|

시장보고서

상품코드

1435541

철근 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Steel Rebar - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

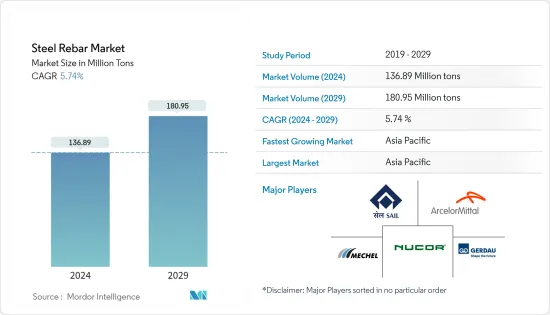

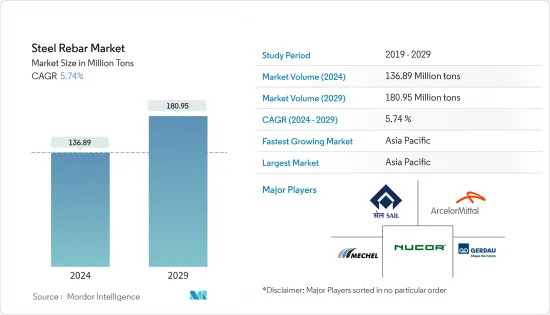

철근 시장 규모는 2024년 1억 3,689만 톤으로 추정되며, 2029년까지 1억 8,095만 톤에 달할 것으로 예상되며, 예측 기간(2024-2029년) 동안 5.74%의 CAGR로 성장할 것으로 예상됩니다.

신종 코로나바이러스 감염증(COVID-19)의 발생으로 전 세계적으로 국가 봉쇄 조치가 시행되면서 제조 활동과 공급망 중단, 생산 중단, 노동력 부족 등이 철근 시장에 악영향을 미치고 있습니다. 그러나 2021년에는 업계가 회복세를 보이며 조사 대상 시장의 수요가 회복되었습니다.

주요 하이라이트

- 단기적으로는 인프라 개발 프로젝트 및 건설 활동에 대한 투자 증가가 조사 대상 시장의 성장을 촉진하는 요인 중 일부입니다.

- 반대로 철근의 저렴한 대체품의 가용성은 조사 대상 시장의 성장을 저해할 수 있습니다.

- 그러나 신흥국의 인프라 활동 증가로 인해 예측 기간 동안 많은 기회가 제공될 것으로 예상됩니다.

- 아시아태평양은 지역 내 여러 국가의 인프라 확장을 위한 신규 프로젝트 건설에 대한 투자 증가로 시장을 장악했습니다.

철근 시장 동향

비주거부문의 수요 확대

- 도시화가 진행됨에 따라 철근은 석유 및 가스 산업, 인프라, 상업 건설, 기업 건물 등 비주거 분야에서 광범위하게 활용되고 있습니다.

- 미국은 2023년 1월 기준 990만 명 이상의 직원을 고용하고 있는 거대한 건설 부문을 자랑합니다. 미국의 건설 부문은 상업 및 비주거용 건설에서 중요한 역할을 하고 있으며, 국가 경제에 큰 기여를 하고 있습니다. 미국의 비주거용 건설 활동이 증가함에 따라 국내 철근 소비량이 증가할 것으로 예상됩니다.

- 미국 인구조사국에 따르면 2022년 12월 미국의 신규 건설 생산액은 1조 7,929억 달러에 달했습니다. 비주거 부문은 2023년 3월 9,971억 4,000만 달러를 차지해 전 세계 대비 18.8%의 성장을 기록했습니다. 전년 동기.

- 또한 미국 인구 조사국에 따르면 2022년 6월 민간 및 공공 건설 비주거 지출은 4,926억 8 천만 달러로 2021년 6월 4,842억 6 천만 달러에 비해 1.74 % 증가했습니다. 따라서 국내 민간 및 공공 비주택 건설에 대한 지출 증가는 철근 시장에 대한 수요를 증가시킬 것으로 예상됩니다.

- 이와는 별도로 미국 레드불 노스아메리카의 노스캐롤라이나주 콩코드에 있는 200만 평방피트 규모의 7억 4,000만 달러 상당의 가공 및 유통 시설에서 다양한 건설 상업 프로젝트가 계획되어 있습니다. 낙농 협동조합 Dairgold 워싱턴 주 파스코 항구에 5억 달러 상당의 400,000평방피트 규모의 가공시설(2023년 완공 예정). Biotics Research Corporation 텍사스 주 로젠버그에 9억 달러 규모의 88,000평방피트 규모의 창고, 실험실 및 사무실 시설 건설(2023년 완공 예정).

- 또한, 사우디는 많은 상업 프로젝트를 진행하고 있으며, 이로 인해 사우디에 더 많은 상업용 건물이 건설될 가능성이 높다: 5,000억 달러 규모의 미래형 거대 도시 '네오엠(Neom)' 프로젝트, 홍해 프로젝트 - 1단계는 2025년까지 완공될 예정이며, 5개의 개의 섬과 2개의 내륙 리조트, 쿠디야 엔터테인먼트 시티, 초호화 웰니스 관광지 아마라, 그리고 알 울라에 위치한 장 누벨의 샤란 리조트에 걸쳐 14개의 3,000실 규모의 고급 호텔과 초호화 호텔이 들어선다.

- 인도는 계속해서 G20 국가 중 가장 빠르게 성장할 것으로 예상됩니다. 인도 정부는 27개 산업 클러스터 개발에 1,205억 달러, 도로, 철도, 항만 연결 프로젝트에 753억 달러 등 3년간(2023-2025년) 3,765억 달러의 인프라 투자 목표를 발표했습니다.

- 위의 모든 요인은 예측 기간 동안 철근에 대한 수요를 촉진할 것으로 예상됩니다.

아시아태평양이 시장을 독점

- 아시아태평양이 세계 시장 점유율을 독점할 것으로 예상됩니다. 인도, 중국, 필리핀, 베트남, 인도네시아 등의 국가에서 주택 및 상업용 건설에 대한 투자가 증가함에 따라 철근 시장은 향후 몇 년 동안 성장할 것으로 예상됩니다.

- 중국의 대규모 건설 부문은 철근 사용에 대한 큰 수요를 창출하고 있습니다. 또한 중국은 지난 몇 년 동안 세계 인프라에 대한 주요 투자 국가 중 하나이며 큰 기여를 하고 있습니다. 예를 들어, 중국 국가통계국(NBS)에 따르면 2022년 중국의 건설 공사 생산액은 27조 6,300억 위안(4조 1,085억 8,100만 달러)에 달해 2021년 대비 6.6% 증가할 것으로 예상했습니다.

- 또한 인도의 주택 부문은 증가 추세에 있으며 정부의 지원과 노력으로 수요가 더욱 증가하고 있습니다. 인도 브랜드 주식 재단(IBEF)에 따르면, 주택 도시 개발부(MoHUA)는 주택 건설과 중단된 프로젝트를 완료하기 위해 기금을 조성하기 위해 2022-2023년 예산에 98억 5 천만 달러를 할당했습니다.

- 또한 인도네시아는 보르네오섬의 새로운 수도 이전과 함께 수천 명의 공무원을 위한 27억 달러 상당의 아파트 건설을 2분기에 시작할 것으로 예상하고 있습니다. 또한 인도네시아 정부는 외국인 투자를 통해 80%를 충당할 예정입니다. 따라서 이로 인해 국내 주택 건설로 인한 철근 소비에 대한 수요 증가가 예상됩니다.

- 인도네시아는 북부 깔리만딴(칼르타라) 주 카얀 강에 10억 달러 규모의 900MW 규모의 수력발전 프로젝트를 개발할 계획입니다. 이 프로젝트는 현재 EPC 단계에 있으며 착공일은 2022년으로 계획되어 있습니다. 이 프로젝트는 2025년 완공 후 가동될 예정입니다.

- 2025년 오사카에서 열리는 엑스포 개최로 일본 건설 업계는 호황을 누릴 것으로 예상됩니다. 또한 ESR 케이맨, OS 코스모스퀘어 데이터센터, 오사카 프로젝트는 20억 달러 규모의 일본 최대 건축 프로젝트로 2022년 4분기 착공에 들어갔으며, ESR 케이맨, OS 코스모스퀘어 데이터센터, 오사카 프로젝트는 2021년 2분기에 발표되었습니다. 에 발표되었습니다. 두 번째로 큰 프로젝트인 아이치현 시타라댐 개발은 프로젝트 가치가 5억 7,000만 달러로 2022년 4분기에 개발이 시작되었으며, 2026년 1분기에 완공될 예정입니다. 일본 국토교통성, 아이치현 시타라 댐 개발 프로젝트는 2022년 3분기에 발표되었으며, 완공 예정일은 2034년 4분기로 예정되어 있습니다.

- 따라서 다양한 국가의 수요 증가는 예측 기간 동안이 지역에서 연구되는 시장을 주도 할 것으로 예상됩니다.

철근 산업 개요

철근 시장은 본질적으로 부분적으로 세분화되어 있습니다. 이 시장의 주요 기업으로는 ArcelorMittal, Gerdau S/A, Nucor Corporation, Mechel, SAIL 등이 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 서론

- 조사 가정

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 아시아태평양의 건설 산업 급성장

- 상업 건축 증가

- 기타 촉진요인

- 성장 억제요인

- 철근 대체품의 입수 가능성

- 기타 저해요인

- 산업 밸류체인 분석

- Porter's Five Forces 분석

- 공급 기업의 교섭력

- 구매자의 교섭력

- 신규 참여업체의 위협

- 대체품의 위협

- 경쟁 정도

제5장 시장 세분화(시장 규모(수량 기준))

- 유형

- 변형

- 마일드

- 최종 이용 산업

- 주택

- 비주택

- 상업

- 인프라

- 시설

- 지역

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카공화국

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 상황

- M&A, 합작투자, 제휴, 협정

- 시장 점유율(%)**/순위 분석

- 주요 기업의 전략

- 기업 개요

- ArcelorMittal

- Celsa Steel(UK) Ltd

- Contractors Materials Company(CMC)

- Daido Steel Co., Ltd.

- Essar

- Gerdau S/A

- HYUNDAI STEEL

- JFE Steel Corporation

- Jiangsu Shagang Group

- KOBE STEEL, LTD.

- Mechel

- NIPPON STEEL CORPORATION

- Nucor Corporation

- SAIL

- Sohar Steel Group

- Tata Steel

제7장 시장 기회와 향후 동향

- 신흥 국가의 인프라 활동 활발화에 의한 수요 증가

- 기타 기회

The Steel Rebar Market size is estimated at 136.89 Million tons in 2024, and is expected to reach 180.95 Million tons by 2029, growing at a CAGR of 5.74% during the forecast period (2024-2029).

Due to the COVID-19 outbreak, nationwide lockdowns around the globe, disruption in manufacturing activities and supply chains, production halts, and labor unavailability have negatively impacted the steel rebar market. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- Over the short term, rising investments in infrastructure development projects and construction activities are some of the factors driving the growth of the market studied.

- On the flip side, the availability of cheap substitutes for steel rebar is likely to hinder the growth of the market studied.

- However, rising infrastructural activities in developing countries are anticipated to provide numerous opportunities over the forecast period.

- Asia-Pacific region dominated the market, owing to the increasing investments in constructing new projects for infrastructural expansion across various countries in the region.

Steel Rebar Market Trends

Growing Demand from the Non-Residential Sector

- With increasing urbanization, steel rebars are experiencing extensive utilization from the non-residential segment, like the oil and gas industry, infrastructure, commercial construction, corporate buildings, etc.

- The United States boasts a colossal construction sector that employs over 9.9 million employees as of January 2023. Playing a prominent role in commercial and non-residential construction, the United States construction sector exhibits a significant contribution to the country's economy. Due to increasing non-residential construction activities in the United States the consumption of steel rebar in the country is expected to increase.

- According to the United States Census Bureau, the value of new construction output in the United States amounted to USD 1,792.9 billion in December 2022. The non-residential sector accounted for USD 997.14 billion in March 2023, registering a growth of 18.8% compared to the same period the previous year.

- Moreover, according to the United States Census Bureau, the private and public construction nonresidential spending in June 2022 was 492.68 billion, which showed an increase of 1.74% compared to June 2021, which amounted to USD 484.26 billion. Therefore, increasing in the spending on private and public non-residential constructions in the country is expected to create an upside demand for steel rebar market.

- Apart from that, there are various construction commercial projects scheduled in the United States Red Bull North America's USD 740 million worth 2 million-square-foot processing and distribution facility in Concord, North Carolina; Dairy cooperative DairgoldUSD 500 million worth 400,000-square-foot processing facility in Port of Pasco, Washington (completion scheduled for 2023); Biotics Research Corporation USD 9 million worth 88,000-square-foot warehouse, laboratory, and office facility in Rosenberg, Texas (completion scheduled for 2023).

- Furthermore, Saudi Arabia is working on a lot of commercial projects, which will likely lead to more commercial buildinings in the country.The USD 500 billion futuristic mega-city "Neom" project, the Red Sea Project - Phase 1, which is expected to be completed by 2025 and has 14 luxury and hyper-luxury hotels with 3,000 rooms spread across five islands and two inland resorts, Qiddiya Entertainment City, Amaala - the uber-luxury wellness tourism destination, and Jean Nouvel's Sharaan resort in Al-Ula.

- India is anticipated to remain the fastest-growing G20 economy. The Indian government announced a target of USD 376.5 billion in infrastructure investment over three years (2023-2025), including USD 120.5 billion for developing 27 industrial clusters and USD 75.3 billion for road, railway, and port connectivity projects.

- All the above-mentioned factors are expected to propel the demand for steel rebar during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is anticipated to dominate the global market share. With growing investments in residential and commercial construction in the countries, such as India, China, the Philippines, Vietnam, and Indonesia, the market for steel rebars is expected to grow in the coming years.

- China's massive construction sector has generated significant demand for the use of steel rebars. Moreover, China is a huge contributor, as it has been one of the leading investors in infrastructure worldwide over the past few years. For instance, according to the National Bureau of Statistics (NBS) of China, in 2022, the output value of construction works in China amounted to 27.63 trillion yuan (USD 4108.581 billion), an increase of 6.6% compared with 2021.

- Moreover, the residential sector in India is on an increasing trend, with government support and initiatives further boosting the demand. According to the India Brand Equity Foundation (IBEF), the Ministry of Housing and Urban Development (MoHUA) allocated USD 9.85 billion in the 2022-2023 budget to construct houses and create funds to complete the halted projects.

- Furthermore, Indonesia expects to begin construction in the second quarter on apartments worth USD 2.7 billion for thousands of civil servants due to move to its new capital city on Borneo island. Moreover, tndonesian government intends to finance it for 80% through foreign investments. Therefore, this is expected to create an upside demand for the consumption of steel rebars from the contry's residential construction.

- Indonesia plans to develop a USD 1 billion worth 900 MW hydropower project in Kayan River in the North Kalimantan (Kaltara) province. The project stands at the EPC stage, with a startup date planned for 2022. The project is expected to be commissioned after the completion of the construction in 2025.

- The Japanese construction industry is expected to be booming as the country will host the World Expo in 2025 in Osaka, Japan. Furthermore, the ESR Cayman, OS Cosmosquare Data Centre, Osaka project, valued at USD 2,000 million, was Japan's largest building project, on which construction started in Q4 2022. The ESR Cayman, OS Cosmosquare Data Centre, Osaka project was announced in Q2 2021 in Osaka (City), Japan, with a completion date of Q1 2026. The second-largest project, the MLIT Japan, Shitara Dam Development, Aichi, with a project value of USD 570 million, began development in Q4 2022. The MLIT Japan, Shitara Dam Development, Aichi project is located in Japan and was announced in Q3 2022, with a completion date of Q4 2034.

- Thus, rising demand from various countries is expected to drive the market studied in the region during the forecast period.

Steel Rebar Industry Overview

The Steel Rebar market is partially fragmented in nature. The major players in this market (not in a particular order) include ArcelorMittal, Gerdau S/A, Nucor Corporation, Mechel, and SAIL, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rapidly Growing Construction Industry in Asia-Pacific Region

- 4.1.2 Increasing Commercial Construction

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Availability of Substitutes for Steel Rebar

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Deformed

- 5.1.2 Mild

- 5.2 End-user Industry

- 5.2.1 Residential

- 5.2.2 Non-Residential

- 5.2.2.1 Commercial

- 5.2.2.2 Infrastructure

- 5.2.2.3 Institutional

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ArcelorMittal

- 6.4.2 Celsa Steel (UK) Ltd

- 6.4.3 Contractors Materials Company (CMC)

- 6.4.4 Daido Steel Co., Ltd.

- 6.4.5 Essar

- 6.4.6 Gerdau S/A

- 6.4.7 HYUNDAI STEEL

- 6.4.8 JFE Steel Corporation

- 6.4.9 Jiangsu Shagang Group

- 6.4.10 KOBE STEEL, LTD.

- 6.4.11 Mechel

- 6.4.12 NIPPON STEEL CORPORATION

- 6.4.13 Nucor Corporation

- 6.4.14 SAIL

- 6.4.15 Sohar Steel Group

- 6.4.16 Tata Steel

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand Due to Rising Infrastructural Activities in Developing Countries

- 7.2 Other Opportunities