|

시장보고서

상품코드

1445968

세계 긴급 대응 및 재해 대응 시장 : 시장 점유율 분석, 업계 동향과 통계, 성장 예측(2024-2029년)Emergency And Disaster Response - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

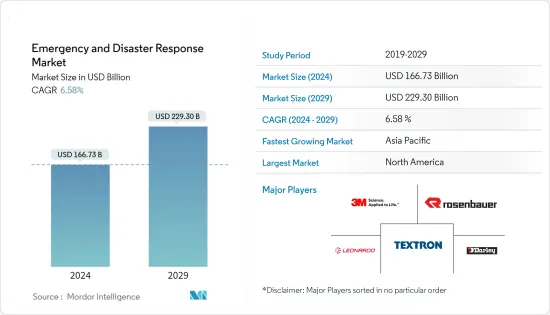

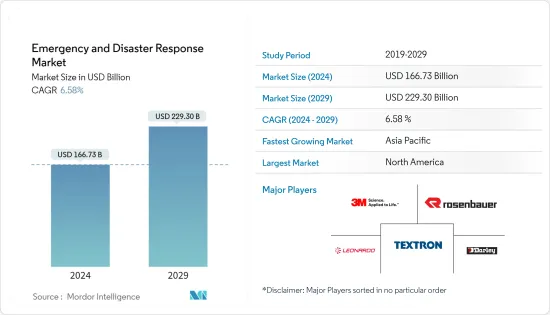

긴급 대응 및 재해 대응 시장 규모는 2024년에 1,667억 3,000만 달러로 추정되고, 2029년까지 2,293억 달러에 달할 것으로 예측되고 있으며, 예측 기간(2024년부터 2029년) 동안 복합 연간 성장률(CAGR) 6.58%로 성장할 전망입니다.

주요 하이라이트

- COVID-19의 팬데믹은 긴급 대응 및 재해 대응에 큰 영향을 주었습니다. 전례가 없는 감염자 수의 급증으로 의료기기, 개인보호구, 긴급용품에 대한 수요가 급증하여 업계 생산 능력에 상당한 압력을 가하고 있습니다. 게다가 팬데믹은 위기의 대응 조정과 자원 할당을 개선하기 위한 강화된 디지털 솔루션과 데이터 분석의 필요성을 부각시켜 시장에서 보다 기술 주도적인 접근 방식으로의 전환으로 이어졌습니다.

- 자연 재해, 기술적 사고, 예기치 않은 유행의 끊임없는 위협을 특징으로하며 항상 변화하는 세계에서는 긴급 상황과 재해에 신속하고 효과적으로 대응할 수있는 능력이 정부, 조직 및 개인에게 똑같이 가장 우선의 관심사가 되고 있습니다. 대비와 탄력성에 대한 주목이 강화되어 미래의 긴급 상황에 효과적으로 대처하기 위한 혁신적인 솔루션의 연구개발에 대한 투자가 촉진되고 있습니다. 세계적으로 자연재해와 인위재해가 증가하고 있기 때문에 관계 정부 기관에 의한 필요한 설비나 대응 차량의 조달이 증가하고 있습니다. 긴급 상황이 더욱 복잡하고 다양해짐에 따라 기존의 접근 방식으로는 충분하지 않은 것으로 밝혀지고 지속적인 적응과 혁신이 필요할 수 있습니다. 이러한 불확실성으로 인해 이해관계자가 모든 잠재적인 시나리오를 예측하고 준비하는 것이 어려워지고 효과적으로 대응하는 시장의 능력에 추가적인 부담을 줄 수 있습니다.

긴급 대응 및 재해 대응 시장 동향

예측 기간 동안 육상 부문이 최고의 복합 연간 성장률(CAGR)를 나타낼 것으로 추이됩니다

- 육상 부문은 예측 기간 동안 시장에서 최고의 복합 연간 성장률(CAGR)을 기록했습니다. 다양한 공공 및 민간 조직에 의한 육상 차량 조달 증가는 시장의 주요 추진력이되었습니다. 육상 차량은 현지에 배치할 수 있어 긴급 피해 경감의 목적으로 간단하고 신속하게 배치할 수 있습니다. 육상 비상 대응 차량의 가용성을 높이기 위해 지역 재해 관리 및 긴급 대응 팀은 이러한 차량을 자유롭게 사용할 수 있도록 노력하고 있습니다.

- 따라서 항공기는 항공기를 유지하는 데 필요한 인프라가 있는 대도시에만 배치되므로 항공기보다 조달량이 많습니다. 그러나 대규모 재해 증가에 따라 소방이나 재해 구호 등의 목적으로 항공기의 배치가 증가하고 있습니다.

- 예를 들어, 2022년 5월 아메리칸 메디컬 리스폰스는 국가 재해 및 응급 상황에 대응하여 의료 운송 및 지원을 제공하는 새로운 12억 달러의 5년 계약을 체결했습니다. AMR은 미국 최대의 지상 의료 운송 공급자이며 FEMA의 주요 EMS 공급자입니다.

예측기간 동안 북미가 시장 점유율을 지배

- 북미는 정부의 많은 지출 외에도 다양한 공공 및 민간 재해 구조 팀의 관련 장비 및 차량의 지속적인 조달로 시장 점유율을 독점하고 있습니다. 최근 몇 년간 격렬한 허리케인과 홍수가 미국을 덮쳐 캐나다와 마찬가지로 지난 5년간 여러 번 산림 화재가 발생했습니다. 이러한 모든 사건에 대응하여 이 지역에서는 재해 대응 자재 및 차량 조달이 증가하고 있습니다. 이러한 요인은 예측 기간 동안 이 지역 시장을 견인할 것으로 예상됩니다.

- 예를 들어, ICF는 1월에 푸에르토리코 주택국(PRDOH)으로부터 연방 단독 재해 복구 및 완화 프로그램을 지원하기 위한 새로운 5,100만 달러의 계약을 획득했습니다. 계약은 3년이며 추가 24개월 연장 옵션이 있습니다. ICF는 허리케인 일마와 마리아가 피해를 입은 주택 수리 및 재건, 건축을 위한 PRDOH 재해 부흥을 위한 커뮤니티 개발 블록 보조금(CDBG-DR) 및 완화를 위한 커뮤니티 개발 블록 보조금(CDBG-MIT) 조성 프로그램의 실시 지원을 확대합니다. 계약 조건에 따라 미래의 자연 재해에 대한 탄력성을 보장합니다.

- 그러나 세계 최대 재해가 발생하기 쉬운 지역 중 하나인 아시아태평양은 시장에서 가장 높은 성장률을 경험할 것으로 예상됩니다. 세계 유수의 인구를 자랑하는 국가의 존재로 인해 긴급 사태나 재해에 대한 대응이 지연되면 사망률이 대폭 상승할 가능성이 있기 때문에 이 지역 정부는 필요한 장비를 조달함으로써 재해 및 기타의 긴급 상황에 대비를 계속할 필요가 강요되고 있습니다. 예를 들어, 필리핀의 Batangas 주 정부는 긴급 대응 능력을 강화하기 위해 신품 히노 200 시리즈 구조 트랙 186 대를 구입할 것이라고 발표했습니다. 마찬가지로 윌리엄슨 카운티는 플러드맵과의 새로운 계약을 통해 홍수 재해에 대비하고 대응, 복구에 혁명을 일으키려고 합니다. FloodMapp은 지역사회에 미치는 영향을 줄이기 위해 비상사태 관리자에게 실시간 홍수 매핑을 제공하는 호주 기술 기업입니다.

긴급 대응 및 재해 대응 업계의 개요

시장은 세분화되어 있으며 시장의 다양한 기업이 긴급 및 재해 대응 시장 전체에 해당하는 다양한 용도로 제품을 공급하고 있습니다. Rosenbauer International AG, Darley, Textron Inc., 3M, Leonardo SpA는 시장의 주요 기업의 일부입니다. 게다가, 각국에 다양한 제품 포트폴리오를 가진 많은 현지 기업들이 존재하기 때문에 시장의 세분화가 진행되고 있습니다.

따라서 기업의 경쟁은 기업이 제공하는 제품 포트폴리오로 제한되며, 기업에게 업계를 넘어선 경쟁자는 존재하지 않습니다. 이 경우 기업은 다양한 제품을 제공하는 여러 산업 기업의 더 큰 집단과 경쟁하는 것보다 상대적으로 적은 수의 직접 경쟁자와 경쟁합니다. 시장에서 확립된 기업은 제휴 또는 인수를 통해 다른 관련 업계에 진입함으로써 자사의 제품 범위를 확대할 수 있는 유연성을 확보할 수 있습니다.

예를 들어, Rosenbauer는 최근 ET 시리즈에서 독일에서 큰 성공을 거두고 있습니다. 현재 연방국민보호,재해지원국 대신 연방내무성이 2021년 말에 발주한 재해구조용 집단소방차량(LF 20 KatS)이 납입되고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 시장 성장 억제요인

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체 제품의 위협

- 경쟁 기업간 경쟁 관계의 격렬

제5장 시장 세분화

- 장치

- 위협 감지 장치

- 개인 보호구

- 의료기기

- 일시 피난 설비

- 등산용품

- 소화기기

- 기타

- 차량 플랫폼

- 육상

- 선박

- 공수

- 지역

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 기타 아시아태평양

- 라틴아메리카

- 브라질

- 멕시코

- 기타 라틴아메리카

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 이집트

- 남아프리카

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 벤더의 시장 점유율

- 기업 프로파일

- Rosenbauer International AG

- Darley

- Ziegler GmbH

- Magirus GmbH

- Emergency One Group

- Viking Air Ltd.

- Textron Inc.

- Leonardo SpA

- 3M

- Emergency Medical International

- Smiths Group plc

- REV Group, Inc.

- Honeywell International, Inc.

- Juvare, LLC

- Esri, Inc.

- Everbridge, Inc.

- Hexagon AB

제7장 시장 기회와 미래 동향

BJH 24.03.15The Emergency And Disaster Response Market size is estimated at USD 166.73 billion in 2024, and is expected to reach USD 229.30 billion by 2029, growing at a CAGR of 6.58% during the forecast period (2024-2029).

Key Highlights

- The COVID-19 pandemic had a significant impact on the emergence and disaster response market. With the unprecedented surge in cases, the demand for medical equipment, personal protective gear, and emergency supplies skyrocketed, putting immense pressure on the industry's capacity. Additionally, the pandemic highlighted the need for enhanced digital solutions and data analytics to improve response coordination and resource allocation in times of crisis, leading to a shift towards more technology-driven approaches in the market.

- In an ever-changing world, marked by the constant threat of natural calamities, technological mishaps, and unforeseen pandemics, the ability to respond swiftly and effectively to emergencies and disasters has become a paramount concern for governments, organizations, and individuals alike. The focus on preparedness and resilience has intensified, driving investment in research and development of innovative solutions to tackle future emergenies effectively. Increasing incidents of natural and anthropogenic hazards globally have led to a rise in the procurement of necessary equipment and response vehicles by the concerned government agencies. As emergencies become more complex and diverse, traditional approaches might prove insufficient, neccessitating continous adaptiona and innovation. This uncertainity can make it difficult for stakeholders to anticipate and prepare for all potential scenerios, adding further strain on the market's ability to respond effectively.

Emergency and Disaster Response Market Trends

Land Segment to Register the Highest CAGR during the Forecast Period

- The land segment recorded the highest CAGR in the market in the forecast period. Increasing procurement of land vehicles by various public and private organizations is acting as the main driver for the market. Land vehicles can be locally stationed and can be easily and promptly deployed for emergency damage alleviation purposes. To increase the availability of land-based emergency response vehicles, local disaster management and emergency response teams keep these vehicles at their disposal.

- Thus, their procurement volumes are higher compared to the aerial vehicles, whose overall fleet is less, as they are stationed only in bigger cities that possess the necessary infrastructure to maintain the aircraft. However, with the growing number of large-scale disasters, the deployment of aerial vehicles for purposes like firefighting and disaster relief logistics is increasing.

- For instance, in May 2022, American Medical Response was awarded a new USD 1.2 billion five-year contract to provide medical transport and support in response to national disasters and emergencies. AMR is the biggest provider of ground medical transportation in the US and FEMA's prime EMS provider.

North America to Dominate Market Share During the Forecast Period

- North America dominates the market share due to high spending from the government, in addition to the continual procurement of related equipment and vehicles by various public and private disaster rescue teams. Severe hurricanes and floods have hit the US in the recent past, and the country, along with Canada, has seen several forest fires in the past five years. In response to all these occurrences, the procurement of disaster response equipment and vehicles has increased in the region. These factors are expected to drive the market in the region during the forecast period.

- For instance, in January, ICF was awarded a new USD 51 million contract by the Puerto Rico Department of Housing (PRDOH) to support the commonwealth's single-family disaster recovery and mitigation programs. The contract is for three years with an option to extend for another 24 months. ICF will expand its implementation support of PRDOH's Community Development Block Grant for Disaster Recovery (CDBG-DR) and Community Development Block Grant for Mitigation (CDBG-MIT) grant programs to repair and rebuild homes damaged by hurricanes Irma and Maria, as well as build resilience against future natural disasters, under the terms of the contract.

- However, the Asia-Pacific region, which is one of the largest disaster-prone zones in the world, is projected to experience the highest growth rates in the market. The presence of some of the largest populated countries in the world, where a delay in emergency and disaster response can increase fatality rates drastically, is compelling the governments in the region to stay prepared for disasters and other emergencies by procuring the necessary equipment. For instance, the Provincial Government of Batangas (Philippines) has announced their purchase of 186 brand new Hino 200 Series Rescue trucks to enhance emergency response capabilities. Likewise, Williamson County is looking to revolutionize its flood disaster preparation, response and recovery with a new contract with FloodMapp. FloodMapp is an Australian technology company that provides real-time flood mapping for emergency managers to reduce the impacts on their communities.

Emergency and Disaster Response Industry Overview

The market is fragmented, with various players in the market supplying their products to various applications that fall under the overall emergency and disaster response market. Rosenbauer International AG, Darley, Textron Inc., 3M, and Leonardo S.p.A. are some of the major players in the market. In addition, the presence of many local players in each country with varying product portfolios is enhancing market fragmentation.

Thus, the competition for the players is restricted to the product portfolios they offer, and there are no cross-industry competitors for the players. In such cases, players compete with a relatively lower direct-competitor pool than facing a larger set of multi-industry players having different product offerings. Established players in the market gain the flexibility to expand their product reach by entering other related industries either by partnerships or acquisitions.

For instance, Rosenbauer is very successful in Germany with its ET series these days. Currently, the group firefighting vehicles for disaster relief (LF 20 KatS) are being delivered, which the Federal Ministry of the Interior ordered at the end of 2021, on behalf of the Federal Office of Civil Protection and Disaster Assistance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Equipment

- 5.1.1 Threat Detection Equipment

- 5.1.2 Personal Protection Gear

- 5.1.3 Medical Equipment

- 5.1.4 Temporary Shelter Equipment

- 5.1.5 Mountaineering Equipment

- 5.1.6 Fire Fighting Equipment

- 5.1.7 Other Equipment

- 5.2 Vehicle Platform

- 5.2.1 Land

- 5.2.2 Marine

- 5.2.3 Airborne

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Russia

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Australia

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Mexico

- 5.3.4.3 Rest of Latin America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Egypt

- 5.3.5.4 South Africa

- 5.3.5.5 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Rosenbauer International AG

- 6.2.2 Darley

- 6.2.3 Ziegler GmbH

- 6.2.4 Magirus GmbH

- 6.2.5 Emergency One Group

- 6.2.6 Viking Air Ltd.

- 6.2.7 Textron Inc.

- 6.2.8 Leonardo S.p.A

- 6.2.9 3M

- 6.2.10 Emergency Medical International

- 6.2.11 Smiths Group plc

- 6.2.12 REV Group, Inc.

- 6.2.13 Honeywell International, Inc.

- 6.2.14 Juvare, LLC

- 6.2.15 Esri, Inc.

- 6.2.16 Everbridge, Inc.

- 6.2.17 Hexagon AB