|

시장보고서

상품코드

1906933

항공화물 : 시장 점유율 분석, 업계 동향 및 통계, 성장 예측(2026-2031년)Air Freight - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

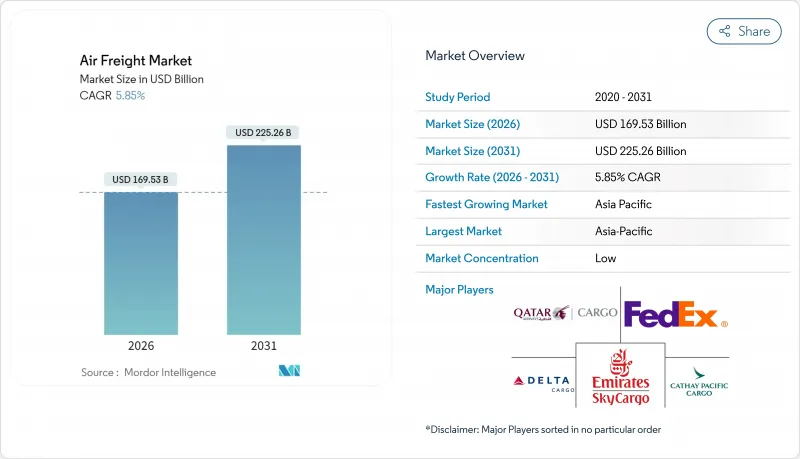

항공화물 시장은 2025년에 1,601억 7,000만 달러로 평가되었으며, 2026년 1,695억 3,000만 달러에서 2031년까지 2,252억 6,000만 달러에 이를 것으로 예상됩니다.

예측 기간(2026-2031년)에 있어서 CAGR은 5.85%를 나타낼 전망입니다.

이 확대의 주요 요인은 국경 간 전자상거래 증가, 지속적인 공급망 재구성, 의약품 콜드체인 수요입니다. 항공사는 운송 능력을 전문화물용으로 재조정하고 있으며, 여객기에서 화물기로의 개조도 추가 수송력으로 공헌하고 있습니다. 지속가능한 항공연료와 동적 가격 설정의 채용에 관한 규제의 움직임이 비용 구조를 바꾸고 있지만, 전반적인 수요는 여전히 견조합니다. 포워더와 통합 사업자 간의 통합은 항공화물 시장에서 경쟁 우위를 유지하기 위해 규모, 네트워크 깊이 및 기술이 중요하다는 것을 보여줍니다.

세계의 항공화물 시장 동향과 인사이트

확대하는 국경 간 EC화물 운송

국경 간 온라인 소매는 항공화물의 속도 우위성을 살리는 소구·고빈도 수송을 가속시키고 있습니다. 항공사는 3-5일 배송을 약속하는 마켓플레이스를 지원하기 위해 화물실 용량의 재구성과 추가 화물편의 운항 빈도를 늘리고 있습니다. 아시아의 생산 거점과 멕시코·미국의 필필먼트 센터를 연결하는 새로운 태평양 횡단 루트가 탄생하여 네트워크 밀도가 심화되어 적재율이 향상되고 있습니다. 통관 프로세스의 효율성과 전자 문서화는 통관 시간을 단축하고 서비스의 신뢰성을 보장합니다. 지속적인 소매 프로모션 사이클은 항공화물 시장의 성장을 지원, 변동은 치열한 전반적으로 상승 추세에 대한 수요를 생산하고 있습니다.

하이테크 전자 기기용 공급망 가속화

동남아시아와 멕시코의 반도체 제조업체는 저스트 인 타임 생산을 지원하기 위해 중요한 부품을 최종 조립 라인에 공수하고 있습니다. 적재에는 종종 고가치 마이크로칩이 포함되어 있으며, 중량 대 가치비에서 항공 운임의 할증이 정당화됩니다. 항공사는 정전기, 진동, 습도의 위험을 줄이는 전문적인 취급 절차를 도입하여 제품의 무결성을 보호합니다. 중국에서 멕시코로의 니어 쇼어링은 수송 루트를 단축·고주파수화하고 허브 구조를 재구축함으로써 내로우 바디기의 개조가 유리해집니다. 이러한 동향은 전자기기 공급 연속성에서 항공화물 시장의 전략적 역할을 강화하고 있습니다.

변동하는 연료 가격과 추가 요금

항공 연료는 운영 비용의 25% 이상을 차지합니다. 항공사는 스팟등유가격에 연동한 월차서차지표를 공표하고 변동위험을 화주에게 전가하고 있습니다. 2025년부터 EU에서 의무화되는 지속 가능한 항공 연료(SAF)는 기존 Jet-A-1 연료의 2-3배의 비용이 들고, 추가 상승 압력을 가하고 있습니다. 일부 항공사는 추가 비용을 회수하기 위해 노선별 '녹색' 요금을 도입하여 가격에 민감한 수요를 손상시킬 수 있습니다. 항공화물 시장의 이익률을 보호하기 위해서는 효과적인 연료 헤지 및 에너지 절약형 장비로의 업데이트가 필수적입니다.

부문 분석

화물 포워딩 사업은 2025년 수익의 44.50%를 차지했고 복잡한 멀티모달 조정 요구를 반영했지만 성장률은 3.74%로 항공화물 시장 전체를 밑돌고 있습니다. 많은 포워더는 현재 디지털 예약 포털과 통관 엔진을 제공하여 고객 유지를 강화하고 있습니다. 화물 운송 하위 부문(전용 화물편·택배·소구 화물 운송)는 CAGR 5.02%로 확대하고 있어 화주가 항공사와의 직접 거래를 요구하는 경향으로부터 포워딩을 웃도는 성장을 보이고 있습니다. 자산을 최소화한 가상 항공사와 블록스페이스 계약을 활용하는 신규 진출기업이 기존 기업의 점유율을 점차적으로 깎고 있지만, 풀서비스 포워더는 부가가치 가시화 서비스와 보험 제공을 통해 존재의의를 유지하고 있습니다.

디지털화는 전통적인 경계를 모호하게 만듭니다. 통합 항공사는 브로컬리지 업무를 확대하고, 포워더는 운송력 부족 시 화물기를 전세합니다. 대규모 화물업체는 종단 간 관리를 요구하며 사업자에게 수직 통합을 촉구합니다. 이러한 변화는 기술, 네트워크 범위, 전문 취급에서 경쟁 차별화를 촉진하고 항공화물 시장의 지속적인 확대를 지원합니다.

국제수송량은 2025년 총 수송량의 83.50%를 차지하며 세계무역의 흐름과 와이드바디기의 경제성에 뒷받침되었습니다. 아시아태평양에서 북미·유럽까지의 장거리 노선은 높은 적재율과 프리미엄 수익을 창출하고 있습니다. 그러나 지역화가 진행됨에 따라 인근공장과 소비지 간의 단거리 보충 수요가 확대되고 국내 항공화물의 CAGR 5.43%는 국제선 성장률을 상회하고 있습니다. 특히 중국, 인도, 미국에서는 EC 당일·다음날 배송 서비스가 전용 국내화물 네트워크의 가속을 뒷받침하고 있습니다.

규제의 간소화, 예측 가능한 스케줄, 급성장하는 익스프레스 소포의 보급이 국내 노선을 지원하고 있습니다. 항공사는 2차 도시 간의 화물 운송으로 개조한 구식 협폭동체를 재배치하여 항공기의 가동률을 향상시키고 있습니다. 이러한 흐름의 상보성은 균형 잡힌 장비 전략을 지원하고 거시 경제의 변동을 완화하며 항공화물 시장의 광범위한 건전성을 강화합니다.

지역별 분석

아시아태평양은 2025년에 40.70%의 수익으로 선두를 차지했으며, 2026년부터 2031년에 걸쳐 5.72%의 연평균 복합 성장률(CAGR)이 전망되고 있습니다. 이는 밀집된 제조 생태계, 급속한 소비자 지출의 성장, 확대되는 지역 내 익스프레스 네트워크를 반영합니다. 싱가포르, 홍콩, 인천의 전략적 허브는 2차 생산 기지를 상호 연결하여 연결성과 네트워크 중복성을 강화하고 있습니다. 인도 및 동남아시아 공항의 단기 용량 확장을 위한 정부 우대 조치는 지역의 중요성을 더욱 높여줍니다.

북미는 견조한 국내 소구화물 수요와 멕시코 주도의 니어 쇼어링에 지지되어 중요한 공헌 지역입니다. 미국에서는 인력 부족 중 슬롯 사용에 대한 규제 완화가 주요 게이트웨이의 서비스 연속성을 보장합니다. 양국간 무역수준이 균형을 이룬 CTK(화물 통로)를 지원하고 구조적인 이용률 향상과 항공화물 시장의 장기적인 건전성을 지원하고 있습니다.

유럽과 중동에서는 대조적인 전망입니다. 유럽 항공사는 탄소 규제 대응에 따른 비용 압력에 직면하는 반면, 고부가가치 수출 구성과 견조한 의약품 수송의 혜택을 받고 있습니다. 중동의 허브 공항은 3대륙 간의 지리적 근접성을 활용하여 견조한 중계 수송량을 달성하고 있습니다. 아프리카와 남미는 규모가 작은 것, 자원 주도 수요와 확대하는 전자상거래의 침투에 기회를 나타내고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 애널리스트 지원(3개월간)

자주 묻는 질문

목차

제1장 서론

- 조사 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 확대하는 국경 간 EC화물 수송

- 하이테크 전자 기기에서 가속화하는 공급망의 요구

- 세계의 의약품 콜드체인 수요

- 무역 재개와 니어 쇼어링의 긴급성

- 화물 전용 내로우 바디기로의 개조

- AI를 활용한 동적 가격 설정 도입

- 시장 성장 억제요인

- 변동하는 연료 가격과 과충전

- 항공기 배출가스 규제

- 2차 허브 공항의 슬롯 제약

- 인정 지상 작업원의 부족

- 가치/공급망 분석

- 규제 상황

- 기술의 전망

- 항공화물 운임 분석

- 중량화물/프로젝트 물류 특집

- 지상 지원 설비에 관한 인사이트

- 위험물 안전 기준의 재검토

- 항공화물의 콜드체인 물류

- Porter's Five Forces

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 규모와 성장 예측

- 서비스별

- 화물 운송(화물/CEP)

- 화물 운송 대행

- 기타 부가가치 서비스(통관 대행, 보험 등)

- 목적지별

- 국내

- 국제

- 운송업자별

- 여객기 화물칸 운송

- 화물기

- 화물 유형별

- 일반 화물

- 특수 화물

- 최종 사용자 업계별

- 전자상거래 및 소매

- 제조업 및 자동차 산업

- 헬스케어 및 제약

- 신선식품 및 농산물

- 첨단기술 및 일렉트로닉스

- 기타

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 남미

- 브라질

- 페루

- 칠레

- 아르헨티나

- 기타 남미

- 아시아태평양

- 인도

- 중국

- 일본

- 호주

- 한국

- 동남아시아(싱가포르, 말레이시아, 태국, 인도네시아, 베트남, 필리핀)

- 기타 아시아태평양

- 유럽

- 영국

- 독일

- 프랑스

- 스페인

- 이탈리아

- 베네룩스(벨기에, 네덜란드, 룩셈부르크)

- 북유럽 국가(덴마크, 핀란드, 아이슬란드, 노르웨이, 스웨덴)

- 기타 유럽

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 남아프리카

- 나이지리아

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- FedEx Corporation

- Emirates SkyCargo

- Qatar Airways Cargo

- Delta Cargo

- Cathay Pacific Cargo

- DHL Supply Chain & Global Forwarding

- UPS Supply Chain Solutions

- Etihad Cargo

- All Nippon Airways Cargo

- Lufthansa Cargo

- Korean Air Cargo

- United Cargo

- American Airlines Cargo

- Kuehne Nagel

- CEVA Logistics

- DSV

- Expeditors

- Sinotrans

- Hellmann Worldwide Logistics

- Kintetsu World Express

- AirBridgeCargo Airlines

제7장 시장 기회와 향후 전망

KTH 26.01.20The Air Freight Market was valued at USD 160.17 billion in 2025 and estimated to grow from USD 169.53 billion in 2026 to reach USD 225.26 billion by 2031, at a CAGR of 5.85% during the forecast period (2026-2031).

Rising cross-border e-commerce volumes, ongoing supply-chain reconfiguration, and pharmaceutical cold-chain needs are the primary forces behind this expansion. Airlines are rebalancing capacity toward specialized cargo, while passenger-to-freighter conversions support additional lift. Regulatory momentum on sustainable aviation fuel and dynamic pricing adoption is reshaping cost structures, yet overall demand remains resilient. Consolidation among forwarders and integrators indicates that scale, network depth, and technology are critical to sustaining competitive advantage in the air freight market.

Global Air Freight Market Trends and Insights

Expanding Cross-Border E-Commerce Shipments

Cross-border online retail is accelerating smaller, more frequent shipments that favor air freight's speed advantage. Airlines are reconfiguring belly capacity and scheduling extra freighter frequencies to support marketplaces that promise three-to-five-day delivery. New trans-Pacific routes connecting production zones in Asia with fulfillment centers in Mexico and the United States have emerged, deepening network density and boosting load factors. Streamlined customs processes and electronic documentation shorten clearance times, protecting service reliability. Continuous retail promotion cycles create highly volatile but generally upward-trending demand that underpins the growth of the air freight market.

Accelerated Supply-Chain Needs for High-Tech Electronics

Semiconductor producers in Southeast Asia and Mexico now fly critical components to final assembly lines to support just-in-time manufacturing. Payloads often contain high-value microchips whose weight-to-value ratio justifies premium air charges. Airlines have introduced specialized handling protocols that mitigate static, vibration, and humidity risks, protecting product integrity. Near-shoring from China to Mexico creates shorter, higher-frequency lanes that reshape hub structures and favor narrow-body aircraft conversions. These dynamics reinforce the strategic role of the air freight market in electronics supply continuity.

Volatile Fuel Prices & Surcharges

Jet fuel accounts for more than 25% of operating costs. Airlines publish monthly surcharge tables pegged to spot kerosene prices, transferring volatility to shippers. Sustainable aviation fuel blends, mandated in the EU from 2025, cost two to three times traditional Jet-A-1 and add further upward pressure. Some carriers introduce route-specific "green" fees to recover incremental expenses, which can erode price-sensitive demand. Effective fuel hedging and energy-efficient fleet renewal are vital to protecting margins in the air freight market.

Other drivers and restraints analyzed in the detailed report include:

- Global Pharmaceutical Cold-Chain Demand

- Resumption of Trade & Near-Shoring Urgency

- Aviation-Emission Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Freight Forwarding 44.50% of 2025 revenue, reflecting complex multi-modal coordination needs, though its growth pace lags the broader air freight market at 3.74%. Many forwarders now offer digital booking portals and customs engines that deepen client retention. The Freight Transport sub-segment, covering dedicated cargo flights and courier-express-parcel lift, is growing at a 5.02% CAGR, outpacing forwarding as shippers seek direct carrier relationships. Market entrants leveraging asset-light virtual airlines and block-space agreements chip away at incumbent share, yet full-service forwarders maintain relevance through value-added visibility and insurance.

Digitalization blurs historic boundaries: integrated carriers expand brokerage desks, while forwarders charter freighters during capacity crunches. Larger shippers demand end-to-end control, pushing providers toward vertical integration. These shifts encourage competitive differentiation in technology, network reach, and specialized handling that underpins the sustained expansion of the air freight market.

International traffic represented 83.50% of 2025 tonnage, benefiting from global trade flows and wide-body aircraft economics. Long-haul lanes from Asia-Pacific to North America and Europe generate high load factors and premium yields. However, domestic air freight's 5.43% CAGR exceeds international growth as regionalization drives short-haul replenishment between near-shored factories and consumption centers. E-commerce same-day and next-day promises accelerate dedicated domestic freighter networks, particularly in China, India, and the United States.

Regulatory simplicity, predictable schedules, and rising express parcel penetration support domestic lanes. Airlines redeploy older narrow-body conversions to shuttle goods between secondary cities, improving aircraft utilization. The complementary nature of these flows supports balanced fleet strategies and cushions macro-volatility, reinforcing the broad-based health of the air freight market.

The Air Freight Market Report is Segmented by Service (Freight Transport, Freight Forwarding, and More), Destination (Domestic and International), Carrier Type (Belly Cargo and Freighter), Cargo Type (General Cargo and Special Cargo), End-User Industry (E-Commerce & Retail, Manufacturing & Automotive, and More), Geography (North America, Asia-Pacific, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominated 2025 with 40.70% revenue and is expected to post a 5.72% CAGR (2026-2031), reflecting dense manufacturing ecosystems, rapid consumer spending growth, and expanding intra-regional express networks. Strategic hubs in Singapore, Hong Kong, and Incheon interlink secondary production centers, boosting connectivity and network redundancy. Government incentives for near-term capacity growth at Indian and Southeast Asian airports further elevate regional significance.

North America is a significant contributor, supported by resilient domestic parcel demand and Mexico-driven near-shoring. United States regulatory relief on slot usage amid staffing shortages safeguards service continuity at major gateways. Bilateral trade levels underpin balanced CTKs, enhancing structural utilization and supporting the long-term health of the air freight market.

Europe and the Middle East present contrasting outlooks. European carriers face cost pressure from carbon compliance but benefit from a high-value export mix and strong pharmaceutical flows. Middle Eastern hubs exploit geographic proximity among three continents, achieving robust transshipment traffic. Africa and South America remain smaller yet demonstrate opportunity in resource-driven demand and growing e-commerce penetration.

- FedEx Corporation

- Emirates SkyCargo

- Qatar Airways Cargo

- Delta Cargo

- Cathay Pacific Cargo

- DHL Supply Chain & Global Forwarding

- UPS Supply Chain Solutions

- Etihad Cargo

- All Nippon Airways Cargo

- Lufthansa Cargo

- Korean Air Cargo

- United Cargo

- American Airlines Cargo

- Kuehne + Nagel

- CEVA Logistics

- DSV

- Expeditors

- Sinotrans

- Hellmann Worldwide Logistics

- Kintetsu World Express

- AirBridgeCargo Airlines

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expanding cross-border e-commerce shipments

- 4.2.2 Accelerated supply-chain needs for high-tech electronics

- 4.2.3 Global pharmaceutical cold-chain demand

- 4.2.4 Resumption of trade & near-shoring urgency

- 4.2.5 Cargo-dedicated narrow-body conversions

- 4.2.6 AI-driven dynamic pricing adoption

- 4.3 Market Restraints

- 4.3.1 Volatile fuel prices & surcharges

- 4.3.2 Aviation-emission regulations

- 4.3.3 Airport slot constraints at secondary hubs

- 4.3.4 Shortage of certified ground-handling labour

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Air-Freight Rates Analysis

- 4.8 Heavy Cargo / Project-Logistics Spotlight

- 4.9 Ground-Handling Equipment Insights

- 4.10 Dangerous-Goods Safety Standards Review

- 4.11 Cold-Chain Logistics in Air Cargo

- 4.12 Porter's Five Forces

- 4.12.1 Threat of New Entrants

- 4.12.2 Bargaining Power of Buyers

- 4.12.3 Bargaining Power of Suppliers

- 4.12.4 Threat of Substitutes

- 4.12.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Service

- 5.1.1 Freight Transport (Cargo/CEP)

- 5.1.2 Freight Forwarding

- 5.1.3 Other Value-Added Services (Customs brokerage, insurance, etc.)

- 5.2 By Destination

- 5.2.1 Domestic

- 5.2.2 International

- 5.3 By Carrier Type

- 5.3.1 Belly Cargo

- 5.3.2 Freighter

- 5.4 By Cargo Type

- 5.4.1 General Cargo

- 5.4.2 Special Cargo

- 5.5 By End-User Industry

- 5.5.1 E-commerce & Retail

- 5.5.2 Manufacturing & Automotive

- 5.5.3 Healthcare & Pharmaceuticals

- 5.5.4 Perishables & Fresh Produce

- 5.5.5 High-Tech & Electronics

- 5.5.6 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Peru

- 5.6.2.3 Chile

- 5.6.2.4 Argentina

- 5.6.2.5 Rest of South America

- 5.6.3 Asia-Pacific

- 5.6.3.1 India

- 5.6.3.2 China

- 5.6.3.3 Japan

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 South East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, and Philippines)

- 5.6.3.7 Rest of Asia-Pacific

- 5.6.4 Europe

- 5.6.4.1 United Kingdom

- 5.6.4.2 Germany

- 5.6.4.3 France

- 5.6.4.4 Spain

- 5.6.4.5 Italy

- 5.6.4.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.6.4.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.6.4.8 Rest of Europe

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab of Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 South Africa

- 5.6.5.4 Nigeria

- 5.6.5.5 Rest of Middle East And Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank / Share, Products & Services, Recent Developments)

- 6.4.1 FedEx Corporation

- 6.4.2 Emirates SkyCargo

- 6.4.3 Qatar Airways Cargo

- 6.4.4 Delta Cargo

- 6.4.5 Cathay Pacific Cargo

- 6.4.6 DHL Supply Chain & Global Forwarding

- 6.4.7 UPS Supply Chain Solutions

- 6.4.8 Etihad Cargo

- 6.4.9 All Nippon Airways Cargo

- 6.4.10 Lufthansa Cargo

- 6.4.11 Korean Air Cargo

- 6.4.12 United Cargo

- 6.4.13 American Airlines Cargo

- 6.4.14 Kuehne + Nagel

- 6.4.15 CEVA Logistics

- 6.4.16 DSV

- 6.4.17 Expeditors

- 6.4.18 Sinotrans

- 6.4.19 Hellmann Worldwide Logistics

- 6.4.20 Kintetsu World Express

- 6.4.21 AirBridgeCargo Airlines

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment