|

시장보고서

상품코드

1901405

전자상거래 포장 시장 : 제품 유형별, 재료별, 최종 사용 산업별, 지역별 예측E-Commerce Packaging Market Product Type (Boxes, Mailers, Tapes, Protective Packaging) By Material (Corrugated Boards, Paper & Paperboards, Plastics), End-use Industry (Electronics, F&B, Apparel, Cosmetics) & Region - Global Forecast to 2030 |

||||||

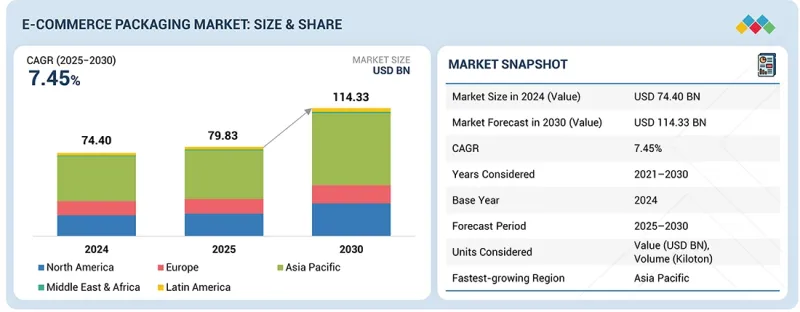

세계의 전자상거래 포장 시장의 규모는 2025년에 798억 3,000만 달러에 이르렀고, 2030년까지 1,143억 3,000만 달러에 이를 것으로 예측되며, 예측기간 동안 CAGR 7.45%의 성장이 예상됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2021-2030년 |

| 기준연도 | 2024년 |

| 예측기간 | 2025-2030년 |

| 단위 | 100만 달러, 킬로톤 |

| 부문 | 제품 유형, 재료, 최종 사용 산업, 지역 |

| 대상 지역 | 북미, 아시아태평양, 유럽, 중동, 아프리카, 남미 |

전자상거래 포장 시장은 주로 전자상거래 매출 증가, 식품 및 음료 수요 증가, 포장 기술 진보, 지속 가능하고 친환경적인 포장 솔루션 채택, 인터넷 및 스마트폰 이용 확대로 급속한 성장이 예상됩니다.

"봉투 부문이 예측기간 동안 가장 빠르게 성장하는 시장이 될 것으로 예측됩니다."

봉투 부문이 전자상거래 포장 시장에서 최대 비율을 차지할 전망입니다. 전자상거래에서 가장 성장하는 유형은 봉투 포장입니다. 봉투 재료는 더 작고 가벼우며 빈도가 높은 온라인 쇼핑 동향에 이상적입니다. 의류, 액세서리, 화장품, 책, 전자기기, 의약품 등 더 많은 소비자가 온라인으로 상품을 구매함에 따라 브랜드는 점점 더 봉투를 선택하고 있습니다. 봉투는 포장의 크기와 무게를 줄이고 들어가는 재료를 줄임으로써 배송 비용 절감에 기여합니다. 비닐 봉투, 종이 봉투, 쿠션 봉투 및 패드 봉투는 보관 공간을 줄이고 신속하게 배송할 수 있으며 대규모 전자상거래용 자동 포장 시스템과 쉽게 통합됩니다.

"판지 부문이 예측기간 동안 두 번째로 큰 부문이 될 것으로 예측됩니다."

전자상거래 포장 재료에서 두 번째로 높은 점유율을 차지하고 있는 부문은 판지 재료입니다. 강도, 지속 가능성, 비용 효율의 이상적인 조합이 환경친화적인 브랜드 구축 포장으로의 급속한 이행에 적합하기 때문입니다. 판지는 가벼우면서도 충분한 강도를 가지고 있으며, 골판지 수준의 강도를 필요로 하지 않는 의류, 화장품, 책, 소형 전자기기 등 다양한 제품에 사용됩니다. 또한 뛰어난 인쇄성을 자랑하고 브랜드가 고품질의 그래픽을 활용하여 고객의 관심을 끌고 인상적인 개봉 체험을 창출할 수 있는 점이 온라인 소매에서의 중요한 차별화 요인이 되고 있습니다.

의류 및 액세서리 부문 시장이 예측기간 동안 두 번째로 높은 성장률을 나타낼 것으로 예측됩니다.

전자상거래 포장에서 두 번째로 큰 시장은 의류 및 액세서리입니다. 이는 패션 상품의 온라인 구매 속도가 빠르고 고객당 주문 수가 많기 때문입니다. 의류, 신발, 액세서리는 가볍고 운송이 용이하며 정리 구매와 충동 구매가 많기 때문에 주로 대량으로 배송됩니다. 의류는 손상 위험이 상대적으로 낮지만 보호성과 비용 효율성을 모두 갖춘 포장이 여전히 요구되고 있습니다. 구체적으로는 비닐 봉투, 종이 봉투, 고급품용 골판지 상자가 있으며 추가적으로 반품을 용이하게 하는 설계가 요구됩니다.

"아시아태평양의 전자상거래 포장 시장이 예측기간 동안 금액 기준으로 가장 높은 CAGR을 나타낼 전망입니다."

아시아태평양은 특히 중국, 인도, 인도네시아, 동남아시아에서의 대규모 인구, 중산층 확대, 온라인 쇼핑의 급증으로 전자상거래 포장 시장에서 가장 빠르게 성장하고 있습니다. 스마트폰의 보급과 인터넷 연결의 확대로 매년 수백만 명의 신규 디지털 소비자가 온라인으로 진입해 전 카테고리에서 출하 수가 증가하고 있습니다. 이 지역에서는 물류 네트워크, 라스트마일 배송 및 풀필먼트 자동화에 대한 적극적인 투자를 통해 성장 기회도 발생하고 있습니다. 이러한 요인들로 인해 신뢰성이 높고 확장 가능한 포장 형태에 대한 수요가 증가하고 있습니다.

이 보고서는 세계의 전자상거래 포장 시장에 대한 조사 분석을 통해 주요 촉진요인 및 억제요인, 제품 개발 및 혁신 및 경쟁 구도에 대한 인사이트를 제공합니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요한 인사이트

- 전자상거래 포장 시장 기업에 매력적인 기회

- 아시아태평양의 전자상거래 포장 시장 : 제품 유형별, 국가별(2024년)

- 전자상거래 포장 시장 : 제품 유형별

- 전자상거래 포장 시장 : 재료별

- 전자상거래 포장 시장 : 용도별(2024년, 2030년)

- 전자상거래 포장 시장 : 국가별

제5장 시장 개요

- 시장 역학

- 촉진요인

- 억제요인

- 기회

- 과제

- 미충족 요구 및 사업 기회

- 지속 가능성과 친환경 솔루션

- 사이즈 최적화와 비용 효율

- 다용도 포장 솔루션

- 재활용성과 업사이클성에 관한 통합 정보

- 포장 디자인의 현지화와 문화적 관련성

- 연관 시장 및 부문 간 기회

- 연관 시장

- 부문 간 기회

- Tier 1, 2, 3 기업의 전략적 움직임

- Tier 1 기업 : 통합과 혁신을 추진하는 세계 리더

- Tier 2 기업 : 지역의 혁신자와 틈새 리더

- Tier 3 기업 : 민첩한 혁신자 및 전문 공급자

제6장 업계 동향

- 고객 사업에 영향을 끼치는 동향 및 혼란

- 밸류체인 분석

- 생태계 분석

- 가격 설정 분석

- 평균 판매 가격 동향 : 지역별

- 무역 분석

- 수입 데이터(HS코드 481910)

- 수출 데이터(HS코드 481910)

- 주요 회의 및 이벤트(2025년)

- Porter's Five Forces 분석

- 사례 연구 분석

- 거시경제 분석

- GDP의 동향 및 예측

- 도시화와 인구동태의 변화

- 무역과 세계 공급망의 역학

- 투자 및 자금조달 시나리오

- 전자상거래 포장 시장에 대한 2025년 미국 관세의 영향

- 주요 관세율

- 가격 영향 분석

- 다양한 지역에 대한 중요한 영향

- 최종 용도 부문에 대한 영향

- 고객 상황과 구매 행동

- 의사결정 프로세스

- 주요 이해관계자와 구매 기준

- 구매 프로세스의 주요 이해관계자

- 구매 기준

- 채용 장벽과 내부 과제

- 다양한 용도에서의 미충족 요구

- 시장의 수익성

- 잠재적인 수익

- 비용 역학

- 사업 기회 : 최종 사용 산업별

- 식품 및 음료

- 전자

- 패션

- 화장품

- 가구

제7장 지속 가능성과 규제 정세

- 지역 규제 및 규정 준수

- 업계 표준

- 지속 가능성에 대한 노력

- 재사용 가능한 포장

- 생분해성, 퇴비화 가능, 재활용 가능한 재료

- 전자상거래 기업의 지속 가능 경영 프로그램

- 포장 제조업체에 의한 소재 혁신

- 인증, 라벨, 환경 기준

- 기술, 특허, 디지털, AI의 채용에 의한 전략적 파괴

- 주요 신기술

- 보완 기술

- 인접 기술

- 기술 및 제품 로드맵

- 단기 : 이행과 디지털 도입 단계(2025-2027년)

- 중기 : 소재 혁신과 지속 가능성 확대 단계(2027-2030년)

- 장기 : 통합 생태계와 차세대 재료 단계(2030-2035년 이후)

- 특허 분석

- 접근

- 문서 유형

- 관할 분석

- 미래 용도

- 스마트 센서 대응 포장(IoT 및 컨디션 모니터링)

- AI 최적화 온디맨드 포장(자동 적정 사이즈화 에코시스템)

- 초개인화, 경험 중심 포장(디지털 인쇄, 데이터 확장 디자인, 몰입형 상호 작용)

- 지속 가능성과 소재 혁신(순환형 디자인, 차세대 섬유, 저탄소 재료 시스템)

- 전자상거래 포장 시장에 대한 AI 및 생성형 AI의 영향

- 주요 이용 사례와 시장의 장래성

- 전자상거래 포장의 모범 사례

- 전자상거래 포장 시장에서의 AI 도입 사례 연구

- 연관 인접 생태계와 시장 기업에 미치는 영향

- 전자상거래 포장 시장에서 생성형 AI 채용에 대한 고객의 준비 상황

- 성공 사례와 실세계 응용

- Mondi Plc : 디지털 인쇄로 KOMSA의 라벨 프리 대량 포장을 실현

- Smurfit Westrock과 Super-Pharm : 경량이며 효율적인 전자상거래 포장

- FHB Group과 Mondi : eComPack에 의한 피크 시즌 풀필먼트 자동화

제8장 전자상거래 포장 시장 : 제품 유형별

- 박스

- 봉투

- 테이프

- 라벨

- 보호 포장

- 기타 제품 유형

제9장 전자상거래 포장 시장 : 재료별

- 플라스틱

- 종이 및 판지

- 골판지

- 기타 재료

제10장 전자상거래 포장 시장 : 최종 사용 산업별

- 전기 및 전자

- 식품 및 음료

- 의류 및 액세서리

- 퍼스널케어 및 화장품

- 의약품

- 공업제품

- 기타 최종 사용 산업

제11장 전자상거래 포장 시장 : 지역별

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 기타 아시아태평양

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 기타 유럽

- 북미

- 미국

- 캐나다

- 멕시코

- 중동 및 아프리카

- GCC 국가

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

제12장 경쟁 구도

- 개요

- 주요 진입기업의 전략 및 강점

- 수익 분석

- 시장 점유율 분석

- 기업 평가 및 재무 지표

- 제품 비교

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업 및 중소기업(2024년)

- 경쟁 시나리오

제13장 기업 프로파일

- 주요 기업

- INTERNATIONAL PAPER

- AMCOR PLC

- MONDI GROUP

- SMURFIT WESTROCK

- RENGO CO., LTD.

- SONOCO PRODUCTS COMPANY

- CCL INDUSTRIES

- HB FULLER

- SEALED AIR CORPORATION

- STORA ENSO OYJ

- 기타 기업

- CASCADES INC.

- PACKAGING CORPORATION OF AMERICA

- NINE DRAGONS PAPER(HOLDINGS) LIMITED

- KLABIN SA

- ULINE INC.

- PACKSIZE INTERNATIONAL, INC.

- LARSEN PACKAGING

- TRIDENT PAPER BOX INDUSTRIES

- GEORGIA-PACIFIC

- SALAZAR PACKAGING

- PREGIS LLC

- STOROPACK HANS REICHENECKER GMBH

- ATLANTIC PACKAGING

- SPECIALIZED PACKAGING GROUP

- HEXCELPACK LLC

제14장 부록

CSM 26.01.16The e-commerce packaging market is projected to be USD 79.83 billion in 2025 and is expected to reach USD 114.33 billion by 2030, at a CAGR of 7.45% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Kiloton) |

| Segments | Product Type, Material, End-use Industry, and Region |

| Regions covered | North America, Asia Pacific, Europe, Middle East & Africa, and South America |

The e-commerce packaging market is poised for rapid growth, primarily driven by an increase in e-commerce sales, rising demand for food & beverages, technological advancements in packaging, the adoption of sustainable and eco-friendly packaging solutions, and the increasing use of the internet and smartphones.

"The mailers segment is predicted to be the fastest-growing market during the forecast period."

The mailers segment will account for the largest percentage of the increase in the e-commerce packaging market. The fastest-growing product in e-commerce is mailer packaging. This is because mailers are perfect for the trend of smaller, lighter, and more frequent online shopping. As more consumers purchase items online, such as clothing, accessories, cosmetics, books, electronics, and pharmaceuticals, brands are increasingly choosing mailers. They help reduce shipping costs by lowering the size and weight of packages and using less material. Poly mailers, paper mailers, cushioned mailers, and padded envelopes occupy less storage space, can be shipped quickly, and integrate well with automated packaging systems for high-volume e-commerce.

"The paperboard segment is projected to be the second largest segment during the forecast period."

The second-largest portion of e-commerce packaging is paperboard materials, due to the perfect combination of strength, sustainability, and cost efficiency that makes it a suitable fit for the fast transition towards environmentally friendly and brand-building packaging. Paperboard is a lightweight and low-weight material that is also strong enough to be used in a wide variety of products, such as clothing, beauty products, books, and small electronic devices, where full corrugated strength is not required. It also boasts excellent printability, allowing brands to utilize high-quality graphics to engage customers and create memorable unboxing experiences, which is a key differentiator in online retail.

"The apparel & accessories segment market is expected to have the second-largest growth during the forecast period."

The second-largest market for e-commerce packaging is apparel and accessories, due to the fast-paced online purchasing rate of fashion and a high number of orders per customer. Apparel, shoes, and accessories are lightweight, easy to transport, and are often purchased in bulk or as impulse buys; thus, they are frequently shipped in bulk. Although apparel is less sensitive, it still requires protective but cost-effective packaging, including poly mailers, paper mailers, and corrugated boxes for high-end products, as well as designs that facilitate returns.

"In terms of value, the Asia Pacific e-commerce packaging market is projected to grow at the highest CAGR during the forecast period."

Asia Pacific is witnessing the fastest growth in e-commerce packaging due to its large population, growing middle class, and rapidly increasing online shopping, especially in China, India, Indonesia, and Southeast Asia. The increasing availability of smartphones and internet access is bringing millions of new digital consumers online each year, resulting in higher shipment volumes across all categories. The region also offers growth opportunities through strong investments in logistics networks, last-mile delivery, and fulfillment automation. These factors increase the need for reliable and scalable packaging formats.

By Company Type: Tier 1: 25%, Tier 2: 42%, and Tier 3: 33%

By Designation: C-level Executives: 20%, Directors: 30%, and Other Designations: 50%

By Region: North America: 20%, Europe: 10%, Asia Pacific: 40%, South America: 10%, and Middle East & Africa 20%

Notes: Other designations include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million-1 Billion; and Tier 3: <USD 500 million

Companies Covered: International Paper (US), Amcor (Australia), Smurfit Westrock (Ireland), Mondi Group (UK), Rengo Co., Ltd. (Japan), Sonoco Products Company (US), CCL Industries (Canada), H.B. Fuller (US), Sealed Air Corporation (US), and Stora Enso Oyj (Finland) among others are covered in the report.

The study includes an in-depth competitive analysis of these key players in the e-commerce packaging market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the e-commerce packaging market based on product type (boxes, mailers, tapes, labels, protective packaging, and other product types), materials (plastic, paper & paperboard, corrugated boards, and other materials), end-use industry (electronics & electrical, apparel & accessories, personal care & cosmetics, food & beverages, pharmaceuticals, industrial goods, and others), and region (Asia Pacific, North America, Europe, South America, and Middle East & Africa). The report's scope encompasses detailed information regarding the drivers, restraints, challenges, and opportunities that influence the growth of the e-commerce packaging market. A detailed analysis of key industry players has been conducted to provide insights into their business overview, products offered, and key strategies, including partnerships, collaborations, product launches, expansions, and acquisitions, associated with the e-commerce packaging market. This report covers a competitive analysis of upcoming startups in the e-commerce packaging market ecosystem.

Reasons to Buy the Report

The report will provide market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall e-commerce packaging market and its subsegments. This report will help stakeholders understand the competitive landscape, gain deeper insights into positioning their businesses more effectively, and develop suitable go-to-market strategies. The report will help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (increase in e-commerce sales, rising demand for food & beverages, technological advancements in packaging, sustainable and eco-friendly packaging solutions, increasing use of internet and smartphones), restraints (lack of appropriate infrastructure), opportunities (emergence of social media platforms, brand identity creation using e-commerce packaging, rise in social commerce), and challenges (adverse effects of plastics on the environment, competitive market for high-quality packaging solutions, rising packaging rules, regulations, and standards).

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the e-commerce packaging market.

- Market Development: Comprehensive information about profitable markets - the report analyzes the e-commerce packaging market across varied regions.

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the e-commerce packaging market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as International Paper (US), Amcor (Australia), Smurfit Westrock (Ireland), Mondi Group (UK), Rengo Co., Ltd. (Japan), Sonoco Products Company (US), CCL Industries (Canada), H.B. Fuller (US), Sealed Air Corporation (US), and Stora Enso Oyj (Finland).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 E-COMMERCE PACKAGING MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 SECONDARY DATA

- 2.2.1 KEY DATA FROM SECONDARY SOURCES

- 2.3 PRIMARY DATA

- 2.3.1 KEY DATA FROM PRIMARY SOURCES

- 2.4 MARKET SIZE ESTIMATION

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RISK ASSESSMENT

- 2.8 GROWTH RATE ASSUMPTIONS

3 EXECUTIVE SUMMARY

- 3.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 3.2 KEY MARKET PARTICIPANTS: SHARE INSIGHTS AND STRATEGIC DEVELOPMENTS

- 3.3 DISRUPTIVE TRENDS SHAPING MARKET

- 3.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

- 3.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN E-COMMERCE PACKAGING MARKET

- 4.2 ASIA PACIFIC: E-COMMERCE PACKAGING MARKET, BY PRODUCT TYPE & COUNTRY (2024)

- 4.3 E-COMMERCE PACKAGING MARKET, BY PRODUCT TYPE

- 4.4 E-COMMERCE PACKAGING MARKET, BY MATERIAL

- 4.5 E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2024 VS. 2030 (KILOTON)

- 4.6 E-COMMERCE PACKAGING MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increase in e-commerce sales

- 5.2.1.2 Rising demand for food & beverages

- 5.2.1.3 Technological advancements in packaging

- 5.2.1.4 Sustainable and eco-friendly packaging solutions

- 5.2.1.5 Increasing use of internet and smartphones

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of appropriate infrastructure

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emergence of social media platforms

- 5.2.3.2 Brand identity creation using e-commerce packaging

- 5.2.3.3 Rise in social commerce

- 5.2.4 CHALLENGES

- 5.2.4.1 Adverse effects of plastics on environment

- 5.2.4.2 Competitive market for high-quality packaging solutions

- 5.2.4.3 Rising packaging rules, regulations, and standards

- 5.2.1 DRIVERS

- 5.3 UNMET NEEDS AND WHITE SPACES

- 5.3.1 SUSTAINABILITY AND ECO-FRIENDLY SOLUTIONS

- 5.3.2 SIZE OPTIMIZATION AND COST-EFFICIENCY

- 5.3.3 MULTIFUNCTIONAL PACKAGING SOLUTIONS

- 5.3.4 INTEGRATED RECYCLABILITY AND UP-CYCLABILITY INFORMATION

- 5.3.5 LOCALIZATION AND CULTURAL RELEVANCE IN PACKAGING DESIGN

- 5.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 5.4.1 INTERCONNECTED MARKETS

- 5.4.2 CROSS-SECTOR OPPORTUNITIES

- 5.4.2.1 E-commerce -> Food & beverages

- 5.4.2.2 E-commerce -> Cosmetics & personal care

- 5.4.2.3 E-commerce -> Fashion & apparel

- 5.4.2.4 E-commerce -> Furniture & home goods

- 5.5 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

- 5.5.1 TIER 1 PLAYERS: GLOBAL LEADERS DRIVING CONSOLIDATION AND INNOVATION

- 5.5.1.1 Acquisition of DS Smith by International Paper

- 5.5.1.2 Acquisition of WestRock by Smurfit Kappa

- 5.5.2 TIER 2 PLAYERS: REGIONAL INNOVATORS AND NICHE LEADERS

- 5.5.2.1 Sealed Air Corporation's sustainable product

- 5.5.2.2 Stora Enso Oyj's expansion of manufacturing facility in Poland

- 5.5.3 TIER 3 PLAYERS: AGILE INNOVATORS AND SPECIALIZED PROVIDERS

- 5.5.3.1 Sustainable packaging solutions by HexcelPack LLC

- 5.5.3.2 Klabin S.A.'s Pioneering sustainable packaging solutions in South America

- 5.5.1 TIER 1 PLAYERS: GLOBAL LEADERS DRIVING CONSOLIDATION AND INNOVATION

6 INDUSTRY TRENDS

- 6.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.2 VALUE CHAIN ANALYSIS

- 6.3 ECOSYSTEM ANALYSIS

- 6.4 PRICING ANALYSIS

- 6.5 AVERAGE SELLING PRICE TREND, BY REGION

- 6.6 TRADE ANALYSIS

- 6.6.1 IMPORT DATA (HS CODE 481910)

- 6.6.2 EXPORT DATA (HS CODE 481910)

- 6.7 KEY CONFERENCES AND EVENTS, 2025

- 6.8 PORTER'S FIVE FORCES ANALYSIS

- 6.8.1 E-COMMERCE PACKAGING MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.8.2 THREAT OF NEW ENTRANTS

- 6.8.3 THREAT OF SUBSTITUTES

- 6.8.4 BARGAINING POWER OF SUPPLIERS

- 6.8.5 BARGAINING POWER OF BUYERS

- 6.8.6 INTENSITY OF COMPETITIVE RIVALRY

- 6.9 CASE STUDY ANALYSIS

- 6.9.1 STORA ENSO OYJ & LINDAB: CUTTING CARBON EMISSIONS WITH REUSABLE CORRUGATED PACKAGING

- 6.9.2 SMURFIT WESTROCK & BUTCHER BASE: REDEFINING COLD-CHAIN SUSTAINABILITY WITH FULLY RECYCLABLE MEAT PACKAGING

- 6.9.3 MONDI GROUP & KRUU: STREAMLINING LOGISTICS AND SUSTAINABILITY IN PHOTO-BOOTH PACKAGING

- 6.10 MACROECONOMIC ANALYSIS

- 6.10.1 INTRODUCTION

- 6.10.2 GDP TRENDS AND FORECASTS

- 6.10.3 URBANIZATION AND DEMOGRAPHIC SHIFTS

- 6.10.4 TRADE AND GLOBAL SUPPLY CHAIN DYNAMICS

- 6.11 INVESTMENT AND FUNDING SCENARIO

- 6.12 IMPACT OF 2025 US TARIFF ON E-COMMERCE PACKAGING MARKET

- 6.12.1 INTRODUCTION

- 6.12.2 KEY TARIFF RATES

- 6.12.3 PRICE IMPACT ANALYSIS

- 6.12.4 KEY IMPACT ON VARIOUS REGIONS

- 6.12.4.1 US

- 6.12.4.2 Europe

- 6.12.4.3 Asia Pacific

- 6.12.5 END-USE SECTOR IMPACT

- 6.13 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 6.14 DECISION-MAKING PROCESS

- 6.15 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 6.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.15.2 BUYING CRITERIA

- 6.16 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 6.17 UNMET NEEDS FROM VARIOUS APPLICATIONS

- 6.18 MARKET PROFITABILITY

- 6.18.1 REVENUE POTENTIAL

- 6.18.2 COST DYNAMICS

- 6.19 MARGIN OPPORTUNITIES BY END-USE INDUSTRIES

- 6.19.1 FOOD & BEVERAGES

- 6.19.2 ELECTRONICS

- 6.19.3 FASHION

- 6.19.4 COSMETICS

- 6.19.5 FURNITURE

7 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.2 INDUSTRY STANDARDS

- 7.3 SUSTAINABILITY INITIATIVES

- 7.3.1 REUSABLE PACKAGING

- 7.3.2 BIODEGRADABLE, COMPOSTABLE, AND RECYCLED MATERIALS

- 7.3.3 E-COMMERCE COMPANIES' SUSTAINABILITY PROGRAMS

- 7.3.4 MATERIAL INNOVATIONS BY PACKAGING MANUFACTURERS

- 7.4 CERTIFICATIONS, LABELING, ECO-STANDARDS

- 7.5 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENT, DIGITAL, AND AI ADOPTIONS

- 7.5.1 KEY EMERGING TECHNOLOGIES

- 7.5.1.1 AI-driven automated packaging systems

- 7.5.1.2 Smart packaging with IoT integration

- 7.5.2 COMPLEMENTARY TECHNOLOGIES

- 7.5.2.1 Biodegradable and repurposable materials

- 7.5.2.2 Interactive AR/QR-enabled packaging

- 7.5.3 ADJACENT TECHNOLOGIES

- 7.5.3.1 Reusable and returnable packaging systems

- 7.5.3.2 3D printing for custom prototyping

- 7.5.1 KEY EMERGING TECHNOLOGIES

- 7.6 TECHNOLOGY/PRODUCT ROADMAP

- 7.6.1 SHORT-TERM (2025-2027): TRANSITION & DIGITAL ADOPTION PHASE

- 7.6.2 MID-TERM (2027-2030): MATERIAL INNOVATION AND SUSTAINABILITY EXPANSION PHASE

- 7.6.3 LONG-TERM (2030-2035+): INTEGRATED ECO-SYSTEM AND NEXT-GENERATION MATERIALS PHASE

- 7.7 PATENT ANALYSIS

- 7.7.1 INTRODUCTION

- 7.7.2 APPROACH

- 7.7.3 DOCUMENT TYPE

- 7.8 JURISDICTION ANALYSIS

- 7.8.1 TOP APPLICANTS

- 7.9 FUTURE APPLICATIONS

- 7.9.1 SMART SENSOR-ENABLED PACKAGING (IOT/CONDITION MONITORING)

- 7.9.2 AI-OPTIMIZED ON-DEMAND PACKAGING (AUTOMATED RIGHT-SIZING ECOSYSTEMS)

- 7.9.3 HYPER-PERSONALIZATION & EXPERIENCE-DRIVEN PACKAGING (DIGITAL PRINT, DATA-AUGMENTED DESIGN, IMMERSIVE INTERACTIONS)

- 7.9.4 SUSTAINABILITY & MATERIAL INNOVATION (CIRCULAR DESIGN, NEXT-GEN FIBERS, LOW-CARBON MATERIAL SYSTEMS)

- 7.10 IMPACT OF AI/GEN AI ON E-COMMERCE PACKAGING MARKET

- 7.10.1 TOP USE CASES AND MARKET POTENTIAL

- 7.10.2 BEST PRACTICES IN E-COMMERCE PACKAGING

- 7.10.3 CASE STUDIES OF AI IMPLEMENTATION IN E-COMMERCE PACKAGING MARKET

- 7.10.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 7.10.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN E-COMMERCE PACKAGING MARKET

- 7.11 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 7.11.1 MONDI PLC'S DIGITAL PRINTING ENABLES LABEL-FREE, HIGH-VOLUME PACKAGING FOR KOMSA

- 7.11.2 SMURFIT WESTROCK AND SUPER-PHARM: LIGHTWEIGHT, EFFICIENT E-COMMERCE PACKAGING

- 7.11.3 FHB GROUP & MONDI: AUTOMATED PEAK-SEASON FULFILMENT WITH ECOMPACK

8 E-COMMERCE PACKAGING MARKET, BY PRODUCT TYPE

- 8.1 INTRODUCTION

- 8.2 BOXES

- 8.2.1 AVAILABILITY OF DIFFERENT TYPES, SIZES, AND MATERIALS TO SUPPORT MARKET GROWTH

- 8.3 MAILERS

- 8.3.1 COST-EFFECTIVENESS AND LIGHTWEIGHT QUALITY TO PROPEL MARKET

- 8.4 TAPES

- 8.4.1 BRAND VISIBILITY PROVIDES POSITIVE UNBOXING EXPERIENCE

- 8.5 LABELS

- 8.5.1 RISING USE OF BARCODE AND CERTIFICATION LABELS TO DRIVE MARKET

- 8.6 PROTECTIVE PACKAGING

- 8.6.1 AVAILABILITY OF ECO-FRIENDLY OPTIONS TO DRIVE DEMAND

- 8.7 OTHER PRODUCT TYPES

9 E-COMMERCE PACKAGING MARKET, BY MATERIAL

- 9.1 INTRODUCTION

- 9.2 PLASTICS

- 9.2.1 LIGHTWEIGHT, WATERPROOF, EASY TO HANDLE, AND EFFECTIVE CHARACTERISTICS TO DRIVE DEMAND

- 9.2.2 BIOPLASTICS

- 9.2.3 NON-BIOPLASTICS

- 9.3 PAPER & PAPERBOARDS

- 9.3.1 GROWING AWARENESS OF SUSTAINABLE PACKAGING TO PROPEL MARKET

- 9.4 CORRUGATED BOARDS

- 9.4.1 ENHANCED PRESENTATION AND BRANDING TO SUPPORT MARKET GROWTH

- 9.5 OTHER MATERIALS

10 E-COMMERCE PACKAGING MARKET, BY END-USE INDUSTRY

- 10.1 INTRODUCTION

- 10.2 ELECTRICAL & ELECTRONICS

- 10.2.1 RISING DEMAND FOR CONSUMER ELECTRONICS AND INCREASING E-COMMERCE SALES TO DRIVE MARKET

- 10.3 FOOD & BEVERAGES

- 10.3.1 INCREASING DEMAND FOR PACKAGED AND BRANDED PRODUCTS TO BOOST MARKET

- 10.4 APPAREL & ACCESSORIES

- 10.4.1 CUSTOMIZED PACKAGING AND ONLINE DEALS TO FUEL MARKET

- 10.5 PERSONAL CARE AND COSMETICS

- 10.5.1 USE OF FLEXOGRAPHY AND ELEGANT DESIGNS TO DRIVE MARKET

- 10.6 PHARMACEUTICALS

- 10.6.1 RISING ONLINE DEMAND FOR MEDICINES TO SUPPORT MARKET GROWTH

- 10.7 INDUSTRIAL GOODS

- 10.7.1 HEAVY-DUTY PROTECTIVE SOLUTIONS TO DRIVE MARKET GROWTH

- 10.8 OTHER END-USE INDUSTRIES

11 E-COMMERCE PACKAGING MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 ASIA PACIFIC

- 11.2.1 CHINA

- 11.2.1.1 Increase in online shopping, government support, and livestreaming trend to boost market

- 11.2.2 JAPAN

- 11.2.2.1 Rapid increase in B2B e-commerce to support market growth

- 11.2.3 INDIA

- 11.2.3.1 Rapid expansion of quick commerce to drive market

- 11.2.4 SOUTH KOREA

- 11.2.4.1 Compact and protective packaging solutions to drive market

- 11.2.5 REST OF ASIA PACIFIC

- 11.2.1 CHINA

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Technological advancements in e-commerce sector to fuel market

- 11.3.2 UK

- 11.3.2.1 Increase in online shopping to drive market

- 11.3.3 FRANCE

- 11.3.3.1 Rising capital investments in food and expansion of e-commerce platforms to boost market

- 11.3.4 ITALY

- 11.3.4.1 Growth in food & beverage and electronics sectors to drive market

- 11.3.5 SPAIN

- 11.3.5.1 Growth in fashion e-commerce turnover to drive market

- 11.3.6 RUSSIA

- 11.3.6.1 Growth in e-commerce adoption to drive market

- 11.3.7 REST OF EUROPE

- 11.3.1 GERMANY

- 11.4 NORTH AMERICA

- 11.4.1 US

- 11.4.1.1 Presence of well-established e-commerce platforms to drive market

- 11.4.2 CANADA

- 11.4.2.1 Availability of internet and rising e-commerce penetration to drive market

- 11.4.3 MEXICO

- 11.4.3.1 Growing e-commerce sales to support market growth

- 11.4.1 US

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.5.1.1 Saudi Arabia

- 11.5.1.1.1 Increasing issuance of e-commerce businesses to drive market

- 11.5.1.2 UAE

- 11.5.1.2.1 Increase in mobile commerce to drive market

- 11.5.1.3 Rest of GCC Countries

- 11.5.1.1 Saudi Arabia

- 11.5.2 SOUTH AFRICA

- 11.5.2.1 Increasing urbanization to propel demand

- 11.5.3 REST OF MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.6 SOUTH AMERICA

- 11.6.1 BRAZIL

- 11.6.1.1 High e-commerce sales to drive market

- 11.6.2 ARGENTINA

- 11.6.2.1 Increasing demand from food & beverages and cosmetics industries to drive market

- 11.6.3 REST OF SOUTH AMERICA

- 11.6.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYERS' STRATEGIES/ RIGHT TO WIN

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.5.1 COMPANY VALUATION

- 12.5.2 FINANCIAL METRICS

- 12.6 PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 End-use industry footprint

- 12.7.5.4 Product type footprint

- 12.7.5.5 Material footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.6 DETAILED LIST OF KEY STARTUPS/SMES

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

- 12.9.4 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 INTERNATIONAL PAPER

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.3.2 Expansions

- 13.1.1.3.3 Other developments

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 AMCOR PLC

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Deals

- 13.1.2.3.3 Expansions

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 MONDI GROUP

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.3.3 Expansions

- 13.1.3.3.4 Other developments

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 SMURFIT WESTROCK

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.3.3 Expansions

- 13.1.4.3.4 Other developments

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 RENGO CO., LTD.

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches

- 13.1.5.3.2 Deals

- 13.1.5.3.3 Expansions

- 13.1.5.3.4 Other developments

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 SONOCO PRODUCTS COMPANY

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.6.3.2 Expansions

- 13.1.6.3.3 Other developments

- 13.1.6.4 MnM view

- 13.1.7 CCL INDUSTRIES

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.7.3.2 Expansions

- 13.1.7.4 MnM view

- 13.1.8 H.B. FULLER

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.8.3.2 Expansions

- 13.1.8.4 MnM view

- 13.1.9 SEALED AIR CORPORATION

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Product launches

- 13.1.9.3.2 Deals

- 13.1.9.3.3 Expansions

- 13.1.9.4 MnM view

- 13.1.10 STORA ENSO OYJ

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Product launches

- 13.1.10.3.2 Deals

- 13.1.10.3.3 Expansions

- 13.1.10.3.4 Other developments

- 13.1.10.4 MnM view

- 13.1.1 INTERNATIONAL PAPER

- 13.2 OTHER PLAYERS

- 13.2.1 CASCADES INC.

- 13.2.2 PACKAGING CORPORATION OF AMERICA

- 13.2.3 NINE DRAGONS PAPER (HOLDINGS) LIMITED

- 13.2.4 KLABIN S.A.

- 13.2.5 ULINE INC.

- 13.2.6 PACKSIZE INTERNATIONAL, INC.

- 13.2.7 LARSEN PACKAGING

- 13.2.8 TRIDENT PAPER BOX INDUSTRIES

- 13.2.9 GEORGIA-PACIFIC

- 13.2.10 SALAZAR PACKAGING

- 13.2.11 PREGIS LLC

- 13.2.12 STOROPACK HANS REICHENECKER GMBH

- 13.2.13 ATLANTIC PACKAGING

- 13.2.14 SPECIALIZED PACKAGING GROUP

- 13.2.15 HEXCELPACK LLC

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS