|

시장보고서

상품코드

1635514

동남아시아의 오프쇼어 지진 탐사 시장 : 시장 점유율 분석, 산업 동향, 성장 예측(2025-2030년)Southeast Asia Offshore Seismic Survey - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

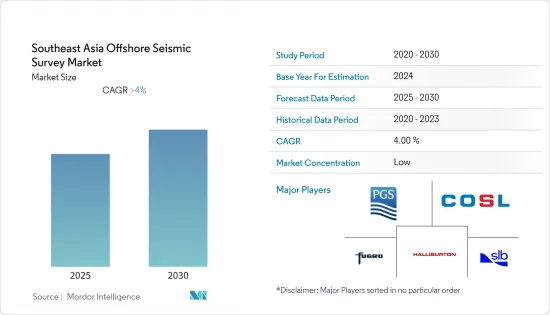

동남아시아의 오프쇼어 지진 탐사 시장은 예측기간 중 4% 이상의 CAGR로 추이할 전망입니다.

시장은 2020년에 COVID-19의 악영향을 받았습니다.

주요 하이라이트

- 중기적으로는 석유 및 가스 탐사에 있어서의 지진 탐사 기술의 이용 확대와 해상 풍력 발전에 대한 투자 증가가 시장의 성장을 견인할 것으로 전망됩니다.

- 한편, 지진 탐사에 수반하는 고비용이 예측 기간 중 시장 성장의 방해가 될 것으로 예상됩니다.

- 지진 탐사 기술의 진보 증가는 동남아시아의 오프쇼어 지진 탐사 시장에 유리한 성장 기회를 가져올 가능성이 높습니다.

- 말레이시아는 예측기간 중에 큰 성장을 이루고 CAGR이 가장 높아질 것으로 예상됩니다.

동남아시아 오프쇼어지진 탐사시장 동향

시장을 독점하는 데이터 취득

- 지진 탐사 데이터를 얻는 것은 지구 내부의 퇴적 분지의 이미지를 얻는 것을 목표로합니다.

- 2021년, 인도네시아는 동남아시아 최대의 산유국이며, 일량 58만 5,000 배럴을 생산하고 있었습니다.

- 데이터의 취득은 멀티 클라이언트 조사, 또는 독자 조사에 의해 행해집니다. 물리 탐사 회사는 데이터를 소유하는 클라이언트를 위해서 독자적인 조사를 개발해, 통상은 한정된 에이커를 커버합니다.

- 2022년 7월, PGS는 3D 탐사와 4D 취득의 2개의 계약을 획득해, 합계 약 5개월의 캠페인을 실시했습니다.

- 지진 탐사 데이터의 취득은 2D 또는 3D의 어느 쪽이라도 가능합니다. 큰 데이터 영역을 수집하는 경우나 3D 탐사가 경제적으로 실행 불가능한 경우에 사용됩니다.

- 전체적으로 주로 동남아시아의 해상풍력발전이나 석유 및 가스섹터로부터의 오프쇼어 지진 탐사 서비스에 대한 수요 증가는 예측기간 중에 오프쇼어 지진 탐사 시장을 증가시킬 가능성이 높습니다.

현저한 성장을 이루는 말레이시아

- 말레이시아의 석유 및 가스 부문은 2020년 시점에서 GDP의 20%를 차지하고 있으며, 이 나라의 경제에 필수적입니다. 가스(LNG)를 수출하는 세계 제4위의 수출국입니다.

- 2021년의 말레이시아의 천연 가스 생산량은 약 630억 3,000만 입방미터입니다. 천연 가스 생산량은 전년대비 6.6% 증가했스빈다.

- 말레이시아의 석유 및 가스 생산의 대부분은 3개의 생산 지역의 해저 유전으로부터 얻어지고 있습니다. 이미 존재하는 유전으로부터의 생산량을 증강해, 사라왁 해와 사바 해안의 심해에서 신광구를 개발하는 것으로, 새로운 투자 기회를 개척하는 것에 주력하고 있습니다.

- 2022년 3월, Petronas는 사바주와 사라왁의 해안에 위치한 5개의 해상광구에 대해 새롭게 4개의 생산물분여계약(PSC)을 체결했습니다. 2021년 2월, Petronas는 사바주 해안에 위치하는 SB412, 2W, X, 사라왁주 해안에 위치하는 SK439/SK440의 5개의 해양 탐광광의 PSC에 조인했습니다.

- 2021년 7월 TGS ASA, PGS ASA, Schlumberger의 WesternGeco는 말레이시아 해안 사라왁 해봉에서 2021년 10월에 시작하는 6,400제곱킬로미터의 멀티 클라이언트 3D 조사를 위한 사전 자금을 확보했습니다. 이 조사는 말레이시아의 국영 석유회사 Petronas가 2020년에 발주한 사라왁 해봉에서 5년간 최대 10만 5,000제곱킬로미터의 멀티 클라이언트 3D 데이터를 취득·처리하는 복수년 계약의 제1단계입니다.

- 전체적으로 말레이시아는 해양석유 및 가스와 해상풍력발전에 대한 투자 증가로 오프쇼어 지진 탐사 서비스 수요가 중간 정도에서 고성장할 것으로 예상됩니다.

동남아시아 오프쇼어 지진 탐사 산업 개요

동남아시아 오프쇼어 지진 탐사 시장은 그 특성상 적당히 통합되어 있습니다. 이 시장의 주요 기업(순부동)에는 Halliburton Company, Schlumberger Ltd, Fugro NV, PGS ASA, China Oilfield Services Limited 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 소개

- 2027년까지 시장 규모와 수요 예측(단위: 10억 달러)

- 최근 동향과 개발

- 정부의 규제와 시책

- 시장 역학

- 성장 촉진요인

- 억제요인

- 공급망 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 서비스별

- 데이터 취득

- 데이터 처리 및 해석

- 섹터별

- 석유 및 가스

- 풍력

- 지역별

- 태국

- 싱가포르

- 인도네시아

- 말레이시아

- 기타 동남아시아 지역

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 프로파일

- Halliburton Company

- BGP Inc.

- CGG SA

- Fugro NV

- ION Geophysical Corporation

- PGS ASA

- China Oilfield Services Limited

- SAExploration Holdings Inc.

- Schlumberger Ltd

- TGS NOPEC GEOPHYSICAL COMPANY ASA(TGS ASA)

- Shearwater GeoServices AS

제7장 시장 기회와 앞으로의 동향

JHS 25.01.31The Southeast Asia Offshore Seismic Survey Market is expected to register a CAGR of greater than 4% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, the increasing use of seismic technology for oil and gas exploration and increasing investments in offshore wind are expected to drive the market's growth.

- On the other hand, the high costs associated with the seismic survey are expected to hamper the market's growth during the forecast period.

- Nevertheless, increasing seismic survey technology advancements will likely create lucrative growth opportunities for the Southeast Asia offshore seismic survey market.

- Malaysia is expected to witness significant growth and the highest CAGR during the forecast period. This growth is attributed to the increasing investments, coupled with supportive government policies, in the country.

Southeast Asia Offshore Seismic Survey Market Trends

Data Acquisition to Dominate the Market

- Seismic data acquisition aims to obtain an image of the sedimentary basins in the earth's interior. It helps create models that facilitate exploration companies to make better-informed exploration and drilling decisions.

- In 2021, Indonesia was the largest oil producer in Southeast Asia, producing 585,000 barrels per day. In the same year, Malaysia produced around 508,000 barrels daily, making it the second-largest oil producer in the region.

- Data is acquired through multi-client surveys or on a proprietary basis. A geophysical company develops proprietary surveys for a client who owns the data and usually covers limited acreage.

- In July 2022, PGS won two contracts for 3D exploration and 4D acquisition, totaling a roughly five-month campaign. In particular, the business signed its first contract for a 3D exploration acquisition offshore Indonesia with an unnamed oil company.

- Seismic data could be acquired for either 2D or 3D imaging. In the 2D seismic acquisition, sources and receivers are deployed along a line on the surface, and the output is a line graphical representation of the subsurface. 2D seismic acquisition is used when collecting large data areas and when a 3D survey is not economically viable.

- Overall, the increasing demand for offshore seismic services from the offshore wind and oil and gas sectors, mainly in Southeast Asia, will likely increase the offshore seismic survey market during the forecast period.

Malaysia to Witness Significant Growth

- Malaysia's oil and gas sector is vital to its economy as it contributes 20% to the GDP as of 2020. The country has the second largest proven reserves in Southeast Asia and is the world's fourth-largest exporter of liquified natural gas (LNG), totaling 35.1 billion cubic meters in 2021, and is strategically located amid important routes for seaborne energy trade.

- In 2021, Malaysia's natural gas production was approximately 63.03 billion cubic meters. Natural gas production has witnessed 6.6% growth compared to the previous year.

- Most of Malaysia's oil and gas production comes from offshore fields in three producing regions: Peninsular Malaysia (Malay Basin), Sarawak, and Sabah. Further, to offset the production declines from mature fields, the government focuses on opening new investment opportunities by enhancing output from existing fields and developing new areas in deepwater offshore Sarawak and Sabah. This has increased the demand for offshore seismic services in the country.

- In March 2022, Petronas signed four new Production Sharing Contracts (PSCs) for five offshore blocks located off the coast of Sabah and Sarawak. Additionally, in February 2021, Petronas signed PSCs for five offshore exploration blocks, SB412, 2W, and X, located off the coast of Sabah, and SK439/SK440, located off the coast of Sarawak.

- In July 2021, TGS ASA, PGS ASA, and Schlumberger's WesternGeco secured pre-funding for a 6,400 square kilometer multi-client 3D survey starting in October 2021 in the Sarawak Basin, offshore Malaysia. The survey is the first phase of a multi-year contract awarded by the Malaysian national oil firm Petronas in 2020 to acquire and process up to 105,000 square kilometers of multi-client 3D data over five years in the Sarawak Basin.

- Overall, Malaysia is expected to witness moderate to high growth in the demand for offshore seismic services, driven by increasing investments in offshore oil and gas and offshore wind power.

Southeast Asia Offshore Seismic Survey Industry Overview

The Southeast Asia offshore seismic survey market is moderately consolidated in nature. Some of the major players in the market (in no particular order) include Halliburton Company, Schlumberger Ltd, Fugro NV, PGS ASA, and China Oilfield Services Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Service

- 5.1.1 Data Acquisition

- 5.1.2 Data Processing and Interpretation

- 5.2 By Sector

- 5.2.1 Oil and Gas

- 5.2.2 Wind

- 5.3 By Geography

- 5.3.1 Thailand

- 5.3.2 Singapore

- 5.3.3 Indonesia

- 5.3.4 Malaysia

- 5.3.5 Rest of Southeast Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Halliburton Company

- 6.3.2 BGP Inc.

- 6.3.3 CGG SA

- 6.3.4 Fugro NV

- 6.3.5 ION Geophysical Corporation

- 6.3.6 PGS ASA

- 6.3.7 China Oilfield Services Limited

- 6.3.8 SAExploration Holdings Inc.

- 6.3.9 Schlumberger Ltd

- 6.3.10 TGS NOPEC GEOPHYSICAL COMPANY ASA (TGS ASA )

- 6.3.11 Shearwater GeoServices AS

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

샘플 요청 목록