|

시장보고서

상품코드

1876464

방출 조절 비료 시장 : 유형별, 기능별, 제품 Tier별, 시용 방식별, 최종 용도별, 지역별 예측(-2030년)Controlled-release Fertilizers Market by Type, Function, Product Tier, Mode of Application, End Use, and Region - Global Forecast to 2030 |

||||||

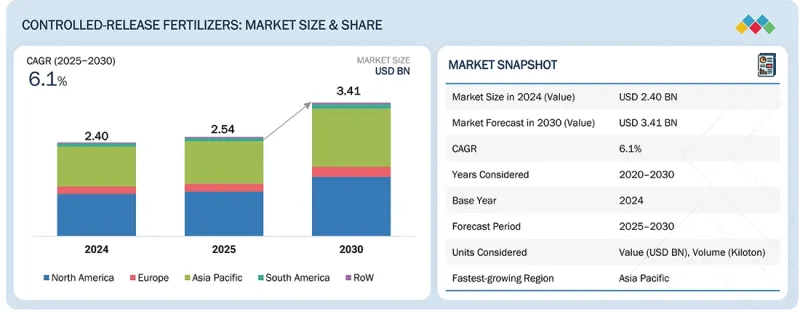

세계의 방출 조절 비료 시장 규모는 2025년에 25억 4,000만 달러이고, 2030년까지 34억 1,000만 달러에 달할 것으로 예상되며, 예측 기간에 CAGR로 6.1%를 나타낼 것으로 전망됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2020-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 달러, 1,000톤 |

| 부문 | 유형, 기능, 제품 Tier, 적용 방식, 최종 용도, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 남미 및 기타 지역 |

방출 조절 비료 시장은 작물 생산성 향상과 효율적인 영양 관리에 대한 수요 증가에 의해 견인되고 있습니다. 농업인들은 영양소를 안정적이고 정확하게 공급하고, 시비 빈도를 줄이고, 식물의 성장을 최적화하기 위해 방출 조절 비료를 채택하고 있습니다.

기존의 비료에 따른 토양 열화, 수질 오염, 온실 가스 배출 등 환경 문제도 비효율 조절 솔루션으로의 전환을 더욱 촉진하고 있습니다. CRF는 침출과 휘발로 인한 영양소 손실을 최소화하고 지속 가능한 농법을 지원합니다. 게다가 정밀농업의 대두로 농가는 작물의 영양요구량을 정확하게 모니터할 수 있게 되어 CRF의 효율성이 향상되어 대규모의 고가치 농업경영에 있어서 채용이 촉진되고 있습니다.

기술 혁신도 시장성장의 큰 촉진요인이며, 폴리머코트, 다영양소비료, 생분해성 CRF 등의 개발에 의해 다양한 작물과 기후조건에 걸쳐 응용이 확대되고 있습니다. 지속 가능한 농업을 촉진하는 정부의 지원 규제와 정책, 장기적인 비용 절감에 대한 인식이 높아짐에 따라 방출 조절 비료 사용을 뒷받침하고 있습니다. 주요 기업에 의한 R&D, 파트너십 및 지역 확대에 대한 전략적 투자는 제품 포트폴리오의 강화와 유통망의 개선으로 이어지고 있습니다. 친환경 작물 투입재료에 대한 수요가 증가하고 토양의 건강상태 향상과 자원효율이 높은 농업에 대한 요구에 따라 CRF는 현대농업에서 중요한 솔루션으로 자리매김하여 지속적인 세계 시장 성장을 가속하고 있습니다.

"제품 Tier 부문에서 프리미엄 스마트/하이브리드 방출 조절 비료 부문이 예측 기간에 현저한 성장률을 보여줄 전망"

고효율 영양 관리 솔루션에 대한 수요가 증가함에 따라 방출 조절 비료 시장에서 프리미엄 스마트/하이브리드 방출 조절 비료가 제품 Tier 부문에서 빠르게 성장할 것으로 예측됩니다. 이러한 첨단 비료는 폴리머 코팅 시스템, 생분해성 매트릭스, 통합 영양소 블렌드와 같은 혁신적인 기술을 결합하여 특정 작물의 요구에 맞는 정밀하고 장기적인 영양소 방출을 실현합니다. 농업자와 농업 관련 기업은 지속 가능한 정밀 농법에 따라 작물 수율 향상, 인건비 절감, 환경 영양소 유출 최소화를 위해 이러한 제품의 채택을 확대하고 있습니다. 프리미엄 부문은 특히 대규모의 고가치 농업 경영에서 스마트 방출 조절 비료의 장기적인 경제적 및 환경적 우위성에 대한 인식이 높아지면서 혜택을 누리고 있습니다. 또한 ICL, Nutrien, SQM, Yara 등 주요 기업의 지속적인 R&D, 전략적 파트너십, 제품 혁신을 통해 프리미엄 스마트/하이브리드 방출 조절 비료의 입수성과 성능을 확대하여 세계 보급과 시장 성장을 더욱 촉진하고 있습니다.

「비효 조절형 비료 부문이 예측 기간에 유형 부문에 있어서 큰 점유율을 차지할 전망입니다」

환경에 미치는 영향을 최소화하면서 작물의 생산성을 높이는 효과가 입증되고 있기 때문에 방출 조절 비료가 방출 조절 비료 시장의 유형 부문에 있어서 큰 점유율을 차지할 것으로 예측됩니다. 이 비료는 시간이 지남에 따라 서서히 양분을 방출하므로 작물의 양분 흡수 패턴에 맞추어 침출, 유출, 휘발에 의한 손실을 최소화합니다. 곡류, 야채, 과일, 고가치 작물과 같은 광범위한 작물에 대한 적용 가능성으로 인해 대규모 농부에서 소규모 농부까지 양쪽 모두에게 선호되는 옵션이 되었습니다. 지속가능한 농업과 토양의 건강상태에 대한 관심 증가가 채용을 더욱 촉진하고 있으며, 방출 조절 비료는 영양 균형의 유지와 장기적인 토양 비옥도의 향상에 기여합니다. 폴리머 코팅이나 영양소 캡슐화 등 기술적 진보로 방출 조절 비료의 성능과 범용성이 향상되고 있습니다. 인건비 절감, 시비 횟수 감소, 수량 품질 향상 등의 이점에 대한 인식이 높아지고 있는 것도 있어, 방출 조절 비료는 세계의 방출 조절 비료 시장에서 중요한 성장 부문이 될 전망입니다.

본 보고서에서는 세계의 방출 조절 비료 시장에 대해 조사 분석하여 주요 성장 촉진요인과 억제요인, 경쟁 구도, 미래 동향 등의 정보를 제공합니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 주요 인사이트

- 방출 조절 비료 시장의 기업에게 매력적인 기회

- 방출 조절 비료 시장 : 시용 방식별, 지역별

- 방출 조절 비료 시장 : 유형별

- 방출 조절 비료 시장 : 기능별

- 방출 조절 비료 시장 : 제품 Tier별

- 방출 조절 비료 시장 : 작물별

- 방출 조절 비료 시장 : 국가별

제5장 시장 개요

- 서론

- 거시경제지표

- 비료와 요소 제품의 생산 증가

- 개발도상국에서의 비료 시용률 증가

- 시장 역학

- 서론

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 미충족 수요(Unmet Needs)와 백스페이스

- 방출 조절 비료 시장에서의 미충족 수요(Unmet Needs)

- 백스페이스의 기회

- 연결된 시장과 부문 간 기회

- 상호연결된 시장

- 부문 간 기회

- 새로운 비즈니스 모델과 생태계의 변화

- 새로운 비즈니스 모델

- 에코시스템의 변화

- Tier 1/2/3 기업의 전략적 움직임

제6장 업계 동향

- Porter's Five Forces 분석

- 밸류체인 분석

- 연구, 제품 개발

- 등록

- 제제, 제조

- 유통

- 마케팅, 판매

- 최종 사용자

- 생태계 분석

- 수요 측

- 공급사이드

- 가격 설정 분석

- 평균 판매 가격 : 주요 기업별

- 평균 판매 가격 동향 : 지역별

- 무역 분석

- HS코드 3105의 수출 시나리오

- HS코드 3105의 수입 시나리오

- 주된 회의와 이벤트(2024-2026년)

- 고객사업에 영향을 주는 동향/혼란

- 투자 및 자금조달 시나리오

- 사례 연구 분석

- 미국 관세의 영향 - 방출 조절 비료 시장(2025년)

- 서론

- 주요 관세율

- 가격의 영향 분석

- 국가/지역에 미치는 영향

- 최종 이용 산업에 대한 영향

제7장 기술, 특허, 디지털, AI의 채용에 의한 파괴적 혁신

- 주요 신기술

- 유기 및 천연 코팅 기술

- 나노 및 첨단 재료 기술

- 미생물 및 생물학적 통합 기술

- 캡슐화 및 마이크로캡슐화 기술

- 수지 및 합성 왁스 기술

- 하이브리드 및 다중 기술 플랫폼

- 온도 반응 시스템

- 보완 기술

- 정밀 농업 기술

- 스마트 관개 및 비료 공급 시스템

- 토양 및 식물 감지 기술

- 생장촉진제 통합

- 기술/제품 로드맵

- 단기(2025-2027년) | 기반 구축 및 조기 상업화

- 중기(2027-2030년)|확장 및 표준화

- 장기(2030-2035년 이후) | 대규모 상업화 및 파괴적 혁신

- 코팅 공정 기술

- 유동층 코팅 기술

- 팬 코팅 기술

- 회전 드럼 스프레이 코팅 기술

- 용융 및 압출 기술

- 역현탁 중합

- 용액 중합 및 가교

- 마이크로파 조사 기술

- 폴리머 베이스 코팅 기술

- 하이브리드 황-폴리머 코팅 기술

- 수지 코팅 기술

- 생분해성 바이오폴리머 코팅 기술

- 특허 분석

- 서론

- 조사 방법

- 문서의 유형

- 인사이트

- 특허의 법적 지위

- 관할분석

- 주요 출원자

- FARMHANNONG CO LTD 특허 목록

- 미래의 응용

- 방출 조절 비료 : 지속가능한 농업의 변화

- AI 통합 CRF : 데이터 구동 영양 관리

- 생분해성 코팅 시스템 : 순환형 농업의 추진

- 센서 대응 CRF : 스마트 방출 시스템

- 하이브리드 CRF-생물학적 시스템 : 작물의 생산성 향상

- 방출 조절 비료 시장에 대한 AI/생성형 AI의 영향

- 주요 이용 사례와 시장의 장래성

- 방출 조절 비료 처리에 있어서 베스트 프랙티스

- 방출 조절 비료 시장에서 AI 도입 사례 연구

- 연결된 인접 생태계와 시장 기업에 미치는 영향

- 방출 조절 비료 시장에서 생성형 AI 채용에 대한 고객의 준비 상황

- 성공 사례와 실제 응용

- ICL GROUP - 첨단 폴리머 코팅 기술

- KINGENTA ECOLOGICAL ENGINEERING GROUP - 바이오베이스 나노캡슐화 CRF

- YARA INTERNATIONAL ASA - 디지털 통합 영양 관리

제8장 지속가능성과 규제정세

- 지역 규제 및 규정 준수

- 북미의 규제 상황

- 유럽의 규제 상황

- 아시아태평양의 규제 상황

- 남미

- 기타 지역

- 업계 표준

- 지속가능성에 대한 노력

- 지속가능성에 미치는 영향과 규제 정책의 노력

- 인증, 라벨, 환경 기준

제9장 고객정세와 구매행동

- 의사결정 프로세스

- 구매 이해관계자와 구입 평가 기준

- 구매 프로세스의 주요 이해 관계자

- 구입 기준

- 채용 장벽과 내부 과제

- 다양한 최종 이용 산업으로부터의 미충족 수요(Unmet Needs)

- 시장의 수익성

- 수익 가능성

- 비용역학

- 마진 기회 : 용도별

제10장 방출 조절 비료 시장 : 유형별

- 서론

- 서방성 비료

- 코팅 및 캡슐화 비료

- 질소 안정제

제11장 방출 조절 비료 시장 : 기능별

- 서론

- 온도 의존형 방출 시스템

- 수분 의존형 방출 시스템

- 미생물 활성화 방출 시스템

- 시간 제어 방출 시스템

- pH 의존형 방출 시스템

- 기타 기능

제12장 방출 조절 비료 시장 : 제품 Tier별

- 서론

- 기본 코팅 비료

- 고급 폴리머/수지 코팅 비료

- 프리미엄 스마트/하이브리드 방출 조절 비료

제13장 방출 조절 비료 시장 : 제제별

- 서론

- 건식

- 액체

제14장 방출 조절 비료 시장 : 시용 방식별

- 서론

- 비료관개

- 엽면시비

- 토양

- 기타 시용 방식

제15장 방출 조절 비료 시장 : 작물별

- 서론

- 농작물

- 비농작물

제16장 방출 조절 비료 시장 : 지역별

- 서론

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 영국

- 프랑스

- 독일

- 스페인

- 이탈리아

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 호주 및 뉴질랜드

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 기타 지역

- 아프리카

- 중동

제17장 경쟁 구도

- 개요

- 주요 진입기업의 전략/강점

- 연간 수익 분석(2020-2024년)

- 시장 점유율 분석(2024년)

- 기업평가 매트릭스 : 주요 기업(2024년)

- 기업의 평가 매트릭스 : 스타트업/중소기업(2024년)

- 기업평가 및 재무 지표

- 제품 비교

- 경쟁 시나리오와 동향

제18장 기업 프로파일

- 주요 기업

- YARA

- NUTRIEN

- MOSAIC

- ICL

- THE ANDERSONS, INC.

- NUFARM

- KINGENTA

- THE SCOTTS COMPANY LLC

- KOCH IP HOLDINGS, LLC.

- COMPO EXPERT GMBH

- HAIFA NEGEV TECHNOLOGIES LTD.

- EUROCHEM GROUP

- SIMPLOT

- JCAM AGRI CO., LTD.

- HELENA AGRI-ENTERPRISES, LLC.

- 기타 기업

- SK SPECIALTIES SDN BHD.

- DELTACHEM INTERNATIONAL BV

- AGROLIQUID

- KNOX FERTILIZER COMPANY INC.

- ALLIED NUTRIENTS

- PURSELL AGRI-TECH, LLC

- AGLUKON SPEZIALDUNGER GMBH

- ANBR

- PARAKH AGRI SOLUTIONS

- RISSO CHEMICAL

제19장 인접 시장과 관련 시장

- 서론

- 제한 사항

- 수용성 비료 시장

- 시장의 정의

- 시장 개요

- 바이오 비료 시장

- 시장의 정의

- 시장 개요

제20장 부록

KTH 25.11.28The global market for controlled-release fertilizers is estimated to be valued at USD 2.54 billion in 2025 and is projected to reach USD 3.41 billion by 2030, at a CAGR of 6.1% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) and Volume (KT) |

| Segments | Type, Function, Product Tier, Mode of Application, End Use, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and RoW |

The controlled-release fertilizers (CRFs) market is driven by the growing need for higher crop productivity and efficient nutrient management. Farmers are increasingly adopting CRFs to provide a steady and targeted supply of nutrients, reducing the frequency of applications and optimizing plant growth.

Environmental concerns, such as soil degradation, water contamination, and greenhouse gas emissions associated with conventional fertilizers, are further driving the shift toward controlled-release solutions. CRFs minimize nutrient losses through leaching and volatilization, supporting sustainable agricultural practices. Additionally, the rise of precision agriculture enables farmers to accurately monitor crop nutrient requirements, enhancing the effectiveness of CRFs and promoting their adoption across large-scale and high-value farming operations.

Technological innovations are also a major factor driving market growth, with developments in polymer-coated, multi-nutrient, and biodegradable CRFs expanding their application across diverse crops and climatic conditions. Supportive government regulations and policies that promote sustainable farming, coupled with an increasing awareness of long-term cost savings, encourage the use of controlled-release fertilizers. Strategic investments by key players in R&D, partnerships, and regional expansions are strengthening product portfolios and improving distribution networks. The growing demand for environmentally friendly crop inputs, alongside the need for improved soil health and resource-efficient farming, positions CRFs as a vital solution in modern agriculture, fueling sustained global market growth.

"The premium smart/hybrid controlled-release fertilizers segment will grow at a significant rate in the product tier segment during the forecast period"

Premium smart and hybrid controlled-release fertilizers are expected to experience significant growth in the product tier segment of the controlled-release fertilizers market, driven by increasing demand for high-efficiency nutrient management solutions. These advanced fertilizers combine innovative technologies, such as polymer-coated systems, biodegradable matrices, and integrated nutrient blends, to provide precise, long-term nutrient release tailored to specific crop requirements. Farmers and agribusinesses are increasingly adopting these products to enhance crop yield, reduce labor costs, and minimize nutrient losses to the environment, aligning with sustainable and precision agriculture practices. The premium segment benefits from growing awareness of the long-term economic and environmental advantages of smart CRFs, particularly in large-scale and high-value farming operations. Additionally, continuous R&D efforts, strategic partnerships, and product innovations by leading players such as ICL, Nutrien, SQM, and Yara are expanding the availability and performance of premium smart and hybrid CRFs, thereby further driving global adoption and market growth.

"The slow-release fertilizers segment will hold a significant share in the type segment during the forecast period"

Slow-release fertilizers are expected to hold a significant share in the type segment of the controlled-release fertilizers market due to their proven effectiveness in enhancing crop productivity while minimizing environmental impact. These fertilizers gradually release nutrients over time, aligning with crop nutrient uptake patterns and minimizing losses from leaching, runoff, and volatilization. Their applicability across a wide range of crops, including cereals, vegetables, fruits, and high-value plantations, makes them a preferred choice for both large-scale and smallholder farmers. The growing emphasis on sustainable agriculture and soil health further drives adoption, as slow-release fertilizers help maintain nutrient balance and improve long-term soil fertility. Technological advancements, such as polymer coatings and nutrient encapsulation, have enhanced the performance and versatility of slow-release fertilizers. Combined with rising awareness of reduced labor costs, fewer applications, and improved yield quality, slow-release fertilizers are poised to become a key growth segment within the controlled-release fertilizers market globally.

"North America holds the largest share, while Asia Pacific is expected to be the fastest growing market during the forecast period"

North America holds the largest share in the controlled-release fertilizers market, driven by its well-established agricultural sector, advanced farming practices, and high adoption of sustainable nutrient management solutions. The region features extensive farmland for row crops, horticulture, and high-value plantations, where farmers increasingly rely on CRFs to optimize nutrient use efficiency and improve crop yields. Strong R&D infrastructure and technological innovations, including polymer-coated, multi-nutrient, and biodegradable formulations, enable the delivery of tailored nutrients for diverse crops and soil conditions. Leading global players such as ICL, Nutrien, Yara, and SQM have established manufacturing facilities, distribution networks, and strategic partnerships in North America, further consolidating market dominance. Supportive government policies promoting precision agriculture, nutrient stewardship, and environmentally friendly practices also accelerate adoption. Additionally, the benefits of reduced application frequency, lower labor costs, and long-term improvements in soil health drive consistent use of CRFs across large-scale and high-value farms, reinforcing North America's position as the largest and most mature CRF market globally.

Asia Pacific is expected to be the fastest-growing market for controlled-release fertilizers due to rising food demand, expanding agricultural activities, and increasing awareness of sustainable farming practices. Rapid population growth, coupled with the need to enhance crop yields on limited arable land, is driving the adoption of nutrient-efficient solutions such as CRFs. Technological advancements, including polymer-coated and biodegradable fertilizers, are being increasingly adopted to improve nutrient use efficiency and reduce environmental impact in the region. Countries such as China, India, Japan, and Southeast Asian nations are witnessing growing investments in modern farming practices, precision agriculture, and fertilizer innovation, which are accelerating the market's growth. Supportive government initiatives promoting sustainable agriculture and efficient fertilizer use, along with increasing participation of global players in regional distribution and partnerships, further boost market potential.

Break-up of primaries

In-depth interviews were conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the controlled-release fertilizers market:

- By Company Type: Tier 1 - 25%, Tier 2 - 45%, and Tier 3 - 30%

- By Designation: Directors- 20%, Managers - 50%, Executives - 30%

- By Region: North America - 25%, Europe - 30%, Asia Pacific - 20%, South America - 15%, and Rest of the World - 10%

Prominent companies in the market include Yara (Norway), Nutrien Ltd. (Canada), Mosaic (US), ICL (Israel), Nufarm (Australia), Kingenta (China), ScottsMiracle-Gro (US), Koch Industries (US), Helena Chemicals (US), SQM (Chile), Haifa Negev Technologies Ltd. (Israel), JCAM AGRI Co., Ltd. (Japan), COMPO EXPERT (Germany), The Andersons Inc. (US), and Van Iperen International (Netherlands).

Other players include OCI Nitrogen (Netherlands), DeltaChem (Germany), AgroLiquid (US), SK Specialties (Malaysia), Pursell Agri-Tech (US), Simonis Fertilizer BV (Netherlands), Florikan ESA LLC (US), BION International (Netherlands), Aglukon (Germany), and Nousbo Co Ltd (South Korea).

Research Coverage

This research report categorizes the controlled-release fertilizers market by type (coated & encapsulated, nitrogen stabilizers, and slow-release), function (temperature-dependent release systems, water-dependent release systems, microbe-activated release systems, time-released systems, pH-dependent release systems, and others), product tier (basic coated fertilizers, advanced polymer/resin coated fertilizers, and premium smart/hybrid controlled-release fertilizers), mode of application (foliar, fertigation, soil, and others), end use (agriculture and non-agriculture), and region (North America, Europe, Asia Pacific, South America, and Rest of the World). The report's scope encompasses detailed information on drivers, restraints, challenges, and opportunities that influence the growth of the controlled-release fertilizers market.

A detailed analysis of key industry players was conducted to provide insights into their business overview, services, key strategies, contracts, partnerships, agreements, new service launches, mergers and acquisitions, and recent developments related to the controlled-release fertilizers market. This report provides a competitive analysis of emerging startups in the controlled-release fertilizers market ecosystem. Furthermore, the study also covers industry-specific trends, including technology analysis, ecosystem and market mapping, and patent and regulatory landscapes, among others.

Reasons to buy this report

The report will help market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall controlled-release fertilizers and the subsegments. It will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market, providing them with information on key market drivers, restraints, challenges, and opportunities.

It provides insights into the following pointers:

- Analysis of key drivers (Rise in sustainable agriculture), restraints (High production costs compared to conventional fertilizers), opportunities (Development of biodegradable and bio-based coating materials), and challenges (Inconsistency and variable performance) influencing the growth of the controlled-release fertilizers market

- Product Launch/Innovation: Detailed insights on R&D activities and product launches in the controlled-release fertilizers market

- Market Development: Comprehensive information about lucrative markets - analysis of the controlled-release fertilizers market across varied regions

- Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the controlled-release fertilizers market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, brand/product comparisons, and product footprints of leading players such as Yara (Norway), Nutrien Ltd. (Canada), Mosaic (US), ICL (Israel), Nufarm (Australia), Kingenta (China), and others in the controlled-release fertilizers market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE AND SEGMENTATION

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.3.6 STAKEHOLDERS

- 1.4 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary participants

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.3 BASE NUMBER CALCULATION

- 2.3 MARKET FORECAST APPROACH

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- 3.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 3.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 3.3 DISRUPTIONS SHAPING CONTROLLED RELEASE FERTILIZERS MARKET

- 3.4 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS

- 3.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CONTROLLED RELEASE FERTILIZERS MARKET

- 4.2 CONTROLLED RELEASE FERTILIZERS MARKET, BY MODE OF APPLICATION AND REGION

- 4.3 CONTROLLED RELEASE FERTILIZERS MARKET, BY TYPE

- 4.4 CONTROLLED RELEASE FERTILIZERS MARKET, BY FUNCTION

- 4.5 CONTROLLED RELEASE FERTILIZERS MARKET, BY PRODUCT TIER

- 4.6 CONTROLLED RELEASE FERTILIZERS MARKET, BY CROP TYPE

- 4.7 CONTROLLED RELEASE FERTILIZERS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 RISE IN PRODUCTION OF FERTILIZERS AND UREA PRODUCTS

- 5.2.2 INCREASE IN APPLICATION RATE OF FERTILIZERS IN DEVELOPING COUNTRIES

- 5.2.3 INCREASE IN APPLICATION RATE OF FERTILIZERS IN DEVELOPING COUNTRIES

- 5.3 MARKET DYNAMICS

- 5.3.1 INTRODUCTION

- 5.3.2 DRIVERS

- 5.3.2.1 Rise in sustainable agriculture

- 5.3.2.2 Expansion of high-value crops requiring precise nutrient delivery

- 5.3.2.3 Government support and regulatory encouragement

- 5.3.2.4 Rising demand from high-value crops

- 5.3.3 RESTRAINTS

- 5.3.3.1 High production costs compared to conventional fertilizers

- 5.3.3.2 Complex manufacturing process for coating and encapsulation materials

- 5.3.3.3 Slow Nutrient Release under Unfavorable Conditions

- 5.3.3.4 Limited awareness and technical knowledge

- 5.3.4 OPPORTUNITIES

- 5.3.4.1 Development of biodegradable and bio-based coating materials

- 5.3.4.2 Expansion into horticulture and specialty crop markets

- 5.3.4.3 Integration with precision farming and smart fertilization systems

- 5.3.4.4 Advancements in coating and encapsulation technologies

- 5.3.5 CHALLENGES

- 5.3.5.1 Inconsistency and variable performance

- 5.3.5.2 Low farmer awareness in developing regions

- 5.3.5.3 Competition of alternative fertilizer technologies

- 5.3.5.4 Market penetration in low-income regions

- 5.4 UNMET NEEDS AND WHITE SPACES

- 5.4.1 UNMET NEEDS IN CONTROLLED RELEASE FERTILIZERS MARKET

- 5.4.2 WHITE SPACE OPPORTUNITIES

- 5.5 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 5.5.1 INTERCONNECTED MARKETS

- 5.5.2 CROSS-SECTOR OPPORTUNITIES

- 5.6 EMERGING BUSINESS MODELS AND ECOSYSTEM SHIFTS

- 5.6.1 EMERGING BUSINESS MODELS

- 5.6.2 ECOSYSTEM SHIFTS

- 5.7 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 5.7.1 KEY MOVES AND STRATEGIC FOCUS

6 INDUSTRY TRENDS

- 6.1 PORTER'S FIVE FORCES ANALYSIS

- 6.1.1 THREAT OF NEW ENTRANTS

- 6.1.2 THREAT OF SUBSTITUTES

- 6.1.3 BARGAINING POWER OF SUPPLIERS

- 6.1.4 BARGAINING POWER OF BUYERS

- 6.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.2 VALUE CHAIN ANALYSIS

- 6.2.1 RESEARCH AND PRODUCT DEVELOPMENT

- 6.2.2 REGISTRATION

- 6.2.3 FORMULATION AND MANUFACTURING

- 6.2.4 DISTRIBUTION

- 6.2.5 MARKETING AND SALES

- 6.2.6 END USERS

- 6.3 ECOSYSTEM ANALYSIS

- 6.3.1 DEMAND SIDE

- 6.3.2 SUPPLY SIDE

- 6.4 PRICING ANALYSIS

- 6.4.1 AVERAGE SELLING PRICE, BY KEY PLAYER

- 6.4.2 AVERAGE SELLING PRICE TREND, BY REGION

- 6.5 TRADE ANALYSIS

- 6.5.1 EXPORT SCENARIO OF HS CODE 3105

- 6.5.2 IMPORT SCENARIO OF HS CODE 3105

- 6.6 KEY CONFERENCES AND EVENTS, 2024-2026

- 6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.8 INVESTMENT AND FUNDING SCENARIO

- 6.9 CASE STUDY ANALYSIS

- 6.9.1 PURSELL AGRI-TECH AND WASTECH PARTNER TO BOOST CONTROLLED RELEASE FERTILIZER PRODUCTION IN SOUTHEAST ASIA

- 6.9.2 NOUSBO CO., LTD. LAUNCHED "HI-COTE" CONTROLLED-RELEASE FERTILIZER FOR TAILORED NUTRIENT DELIVERY

- 6.9.3 SOLLIO AGRICULTURE OPENED CONTROLLED RELEASE FERTILIZER PLANT TO STRENGTHEN SUSTAINABLE FARMING IN ONTARIO

- 6.10 IMPACT OF 2025 US TARIFF - CONTROLLED RELEASE FERTILIZERS MARKET

- 6.10.1 INTRODUCTION

- 6.10.2 KEY TARIFF RATES

- 6.10.3 PRICE IMPACT ANALYSIS

- 6.10.4 IMPACT ON COUNTRY/REGION

- 6.10.4.1 US

- 6.10.4.2 Europe

- 6.10.4.3 Asia Pacific

- 6.10.5 IMPACT ON END-USE INDUSTRIES

7 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTION

- 7.1 KEY EMERGING TECHNOLOGIES

- 7.1.1 ORGANIC & NATURAL COATING TECHNOLOGIES

- 7.1.2 NANO & ADVANCED MATERIALS TECHNOLOGY

- 7.1.3 MICROBIAL & BIOLOGICAL INTEGRATION TECHNOLOGY

- 7.1.4 ENCAPSULATION & MICROENCAPSULATION TECHNOLOGY

- 7.1.5 RESIN & SYNTHETIC WAX TECHNOLOGY

- 7.1.6 HYBRID & MULTI-TECHNOLOGY PLATFORMS

- 7.1.7 TEMPERATURE-RESPONSIVE SYSTEMS

- 7.2 COMPLEMENTARY TECHNOLOGIES

- 7.2.1 PRECISION AGRICULTURE TECHNOLOGIES

- 7.2.2 SMART IRRIGATION AND FERTIGATION SYSTEMS

- 7.2.3 SOIL AND PLANT SENSING TECHNOLOGIES

- 7.2.4 BIOSTIMULANT INTEGRATION

- 7.3 TECHNOLOGY/PRODUCT ROADMAP

- 7.3.1 SHORT-TERM (2025-2027) | FOUNDATION & EARLY COMMERCIALIZATION

- 7.3.2 MID-TERM (2027-2030) | EXPANSION & STANDARDIZATION

- 7.3.3 LONG-TERM (2030-2035+) | MASS COMMERCIALIZATION & DISRUPTION

- 7.4 COATING PROCESS TECHNOLOGIES

- 7.4.1 FLUIDIZED BED COATING TECHNOLOGY

- 7.4.2 PAN COATING TECHNOLOGY

- 7.4.3 ROTARY DRUM SPRAY COATING TECHNOLOGY

- 7.4.4 MELTING AND EXTRUSION TECHNOLOGY

- 7.4.5 INVERSE SUSPENSION POLYMERIZATION

- 7.4.6 SOLUTION POLYMERIZATION AND CROSS-LINKING

- 7.4.7 MICROWAVE IRRADIATION TECHNOLOGY

- 7.4.8 POLYMER-BASED COATING TECHNOLOGY

- 7.4.9 HYBRID SULFUR-POLYMER COATING TECHNOLOGY

- 7.4.10 RESIN COATING TECHNOLOGY

- 7.4.11 BIODEGRADABLE BIO-POLYMER COATING TECHNOLOGY

- 7.5 PATENT ANALYSIS

- 7.5.1 INTRODUCTION

- 7.5.2 METHODOLOGY

- 7.5.3 DOCUMENT TYPE

- 7.5.4 INSIGHTS

- 7.5.5 LEGAL STATUS OF PATENTS

- 7.5.6 JURISDICTION ANALYSIS

- 7.5.7 TOP APPLICANTS

- 7.5.8 LIST OF PATENTS BY FARMHANNONG CO LTD

- 7.6 FUTURE APPLICATIONS

- 7.6.1 CONTROLLED-RELEASE FERTILIZERS: SUSTAINABLE AGRICULTURE TRANSFORMATION

- 7.6.2 AI-INTEGRATED CRFS: DATA-DRIVEN NUTRIENT MANAGEMENT

- 7.6.3 BIODEGRADABLE COATING SYSTEMS: CIRCULAR AGRICULTURE ADVANCEMENT

- 7.6.4 SENSOR-ENABLED CRFS: SMART RELEASE SYSTEMS

- 7.6.5 HYBRID CRF-BIOLOGICAL SYSTEMS: ENHANCED CROP PERFORMANCE

- 7.7 IMPACT OF AI/GEN AI ON CONTROLLED RELEASE FERTILIZER MARKET

- 7.7.1 TOP USE CASES AND MARKET POTENTIAL

- 7.7.2 BEST PRACTICES IN CONTROLLED RELEASE FERTILIZER PROCESSING

- 7.7.3 CASE STUDIES OF AI IMPLEMENTATION IN CONTROLLED RELEASE FERTILIZERS MARKET

- 7.7.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 7.7.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN CONTROLLED RELEASE FERTILIZERS MARKET

- 7.8 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 7.8.1 ICL GROUP - ADVANCED POLYMER COATING TECHNOLOGY

- 7.8.2 KINGENTA ECOLOGICAL ENGINEERING GROUP - BIO-BASED AND NANO-ENCAPSULATED CRFS

- 7.8.3 YARA INTERNATIONAL ASA - DIGITAL-INTEGRATED NUTRIENT MANAGEMENT

8 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 8.1 REGIONAL REGULATIONS AND COMPLIANCE

- 8.1.1 NORTH AMERICA: REGULATORY LANDSCAPE

- 8.1.1.1 US

- 8.1.1.2 Canada

- 8.1.2 EUROPE: REGULATORY LANDSCAPE

- 8.1.3 ASIA PACIFIC: REGULATORY LANDSCAPE

- 8.1.3.1 Australia

- 8.1.3.2 China

- 8.1.3.3 India

- 8.1.4 SOUTH AMERICA

- 8.1.4.1 Brazil

- 8.1.5 ROW

- 8.1.5.1 South Africa

- 8.1.5.2 Israel

- 8.1.6 INDUSTRY STANDARDS

- 8.1.1 NORTH AMERICA: REGULATORY LANDSCAPE

- 8.2 SUSTAINABILITY INITIATIVES

- 8.2.1 ENVIRONMENTAL IMPACT AND ECO-APPLICATIONS OF CONTROLLED RELEASE FERTILIZERS

- 8.2.1.1 Nutrient Loss and Emission Reduction

- 8.2.1.2 Eco-Applications

- 8.2.1 ENVIRONMENTAL IMPACT AND ECO-APPLICATIONS OF CONTROLLED RELEASE FERTILIZERS

- 8.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 8.4 CERTIFICATIONS, LABELING, ECO-STANDARDS

9 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 9.1 DECISION-MAKING PROCESS

- 9.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 9.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 9.2.2 BUYING CRITERIA

- 9.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 9.4 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

- 9.5 MARKET PROFITABILITY

- 9.5.1 REVENUE POTENTIAL

- 9.5.2 COST DYNAMICS

- 9.5.3 MARGIN OPPORTUNITIES BY APPLICATION

10 CONTROLLED RELEASE FERTILIZERS MARKET, BY TYPE

- 10.1 INTRODUCTION

- 10.1.1 SLOW-RELEASE FERTILIZERS

- 10.1.1.1 Rising demand for high-efficiency and sustainable fertilizers

- 10.1.1.2 Urea-formaldehyde

- 10.1.1.3 Urea-isobutyraldehyde

- 10.1.1.4 Urea-acetaldehyde

- 10.1.1.5 Other slow-release fertilizers

- 10.1.2 COATED & ENCAPSULATED FERTILIZERS

- 10.1.2.1 Need for optimized nutrient efficiency and sustainable farming approaches to drive segment

- 10.1.2.2 Sulfur-coated fertilizers

- 10.1.2.3 Polymer-coated fertilizers

- 10.1.2.4 Sulfur-polymer-coated fertilizers

- 10.1.2.5 Other coated & encapsulated fertilizers

- 10.1.2.5.1 Bio-based/organic-coated fertilizers

- 10.1.2.5.2 Nano-enabled/advanced material-coated fertilizers

- 10.1.2.5.3 Hybrid & smart controlled-release fertilizers

- 10.1.3 NITROGEN STABILIZERS

- 10.1.3.1 Growing demand for sustainable fertilizers to reduce nitrogen loss and environmental impact

- 10.1.3.2 Nitrification inhibitors

- 10.1.3.3 Urease inhibitors

- 10.1.1 SLOW-RELEASE FERTILIZERS

11 CONTROLLED RELEASE FERTILIZERS MARKET, BY FUNCTION

- 11.1 INTRODUCTION

- 11.2 TEMPERATURE-DEPENDENT RELEASE SYSTEMS

- 11.2.1 ALIGN NUTRIENT RELEASE WITH CROP GROWTH UNDER VARYING CLIMATES

- 11.3 WATER-DEPENDENT RELEASE SYSTEMS

- 11.3.1 ENHANCE NUTRIENT EFFICIENCY IN MOISTURE-VARIABLE AND ARID SOILS

- 11.4 MICROBE-ACTIVATED RELEASE SYSTEMS

- 11.4.1 PROMOTE ECO-FRIENDLY NUTRIENT DELIVERY THROUGH MICROBIAL ACTIVATION

- 11.5 TIME-RELEASE SYSTEMS

- 11.5.1 REDUCE APPLICATION FREQUENCY WITH STEADY, LONG-TERM NUTRIENT SUPPLY

- 11.6 PH-DEPENDENT RELEASE SYSTEMS

- 11.6.1 OPTIMIZE NUTRIENT RELEASE BASED ON SOIL ACIDITY OR ALKALINITY

- 11.7 OTHER FUNCTIONS

12 CONTROLLED RELEASE FERTILIZERS MARKET, BY PRODUCT TIER

- 12.1 INTRODUCTION

- 12.2 BASIC COATED FERTILIZERS

- 12.2.1 RISING EMPHASIS ON NITROGEN USE EFFICIENCY AND ENVIRONMENTAL COMPLIANCE TO BOOST MARKET

- 12.3 ADVANCED POLYMER/RESIN-COATED FERTILIZERS

- 12.3.1 GROWING FOCUS ON PRECISION AND SUSTAINABLE FARMING TO DRIVE MARKET

- 12.4 PREMIUM SMART/HYBRID CONTROLLED-RELEASE FERTILIZERS

- 12.4.1 INCREASING ADOPTION OF SMART FARMING AND SUSTAINABLE NUTRIENT MANAGEMENT PRACTICES TO PROPEL MARKET

13 CONTROLLED RELEASE FERTILIZERS MARKET, BY FORMULATION

- 13.1 INTRODUCTION

- 13.2 DRY

- 13.2.1 NEED TO REDUCE APPLICATION FREQUENCY AND NUTRIENT LOSSES

- 13.2.2 GRANULAR

- 13.2.3 PRILLED

- 13.2.4 POWDER

- 13.3 LIQUID

- 13.3.1 DEMAND FOR EFFICIENT NUTRIENT DELIVERY AND COMPATIBILITY WITH MODERN IRRIGATION SYSTEMS

- 13.3.2 SOLUTIONS

- 13.3.3 SUSPENSIONS/ EMULSIONS

- 13.3.4 CONCENTRATES

14 CONTROLLED RELEASE FERTILIZERS MARKET, BY MODE OF APPLICATION

- 14.1 INTRODUCTION

- 14.2 FERTIGATION

- 14.2.1 NEED FOR HOMOGENOUS APPLICATION OF FERTILIZERS ACROSS CROP ROOTS TO DRIVE DEMAND

- 14.3 FOLIAR

- 14.3.1 FOCUS ON INCREASING NUTRIENT SUPPLY DURING EARLY GROWTH STAGES OF CROPS TO DRIVE DEMAND

- 14.4 SOIL

- 14.4.1 GROWING EMPHASIS ON INCREASING CROP YIELD TO BOOST DEMAND

- 14.5 OTHER MODES OF APPLICATION

15 CONTROLLED RELEASE FERTILIZERS MARKET, BY CROP TYPE

- 15.1 INTRODUCTION

- 15.2 AGRICULTURAL CROPS

- 15.2.1 RISING GLOBAL CONSUMPTION OF CEREALS & GRAINS TO BOOST MARKET

- 15.2.1.1 Cereals & grains

- 15.2.1.2 Oilseed & pulses

- 15.2.1.3 Vegetables

- 15.2.1.4 Fruits

- 15.2.1.5 Plantation crops

- 15.2.1 RISING GLOBAL CONSUMPTION OF CEREALS & GRAINS TO BOOST MARKET

- 15.3 NON-AGRICULTURAL CROPS

- 15.3.1 GROWING USE OF TURF AND ORNAMENTALS IN SPORTS ARENAS TO DRIVE MARKET

- 15.3.2 TURF & ORNAMENTALS

- 15.3.3 NURSERIES & GREENHOUSES

- 15.3.4 OTHER NON-AGRICULTURAL CROPS

16 CONTROLLED RELEASE FERTILIZERS MARKET, BY REGION

- 16.1 INTRODUCTION

- 16.2 NORTH AMERICA

- 16.2.1 US

- 16.2.1.1 Demand for environmentally friendly agricultural inputs to drive market

- 16.2.2 CANADA

- 16.2.2.1 Growing focus on superior-quality crops to boost market

- 16.2.3 MEXICO

- 16.2.3.1 Increasing export of processed food products to drive market

- 16.2.1 US

- 16.3 EUROPE

- 16.3.1 UK

- 16.3.1.1 Consumer awareness and diverse applications to drive demand for CRFs

- 16.3.2 FRANCE

- 16.3.2.1 Demand for better-quality crops to encourage market expansion.

- 16.3.3 GERMANY

- 16.3.3.1 Rising awareness regarding sustainable agricultural practices to boost market

- 16.3.4 SPAIN

- 16.3.4.1 Need to improve input efficiency in agricultural sector to encourage market growth

- 16.3.5 ITALY

- 16.3.5.1 Growing awareness regarding scientific upkeep of nurseries to fuel demand for CRFs

- 16.3.6 REST OF EUROPE

- 16.3.1 UK

- 16.4 ASIA PACIFIC

- 16.4.1 CHINA

- 16.4.1.1 Investments in new technologies for better agricultural inputs to boost market

- 16.4.2 JAPAN

- 16.4.2.1 Advanced agricultural practices to propel adoption of CRFs

- 16.4.3 INDIA

- 16.4.3.1 Large-scale production of wheat, rice, and grains to drive market

- 16.4.4 SOUTH KOREA

- 16.4.4.1 Government initiatives and increased demand for high-yielding crops to drive market

- 16.4.5 AUSTRALIA & NEW ZEALAND

- 16.4.5.1 Increasing demand for nitrogen-based fertilizers to boost market

- 16.4.6 REST OF ASIA PACIFIC

- 16.4.1 CHINA

- 16.5 SOUTH AMERICA

- 16.5.1 BRAZIL

- 16.5.1.1 Ease of application to boost demand for controlled-release fertilizers

- 16.5.2 ARGENTINA

- 16.5.2.1 Rapid advancements in farming techniques to drive market

- 16.5.3 REST OF SOUTH AMERICA

- 16.5.1 BRAZIL

- 16.6 REST OF THE WORLD

- 16.6.1 AFRICA

- 16.6.1.1 Water scarcity, rising fertilizer costs, and need for sustainable agricultural solutions to drive market

- 16.6.2 MIDDLE EAST

- 16.6.2.1 Increasing consumption of fruits and vegetables to drive demand for CRFs

- 16.6.1 AFRICA

17 COMPETITIVE LANDSCAPE

- 17.1 OVERVIEW

- 17.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 17.3 ANNUAL REVENUE ANALYSIS, 2020-2024

- 17.4 MARKET SHARE ANALYSIS, 2024

- 17.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 17.5.1 STARS

- 17.5.2 EMERGING LEADERS

- 17.5.3 PERVASIVE PLAYERS

- 17.5.4 PARTICIPANTS

- 17.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 17.5.5.1 Company footprint

- 17.5.5.2 Region footprint

- 17.5.5.3 Type footprint

- 17.5.5.4 Mode of application footprint

- 17.5.5.5 Crop type footprint

- 17.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 17.6.1 PROGRESSIVE COMPANIES

- 17.6.2 RESPONSIVE COMPANIES

- 17.6.3 DYNAMIC COMPANIES

- 17.6.4 STARTING BLOCKS

- 17.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 17.6.5.1 Detailed list of key startups/SMEs

- 17.6.5.2 Competitive benchmarking of key startups/SMEs

- 17.7 COMPANY VALUATION AND FINANCIAL METRICS

- 17.8 PRODUCT COMPARISON

- 17.9 COMPETITIVE SCENARIO AND TRENDS

- 17.9.1 PRODUCT LAUNCHES

- 17.9.2 DEALS

- 17.9.3 EXPANSIONS

18 COMPANY PROFILES

- 18.1 KEY PLAYERS

- 18.1.1 YARA

- 18.1.1.1 Business overview

- 18.1.1.2 Products offered

- 18.1.1.3 Recent developments

- 18.1.1.3.1 Product launches

- 18.1.1.3.2 Deals

- 18.1.1.3.3 Expansions

- 18.1.1.4 MnM view

- 18.1.1.4.1 Right to win

- 18.1.1.4.2 Strategic choices

- 18.1.1.4.3 Weaknesses and competitive threats

- 18.1.2 NUTRIEN

- 18.1.2.1 Business overview

- 18.1.2.2 Products offered

- 18.1.2.3 Recent developments

- 18.1.2.3.1 Deals

- 18.1.2.4 MnM view

- 18.1.2.4.1 Right to win

- 18.1.2.4.2 Strategic choices

- 18.1.2.4.3 Weaknesses and competitive threats

- 18.1.3 MOSAIC

- 18.1.3.1 Business overview

- 18.1.3.2 Products offered

- 18.1.3.3 Recent developments

- 18.1.3.3.1 Deals

- 18.1.3.3.2 Expansions

- 18.1.3.4 MnM view

- 18.1.3.4.1 Right to win

- 18.1.3.4.2 Strategic choices

- 18.1.3.4.3 Weaknesses and competitive threats

- 18.1.4 ICL

- 18.1.4.1 Business overview

- 18.1.4.2 Products offered

- 18.1.4.3 Recent developments

- 18.1.4.3.1 Product launches

- 18.1.4.3.2 Deals

- 18.1.4.4 MnM view

- 18.1.4.4.1 Right to win

- 18.1.4.4.2 Strategic choices

- 18.1.4.4.3 Weaknesses and competitive threats

- 18.1.5 THE ANDERSONS, INC.

- 18.1.5.1 Business overview

- 18.1.5.2 Products offered

- 18.1.5.3 Recent developments

- 18.1.5.3.1 Product launches

- 18.1.5.4 MnM view

- 18.1.5.4.1 Right to win

- 18.1.5.4.2 Strategic choices

- 18.1.5.4.3 Weaknesses and competitive threats

- 18.1.6 NUFARM

- 18.1.6.1 Business overview

- 18.1.6.2 Products offered

- 18.1.6.3 MnM view

- 18.1.6.3.1 Right to win

- 18.1.6.3.2 Strategic choices

- 18.1.6.3.3 Weaknesses and competitive threats

- 18.1.7 KINGENTA

- 18.1.7.1 Business overview

- 18.1.7.2 Products offered

- 18.1.7.3 Recent developments

- 18.1.7.3.1 Product launches

- 18.1.7.3.2 Deals

- 18.1.7.4 MnM view

- 18.1.7.4.1 Right to win

- 18.1.7.4.2 Strategic choices

- 18.1.7.4.3 Weaknesses and competitive threats

- 18.1.8 THE SCOTTS COMPANY LLC

- 18.1.8.1 Business overview

- 18.1.8.2 Products offered

- 18.1.8.3 MnM view

- 18.1.9 KOCH IP HOLDINGS, LLC.

- 18.1.9.1 Business overview

- 18.1.9.2 Products offered

- 18.1.9.3 Recent developments

- 18.1.9.3.1 Deals

- 18.1.9.4 MnM view

- 18.1.10 COMPO EXPERT GMBH

- 18.1.10.1 Business overview

- 18.1.10.2 Products offered

- 18.1.10.3 Recent developments

- 18.1.10.3.1 Expansions

- 18.1.10.4 MnM view

- 18.1.11 HAIFA NEGEV TECHNOLOGIES LTD.

- 18.1.11.1 Business overview

- 18.1.11.2 Products offered

- 18.1.11.3 Recent developments

- 18.1.11.3.1 Deals

- 18.1.11.3.2 Expansions

- 18.1.11.4 MnM view

- 18.1.12 EUROCHEM GROUP

- 18.1.12.1 Business overview

- 18.1.12.2 Products offered

- 18.1.12.3 Recent developments

- 18.1.12.3.1 Product launches

- 18.1.12.4 MnM view

- 18.1.13 SIMPLOT

- 18.1.13.1 Business overview

- 18.1.13.2 Products offered

- 18.1.13.3 MnM view

- 18.1.14 JCAM AGRI CO., LTD.

- 18.1.14.1 Business overview

- 18.1.14.2 Products offered

- 18.1.14.3 Recent developments

- 18.1.14.3.1 Expansions

- 18.1.14.4 MnM view

- 18.1.15 HELENA AGRI-ENTERPRISES, LLC.

- 18.1.15.1 Business overview

- 18.1.15.2 Products offered

- 18.1.15.3 MnM view

- 18.1.1 YARA

- 18.2 OTHER PLAYERS

- 18.2.1 SK SPECIALTIES SDN BHD.

- 18.2.1.1 Business overview

- 18.2.1.2 Products offered

- 18.2.1.3 MnM view

- 18.2.2 DELTACHEM INTERNATIONAL B.V.

- 18.2.2.1 Business overview

- 18.2.2.2 Products offered

- 18.2.2.3 MnM view

- 18.2.3 AGROLIQUID

- 18.2.3.1 Business overview

- 18.2.3.2 Products offered

- 18.2.3.3 MnM view

- 18.2.4 KNOX FERTILIZER COMPANY INC.

- 18.2.4.1 Business overview

- 18.2.4.2 Products offered

- 18.2.4.3 MnM view

- 18.2.5 ALLIED NUTRIENTS

- 18.2.5.1 Business overview

- 18.2.5.2 Products offered

- 18.2.5.3 MnM view

- 18.2.6 PURSELL AGRI-TECH, LLC

- 18.2.7 AGLUKON SPEZIALDUNGER GMBH

- 18.2.8 ANBR

- 18.2.9 PARAKH AGRI SOLUTIONS

- 18.2.10 RISSO CHEMICAL

- 18.2.1 SK SPECIALTIES SDN BHD.

19 ADJACENT AND RELATED MARKETS

- 19.1 INTRODUCTION

- 19.2 LIMITATIONS

- 19.3 WATER-SOLUBLE FERTILIZERS MARKET

- 19.3.1 MARKET DEFINITION

- 19.3.2 MARKET OVERVIEW

- 19.4 BIOFERTILIZERS MARKET

- 19.4.1 MARKET DEFINITION

- 19.4.2 MARKET OVERVIEW

20 APPENDIX

- 20.1 DISCUSSION GUIDE

- 20.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 20.3 CUSTOMIZATION OPTIONS

- 20.4 RELATED REPORTS

- 20.5 AUTHOR DETAILS