|

시장보고서

상품코드

1911331

공유 오피스 공간 시장 : 점유율 분석, 업계 동향 및 통계, 성장 예측(2026-2031년)Shared Office Spaces - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

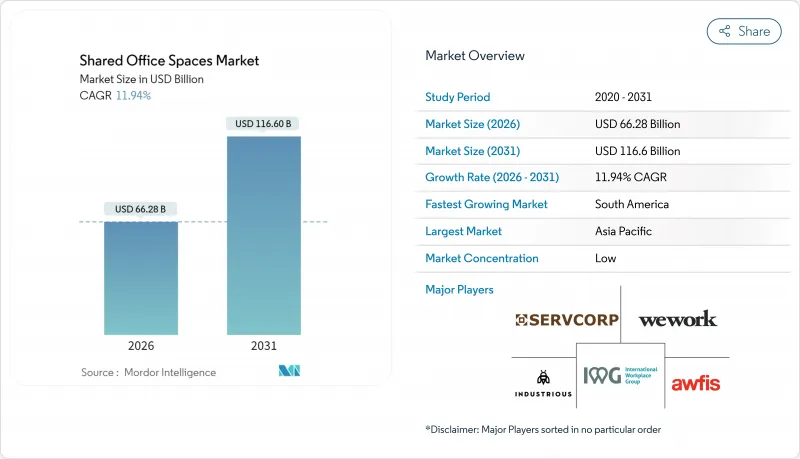

공유 오피스 공간 시장은 2025년 592억 달러에서 2026년에는 662억 8,000만 달러로 성장하고 2026-2031년에 걸쳐 CAGR 11.94%로 추이하여 2031년에는 1,166억 달러에 달할 것으로 예측되고 있습니다.

기업의 하이브리드 워크 도입 가속화, 자산 경량형 모델에 대한 투자자의 관심 증가, 지방 도시로의 꾸준한 확대가 이 성장을 뒷받침하고 있습니다. 사업자 측은 임대 부채를 억제하면서 네트워크 범위를 확대하는 수익 분배형 파트너십으로 전환하고 있습니다. 웰니스 인증 취득과 데이터 구동형 공간에 대한 기술 투자는 고객의 정착률을 높이지만 기존 도심부의 공급 과잉이 이익률을 압박하는 상황도 계속되고 있습니다. 아시아태평양이 성장을 견인하는 한편, 남미에서는 신규 참가자가 최초로 공유 오피스 공간 이용자를 도입하기 위한 급성장의 여지가 가장 큰 상황입니다.

세계의 공유 오피스 공간 시장의 동향 및 인사이트

대기업에서 중소기업에 이르는 하이브리드 탄력 근무 형태의 급속한 보급

하이브리드 및 탄력 근무 형태가 대기업에서 중소기업에 이르기까지 빠르게 확산되고 있습니다. CBRE의 조사에 따르면, 응답 기업의 92% 이상이 하이브리드 근무를 도입하고 있으며, 그 중 3분의 2는 직원이 일주일에 최소 3일은 출근하는 것으로 예측했습니다. 이러한 변화로 인해 장기 임대 계약은 잠재적인 부채가 되고 유연한 계약 조건이 전략적 요건이 되었습니다. 기업은 공유 오피스 공간에 주력하여 변동하는 출근 상황에 따라 좌석 수를 조정할 수 있으며, 미사용 공간과 관련된 비용을 줄일 수 있습니다. 이 메커니즘은 비용 절감으로 이어질 뿐만 아니라 직원들이 근무지의 유연성을 점점 더 중시하는 가운데 인재 획득에도 기여하고 있습니다. 여러 도시에서 최고 수준의 보안과 일관된 품질을 보장할 수 있는 운영 회사는 수요의 급증을 목표로 하고 있습니다.

신흥도시 및 지방도시에 대한 세계의 코워킹 사업자 진출

세계의 코워킹 사업자는 증가하는 수요에 대응하기 위해 신흥 도시와 지방 도시로의 진출을 가속화하고 있습니다. 2024년에는 IWG가 867개 거점을 제휴로 개설하여 수익을 33억 파운드(41억 달러)로 확대했습니다. 자산 경량형 거래에 주력함으로써, 회사는 임대 계약보다 인테리어 공사에 더 많은 자본을 배분하고 있습니다. 이 접근법은 투자 자본 이익률(ROIC)을 향상시키고, 지금까지 프리미엄 코워킹 공간이 부족했던 교외 및 지방 도시로의 성장을 뒷받침하고 있습니다. 분산형 위치를 통해 IWG는 원격 팀의 출근 시간을 단축하고 기존 도심 중심 모델에서 허브 앤 스포크 네트워크로 전환하고 있습니다. 이 전략은 사업자를 도심부의 잠재적인 공실 위험으로부터 보호할 뿐만 아니라 현지 중소기업의 미충족 요구에도 대응하고 있습니다.

높은 운영비와 인테리어비로 사업자의 수익성 저하

공유 오피스 공간 시장에서 높은 운영 비용과 인테리어 비용은 사업자의 수익성에 심각한 영향을 미칩니다. 2024년 2분기에는 WeWork의 가동률이 67%로 떨어졌고 고정비가 매출액을 웃돌아 회사의 지불 능력에 대한 우려가 높아졌습니다. 이 회사의 고급 인테리어, 기업용 IT 인프라 및 최고 수준의 서비스에는 많은 설비 투자가 필요합니다. 이러한 비용은 특히 공석이 발생하는 경우 부담이 될 수 있습니다. 운영회사는 이러한 자본 부담을 경감하기 위해 건물주에게 협력을 요구하는 사례가 증가하고 있지만 소규모 공급자는 현대적인 리모델링 자금의 조달에 고전하고 있습니다. 이 과제는 시장에서 철수를 가속화하고 산업 재구성을 촉진할 수 있습니다.

부문 분석

2025년 시점에서 코워킹 스페이스는 공유 오피스 시장 전체에서 59.12%를 차지했습니다. 성공 요인은 즉시 사용 가능한 환경, 커뮤니티 프로그램, 파일럿 팀 및 신규 시장 진출의 비용 효율성에 있습니다. 기업은 프라이버시와 협동 기회의 균형을 맞추기 위해 코워킹 허브의 전용 스위트를 선호합니다. 서비스 오피스 및 이그제큐티브 스위트는 고정된 조건에서 완전한 장비를 갖춰 개인 공간을 필요로 하는 기업들 사이에서 여전히 수요가 있습니다.

하이브리드 및 가상 솔루션은 2026-2031년에 걸쳐 CAGR 12.75%로 가장 빠르게 성장할 것으로 예상되는 부문을 형성합니다. 이들은 클라우드 기반 데스크 예약, 분산 멤버십, 온디맨드 컨퍼런스 크레딧을 결합하여 광범위한 하이브리드 워크 프로토콜을 반영합니다. WeWork가 Vast Coworking Group과 제휴하여 임대 계약을 맺지 않고 75개의 교외 거점을 도입한 사례는 운영 사업자가 네트워크화된 서비스 제공으로 전환하고 있음을 보여줍니다. 이러한 모델을 통해 기업은 프로젝트 진행에 따라 물리적 존재를 유연하게 조정할 수 있어 공유 오피스 공간 시장의 가치 제안을 강화하고 있습니다.

지역별 분석

2025년 아시아태평양은 급속한 도시화와 정부 지원 혁신 허브를 배경으로 세계 매출의 37.10%를 차지했습니다. 인도의 코워킹 스페이스(Smartworks 및 IndiQube 등이 주도)는 특히 2급 도시로의 확대에 따라 거의 만실 상태의 가동률을 기록했습니다. 중국에서는 공유 오피스가 스마트 시티 계획의 일환으로 자리매김하고 있습니다. 동남아시아에서는 관광객과 디지털 노마드 증가가 원동력이 되고, 지역 운영회사는 네트워크 확대 전략의 일환으로 문화에 맞는 커뮤니티 이벤트를 기획하고 있습니다.

북미는 규모로는 두 번째로 큰 시장이지만 상황은 복잡합니다. 도심부에서는 공실률 상승에 의해 임대료가 하락하고 있어, 운영회사는 임대료 유지를 위해 설비의 충실을 도모하고 있습니다. 한편 교외는 호황을 보이고 있으며 미국의 공유 오피스 공간의 45%가 현재 중심업무지구(CBD) 밖에 위치해 통근시간의 단축 요구에 부응하고 있습니다. 기업 고객이 교외 공간을 위성 사무실로 활용하는 경향이 강해지면서 기존에 주택지였던 지역에서 네트워크의 확대가 진행되고 있습니다.

남미는 가장 빠르게 성장하고 있으며 2031년까지 연평균 복합 성장률(CAGR) 13.28%를 달성할 것으로 예상됩니다. 브라질이 이 성장을 견인하고 있지만, 콜롬비아와 칠레의 2차 시장에서도 라틴아메리카에 최초로 진출하는 다국적 기업의 관심이 높아지고 있습니다. 통화 변동 위험은 존재하지만 소유자 측은 관리 계약을 통해 운영 회사와 제휴하여 진입 위험을 줄이고 있습니다. 유럽에서는 성장이 꾸준하고 완만한 속도로 발생합니다. 모빌리티의 틀과 크로스보더 GDPR(EU 개인정보보호규정)에 대한 준수가 성장을 뒷받침하고 있어 특히 원격 워크 비자에 관한 시책이 안정된 수도권에서 현저합니다.

기타 혜택

- 시장 예측(ME) 엑셀 시트

- 3개월 애널리스트 서포트

자주 묻는 질문

목차

제1장 서론

- 조사 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 촉진요인

- 대기업에서 중소기업에 이르기까지 하이브리드형과 탄력 근무 형태의 급속한 보급

- 세계의 코워킹 사업자의 신흥 도시 및 지방 도시로의 진출

- 스타트업 기업, 프리랜서, 디지털 노마드에서의 수요 증가

- 회복력 있는 자산 클래스로서의 공유 오피스 포트폴리오에 대한 투자자의 관심 증가

- 테넌트의 웰니스 인증 취득 완료, 기술 도입 완료, 커뮤니티 주도형 스페이스에 대한 선호도 증가

- 억제요인

- 높은 운영 비용과 인테리어 비용이 사업자의 수익성을 저하시킴

- 성숙 시장에서 공급 과잉 위험과 이에 따른 가격 압력

- 중소 및 스타트업 기업에서의 가동률 안정성에 영향을 주는 경제 변동성

- 가치 및 공급망 분석

- 개요

- 부동산 개발업체와 자산 소유자 - 주요 정량 및 정성적 인사이트

- 오피스 공간 설계 기술 컨설턴트 - 주요 정량 및 정성적 인사이트

- 모듈형 가구와 스마트 오피스 솔루션 제공 기업 - 주요 정량 및 정성적 인사이트

- 산업에서의 정부 규제와 시책

- 공유 오피스 부동산 시장의 기술 혁신

- 주요 오피스 부동산업 지표에 관한 인사이트(공급량, 임대료, 가격, 가동률/공실률(%))

- 원격 근무가 공간 수요에 미치는 영향

- Porter's Five Forces

- 공급자의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 규모 및 성장 예측(금액, 달러)

- 유형별

- 코워킹 스페이스

- 서비스 오피스 및 이그제큐티브 스위트

- 기타(하이브리드, 가상 오피스)

- 부문별

- 정보기술(IT 및 ITES)

- BFSI(은행, 금융 서비스 및 보험)

- 비즈니스 컨설팅 및 전문 서비스

- 기타 서비스(소매, 생명과학, 에너지, 법무 서비스)

- 최종 용도별

- 프리랜서

- 기업

- 스타트업 및 기타

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 남미

- 브라질

- 기타 남미

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 기타 중동 및 아프리카

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 인도네시아

- 기타 아시아태평양

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 기업 프로파일

- IWG plc(Regus, Spaces)

- WeWork Inc.

- Industrious

- Servcorp Ltd.

- Awfis Space Solutions

- Smartworks

- Ucommune International

- JustCo

- Convene

- Knotel

- Impact Hub

- Office Evolution

- Serendipity Labs

- Expansive(구 Novel Coworking)

- CommonGrounds Workplace

- The Executive Centre

- Bizspace

- Workbar

- WorkSuites

- Office Partners 360

제7장 시장 기회 및 미래 전망

CSM 26.02.04The shared office spaces market is expected to grow from USD 59.20 billion in 2025 to USD 66.28 billion in 2026 and is forecast to reach USD 116.6 billion by 2031 at 11.94% CAGR over 2026-2031.

Rapid enterprise adoption of hybrid work, investor appetite for asset-light models, and steady expansion into secondary cities fuel this momentum. Operators are pivoting toward revenue-sharing partnerships that limit lease liabilities while extending network reach. Technology investments in wellness-certified, data-driven spaces deepen client stickiness, even as oversupply in legacy urban cores pressures margins. Asia-Pacific drives headline growth, while South America offers the steepest runway for new entrants courting first-time flexible-workspace users.

Global Shared Office Spaces Market Trends and Insights

Rapid Adoption of Hybrid and Flexible Work Models Across Corporations and SMEs

Hybrid and flexible work models are becoming increasingly prevalent among corporations and SMEs. Over 92% of clients surveyed by CBRE have adopted hybrid work schedules, with two-thirds anticipating their staff will be onsite a minimum of three days each week. This transition has turned extended leases into potential liabilities, making flexible terms a strategic imperative. Companies are gravitating towards shared office spaces, allowing them to adjust seating based on fluctuating attendance and reducing costs associated with unused space. This setup not only cuts costs but also attracts talent, as employees increasingly value location flexibility. Operators who can ensure top-tier security and consistent quality across different cities are witnessing a surge in demand.

Expansion of Global Co-working Operators into Emerging and Secondary Cities

Global co-working operators are increasingly expanding into emerging and secondary cities to meet growing demand. In 2024, IWG increased its revenue to GBP3.3 billion (USD 4.1 billion) by opening 867 sites, primarily through partnerships. By focusing on asset-light deals, the company allocates more capital to fit-outs rather than leases. This approach improves their Return on Invested Capital (ROIC) and supports their growth into suburbs and tier-II metros, areas previously lacking premium co-working spaces. With distributed locations, IWG reduces commute times for remote-first teams, shifting from a traditional downtown-focused model to a hub-and-spoke network. This strategy not only protects operators from potential vacancies in central business districts but also addresses the unmet needs of local SMEs.

High Operational and Fit-out Costs Reducing Operator Profitability

High operational and fit-out costs are significantly impacting the profitability of operators in the flexible workspace market. In Q2 2024, WeWork's occupancy dipped to 67%, raising concerns about its solvency as fixed costs eclipsed its billings. The company's premium interiors, enterprise-level IT, and top-tier services demand hefty capital expenditures. These costs weigh heavily, especially when seats remain unoccupied. While operators are increasingly partnering with landlords to alleviate these capital burdens, smaller providers face challenges in financing modern refurbishments. This struggle could hasten their exit from the market and fuel further consolidation.

Other drivers and restraints analyzed in the detailed report include:

- Rising Demand from Start-ups, Freelancers, and Digital Nomads

- Investor Interest in Shared Office Portfolios as a Resilient Asset Class

- Oversupply Risks in Mature Markets Leading to Price Pressures

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Co-working accounted for 59.12% of the shared office spaces market share in 2025. Its success stems from turnkey access, community programming, and cost efficiency for pilot teams or market entries. Enterprises favor dedicated suites within co-working hubs to balance privacy with collaboration opportunities. Serviced offices and executive suites maintain relevance among firms needing fully equipped private spaces on sealed terms.

Hybrid and virtual solutions form the fastest-growing cohort at a 12.75% CAGR as 2026-2031 unfolds. They blend cloud-based desk bookings, distributed memberships, and on-demand meeting credits, mirroring wider hybrid-work protocols. WeWork's alliance with Vast Coworking Group to onboard 75 suburban sites without signing leases demonstrates operator migration toward networked service delivery. These models let companies toggle physical presence as project pipelines ebb and flow, reinforcing the value proposition of the shared office spaces market.

The Shared Office Spaces Market Report is Segmented by Type (Co-Working Space, Serviced Offices/Executive Suites and Others), by Sector (Information Technology, Business Consulting & Professional Service, and More), by End Use (Freelancers, Enterprises and Start Ups and Others), and by Geography (North America, South America, Europe, Asia-Pacific and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2025, the Asia-Pacific region contributed 37.10% of global revenue, driven by rapid urbanization and government-supported innovation hubs. Co-working spaces in India, led by companies like Smartworks and IndiQube, saw occupancy levels near full capacity, especially as they expanded into tier-II cities. In China, shared offices are part of the country's smart-city plans. Southeast Asia is benefiting from an increase in tourists and digital nomads. Operators in the region are organizing culturally relevant community events to strengthen their network expansion strategies.

North America, while ranking second in value, faces mixed conditions. Downtown areas are experiencing lower prices due to rising vacancies, prompting operators to improve amenities to maintain rates. Suburbs, however, are performing well; 45% of flexible workspaces in the U.S. are now located outside central business districts, meeting the demand for shorter commutes. Enterprise clients are increasingly using suburban spaces as satellite offices, leading to the growth of networks in previously residential areas.

South America is growing the fastest, with a 13.28% CAGR projected through 2031. Brazil is leading this growth, but secondary markets in Colombia and Chile are also seeing increased interest from multinationals entering Latin America for the first time. Although currency volatility poses a risk, landlords are partnering with operators through management agreements to reduce entry risks. In Europe, growth is steady but moderate. Mobility frameworks and compliance with cross-border GDPR support this growth, particularly in capitals with stable policies for remote work visas.

- IWG plc (Regus, Spaces)

- WeWork Inc.

- Industrious

- Servcorp Ltd.

- Awfis Space Solutions

- Smartworks

- Ucommune International

- JustCo

- Convene

- Knotel

- Impact Hub

- Office Evolution

- Serendipity Labs

- Expansive (-formerly Novel Coworking)

- CommonGrounds Workplace

- The Executive Centre

- Bizspace

- Workbar

- WorkSuites

- Office Partners 360

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid adoption of hybrid and flexible work models across corporates and SMEs

- 4.2.2 Expansion of global co-working operators into emerging and secondary cities

- 4.2.3 Rising demand from start-ups, freelancers, and digital nomads

- 4.2.4 Investor interest in shared office portfolios as resilient asset class

- 4.2.5 Increasing tenant preference for wellness-certified, tech-enabled, and community-driven spaces

- 4.3 Market Restraints

- 4.3.1 High operational and fit-out costs reducing operator profitability

- 4.3.2 Oversupply risks in mature markets leading to price pressures

- 4.3.3 Economic volatility impacting occupancy stability for SMEs and start-ups

- 4.4 Value / Supply-Chain Analysis

- 4.4.1 Overview

- 4.4.2 Real Estate Developers and Asset Owners - Key Quantitative and Qualitative Insights

- 4.4.3 Workspace Design and Technology Consultants - Key Quantitative and Qualitative Insights

- 4.4.4 Modular Furniture and Smart Office Solutions Providers - Key Quantitative and Qualitative Insights

- 4.5 Government Regulations and Initiatives in the Industry

- 4.6 Technological Innovations in the Shared Office Space Real Estate Market

- 4.7 Insights into the Key Office Real Estate Industry Metrics (Supply, Rentals, Prices, Occupancy/Vacancy (%))

- 4.8 Impact of Remote Working on Space Demand

- 4.9 Porter's Five Forces

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Buyers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitutes

- 4.9.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value USD)

- 5.1 By Type

- 5.1.1 Co-Working Space

- 5.1.2 Serviced offices / Executive suites

- 5.1.3 Others (Hybrid, Virtual Office)

- 5.2 By Sector

- 5.2.1 Information Technology (IT and ITES)

- 5.2.2 BFSI (Banking, Financial Services and Insurance)

- 5.2.3 Business Consulting & Professional Service

- 5.2.4 Other Services (Retail, Lifesciences, Energy, Legal Services)

- 5.3 By End Use

- 5.3.1 Freelancers

- 5.3.2 Enterprises

- 5.3.3 Start Ups and Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Rest of Europe

- 5.4.4 Middle East and Africa

- 5.4.4.1 Saudi Arabia

- 5.4.4.2 United Arab Emirates

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 Asia-Pacific

- 5.4.5.1 China

- 5.4.5.2 India

- 5.4.5.3 Japan

- 5.4.5.4 South Korea

- 5.4.5.5 Australia

- 5.4.5.6 Indonesia

- 5.4.5.7 Rest of Asia-Pacific

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)}

- 6.3.1 IWG plc (Regus, Spaces)

- 6.3.2 WeWork Inc.

- 6.3.3 Industrious

- 6.3.4 Servcorp Ltd.

- 6.3.5 Awfis Space Solutions

- 6.3.6 Smartworks

- 6.3.7 Ucommune International

- 6.3.8 JustCo

- 6.3.9 Convene

- 6.3.10 Knotel

- 6.3.11 Impact Hub

- 6.3.12 Office Evolution

- 6.3.13 Serendipity Labs

- 6.3.14 Expansive (-formerly Novel Coworking)

- 6.3.15 CommonGrounds Workplace

- 6.3.16 The Executive Centre

- 6.3.17 Bizspace

- 6.3.18 Workbar

- 6.3.19 WorkSuites

- 6.3.20 Office Partners 360