|

시장보고서

상품코드

1686225

소형 위성 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Small Satellite - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

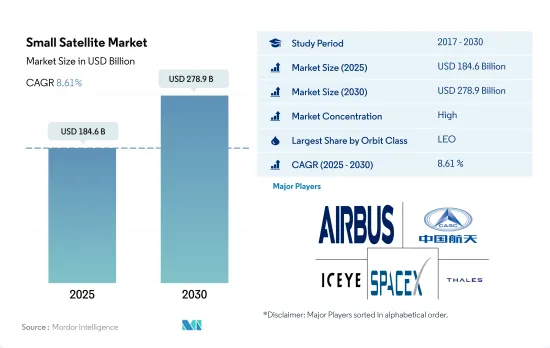

소형 위성 시장 규모는 2025년에 1,846억 달러로 추정되고, 2030년에는 2,789억 달러에 이를 것으로 예측되며, 예측 기간 중(2025-2030년) CAGR은 8.61%를 나타낼 전망입니다.

LEO 위성이 시장 점유율의 대부분을 차지하며 시장 성장을 주도

- 위성 또는 우주선은 일반적으로 지구 주변의 여러 특수 궤도 중 하나에 배치되거나 행성 간 여행을 위해 발사됩니다. 소형 위성은 과학 연구부터 상업 및 군사용 애플리케이션에 이르기까지 다양한 분야에서 저렴한 비용으로 우주에 접근할 수 있게 되면서 최근 몇 년간 우주 산업에 혁명을 일으켰습니다. 소형 위성의 잠재력을 완전히 실현하려면 발사할 수 있는 다양한 궤도 유형을 이해하는 것이 필수적입니다. NASA의 지구 관측 시스템을 포함한 대부분의 과학 위성은 지구 저궤도에 있습니다.

- 소형 위성 시장은 통신, 내비게이션, 지구 관측, 군사 정찰, 과학 임무에 사용되는 LEO 위성에 대한 수요 증가로 인해 계속해서 강력한 성장세를 보이고 있습니다. 2017년부터 2022년까지 약 2900개의 소형 LEO 위성이 제작 및 발사되었으며, 주로 통신 목적으로 사용되었습니다. 이에 따라 SpaceX, OneWeb, Amazon과 같은 기업들은 수천 개의 위성을 LEO로 발사할 계획을 세웠습니다. 지구 관측, 내비게이션, 기상학, 군사 통신 등 다양한 분야에서 저지구 궤도에 대한 수요가 증가함에 따라 LEO 위성 발사 건수가 증가하고 있습니다.

- 최근 몇 년 동안 소형 위성을 GEO 및 MEO로 발사하는 사례는 매우 적지만, 그럼에도 불구하고 군의 MEO 및 GEO 위성 사용은 증가하고 있습니다. 또한 신호 강도 증가, 통신 및 데이터 전송 기능 향상, 더 넓은 커버리지 영역 등의 장점으로 인해 그 사용은 더욱 증가할 것으로 예상됩니다. 예를 들어, 레이시온 테크놀로지스와 보잉의 밀레니엄 스페이스 시스템은 미 우주군을 위한 최초의 프로토타입 미사일 궤도 보관(MTC) MEO OPIR 페이로드를 개발하고 있습니다.

북미 지역은 예측 기간 동안 상당한 성장이 예상

- 세계의 소형 위성 시장은 다양한 산업 분야에서 초고속 인터넷, 통신 서비스 및 데이터 전송에 대한 수요 증가로 인해 향후 몇 년 동안 크게 성장할 것으로 예상됩니다. 시장은 시장 점유율과 수익 창출 측면에서 주요 지역인 북미, 유럽 및 아시아태평양을 중심으로 분석됩니다.

- 북미는 Swarm Technologies, Planet Labs, SpaceX 등 여러 대형 기업들이 존재하기 때문에 예측 기간 동안 세계의 소형 위성 시장을 지배 할 것으로 예상됩니다. 미국 정부도 첨단 위성 기술 개발에 막대한 투자를 하고 있으며, 이는 북미 소형 위성 시장을 주도할 것으로 예상됩니다. 2017-2022년 동안 이 지역은 전체 소형 위성 제조량의 75%를 차지했습니다.

- 유럽의 소형 위성 시장은 초고속 인터넷 및 통신 서비스에 대한 수요 증가로 인해 예측 기간 동안 크게 성장할 것으로 예상됩니다. 유럽우주국(ESA)은 첨단 위성 기술 개발에 막대한 투자를 하고 있으며, 이는 유럽 소형 위성 시장의 성장을 견인할 것으로 예상됩니다. 2017-2022년 동안 이 지역은 제조된 전체 소형 위성의 13%를 차지했습니다.

- 아시아태평양은 중국, 인도, 일본과 같은 국가에서 위성 기반 통신 서비스 및 내비게이션 시스템에 대한 수요가 증가함에 따라 예측 기간 동안 소형 위성 시장이 크게 성장할 것으로 예상됩니다. 2017-2022년 동안 이 지역은 제조된 전체 소형 위성의 6%를 차지했습니다.

세계의 소형 위성 시장 동향

연료 및 운영 효율성 개선 트렌드가 시장에 긍정적인 영향을 미칠 것으로 예상

- 오늘날 위성은 계속해서 소형화되고 있습니다. 소형 위성은 기존 위성에 비해 훨씬 적은 비용으로 기존 위성이 수행하는 거의 모든 작업을 수행할 수 있어 소형 위성의 구축, 발사, 운영이 점점 더 실용화되고 있습니다. 이에 따라 소형 위성에 대한 의존도도 기하급수적으로 증가하고 있습니다. 소형 위성은 일반적으로 개발 주기가 짧고 개발 팀도 더 작으며 발사 비용도 훨씬 저렴합니다. 혁신적인 기술 발전으로 전자 장치의 소형화가 촉진되면서 스마트 소재의 발명이 추진되었고, 제조업체는 시간이 지남에 따라 위성 버스 크기와 질량을 줄였습니다.

- 위성은 질량에 따라 분류됩니다. 질량이 500kg 미만인 위성은 소형 위성으로 간주됩니다. 전 세계적으로 약 3,800개 이상의 소형 위성이 발사되었습니다. 소형 위성은 개발 기간이 짧아 전체 임무 비용을 절감할 수 있기 때문에 전 세계적으로 소형 위성이 증가하는 추세입니다. 소형 위성은 과학 및 기술 결과를 얻는 데 필요한 시간을 크게 줄여줍니다. 소형 우주선 임무는 유연한 경향이 있으므로 새로운 기술 기회나 요구에 더 잘 대응할 수 있습니다. 미국의 소형 위성 산업은 특정 애플리케이션 프로필에 맞게 맞춤화된 소형 위성의 설계 및 제조를 위한 강력한 프레임워크의 존재에 의해 지원됩니다. 상업 및 군사 우주 부문의 수요 증가로 인해 2023-2030년 동안 소형 위성의 수가 증가할 것으로 예상됩니다.

여러 우주 기관의 우주 지출 증가는 소형 위성 산업에 긍정적인 영향을 미칠 것으로 예상

- 캐나다 정부에 따르면 우주 부문은 캐나다 GDP에 23억 달러를 추가합니다. 캐나다 정부는 캐나다 우주 기업의 90%가 중소기업이라고 보고하고 있습니다. 캐나다 우주국 예산은 크지 않으며 2022-2023년 예상 예산 지출은 3억 2,900만 달러였습니다. 2022년 11월 ESA의 발표에 따르면 향후 3년간 우주 예산을 25% 증액하여 지구 관측 분야에서 유럽의 주도권을 유지하고, 내비게이션 서비스를 확대하며, 미국과의 탐사 파트너로 남기 위해 우주 예산을 늘릴 것을 제안했습니다.

- 예를 들어, 2020년 12월 IABG와 BMWi는 고해상도 카메라, 이미지 센서, 이미지 변환기를 갖춘 위성을 제작하기 위해 2억 3,000만 유로의 계약을 체결했습니다. 이 새로운 기술은 2022년 말까지 뮌헨에서 대량 생산을 시작하여 전 세계에 매핑과 내비게이션에 필요한 위성을 설치하는 데 사용될 예정입니다. 독일은 위성 관측 역량도 점진적으로 발전시키고 있습니다. 국가 전체의 환경 영향을 줄이기 위해 새로운 관측 위성 기술을 궤도에 올려놓았습니다.

- 연구 및 투자 보조금 측면에서 전 세계 정부와 민간 부문은 우주 분야의 연구와 혁신을 위해 전용 기금을 마련하고 있습니다. 예를 들어, 2023년 2월까지 미국 항공우주국(NASA)은 3억 3,300만 달러를 연구 보조금으로 배분했습니다. 소형 위성은 상업용에 비해 과학 연구, 군사 및 방위 분야에서 점점 더 선호되고 있습니다. 지구 및 천체 관측, 우주 연구, 통신과 같은 데이터 집약적인 용도의 요구 사항이 증가함에 따라 소형 위성에 대한 수요가 최고치를 기록했습니다.

소형 위성 산업 개요

소형 위성 시장은 상당히 통합되어 있으며 상위 5개 기업에서 98.09%를 차지하고 있습니다. 이 시장 주요 기업은 다음과 같습니다. Airbus SE, China Aerospace Science and Technology Corporation(CASC), ICEYE Ltd., Space Exploration Technologies Corp. and Thales(알파벳순).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 지원

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 위성의 질량

- 우주 개발에의 지출

- 규제 프레임워크

- 세계

- 호주

- 브라질

- 캐나다

- 중국

- 프랑스

- 독일

- 인도

- 이란

- 일본

- 뉴질랜드

- 러시아

- 싱가포르

- 한국

- 아랍에미리트(UAE)

- 영국

- 미국

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 용도

- 통신

- 지구 관측

- 네비게이션

- 우주 관측

- 기타

- 궤도 클래스

- GEO

- LEO

- MEO

- 최종 사용자

- 상업

- 군사 및 정부

- 기타

- 추진 기술

- 전기

- 가스

- 액체 연료

- 지역

- 아시아태평양

- 유럽

- 북미

- 세계 기타 지역

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- Airbus SE

- Astrocast

- Axelspace Corporation

- Chang Guang Satellite Technology Co. Ltd

- China Aerospace Science and Technology Corporation(CASC)

- German Orbital Systems

- GomSpaceApS

- ICEYE Ltd.

- Planet Labs Inc.

- Satellogic

- Space Exploration Technologies Corp.

- SpaceQuest Ltd

- Spire Global, Inc.

- Swarm Technologies, Inc.

- Thales

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 출처 및 참고문헌

- 도표 목록

- 주요 인사이트

- 데이터 팩

- 용어집

The Small Satellite Market size is estimated at 184.6 billion USD in 2025, and is expected to reach 278.9 billion USD by 2030, growing at a CAGR of 8.61% during the forecast period (2025-2030).

LEO satellites dominate the market's growth by occupying majority of the market share

- A satellite or spacecraft is usually placed into one of many special orbits around the Earth or launched into an interplanetary journey. Small satellites revolutionized the space industry in recent years as they have enabled low-cost access to space for a wide range of applications, from scientific research to commercial and military applications. To fully realize the potential of small satellites, it is essential to understand the different types of orbits they can be launched into. Most science satellites, including NASA's Earth Observation System, are in low Earth orbit.

- The small satellite market continues to experience strong growth, driven by the increasing demand for LEO satellites used for communication, navigation, Earth observation, military reconnaissance, and scientific missions. Between 2017 and 2022, around 2900 small LEO satellites were manufactured and launched, primarily used for communication purposes. This led companies such as SpaceX, OneWeb, and Amazon to plan the launch of thousands of satellites into LEO. With the rising demand for low earth orbit from various sectors like Earth observation, navigation, meteorology, and military communications, the market has witnessed a rise in the number of launches of LEO satellites.

- Though the launch of small satellites into GEO and MEO is very few in recent years, despite this fact, the military's use of MEO and GEO satellites has grown. It is also expected to increase, owing to the advantages, such as increased signal strength, improved communications and data transfer capabilities, and greater coverage area. For instance, Raytheon Technologies' and Boeing's Millennium Space Systems are developing the first prototype Missile Track Custody (MTC) MEO OPIR payloads for the US Space Force.

North America may witness significant growth during the forecast period

- The global small satellite market is expected to grow significantly in the coming years, driven by increasing demand for high-speed internet, communication services, and data transfer across different industries. The market is analyzed with respect to North America, Europe, and Asia-Pacific, which are the major regions in terms of market share and revenue generation.

- North America is expected to dominate the global small satellite market during the forecast period due to the presence of several leading players, such as Swarm Technologies, Planet Labs, and SpaceX. The US government has also been investing heavily in developing advanced satellite technology, which is expected to drive the North American small satellite market. During 2017-2022*, the region accounted for 75% of the total small satellites manufactured.

- The small satellite market in Europe is expected to grow significantly during the forecast period due to the rising demand for high-speed internet and communication services. The European Space Agency (ESA) has been investing heavily in developing advanced satellite technology, which is expected to drive the growth of the European small satellite market. During 2017-2022*, the region accounted for 13% of the total small satellites manufactured.

- Asia-Pacific is expected to witness significant growth in the small satellite market during the forecast period due to the increasing demand for satellite-based communication services and navigation systems in countries such as China, India, and Japan. During 2017-2022*, the region accounted for 6% of the total small satellites manufactured.

Global Small Satellite Market Trends

The trend of for better fuel and operational efficiency is expected to positively impact the market

- Satellites continue to be small-sized nowadays. They are capable of almost every task a conventional satellite does at a fraction of the cost of the conventional satellite, thereby making the building, launching, and operation of small satellite constellations increasingly viable. Correspondingly, our reliance on them continues to grow exponentially. Small satellites typically have shorter development cycles, smaller development teams, and cost much less for launch. Revolutionary technological advancements facilitated the miniaturization of electronics, leading to a push for the invention of smart materials and reducing satellite bus size and mass over time for manufacturers.

- Satellites are classified according to mass. Those with a mass of less than 500 kg are considered small satellites. Globally, around 3800+ small satellites were launched. There has been a growing trend for small satellites worldwide owing to their shorter development time, which could reduce overall mission costs. They significantly reduce the time required to obtain scientific and technological results. Small spacecraft missions tend to be flexible and can, therefore, be more responsive to new technological opportunities or needs. The small satellite industry in the United States is supported by the presence of a robust framework for the design and manufacture of small satellites tailored to serve specific application profiles. Owing to the growing demand in the commercial and military space sector, a rise in the number of small satellites is expected during 2023-2030.

Increasing space expenditures of different space agencies are expected to positively impact the small satellites industry

- According to the Canadian government, the space sector adds USD 2.3 billion to the Canadian GDP. The government reports that 90% of Canadian space firms are small- and medium-sized businesses. The Canadian Space Agency budget is modest, and the estimated budgetary spending for 2022-2023 is USD 329 million. In November 2022, as per the announcement that was made by ESA, a 25% boost was proposed in space funding over the next three years, which was designed to maintain Europe's lead in Earth observation, expand navigation services, and remain a partner in exploration with the United States

- For instance, in December 2020, IABG and BMWi signed a EUR 230 million contract to create satellites with high-resolution cameras, image sensors, and image converters. The new technology began mass production in Munich by the end of 2022 and will be used to install satellites needed for mapping and navigation around the world. Germany is also gradually developing its satellite observation capabilities. New observation satellite technologies were launched into orbit in a significant effort to reduce the environmental impact across the nation.

- In terms of research and investment grants, governments globally governments and the private sector have dedicated funds for research and innovation in the space sector. For instance, till February 2023, the National Aeronautics and Space Administration (NASA) distributed USD 333 million as research grants. Small satellites are increasingly being preferred for scientific research, military, and defense sectors, compared to commercial applications. The demand for small satellites reached a new high owing to the increasing requirements of data-intense applications like Earth and celestial observation, space research, and communication,

Small Satellite Industry Overview

The Small Satellite Market is fairly consolidated, with the top five companies occupying 98.09%. The major players in this market are Airbus SE, China Aerospace Science and Technology Corporation (CASC), ICEYE Ltd., Space Exploration Technologies Corp. and Thales (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Satellite Mass

- 4.2 Spending On Space Programs

- 4.3 Regulatory Framework

- 4.3.1 Global

- 4.3.2 Australia

- 4.3.3 Brazil

- 4.3.4 Canada

- 4.3.5 China

- 4.3.6 France

- 4.3.7 Germany

- 4.3.8 India

- 4.3.9 Iran

- 4.3.10 Japan

- 4.3.11 New Zealand

- 4.3.12 Russia

- 4.3.13 Singapore

- 4.3.14 South Korea

- 4.3.15 United Arab Emirates

- 4.3.16 United Kingdom

- 4.3.17 United States

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application

- 5.1.1 Communication

- 5.1.2 Earth Observation

- 5.1.3 Navigation

- 5.1.4 Space Observation

- 5.1.5 Others

- 5.2 Orbit Class

- 5.2.1 GEO

- 5.2.2 LEO

- 5.2.3 MEO

- 5.3 End User

- 5.3.1 Commercial

- 5.3.2 Military & Government

- 5.3.3 Other

- 5.4 Propulsion Tech

- 5.4.1 Electric

- 5.4.2 Gas based

- 5.4.3 Liquid Fuel

- 5.5 Region

- 5.5.1 Asia-Pacific

- 5.5.2 Europe

- 5.5.3 North America

- 5.5.4 Rest of World

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Airbus SE

- 6.4.2 Astrocast

- 6.4.3 Axelspace Corporation

- 6.4.4 Chang Guang Satellite Technology Co. Ltd

- 6.4.5 China Aerospace Science and Technology Corporation (CASC)

- 6.4.6 German Orbital Systems

- 6.4.7 GomSpaceApS

- 6.4.8 ICEYE Ltd.

- 6.4.9 Planet Labs Inc.

- 6.4.10 Satellogic

- 6.4.11 Space Exploration Technologies Corp.

- 6.4.12 SpaceQuest Ltd

- 6.4.13 Spire Global, Inc.

- 6.4.14 Swarm Technologies, Inc.

- 6.4.15 Thales

7 KEY STRATEGIC QUESTIONS FOR SATELLITE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms