|

시장보고서

상품코드

1687872

패널 레벨 패키징 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Panel Level Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

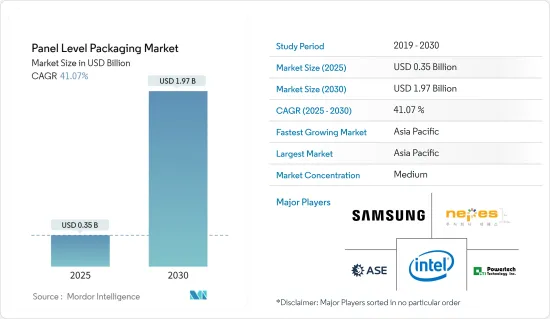

패널 레벨 패키징 시장 규모는 2025년에 3억 5,000만 달러로 추정되고, 예측 기간인 2025-2030년 CAGR 41.07%로 성장할 전망이며, 2030년에는 19억 7,000만 달러에 달할 것으로 예측됩니다.

반도체 산업은 급속한 성장을 이루고 있으며, 반도체는 모든 현대 기술의 기본 구성 요소가 되고 있습니다. 이 부문의 진보 및 혁신은 하류의 모든 기술에 직접적인 영향을 주어 시장 조사의 필요성을 뒷받침하고 있습니다.

주요 하이라이트

- 반도체 산업의 중요성이 높아짐에 따라 포장 솔루션의 강화에 대한 수요도 높아지고 새로운 반도체 포장 기술의 개발로 이어지고 있습니다.

- 패널 레벨 패키징(PLP)은 최근 각광을 받고 있는 기술입니다. PLP는 패널 사이즈로 처리되는 반도체 포장을 가리킵니다. 패널 레벨 패키징에서는 조립 프로세스에 패널 레벨에서의 다이아 터치, 재배선, 몰드, 범프의 제조가 포함됩니다.

- 패널 병렬 형식은 더 많은 포장을 처리하기 때문에 이러한 유형의 패키징은 라운드 웨이퍼 형태와 비교하여 훨씬 더 나은 면적 사용(패널/웨이퍼 크기 및 패키징 크기의 비율)이 용이해집니다. 따라서 패키징 비용의 저감이 시장 성장의 주요 촉진 요인 중 하나가 되고 있습니다. PLP는 폐기물 발생이나 탄소발자국이 적기 때문에 환경에 미치는 영향도 적습니다.

- 패널 레벨 패키징(PLP) 시장에는 과제도 있습니다. 이 기술과 관련된 많은 비용과 그 구현의 복잡한 성질이 널리 받아들여지는 방해가 될 가능성이 있습니다. 포장 프로세스에는 금형 선행형 및 RDL 선행형이 있습니다. 그러나 패키징 유형에 따라 다이 시프트에 문제가 발생합니다. 다이 시프트는 수율 저하나 수율에 악영향을 미칠 수 있기 때문에 가장 큰 문제 중 하나로 여겨지고 있습니다. 이 때문에 패키징 프로세스를 보다 상세하게 관리할 필요성이 높아지고 복잡성이 증가하여 시장의 성장을 억제하고 있습니다.

- COVID-19 이후에는 비용면에서의 장점과 웨이퍼에서 대형 패널 형식으로의 패키징 크기의 확대로 패널 레벨 패키징에 대한 주목이 높아질 것으로 예상됩니다. 병행해서 제조되는 포장의 수가 증가하는 것도, 시장의 성장을 지지하는 큰 이점입니다. PLP는 다른 기술 부문의 프로세스, 재료, 설비를 채택할 가능성이 있습니다. 인쇄 회로 기판(PCB), 액정 디스플레이(LCD), 솔라 기기 등은 패널 사이즈로 제조되고 있어 팬 아웃형의 패널 레벨 패키징에 새로운 어프로치를 제공하고 있습니다.

패널 레벨 패키징 시장 동향

시장 세분화는 소비자용 전자기기 부문이 주요 점유율을 차지합니다.

- 스마트폰, 웨어러블 단말, 태블릿 단말 등의 소비자용 전자기기 제품은 박형화 및 소형화가 진행되고 있습니다. 소형화 및 경량화에 대한 요구에 대응하기 위해, PLP에 의해서 메이커는 부품 밀도를 높여, 스페이스를 보다 효율적으로 이용할 수 있습니다. 이러한 기기에서 PLP에 의한 풋 프린트의 축소는, 세련된 디자인을 가능하게 하고, 이용 가능한 공간을 최대한으로 활용하기 위해서 불가결합니다.

- 소비자용 전자기기 산업은 제품의 차별화에 노력하는 제조업체와 경쟁하고 있습니다. 소비자용 전자기기의 세련된 디자인, 기능성 향상, 성능 개선을 가능하게 함으로써 PLP는 시장에 우위를 가져다 줍니다. 시장에서의 지위를 유지하기 위해 제조사는 PLP를 활용하여 소비자 수요를 충족시키고 혁신적인 제품을 투입하고 있습니다.

- 최근 5G와 IoT의 보급이 진행되고 있는 것은 시장에 큰 성장 기회를 가져오고 있습니다. 예를 들어 5G Americas에 따르면 세계 5G 가입 건수는 2024년 28억 건에 이르렀으며, 2027년 59억 건에 이를 것으로 추정되고 있습니다.

- 5G에 대한 투자가 높아짐에 따라 5G 대응 스마트폰 수요도 병행하여 증가하고 있습니다. 사이버미디어리서치 보고서에 따르면 2020년 첫 도입 이후 5G 스마트폰 판매량이 13배를 기록한 이후 2023년 말까지 5G 스마트폰 출하량은 매년 70% 증가했습니다. 2020년 4%에 불과했던 5G 스마트폰의 시장 점유율은 2023년 45%에 이를 것으로 예측되고 있습니다.

- 마찬가지로 인터넷과 IP 대응 프로토콜을 사용하여 사물과 사람 간의 통신을 가능하게 하는 기술인 사물인터넷(IoT)의 채용이 증가하고 있기 때문에 연결된 장치의 수가 최근 급속히 증가 예를 들어, 시스코에 따르면, 2023년에는 네트워크 접속된 디바이스의 수는 293억 대가 된다고 합니다. IoT 활용 사례의 대폭적인 확대는 시장 성장의 큰 원동력이 될 것으로 보입니다.

중국이 시장을 선도할 전망

- 중국은 최대의 반도체 소비국이며, 그 주요 이유는 국내 전자기기 시장 규모에 있습니다. 이 나라는 세계 최대의 소비자용 전자기기의 생산 및 수출국으로, 저렴한 노동 비용의 메리트를 활용하기 위해, 많은 세계 벤더가 시설을 설립하고 있습니다.

- 전자기기 제조업도 최근 꾸준한 확대를 계속하고 있습니다. 산업 정보화부 보고서에 따르면 2023년 전자정보 제조부문의 주요 기업의 산업부가가치는 연률 3.4% 증가했습니다. 동 부서에 따르면 주요 제품 중 휴대전화 생산 대수는 전년 대비 6.9% 증가한 15억 7,000만 대로, 이 중 스마트폰 대수는 전년 대비 1.9% 증가한 11억 4,000만 대였습니다. 최근 몇 년 동안 전자 산업의 성장을 가속하기 위해 여러 가지 노력이 이루어지고 있습니다.

- 또한 중국은 5G의 보급에서도 세계를 선도하고 있습니다. 산업정보화성(MIIT)에 따르면 중국은 2023년 2월 현재 5억 9,201만 명의 5G 사용자를 목표로 하고 있습니다. 이 수는 2025년까지 10억 명을 돌파할 것으로 예상됩니다. 중국 전역에 5G의 보급을 확대하기 위해 인프라 정비가 진행되고 있습니다.

- 예를 들어 2023년 10월 현재 중국의 5G 기지국은 약 322만국으로 모바일 기지국 전체의 28.1%를 차지하고 있습니다.

- 국내에서의 5G의 도입이 진행됨에 따라 5G 대응 디바이스의 보급도 진행되고 있습니다. 예를 들어 중국 정보통신기술연구원(CAICT)에 따르면 2023년 이 나라의 5G 스마트폰 출하량은 전년 대비 약 11.9% 증가한 2억 4,000만 대에 이르렀으며, 스마트폰 출하 시장 전체는 전년 대비 약 1.1% 증가했습니다. 첨단 패키징 기술은 5G 칩의 성능 요구 사항 중 많은 부분을 해결하는 데 도움이 될 수 있기 때문에 이러한 추세는 일본의 연구 시장 성장에 유리하게 작용할 것으로 예상됩니다.

- 또한 중국은 생산과 소비 양면에서 자동차 시장을 선도하고 있으며, 이 나라 시장 성장에도 유리하게 작용할 것으로 예상됩니다. 보다 깨끗하고 안전한 자동차에 대한 수요 증가는 이 나라의 자동차 산업의 주요 동향 중 하나이며 조사 대상 시장의 성장을 뒷받침하고 있습니다. 자율주행차, 전동화, 캐빈의 충실, 접속성과 소프트웨어 정의, 존 아키텍처 등 시장 메가 동향도 자동차 부문 시장 성장을 지원하고 있습니다.

패널 레벨 패키징 산업 개요

패널 레벨 패키징 시장은 Samsung Electronics, Intel Corporation, Nepes Corporation, ASE Group, Powertech Technology Inc.와 같은 대기업이 존재하고 반고체화하고 있습니다. 시장의 참가 기업은, 제품 라인 업을 강화해, 지속가능한 경쟁 우위성을 획득하기 위해서, 제휴나 매수등의 전략을 채용하고 있습니다.

- 2023년 12월-NEPES가 엣지 컴퓨팅용 인텔리전트 반도체 'METIS'를 개발. Metis는 네패스의 최첨단 2.5D&3D 포장 플랫폼인 nePACTM의 cx-BGA(Ball Grid Array)를 채택했습니다. nePACTM은 팬아웃 기술과 플립칩 본딩 기술을 기반으로 다층·미세 RDL 배선을 구현한 차세대 최첨단 포장 기술입니다. 인공지능반도체등의고집적,고성능칩에적합합니다.

- 2023년 6월-ASE Technology Holding의 자회사인 USI가 폴란드에 공장을 설립. 이 움직임은, 유럽 고객으로부터의 동사 제품에 대한 요구의 고조를 반영한 것입니다. 확대를 통해 USI는 폴란드에서 더 많은 제품을 제조하고 고객의 요구에 부응하며 시장 성장에 대응할 수 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업의 매력-Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

- 산업 밸류체인 및 공급망 분석

- 거시 경제 요인이 시장에 미치는 영향 평가

제5장 시장 역학

- 시장 성장 촉진요인

- 포장 공정 비용 절감

- 작고 고기능 전자 기기에 대한 수요 증가

- 연구개발 투자 증가

- 시장 성장 억제요인

- 패키징 공정의 복잡화

제6장 시장 세분화

- 산업 용도별

- 소비자 일렉트로닉스

- 자동차

- 통신

- 기타 산업 용도

- 지역별

- 미국

- 중국

- 한국

- 대만

- 일본

- 유럽

- 기타

제7장 경쟁 구도

- 기업 프로파일

- Samsung Electronics Co. Ltd

- Intel Corporation

- Nepes Corporation

- ASE Group

- Powertech Technology Inc.

- Fraunhofer Institute for Reliability and Micro integration IZM

- Unimicron Technology Corporation

- DECA Technologies Inc.

- JCET/STATSChipPAC

제8장 투자 분석

제9장 시장의 미래

AJY 25.05.07The Panel Level Packaging Market size is estimated at USD 0.35 billion in 2025, and is expected to reach USD 1.97 billion by 2030, at a CAGR of 41.07% during the forecast period (2025-2030).

The semiconductor industry is witnessing rapid growth, with semiconductors emerging as the basic building blocks of all modern technology. The advancements and innovations in this field directly impact all downstream technologies and drive the need for the market studied.

Key Highlights

- With the importance of the semiconductor industry growing, the demand for enhanced packaging solutions is also increasing, leading to the development of new semiconductor packaging techniques.

- Panel-level packaging (PLP) is a technology that has gained prominence recently. PLP refers to semiconductor packaging processed on a panel size. In panel-level packaging, the assembly process includes the fabrication of die attach, redistribution lines, molding, and bumping at the panel level.

- As more packages may be processed in panel and parallel formats, this type of packaging facilitates a much better area utilization (ratio between panel/wafer size and package size) compared to round wafer shapes. Hence, a lower packaging cost is among the primary drivers for the market's growth. PLP has a lower environmental impact due to a lower waste generation and carbon footprint.

- The panel-level packaging (PLP) market also encounters certain challenges. The substantial expenses linked to the technology and the intricate nature of its implementation might impede its extensive acceptance. The packaging process involves both types, mold first and RDL first. However, the type of packaging involves problems in die shift. Shifting the die is considered one of the biggest issues as it may cause lesser yield or negatively influence the yields. This increases the need for more control over the packaging process and adds complexity, restraining the market's growth.

- In the post-COVID-19 period, the focus on panel-level packaging is anticipated to increase due to the cost benefits and the expansion of the packaging size from wafers to larger panel formats. Increasing the number of packages manufactured in parallel is another major advantage supporting the market's growth. PLP may adopt processes, materials, and equipment from other technology areas. Printed circuit boards (PCB), liquid crystal displays (LCD), or solar equipment are manufactured on panel sizes and offer new approaches for fan-out panel-level packaging.

Panel Level Packaging Market Trends

Consumer Electronics Segment to Hold Major Market Share

- Consumer electronics such as smartphones, wearables, and tablets are becoming increasingly thin and compact. To meet the needs of miniaturization and light form factors, PLP allows manufacturers to achieve greater component density and more efficient use of space. For these devices, the reduced footprint caused by PLP is essential as it will enable sleek designs and maximize their utilization of available space.

- The consumer electronics industry competes with manufacturers who strive to differentiate products. By enabling sleek designs, increased functionality, and improved performance for consumer electronics devices, PLP provides an advantage to the market. To maintain their position in the market, manufacturers take advantage of PLP to meet consumer demands and introduce innovative products.

- The increasing penetration of 5G and IoT in recent years presents significant growth opportunities for the market. For instance, as per 5G Americas, the 5G subscriptions worldwide are estimated to reach 2.8 billion in 2024 and 5.9 billion by 2027.

- With the rising investments in 5G, the demand for 5G-enabled smartphones is also increasing parallelly. According to a report from Cybermedia Research, by the end of 2023, after recording a 13 times increase in 5G smartphone sales since its first introduction in 2020, shipments of 5G smartphones increased by 70% yearly. From only 4% in 2020, 5G smartphones were projected to capture a possible 45% market share in 2023.

- Similarly, owing to the rising adoption of the Internet of Things (IoT), the technology that enables communications between things and people using the Internet and IP-enabled protocols, the number of connected devices has been increasing rapidly in recent years. For instance, as per Cisco, there would be 29.3 billion networked devices in 2023. The massive expansion in IoT use cases will provide a significant impetus to market growth.

China is Expected to Lead the Market

- China is the largest semiconductor consumer, primarily due to the size of the domestic electronics market. The country is the world's largest producer and exporter of consumer electronics, as a significantly more significant number of global vendors have established their facilities to leverage the benefits of cheap labor costs.

- The electronics manufacturing industry has also recently continued to maintain steady expansion. As per a report by the Ministry of Industry and Information Technology via China Daily, in 2023, the industrial added value of major companies in the electronic information manufacturing sector grew by 3.4% yearly. According to the ministry, among significant products, the output of mobile phones increased by 6.9% Y-o-Y to 1.57 billion units, within which the number of smartphones increased by 1.9% Y-o-Y to 1.14 billion units. Several initiatives have been taken in recent years to boost the electronics industry's growth.

- China also leads in 5G adoption globally. According to the Ministry of Industry and Information Technology (MIIT), China aims to have 592.01 million 5G users as of February 2023. This number is anticipated to surpass 1 billion mark by 2025. A combined effort is being made to develop the supporting infrastructure to expand the footprint of 5G across the country.

- For instance, as of October 2023, China had about 3.22 million 5G base stations, constituting 28.1% of its entire mobile base station.

- The growing implementation of 5G in the country has also increased the uptake of 5G-enabled devices. For instance, according to the China Academy of Information and Communications Technology (CAICT), in 2023, 5G smartphone shipments in the country grew by about 11.9% Y-o-Y to 240 million units, while the overall smartphone shipments market grew by about 1.1%, compared to the previous year. As advanced packaging technologies may help resolve many of the 5G chip performance requirements, such trends are anticipated to favor the studied market's growth in the country.

- China is also a leading automotive market in production and consumption, which is anticipated to favor the market's growth in the country. The rising demand for cleaner and safer vehicles is among the major trends in the country's automotive industry, which supports the studied market's growth. Industry megatrends, including autonomous vehicles, electrification, enriched cabins, connectivity and software definition, and zonal architecture, also support the market's growth in the automotive segment.

Panel Level Packaging Industry Overview

The panel level packaging market is semi-consolidated with the presence of major players like Samsung Electronics Co. Ltd, Intel Corporation, Nepes Corporation, ASE Group, and Powertech Technology Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- December 2023 - NEPES developed 'METIS,' an intelligent semiconductor for edge computing. Metis applied cx-BGA (Ball Grid Array) of nePACTM, Nepes' cutting-edge 2.5D & 3D package platform. nePACTM is a next-generation cutting-edge package technology that implements multi-layer and fine RDL wiring based on fan-out technology and flip-chip bonding technology. It is suitable for highly integrated, high-performance chips such as artificial intelligence semiconductors.

- June 2023 - USI, a subsidiary of ASE Technology Holding Co. Ltd, inaugurated another factory in Poland. This move reflects the growing need for the company's products from European customers. By expanding, USI may make more goods in Poland, meet customer needs, and keep up with market growth.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain/Supply Chain Analysis

- 4.4 Assessment of Impact of Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Reduced Cost of Packaging Process

- 5.1.2 Increasing Demand for Compact and High Functionality Electronic Devices

- 5.1.3 Increased Investment on Research and Development Activities

- 5.2 Market Restraints

- 5.2.1 Complexity in Packaging Process

6 MARKET SEGMENTATION

- 6.1 By Industry Application

- 6.1.1 Consumer Electronics

- 6.1.2 Automotive

- 6.1.3 Telecommunication

- 6.1.4 Other Industry Applications

- 6.2 By Geography

- 6.2.1 United States

- 6.2.2 China

- 6.2.3 Korea

- 6.2.4 Taiwan

- 6.2.5 Japan

- 6.2.6 Europe

- 6.2.7 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Samsung Electronics Co. Ltd

- 7.1.2 Intel Corporation

- 7.1.3 Nepes Corporation

- 7.1.4 ASE Group

- 7.1.5 Powertech Technology Inc.

- 7.1.6 Fraunhofer Institute for Reliability and Micro integration IZM

- 7.1.7 Unimicron Technology Corporation

- 7.1.8 DECA Technologies Inc.

- 7.1.9 JCET/ STATSChipPAC