|

시장보고서

상품코드

1430696

일본의 상용차 윤활유 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2021-2026년)Japan Commercial Vehicles Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2021 - 2026) |

||||||

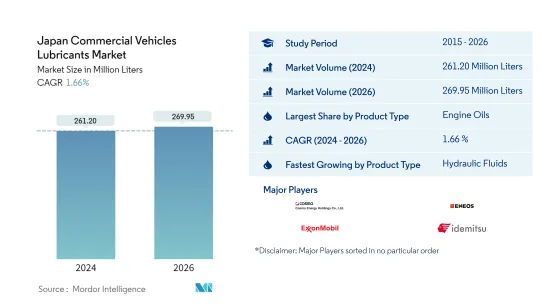

일본의 상용차 윤활유 시장 규모는 2024년 2억 6,120만 리터로 추정 및 예측되며, 2026년에는 2억 6,995만 리터에 달할 것으로 예상되며, 예측 기간(2024-2026년) 동안 1.66%의 연평균 복합 성장률(CAGR)을 나타낼 것으로 예측됩니다.

주요 하이라이트

- 제품 유형별 최대 부문 - 엔진오일: 엔진오일은 필요량이 많고 배출 간격이 짧아 고온, 고압 용도에 적합하며, 주요 제품 유형으로 꼽힙니다.

- 가장 빠른 제품 유형별 부문 - 유압유압유: 2021년 이후 일본의 상용차 판매 및 생산이 회복될 것으로 예상됨에 따라 예측 기간 동안 유압유압유에 대한 수요가 촉진될 것으로 예상됩니다.

일본 상용차 윤활유 시장 동향

제품 유형별 최대 부문: 엔진오일

- 일본에서는 상용차가 윤활유 소비량의 48.3%를 차지하며 2위를 차지하고 있으며, 2015년부터 2019년까지 상용차 부문의 윤활유 소비량은 노후 트럭의 높은 단계적 폐차 비율로 인해 상용차 운행 인구가 감소함에 따라 CAGR 2.64% 감소했습니다. 로 감소했습니다.

- 2020년, 코로나19 사태가 생산에 영향을 미치면서 상용차 윤활유 소비량은 12.28% 감소했습니다. 상용차 윤활유 소비량에서 엔진 오일이 61.79%의 점유율을 차지했고, 그리스(16.14%), 변속기 오일(11.99%)이 그 뒤를 이었습니다. 상용차의 변속기 오일 소비량은 13.54% 감소했습니다.

- 2021년부터 26년까지 유압유압유 부문은 연평균 2.24%의 연평균 복합 성장률(CAGR)을 나타내고, 가장 빠르게 성장하는 부문이 될 것으로 보입니다. 이러한 성장은 화물 운송 활동 증가와 시장에서 전기 트럭의 보급으로 인한 것으로 보입니다.

일본 상용차 윤활유 산업 개요

일본 상용차 윤활유 시장은 상위 5개 업체가 94.73%를 점유하는 등 상당히 통합되어 있습니다. 이 시장의 주요 기업은 Cosmo Energy Holdings, ENEOS Corporation, ExxonMobil Corporation, Idemitsu Kosan, Royal Dutch Shell Plc(알파벳순)입니다.

기타 혜택 :

기타 혜택- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 주요 요약과 주요 조사 결과

제2장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제3장 주요 산업 동향

- 자동차 업계 동향

- 규제 프레임워크

- 밸류체인과 유통 채널 분석

제4장 시장 세분화

- 제품 유형별

- 엔진오일

- 그리스

- 유압작동유

- 변속기&기어 오일

제5장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 개요

- AKT Japan Co. Ltd(TAKUMI Motor Oil)

- Chugoku Kogyo Co. Ltd

- Cosmo Energy Holdings Co. Ltd

- ENEOS Corporation

- ExxonMobil Corporation

- FUCHS

- Idemitsu Kosan Co. Ltd

- Japan Sun Oil Company Ltd(SUNOCO Inc.)

- MITASU OIL CORPORATION

- Royal Dutch Shell Plc

제6장 부록

- 부록 1 참고 문헌

- 부록 2 도표

제7장 CEO에 대한 주요 전략적 질문

LSH 24.02.29The Japan Commercial Vehicles Lubricants Market size is estimated at 261.20 Million Liters in 2024, and is expected to reach 269.95 Million Liters by 2026, growing at a CAGR of 1.66% during the forecast period (2024-2026).

Key Highlights

- Largest Segment by Product Type - Engine Oils : Engine oil is the leading product type due to its high volume requirements and shorter drain intervals, making it ideal for high-temperature and high-pressure applications.

- Fastest Segment by Product Type - Hydraulic Fluids : The expected recovery of commercial vehicle sales and production in Japan from 2021 is expected to drive the demand for hydraulic fluids during the forecast period.

Japan Commercial Vehicles Lubricants Market Trends

Largest Segment By Product Type : Engine Oils

- In Japan, commercial vehicles formed the second largest segment and accounted for 48.3% of lubricant consumption. During 2015-2019, lubricant consumption in the commercial vehicle segment declined at a CAGR of 2.64% due to the high rate of phasing out of older trucks, which led to a decline in the on-road population of commercial vehicles.

- In 2020, commercial vehicle lubricant consumption declined by 12.28% as the COVID-19 pandemic affected production. In terms of lubricant consumption by commercial vehicles, engine oil accounted for a 61.79% share, followed by greases (16.14%) and transmission oils (11.99%). A major dip of 13.54% was observed in the consumption of transmission oils by commercial vehicles during the year.

- During 2021-26, the hydraulic fluids segment is likely to be the fastest-growing segment, recording a CAGR of 2.24%. This growth is likely to be driven by the rise in freight transportation activities and the penetration of electric trucks in the market.

Japan Commercial Vehicles Lubricants Industry Overview

The Japan Commercial Vehicles Lubricants Market is fairly consolidated, with the top five companies occupying 94.73%. The major players in this market are Cosmo Energy Holdings Co. Ltd, ENEOS Corporation, ExxonMobil Corporation, Idemitsu Kosan Co. Ltd and Royal Dutch Shell Plc (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Executive Summary & Key Findings

2 Introduction

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 Key Industry Trends

- 3.1 Automotive Industry Trends

- 3.2 Regulatory Framework

- 3.3 Value Chain & Distribution Channel Analysis

4 Market Segmentation

- 4.1 By Product Type

- 4.1.1 Engine Oils

- 4.1.2 Greases

- 4.1.3 Hydraulic Fluids

- 4.1.4 Transmission & Gear Oils

5 Competitive Landscape

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Profiles

- 5.3.1 AKT Japan Co. Ltd (TAKUMI Motor Oil)

- 5.3.2 Chugoku Kogyo Co. Ltd

- 5.3.3 Cosmo Energy Holdings Co. Ltd

- 5.3.4 ENEOS Corporation

- 5.3.5 ExxonMobil Corporation

- 5.3.6 FUCHS

- 5.3.7 Idemitsu Kosan Co. Ltd

- 5.3.8 Japan Sun Oil Company Ltd (SUNOCO Inc.)

- 5.3.9 MITASU OIL CORPORATION

- 5.3.10 Royal Dutch Shell Plc

6 Appendix

- 6.1 Appendix-1 References

- 6.2 Appendix-2 List of Tables & Figures