|

시장보고서

상품코드

1435250

일본의 계약 물류 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Japan Contract Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

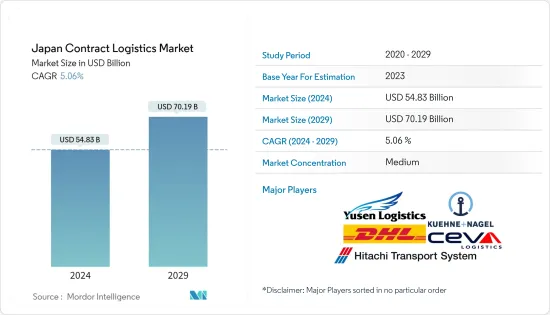

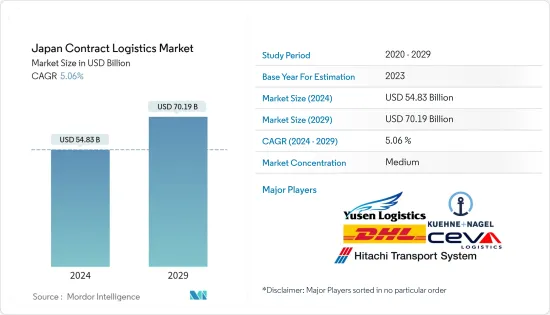

일본의 계약 물류 시장 규모는 2024년 548억 3,000만 달러로 추정되며, 2029년까지 701억 9,000만 달러에 달할 것으로 예상되며, 예측 기간(2024-2029년) 동안 5.06%의 CAGR로 성장할 것으로 예상됩니다.

이 분야의 주요 기업들은 E-Commerce 분야에 대한 소비자 행동의 변화로 인해 수익이 증가했다고 보고했습니다.

일본의 소규모 벤더들은 시장의 물류 수요를 촉진하는 일본 소비자들의 인터넷 사용 증가에 대응하여 온라인 시장으로 적극적으로 전환하고 있습니다.

일본의 계약 물류 시장 동향

E-Commerce의 성장

일본의 E-Commerce 소매업은 패션, 전자 및 미디어, 식품 및 퍼스널케어, 가구 및 가전제품, 장난감 등 다양한 분야의 제품을 판매하는 기업들로 분류됩니다. 시장 성장에 따라 대기업은 최신 기술 도입에 주력하는 반면, 소규모 소매업체들은 재고 관리, 포장, 배송 등의 서비스를 위해 아마존(Amazon Fulfillment Services), 라쿠텐(Rakuten Fulfillment Services)과 같은 대형 업체들과 적극적으로 협력하고 있습니다. )와 같은 대형 시장 기업과 적극적으로 협력하고 있습니다. 최근 일본 최대 쇼핑몰 개발 및 운영 업체인 이온은 영국의 자동 창고 업체인 오카도(Okado)와 자동 창고 개발 계약을 체결하고 2035년까지 매출이 1조원까지 증가할 것으로 예상하고 있습니다.

또한, 물류 서비스에서 블록체인 시설의 보급과 소매 및 외식업계에서 미국식 스테이크에 대한 관심이 높아지면서 쇠고기 생산량이 10% 감소하고 수요가 증가함에 따라 소매 E-Commerce에서 온도 제어 물류 시설에 대한 수요 증가를 촉진하고 있습니다.

노동력 감소로 물류 자동화가 진행 중

노동력 부족은 전 세계 물류기업이 직면한 공통의 과제이지만, 일본은 고령화와 인구 감소로 인해 가장 큰 영향을 받는 국가 중 하나입니다. 노동력 부족, E-Commerce의 확산, 흥미로운 기술 발전의 도입 등은 창고 시설에 자동화된 기계와 기술을 도입하도록 유도하는 추세의 일부입니다. 일본 패션 대기업 유니클로(UNIQLO)와 다이후쿠 물류 솔루션(Daifuku Logistics Solutions)은 재고 관리 및 배송에 대한 직원의 개입을 100%까지 줄일 수 있는 로봇 공학 및 자재 취급 시스템을 개발하기 위해 1,000억 파운드를 투자할 계획입니다. Mujin Inc. 및 Exotec Solutions와 파트너십을 맺었습니다. 아마존은 패밀리마트, 오다큐 전철 등과 공동으로 아마존에서 보낸 바코드를 갖다 대면 이용할 수 있는 '아마존 허브 로커' 서비스를 2020년까지 도쿄도와 가나가와현을 중심으로 총 200곳에 설치할 예정입니다. 리더기로 이메일을 전송하여 상품을 수령할 수 있습니다.

일본의 계약 물류 산업 개요

이 시장은 비교적 집중화되어 있으며, 주요 기업으로는 요우센 로지스틱스, Hitachi 물류, 퀴네앤드나겔이 있으며, 시장을 주도하는 소매기업과 제조기업의 사내 물류 부문도 포함되어 있습니다. 기술 발전과 노동 인구 감소에 따른 물류 시설의 집적화가 물류 서비스 수요를 뒷받침하며 시장 성장을 견인하고 있습니다. 미국 투자회사 블랙스톤 그룹은 2019년 7월 일본 E-Commerce 시장의 성장 여력을 보고 일본 물류센터 인수에 1,000억 파운드 이상을 투자할 것이라고 발표했습니다. 요우센 로지스틱스와 시나몬 AI는 항공 수출 물류 업무를 개선하기 위해 Flax Scanner와 같은 솔루션을 제공하기 위한 제휴를 발표했습니다. 일본 GLP(물류 부동산 및 그 기술 전문 회사)는 오픈 허브, 통합 체인, 공유 솔루션 기능을 갖춘 창조적 체인 물류 플랫폼 'GLP ALFALINK'로 사가미하라에 5곳의 첨단 물류 시설을 개발할 것이라고 발표했습니다.

ZigZag Global은 일본 시장의 선두주자인 Yamato Transport와 제휴하여 전 세계 소매업체가 일본 고객의 반품을 지원하는 최초의 반품 관리 솔루션을 출시했습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 서론

- 조사 성과

- 조사 가정

- 조사 범위

제2장 조사 방법

- 분석 방법

- 조사 단계

제3장 주요 요약

제4장 시장 역학과 인사이트

- 현재 시장 시나리오

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 업계의 매력 - Porter's Five Forces 분석

- 밸류체인/공급망 분석

- 업계 규제와 정책

- 기술 통합

제5장 시장 세분화

- 유형별

- 인소싱

- 아웃소싱

- 최종사용자별

- 자동차

- 소비재·소매

- 에너지

- 하이테크·헬스케어

- 산업·항공우주

- 테크놀러지

- 기타 최종사용자

제6장 경쟁 상황

- 시장 집중 개요

- 기업 개요

- DHL

- Ceva Logistics

- Daifuku Co. Ltd.

- Hitachi Transport System

- Honeywell International Inc.

- KION Group AG

- Kuehne+Nagel

- Nippon Logistics

- Yamato Holdings

- Yusen Logistics

제7장 투자 분석

- 최근의 M&A

제8장 일본의 계약 물류 시장 전망

제9장 면책사항

ksm 24.03.06The Japan Contract Logistics Market size is estimated at USD 54.83 billion in 2024, and is expected to reach USD 70.19 billion by 2029, growing at a CAGR of 5.06% during the forecast period (2024-2029).

The major companies in the sector report their revenue growth as an output of change in the consumer behaviour towards e-commerce sector.

The small Japanese vendors are actively moving to the online market in response to the growing use of the internet by the Japanese consumers driving the demand for logistics in the market.

Japan Contract Logistics Market Trends

Growth in E-Commerce

The e-commerce retail in Japan is segmented by the companies selling products of various domains like fashion, electronics & media, food & personal care, furniture & appliances and Toys. With the growing market, the big companies are focusing adapting the updated technologies while the small retail companies are actively collaborating with the big market players like Amazon (Amazon Fulfilment Services) and Rakuten (Rakuten Fulfilment Services) for services like inventory management, packaging and delivery. Among the recent developments, Aeon (Japan's largest shopping mall developer and operator) agreed upon a deal to develop automated warehouses with Ocado (the UK automated warehouse provider), expecting its sales to increase to ¥ 1 trillion by 2035.

Further, the penetration of the blockchain facilities in logistics services and a 10% decrease in production and rising demand of beef - backed by the growing interest in American-style steak in retail and foodservice is also driving the growth in the demand for the temperature-controlled logistics facilities in the retail e-commerce.

Decreasing Workforce Pushing the Automation in Logistics

The labour skill shortage is a common issue faced by logistics companies worldwide, but Japan is one of the most affected countries due to its ageing and declining population. The labour shortage, increasing e-commerce penetration and introduction of intriguing technical advancements are some of the trends thrusting the inculcation of automated machines and technologies with the warehousing facilities. The Japanese fashion giant Uniqlo along with Daifuku Logistics Solutions plans on investing ¥ 100 billion and has partnered with two robotic startups - Mujin Inc. and Exotec Solutions to develop robotics and material handling systems reducing workforce involvement in the inventory management and delivery to 100%. Amazon, along with FamilyMart Co., Odakyu Electric Railway Co. and other firms is planning to set up the "Amazon Hub Locker" service at a total of 200 locations mainly in Tokyo and Kanagawa Prefecture by 2020 where Amazon customers can swipe barcodes sent by e-mail over reading machines to receive their goods.

Japan Contract Logistics Industry Overview

The market is relatively concentrated with Yusen Logistics, Hitachi Transport System, and Kuehne Nagel as its major players along with the inhouse logistic segments of the retail and manufacturing companies leading the market. The technological advancements and consolidation of the logistics facilities response to the declining workforce are supporting the demand for the logistics services and driving the growth in the market. The U.S. investment firm Blackstone Group in July 2019, announced to spend over ¥ 100 billion to buy distribution centres in Japan, seeing room for growth in the country's e-commerce market. Yusen Logistics and Cinnamon AI have announced a collaboration to provide solutions like Flax Scanner for improving the logistics operations for aviation exports. Japan GLP (a company specializing in logistics real estate and its technology) has announced the development of 5 advanced logistics facilities as GLP ALFALINK at Sagamihara, a creative chain logistics platform, which will include the functions of an Open Hub, Integrated Chain and Shared Solution for the tenant companies.

ZigZag Global partnered with Japanese market leader Yamato Transport to facilitate the first Returns Management Solution to support retailers from all over the world with their Japanese customer returns.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.2 Restraints

- 4.2.3 Opportunities

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Industry Policies and Regulations

- 4.6 Technological Integration

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Insourced

- 5.1.2 Outsourced

- 5.2 By End-User

- 5.2.1 Automotive

- 5.2.2 Consumer & Retail

- 5.2.3 Energy

- 5.2.4 Hi-Tech and Healthcare

- 5.2.5 Industrial & Aerospace

- 5.2.6 Technology

- 5.2.7 Other End Users

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 DHL

- 6.2.2 Ceva Logistics

- 6.2.3 Daifuku Co. Ltd.

- 6.2.4 Hitachi Transport System

- 6.2.5 Honeywell International Inc.

- 6.2.6 KION Group AG

- 6.2.7 Kuehne + Nagel

- 6.2.8 Nippon Logistics

- 6.2.9 Yamato Holdings

- 6.2.10 Yusen Logistics

7 INVESTMENT ANALYSIS

- 7.1 Recent Mergers and Acquisitions