|

시장보고서

상품코드

1851423

폐기물 에너지화(WTE) 시장 : 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Waste To Energy (WTE) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

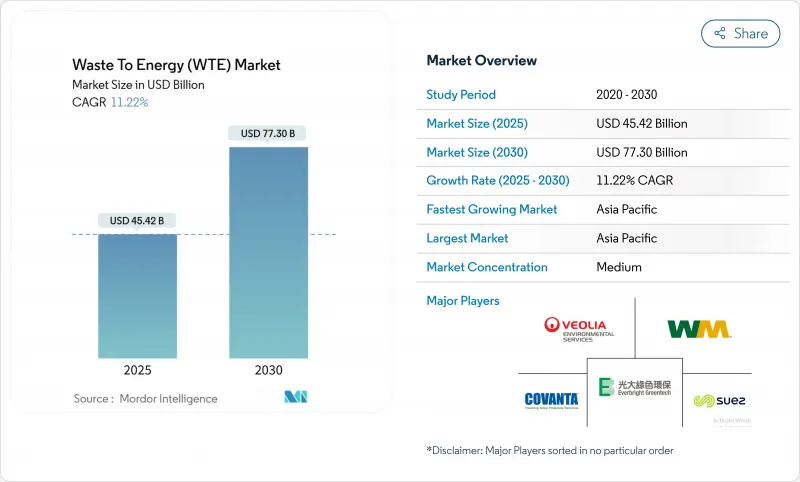

2025년 폐기물 에너지화(WTE) 시장 규모는 454억 2,000만 달러, 2030년에는 CAGR 11.22%로, 773억 달러에 이를 것으로 예측됩니다.

성장의 배경에는 도시 폐기물 증가와 저탄소 전력에 대한 세계적인 요구라는 두 가지 압력이 있습니다. 화력발전기술은 여전히 설비 증설의 기간기술이지만 투자는 플라즈마 아크나 개량형 혐기성 소화법 등의 선진적이고 저배기 가스 솔루션으로 이동하고 있습니다. 한국과 유럽연합(EU)의 적극적인 탄소가격제도가 프로젝트의 경제성을 재구축하고 있는 한편, 인도의 2급 도시에서는 매립이 금지되어 원료의 입수가 가속되고 있습니다. 유틸리티 기업, 환경 서비스 기업, 기술 전문가의 전략적 통합이 이어지면서 디지털 최적화 툴은 신설·개수 플랜트 전체의 운전 마진과 컴플라이언스 성능을 끌어올리고 있습니다. 이러한 힘이 결합되어 은행 거래가 가능한 프로젝트의 견고한 파이프라인이 유지되고 폐기물 발전 시장이 순환형 경제의 매우 중요한 요소로 자리매김하고 있습니다.

세계의 폐기물 에너지화(WTE) 시장 동향과 통찰

중국 대만 해안 지역에서 EfW 관민 파트너십 파이프라인의 급속한 개발

350억 위안을 넘는 투자로 첨단 배출 모니터링 및 재료 회수 설계를 도입하는 80개 이상의 프로젝트에 자금이 공급되고 있습니다. 새로운 플랜트는 매일 400,000톤 이상을 처리하는 대용량 클러스터를 형성하며, 이 지역의 확장 가능한 도시 폐기물 솔루션의 편지지를 강화하고 있습니다. WTE를 포함한 깨끗한 전력원으로부터의 발전량은 2024년에는 전년 대비 16.4% 증가하여 정책 기세와 투자자의 신뢰를 뒷받침하고 있습니다.

기존 소각로의 개조를 가속화하는 EU 그린 세제 우대 조치

그린 세제는 대출을 엄격한 에너지 효율 지표에 연결하고 배기 가스 시스템 업그레이드와 원료 재사용 확대를 결합한 보수 공사에 약 3억 유로의 자금을 제공합니다. 이를 준수하는 사업자는 자금 조달 비용을 절감하고 우선적인 송전망을 이용할 수 있어 서유럽 및 북유럽 전역의 폐기물 발전 시장이 강화됩니다.

다이옥신 배출 규제 강화로 독일의 화로 개수 허가 연기

2024년 산업 배출 지령은 규제를 강화하고 2035년까지 전자 허가를 의무화하는 것으로, 오래된 플랜트의 조업자는 대기 오염 방지 시스템의 재설계를 강요하게 됩니다. 컴플라이언스 비용과 승인에 시간이 걸리기 때문에 용량 업그레이드가 지연되고 유럽에서 가장 큰 경제권 폐기물 발전 시장이 부진했습니다.

부문 분석

소각은 입증된 조업의 역사와 유럽과 동아시아 전역의 지역열 인프라와의 통합에 힘입어 2024년 폐기물 에너지화화 시장 점유율의 65%를 유지. 연간 20만 톤 이상의 공장에서는 예측 가능한 운전 시간과 확립된 공급업체 네트워크를 통해 화격자로 설계를 계속 채택하고 있습니다. 그럼에도 불구하고 플라즈마 아크로의 생산 능력은 폐기물에서 싱가스로의 변환 효율이 99%에 이르고 다이옥신 생성량이 크게 감소하기 때문에 2030년까지 연평균 복합 성장률(CAGR)은 16%를 보일 것으로 예측됩니다. 낮은 배출량과 높은 금속 회수율에 맞는 보조금 제도는 특히 인구밀도가 높은 아시아 도시에서는 프로젝트의 파이프라인을 플라즈마 아크로 더욱 기울입니다. 따라서 첨단 열 플랫폼과 연계된 폐기물 발전 시장 규모는 헤드라인 속도를 초과하는 속도로 가속화되고 있습니다.

하이브리드화 동향은 자산 사양을 재구성하고 있습니다. 일부 신설 플랜트는 열 변환 전에 재활용 수율을 높이기 위해 프론트 엔드의 기계적 생물학적 처리와 가스화 또는 플라즈마 아크를 번들로 제공합니다. 한편, 혐기성 소화는 고수분의 유기폐기물이 우수한 바이오가스 수율을 적당한 자본비용으로 제공하는 농업지역에서 다시 주목을 받고 있습니다. 현재는 기계적, 열적, 화학적 전처리에 의해 메탄 생산량이 25%-190% 상승하여 분산형 소화장치의 경제적 스위트 스폿이 넓어지고 있습니다. 예측 기간 중 디지털 트윈과 AI 지원 연소 제어에 의해 아타시마 효율이 라이프사이클 베이스로 4-6% 향상되어 차세대 시설의 차별화가 더욱 진행될 것으로 예측됩니다.

도시 고형 폐기물은 꾸준한 회수량과 매립으로부터의 탈퇴를 요구하는 규제 압력에 힘입어 2024년 폐기물 에너지화(WTE) 시장 규모의 70%를 차지했습니다. 주요 도시의 고발열 산업 폐기물 및 발생원 분별 프로그램은 견조한 원료 품질을 유지하고 베이스 로드 에너지 생산을 지원하고 있습니다. 한편, 농업·농산업 잔류물은 정부가 농촌공급 체인에 있어서의 메탄 삭감을 목표로 하고 있기 때문에 2030년까지의 CAGR이 14%가 될 것으로 예측됩니다. 농부가 작물의 줄기와 분뇨를 공급하기 위한 재정적 인센티브는 지금까지 미개척했던 에너지의 가능성을 풀어내고, 소화액 이용에 의한 토양 건전성 목표에 부합합니다.

플라스틱, 용매, 높은 Bt 슬러지와 같은 산업 폐기물의 흐름은 특수 로터리 킬른 및 유동층 시스템에 대한 안정적인 수요를 초래합니다. 하수 슬러지는 배출 규제의 엄격화에 의해 추가 치료가 필요한 곳에서 그 존재감을 늘리고 있습니다. 열건조와 단소각을 결합하여 현재는 비료로 재활용할 수 있는 인의 풍부한 재를 얻을 수 있습니다. 이 추세는 폐기물 에너지화 시장에서 플랜트의 가동률 향상과 유지 보수 사이클의 장기화를 지원합니다.

폐기물 에너지화(WTE) 시장 보고서는 기술별(물리적, 열적, 생물학적), 폐기물 유형별(도시 고형 폐기물, 산업 폐기물, 기타), 에너지 출력별(전기, 열, 기타), 엔 드유저별(유틸리티 및 IPP, 산업용 캡티브 플랜트, 지역 난방사업자, 운송연료 판매업자), 지역별(북미, 유럽, 아시아태평양, 남미, 중동 및 아프리카)로 분류됩니다.

지역 분석

아시아태평양은 2024년 매출의 45%를 차지했고, 2030년까지 지역별 CAGR은 13%를 나타낼 전망입니다. 중국만으로도 닛산 40만톤을 처리하는 400개 이상의 공장이 가동되고 있으며, 2025년에는 닛산 70만톤까지 능력이 상승합니다. 인도의 Tier-2 도시는 Swachh Bharat Mission 2.0으로 인도되어 300-500톤/일의 모듈식 라인을 선호하는 건설·조업·양도 계약을 맺고 있습니다. 일본은 배출규제기술로 리더십을 유지하고 한국의 배출권거래계획은 모델 IRR을 최대 2.5포인트 인상해 동북아 폐기물발전시장을 확대합니다.

유럽은 고밀도 지역 열 통합과 엄격한 환경 규제를 특징으로 매출에서 2위를 차지하고 있습니다. 덴마크와 스웨덴은 지방자치단체의 열공급 네트워크에서 재생가능 에너지의 비율이 이미 75%를 넘어서고 있으며, EU의 녹색 세제는 양허 자본을 플랜트 개보수로 돌리고 있습니다. 독일은 다이옥신 규제 강화에 의한 개수 지연에 직면하고 영국은 발열량 규제에 의해 저품위 RDF를 국내 소각로에 휘두르는 새로운 지역 수요를 창출하고 있습니다.

북미에서는 미국에서의 유틸리티 스케일 프로젝트와 캐나다에서 바이오메탄에 대한 투자를 중심으로 꾸준한 확대를 볼 수 있습니다. Covanta, Waste Management, FCC Environmental Services는 대규모 지자체와의 계약을 다투고 있으며 최근 인수는 추가 통합을 제안합니다. 중남미에서는 브라질의 중남부 설탕지역에서 바이오가스의 도입이 진행되고 있지만, 원료 가격의 변동이 프로젝트 파이프라인을 불안정하게 하고 있습니다. 중동 및 아프리카에서는 이집트의 1억 2,000만 달러의 고형 폐기물 발전소가 관심 증가를 보이고 있지만, 전체적인 전개는 아직 초기 단계입니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 중국 대만구에서의 EfW 관민 파트너십 파이프라인의 급속한 전개

- EU의 친환경 세제 우대 조치가 레거시 소각로의 레트로 피트 가속

- 인도의 Tier-2 도시에서 MSW 전환을 유발하는 무분별 매립의 전국적 금지

- 탄소 신용가격 상승으로 한국의 WTE 프로젝트 IRR 개선

- 순환 경제 주도형 북유럽의 바이오가스 CPPA(기업간 전력 구입 계약)

- 브렉시트 후 영국에서의 RDF 수출의 발열량 기준치의 의무화

- 시장 성장 억제요인

- 독일에서 화격자 공장 개조 허가를 연기하는 다이옥신 배출 한도 강화

- 인도네시아의 프로젝트 은행성을 저해하는 제한적인 팁 수수료 인상 조항

- 브라질의 혐기성 소화 원료 가격 변동성으로 인한 마진 약화

- 호주 도시 주변 지역의 플라즈마 아크 시설에 대한 지역 사회의 반발

- 공급망 분석

- 기술의 전망

- 규제 전망

- Porter's Five Forces

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 투자 분석

제5장 시장 규모와 성장 예측

- 기술별

- 물리적(폐기물 유래 연료, 기계적 생물학적 치료)

- 열(소각/연소, 가스화, 열분해 및 플라즈마 아크)

- 생물학적(혐기성 소화, 발효)

- 폐기물 유형별

- 고형 폐기물

- 산업폐기물

- 농업 및 농산업 잔류물

- 하수 슬러지

- 기타(상업, 건설, 위험물)

- 에너지 출력별

- 전기

- 열

- 열 및 전력(CHP) 결합

- 수송용 연료(바이오 NG, 바이오 LNG, 에탄올)

- 최종 사용자별

- 유틸리티 및 독립 발전 사업자(IPP)

- 산업 캡티브 플랜트

- 지역난방사업자

- 수송용 연료 유통업체

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 영국

- 독일

- 프랑스

- 스페인

- 북유럽 국가

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- ASEAN 국가

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 콜롬비아

- 기타 남미

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 남아프리카

- 이집트

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 움직임(M&A, 파트너십, PPA)

- 시장 점유율 분석(주요 기업의 시장 순위/점유율)

- 기업 프로파일

- Veolia Environnement SA

- Suez SA

- Waste Management Inc.

- Covanta Holding Corp.

- Wheelabrator Technologies Inc.

- Mitsubishi Heavy Industries Ltd

- Hitachi Zosen Corp.

- Babcock & Wilcox Enterprises Inc.

- A2A SpA

- MVV Energie AG

- Martin GmbH fur Umwelt-und Energietechnik

- China Everbright Environment Group Ltd

- China Jinjiang Environment Holding Co.

- Xcel Energy Inc.

- Shenzhen Energy Group Co.

- Keppel Seghers

- Remondis SE & Co. KG

- FCC Servicios Medio Ambiente

- Enerkem Inc.

- Sembcorp Industries Ltd

- Green Conversion Systems LLC

- Fortum Oyj

제7장 시장 기회와 장래의 전망

SHW 25.11.21The Waste To Energy Market size is estimated at USD 45.42 billion in 2025, and is expected to reach USD 77.30 billion by 2030, at a CAGR of 11.22% during the forecast period (2025-2030).

Growth rests on two converging pressures: swelling urban waste streams and the worldwide push for low-carbon power. Thermal technologies remain the backbone of capacity additions, yet investments are shifting toward advanced, lower-emission solutions such as plasma-arc and upgraded anaerobic digestion. Active carbon-price regimes in South Korea and the European Union are reshaping project economics, while landfill bans in India's Tier-2 cities accelerate feedstock availability. Strategic consolidation among utilities, environmental services firms, and technology specialists continues, and digital optimization tools are lifting operating margins and compliance performance across new and retrofit plants. Together, these forces sustain a robust pipeline of bankable projects and position the waste-to-energy market as a pivotal element of the circular economy.

Global Waste To Energy (WTE) Market Trends and Insights

Rapid Roll-out of EfW Public-Private Partnership Pipelines in China's Greater Bay Area

Investments topping CNY 35 billion are funding more than 80 projects that deploy advanced emissions monitoring and material-recovery designs. New plants form a high-capacity cluster processing over 400,000 tons daily, cementing the region's template for scalable urban waste solutions. Electricity output from clean sources, including WTE, rose 16.4% year-on-year in 2024, confirming policy momentum and investor confidence.

EU Green Taxonomy Incentives Accelerating Retrofit of Legacy Incineration Fleets

The Green Taxonomy links financing to strict energy-efficiency metrics, unlocking roughly EUR 300 million for retrofit work that couples upgraded flue-gas systems with expanded material reclamation. Operators that comply gain lower funding costs and priority grid access, reinforcing the waste-to-energy market across Western and Northern Europe.

Stricter Dioxin Emission Caps Postponing Permits for Grate-Furnace Refurbishments in Germany

The 2024 Industrial Emissions Directive tightens limits and mandates e-permits by 2035, forcing operators of older plants to redesign air-pollution-control systems. Compliance costs and protracted approvals delay capacity upgrades and dampen the waste-to-energy market in Europe's largest economy.

Other drivers and restraints analyzed in the detailed report include:

- National Bans on Unsegregated Landfill Triggering MSW Diversion in India's Tier-2 Cities

- Soaring Carbon Credit Prices Improving WTE Project IRRs in South Korea

- Limited Tipping-Fee Escalation Clauses Hurting Project Bankability in Indonesia

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Incineration retained 65% of the waste to energy market share in 2024, anchored by proven operational history and integration with district-heat infrastructure across Europe and East Asia. Plants above 200,000 tpa continue to deploy grate-furnace designs due to predictable runtime and established supplier networks. Nevertheless, plasma-arc capacity is forecast to log a 16% CAGR to 2030, thanks to 99% waste-to-syngas conversion efficiency and sharply lower dioxin formation. Subsidy schemes that reward lower emissions and higher metals recovery further tilt project pipelines toward plasma-arc, especially in densely populated Asian conurbations. The waste to energy market size tied to advanced thermal platforms therefore accelerates faster than the headline rate.

Hybridization trends are reshaping asset specifications: several new builds bundle front-end mechanical biological treatment with either gasification or plasma-arc to boost recycling yields before thermal conversion. Meanwhile, anaerobic digestion enjoys renewed focus in agrarian regions where high-moisture organic waste offers superior biogas yields at modest capital cost. Mechanical, thermal, and chemical pretreatments now lift methane production by 25%-190%, widening the economic sweet spot for distributed digesters. Over the forecast period, digital twins and AI-assisted combustion controls are expected to enhance thermal-island efficiency by 4%-6% on a lifecycle basis, further differentiating next-generation facilities.

Municipal solid waste accounted for 70% of the waste to energy market size in 2024, buoyed by steady collection volumes and regulatory pressure to move away from landfilling. High calorific industrial fractions and source-segregation programs in major cities sustain robust feedstock quality, supporting baseload energy output. Agricultural and agro-industrial residues, however, will post a 14% CAGR through 2030 as governments target methane mitigation in rural supply chains. Financial incentives for farmers to supply crop stover and manure unlock previously untapped energy potential and align with soil-health goals via digestate use.

Industrial waste streams featuring plastics, solvents, and high-Btu sludges present stable demand for specialized rotary-kiln and fluidized-bed systems. Sewage sludge gains visibility where stricter discharge norms require additional treatment: thermal drying coupled with mono-incineration now yields phosphorus-rich ash that can be recycled into fertilizer. Across categories, pre-processing and optical sorting technologies are raising net calorific value and reducing contaminants, a trend that supports higher plant availability and longer maintenance cycles within the waste to energy market.

The Waste To Energy (WTE) Market Report is Segmented by Technology (Physical, Thermal, and Biological), Waste Type (Municipal Solid Waste, Industrial Waste, and Others), Energy Output (Electricity, Heat, and Others), End-Users (Utilities and IPPs, Industrial Captive Plants, District Heating Operators, and Transport Fuel Distributors), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific posted 45% of 2024 revenue and will hold the pole position with a 13% regional CAGR to 2030. China alone operates over 400 plants processing 400,000 tons daily, with the capacity to climb to 700,000 tons per day by 2025. India's Tier-2 cities, guided by Swachh Bharat Mission 2.0, are issuing build-operate-transfer contracts that favor modular lines sized at 300-500 tpd. Japan sustains leadership in emissions control technologies, and South Korea's emissions-trading scheme raises modeled IRRs by up to 2.5 percentage points, broadening the waste-to-energy market in Northeast Asia.

Europe ranks second by revenue, characterized by dense district-heat integration and rigorous environmental regulation. Denmark and Sweden already surpass 75% renewable share in municipal heat networks, and the EU Green Taxonomy channels concessional capital into plant retrofits. Germany faces retrofit delays from stricter dioxin caps, while the United Kingdom's calorific-value rules redirect lower-grade RDF to domestic incinerators, creating new local capacity demand.

North America registers steady expansion anchored by utility-scale projects in the United States and biomethane investments in Canada. Covanta, Waste Management, and FCC Environmental Services vie for large municipal contracts, with recent acquisitions signaling further consolidation. South America sees biogas rollouts in Brazil's south-central sugar belt, yet feedstock-price volatility tempers project pipelines. In the Middle East and Africa, Egypt's USD 120 million solid waste-to-electricity plant illustrates rising interest, though overall deployment remains early-stage.

- Veolia Environnement SA

- Suez SA

- Waste Management Inc.

- Covanta Holding Corp.

- Wheelabrator Technologies Inc.

- Mitsubishi Heavy Industries Ltd

- Hitachi Zosen Corp.

- Babcock & Wilcox Enterprises Inc.

- A2A SpA

- MVV Energie AG

- Martin GmbH fur Umwelt- und Energietechnik

- China Everbright Environment Group Ltd

- China Jinjiang Environment Holding Co.

- Xcel Energy Inc.

- Shenzhen Energy Group Co.

- Keppel Seghers

- Remondis SE & Co. KG

- FCC Servicios Medio Ambiente

- Enerkem Inc.

- Sembcorp Industries Ltd

- Green Conversion Systems LLC

- Fortum Oyj

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid roll-out of EfW public-private partnership pipelines in China's Greater Bay Area

- 4.2.2 EU Green Taxonomy incentives accelerating retrofit of legacy incineration fleets

- 4.2.3 National bans on unsegregated landfill triggering MSW diversion in India's Tier-2 cities

- 4.2.4 Soaring carbon credit prices improving WTE project IRRs in South Korea

- 4.2.5 Circular-economy led corporate power-purchase agreements (CPPAs) for biogas in Nordics

- 4.2.6 Mandatory calorific value thresholds for RDF exports in the UK post-Brexit

- 4.3 Market Restraints

- 4.3.1 Stricter dioxin emission caps postponing permits for grate-furnace refurbishments in Germany

- 4.3.2 Limited tipping-fee escalation clauses hurting project bankability in Indonesia

- 4.3.3 Anaerobic-digestion feedstock price volatility undermining margins in Brazil

- 4.3.4 Community push-back against plasma-arc facilities in Australia's peri-urban regions

- 4.4 Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 Market Size & Growth Forecasts

- 5.1 By Technology

- 5.1.1 Physical (Refuse-Derived Fuel, Mechanical Biological Treatment)

- 5.1.2 Thermal (Incineration/Combustion, Gasification, Pyrolysis and Plasma-Arc)

- 5.1.3 Biological (Anaerobic Digestion, Fermentation)

- 5.2 By Waste Type

- 5.2.1 Municipal Solid Waste

- 5.2.2 Industrial Waste

- 5.2.3 Agricultural and Agro-industrial Residues

- 5.2.4 Sewage Sludge

- 5.2.5 Others (Commercial, Construction, Hazardous)

- 5.3 By Energy Output

- 5.3.1 Electricity

- 5.3.2 Heat

- 5.3.3 Combined Heat and Power (CHP)

- 5.3.4 Transportation Fuels (Bio-SNG, Bio-LNG, Ethanol)

- 5.4 By End-user

- 5.4.1 Utilities and Independent Power Producers (IPPs)

- 5.4.2 Industrial Captive Plants

- 5.4.3 District Heating Operators

- 5.4.4 Transport Fuel Distributors

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Spain

- 5.5.2.5 Nordic Countries

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 ASEAN Countries

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Egypt

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Veolia Environnement SA

- 6.4.2 Suez SA

- 6.4.3 Waste Management Inc.

- 6.4.4 Covanta Holding Corp.

- 6.4.5 Wheelabrator Technologies Inc.

- 6.4.6 Mitsubishi Heavy Industries Ltd

- 6.4.7 Hitachi Zosen Corp.

- 6.4.8 Babcock & Wilcox Enterprises Inc.

- 6.4.9 A2A SpA

- 6.4.10 MVV Energie AG

- 6.4.11 Martin GmbH fur Umwelt- und Energietechnik

- 6.4.12 China Everbright Environment Group Ltd

- 6.4.13 China Jinjiang Environment Holding Co.

- 6.4.14 Xcel Energy Inc.

- 6.4.15 Shenzhen Energy Group Co.

- 6.4.16 Keppel Seghers

- 6.4.17 Remondis SE & Co. KG

- 6.4.18 FCC Servicios Medio Ambiente

- 6.4.19 Enerkem Inc.

- 6.4.20 Sembcorp Industries Ltd

- 6.4.21 Green Conversion Systems LLC

- 6.4.22 Fortum Oyj

7 Market Opportunities & Future Outlook

- 7.1 White-space & unmet-need assessment