|

시장보고서

상품코드

1437608

일본 항공우주 및 방위 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Japan Aerospace And Defense - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

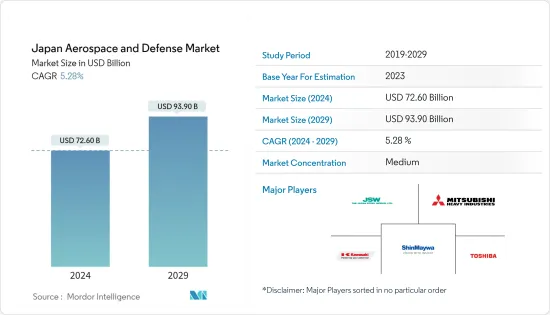

일본 항공우주 및 방위 시장 규모는 2024년에 726억 달러로 추정되며, 2029년에는 939억 달러에 이르고, 예측 기간 중(2024-2029년) CAGR 5.28%로 성장할 것으로 예측됩니다.

일본의 항공우주분야는 세계 최대 규모의 하나이며, 특히 연구개발(R&D) 분야에서 국제적으로 높은 평가를 얻고 있습니다. 일본기업은 헬리콥터나 경공격기 등 군민양용 항공우주방위기술의 연구개발에 큰 가능성을 갖고 있습니다. 2022년에는 일본 항공사의 국제선 승객 수는 약 680만명으로 전년 140만명에서 증가했습니다.

방위비 증가, 차세대 무기의 조달 증가, 군용 통신에 있어서의 선진 기술의 도입이 일본 전체 시장 성장을 가속하고 있습니다. 스톡홀름 국제평화조사(SIPRI)가 2022년에 발표한 보고서에 따르면 일본의 방위비는 460억 달러로 세계에서 10번째로 큰 국방지출국이 되었습니다. 이 나라는 2023 회계 연도에 514억 달러의 국방 지출을 승인했습니다.

일부 국제적인 과제와 불안정 요인이 심각해지고 있으며, 일본의 안보 환경은 점점 더 스트레스를 받고 있습니다. 이 때문에 안보 환경의 변화의 증대에 적응하기 위해, 일본은 방위력의 강화를 급속도로 진행하고 있습니다. 방위예산안은 9년 연속으로 일본의 국방예산의 신기록을 수립했습니다. 2023년도에 대해 일본 정부는 전년도 대비 26.3% 증가한 6조 8,200억엔(514억 달러)을 승인했습니다. 국방예산 증가와 진행중인 군사근대화가 시장성장의 주요 촉진요인이 될 것으로 예상됩니다.

일본 항공우주 및 방위시장 동향

2023년에는 제조 부문이 큰 점유율을 차지

제조 서비스 유형 부문이 돌출하고 있으며 최대 점유율을 차지합니다. Mitsubishi Heavy Industries, Ltd.와 Kawasaki Heavy Industries, Ltd. 등의 유명 기업이 이 분야의 형성에 있어서 중요한 역할을 하고 있습니다. 이러한 업계 선두는 정밀 공학과 최첨단 기술의 전문 지식을 활용하여 전투기와 헬리콥터에서 고급 미사일 시스템에 이르기까지 다양한 항공우주 및 방위 제품을 생산하고 있습니다. 제조 서비스형의 중요성은 이러한 기업과 일본 정부와의 복잡한 연계에 의해 강조되어 국가 안보를 위한 전략적 파트너십을 촉진합니다. 또한 Subaru Corporation와 같은 신흥 기업은 항공우주 부품을 포함하여 포트폴리오를 다양화함으로써 이 분야의 성장에 기여하고 있습니다. 혁신, 품질, 신뢰성을 중시함으로써 일본의 제조 서비스 부문은 기술력과 전략적 선견성의 시너지 효과를 반영하여 일본의 항공우주 및 방위 능력의 요점으로 자리매김하고 있습니다. 또한 일본 정부의 국산 제품 수주 증가도 제조업 성장에 기여하고 있습니다. 예를 들어 Mitsubishi Heavy Industries은 2023년 11월 방위관련 매출액이 2026년까지 두배로 1조엔(67억 달러)에 달하고, 지정학적 긴장이 사업을 밀어올리는 가운데 계속 견조 로 추이할 것으로 예측했습니다. 일본 정부의 최신 5년 전략은 일본의 방위력 강화를 위해 2027년까지 방위비를 전기 대비 56% 증액할 것을 시사하고 있습니다. 기업의 주요 초점은 1,000킬로미터 이상의 거리를 달성할 수 있는 장거리 미사일을 국내에서 생산하는 능력을 개발하는 것입니다. 정부는 또한 현지 기술 혁신과 제조를 장려하기 위해 제조업체에 최대 10%의 이익률을 제공하며 고인플레이션을 지원하기 위해 최대 5%의 비용 증가를 상쇄할 준비가 되어 있습니다. 이러한 분야에서의 발전은 일본의 새로운 다차원 통합 방위력의 일부가 될 것으로 기대되고 있습니다. 따라서 이러한 진행 중인 개발은 예측 기간 동안 일본의 방위 시장을 견인할 것으로 예상됩니다.

항공우주산업은 예측기간 동안 상당한 성장을 이

항공우주분야는 예측기간 동안 눈부신 성장을 보여줍니다. 일본은 수입 항공기, 항공기 부품, 엔진에 유리한 시장을 계속 제공합니다. 현재 일본은 B777, B777X, B787을 포함한 여러 항공기 제품군의 개발에 중심적인 역할을 하고 있습니다. 2023년 3월 일본 대표 항공회사 Japan Airlines(JAL)은 보잉 B737 MAX형기 21기의 발주를 발표했습니다. 이 회사는 2026년부터 선진적이고 연료 효율적인 항공기를 자사 장비에 도입하는 것을 목표로 하고 있습니다. 계약액은 약 25억 달러였습니다. 하네다 국제공항(HND), 나리타 국제공항(NRT), 간사이 국제공항(KIX), 후쿠오카 국제공항(FUK)은 일본의 4개 주요 공항으로, 연간 2억명 이상의 승객이 이용하고 있습니다.

또한 일본 기업은 V2500, Trent1000, GEnx, GE9X, PW1100G-JM 등 항공기 엔진 개발 및 MRO를 위한 엔지니어링 서비스 제공에도 적극적으로 노력하고 있습니다. 마찬가지로 2022년 1월 미국 국방부(국방부)는 항공 자위대(JASDF)의 F-15 이글 슈퍼 인터셉터 부대를 위한 새로운 시스템 개발과 관련하여 보잉과 4억 7,100만 달러 상당의 계약 를 체결했다고 발표했습니다. 일본 기업은 해바라기 8호, 9호 등 기상위성을 비롯해 각종 공학시험위성, 해양·지상관측위성, 통신, 방송, 전지구 측위위성 등의 개발에도 공헌해 왔습니다. 2021년 일본 정부는 우주 활동에 41억 4,000만 달러를 지출했습니다. 일본의 우주 기업은 MV, H-IIA/B, 입실론 로켓 등 발사 로켓을 개발했습니다. 일본의 위성 제조업체도 높은 기술력, 고품질, 경쟁력있는 비용을 무기로 해외 시장 개척에 임하고 있습니다. 따라서 연구개발에 대한 지출 증가와 항공 인프라의 강화에 대한 지출 증가는 전국 시장 성장을 가속하고 있습니다.

일본 항공우주 및 방위 산업 개요

일본의 항공우주 및 방위시장은 반통합되어 있으며 Mitsubishi Heavy Industries, Ltd., Toshiba Corporation, Kawasaki Heavy Industries, Ltd., ShinMaywa Industries, Ltd., and Japan Steel Works, Ltd. 등 일부 주요 기업이 보다 높은 시장 점유율을 얻기 위해 제품 및 서비스 수준에서 경쟁하고 있습니다. 일본은 무기 수출에 관한 새로운 원칙과 가이드라인을 채용하고 있으며, 국제협력과 안보상의 이익에 공헌하는 목적에 해당하는 경우에 한해 한 나라로의 무기 수출을 허가하고 있습니다. 2022년 국방백서에 따르면 전투기 제조에는 약 1,100개사, 구축함 건조에는 약 8,300사, 전차 제조에는 약 1,300사가 종사하고 있습니다. 따라서 현지 항공우주 및 방위 제조업체에 대한 지원 확대와 연구 개발 투자 증가로 예측 기간 동안 시장 성장이 촉진됩니다. 예를 들어 일본의 방위성(MoD)은 탄약 관련 지출로 2022년 대비 330% 증가한 62억 3,000만 달러를 확보했습니다. 이 안에는 미국제 장거리 순항 미사일 '토마호크' 500발의 조달에 15억 9,000만 달러가 포함되어 있습니다. 일본의 방위성은 반격 능력의 개발을 목표로, 2026-27년도에 토마호크를 배치할 예정입니다. 도쿄도는 해상 자위대의 이지스함에 탑재하기 위한 선진형 토마호크 블록 V를 취득합니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 시장 성장 억제요인

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체 제품의 위협

- 경쟁 기업간 경쟁 관계의 격렬

제5장 시장 세분화

- 분야

- 항공우주

- 방어

- 서비스 유형

- 제조

- MRO

- 플랫폼

- 육상

- 항공

- 해상

제6장 경쟁 구도

- 기업 프로파일

- BAE Systems plc

- Kawasaki Heavy Industries, Ltd.

- Komatsu Ltd.

- Lockheed Martin Corporation

- Mitsubishi Heavy Industries, Ltd.

- Northrop Grumman Corporation

- RTX Corporation

- ShinMaywa Industries Ltd.

- THALES

- The Boeing Company

- Japan Steel Works, Ltd.

- Toshiba Corporation

- Toray Industries, Inc.

제7장 시장 기회와 미래 동향

JHS 24.03.15The Japan Aerospace And Defense Market size is estimated at USD 72.60 billion in 2024, and is expected to reach USD 93.90 billion by 2029, growing at a CAGR of 5.28% during the forecast period (2024-2029).

The Japanese aerospace sector is one of the largest in the world, with a strong international reputation, particularly in the field of research and development (R&D). Japanese companies have great potential in the research and development of dual-use aerospace defense technology, such as helicopters and light attack aircraft. In 2022, around 6.8 million passengers were carried on international flights via Japanese airlines, up from 1.4 million passengers in the previous year.

An increase in defense expenditure, rising procurement of next-generation weapons, and adoption of advanced technologies in military communication drive the growth of the market across Japan. According to the report published by Stockholm International Peace Research Institute (SIPRI) in 2022, Japan was the tenth largest defense spender in the world, with a defense budget of USD 46 billion. The country approved USD 51.4 billion in defense spending in FY2023.

The security environment in Japan has become increasingly stressed, with several international challenges and destabilizing factors becoming more acute. Hence, to adapt to the growing changes in the security environment, Japan has been strengthening its defense capabilities at a rapid pace. For the ninth consecutive year, the defense budget draft set a new record for Japan's national defense budget. For FY2023, the Japanese government approved 6.82 trillion yen (USD 51.4 billion), which showed an increase of 26.3% from the previous year. The growth in the defense budget and the ongoing military modernization are expected to be the major drivers for the growth of the market.

Japan Aerospace And Defense Market Trends

The Manufacturing Segment Accounted for a Major Share in 2023

The manufacturing service type segment stands out as the dominant force, holding the largest market share. Renowned companies such as Mitsubishi Heavy Industries, Ltd. and Kawasaki Heavy Industries, Ltd. play pivotal roles in shaping this sector. These industry giants leverage their expertise in precision engineering and cutting-edge technology to manufacture a wide array of aerospace and defense products, ranging from fighter jets and helicopters to sophisticated missile systems. The significance of the manufacturing service type is underscored by the intricate collaboration between these companies and the Japanese government, fostering a strategic partnership for national security. Additionally, emerging players like Subaru Corporation contribute to the sector's growth by diversifying their portfolios to include aerospace components. The emphasis on innovation, quality, and reliability positions Japan's manufacturing service type segment as a linchpin in the nation's aerospace and defense capabilities, reflecting a synergy between technological prowess and strategic foresight. Moreover, increasing orders from Japan government for indigenous manufactured products is also contributing to the growth of manufacturing sector. For instance, in November 2023, Mitsubishi Heavy Industries forecast its defense sales to double to 1 trillion yen (USD 6.7 billion) by 2026 and stay strong as geopolitical tensions boost business for MHI. The Japanese government's latest five-year strategy suggests a 56% increase in defense spending, through 2027, from the previous term as it strives to build up the Japan's defense capabilities. Major key focus of MHI is to develop a domestic capability to produce long-range missiles that can achieve distances of over 1,000 kilometers. The government is also offering manufacturers profit margins of up to 10% to encourage indigenous innovation and manufacturing and is prepared to offset up to 5% in cost increases to help with high inflation rates. Developments in such domains are expected to be a part of Japan's new multidimensional integrated defense force. Thus, such ongoing developments are expected to drive the Japanese defense market during the forecast period.

Aerospace Sector to Witness Significant Growth During the Forecast Period

The aerospace sector is poised to showcase remarkable growth during the forecast period. Japan continues to offer a lucrative market for imported aircraft, aircraft parts, and engines. Currently, Japan is playing a pivotal role in the development of several aircraft families, including the B777, B777X, and B787. In March 2023, Japan Airlines (JAL), Japan's national flag carrier, announced an order of 21 Boeing B737 MAX aircraft. The airline aims to bring advanced and fuel-efficient aircraft into its fleet starting in 2026. The value of the contract was approximately USD 2.5 billion. Haneda International Airport (HND), Narita International Airport (NRT), Kansai International Airport (KIX), and Fukoma International Airport (FUK) are the four major airports in Japan that together handle over 200 million passengers annually.

Furthermore, Japanese companies are also actively engaged in providing engineering services towards the development and MRO of aircraft engines, such as the V2500, Trent1000, GEnx, GE9X, PW1100G-JM, etc. Similarly, in January 2022, the US Department of Defense (DoD) announced a contract worth USD 471 million to the Boeing Company for the development of new systems for Japan Air Self-Defense Force's (JASDF) F-15 Eagle Super Interceptors fleet. The Japanese firms have also contributed to the development of various engineering test satellites, marine and terrestrial observation satellites, communications, broadcasting, global navigation satellites, etc., including weather satellites such as the HIMAWARI 8 and 9. In 2021, the Japanese government spent USD 4.14 billion on space activities. The Japanese space firms developed Launch vehicles such as the M-V, H-IIA/B, and Epsilon rockets. The Japanese satellite manufacturers are also using their advanced technical capabilities, high quality, and competitive costs to open the overseas market. Thus, growing expenditure on research and development and rising spending on enhancing aviation infrastructure drive market growth across the country.

Japan Aerospace And Defense Industry Overview

The Japan aerospace and defense market is semi-consolidated and several key players such as Mitsubishi Heavy Industries, Ltd., Toshiba Corporation, Kawasaki Heavy Industries, Ltd., ShinMaywa Industries, Ltd., and Japan Steel Works, Ltd. compete on product and services level to gain higher market share. Japan has adopted new principles and guidelines on arms exports and would permit arms exports to a country only if they serve the purpose of contributing to international cooperation and its security interests. According to the 2022 defense white paper, nearly 1,100 companies are involved in the manufacture of fighter aircraft, about 8,300 in building destroyers, and around 1,300 in the production of tanks. Thus, growing support for local aerospace and defense manufacturers and rising investment in research and development boost the market growth during the forecast period. For instance, The Japanese Ministry of Defense (MoD) secured USD 6.23 billion for ammunition-related spending, which is 330% higher than in 2022. It included USD 1.59 billion for the procurement of 500 US-made long-range Tomahawk cruise missiles. The Japanese MoD will deploy the Tomahawks in fiscal year 2026-27 as it aims to develop counterstrike capabilities. Tokyo will acquire the advanced model Tomahawk Block V to be equipped with Japan Maritime Self-Defense Force (JMSDF) Aegis-equipped destroyers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Sector

- 5.1.1 Aerospace

- 5.1.2 Defense

- 5.2 Service Type

- 5.2.1 Manufacturing

- 5.2.2 MRO

- 5.3 Platform

- 5.3.1 Terrestrial

- 5.3.2 Aerial

- 5.3.3 Naval

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 BAE Systems plc

- 6.1.2 Kawasaki Heavy Industries, Ltd.

- 6.1.3 Komatsu Ltd.

- 6.1.4 Lockheed Martin Corporation

- 6.1.5 Mitsubishi Heavy Industries, Ltd.

- 6.1.6 Northrop Grumman Corporation

- 6.1.7 RTX Corporation

- 6.1.8 ShinMaywa Industries Ltd.

- 6.1.9 THALES

- 6.1.10 The Boeing Company

- 6.1.11 Japan Steel Works, Ltd.

- 6.1.12 Toshiba Corporation

- 6.1.13 Toray Industries, Inc.