|

시장보고서

상품코드

1850153

유체 생검 시장 : 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Fluid Biopsy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

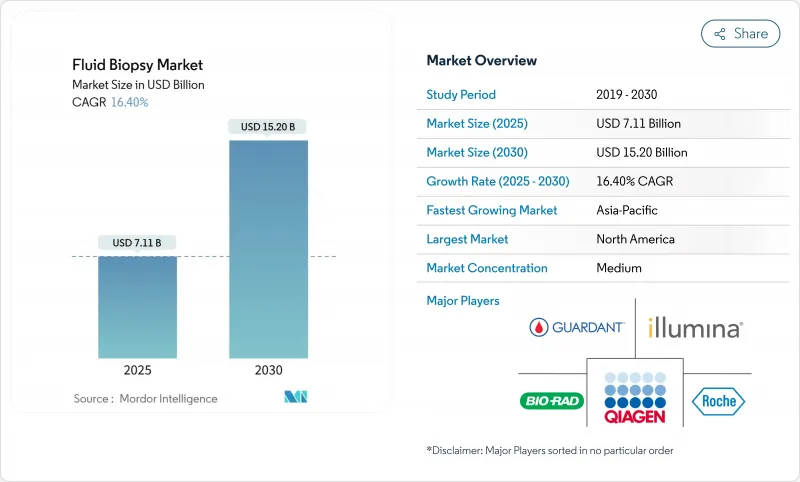

유체 생검 시장 규모는 2025년에 71억 1,000만 달러, 2030년에는 152억 달러로 확대될 것으로 예측되며, CAGR은 16.40%를 나타낼 전망입니다.

AI가 유도하는 신속한 신호 농축 기술, Medicare 적용 범위 확대, 여러 FDA 획기적인 장비 지정으로 유체 생검은 정밀 종양학 워크플로우의 일상적인 요소로 자리매김합니다. 머신러닝에 의한 단편 믹스는 조기 암에서 순환 종양 DNA(ctDNA)의 검출을 개선하고 한때 스크리닝 프로그램을 제한했던 낮은 수율 장벽을 완화합니다. 차세대 시퀀서(NGS)와 턴어라운드 시간을 단축하는 분산형 오토메이션을 결합한 플랫폼 개발 기업에 대한 1회의 자금 조달액은 현재 1억 500만 달러를 초과하고 있습니다. 신흥기업이 소프트웨어 중심의 툴을 제공하고, 감도, 가격, 확장성으로 기존 기업에 과제하고 있기 때문에 경쟁의 격렬함이 증가하고 있습니다. 아시아태평양의 규제 민첩성과 위험이 높은 인구가 많아지면서 성장 가능성이 커지고 있는 반면, 북미는 상환의 확실성과 연구 깊이를 통해 리더십을 유지하고 있습니다.

세계 유체 생검 시장 동향과 통찰

비침습성 종양 진단에 대한 선호도 증가

보다 안전한 수술을 요구하는 환자의 요망이, 암 검진의 형태를 바꾸었습니다. 가던트 헬스의 차폐 분석에 대한 메디케어의 2025년 보험 적용은 일상적인 스크리닝에서 리퀴드 바이옵시의 유용성을 검증하고 퇴역군 인국의 수혜자에 대한 액세스를 확대합니다. 조직 생검의 합병증은 병존 질환에 의해 급증하기 때문에 노인 코호트가 가장 혜택을 받습니다. 실시간 혈액 기반 모니터링을 통해 암 전문의는 이미지 기반 일정보다 빨리 치료를 변경할 수 있으며 유체 생검 시장 솔루션에 대안이 아닌 보완적인 역할을 합니다. 외래 진료소에서는 샘플 채취에 필요한 것은 사혈 기술뿐이므로이 검사는 즉시 채택됩니다. 이 동향은 분산 검사 수요를 강화하고 정기적인 시약 수입을 지원합니다.

AI 구동형 플래그메노믹스가 조기단계의 검출 정밀도를 높입니다.

머신러닝 모델은 비소세포 폐암의 임상시험에서 무세포 DNA로부터 단편의 길이, 말단 모티프, 메틸화 패턴을 해석하여 조기 종양을 92%의 감도와 90%의 특이성으로 확인할 수 있게 되었습니다. Weill Cornell Medicine의 MRD-EDGE 프로토콜은 엑스레이 사진으로 재발하기 몇 달 전에 잔존 병변을 검출하여 선제적인 치료 전환을 촉진합니다. 존스 홉킨스의 ARTEMIS-DELFI 플랫폼은 실시간으로 췌장암의 반응 지표를 제공하여 지금까지 감시에서 벗어난 악성 종양을 다루고 있습니다. 이러한 발전으로 AI는 미래의 유체 생검 시장 플랫폼의 핵심 인프라가 될 것입니다. 세계 데이터 세트를 통한 지속적인 알고리즘 트레이닝은 AI 네이티브 분석과 기존 분석의 성능 차이를 확대할 가능성이 높습니다.

높은 검사 비용과 상환 장애물

종합적인 액체 바이옵시 패널의 1 회당 평균 사용 가격은 여전히 2,800 달러이며 종양학 예산에 제약이있는 시스템에서 채택하기가 어렵습니다. 의료 경제 모델에 따르면 비용 효과의 임계값에 도달하려면 대장의 2차 스크리닝 가격을 3분의 2까지 낮춰야 합니다. 지불측의 심사주기는 여전히 길고, 분석적 타당성 데이터보다 임상적 유용성에 대한 확고한 증거가 요구됩니다. 신흥 시장은 수입 시약의 예산 편성을 복잡하게 하는 환율 변동 위험에도 직면하고 있습니다. 확장 가능한 제조가 2자리 비용 절감을 달성할 때까지 3차 의료기관 이외의 보급은 소폭 유지될 수 있습니다.

부문 분석

2024년에는 EGFR, ALK, MET 억제제 치료의 선택을 이끄는 복수의 FDA 인가 동반진단제에 의해 리더십이 강화되어 폐에의 응용이 매출 전체의 33.55%를 차지합니다. 유체 생검 시장은 충분히 매핑된 돌연변이 프로파일과 임상적으로 필요한 진행 중 반복 검사로부터 이익을 얻고 있으며 시약의 풀스루를 뒷받침하고 있습니다. 췌장 프로그램은 소규모로 시작되었지만 며칠 이내에 실용적인 지식을 제공하는 AI 대응 응답 모니터링 플랫폼의 강점으로 예측 CAGR은 18.25%로 눈부신 성장을 나타냅니다. 리퀴드 바이옵시를 기준선의 병기 분류 프로토콜에 통합하도록 병원을 촉구합니다.

실제 데이터에서 유방암과 대장암 팀은 이미징주기 동안 혈액 기반 감시를 추가하여 방사선과의 평균 이용률을 15% 줄였습니다. BRCA 양성의 전이성 거세 저항성의 승인에 의해 전립선암의 적응증은 유전체 연구소 뿐만이 아니라 비뇨기과 클리닉에까지 검사가 확대해, 견인역이 되고 있습니다. 난소암과 위암의 임상시험은 멀티오믹스 어세이가 돌연변이 중심의 패널에 없는 후성적 서명을 발견하고 꾸준히 진전하고 있습니다. 종양의 유형을 불문하고 다양한 채택은 단일 효능에 의한 상환의 역풍에 대한 수익 사이클의 쿠션이 되고, 유체 생검 시장은 안정된 확대 경로를 유지하고 있습니다.

ctDNA는 2024년 바이오마커 매출의 45.53%를 차지하며, 10년에 걸친 임상 검증의 적층과 규제 당국의 클리어런스를 반영하고 있습니다. 그러나 소포 기반 분석은 19.15%의 연평균 복합 성장률(CAGR)로 확대되었습니다. 지질막은 분석물을 분해로부터 보호하고, 스테이지 i의 진단에서 보다 높은 분석 감도를 초래하기 때문입니다. 엑소좀 내의 단백질과 RNA 카고의 복합 분석은 위양성의 확인을 개선하는 직교 데이터를 제공합니다. ctDNA와 소포 지표를 결합한 다항목 검사는 양성 적중률을 이미지 검사와 동등한 범위로 밀어 올려 검사 위험을 수반하지 않습니다.

순환 종양 세포는 전이 진행의 표현형 결정과 틈새 관련성을 가지고 있으며, 마이크로 RNA 서명은 조직 진단 프로그램을 보충합니다. 통합 AI 파이프라인은 현재 단편 믹스, 메틸화, 소포 수송 데이터를 융합하여 10 mm 이하의 종양 부하로 조직 기원 예측을 가능하게 합니다. 조기 발견을 우선하는 투자자는 감도의 장애물이 클리어되면 스크리닝 코드 세트에 대한 프리미엄 상환을 기대해 소포 스타트업에 자본을 돌려보냅니다. 바이오마커 경쟁은 수익원을 다양화하고, 단일 분석에 대한 의존도를 낮추고, 유체 생검 업계 전체의 혁신을 촉진합니다.

지역 분석

북미는 2024년 유체 생검 시장 매출의 38.72%를 차지하며, FDA의 브레이크 스루 패스웨이, 메디케어의 두꺼운 보장, 산학 연계의 조밀한 에코시스템에 지지되고 있습니다. 미국의 종양학 네트워크가 검사량의 대부분을 흡수하고 캐나다와 멕시코에 국경을 넘어 환자가 지역 수요를 증진하고 있습니다. 검체 취급 기준을 조화시키기 위한 현재 진행 중인 정책 노력은 검사실 간의 편차를 줄이고 질의 지표에 연결된 상환 수준을 지키는 것을 목적으로 하고 있습니다.

중국, 일본, 인도가 분자 종양학 예산을 확대함에 따라 아시아태평양의 2030년까지 연평균 복합 성장률(CAGR)은 가장 빠른 19.52%를 기록합니다. 중국이 2024년 메틸화 기반 간암 분석을 승인한 것은 규제 당국이 국내 혁신을 촉진할 의지가 있음을 강조합니다. 일본의 표적 치료제에 대한 최근의 동반진단제의 승인은 제품 사이클을 가속화하는 정교한 규제 당국과 산업계의 상호 작용을 반영합니다. 정부의 제조 장려 조치는 지역 특유의 시약 비용을 낮추고 더욱 보급을 촉진합니다.

유럽은 성숙하고 있지만 아직 확대 도상에 있습니다. 체외진단제에 관한 규제가 통일되어 에비던스 패키지가 충실해 온 것으로, 각국의 지불자는 파일럿 프로그램 이외의 MRD 모니터링에도 보험금을 지불하게 되었습니다. 독일, 프랑스, 영국은 종합적인 유전체 보고서를 중시하는 종합암 센터를 통해 시장 수요를 지지하고 있습니다. 남유럽과 스칸디나비아는 취득 비용을 절감하는 범유럽 조달 방식을 통해 이를 추구합니다. 중동 및 아프리카, 남미는 아직 발전도상이지만 임상시험 참여가 증가하고 있으며, 상환경로가 정식으로 확립되면 장기적인 상업적 기회가 있을 것으로 예상됩니다..

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 비침습성 종양 진단에 대한 관심 증가

- 세계의 암 발병률의 급증

- 시퀀싱 비용 저하 및 NGS 워크플로우 자동화

- 미소잔존병변(MRD) 혈액검사의 상환확대

- AI를 활용한 단편 믹스로 조기 발견의 정밀도 향상

- 분산형 유체 생검 플랫폼에의 벤처 캐피탈의 유입

- 시장 성장 억제요인

- 고액의 검사 비용과 상환의 장애물

- 새로운 광학 생검 및 영상 진단의 대체 수단

- 분석 전의 샘플 처리의 편차

- 조기 종양에서 ctDNA 수율 감소

- 기술의 전망

- Porter's Five Forces

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 업계 간 경쟁

제5장 시장 규모와 성장 예측

- 적응증별

- 폐암

- 유방암

- 대장암

- 전립선암

- 췌장암

- 기타 적응증

- 바이오마커유형별

- 순환 종양 세포(CTC)

- 순환 종양 DNA(ctDNA)

- 유리 DNA(cfDNA)

- 세포외 소포/엑소좀

- 기타 바이오마커(miRNA, TEP, 단백질)

- 제품 및 서비스별

- 키트 및 시약

- 장비 및 플랫폼

- 소프트웨어와 바이오인포매틱스

- 테스트 서비스

- 기술별

- 차세대 시퀀싱(NGS)

- 디지털 PCR/ddPCR

- 실시간 PCR

- 마이크로어레이와 qPCR

- 기타(나노포어, 랩 온칩 등)

- 최종 사용자별

- 레퍼런스 랩

- 병원 및 의사의 검사실

- 학술연구센터

- CRO와 바이오의약품

- 샘플 유형별

- 혈액(혈장/혈청)

- 소변

- 타액·가래

- 뇌척수액

- 기타 체액

- 지역

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 호주

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 시장 점유율 분석

- 기업 프로파일

- Guardant Health

- Roche Diagnostics

- Illumina Inc.

- Grail Inc.

- Bio-Rad Laboratories

- Qiagen NV

- Foundation Medicine

- Natera Inc.

- Thermo Fisher Scientific

- Exact Sciences

- NeoGenomics Laboratories

- Inivata Ltd

- Lucence Diagnostics

- Predicine Inc.

- LungLife AI Inc.

- Exosome Diagnostics

- Biocept Inc.

- Angle plc

- Adaptive Biotechnologies

- Singlera Genomics

- Oncocyte Corporation

제7장 시장 기회와 장래의 전망

SHW 25.11.07The fluid biopsy market size stands at USD 7.11 billion in 2025 and is forecast to advance to USD 15.20 billion by 2030, reflecting a 16.40% CAGR.

Rapid AI-guided signal-enrichment techniques, broader Medicare coverage, and multiple FDA breakthrough device designations position fluid biopsies as a routine component of precision oncology workflows. Machine-learning fragmentomics improves detection of circulating tumor DNA (ctDNA) in early-stage cancers, mitigating the low-yield barrier that once limited screening programs. Investment momentum remains strong: single funding rounds now exceed USD 105 million for platform developers that combine next-generation sequencing (NGS) with decentralized automation to shorten turnaround times. Competitive intensity is rising as emerging players deliver software-centric tools that challenge incumbents on sensitivity, price, and scalability. Asia-Pacific's regulatory agility and large at-risk population create outsized growth potential, while North America retains leadership through reimbursement certainty and research depth.

Global Fluid Biopsy Market Trends and Insights

Rising Preference for Non-Invasive Oncology Diagnostics

Patient demand for safer procedures has re-shaped cancer work-ups. Medicare's 2025 coverage of Guardant Health's Shield assay validates liquid biopsy utility for routine screening and extends access to Veterans Affairs beneficiaries. Elderly cohorts gain most because tissue biopsy complications rise sharply with comorbidities. Real-time blood-based monitoring allows oncologists to modify therapy sooner than imaging-based schedules, giving fluid biopsy market solutions a complementary role rather than a replacement one. Outpatient clinics adopt the tests quickly because sample collection requires only phlebotomy skills. The trend reinforces decentralized testing demand and underpins recurring reagent revenue.

AI-Driven Fragmentomics Boosting Early-Stage Detection Accuracy

Machine-learning models now interpret fragment length, end motif, and methylation patterns from cell-free DNA to identify early tumors with 92% sensitivity at 90% specificity in non-small cell lung cancer trials. Weill Cornell Medicine's MRD-EDGE protocol detects residual disease months before radiographic relapse, facilitating pre-emptive therapy switches. Johns Hopkins' ARTEMIS-DELFI platform provides real-time pancreatic cancer response metrics, addressing a malignancy that historically evaded surveillance. These advances make AI the core infrastructure for future fluid biopsy market platforms. Continuous algorithm training with global data sets will likely widen performance gaps between AI-native and conventional assays.

High Test Cost & Reimbursement Hurdles

Comprehensive liquid biopsy panels still average USD 2,800 per use, challenging adoption in systems with constrained oncology budgets. Health-economic models indicate prices must drop by two-thirds for second-line colorectal screening to reach cost-effectiveness thresholds. Payer review cycles remain lengthy, demanding robust clinical-utility evidence rather than analytical-validity data. Emerging markets face additional currency fluctuation risks that complicate budgeting for imported reagents. Until scalable manufacturing achieves double-digit cost reductions, uptake outside premium tertiary centers may remain modest.

Other drivers and restraints analyzed in the detailed report include:

- Sequencing-Cost Decline & NGS Workflow Automation

- Reimbursement Expansion for Minimal Residual-Disease Blood Tests

- Low ctDNA Yield in Early-Stage Tumors

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, lung applications generated 33.55% of overall revenues, consolidating leadership through multiple FDA-cleared companion diagnostics that guide EGFR, ALK, and MET inhibitor therapy selections. The fluid biopsy market benefits from well-mapped mutation profiles and the clinical necessity of repeat testing at progression, which boosts reagent pull-through. Pancreatic programs, although starting smaller, post an impressive 18.25% forecast CAGR on the strength of AI-enabled response monitoring platforms that deliver actionable insight within days. Broad payer support for therapy-selection panels encourages hospitals to integrate liquid biopsy into baseline staging protocols.

Real-world data show breast and colorectal oncology teams now add blood-based surveillance between imaging cycles, cutting average radiology utilization by 15%. Prostate cancer indications gain traction after BRCA-positive metastatic castration-resistant approvals expanded testing beyond genomic labs to urology clinics. Ovarian and gastric trials progress steadily as multi-omics assays uncover epigenetic signatures absent in mutation-centric panels. Adoption diversity across tumor types helps cushion revenue cycles against single-indication reimbursement headwinds and keeps the fluid biopsy market on a stable expansion path.

ctDNA supplied 45.53% of the 2024 biomarker revenue, reflecting a decade of cumulative clinical validation and regulatory clearance. However, vesicle-based assays are scaling at a 19.15% CAGR because lipid membranes protect analytes from degradation, yielding higher analytical sensitivity in Stage I diagnoses. Combined protein and RNA cargo analysis inside exosomes supplies orthogonal data that improve false-positive discrimination. Multi-analyte tests pairing ctDNA with vesicle metrics push positive predictive values into imaging-equivalent ranges without procedural risks.

Circulating tumor cells hold niche relevance for phenotyping metastatic progression, while microRNA signatures supplement histology-agnostic programs. Integrative AI pipelines now fuse fragmentomics, methylation, and vesicle-cargo data, enabling tissue-of-origin predictions with sub-10-millimeter tumor burden. Investors prioritizing early-detection claims channel capital into vesicle startups, anticipating premium reimbursement for screening code sets once sensitivity hurdles are cleared. The biomarker race diversifies revenue streams, reducing single-analyte dependence and fostering innovation across the fluid biopsy industry.

The Fluid Biopsy Market Report is Segmented by Indication (Lung Cancer, Breast Cancer, and More), Biomarker Type (Circulating Tumor Cells, and More), Product & Service (Kits & Reagents, and More), Technology (Next-Generation Sequencing (NGS), and More), End User (Reference Laboratories and More), Sample Type (Blood, Urine, and More), and Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America controlled 38.72% of global fluid biopsy market revenue in 2024, supported by FDA breakthrough pathways, generous Medicare coverage, and a dense ecosystem of academic-industry collaborations. United States oncology networks absorb the majority of test volumes, while cross-border patients to Canada and Mexico augment regional demand. Ongoing policy efforts to harmonize sample-handling standards aim to reduce inter-lab variability and protect reimbursement levels tied to quality measures.

Asia-Pacific records the fastest 19.52% CAGR through 2030 as China, Japan, and India expand molecular oncology budgets. China's 2024 approval of a methylation-based liver cancer assay underscores regulatory willingness to catalyze domestic innovation. Japan's recent companion diagnostic endorsements for targeted therapies reflect sophisticated regulator-industry dialogue that accelerates product cycles. Government-linked manufacturing incentives lower localized reagent costs, further stimulating uptake.

Europe occupies a mature but still expanding position. Harmonized in-vitro diagnostic regulation, coupled with growing evidence packages, prompts national payers to reimburse MRD monitoring beyond pilot programs. Germany, France, and the United Kingdom anchor market demand through comprehensive cancer centers that value integrated genomic reports. Southern Europe and Scandinavia follow via pan-European procurement schemes that cut acquisition costs. Middle East, Africa, and South America remain nascent but demonstrate increasing trial participation, foreshadowing longer-term commercial opportunities once reimbursement pathways formalize.

- Guardant Health

- Roche

- Illumina

- Grail

- Bio-Rad Laboratories

- Qiagen N V

- Foundation Medicine

- Natera

- Thermo Fisher Scientific

- Exact Sciences

- NeoGenomics Laboratories

- Inivata

- Lucence Diagnostics

- Predicine Inc.

- LungLife AI

- Exosome Diagnostics

- Biocept

- Angle plc

- Adaptive Biotechnologies

- Singlera Genomics

- Oncocyte Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Preference For Non-Invasive Oncology Diagnostics

- 4.2.2 Rapid Increase In Global Cancer Incidence

- 4.2.3 Sequencing-Cost Decline & NGS Workflow Automation

- 4.2.4 Reimbursement Expansion For Minimal Residual-Disease (MRD) Blood Tests

- 4.2.5 AI-Driven Fragmentomics Boosting Early-Stage Detection Accuracy

- 4.2.6 Venture Capital Inflow To Decentralized Fluid-Biopsy Platforms

- 4.3 Market Restraints

- 4.3.1 High Test Cost & Reimbursement Hurdles

- 4.3.2 Emerging Optical-Biopsy & Imaging Substitutes

- 4.3.3 Pre-Analytical Sample-Handling Variability

- 4.3.4 Low ctDNA Yield In Early-Stage Tumors

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Industry Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Indication

- 5.1.1 Lung Cancer

- 5.1.2 Breast Cancer

- 5.1.3 Colorectal Cancer

- 5.1.4 Prostate Cancer

- 5.1.5 Pancreatic Cancer

- 5.1.6 Other Indications

- 5.2 By Biomarker Type

- 5.2.1 Circulating Tumour Cells (CTCs)

- 5.2.2 Circulating Tumour DNA (ctDNA)

- 5.2.3 Cell-free DNA (cfDNA)

- 5.2.4 Extracellular Vesicles / Exosomes

- 5.2.5 Other Biomarkers (miRNA, TEPs, proteins)

- 5.3 By Product & Service

- 5.3.1 Kits & Reagents

- 5.3.2 Instruments & Platforms

- 5.3.3 Software & Bioinformatics

- 5.3.4 Testing Services

- 5.4 By Technology

- 5.4.1 Next-Generation Sequencing (NGS)

- 5.4.2 Digital PCR / ddPCR

- 5.4.3 Real-Time PCR

- 5.4.4 Microarray & qPCR

- 5.4.5 Other (Nanopore, Lab-on-Chip, etc.)

- 5.5 By End User

- 5.5.1 Reference Laboratories

- 5.5.2 Hospital & Physician Labs

- 5.5.3 Academic & Research Centers

- 5.5.4 CROs & Biopharma

- 5.6 By Sample Type

- 5.6.1 Blood (Plasma/Serum)

- 5.6.2 Urine

- 5.6.3 Saliva / Sputum

- 5.6.4 Cerebrospinal Fluid

- 5.6.5 Other Body Fluids

- 5.7 Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 India

- 5.7.3.4 South Korea

- 5.7.3.5 Australia

- 5.7.3.6 Rest of Asia-Pacific

- 5.7.4 Middle East and Africa

- 5.7.4.1 GCC

- 5.7.4.2 South Africa

- 5.7.4.3 Rest of Middle East and Africa

- 5.7.5 South America

- 5.7.5.1 Brazil

- 5.7.5.2 Argentina

- 5.7.5.3 Rest of South America

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Guardant Health

- 6.3.2 Roche Diagnostics

- 6.3.3 Illumina Inc.

- 6.3.4 Grail Inc.

- 6.3.5 Bio-Rad Laboratories

- 6.3.6 Qiagen N V

- 6.3.7 Foundation Medicine

- 6.3.8 Natera Inc.

- 6.3.9 Thermo Fisher Scientific

- 6.3.10 Exact Sciences

- 6.3.11 NeoGenomics Laboratories

- 6.3.12 Inivata Ltd

- 6.3.13 Lucence Diagnostics

- 6.3.14 Predicine Inc.

- 6.3.15 LungLife AI Inc.

- 6.3.16 Exosome Diagnostics

- 6.3.17 Biocept Inc.

- 6.3.18 Angle plc

- 6.3.19 Adaptive Biotechnologies

- 6.3.20 Singlera Genomics

- 6.3.21 Oncocyte Corporation

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment