|

시장보고서

상품코드

1445816

일본 인슐린 제제 및 딜리버리 디바이스 시장 : 시장 점유율 분석, 업계 동향과 통계, 성장 예측(2024-2029년)Japan Insulin Drugs and Delivery Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

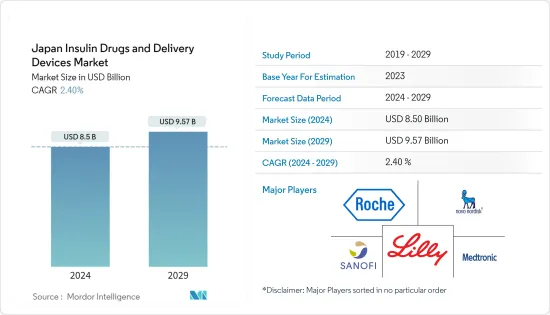

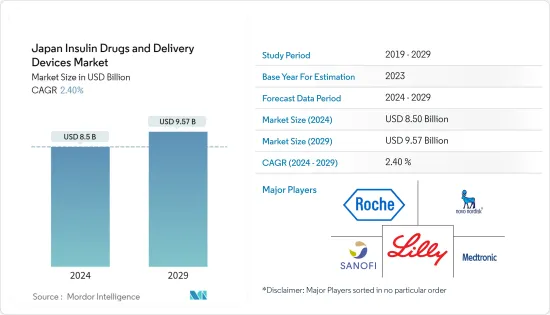

일본 인슐린 제제 및 딜리버리 디바이스 시장 규모는 2024년에 85억 달러로 추정되고, 2029년까지 95억 7,000만 달러에 달할 것으로 예측되고 있으며, 예측 기간(2024년부터 2029년) 동안 복합 연간 성장률(CAGR) 2.40%로 성장할 전망입니다.

COVID-19의 유행 중 일본인 희생자의 수는 기타 국가에 비해 적었습니다. 때문에 생각할 수 있습니다. 병원의 혼잡을 완화하기 위해 오사카 부는 환자를 경증, 중등증, 중증으로 분류하여 다양한 대체 숙박 시설에 할당했습니다. 환자는 국가 정부의 지침에 따라 병원에서 치료를 받았습니다. 중간 정도의 환자, 즉 컴퓨터 단층 촬영에 특징이 있음에도 불구하고 허용 가능한 산소 포화 수준을 가진 환자에 중점을 둡니다. 1형 당뇨병은 면역계의 기능 장애로 인해 발생하지만, 2형 당뇨병은 좌석이 없는 라이프스타일과 관련되어 있으며, 이는 선천적인 인슐린 저항성의 발병으로 이어집니다. 그 결과, 1형 당뇨병은 인슐린 요구성으로 분류되고, 2형 당뇨병은 인슐린 의존성으로 분류됩니다. 일본은 세계 최대의 고령자 인구를 안고 있기 때문에 2형 당뇨병의 발병이 보다 일어나기 쉬워지고 있습니다. 고령화가 진행되는 일본에서는 당뇨병이 보다 일반적으로 되고 있습니다. 심혈관 질환, 신장 장애 및 기타 다양한 상태와 같은 악영향을 피하기 위해 혈당 수치를 모니터링하고 관리하는 것이 더 일반적입니다.

앞서 언급한 요인의 결과, 조사 대상 시장은 분석 기간 동안 성장할 것으로 예상됩니다.

일본 인슐린 제제 및 딜리버리 디바이스 시장 동향

일본 당뇨병과 비만 인구 증가

일본에서는 병에 걸리기 쉬운 고령자 증가에 가세해 운동 부족이나 불규칙한 식생활에 의한 비만 증가에 의해 당뇨병 환자가 증가하고 있는 것으로 생각되고 있습니다. 또 다른 이유는 생활습관병 예방을 목적으로 2008년에 도입된 대사 증후군 검사 결과에 따라 의료기관을 진찰하고 대사 증후군으로 진단받는 사람이 늘어났기 때문입니다. 고령화가 진행되는 일본에서는 당뇨병 환자가 더욱 증가할 것으로 예상됩니다. 당뇨병은 세계 유행병으로 부상하고 있습니다. IDF 2021 데이터에 따르면 일본에는 약 1,100만 명의 당뇨병 환자가 있습니다. 1형 당뇨병은 면역계의 기능부전으로 인한 반면, 2형 당뇨병은 앉지 않은 라이프스타일과 연관되어 있으며 고유의 인슐린 저항성을 유발합니다. 그 결과, 1형 당뇨병은 인슐린 요구성으로 분류되고, 2형 당뇨병은 인슐린 의존성으로 분류됩니다. 일본은 세계 최대의 고령자 인구를 안고 있기 때문에 2형 당뇨병의 발병이 보다 일어나기 쉬워지고 있습니다. 고령화가 진행되는 일본에서는 당뇨병이 보다 일반적으로 되고 있습니다. 심혈관 질환 및 신장 장애와 같은 악영향을 피하기 위해 혈당치의 모니터링과 관리가 일반적으로 되고 있습니다.

위와 같은 요인으로 인해 시장이 더욱 확대될 것으로 예상됩니다.

인슐린 펌프 부문은 예측 기간 동안 최고의 성장률을 나타낼 것으로 예상

인슐린은 패치에 부착된 캐뉼라를 통해 피하로 전달됩니다. 펌프를 AID 시스템과 독립적으로 사용하는 경우, 리모컨으로 기초 및 볼러스와 같은 투여 설정을 조정할 수 있습니다.

예측 저혈당 관리(PLGM) 인슐린 펌프가 일본에 도입되었습니다. 센서는 저혈당 수치를 감지하거나 예측할 때 인슐린 투여를 자동으로 일시 중지합니다. 일본인의 1형 당뇨병 환자에 있어서의 인슐린 펌프 사용자수는 약 1만명으로 추정되고 있어 일본에서는 아직 인슐린 펌프가 침투하고 있지 않다고 생각됩니다. 센서 확장 펌프 요법을 갖춘 MiniMed 620G 장치(Medtronic, 노스리지, 캘리포니아, 미국)는 일본 펌프 사용자 수가 적음을 반영하여 2015년 2월에 출시되었으며, MiniMed 640G 장치는 각각 몇년후 2018년 3월에 출시되었습니다. 기기가 유럽 국가에서 출시되었습니다. MiniMed 640G 장치의 예측적 저혈당 관리(PLGM) 구성요소는 센서가 저혈당 수치를 감지하거나 혈당 수치가 미리 설정된 저혈당 한도를 20 mg/dL(1.1 mmol/L) 초과할 때 예상되는 경우 인슐린 투여를 자동으로 일시 중지합니다. 30분.

당뇨병은 후생 노동성(MHLW)에 의해 우선 건강 관리로 확인됩니다. 2형 당뇨병의 이환율의 높이는 심각한 경제적 부담과 관련이 있습니다. 당뇨병의 비용은 고혈압이나 고지혈증 등의 병존 질환이 있는 환자나 합병증을 발병한 환자에서는 증가합니다. 합병증의 수가 증가하면 비용도 증가합니다. 일본에서는 의료보험제도가 정비되어, 당뇨병의 의료비는 전액 부담되고, 당뇨병 환자는 자유롭게 의사의 진찰을 받을 수 있습니다. 또한 자가주사에 의한 인슐린요법도 합법이 되어 건강보험이 적용됩니다. 이러한 이점은 일본 시장에서 이러한 제품의 채용을 촉진했습니다.

일본 인슐린 제제 및 납품 장치 산업 개요

일본 인슐린 제제 및 전달 장치 시장은 통합되어 있으며 주요 제너릭 기업은 거의 없습니다. 최근 양사간에 이루어진 합병과 인수는 양사가 시장에서의 존재감을 강화하는 데 도움이 되었습니다. Eli Lilly와 Boehringer Ingelheim은 바사그라(인슐린 글라진)의 개발과 상품화에 있어 제휴 관계를 맺고 있습니다. 또한, 최근의 기업은 기업이 시장에서의 존재감을 강화하는 데 도움이되었습니다. 예를 들어, Novo Nordisk는 Ypsomed와 협력하여 더 나은 인슐린 치료 솔루션을 제공했습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 시장 성장 억제요인

- Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체 제품 및 서비스의 위협

- 경쟁 기업간 경쟁 관계의 격렬

제5장 시장 세분화

- 의약품

- 기초 인슐린 또는 장시간 작용형 인슐린

- 란타스(인슐린 글라진)

- 레베밀(인슐린 데테밀)

- 토우조(인슐린 글라진)

- 트레시버(인슐린 데글루덱)

- 바사그라(인슐린 글라진)

- 볼러스 또는 즉효형 인슐린

- NovoRapid/Novolog(인슐린 아스파르트)

- 휴머로그(인슐린 리스프로)

- 아피드라(인슐린 룰리신)

- FIASP(인슐린 아스파르트)

- Admelog(인슐린 리스프로 사노피)

- 기존 인간 인슐린

- Novolin/믹스타드/액터피드/인슐라타드

- 후무린

- Insuman

- 혼합 인슐린

- NovoMix(이상성 인슐린 아스파르트)

- Ryzodeg(인슐린 데글루덱 및 인슐린 아스파르트)

- Xultophy(인슐린 데글루덱 및 리라글루티드)

- Soliqua/Suliqua(인슐린 글라진 및 릭시세나티드)

- 바이오시밀러 인슐린

- Insulin glargine biosimilars

- Human insulin biosimilars

- 기초 인슐린 또는 장시간 작용형 인슐린

- 디바이스

- 인슐린 펌프

- 인슐린 펌프 장치

- 인슐린 펌프 저장소

- 인슐린 주입 세트

- 인슐린 펜

- 재사용 가능한 펜 카트리지

- 일회용 인슐린 펜

- 인슐린 주사기

- 인슐린 제트 인젝터

- 인슐린 펌프

제6장 시장 지표

- 1형 당뇨병의 인구

- 2형 당뇨병의 인구

제7장 경쟁 구도

- 기업 프로파일

- Novo Nordisk

- Sanofi

- Eli Lilly

- Biocon

- Julphar

- Medtronic

- Ypsomed

- Becton Dickinson

- 기업 점유율 분석

제8장 시장 기회와 장래의 동향

BJH 24.03.15The Japan Insulin Drugs and Delivery Devices Market size is estimated at USD 8.5 billion in 2024, and is expected to reach USD 9.57 billion by 2029, growing at a CAGR of 2.40% during the forecast period (2024-2029).

The number of Japanese victims during the COVID-19 pandemic was lower than in other countries, possibly due to genetic differences, aspects of Japanese culture, and coagulation system characteristics that are less potent in Japanese than in Caucasians. To relieve overcrowding in hospitals, the prefectural government of Osaka classified patients as mild, moderate, or severe and assigned them to various alternative accommodations. Patients were cared for in hospitals in accordance with national government guidelines. Concentrating on moderate patients, that is, those with acceptable oxygen saturation levels despite the presence of characteristics on computed tomography. While Type 1 diabetes is caused by an immune system malfunction, Type 2 diabetes is associated with a sedentary lifestyle, which leads to the development of inherent insulin resistance. As a result, Type 1 diabetes can be classified as insulin-requiring, whereas Type 2 diabetes can be classified as insulin-dependent. Japan has one of the world's largest elderly populations, making it more vulnerable to the onset of type 2 diabetes. Diabetes is becoming more common in Japan as the country's population ages. Blood glucose monitoring and management are becoming more common in order to avoid negative consequences such as cardiovascular disease, kidney disorders, and a variety of other conditions.

As a result of the aforementioned factors, the studied market is expected to grow during the analysis period.

Japan Insulin Drugs And Delivery Devices Market Trends

Growing Diabetes and Obesity Population in Japan

Diabetes cases are thought to be increasing in Japan due to an increase in the number of older adults, who are more vulnerable to disease, as well as an increase in obesity due to a lack of exercise and irregular eating habits. Another reason is that more people have been diagnosed with the disease due to being referred to a medical facility based on the results of the metabolic syndrome examination, which was introduced in 2008 to prevent lifestyle-related diseases. Diabetes cases are expected to rise even further in Japan as the population ages. Diabetes has emerged as a global epidemic; according to IDF 2021 data, Japan has approximately 11 million diabetics. While an immune system malfunction causes Type 1 diabetes, Type 2 diabetes is associated with a sedentary lifestyle, leading to inherent insulin resistance. As a result, Type 1 diabetes can be classified as insulin-requiring, whereas Type 2 diabetes can be classified as insulin-dependent. Japan has one of the world's largest elderly populations, making it more vulnerable to the onset of type 2 diabetes. Diabetes is becoming more common in Japan as the country's population ages. Blood glucose monitoring and management are becoming more popular to avoid negative consequences such as cardiovascular disease, kidney disorders, etc.

Because of the factors above, the market is expected to expand further.

The Insulin Pumps Segment is Expected to Witness Highest Growth Rate Over the Forecast Period

Insulin is delivered subcutaneously via a cannula attached to a patch. When the pump is used independently of the AID system, a remote control can adjust administration settings such as basal and bolus.

A predictive low-glucose management (PLGM) insulin pump was introduced in Japan. The sensor automatically suspends insulin delivery when it detects or predicts low glucose levels. The number of insulin pump users among Japanese patients with type 1 diabetes mellitus is estimated to be around 10,000, implying that the insulin pump has not yet permeated Japan. The MiniMed 620G device (Medtronic, Northridge, CA, USA) with sensor-augmented pump therapy was launched in February 2015, reflecting the small number of pump users in Japan, and the MiniMed 640G device was launched in March 2018, several years after each device was launched in European countries. The MiniMed 640G device's predictive low-glucose management (PLGM) component automatically suspends insulin delivery when the sensor detects low glucose values or glucose values are predicted to rise to 20 mg/dL (1.1 mmol/L) above a preset low-glucose limit within 30 minutes.

Diabetes has been identified as a healthcare priority by the Ministry of Health, Labour, and Welfare (MHLW). The high prevalence of type 2 diabetes is associated with a significant economic burden. The costs of diabetes are increased in patients with co-morbidities such as hypertension and hyperlipidemia and in patients who develop complications. Costs increase with an increasing number of complications. Well-organized medical insurance systems cover all medical fees for diabetes mellitus, and people with diabetes can visit doctors freely in Japan. Also, insulin therapy by self-injection became legal and is covered by health insurance. Such advantages have helped the adoption of these products in the Japanese market.

Japan Insulin Drugs And Delivery Devices Industry Overview

Japan Insulin Drugs and Delivery Devices Market is consolidated, with few significant and generic players. Mergers and acquisitions that happened between the players in the recent past have helped the companies strengthen their market presence. Eli Lilly and Boehringer Ingelheim together have an alliance in developing and commercializing Basaglar (Insulin Glargine). Additionally, the players in the recent past helped the companies strengthen their market presence; for example, Novo Nordisk collaborated with Ypsomed to provide better insulin therapy solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Drug

- 5.1.1 Basal or Long-acting Insulins

- 5.1.1.1 Lantus (Insulin Glargine)

- 5.1.1.2 Levemir (Insulin Detemir)

- 5.1.1.3 Toujeo (Insulin Glargine)

- 5.1.1.4 Tresiba (Insulin Degludec)

- 5.1.1.5 Basaglar (Insulin Glargine)

- 5.1.2 Bolus or Fast-acting Insulins

- 5.1.2.1 NovoRapid/Novolog (Insulin aspart)

- 5.1.2.2 Humalog (Insulin lispro)

- 5.1.2.3 Apidra (Insulin glulisine)

- 5.1.2.4 FIASP (Insulin aspart)

- 5.1.2.5 Admelog (Insulin lispro Sanofi)

- 5.1.3 Traditional Human Insulins

- 5.1.3.1 Novolin/Mixtard/Actrapid/Insulatard

- 5.1.3.2 Humulin

- 5.1.3.3 Insuman

- 5.1.4 Combination Insulins

- 5.1.4.1 NovoMix (Biphasic Insulin aspart)

- 5.1.4.2 Ryzodeg (Insulin degludec and Insulin aspart)

- 5.1.4.3 Xultophy (Insulin degludec and Liraglutide)

- 5.1.4.4 Soliqua/Suliqua (Insulin glargine and Lixisenatide)

- 5.1.5 Biosimilar Insulins

- 5.1.5.1 Insulin Glargine Biosimilars

- 5.1.5.2 Human Insulin Biosimilars

- 5.1.1 Basal or Long-acting Insulins

- 5.2 Device

- 5.2.1 Insulin Pumps

- 5.2.1.1 Insulin Pump Devices

- 5.2.1.2 Insulin Pump Reservoirs

- 5.2.1.3 Insulin Infusion sets

- 5.2.2 Insulin Pens

- 5.2.2.1 Cartridges in reusable pens

- 5.2.2.2 Disposable insulin pens

- 5.2.3 Insulin Syringes

- 5.2.4 Insulin Jet Injectors

- 5.2.1 Insulin Pumps

6 MARKET INDICATORS

- 6.1 Type-1 Diabetes Population

- 6.2 Type-2 Diabetes Population

7 COMPETITIVE LANDSCAPE

- 7.1 COMPANY PROFILES

- 7.1.1 Novo Nordisk

- 7.1.2 Sanofi

- 7.1.3 Eli Lilly

- 7.1.4 Biocon

- 7.1.5 Julphar

- 7.1.6 Medtronic

- 7.1.7 Ypsomed

- 7.1.8 Becton Dickinson

- 7.2 COMPANY SHARE ANALYSIS