|

시장보고서

상품코드

1687223

푸드서비스용 포장 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Food Service Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

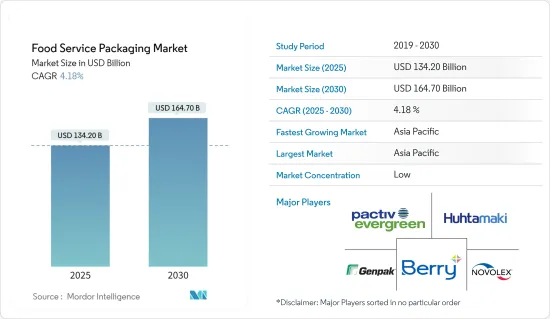

푸드서비스용 포장 시장 규모는 2025년에 1,342억 달러로 추정되고, 예측 기간인 2025-2030년 CAGR 4.18%로 성장할 전망이며, 2030년에는 1,647억 달러에 달할 것으로 예측됩니다.

주요 하이라이트

- 온라인 배달 플랫폼 및 모바일 앱은 푸드서비스용 포장 제품의 성장에 박차를 가하고 있습니다. 기술이 먹거리 전망을 재형성하고 더 많은 투자를 불러들임에 따라 이 급증은 더욱 강해질 것으로 보입니다. 서드파티의 온라인 음식 주문 서비스는 급증할 것으로 예상되며, 다수의 소규모 독립 음식점이 보다 광범위한 고객 기반을 획득할 수 있게 됩니다. 게다가 온라인 배달 음식 트럭을 포함한 퀵 서비스 레스토랑(QSR)의 성장은 식품 서비스용 포장, 특히 일회용 포장의 수요를 강화합니다.

- 최근 몇 년간 온라인 주문과 레스토랑 딜리버리는 20% 이상의 성장을 이루었습니다. 온라인 식품 배달 시스템의 채택이 증가함에 따라 지속가능한 포장의 수요와 사용이 높아지면서 제조사들은 지속가능한 포장 솔루션을 선택하게 되고 있습니다.

- 카페와 레스토랑은 세계적으로 증가 추세에 있으며, 푸드서비스용 포장 시장을 뒷받침하고 있습니다. CBN-Data가 보고한 것처럼 중국만 해도 카페 수는 2022년 11만 5,820에서 2023년 13만 2,830개로 급증했습니다. 이 카페 수의 증가는 푸드서비스용 포장 수요를 직접 촉진합니다. 많은 카페가 테이크 아웃 옵션을 우선시하는 것을 고려하면 종이 봉투나 플라스틱 용기 등의 포장의 필요성이 가장 중요합니다. 그 결과, 카페나 레스토랑이 확대되면서 소매용 봉투의 수요도 증가 일로를 걷고 있습니다.

- Hinojosa와 같은 몇몇 포장 회사는 음식 식품 산업에서 보다 친환경 소비 습관을 촉진하기 위해 기업을 지원하고 전략적으로 경쟁 우위로서 지속가능성을 포함하는 것을 용이하게 하고 있습니다. 외식산업은 플라스틱 포장 수요가 가장 큰 산업 중 하나로 2021년에는 플라스틱 사용량이 33% 이상 증가했습니다.

주요 하이라이트

- 2023년 3월, Hinojosa Packaging Group은 식품에 접해도 안전한 인쇄 방법을 이용해 다양한 솔루션을 제공하는 푸드서비스용 포장 제품의 새로운 시리즈를 출시했습니다. 이 용기는 모두 재활용 가능한 종이로 구성되어 생분해성이기 때문에 다른 포장과는 차별화되어 있습니다.

- 그러나 지속 가능한 포장은 개발 비용이 높고 과제도 많습니다. 많은 기업들은 더 많은 자원을 필요로 하고, 더 나은 포장을 위해서는 연구개발에 대한 투자가 필요합니다. 포장 합리화를 통한 비용 절감 가능성도 고려해야 합니다. 지속가능한 포장을 사용하는 비용은 기존 포장보다 높습니다. 이것은 관련된 재료와 그 조달(버진과 중고 양쪽 모두), 확립되지 않은 공급망, 제조 프로세스, 규모의 경제성이 낮기 때문입니다.

- 강화된 포장재료와 커스터마이즈는 푸드서비스용 포장 시장의 성장에 있어 매우 중요한 촉진요인입니다. 이것들은 진화하는 소비자의 기호에 대응할 뿐만 아니라, 브랜드 ID 확인을 강화해, 지속 가능성에 대한 염려에 임하는 것이기도 합니다. 2024년 4월, 식품 포장의 큰 혁신가인 Sabert Corporation은 최신 제품군을 발표했습니다. : 펄프 프로틴 트레이와 청과물 트레이입니다. 상업적으로 퇴비화 가능하다는 것이 증명된 이러한 트레이는 외식 사업자에게 기존의 발포 트레이를 대체할 지속가능한 선택지를 제공하고, 게다가 톱 클래스의 품질과 성능을 유지하고 있습니다.

외식 포장 시장 동향

퀵 서비스 레스토랑(QSR)이 가장 큰 점유율을 차지할 전망

- KFC, Domino's, Starbucks 등 세계의 대기업과 지역 밀착형 기업이 제공하는 메뉴가 급증하고, 세계 소비자의 퍼스트 식품에 대한 관심이 높아지고 있습니다. 이 동향에 박차를 가하고 있는 것은, 외식 지향의 고조, 이문화 음식 기호의 융합, 어지러운 생활 속에서의 패스트 식품의 편리성입니다. QSR 부문의 성장은 국제적 브랜드가 제공하는 다양한 요리 선택지에 의해 뒷받침되고 있습니다. 인구 구성의 변화와 밀레니얼 세대와 베이비붐 세대의 건강 지향의 고조는 건강을 우선으로 한 식품에 대한 수요를 증폭시키고 있습니다.

- QSR은 합리적인 가격의 퍼스트 식품에 특화되어 서비스의 효율을 우선하고 있습니다. QSR은 테이블 서비스를 최소화하고 셀프 서비스를 중시함으로써 기존 음식점과는 차별화하고 있습니다. 일반적으로 QSR은, 경질 폴리스티렌(PS), 발포 폴리스티렌(EPS), 폴리프로필렌(PP), 폴리에틸렌 테레프탈레이트(PET), 폴리젖산(PLA)등의 일회용 플라스틱 제품을 이용하고 있습니다.

- 봉쇄 동안 많은 카페와 레스토랑은 커브 사이드 픽업과 캐리 아웃에 중점을 두었습니다. 또, 점포내의 용량을 삭감해, 식품 배달의 수요에 응하기 위해서 혁신적인 배달 서비스를 도입하는 가게도 있었습니다. 그 결과, 식음료 산업은 외식 산업용 포장의 수요 확대를 창출할 태세를 갖추었습니다. 이 배경에는 위생과 지속가능성이 중시되면서 포장재료로서 종이가 최전선으로 밀려 올라간 것이 큰 영향을 미치고 있습니다.

- 발포 스티롤 컵, 플라스틱 뚜껑, 무기질 고기가 보급되는 가운데, 산업은 점점 환경 친화적 인 방향으로 방향을 전환하고 있습니다. 지속가능한 프랙티스에 대한 고객의 기호의 고조에 힘입어 많은 기업이 보다 에코 프렌들리 대체품을 도입하고 있습니다. 맥도날드의 독립계 프랜차이지인 Arcos Dorados Holdings는, 2024년 6월에 J&J Green Paper의 '올 천연' 배리어 코팅을 채용했습니다. 이 움직임은 플라스틱과 PFAS 화학품을 배제하고 소비자의 폐기물을 줄이는 것을 목적으로 한 것으로, 퍼스트 식품 산업의 지속 가능성에 대한 대처에 있어서 중요한 한 걸음이 되었습니다.

- 온 더 고 다이닝의 추세와 식비 증가는 QSR 부문을 강화하여 푸드서비스 포장에 대한 수요를 높입니다. Yum! Brands의 2024년 2월 보고서에 따르면 KFC의 세계 매장 수는 2020년 약 2만 5,000개에서 2023년 경이로운 2만 9,900개로 급증했습니다. 이러한 QSR 점포의 세계의 증가는, 향후 몇 년간에 식품 서비스용 포장의 요구를 한층 더 확대시킬 자세입니다.

아시아태평양이 가장 큰 시장 점유율을 차지

- 아시아태평양은 인구 밀도가 높은 국가들과 중국과 인도와 같은 신흥 경제국으로 구성되어 있습니다. 식품 서비스의 수요는 급속히 증가하고 있고, 지속가능한 포장의 채용이 기세를 올리고 있습니다.

- 플라스틱은 소비자의 편리성 문화의 기반을 형성하는 포장 산업에 필수적인 요소입니다. 높은 가성비로 인해 외식 산업에서는 골판지, 유리, 금속과 같은 기존의 포장 재료가 플라스틱으로 대체되어 왔습니다.

- 퇴비화 가능한 푸드서비스 브랜드의 CHUK는 퀵 커머스 기업의 Blinkit를 지속 가능 파트너로 맞이했습니다. Blinkit은 CHUK의 제품을 10분 안에 소비자에게 전달하여 소비자와 CHUK의 다리를 놓아줍니다. 이 파트너십을 통해 CHUK는 2022-2023년에는 이 플랫폼에서 소비자에게 1조 개의 상품을 제공하게 됩니다.

- 일본은 1인당 포장재 소비량이 많아 식품 산업과 포장 산업은 밀접한 관계에 있습니다. 일본의 식품 제조업체는, 하이테크 포장 기술을 사용해, 포장 디자인에 창의 궁리를 하는 경향이 있는 것으로 알려져 있습니다. 이러한 포장 기술 혁신에의 주력은, 일본에서 매력적이고 효율적인 포장 솔루션의 개발로 이어졌습니다.

- 인도에서는 지난 몇 년간 중국 요리, 인도 요리, 일본 요리, 범아시아 요리 등 다양한 유형의 아시아 요리의 소비가 증가했기 때문에 FSR이 강력한 성장을 이루었습니다. 인도 요리는 동아시아 문화의 영향을 크게 받고 있으며 특히 젊은 세대에 인기가 있습니다.

- Speciality Restaurants의 보고서에 의하면, 2023년도에는 인도의 Speciality Restaurants Limited의 점포수는 약 127점이 되어, 2년전의 117점으로부터 증가했습니다. 이러한 증가세는 향후 몇 년간 지속될 것으로 예상되며, 이에 따라 외식 포장 제품의 수요가 강화됩니다.

- 산업 관계자에 의하면 외식 포장 제조업체는 외형이 좋고 비용 효율적이며 오래 지속되는 연질 포장에 매료되고 있습니다. India Brand Equity Foundation(IBEF)에 따르면 인도의 식품 및 식료품 시장은 세계 제6위로 소매가 매출의 70%를 차지했습니다. 인도의 식품 가공 산업은 동 국의 식품 시장 전체의 32%를 차지해 생산, 소비, 수출, 기대되는 성장에 있어 제 6위에 랭크되어 있습니다.

푸드서비스용 포장 산업 개요

푸드서비스용 포장 시장은 세분화되어 있으며, 많은 진출기업이 그 제공품에 의해 강한 존재감을 나타내고 있습니다. 혁신과 수요로 인해 시장은 신규 참가 기업에게 매력적입니다.

- 2023년 9월-Berry는 소비자 사용 후 재생 플라스틱을 적어도 30%(PCR) 포함하는 식품 등급의 저밀도 폴리에틸렌(LLDPE) 필름으로, 연질 플라스틱 포장에 식품 등급의 재생 재료를 도입했습니다. 견고한 필름 포트폴리오에 대한 이 추가를 통해 베리는 식품 포장에 PCR을 포함하겠다는 브랜드의 지속 가능성에 대한 약속에 대한 솔루션을 제공했습니다.

- 2023년 2월-Pactiv Evergreen은 AmSty와 협력하여 순환 형 폴리스티렌 식품 포장 제품을 출시했습니다. 팩티브 에버그린의 포장에는 AmSty의 ISCC PLUS 인증 재생 폴리스티렌이 사용되며, 에버그린은 매스 밸런스 배분을 이용한 선진 재활용 기술에서 탄생한 ISCC PLUS 인증 소비자 사용 후 재생 폴리스티렌에 링크된 포장을 구매할 수 있는 기능을 고객에게 제공하기 시작했습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 산업의 매력-Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

- 산업 생태계 분석

제5장 시장 역학

- 시장 성장 촉진요인

- 주요 시장에서 높아지는 편의식품 수요

- 지속가능성 중시로 재생 플라스틱에 대한 벤더 주목의 고조

- 시장의 과제

- 환경 압력 및 폴리머 가격 불안정성에 의한 연포장의 꾸준한 성장

제6장 시장 세분화

- 제품 유형별

- 골판지 상자 및 판지

- 플라스틱 병

- 트레이, 접시, 식품 용기 및 그릇

- 컵 및 뚜껑

- 클램쉘

- 기타

- 최종 사용자 산업별

- 퀵 서비스 레스토랑(QSR)

- 풀 서비스 레스토랑(FSR)

- 시설

- 접객(다이닝 인, 커피 및 스낵 등)

- 기타

- 지역별

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 아시아

- 중국

- 일본

- 인도

- 호주 및 뉴질랜드

- 라틴아메리카

- 브라질

- 아르헨티나

- 멕시코

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 남아프리카

- 북미

제7장 경쟁 구도

- 기업 프로파일

- Pactiv Evergreen Inc.

- Dart Container Corporation

- Amhil North America

- Genpak LLC

- Huhtamaki Oyj

- Berry Global Inc.

- Novolex Holdings LLC

- Sabert Corporation

- Silgan Plastic Food Container

- B& R Plastics Inc.

- Graphic Packaging International Inc.

- Amcor PLC

- Sonoco Products Company

제8장 투자 분석

제9장 시장의 미래

AJY 25.05.02The Food Service Packaging Market size is estimated at USD 134.20 billion in 2025, and is expected to reach USD 164.70 billion by 2030, at a CAGR of 4.18% during the forecast period (2025-2030).

Key Highlights

- Online delivery platforms and mobile apps fuel the growth of foodservice packaging products. This surge is poised to intensify as technology reshapes the food landscape, drawing in more investments. Third-party online food ordering services are expected to surge, empowering numerous small, independent eateries to tap into a wider customer base. Additionally, the growth of quick service restaurants (QSRs), including online delivery food trucks, bolsters the demand for foodservice packaging, especially disposables.

- Over the last few years, online food ordering and restaurant delivery have grown more than 20%. With the increasing adoption of the online food delivery system, the demand and use of sustainable packaging are rising, causing manufacturers to opt for sustainable packaging solutions.

- Cafes and restaurants worldwide are on the rise, propelling the foodservice packaging market. In China alone, the cafe count surged from 115.82 thousand in 2022 to 132.83 thousand in 2023, as reported by CBN-Data. This uptick in cafe numbers directly fuels the demand for foodservice packaging. Given that many cafes prioritize takeout options, the need for packaging, such as paper bags and plastic containers, becomes paramount. Consequently, with the expanding cafe and restaurant landscape, the demand for retail bags is poised to climb.

- Several packaging companies, such as Hinojosa, assist firms in promoting more environmentally friendly consumption habits in the food and beverage industry, strategically making it easier to include sustainability as a competitive advantage. Foodservice was one of the industries with the most significant demand for plastic packaging, which witnessed plastic usage climb by more than 33% in 2021.

- In March 2023, Hinojosa Packaging Group launched a new line of foodservice packaging products that offers a range of solutions using printing methods safe for contact with food. This container is constructed entirely of recyclable paper and is biodegradable, which makes it stand out from other packaging.

- However, sustainable packaging can be expensive and challenging to develop. Many businesses need more resources, and investing in R&D would be required for better packaging. The potential cost savings from streamlined packaging must be considered. The cost of using sustainable packaging is higher than conventional packaging. This is due to the materials involved and their sourcing (both virgin and used), the less-established supply chains, manufacturing processes, and lower economies of scale.

- Enhanced packaging materials and customization are pivotal drivers of growth in the foodservice packaging market. They not only meet evolving consumer preferences but also bolster brand identity and tackle sustainability concerns. In April 2024, Sabert Corporation, a leading innovator in food packaging, unveiled its latest range: Pulp Protein and Produce Trays. These Trays, certified as commercially compostable, offer foodservice operators a sustainable choice over conventional foam trays, all while maintaining top-tier quality and performance.

Key Highlights

Food Service Packaging Market Trends

Quick Service Restaurants (QSR) Are Expected to Hold the Largest Share

- Global consumers are increasingly turning to fast food, with a surge in offerings from global giants like KFC, Domino's, and Starbucks, as well as regional players. This trend is fueled by the growing penchant for dining out, a melding of cross-cultural dietary tastes, and fast food's convenience in fast-paced lives. The QSR segment's growth is bolstered by the diverse culinary options offered by international brands. Shifting population demographics and a growing health consciousness among millennials and baby boomers are amplifying the demand for food products that prioritize wellness.

- QSRs specialize in affordable, fast food and prioritize service efficiency. They stand out from traditional dining establishments by offering minimal table service and a strong focus on self-service. Commonly, QSRs utilize single-use plastic products such as rigid polystyrene (PS), expanded polystyrene (EPS), polypropylene (PP), polyethylene terephthalate (PET), and polylactic acid (PLA).

- During the lockdowns, many cafes and restaurants pivoted to emphasize curbside pickup and carryout exclusively. Others slashed their in-store capacities, introducing innovative delivery services to meet the demand for food delivery. As a result, the food and beverage industry is poised to generate increased demand for foodservice packaging. This can be largely attributed to the heightened emphasis on hygiene and sustainability, propelling paper to the forefront as a preferred packaging material.

- Amidst the prevalence of styrofoam cups, plastic lids, and inorganic meat, the industry is increasingly pivoting toward eco-friendliness. Driven by a rising customer preference for sustainable practices, numerous companies are embracing greener alternatives. Arcos Dorados Holdings, an independent McDonald's franchisee, adopted J&J Green Paper's 'all-natural' barrier coating in June 2024. This move aimed to eliminate plastics and PFAS chemicals and reduce consumer waste, marking a significant step in the fast food industry's sustainability efforts.

- The rising trend of on-the-go dining and heightened food expenditures have bolstered the QSR segment, consequently driving up the demand for foodservice packaging. As per Yum! Brands' February 2024 report, the global count of KFC outlets surged from approximately 25,000 in 2020 to a staggering 29,900 by 2023. This global uptick in QSR establishments is poised to further escalate the need for foodservice packaging in the coming years.

Asia-Pacific Accounts for the Largest Market Share

- Asia-Pacific comprises densely populated countries and emerging economies like China and India. The demand for foodservice is growing rapidly, and the adoption of sustainable packaging is gaining momentum; it is expected to increase further during the forecast period.

- Plastic is an essential part of the packaging industry that forms the foundation of the consumer convenience culture. Owing to their cost-to-performance ratio, traditional packaging materials, such as corrugated paper boards, glass, and metals, have been substituted by plastics in foodservice.

- CHUK, a compostable foodservice brand, joined quick commerce firm Blinkit as its sustainability partner. Blinkit delivers CHUK's products to consumers within 10 minutes, bridging the gap between the consumers and CHUK. The partnership helped CHUK to serve one crore pieces to consumers on the platform FY 2022-23.

- Japan has a high per capita consumption of packaging materials, and there is a close relationship between the food and packaging industries in the country. Japanese food manufacturers are known for using high-tech packaging techniques and their tendency toward ingenuity in packaging designs. This focus on packaging innovation has led to the development of attractive and efficient packaging solutions in Japan.

- There has been strong growth of FSRs in India during the past years due to the rise in the consumption of different varieties of Asian cuisine, including Chinese, Indian, Japanese, and Pan-Asian. Indian cuisine is significantly influenced by East Asian culture and is particularly popular among the younger generation.

- As per the Speciality Restaurants report, in FY 2023, there were about 127 outlets of Speciality Restaurants Limited in India, up from 117 stores two years prior. This uptrend is also expected to be witnessed in the upcoming years, thereby bolstering the demand for foodservice packaging products.

- According to industry insiders, foodservice packaging manufacturers are gravitating toward flexible packaging as it is visually appealing, cost-effective, and long-lasting. According to the India Brand Equity Foundation (IBEF), the Indian food and grocery market is the sixth-largest globally, with retail accounting for 70% of sales. The Indian food processing industry accounted for 32% of the country's overall food market, ranking sixth in production, consumption, export, and expected growth.

Food Service Packaging Industry Overview

The foodservice packaging market is fragmented, as many players have a strong presence due to their offerings. With innovations and demand, the market is attractive for new players.

- September 2023: Berry introduced food-grade recycled content in flexible plastic packaging with food-grade low-density polyethylene (LLDPE) films containing at least 30% (PCR) post-consumer recycled plastic. Through this addition to its robust film portfolio, Berry offered brands a solution to their sustainability commitments to include PCR in food packaging.

- February 2023: Pactiv Evergreen collaborated with AmSty to launch Circular Polystyrene Food Packaging Products, where Pactiv Evergreen packaging will use ISCC PLUS-certified recycled polystyrene from AmSty, and Evergreen will begin offering customers the ability to purchase packaging linked to ISCC PLUS-certified post-consumer recycled polystyrene derived from advanced recycling technologies using mass balance allocation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Ecosystem Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand For Convenience Food Continues In Major Markets

- 5.1.2 Increasing Vendor Focus On Recycled Plastic Due To Emphasis On Sustainability

- 5.2 Market Challenges

- 5.2.1 Steady Growth Of Flexible Packaging Due To Environmental Pressure And Uncertainty In Polymer Prices

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Corrugated Boxes And Cartons

- 6.1.2 Plastic Bottles

- 6.1.3 Trays, Plates, Food Containers, And Bowls

- 6.1.4 Cups And Lids

- 6.1.5 Clamshells

- 6.1.6 Other Product Types

- 6.2 By End-user Industries

- 6.2.1 Quick Service Restaurants (QSR)

- 6.2.2 Full-service Restaurants (FSR)

- 6.2.3 Institutional

- 6.2.4 Hospitality (Dine-ins, Coffee & Snack, Etc.)

- 6.2.5 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Spain

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Australia and New Zealand

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Argentina

- 6.3.4.3 Mexico

- 6.3.5 Middle East and Africa

- 6.3.5.1 Saudi Arabia

- 6.3.5.2 United Arab Emirates

- 6.3.5.3 South Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Pactiv Evergreen Inc.

- 7.1.2 Dart Container Corporation

- 7.1.3 Amhil North America

- 7.1.4 Genpak LLC

- 7.1.5 Huhtamaki Oyj

- 7.1.6 Berry Global Inc.

- 7.1.7 Novolex Holdings LLC

- 7.1.8 Sabert Corporation

- 7.1.9 Silgan Plastic Food Container

- 7.1.10 B&R Plastics Inc.

- 7.1.11 Graphic Packaging International Inc.

- 7.1.12 Amcor PLC

- 7.1.13 Sonoco Products Company

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

샘플 요청 목록