|

시장보고서

상품코드

1444358

지진 탐사 서비스 - 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Seismic Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

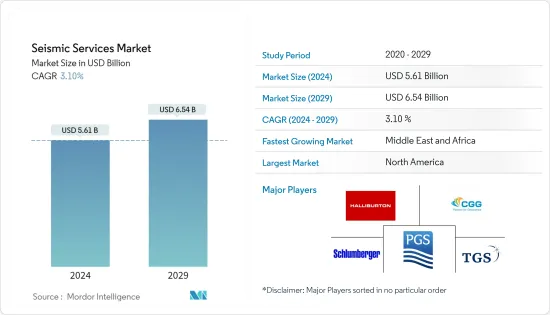

지진 탐사 서비스 시장 규모는 2024년 56억 1,000만 달러로 추정됩니다. 2029년까지 65억 4,000만 달러에 달할 것으로 예측되며, 예측 기간(2024-2029년) 동안 3.10%의 연평균 복합 성장률(CAGR)을 나타낼 것으로 예상됩니다.

주요 하이라이트

- 중기적으로는 서아프리카, 멕시코만 등 해양 지역에서의 탐사 증가와 유가 상승, 업스트림 지역에서의 활동의 경제적 타당성 확보 등의 요인이 시장을 견인할 것으로 보입니다.

- 한편, 많은 국가들이 재생 가능 에너지로 전환하고 원유에 대한 의존도를 낮추면서 예측 기간 동안 시장 성장이 억제될 수 있습니다.

- 그럼에도 불구하고 육상 및 얕은 수심 유전은 이미 성숙기에 접어들었고, 이 지역에서는 새로운 유전이 발견될 여지가 거의 없습니다. 따라서 심해 및 초심해수 매장량 개발은 향후 지진 탐사 서비스 시장에 큰 기회를 창출할 것으로 예상됩니다.

지진 탐사 서비스 시장 동향

해양 석유 및 가스 산업 수요 증가

- 해양 부문은 지진 탐사 서비스 시장에서 가장 큰 점유율을 차지하고 있습니다. 해양 지진 데이터는 일반적으로 재현성과 일관된 진원, 진원과 수신기 결합에 적합한 조건, 매체로서의 물의 균일한 특성 등 몇 가지 유리한 조건으로 인해 육상보다 훨씬 더 높은 품질을 가지고 있습니다.

- Baker Hughes에 따르면 2022년 세계 평균 시추기 수는 1,824개로 2022년 세계 평균 1,747개보다 더 많습니다. 리그 수가 증가함에 따라 탐사 활동이 증가하여 지진 발생을 촉진할 것으로 예상됩니다. 세계 서비스 수요.

- 지난 1월, 쉘 PLC는 나미비아에서 상당한 양의 해양 석유와 가스를 발견했다고 발표했습니다. 시추의 초기 분석에 따르면 새로 발견 된 유정에는 2 억 5 천만 배럴에서 3 억 배럴의 석유와 가스가 포함되어있을 것으로 추정됩니다. 이번 발견 이후 상업적 석유 생산에 필요한 유층 개발 작업이 시장을 주도할 것으로 보입니다.

- 또한 노르웨이 석유총국은 선반에 남아있는 전체 자원의 약 47%를 발견해야할 것으로 추정하고 있습니다. 영국 대륙붕(UKCS)의 약 350개의 미개발 발견에는 32억 배럴의 석유 환산량(bboe)이 포함되어 있습니다.

- 따라서 심해 및 초심해 매장량의 탐사 및 생산(E&P) 활동 증가와 미발견 자원을 활용하기 위한 석유 및 가스 메이저의 노력 증가가 해양 지진 서비스 시장을 견인할 것으로 예상됩니다.

중동 및 아프리카는 큰 성장을 이룰 가능성이 높습니다.

- 해양 지진 조사는 석유 및 가스 매장지를 매핑하는 가장 저렴한 방법입니다. 이 접근법은 지하 구조물의 위치를 파악하고 굴절과 반사에 대한 데이터를 기록합니다. 조사에는 여러 정보 소스가 필요하기 때문에 데이터 수집을 위해 여러 WG가 사용됩니다.

- 중동 및 아프리카에서는 서아프리카 연안 등 미개발 자원이 많은 지역에서 해양 탐사가 증가하고 있으며, 이는 석유 및 가스 탐사 회사들에게 기회를 가져다주고 있습니다. 따라서 이 지역의 탐사는 지진 서비스 시장을 주도할 수 있습니다.

- 2022년 1월, 쉘 PLC는 나미비아 앞바다의 그래프1 유정에서 중요한 석유와 가스를 발견하여 나미비아에 대한 투자의 물결을 일으킬 수 있습니다. 시추 결과, 최소 60미터 깊이의 탄화수소층이 존재하며, 약 2억 5천만 배럴에서 3억 배럴 상당의 석유와 가스가 매장되어 있는 것으로 밝혀졌습니다. 이 분야는 시장을 견인할 것으로 예상되는 내진 조사 등 개발이 완료되고 2026년까지 생산이 시작될 예정입니다.

- 또한 2022년 1월, 호주의 지구과학 회사 서처(Searcher)는 다수의 석유 면허 광구를 대상으로 하는 다중 고객 조사 프로그램을 위해 남아프리카공화국 서해안에서 지진 조사를 시작했습니다. 허가 면적은 약 297,087 평방미터이며, 이 허가는 2 차원 및 3 차원 투기적 지진 탐사 프로그램의 실행을 규정하고 있습니다. 이는 이 지역 시장 성장을 가속할 수 있습니다.

- 따라서 새로운 석유 및 가스 발견, 내진 테스트 승인과 같은 위의 요인들은 예측 기간 동안 중동 및 아프리카의 지진 탐사 서비스 시장을 견인할 것으로 예상됩니다.

지진 탐사 서비스 산업 개요

지진 탐사 서비스 시장은 매우 집중되어 있습니다. 주요 기업으로는 Schlumberger NV, CGG SA, PGS ASA, TGS ASA, Halliburton Company 등이 있습니다.

지난 8월, 슐룸베르거와 마이크로소프트는 에너지 산업을 위한 개방적이고 확장 가능한 클라우드 네이티브 데이터 제품을 구축하기 위해 공동의 전문지식을 결합하는 다년 계약을 체결했습니다. 다음 단계에서는 OSDU 데이터 플랫폼의 개방성과 민첩성을 활용하여 최초의 클라우드 네이티브 지진 처리 솔루션인 DELFI 지진 처리 솔루션을 개발할 예정입니다. OSDU 데이터 플랫폼을 활용함으로써 파트너들은 현재의 지진 수요를 충족하는 혁신적인 용도과 워크플로우를 개발할 수 있는 비용 효율적인 기반을 제공받게 됩니다. 타사 개발자는 자체적으로 사용하거나 시장에 제공하기 위해 지진 처리 솔루션을 구축 및 강화할 수 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제조건

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 서론

- 2028년까지 시장 규모와 수요 예측(10억 달러)

- 최근 동향과 발전

- 정부 정책과 규제

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 공급망 분석

- Porter의 Five Forces 분석

- 공급 기업의 교섭력

- 소비자의 교섭력

- 신규 진출업체의 위협

- 대체 제품 및 서비스의 위협

- 경쟁 기업간 경쟁도

제5장 시장 세분화

- 서비스

- 데이터 수집

- 데이터 처리 및 분석

- 전개 장소

- 온쇼어

- 오프쇼어

- 지역

- 북미

- 미국

- 캐나다

- 기타 북미

- 아시아태평양

- 중국

- 인도

- 호주

- 기타 아시아태평양

- 유럽

- 독일

- 러시아

- 영국

- 프랑스

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 이란

- 이라크

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 인수합병(M&A)/합작투자(JV)/협업/계약

- 유력 기업이 채택한 전략

- 기업 개요

- Halliburton Company

- Briscoe Group Limited

- CGG SA

- Fugro NV

- ION Geophysical Corporation

- PGS ASA

- Polarcus Ltd

- SAExploration Holdings Inc.

- Schlumberger NV

- SeaBird Exploration PLC

- Shearwater GeoServices Holding AS

- TGS ASA

- Magseis Fairfield ASA(WGP Group Ltd)

- China Oilfield Services Limited

제7장 시장 기회와 향후 동향

- 심해 및 초심해 수자원 이용 가능성

The Seismic Services Market size is estimated at USD 5.61 billion in 2024, and is expected to reach USD 6.54 billion by 2029, growing at a CAGR of 3.10% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, factors such as increasing exploration in the offshore areas such as in West Africa and the Gulf of Mexico, coupled with the strengthening of crude oil prices, making the upstream activities economically feasible, are likely to drive the market.

- On the other hand, a lot of countries are shifting to renewable energy sources and ending their reliance on crude oil, which may restrain the market growth during the forecast period.

- Nevertheless, land-based and shallow-water oil fields have reached their maturity, and there is little scope for any new field discovery in these areas. Therefore, the development of deepwater and ultra-deepwater water reserves is expected to create significant opportunities for the seismic services market in the future.

Seismic Services Market Trends

Increasing Demand from the Offshore Oil and Gas Industry

- The offshore segment accounts for the largest share of the seismic services market. Offshore seismic data usually has much higher quality than onshore due to several favorable conditions, including repeatable and consistent sources, good conditions for coupling at sources and receivers, and the uniform property of water as the medium.

- According to Baker Hughes, the total world average rig count was 1,824 in 2022, more significant than the world average of 1,747 in 2022. With the increasing number of rigs, exploration activities will grow, which, in turn, is expected to drive the seismic services demand in the world.

- In January 2022, Shell PLC announced the discovery of a substantial offshore oil and gas well in Namibia. Early analysis of the exploratory drilling estimates that the newly discovered well could contain 250 to 300 million barrels of oil and gas. After this discovery, the reservoir development work necessary for commercial petroleum production will likely drive the market.

- Furthermore, the Norwegian Petroleum Directorate has estimated that around 47% of all the remaining resources on the shelf must be discovered. Around 350 undeveloped discoveries in the United Kingdom Continental Shelf (UKCS) contain 3.2 billion barrels of oil equivalent (bboe).

- Therefore, increasing exploration and production (E&P) activities in the deepwater and ultra-deepwater reserves and increasing efforts by the oil and gas majors to tap into the undiscovered resources are expected to drive the offshore seismic services market.

Middle-East and Africa is Likely to Experience Significant Growth

- The Offshore Seismic Survey is the least expensive method of mapping oil and gas deposits. This approach locates subsurface structures and records data on refraction and reflection. Because the survey requires more than one source, several WGs are employed to collect data.

- Middle-East and Africa is witnessing increasing offshore exploration in regions such as offshore West Africa, which has widespread untapped resources, creating opportunities for the oil and gas exploration companies. Thus, explorations in this region are likely to drive the seismic services market.

- In January 2022, Shell PLC made a significant oil and gas discovery in the Graff-1 well in offshore Namibia, which can spark a wave of investment in Namibia. The drilling results have shown one layer of at least 60 meters deep of hydrocarbons, holding an estimated 250 to 300 million barrels of oil and gas equivalent. The field expects to go into production by 2026 after its development, including seismic surveys, which are expected to drive the market.

- Furthermore, in January 2022, the Australian geoscience company Searcher started its seismic survey off the West Coast of South Africa for a multi-client survey program that covers a number of petroleum license blocks. The permit area is approximately 297,087 m2, and the permit provides for the undertaking of a two-dimensional and three-dimensional speculative seismic survey program. This is likely to aid the growth of the market in the region.

- Therefore, the above-mentioned factors, such as new oil and gas discoveries and approvals for seismic testing, are expected to drive the seismic services market in the Middle-East and Africa region over the forecast period.

Seismic Services Industry Overview

The seismic services market is highly concentrated. Some of the major companies include (not in a particular order ) Schlumberger NV, CGG SA, PGS ASA, TGS ASA, and Halliburton Company, among others.

In August 2022, Schlumberger and Microsoft have signed a multi-year agreement to pool joint expertise and build open and extensible cloud-native data products for the energy industry. The next phase will use the openness and agility of the OSDU Data Platform to develop the first cloud-native seismic processing solution - DELFI Seismic Processing. By leveraging the OSDU Data Platform, the partners are providing a cost-effective foundation for developing innovative applications and workflows to address current seismic needs. Third-party developers will build and augment seismic processing solutions, either for their internal use or to offer to the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Exploration in Offshore Areas

- 4.5.1.2 The Strengthening of Crude Oil Prices, Making the Upstream Activities Economically Feasible

- 4.5.2 Restraints

- 4.5.2.1 Shifting to Renewable Energy Sources

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Service

- 5.1.1 Data Acquisition

- 5.1.2 Data Processing and Interpretation

- 5.2 Location of Deployment

- 5.2.1 Onshore

- 5.2.2 Offshore

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States of America

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Asia-Pacific

- 5.3.2.1 China

- 5.3.2.2 India

- 5.3.2.3 Australia

- 5.3.2.4 Rest of Asia-Pacific

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 Russia

- 5.3.3.3 United Kingdom

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of the South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Iran

- 5.3.5.4 Iraq

- 5.3.5.5 Rest of the Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Halliburton Company

- 6.3.2 Briscoe Group Limited

- 6.3.3 CGG SA

- 6.3.4 Fugro NV

- 6.3.5 ION Geophysical Corporation

- 6.3.6 PGS ASA

- 6.3.7 Polarcus Ltd

- 6.3.8 SAExploration Holdings Inc.

- 6.3.9 Schlumberger NV

- 6.3.10 SeaBird Exploration PLC

- 6.3.11 Shearwater GeoServices Holding AS

- 6.3.12 TGS ASA

- 6.3.13 Magseis Fairfield ASA (WGP Group Ltd)

- 6.3.14 China Oilfield Services Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Availability of Deepwater and Ultra-Deepwater Water Reserves