|

시장보고서

상품코드

1863601

필드 서비스 관리 시장 예측(-2030년) : 오퍼링별, 배포 모드별, 조직 규모별, 업계별, 지역별Field Service Management Market by Solutions, Deployment mode, Organization Size, Vertical and Region - Global Forecast to 2030 |

||||||

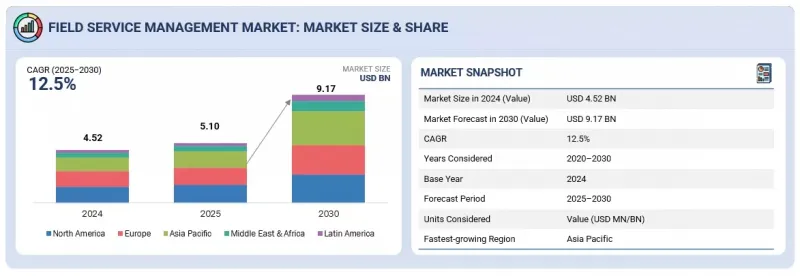

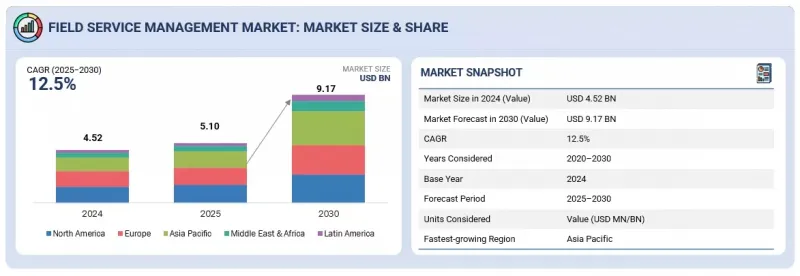

필드 서비스 관리 시장 규모는 급속히 확대하고 있으며, 2025년 약 51억 달러에서 2030년까지 91억 7,000만 달러로 성장하며, CAGR은 12.5%로 예측되고 있습니다.

이 시장의 급격한 성장은 통신, 제조, 물류 산업에서 기업이 업무 효율화, 고객 만족도 향상, 디지털 전환을 우선순위에 두고 있는 것이 주요 요인으로 작용하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2020-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 대상 단위 | 10억 달러 |

| 부문 | 오퍼링별, 배포 모드별, 조직 규모별, 업계별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동 및 아프리카, 라틴아메리카 |

최신 FSM 플랫폼은 직원 효율성을 최적화하고, 고객 경험을 개선하며, 클라우드, AI, IoT 기술과의 원활한 통합을 통해 엔드 투 엔드 우수한 서비스를 제공합니다. 주요 요인으로는 클라우드 기반 플랫폼과 자동화, 실시간 추적, 예지보전, 예지보전, 모바일 직원 관리 등을 들 수 있으며, 이를 종합적으로 활용하여 스케줄링, 자산 활용, 서비스 품질 향상을 도모할 수 있습니다.

AI, IoT, 애널리틱스 등 첨단 기술의 통합을 통해 기술자의 생산성 향상과 데이터베이스 의사결정을 가능하게 합니다. 한편, 규제 준수와 높아지는 고객의 기대치가 현장 서비스 관리 솔루션의 도입을 더욱 가속화하고 있습니다. 그러나 시장에는 눈에 띄는 제약도 존재합니다. 구체적으로, 지속적인 인력 기술력 부족, 레거시 인프라와의 통합 문제, 클라우드 환경에서의 데이터 보안 문제 등을 들 수 있습니다. 이러한 문제들은 교육 및 도입 비용을 증가시키고, 일부 조직에서는 기술 도입 속도를 늦출 수 있으며, 인력 개발과 안전한 디지털 전환에 대한 지속적인 노력을 요구합니다.

클라우드 기술은 본질적인 확장성, 유연성, 실시간 데이터 액세스 제공 능력으로 인해 현장 서비스 관리 시장의 급속한 성장을 주도하는 주요 요인입니다. 클라우드 기반 FSM 솔루션은 기술자, 고객, 백오피스 팀이 장소에 구애받지 않고 원활하게 협업할 수 있도록 하며, 중앙 집중식 디지털 플랫폼을 통해 스케줄링, 파견, 재고 관리를 최적화합니다. 클라우드는 ERP, CRM 등 보완적인 기업 시스템과의 통합을 촉진하고, 업무 효율성을 높이며, 일관된 워크플로우를 보장합니다.

또한 클라우드 인프라가 지원하는 IoT, AI, 모바일 연결성의 발전은 예지보전과 지능형 리소스 배분을 통해 다운타임을 줄이고 최초 해결률을 향상시킬 수 있습니다. 클라우드 FSM 플랫폼은 셀프 서비스 포털과 실시간 서비스 추적을 지원하여 고객 경험을 향상시킵니다. 보안 및 컴플라이언스 기능은 분산 환경에서 기밀 데이터 보호를 보장하는 중요한 구성 요소입니다. 클라우드 기술은 FSM의 지속적인 혁신과 적응성을 지원하며, 조직이 업무를 효율화하고 진화하는 고객의 기대에 비용 효율적으로 대응할 수 있도록 경쟁 우위를 제공합니다.

배포 모드별로 보면 가장 큰 시장 점유율을 차지하는 솔루션은 기업이 현장 업무를 관리하는 방식을 간소화하고 개선하는 것으로 알려져 있습니다. 이러한 솔루션은 작업 일정 관리, 기술자 추적, 재고 관리, 서비스 요청의 효율적인 자동화를 지원합니다. Oracle, Microsoft, Salesforce, SAP는 접근이 용이하고 확장 가능한 클라우드 기반 플랫폼을 제공합니다. 또한 CRM, ERP 시스템 등 다른 비즈니스 툴와 연동하여 워크플로우를 원활하게 유지하고 데이터의 무결성을 유지합니다.

또한 이러한 솔루션은 인공지능, IoT 등 스마트 기술을 활용하여 문제 예측 및 업무 최적화를 통해 서비스 속도와 품질을 향상시킵니다. 사용자 친화적인 인터페이스와 강력한 보안 기능은 다양한 산업의 다양한 요구를 충족시키며, 신뢰할 수 있는 선택이 되고 있습니다. 유연한 가격 책정과 맞춤형 기능을 제공하는 기업은 기업이 FSM을 특정 요구에 맞게 조정할 수 있도록 지원합니다.

북미는 실시간 가시성, 자동화, 고객 참여 강화에 대한 기업 수요 증가로 인해 현장 서비스 관리 시장을 촉진할 것으로 예측됩니다. 이 지역의 첨단 디지털 인프라와 AI, IoT, 분석 기반 FSM 플랫폼의 조기 도입으로 조직은 스케줄링, 디스패치, 예지보전 업무의 최적화를 실현하고 있습니다. 솔루션 프로바이더에게는 유틸리티, 제조, 통신, 의료 등 다양한 산업군에 확장성과 통합성을 갖춘 플랫폼을 제공할 수 있는 기회가 생기고 있습니다.

한편, 아시아태평양에서는 클라우드 기반 배포 모델 채택 확대, 모바일 연결성 확대, 디지털 서비스 현대화를 지원하는 정부 프로그램 등으로 인해 FSM의 성장이 가속화되고 있습니다. 기술 공급업체와 지역 기업과의 전략적 제휴를 통해 효율적인 현장 운영, 데이터베이스 의사결정, 서비스 제공 모델 개선을 촉진하고 있습니다. FSM 프로바이더는 이러한 발전된 기술을 활용하여 직원 생산성 향상, 운영 비용 절감, 다양한 산업 분야에서 고객의 변화하는 기대에 부응할 수 있습니다.

세계의 필드 서비스 관리 시장에 대해 조사했으며, 오퍼링별, 배포 모드별, 조직 규모별, 업계별, 지역별 동향 및 시장에 참여하는 기업의 개요 등을 정리하여 전해드립니다.

자주 묻는 질문

목차

제1장 서론

제2장 개요

제3장 주요 인사이트

제4장 시장 개요와 업계 동향

- 서론

- 시장 역학

- 미충족 요구와 공백

- 상호접속된 시장과 분야 횡단적인 기회

- 새로운 비즈니스 모델과 에코시스템의 변화

- Tier1/2/3 기업의 전략적 움직임

- Porter's Five Forces 분석

- 거시경제 지표

- 공급망 분석

- 에코시스템 분석

- 가격 분석

- 2025-2026년의 주요 컨퍼런스와 이벤트

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 투자와 자금조달 시나리오

- 사례 연구 분석

- 2025년 미국 관세의 영향 - 필드 서비스 관리 시장

제5장 전략적 파괴 : 특허, 디지털, AI의 도입

- 주요 신규 기술

- 보완적 기술

- 기술/제품 로드맵

- 특허 분석

- AI/생성형 AI가 필드 서비스 관리 시장에 미치는 영향

제6장 규제 상황

- 서론

- 지역의 규제와 컴플라이언스

- 규제기관, 정부기관, 기타 조직

- 지역별 규제

- 업계표준

제7장 고객 상황과 구매 행동

- 의사결정 프로세스

- 구입자 이해관계자와 구입 평가 기준

- 구입 기준

- 채택 장벽과 내부 과제

- 다양한 최종 용도 산업에서 미충족 요구

제8장 필드 서비스 관리 시장(오퍼링별)

- 서론

- 솔루션

- 서비스

제9장 필드 서비스 관리 시장(배포 모드별)

- 서론

- 온프레미스

- 클라우드

제10장 필드 서비스 관리 시장(조직 규모별)

- 서론

- 대기업

- 중소기업

제11장 필드 서비스 관리 시장(업계별)

- 서론

- 제조

- 운송·물류

- 건설·부동산

- 헬스케어·생명과학

- 에너지·유틸리티

- 통신

- IT·ITES

- 석유 및 가스

- 기타

제12장 필드 서비스 관리 시장(지역별)

- 서론

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 기타

- 아시아태평양

- 중국

- 일본

- 인도

- 기타

- 중동 및 아프리카

- 걸프협력회의

- 남아프리카공화국

- 기타

- 라틴아메리카

- 브라질

- 멕시코

- 기타

제13장 경쟁 구도

- 서론

- 주요 참여 기업의 전략/강점, 2023-2025년

- 매출 분석, 2020-2024년

- 시장 점유율 분석, 2024년

- 제품 비교

- 기업 평가 매트릭스 : 주요 참여 기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 기업 평가와 재무 지표

- 경쟁 시나리오

제14장 기업 개요

- 서론

- 주요 참여 기업

- ORACLE

- MICROSOFT

- SALESFORCE

- IFS

- SAP

- INFOR

- TRIMBLE

- COMARCH

- OVERIT

- PTC

- 기타 기업

- SERVICEPOWER

- SYNCRON

- FIELDAWARE

- ZINIER

- ACCRUENT

- PRAXEDO

- FIELDEZ

- FIELDEDGE

- JOBBER

- SERVICETITAN

- PEGASYSTEMS

- SKEDULO

- SERVICE FUSION

- HUSKY INTELLIGENCE

- FIELDPULSE

- WORKIZ

- KICKSERV

- DASSAULT SYSTEMS

제15장 조사 방법

제16장 인접 시장과 관련 시장

제17장 부록

KSA 25.11.20The field service management market is expanding rapidly, with a projected market size anticipated to rise from about USD 5.10 billion in 2025 to USD 9.17 billion by 2030, featuring a CAGR of 12.5%. The market is expanding rapidly, driven by companies prioritizing operational efficiency, customer satisfaction, and digital transformation across the telecom, manufacturing, and logistics industries.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | USD Billion |

| Segments | By Offering, By Deployment Mode, By Organization Size, By Vertical |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

Modern FSM platforms optimize workforce efficiency, enhance customer experience, and enable seamless integration with cloud, AI, and IoT technologies to support end-to-end service excellence. Key factors include the adoption of cloud-based platforms and automation, real-time tracking, predictive maintenance, and mobile workforce management, which collectively improve scheduling, asset utilization, and service quality.

The integration of advanced technologies, such as AI, IoT, and analytics, enables improved technician productivity and data-driven decision-making, while regulatory compliance and rising customer expectations further accelerate the adoption of field service management solutions. However, the market faces significant restraints, including persistent workforce skill shortages, integration issues with legacy infrastructure, and data security concerns within cloud environments. These challenges increase training and onboarding costs and may slow the pace of technology adoption for some organizations, requiring sustained focus on workforce development and secure digital transformation.

"In deployment mode, Cloud is expected to account for the fastest growth rate during the forecast period"

Cloud technology is a key driver behind the rapid growth of the field service management market due to its inherent scalability, flexibility, and ability to provide real-time data access. Cloud-based FSM solutions enable seamless collaboration among technicians, customers, and back-office teams regardless of location, optimizing scheduling, dispatching, and inventory management through centralized digital platforms. Cloud facilitates integration with complementary enterprise systems such as ERP and CRM, enhancing operational efficiency and ensuring a cohesive workflow.

Additionally, advancements in IoT, AI, and mobile connectivity supported by cloud infrastructure empower predictive maintenance and intelligent resource allocation, reducing downtime and improving first-time fix rates. Cloud FSM platforms also enhance customer experience by supporting self-service portals and real-time service tracking. Security and compliance features are critical components, ensuring the protection of sensitive data across distributed environments. Cloud technology supports continuous innovation and adaptability in FSM, providing organizations with a competitive advantage as they streamline operations and respond to evolving customer expectations in a cost-effective manner.

"By offering, solutions segment is expected to hold the largest market share during the forecast period"

By offering, solutions that hold the largest market share are known for simplifying and improving how companies manage on-field operations. These solutions help schedule jobs, track technicians, manage inventories, and automate service requests efficiently. Oracle, Microsoft, Salesforce, and SAP provide cloud-based platforms that are easy to access and scale. They also integrate well with other business tools such as CRM and ERP systems to keep workflows smooth and data consistent.

Additionally, these solutions use smart technologies such as artificial intelligence and IoT to predict issues and optimize work, which enhances service speed and quality. Their user-friendly interfaces and robust security features cater to the diverse needs of various industries, making them reliable choices. Companies offering flexible pricing and customizable features support businesses in adapting FSM to their specific needs.

"North America leads the field service management market with strong adoption of cloud-based solutions, while Asia Pacific is the fastest-growing region driven by rapid digital transformation"

North America is expected to dominate the field service management market, driven by the growing enterprise demand for real-time visibility, automation, and enhanced customer engagement. The region's advanced digital infrastructure and early adoption of AI, IoT, and analytics-based FSM platforms enable organizations to optimize scheduling, dispatch, and predictive maintenance operations. For solution providers, this creates opportunities to deliver scalable and integrated platforms across various industries, including utilities, manufacturing, telecommunications, and healthcare.

In contrast, Asia Pacific is witnessing accelerated FSM growth due to the increasing adoption of cloud-based deployment models, expanding mobile connectivity, and government programs supporting digital service modernization. Strategic collaborations between technology vendors and regional enterprises are fostering efficient field operations, data-driven decision-making, and improved service delivery models. Capitalizing on these advancements enables FSM providers to enhance workforce productivity, reduce operational costs, and meet the evolving expectations of customers across diverse industries.

Breakdown of Primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the field service management market.

- By Company: Tier I - 46%, Tier II - 16%, and Tier III - 38%

- By Designation: C-Level Executives - 32%, D-Level Executives -42%, and Others - 26%

- By Region: North America - 40%, Europe - 33%, Asia Pacific - 17%, and Rest of the world - 10%

The report includes a study of key players offering field service management. It profiles major vendors in the field service management market. The major market players include Oracle (US), Microsoft (US), Salesforce (US), IFS (Sweden), SAP SE (Germany), Infor (US), Trimble (US), Comarch (Poland), Syncron (Sweden), PTC (US), ServicePower (UK), OverIT (Italy), FieldAware (US), Zinier (US), Accruent (US), Praxedo (France), Fielde (US), FieldEdge (US), Jobber (Canada), ServiceM8 (Australia), Kickserv(US), Pegasystems (US), Skedulo(US), Service Fusion(US), Husky Intelligence (Finland), FieldPulse (US), Dassault Systems (France), and Workiz(US).

Research Coverage

This research report categorizes the field service management market based on based on Offering (solutions (scheduling, dispatch, & route optimization, work order management, customer management, reporting & analytics, inventory management , Service Contract Management and Other Solutions), Services (consulting, integration & implementation, training & support), Deployment Mode (on-premises and cloud), Organization Size (large enterprises and SMEs), Vertical (manufacturing, transportation & logistics, construction & real estate, healthcare & life sciences, energy & utilities, telecom, IT & ITES, oil & gas, other verticals and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America). The report's scope encompasses detailed information regarding the major factors, including drivers, restraints, challenges, and opportunities, that influence the growth of the field service management market. A detailed analysis of key industry players was conducted to provide insights into their business overview, solutions, and services, as well as key strategies, contracts, partnerships, agreements, new product & service launches, mergers and acquisitions, and recent developments associated with the field service management market. This report also includes a competitive analysis of emerging startups in the field service management market ecosystem.

Reason to Buy this Report

The report would provide market leaders and new entrants with information on the closest approximations of the revenue numbers for the overall field service management market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. It also helps stakeholders understand the market's pulse and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (Acceleration of Cloud-based deployment models; Increasing focus on customer experience and satisfaction; Rising adoption of mobile based FSM solutions), restraints (Talent shortage and workforce skill gaps; Resistance from field technicians to adopt new digital tools), opportunities (Integration with ERP and CRM systems; Use of augmented reality and remote assistance in field service; Providing industry-specific customized solutions), and challenges (Complexity of managing multi-vendor and multi-system environment; Integration challenges with legacy IT systems)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the field service management market

- Market Development: Comprehensive information about lucrative markets - analysis of the field service management market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the field of service management market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players such as Oracle (US), Microsoft (US), Salesforce (US), IFS (Sweden), SAP SE (Germany), Infor (US), Trimble (US), Comarch (Poland), Syncron (Sweden), PTC (US), ServicePower (UK), OverIT (Italy), FieldAware (US), Zinier (US), Accruent (US), Praxedo (France), Fielde (US), FieldEdge (US), Jobber (Canada), ServiceM8 (Australia), Kickserv(US), Pegasystems (US), Skedulo(US), Service Fusion(US), Husky Intelligence (Finland), FieldPulse (US), Dassault Systems (France) and Workiz(US). The report also helps stakeholders understand the field service management market, providing information on key market drivers, restraints, challenges, and opportunities

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF STRATEGIC CHANGE IN MARKET

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: SHARE INSIGHTS AND STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING MARKET

- 2.4 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FIELD SERVICE MANAGEMENT MARKET

- 3.2 FIELD SERVICE MANAGEMENT MARKET, BY OFFERING

- 3.3 FIELD SERVICE MANAGEMENT MARKET, BY ORGANIZATION SIZE

- 3.4 FIELD SERVICE MANAGEMENT MARKET, BY VERTICAL

- 3.5 FIELD SERVICE MANAGEMENT MARKET, BY REGION

4 MARKET OVERVIEW AND INDUSTRY TRENDS

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Acceleration of cloud-based deployment models

- 4.2.1.2 Increasing focus on customer experience and satisfaction

- 4.2.1.3 Rising adoption of mobile-based FSM solutions

- 4.2.2 RESTRAINTS

- 4.2.2.1 Talent shortage and workforce skill gaps

- 4.2.2.2 Resistance from field technicians to adopt new digital tools

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Integration with ERP and CRM systems

- 4.2.3.2 Use of augmented reality and remote assistance in field service

- 4.2.3.3 Providing industry-specific customized solutions

- 4.2.4 CHALLENGES

- 4.2.4.1 Complexity of managing multi-vendor and multi-system environments

- 4.2.4.2 Integration challenges with legacy IT systems

- 4.2.1 DRIVERS

- 4.3 BOTTOM OF FORM UNMET NEEDS AND WHITE SPACES

- 4.3.1 UNMET NEEDS IN FIELD SERVICE MANAGEMENT MARKET

- 4.3.2 WHITE SPACE OPPORTUNITIES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 INTERCONNECTED MARKETS

- 4.4.2 CROSS-SECTOR OPPORTUNITIES

- 4.5 EMERGING BUSINESS MODELS AND ECOSYSTEM SHIFTS

- 4.5.1 EMERGING BUSINESS MODELS

- 4.5.2 ECOSYSTEM SHIFTS

- 4.6 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 4.7 PORTER'S FIVE FORCES ANALYSIS

- 4.7.1 THREAT OF NEW ENTRANTS

- 4.7.2 THREAT OF SUBSTITUTES

- 4.7.3 BARGAINING POWER OF SUPPLIERS

- 4.7.4 BARGAINING POWER OF BUYERS

- 4.7.5 INTENSITY OF COMPETITIVE RIVALRY

- 4.8 MACROECONOMICS INDICATORS

- 4.8.1 INTRODUCTION

- 4.8.2 GDP TRENDS AND FORECAST

- 4.8.3 TRENDS IN GLOBAL ICT INDUSTRY

- 4.9 SUPPLY CHAIN ANALYSIS

- 4.10 ECOSYSTEM ANALYSIS

- 4.11 PRICING ANALYSIS

- 4.11.1 AVERAGE SELLING PRICE TREND OF FIELD SERVICE MANAGEMENT, BY REGION, 2022-2024

- 4.11.2 INDICATIVE PRICING FOR KEY PLAYERS, BY FIELD SERVICE MANAGEMENT SOLUTIONS, 2025

- 4.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 4.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 4.14 INVESTMENT & FUNDING SCENARIO

- 4.15 CASE STUDY ANALYSIS

- 4.15.1 CASE STUDY 1: ENABLING SCALABLE, FLEXIBLE FIELD & REVERSE-LOGISTICS SERVICE FOR RETAIL SUPPORT

- 4.15.2 CASE STUDY 2: SCALING FIELD SERVICE FOR RENEWABLE ENERGY THROUGH INTELLIGENT SCHEDULING & MOBILE ENABLEMENT

- 4.15.3 CASE STUDY 3: DIGITALIZING FIELD EXECUTION & DATA COLLECTION FOR SERVICE EXCELLENCE

- 4.15.4 CASE STUDY 4: TRANSFORMING FIELD SERVICE EFFICIENCY: WESTMOR INDUSTRIES' JOURNEY TO DIGITAL EXCELLENCE

- 4.15.5 CASE STUDY 5: NETLINE'S TRANSFORMATION: ENHANCING CUSTOMER EXPERIENCE WITH ZINIER'S UNIFIED FIELD SERVICE PLATFORM

- 4.16 IMPACT OF 2025 US TARIFF - FIELD SERVICE MANAGEMENT MARKET

- 4.16.1 INTRODUCTION

- 4.16.2 KEY TARIFF RATES

- 4.16.3 PRICE IMPACT ANALYSIS

- 4.16.4 IMPACT ON COUNTRY/REGION

- 4.16.4.1 North America

- 4.16.4.1.1 US

- 4.16.4.1.2 Canada

- 4.16.4.1.3 Mexico

- 4.16.4.2 Europe

- 4.16.4.2.1 Germany

- 4.16.4.2.2 France

- 4.16.4.2.3 UK

- 4.16.4.3 Asia Pacific

- 4.16.4.3.1 China

- 4.16.4.3.2 India

- 4.16.4.1 North America

5 STRATEGIC DISRUPTIONS: PATENTS, DIGITAL, AND AI ADOPTION

- 5.1 KEY EMERGING TECHNOLOGIES

- 5.1.1 ARTIFICIAL INTELLIGENCE & MACHINE LEARNING (AI/ML)

- 5.1.2 MOBILE COMPUTING & APPLICATION PLATFORMS

- 5.1.3 CLOUD COMPUTING AND SAAS PLATFORM

- 5.2 COMPLEMENTARY TECHNOLOGIES

- 5.2.1 IOT AND TELEMATICS

- 5.2.2 GIS & LOCATING INTELLIGENCE

- 5.2.3 CRM & ERP INTEGRATIONS

- 5.3 TECHNOLOGY/PRODUCT ROADMAP

- 5.3.1 SHORT-TERM (2025-2027) | FOUNDATIONAL DIGITIZATION

- 5.3.2 MID-TERM (2027-2030) | INTELLIGENT INTEGRATION

- 5.3.3 LONG-TERM (2030-2035+) | AUTONOMOUS OPERATIONS

- 5.4 PATENT ANALYSIS

- 5.4.1 LIST OF MAJOR PATENTS

- 5.5 IMPACT OF AI/GEN AI ON FIELD SERVICE MANAGEMENT MARKET

- 5.5.1 CASE STUDY

- 5.5.1.1 Use Case 1: Waters Delivers Trusted Partnerships Through Quality Field Service Outcomes

- 5.5.2 VENDOR INITIATIVES

- 5.5.2.1 Salesforce

- 5.5.2.2 PTC (ServiceMax)

- 5.5.3 BEST PRACTICES

- 5.5.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 5.5.5 CLIENT READINESS

- 5.5.1 CASE STUDY

6 REGULATORY LANDSCAPE

- 6.1 INTRODUCTION

- 6.2 REGIONAL REGULATIONS AND COMPLIANCE

- 6.2.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.2.2 REGULATIONS BY REGION

- 6.2.2.1 North America

- 6.2.2.2 Europe

- 6.2.2.3 Asia Pacific

- 6.2.2.4 Middle East & South Africa

- 6.2.2.5 Latin America

- 6.2.3 INDUSTRY STANDARDS

- 6.2.3.1 General Data Protection Regulation

- 6.2.3.2 SEC Rule 17a-4

- 6.2.3.3 ISO/IEC 27001

- 6.2.3.4 System and Organization Controls 2 Type II

- 6.2.3.5 Financial Industry Regulatory Authority

- 6.2.3.6 Health Insurance Portability and Accountability Act

7 CUSTOMER LANDSCAPE & BUYING BEHAVIOR

- 7.1 DECISION-MAKING PROCESS

- 7.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 7.3 BUYING CRITERIA

- 7.4 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 7.5 UNMET NEEDS IN VARIOUS END-USE INDUSTRIES

8 FIELD SERVICE MANAGEMENT MARKET, BY OFFERING

- 8.1 INTRODUCTION

- 8.1.1 OFFERING: FIELD SERVICE MANAGEMENT MARKET DRIVERS

- 8.2 SOLUTIONS

- 8.2.1 SCHEDULING, DISPATCH, & ROUTE OPTIMIZATION

- 8.2.1.1 Enhancing workforce efficiency through intelligent scheduling

- 8.2.1.2 Automated Scheduling & Workforce Planning

- 8.2.1.3 Field Resource Optimization

- 8.2.1.4 Predictive Scheduling

- 8.2.2 WORK ORDER MANAGEMENT

- 8.2.2.1 Streamlining operations with automated workflows to ensure accurate service execution

- 8.2.2.2 Work Order Creation & Tracking

- 8.2.2.3 Job Assignment & Workflow Automation

- 8.2.3 CUSTOMER MANAGEMENT

- 8.2.3.1 Elevating customer experience through connected engagement

- 8.2.3.2 Proactive Customer Communication and Appointment Management

- 8.2.3.3 Personalized Service History and Predictive Maintenance

- 8.2.4 REPORTING & ANALYTICS

- 8.2.4.1 Driving data-backed decisions with real-time insights

- 8.2.4.2 Data Visualization & BI Integration

- 8.2.4.3 Performance Dashboards

- 8.2.5 INVENTORY MANAGEMENT

- 8.2.5.1 Optimizing spare parts and asset availability for service delivery of consumables

- 8.2.5.2 Stock Reconciliation & Audit

- 8.2.5.3 Integration with Procurement Systems

- 8.2.6 SERVICE CONTRACT MANAGEMENT

- 8.2.6.1 Maximizing service value through contract automation systematic handling of customer agreements

- 8.2.6.2 Field Technician Inventory Tracking

- 8.2.6.3 Automatic Reordering and Alerts

- 8.2.7 OTHERS

- 8.2.1 SCHEDULING, DISPATCH, & ROUTE OPTIMIZATION

- 8.3 SERVICES

- 8.3.1 CONSULTING

- 8.3.1.1 Guiding strategic transformation through expert consulting

- 8.3.2 INTEGRATION & IMPLEMENTATION

- 8.3.2.1 Accelerating deployment with seamless system integration

- 8.3.3 TRAINING & SUPPORT

- 8.3.3.1 Empowering users through continuous training and support

- 8.3.1 CONSULTING

9 FIELD SERVICE MANAGEMENT MARKET, BY DEPLOYMENT MODE

- 9.1 INTRODUCTION

- 9.1.1 DEPLOYMENT MODE: FIELD SERVICE MANAGEMENT MARKET DRIVERS

- 9.2 ON PREMISES

- 9.2.1 STRENGTHENING CONTROL WITH SECURE ON-PREMISE DEPLOYMENT

- 9.3 CLOUD

- 9.3.1 DRIVING AGILITY AND SCALABILITY THROUGH CLOUD-BASED DEPLOYMENT

10 FIELD SERVICE MANAGEMENT MARKET, BY ORGANIZATION SIZE

- 10.1 INTRODUCTION

- 10.1.1 ORGANIZATION SIZE: FIELD SERVICE MANAGEMENT MARKET DRIVERS

- 10.2 LARGE ENTERPRISES

- 10.2.1 ENHANCING OPERATIONAL EXCELLENCE IN LARGE-SCALE ENTERPRISES

- 10.3 SMES

- 10.3.1 ENABLING GROWTH AND EFFICIENCY FOR SMALL AND MEDIUM ENTERPRISES

11 FIELD SERVICE MANAGEMENT MARKET, BY VERTICAL

- 11.1 INTRODUCTION

- 11.1.1 VERTICAL: FIELD SERVICE MANAGEMENT MARKET DRIVERS

- 11.2 MANUFACTURING

- 11.2.1 OPTIMIZING PRODUCTION UPTIME THROUGH INTELLIGENT FIELD OPERATIONS

- 11.2.2 MANUFACTURING: APPLICATION AREAS

- 11.2.2.1 Asset Tracking

- 11.2.2.2 Inventory Management

- 11.2.2.3 Workforce Management

- 11.2.2.4 Others (Quality Control and Field Service Operations)

- 11.3 TRANSPORTATION & LOGISTICS

- 11.3.1 STREAMLINING FLEET AND DELIVERY EFFICIENCY WITH FSM SOLUTIONS

- 11.3.2 TRANSPORTATION & LOGISTICS: APPLICATION AREAS

- 11.3.2.1 Fleet Management

- 11.3.2.2 Route Optimization

- 11.3.2.3 Workforce Management

- 11.3.2.4 Inventory & Warehouse Management

- 11.4 CONSTRUCTION & REAL ESTATE

- 11.4.1 DRIVING PROJECT EFFICIENCY WITH CONNECTED FIELD OPERATIONS TO IMPROVE WORKFORCE PRODUCTIVITY

- 11.4.2 CONSTRUCTION & REAL ESTATE: APPLICATION AREAS

- 11.4.2.1 Work Order Management

- 11.4.2.2 Job Scheduling & Dispatch

- 11.4.2.3 Project Scheduling & Planning

- 11.4.2.4 Equipment & Asset Management

- 11.5 HEALTHCARE & LIFE SCIENCES

- 11.5.1 ENSURING EQUIPMENT UPTIME AND COMPLIANCE IN CRITICAL ENVIRONMENTS

- 11.5.2 HEALTHCARE & LIFE SCIENCES: APPLICATION AREAS

- 11.5.2.1 Medical Equipment Maintenance

- 11.5.2.2 Patient Care Services

- 11.5.2.3 Remote Patient Monitoring

- 11.5.2.4 Pharmaceutical Logistics

- 11.6 ENERGY & UTILITIES

- 11.6.1 EMPOWERING RELIABLE SERVICE DELIVERY THROUGH SMART FIELD MANAGEMENT

- 11.6.2 ENERGY & UTILITIES: APPLICATION AREAS

- 11.6.2.1 Asset Maintenance & Management

- 11.6.2.2 Field Workforce Management

- 11.6.2.3 Compliance & Audits

- 11.6.2.4 Grid Maintenance & Operations

- 11.7 TELECOMMUNICATION

- 11.7.1 IMPROVING NETWORK MAINTENANCE THROUGH AUTOMATED FIELD COORDINATION

- 11.7.2 TELECOMMUNICATIONS: APPLICATION AREAS

- 11.7.2.1 Equipment Configuration & Optimization

- 11.7.2.2 Workforce Scheduling & Dispatch

- 11.7.2.3 Inventory Management

- 11.7.2.4 Customer Service & On-site Support

- 11.7.2.5 Compliance & Regulatory Management

- 11.8 IT & ITES

- 11.8.1 DELIVERING SEAMLESS TECH SUPPORT THROUGH INTELLIGENT SERVICE AUTOMATION

- 11.8.2 IT & ITES: APPLICATION AREAS

- 11.8.2.1 Asset Tracking & Inventory Management

- 11.8.2.2 Software Deployment & Updates

- 11.8.2.3 Emergency Response & Disaster Recovery

- 11.8.2.4 Data Center Support

- 11.9 OIL & GAS

- 11.9.1 ENHANCING ASSET RELIABILITY THROUGH PREDICTIVE FIELD SERVICE MANAGEMENT

- 11.9.2 OIL & GAS: APPLICATION AREAS

- 11.9.2.1 Asset Maintenance & Management

- 11.9.2.2 Field Inspection & Audits

- 11.9.2.3 Health, Safety, & Environmental Compliance

- 11.10 OTHER VERTICALS

12 FIELD SERVICE MANAGEMENT MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 US

- 12.2.1.1 Adoption of IoT connectivity to boost demand for field service management

- 12.2.2 CANADA

- 12.2.2.1 Government-driven digital modernization to accelerate FSM adoption

- 12.2.1 US

- 12.3 EUROPE

- 12.3.1 UK

- 12.3.1.1 Adoption of 5G connectivity to accelerate digital transformation and operational efficiency in field service management

- 12.3.2 GERMANY

- 12.3.2.1 Rising electric vehicle production to fuel demand for advanced field service management solutions

- 12.3.3 FRANCE

- 12.3.3.1 Renewable energy expansion to accelerate adoption of service management solutions

- 12.3.4 ITALY

- 12.3.4.1 Expansion of hydropower infrastructure to drive demand for advanced field service management solutions

- 12.3.5 REST OF EUROPE

- 12.3.1 UK

- 12.4 ASIA PACIFIC

- 12.4.1 CHINA

- 12.4.1.1 Driving FSM growth through expanding industrial automation landscape to boost demand

- 12.4.2 JAPAN

- 12.4.2.1 Adoption of industrial automation and robotics to accelerate FSM deployment

- 12.4.3 INDIA

- 12.4.3.1 Data privacy regulations to propel demand for secure field service management

- 12.4.4 REST OF ASIA PACIFIC

- 12.4.1 CHINA

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 GULF COOPERATION COUNCIL

- 12.5.1.1 UAE

- 12.5.1.1.1 Empowering smart infrastructure with advanced FSM solutions

- 12.5.1.2 Kingdom of Saudi Arabia

- 12.5.1.2.1 Expanding 5G coverage to drive market

- 12.5.1.3 Rest of Gulf Cooperation Council (GCC) Countries

- 12.5.1.1 UAE

- 12.5.2 SOUTH AFRICA

- 12.5.2.1 Enhancing growth through rising internet penetration to drive market

- 12.5.3 REST OF MIDDLE EAST & AFRICA

- 12.5.1 GULF COOPERATION COUNCIL

- 12.6 LATIN AMERICA

- 12.6.1 BRAZIL

- 12.6.1.1 Expanding mobile internet connectivity to fuel technology-driven efficiency

- 12.6.2 MEXICO

- 12.6.2.1 Expanding internet connectivity to accelerate digital transformation and IoT-driven field service management

- 12.6.3 REST OF LATIN AMERICA

- 12.6.1 BRAZIL

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2023-2025

- 13.3 REVENUE ANALYSIS, 2020-2024

- 13.4 MARKET SHARE ANALYSIS, 2024

- 13.5 PRODUCT COMPARISON

- 13.5.1 SAP

- 13.5.2 ORACLE

- 13.5.3 MICROSOFT

- 13.5.4 IFS

- 13.5.5 SALESFORCE

- 13.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.6.1 STARS

- 13.6.2 EMERGING LEADERS

- 13.6.3 PERVASIVE PLAYERS

- 13.6.4 PARTICIPANTS

- 13.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.6.5.1 Company footprint

- 13.6.5.2 Region footprint

- 13.6.5.3 Offering footprint

- 13.6.5.4 Vertical footprint

- 13.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.7.1 PROGRESSIVE COMPANIES

- 13.7.2 RESPONSIVE COMPANIES

- 13.7.3 DYNAMIC COMPANIES

- 13.7.4 STARTING BLOCKS

- 13.7.5 COMPETITIVE BENCHMARKING: STARTUP/SMES, 2024

- 13.7.5.1 Detailed list of key startups/SMEs

- 13.7.5.2 Competitive benchmarking of key startups/SMEs

- 13.8 COMPANY VALUATION AND FINANCIAL METRICS

- 13.8.1 COMPANY VALUATION OF KEY VENDORS

- 13.8.2 FINANCIAL METRICS OF KEY VENDORS

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

14 COMPANY PROFILES

- 14.1 INTRODUCTION

- 14.2 KEY PLAYERS

- 14.2.1 ORACLE

- 14.2.1.1 Business overview

- 14.2.1.2 Products/Solutions/Services offered

- 14.2.1.3 Recent developments

- 14.2.1.3.1 Product launches

- 14.2.1.3.2 Deals

- 14.2.1.4 MnM view

- 14.2.1.4.1 Right to win

- 14.2.1.4.2 Strategic choices

- 14.2.1.4.3 Weaknesses and competitive threats

- 14.2.2 MICROSOFT

- 14.2.2.1 Business overview

- 14.2.2.2 Products/Solutions/Services offered

- 14.2.2.3 Recent developments

- 14.2.2.3.1 Product launches

- 14.2.2.4 MnM view

- 14.2.2.4.1 Right to win

- 14.2.2.4.2 Strategic choices

- 14.2.2.4.3 Weaknesses and competitive threats

- 14.2.3 SALESFORCE

- 14.2.3.1 Business overview

- 14.2.3.2 Products/Solutions/Services offered

- 14.2.3.3 Recent developments

- 14.2.3.3.1 Product launches

- 14.2.3.3.2 Deals

- 14.2.3.4 MnM view

- 14.2.3.4.1 Right to win

- 14.2.3.4.2 Strategic choices

- 14.2.3.4.3 Weaknesses and competitive threats

- 14.2.4 IFS

- 14.2.4.1 Business overview

- 14.2.4.2 Products/Solutions/Services offered

- 14.2.4.3 Recent developments

- 14.2.4.3.1 Deals

- 14.2.4.4 MnM view

- 14.2.4.4.1 Right to win

- 14.2.4.4.2 Strategic choices

- 14.2.4.4.3 Weaknesses and competitive threats

- 14.2.5 SAP

- 14.2.5.1 Business overview

- 14.2.5.2 Products/Solutions/Services offered

- 14.2.5.3 Recent developments

- 14.2.5.3.1 Product launches

- 14.2.5.3.2 Deals

- 14.2.5.4 MnM view

- 14.2.5.4.1 Right to win

- 14.2.5.4.2 Strategic choices

- 14.2.5.4.3 Weaknesses and competitive threats

- 14.2.6 INFOR

- 14.2.6.1 Business overview

- 14.2.6.2 Products/Solutions/Services offered

- 14.2.7 TRIMBLE

- 14.2.7.1 Business overview

- 14.2.7.2 Products/Solutions/Services offered

- 14.2.7.3 Recent developments

- 14.2.7.3.1 Product launches

- 14.2.8 COMARCH

- 14.2.8.1 Business overview

- 14.2.8.2 Products/Solutions/Services offered

- 14.2.8.2.1 Deals

- 14.2.9 OVERIT

- 14.2.9.1 Business overview

- 14.2.9.2 Products/Solutions/Services offered

- 14.2.9.3 Recent developments

- 14.2.9.3.1 Product launches and enhancements

- 14.2.9.3.2 Deals

- 14.2.10 PTC

- 14.2.10.1 Business overview

- 14.2.10.2 Products/Solutions/Services offered

- 14.2.10.3 Recent developments

- 14.2.10.3.1 Product launches and enhancements

- 14.2.10.3.2 Deals

- 14.2.1 ORACLE

- 14.3 OTHER PLAYERS

- 14.3.1 SERVICEPOWER

- 14.3.2 SYNCRON

- 14.3.3 FIELDAWARE

- 14.3.4 ZINIER

- 14.3.5 ACCRUENT

- 14.3.6 PRAXEDO

- 14.3.7 FIELDEZ

- 14.3.8 FIELDEDGE

- 14.3.9 JOBBER

- 14.3.10 SERVICETITAN

- 14.3.11 PEGASYSTEMS

- 14.3.12 SKEDULO

- 14.3.13 SERVICE FUSION

- 14.3.14 HUSKY INTELLIGENCE

- 14.3.15 FIELDPULSE

- 14.3.16 WORKIZ

- 14.3.17 KICKSERV

- 14.3.18 DASSAULT SYSTEMS

15 RESEARCH METHODOLOGY

- 15.1 RESEARCH APPROACH

- 15.1.1 SECONDARY DATA

- 15.1.1.1 Key data from secondary sources

- 15.1.2 PRIMARY DATA

- 15.1.2.1 Key data from primary sources

- 15.1.2.2 Breakup of primary profiles

- 15.1.2.3 Key industry insights

- 15.1.1 SECONDARY DATA

- 15.2 MARKET BREAKUP AND DATA TRIANGULATION

- 15.3 MARKET SIZE ESTIMATION

- 15.3.1 TOP-DOWN APPROACH

- 15.3.2 BOTTOM-UP APPROACH

- 15.3.3 MARKET ESTIMATION APPROACHES

- 15.4 MARKET FORECAST

- 15.5 RESEARCH ASSUMPTIONS

- 15.6 RESEARCH LIMITATIONS

16 ADJACENT AND RELATED MARKETS

- 16.1 INTRODUCTION

- 16.1.1 RELATED MARKETS

- 16.1.2 LIMITATIONS

- 16.2 WORK FORCE MANAGEMENT MARKET

- 16.3 WORK ORDER MANAGEMENT SYSTEMS MARKET

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS