2 BUYING CRITERIA

- 7.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 7.4 UNMET NEEDS FROM VARIOUS VERTICALS

8 REGULATORY LANDSCAPE

- 8.1 INTRODUCTION

- 8.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 8.1.2 STANDARDS

- 8.1.2.1 DO-254

- 8.1.2.2 ANSI/VITA Standards

- 8.1.2.3 Moisture Sensitivity Level

- 8.1.2.4 ISO 9001:2015

- 8.1.2.5 ISO 14001:2015

- 8.1.2.6 International Automotive Task Force 16949

- 8.1.2.7 IEEE 1149.1

- 8.1.2.8 UL 60950-1

- 8.1.2.9 IEC 62368-1

- 8.1.2.10 IEC 62443

- 8.1.2.11 IEC 61508

- 8.1.2.12 JEDEC JESD47

- 8.1.2.13 RoHS (Restriction of Hazardous Substances) Directive (EU 2011/65/EU)

- 8.1.3 GOVERNMENT REGULATIONS

- 8.1.3.1 US

- 8.1.3.2 Europe

- 8.1.3.3 China

- 8.1.3.4 Japan

- 8.1.3.5 India

9 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTION

- 9.1 KEY EMERGING TECHNOLOGIES

- 9.1.1 EMBEDDED PROCESSORS

- 9.1.2 ON-CHIP MEMORY

- 9.1.3 HETEROGENEOUS INTEGRATION

- 9.2 COMPLEMENTARY TECHNOLOGIES

- 9.2.1 HIGH-SPEED INTERFACES AND PROTOCOLS

- 9.2.2 COOLING AND POWER MANAGEMENT SOLUTIONS

- 9.3 ADJACENT TECHNOLOGIES

- 9.3.1 APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC)

- 9.3.2 GRAPHICS PROCESSING UNIT (GPU)

- 9.3.3 SYSTEM-ON-CHIP (SOC)

- 9.4 TECHNOLOGY/PRODUCT ROADMAP

- 9.4.1 SHORT-TERM (2025-2027): ARCHITECTURE OPTIMIZATION AND AI INTEGRATION

- 9.4.2 MID-TERM (2027-2030): HETEROGENEOUS INTEGRATION & DESIGN ECOSYSTEM EXPANSION

- 9.4.3 LONG-TERM (2030-2035+): UNIVERSAL RECONFIGURABLE COMPUTING AND SYSTEM-LEVEL CONVERGENCE

- 9.5 PATENT ANALYSIS

- 9.6 IMPACT OF AI

- 9.6.1 TOP USE CASES AND MARKET POTENTIAL

- 9.6.2 BEST PRACTICES IN FPGA MARKET

- 9.6.3 CASE STUDIES OF AI IMPLEMENTATION IN FPGA MARKET

- 9.6.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 9.6.5 CLIENTS' READINESS TO ADOPT AI IN FPGA MARKET

10 MARKET SIZE FOR FPGA AND EFPGA

- 10.1 INTRODUCTION

- 10.2 FPGA

- 10.2.1 EMERGENCE OF AI/ML WORKLOADS, NETWORK VIRTUALIZATION, AND HIGH-PERFORMANCE EDGE APPLICATIONS TO DRIVE MARKET

- 10.3 EFPGA

- 10.3.1 INCREASING DEMAND FOR CUSTOMIZABLE HARDWARE ACCELERATORS, AI INFERENCE ENGINES, AND SECURE CRYPTOGRAPHIC APPLICATIONS TO DRIVE MARKET

11 FPGA MARKET, BY CONFIGURATION

- 11.1 INTRODUCTION

- 11.2 LOW-END FPGA

- 11.2.1 SURGE IN POWER-CONSCIOUS SOLUTIONS IN EMBEDDED AND INDUSTRIAL APPLICATIONS TO DRIVE DEMAND

- 11.3 MID-RANGE FPGA

- 11.3.1 ENTERPRISES SEEKING SCALABLE, HIGH-THROUGHPUT SOLUTIONS FOR DATA-CENTRIC AND NETWORKING WORKLOADS TO DRIVE DEMAND

- 11.4 HIGH-END FPGA

- 11.4.1 EXPONENTIAL GROWTH IN AI TRAINING, CLOUD COMPUTING, AND DATA CENTER WORKLOADS TO DRIVE DEMAND

12 FPGA MARKET, BY NODE SIZE

- 12.1 INTRODUCTION

- 12.2 <= 16 NM

- 12.2.1 DESIGNED FOR DATA-INTENSIVE, LATENCY-SENSITIVE WORKLOADS

- 12.3 20-90 NM

- 12.3.1 OFFERS MODERATE-TO-HIGH LOGIC DENSITY, MULTI-GBPS TRANSCEIVERS, AND EMBEDDED DSP AND MEMORY BLOCKS

- 12.4 >90 NM

- 12.4.1 MODERNIZATION OF DEFENSE AND SPACE INFRASTRUCTURE TO REINFORCE DEMAND FOR >90 NM RADIATION-HARDENED FPGAS

13 FPGA MARKET, BY TECHNOLOGY

- 13.1 INTRODUCTION

- 13.2 STATIC RANDOM-ACCESS MEMORY (SRAM)

- 13.2.1 RECONFIGURABLE, HIGH-PERFORMANCE LOGIC, AND AI/ML ACCELERATION TO DRIVE DEMAND

- 13.3 FLASH

- 13.3.1 LOW-POWER AND SECURE PROGRAMMABLE LOGIC TO DRIVE DEMAND

- 13.4 ANTIFUSE

- 13.4.1 EXTREME ENVIRONMENT TOLERANCE AND LONG-TERM SUPPORT TO STRENGTHEN ANTIFUSE FPGA MARKET

14 FPGA MARKET, BY VERTICAL

- 14.1 INTRODUCTION

- 14.2 TELECOMMUNICATIONS

- 14.2.1 WIRED COMMUNICATION

- 14.2.1.1 Optical transport network (OTN)

- 14.2.1.1.1 Backbone of next-generation networks

- 14.2.1.2 Backhaul & access network

- 14.2.1.2.1 Open RAN adoption and programmable baseband processing to drive FPGA deployment for access network

- 14.2.1.3 Network processing

- 14.2.1.3.1 Growing demand for reconfigurable and secure networking systems to fuel FPGA integration across telecom networks

- 14.2.1.4 Wired connectivity

- 14.2.1.4.1 Growing need for ultra-low latency and high-throughput communication to enhance FPGA utilization in wired connectivity

- 14.2.1.5 Packet-based processing & switching

- 14.2.1.5.1 Growing need for real-time packet inspection and low-latency switching to drive FPGA integration in network fabrics

- 14.2.1.1 Optical transport network (OTN)

- 14.2.2 WIRELESS COMMUNICATION

- 14.2.2.1 Wireless baseband solutions

- 14.2.2.1.1 Rising focus on high-capacity, low-power wireless infrastructure to enhance FPGA adoption in baseband solutions

- 14.2.2.2 Wireless backhaul solutions

- 14.2.2.2.1 Growing deployment of dense urban and rural wireless backhaul links to drive demand for FPGA-based high-performance platforms

- 14.2.2.3 Radio solutions

- 14.2.2.3.1 Expansion of software-defined radio and multi-band wireless networks to accelerate FPGA adoption in radio solutions

- 14.2.2.1 Wireless baseband solutions

- 14.2.3 5G

- 14.2.3.1 Growing 5G network capacity demand to spur FPGA advancements for high-density logic and fast memory interfaces

- 14.2.1 WIRED COMMUNICATION

- 14.3 CONSUMER ELECTRONICS

- 14.3.1 RISING DEMAND FOR SMART AND CONNECTED CONSUMER DEVICES TO DRIVE DEMAND

- 14.4 TESTING, MEASUREMENT, AND EMULATION

- 14.4.1 EXPANSION OF AUTOMATED TEST EQUIPMENT AND EMULATION PLATFORMS TO STRENGTHEN FPGA UTILIZATION

- 14.5 DATA CENTER & COMPUTING

- 14.5.1 STORAGE INTERFACE CONTROL

- 14.5.1.1 Increasing need for energy-efficient, flexible, and upgradeable storage systems to drive growth

- 14.5.2 NETWORK INTERFACE CONTROL

- 14.5.2.1 Increasing complexity of networking protocols and multi-tenant architectures to drive growth

- 14.5.3 HARDWARE ACCELERATOR

- 14.5.3.1 Growth in real-time data analytics and high-performance computing to drive growth

- 14.5.4 HIGH-PERFORMANCE COMPUTING

- 14.5.4.1 Rising demand for exascale computing, AI integration, and real-time simulations to drive growth

- 14.5.1 STORAGE INTERFACE CONTROL

- 14.6 MILITARY & AEROSPACE

- 14.6.1 AVIONICS

- 14.6.1.1 Growing use of programmable FPGAs to enhance next-generation radar, communication, and flight control capabilities

- 14.6.2 MISSILES AND MUNITIONS

- 14.6.2.1 Growth in autonomous and software-defined weapon systems to drive growth

- 14.6.3 RADARS AND SENSORS

- 14.6.3.1 Advanced signal processing for multi-function radars to drive growth

- 14.6.4 OTHERS

- 14.6.1 AVIONICS

- 14.7 INDUSTRIAL

- 14.7.1 VIDEO SURVEILLANCE SYSTEMS

- 14.7.1.1 Growing need for low-latency image processing and hardware-level security to drive FPGA utilization in surveillance applications

- 14.7.2 MACHINE VISION SOLUTIONS

- 14.7.2.1 Proliferation of robotics and automated inspection systems to enhance demand for FPGA-based machine vision architecture

- 14.7.3 INDUSTRIAL NETWORKING SOLUTIONS

- 14.7.3.1 Expanding use of time-sensitive networking and multi-protocol communication to boost FPGA-based industrial connectivity solutions

- 14.7.4 INDUSTRIAL MOTOR CONTROL SOLUTIONS

- 14.7.4.1 Industrial motor control applications to propel FPGA adoption for faster processing and adaptive control

- 14.7.5 ROBOTICS

- 14.7.5.1 Surge in intelligent robotics and multi-sensor systems to drive growth

- 14.7.6 INDUSTRIAL SENSORS

- 14.7.6.1 Integration of FPGAs into industrial systems to enable faster signal processing

- 14.7.7 OTHERS

- 14.7.1 VIDEO SURVEILLANCE SYSTEMS

- 14.8 AUTOMOTIVE

- 14.8.1 ADAS/SENSOR FUSION

- 14.8.1.1 FPGA growth supported by integration of AI and machine learning in advanced driver assistance systems

- 14.8.2 AUTOMOTIVE INFOTAINMENT AND DRIVER INFORMATION SYSTEMS

- 14.8.2.1 Growing complexity in automotive digital cockpits to drive increased FPGA integration for infotainment and driver information applications

- 14.8.3 ELECTRIC VEHICLES

- 14.8.3.1 EV powertrain

- 14.8.3.1.1 Increasing complexity of EV powertrains to propel FPGA utilization for multi-motor and regenerative braking systems

- 14.8.3.2 EV charging

- 14.8.3.2.1 Expansion of fast EV chargers to drive FPGA utilization for optimized energy management

- 14.8.3.3 Vehicle-to-Grid (V2G) communication

- 14.8.3.3.1 Rising EV adoption and grid modernization to accelerate FPGA integration in vehicle-to-grid communication

- 14.8.3.1 EV powertrain

- 14.8.1 ADAS/SENSOR FUSION

- 14.9 HEALTHCARE

- 14.9.1 IMAGE DIAGNOSTIC SYSTEMS

- 14.9.1.1 Ultrasound machines

- 14.9.1.1.1 Increasing need for low-latency image processing to drive demand

- 14.9.1.2 X-ray machines

- 14.9.1.2.1 Rising demand for high-speed digital radiography to drive growth

- 14.9.1.3 CT scanners

- 14.9.1.3.1 Increasing healthcare imaging volumes and precision requirements to drive demand

- 14.9.1.4 MRI machines

- 14.9.1.4.1 Increasing MRI complexity to accelerate adoption of FPGA for real-time processing and enhanced image quality

- 14.9.1.1 Ultrasound machines

- 14.9.2 WEARABLE DEVICES

- 14.9.2.1 Growing integration of multi-sensor platforms to support growth

- 14.9.3 OTHERS

- 14.9.1 IMAGE DIAGNOSTIC SYSTEMS

- 14.10 MULTIMEDIA

- 14.10.1 AUDIO DEVICES

- 14.10.1.1 Increasing consumer demand for high-fidelity audio to drive FPGA deployment across professional and consumer electronics

- 14.10.2 VIDEO PROCESSING

- 14.10.2.1 Growing demand for multi-format video processing to drive market

- 14.10.1 AUDIO DEVICES

- 14.11 BROADCASTING

- 14.11.1 BROADCASTING PLATFORM SYSTEMS

- 14.11.1.1 High adoption of FPGAs due to their hardware acceleration ability

- 14.11.2 HIGH-END BROADCASTING SYSTEMS

- 14.11.2.1 Growing need for adaptive video processing and multi-format compatibility to drive demand

- 14.11.1 BROADCASTING PLATFORM SYSTEMS

15 FPGA MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 NORTH AMERICA

- 15.2.1 US

- 15.2.1.1 Rising defense modernization and strategic military spending to drive market

- 15.2.2 CANADA

- 15.2.2.1 Strategic partnerships and telecom expansion to drive market

- 15.2.3 MEXICO

- 15.2.3.1 Expansion of high-tech manufacturing and localized supply chains to drive market

- 15.2.1 US

- 15.3 EUROPE

- 15.3.1 GERMANY

- 15.3.1.1 Electric vehicle expansion and automotive innovation to drive market

- 15.3.2 UK

- 15.3.2.1 Government-led semiconductor investments and data center expansion to drive market

- 15.3.3 FRANCE

- 15.3.3.1 Strategic eFPGA deployments to fuel aerospace and defense technology to drive market

- 15.3.4 ITALY

- 15.3.4.1 Strategic semiconductor investments to drive market

- 15.3.5 REST OF EUROPE

- 15.3.1 GERMANY

- 15.4 ASIA PACIFIC

- 15.4.1 CHINA

- 15.4.1.1 Large-scale investments in semiconductor manufacturing to drive market

- 15.4.2 JAPAN

- 15.4.2.1 Shift toward smart factories to drive market

- 15.4.3 INDIA

- 15.4.3.1 Digital transformation and 5G rollout to drive market

- 15.4.4 SOUTH KOREA

- 15.4.4.1 Expanding digital economy and high-performance computing needs to drive market

- 15.4.5 REST OF ASIA PACIFIC

- 15.4.1 CHINA

- 15.5 REST OF THE WORLD (ROW)

- 15.5.1 SOUTH AMERICA

- 15.5.1.1 Surging demand for cloud computing and edge AI applications to drive market

- 15.5.2 GULF COOPERATION COUNCIL (GCC)

- 15.5.2.1 Strategic partnerships in semiconductor design to drive market

- 15.5.3 REST OF MIDDLE EAST & AFRICA

- 15.5.1 SOUTH AMERICA

16 COMPETITIVE LANDSCAPE

- 16.1 OVERVIEW

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 16.3 REVENUE ANALYSIS, 2021-2024

- 16.4 MARKET SHARE ANALYSIS, 2024

- 16.5 COMPANY VALUATION AND FINANCIAL METRICS

- 16.6 BRAND/PRODUCT COMPARISON

- 16.7 COMPANY EVALUATION MATRIX FOR FPGA: KEY PLAYERS, 2024

- 16.7.1 STARS

- 16.7.2 EMERGING LEADERS

- 16.7.3 PERVASIVE PLAYERS

- 16.7.4 PARTICIPANTS

- 16.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 16.7.5.1 Company footprint

- 16.7.5.2 Regional footprint

- 16.7.5.3 Configuration footprint

- 16.7.5.4 Node size footprint

- 16.7.5.5 Technology footprint

- 16.7.5.6 Vertical footprint

- 16.8 COMPANY EVALUATION MATRIX FOR FPGA: STARTUPS/SMES, 2024

- 16.8.1 PROGRESSIVE COMPANIES

- 16.8.2 RESPONSIVE COMPANIES

- 16.8.3 DYNAMIC COMPANIES

- 16.8.4 STARTING BLOCKS

- 16.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 16.8.5.1 List of key startups/SMEs

- 16.8.5.2 Competitive benchmarking of key startups/SMEs (1/2)

- 16.8.5.3 Competitive benchmarking of key startups/SMEs (2/2)

- 16.9 COMPETITIVE SCENARIO

- 16.9.1 PRODUCT LAUNCHES

- 16.9.2 DEALS

17 COMPANY PROFILES

- 17.1 KEY PLAYERS

- 17.1.1 ADVANCED MICRO DEVICES, INC.

- 17.1.1.1 Business overview

- 17.1.1.2 Products offered

- 17.1.1.3 Recent developments

- 17.1.1.3.1 Product launches

- 17.1.1.3.2 Deals

- 17.1.1.4 MnM view

- 17.1.1.4.1 Key strengths

- 17.1.1.4.2 Strategic choices

- 17.1.1.4.3 Weaknesses and competitive threats

- 17.1.2 ALTERA CORPORATION

- 17.1.2.1 Business overview

- 17.1.2.2 Products offered

- 17.1.2.3 Recent developments

- 17.1.2.3.1 Product launches

- 17.1.2.3.2 Deals

- 17.1.2.3.3 Expansions

- 17.1.2.3.4 Other developments

- 17.1.2.4 MnM view

- 17.1.2.4.1 Key strengths

- 17.1.2.4.2 Strategic choices

- 17.1.2.4.3 Weaknesses and competitive threats

- 17.1.3 MICROCHIP TECHNOLOGY INC.

- 17.1.3.1 Business overview

- 17.1.3.2 Products offered

- 17.1.3.3 Recent developments

- 17.1.3.3.1 Product launches

- 17.1.3.3.2 Deals

- 17.1.3.3.3 Expansions

- 17.1.3.3.4 Other developments

- 17.1.3.4 MnM view

- 17.1.3.4.1 Key strengths

- 17.1.3.4.2 Strategic choices

- 17.1.3.4.3 Weaknesses and competitive threats

- 17.1.4 LATTICE SEMICONDUCTOR CORPORATION

- 17.1.4.1 Business overview

- 17.1.4.2 Products offered

- 17.1.4.3 Recent developments

- 17.1.4.3.1 Product launches

- 17.1.4.3.2 Deals

- 17.1.4.3.3 Other developments

- 17.1.4.4 MnM view

- 17.1.4.4.1 Key strengths

- 17.1.4.4.2 Strategic choices

- 17.1.4.4.3 Weaknesses and competitive threats

- 17.1.5 ACHRONIX SEMICONDUCTOR CORPORATION

- 17.1.5.1 Business overview

- 17.1.5.2 Products offered

- 17.1.5.3 Recent developments

- 17.1.5.3.1 Product launches

- 17.1.5.3.2 Deals

- 17.1.5.3.3 Other developments

- 17.1.5.4 MnM view

- 17.1.5.4.1 Key strengths

- 17.1.5.4.2 Strategic choices

- 17.1.5.4.3 Weaknesses and competitive threats

- 17.1.6 QUICKLOGIC CORPORATION

- 17.1.6.1 Business overview

- 17.1.6.2 Products offered

- 17.1.6.3 Recent developments

- 17.1.6.3.1 Product launches

- 17.1.6.3.2 Deals

- 17.1.6.3.3 Other developments

- 17.1.7 EFINIX, INC.

- 17.1.7.1 Business overview

- 17.1.7.2 Products offered

- 17.1.7.3 Recent developments

- 17.1.7.3.1 Product launches

- 17.1.7.3.2 Deals

- 17.1.8 SHENZHEN PANGO MICROSYSTEMS CO., LTD.

- 17.1.8.1 Business overview

- 17.1.8.2 Products offered

- 17.1.9 GOWIN SEMICONDUCTOR CORP.

- 17.1.9.1 Business overview

- 17.1.9.2 Products offered

- 17.1.9.3 Recent developments

- 17.1.9.3.1 Product launches

- 17.1.9.3.2 Deals

- 17.1.10 RENESAS ELECTRONICS CORPORATION

- 17.1.10.1 Business overview

- 17.1.10.2 Products offered

- 17.1.10.3 Recent developments

- 17.1.10.3.1 Product launches

- 17.1.10.3.2 Deals

- 17.1.1 ADVANCED MICRO DEVICES, INC.

- 17.2 OTHER PLAYERS

- 17.2.1 AGM MICRO

- 17.2.2 SHANGHAI ANLOGIC INFOTECH CO., LTD.

- 17.2.3 HERCULES MICROELECTRONICS INC.

- 17.2.4 XI'AN ZHIDUOJING MICROELECTRONICS CO., LTD.

- 17.2.5 NANOXPLORE

- 17.2.6 COLOGNE CHIP AG

- 17.2.7 LEAFLABS, LLC

- 17.2.8 LOGIC FRUIT TECHNOLOGIES PRIVATE LIMITED

- 17.2.9 RAPID SILICON

- 17.2.10 ZERO ASIC

- 17.2.11 ADICSYS

- 17.2.12 RAPID FLEX

- 17.2.13 MENTA

- 17.2.14 SARACA SOLUTIONS PRIVATE LIMITED

- 17.2.15 BYTESNAP DESIGN

18 APPENDIX

- 18.1 DISCUSSION GUIDE

- 18.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.3 CUSTOMIZATION OPTIONS

- 18.4 RELATED REPORTS

- 18.5 AUTHOR DETAILS