|

시장보고서

상품코드

1550027

반도체 테스트 장비 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Semiconductor Test Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

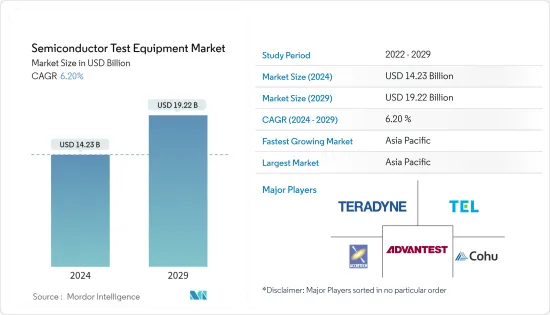

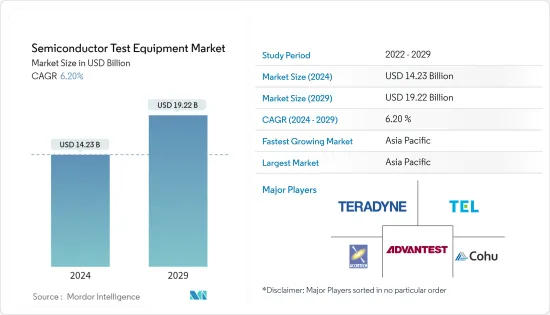

반도체 테스트 장비 시장 규모는 2024년 142억 3,000만 달러로 추정되며, 2029년에는 192억 2,0000만 달러에 달할 것으로 예상되며, 예측 기간(2024-2029년) 동안 6.20%의 CAGR로 성장할 것으로 예상됩니다.

주요 하이라이트

- 반도체 테스트 장비 시장은 AI, HPC, 5G, 자율주행차 등의 기술 발전으로 성장이 예상됩니다. 또한, 칩 기술의 발전과 3nm 및 5nm 반도체 칩의 생산 확대로 인해 미세한 공정 형상을 테스트할 수 있는 효율적인 테스트 장비에 대한 수요가 증가하고 있습니다.

- 차세대 디바이스는 더 작은 칩으로 설계되고 있으며, 애플은 iPhone 15 Pro/Ultra에 3nm 기술을 채택 할 것이라고 발표했으며, 5nm 이하의 공정 노드에서 반도체를 테스트하는 것은 도전 과제입니다. 제조업체들은 최고의 수율과 품질을 보장하고 비용을 관리하기 위해 새롭고 진보된 테스트 솔루션을 개발하는 데 주력하고 있습니다.

- 국내 제조를 촉진하기 위한 정부의 노력과 주요 반도체 공장의 투자는 반도체 생산량을 증가시키고 테스트 장비 시장을 촉진할 가능성이 높습니다. 예를 들어, 2024년 2월 인도 정부는 인도의 반도체 및 디스플레이 제조 생태계 개발을 위해 3개의 반도체 단위를 승인했습니다.

- 자동차 내비게이션, 안전 시스템, 인포테인먼트에 전자부품의 사용이 증가하고 있는 것도 반도체 검사 장비의 성장을 촉진하는 데 중요한 역할을 하고 있습니다. 또한, 스마트폰, 태블릿, 노트북/PC와 같은 가정용 전자제품의 반도체 수요 증가는 이 시장의 주요 성장 동력이 될 것으로 예상됩니다. 또한, 반도체 테스트 장비 시장은 다양한 산업 분야에서 사물인터넷(IoT)의 채택이 증가함에 따라 수혜를 받을 것으로 예상됩니다.

- 고급 테스트 장비의 높은 비용이 시장 성장을 제한하고 있습니다. 첨단 칩 기술의 도입과 함께 테스트 장비는 최신 기술을 포함하도록 업그레이드되어 장비 비용이 상승했습니다. 또한, 반도체 장비 관련 정부의 엄격한 규제가 시장 성장을 촉진하고 있습니다.

- 또한 우크라이나 사태는 최근 발생한 장애물로 하이테크, 자동차, 가전, 가전제품 등 다양한 제조 부문에 큰 혼란을 야기할 수 있습니다. 이는 산업 전반에 걸쳐 광범위한 영향을 미칠 수 있습니다. 러시아와 우크라이나는 세계 반도체 공급망에서 중요한 역할을 담당하고 있으며, 최신 기기 및 장비에 사용되는 실리콘 웨이퍼 생산에 필수적인 팔라듐 및 네온과 같은 필수 재료를 공급하고 있습니다. 반도체 생산 중단은 검사 장비 판매에 큰 영향을 미칩니다. 미국과 중국 간의 갈등은 중국이 세계 주요 가전 시장이라는 점에서 시장 성장에 큰 영향을 미칠 것으로 보입니다. 그러나 첨단 반도체 장비는 다른 나라에 크게 의존하고 있습니다.

반도체 테스트 장비 시장 동향

반도체 자동 테스트 장비(ATE)가 큰 시장 점유율을 차지

- IoT 애플리케이션의 확대로 스마트 기기 및 소형 반도체의 보급이 확대되면서 첨단 반도체 자동 테스트 장비에 대한 수요가 증가하고 있습니다.

- 에릭슨에 따르면, 2022년부터 2028년까지 전 세계 커넥티드 기기의 수가 거의 두 배로 증가할 것으로 예상됩니다. 이 성장을 주도하는 것은 근거리 IoT 기기의 증가로, 2028년에는 287억 2,000만 대에 달할 것으로 예측됩니다. 커넥티드 디바이스에는 웨어러블, 커넥티드카, 스마트 센서 등이 포함됩니다.

- 자동 테스트 장비는 생산 비용과 시간을 줄이고 생산성을 향상시킵니다. 더 나은 애플리케이션을 위한 복잡한 장치의 개발이 진행됨에 따라 처리량이 높은 테스트 장비에 대한 수요가 증가하고 있으며, ATE는 인적 오류에 취약한 프로세스를 자동화하여 잘못된 테스트 보고서 결과를 제거할 수 있습니다. 테스트가 자동으로 수행되면 테스트 결과가 균일하고 왜곡되지 않아 제품 품질의 일관성을 보장하며, ATE는 필요한 시간과 재료를 줄여 테스트 비용을 절감하는 데 도움이 됩니다. 이는 테스트 시퀀스를 자동화하는 ATE의 프로그래밍 가능한 기능을 사용하여 달성할 수 있습니다.

- 오늘날 자동차는 ADAS, 인포테인먼트 시스템, AI 어시스턴트 등 스마트 전자부품 및 첨단 기술의 채택이 확대되면서 큰 성장 기회를 창출하고 있으며, ATE 시스템은 ECU, 센서, 인포테인먼트 시스템 등의 구성요소를 상세하게 테스트하여 신뢰성, 기능 및 자동차 산업 규범 준수를 보장합니다.

- IEA에 따르면, 2023년에도 전기자동차 판매량이 급증할 것으로 예상됩니다. 1분기에만 약 230만 대의 전기자동차가 판매되어 전년 동기 대비 25% 증가했습니다. 이 같은 성장세는 국가 정책과 인센티브, 유가 상승으로 구매 의욕이 높아진 것이 주요 요인으로 꼽힙니다. 전기자동차와 커넥티드카에 대한 수요 증가가 ATE 시장의 성장을 견인할 것으로 보입니다.

아시아태평양이 큰 시장 점유율을 차지

- 중국은 테스트 장비 시장에서 큰 점유율을 차지하고 있습니다. 중국은 1,500억 달러의 자금을 투자하여 야심찬 반도체 아젠다를 추진하고 있습니다. 중국은 국내 IC 산업을 강화하고 칩 생산량을 늘리는 것을 목표로 하고 있습니다.

- 현재 진행 중인 미국과 중국의 무역 전쟁은 최첨단 공정 기술이 집중된 이 중요한 분야에서 긴장을 고조시키고 있으며, 많은 중국 기업들이 반도체 파운드리에 투자하도록 유도하고 있습니다. 중국은 파운드리, 질화갈륨(GaN), 탄화규소(SiC) 시장에서의 대대적인 확장 캠페인 등 반도체 부문을 강화하기 위한 다양한 이니셔티브를 발표했습니다. 이 지역의 반도체 사업 성장과 칩 생산능력 증가는 테스트 장비에 대한 수요를 촉진할 것으로 예상됩니다. 중국 하이테크 산업은 통신, 재생에너지, 전기자동차(EV)에서의 강력한 입지를 활용하여 세계 기술 가치사슬을 상승시키는 것을 목표로 하고 있습니다. 이러한 분야 외에도 현재 첨단 반도체 분야에도 집중하고 있습니다. 이러한 전환은 주로 첨단 노드 제조의 발전, 메모리 시장 확대, 탄화규소(SiC) 경쟁에 대한 적극적인 참여, 첨단 패키징 및 제조 장비에 대한 전략적 투자에 의해 주도되고 있습니다. 중국 전역의 파운드리 사업 확장과 팹에 대한 투자는 시장 성장을 촉진할 것으로 예상됩니다.

- 또한 중국과 미국은 반도체 지적재산권 및 제조를 둘러싼 경쟁을 심화시키고 있습니다. 미국은 자국 내 칩 생산을 강화하는 한편, 이 중요한 산업에서 자립하려는 중국의 노력을 방해하는 제재를 가하고 있습니다. 그 결과, 이 지역은 자생력을 높이기 위해 반도체 제조 및 테스트 사업에 대규모 투자를 하고 있습니다. 2023년 9월에 발표된 중국의 새로운 국영 투자 펀드는 반도체 부문에 약 400억 달러의 자금을 조달하는 것을 목표로 하고 있습니다. 이 펀드는 주로 미국 및 기타 경쟁업체를 따라잡기 위해 칩 제조 장비를 인수하는 데 초점을 맞추고 있습니다.

- 파운드리의 확장은 테스트 장비 시장의 성장에 직접적인 영향을 미칩니다. 이 장려책을 통해 중국은 중국 칩 기업이 제조, 조립, 포장, 연구 개발을 위해 국내 시설을 건설, 확장 및 업그레이드하는 데 대한 지원을 강화할 계획입니다.

- 또한 IEA에 따르면, 2023년에는 중국이 전 세계 전기자동차 신규 등록대수의 60%에 육박할 것으로 전망하고 있습니다. 이 지역은 주로 BYD와 같은 기업들이 전기자동차 생산에 많은 투자를 하고 있습니다. 이 지역의 전기자동차 분야의 성장은 시장 잠재력을 촉진할 것으로 예상됩니다.

반도체 테스트 장비 산업 개요

반도체 테스트 장비 시장은 Advantest Corporation, Teradyne, Inc, Cohu Inc, Tokyo Electron Limited, HCT, Tokyo Seimitsu Company 등 주요 기업들에 의해 반고정적으로 지배되고 있습니다. 지배하고 있습니다.

- 2024년 2월 - Cohu Inc.는 Cohu의 최신 MEMS 테스트 솔루션 포트폴리오 제품인 Sense 시스템이 미국 팹리스 반도체 제조업체인 Tuo Sense의 차세대 하이파이 마이크로폰 테스트에 채택되었다고 발표했습니다.

- 2023년 12월 - 어드밴테스트는 단일 통합 플랫폼에서 AI, ML 및 데이터 분석 의사결정을 강화하는 ACS 실시간 데이터 인프라(RTDI)를 발표했습니다. 이 새로운 인프라는 테스트 데이터를 안전하게 수집, 처리, 분석 및 모니터링하고, 고객이 인사이트를 실행 가능한 테스트 의사결정으로 전환하는 절차를 자동화할 수 있도록 지원합니다. 이를 통해 소비자와 파트너는 품질을 최적화하고, 테스트 시간을 단축하며, 스마트 포장을 강화할 수 있습니다.

기타 혜택:

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 가정과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 업계의 매력 - Porter's Five Forces 분석

- 신규 참여업체의 위협

- 구매자/소비자의 협상력

- 공급 기업의 교섭력

- 대체품의 위협

- 경쟁 기업 간의 경쟁 관계

- 기기 카테고리 기술 개요

- COVID-19의 영향과 기타 거시경제 요인이 시장에 미치는 영향

제5장 시장 역학

- 시장 성장 촉진요인

- 업계 딴사람공 지능, IoT, 커넥티드 디바이스 보급

- 자동차의 반도체 용도 확대

- 시장 과제

- 반도체 부족을 가져오는 공급망 혼란

- 기술의 역동적인 성질에 의해 기기 몇차례 변경이 필요

제6장 시장 세분화

- 제품 유형별

- 반도체 자동 테스트 장비(ATE)

- 번인 시스템

- 핸들러 장비

- 프로브 장비

- 광학 검사 장비

- 기타 제품 유형

- 지역별

- 북미

- 유럽

- 아시아

- 호주·뉴질랜드

- 중동 및 아프리카

- 라틴아메리카

제7장 경쟁 상황

- 기업 개요

- Advantest Corporation

- Tokyo Electron Limited

- Teradyne Inc.

- Cohu Inc.

- HCT Co. Ltd

- Tokyo Seimitsu Co. Ltd

- National Instruments

- Astronics Corporation

- TESEC Inc.

- Chroma ATE Inc.

제8장 벤더 점유율 분석

제9장 시장 전망

ksm 24.09.13The Semiconductor Test Equipment Market size is estimated at USD 14.23 billion in 2024, and is expected to reach USD 19.22 billion by 2029, growing at a CAGR of 6.20% during the forecast period (2024-2029).

Key Highlights

- The semiconductor test equipment market is expected to grow due to technological advancements such as AI, HPC, 5G, and automated vehicles. Further, the technological advancement in chip technology and growing production of 3nm and 5nm semiconductor chips create a huge demand for efficient test equipment to test small process geometrics.

- As next-generation devices are designed with smaller chips, Apple announced it would use 3nm technology in iPhone 15 Pro/Ultra; such developments drive market growth. Testing semiconductors with 5nm or smaller process nodes is challenging. Manufacturers focus on developing new and advanced test solutions that ensure the best yield, quality, and control costs.

- The government's efforts to increase in-house production and investment by leading semiconductor fabs will increase semiconductor production, which will likely foster the market for testing equipment. For instance, in February 2024, the Government of India approved three semiconductor units for the development of semiconductor and display manufacturing ecosystems in India.

- The rising utilization of electronic components in automobile navigation, safety systems, and infotainment also plays a significant role in propelling the growth of semiconductor testing equipment. Moreover, the increasing demand for semiconductors in consumer electronics like smartphones, tablets, and laptops/PCs is anticipated to be a key driver in this market. Moreover, the semiconductor test equipment market is expected to benefit from the increasing adoption of internet-of-things (IoT) in different industrial sectors.

- The high cost of advanced testing equipment restricts market growth. With the introduction of advanced chip technology, testing equipment was upgraded to include the latest technology, increasing the equipment cost. Further, stringent government regulations related to semiconductor equipment facilitate market growth.

- Also, the crisis in Ukraine is the latest obstacle to arise, and it can cause significant disruptions in various manufacturing sectors such as high-tech, automotive, consumer electronics, and household appliances. This could have far-reaching consequences for the industry as a whole. Russia and Ukraine play crucial roles in the global semiconductor supply chain, supplying essential materials such as palladium and neon, vital for producing silicon wafers used in modern devices and equipment. The suspended semiconductor production significantly impacts the sales of testing equipment. The ongoing dispute between the US and China will significantly impact the market growth as China is the major consumer electronics market in the world. However, it largely depends on other countries for advanced semiconductor equipment.

Semiconductor Test Equipment Market Trends

Semiconductor Automated Test Equipment (ATE) to Hold Significant Market Share

- Owing to the expansion of IoT applications, smart devices, and small semiconductors are becoming more prevalent, driving demand for advanced semiconductor automated testing equipment.

- According to Ericsson, the number of connected devices worldwide will almost double between 2022 and 2028. This growth is expected to be driven by a rise in short-range IoT devices, with a forecast of 28.72 billion such devices by 2028. Connected devices include wearables, connected cars, and smart sensors.

- Automated testing equipment reduces manufacturing costs and time and increases productivity. The ongoing development of complex devices for better applications drives demand for high-throughput test equipment. An ATE can eliminate false test report results by automating processes susceptible to human mistakes. When testing is done automatically, test results are uniform and cannot be distorted, guaranteeing consistency in product quality. An ATE can help reduce testing costs by reducing the time and materials required. This can be achieved by using programmable functions on ATEs that automate test sequences.

- The growing adoption of smart electronics components and advanced technologies such as ADAS, infotainment systems, and AI assistants in today's vehicles creates significant growth opportunities. ATE systems allow for detailed testing of components such as ECUs, sensors, and infotainment systems, guaranteeing reliability, functionality, and compliance with automotive industry norms.

- According to the IEA, EV sales were expected to continue to surge in 2023. Approximately 2.3 million electric cars were sold in the first quarter alone, representing a 25% increase from the same period last year. This growth is largely attributed to national policies and incentives, as well as high oil prices, which are motivating prospective buyers. The increased demand for electric and connected vehicles will drive the ATE market growth.

Asia-Pacific to Hold Significant Market Share

- China holds a significant share of the testing equipment market. The country is pursuing an ambitious semiconductor agenda with USD 150 billion in funding. The country aims to enhance its domestic IC industry and increase its chip production.

- The ongoing US-China trade war has intensified tensions in this crucial sector, where the most advanced process technology is concentrated, leading many Chinese companies to invest in semiconductor foundries. China has unveiled various initiatives to strengthen its semiconductor sector, such as a substantial expansion campaign in the foundry, gallium-nitride (GaN), and silicon carbide (SiC) markets. The growing semiconductor business and increasing chip production capabilities in the region are expected to drive the demand for testing equipment. China's tech industry aims to ascend the global technology value chain by capitalizing on its strong presence in telecommunications, renewables, and electric vehicles (EVs). In addition to these sectors, the industry is now focusing on advanced semiconductors. This transition is primarily driven by advancements in advanced node manufacturing, the expansion of the memory market, active involvement in the silicon carbide (SiC) race, and strategic investments in advanced packaging and manufacturing equipment. The growing foundry business and investments in fabs throughout China are anticipated to stimulate market growth.

- Moreover, China and the United States are growing competition over semiconductor intellectual property and manufacturing. The United States is taking steps to boost its chip production while imposing sanctions to hinder China's efforts to achieve self-reliance in this crucial industry. As a result, the region is making significant investments in the semiconductor manufacturing and testing business to enhance its self-reliance capabilities. An example is the recent announcement in September 2023 of China's new state-backed investment fund, which aims to raise approximately USD 40 billion for the semiconductor sector. This fund will primarily focus on acquiring chip manufacturing equipment to catch up to the United States and other competitors.

- The expansion of foundries directly impacts the growth of the testing equipment market. Through the incentive package, Beijing intends to enhance its assistance to Chinese chip companies in constructing, expanding, or upgrading domestic facilities for fabrication, assembly, packaging, and research and development.

- Further, according to IEA, China accounted for nearly 60% of all new electric car registrations worldwide in 2023. This region is primarily dominated by companies like BYD and others, which are making significant investments in the production of electric vehicles. The growth of the EV sector in the region is expected to drive the market's potential.

Semiconductor Test Equipment Industry Overview

The semiconductor test equipment market is semi-consolidated and dominated by leading vendors such as Advantest Corporation, Teradyne, Inc., Cohu Inc., Tokyo Electron Limited, HCT Co. Ltd, and Tokyo Seimitsu Co. Ltd. Companies continuously focus on enhancing their market presence by launching new products, expanding their operations, or entering strategic mergers and acquisitions, partnerships, and collaborations.

- February 2024 - Cohu Inc. announced that the Sense+ system, Cohu's recent MEMS test solution portfolio product, was selected by the United States fabless semiconductor manufacturer with μ-sense to test their next-generation high-fidelity microphones.

- December 2023 - Advantest Corporation launched ACS Real-time Data Infrastructure (RTDI) to enhance AI, ML, and data analytics decision-making in a single, integrated platform. The new infrastructure securely gathers, processes, analyzes, and monitors test data to enable customers to automate the procedure of converting insights into actionable test decisions. This helps consumers and partners optimize quality, reduce test time, and enhance smart packaging.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technological Overview of Equipment Categories

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Proliferation of Artificial Intelligence, IoT, and Connected Devices across Industry Verticals

- 5.1.2 Increased Applications of Semiconductors in Automotive

- 5.2 Market Challenges

- 5.2.1 Supply Chain Disruptions Resulting in Semiconductor Shortage

- 5.2.2 Dynamic Nature of Technologies Requires Several Changes in Equipment

6 MARKET SEGMENTATION

- 6.1 By Type of Product

- 6.1.1 Semiconductor Automated Test Equipment (ATE)

- 6.1.2 Burn-in Systems

- 6.1.3 Handler Equipment

- 6.1.4 Probe Equipment

- 6.1.5 Optical Inspection Systems

- 6.1.6 Other Equipment Categories

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia

- 6.2.4 Australia and New Zealand

- 6.2.5 Middle East and Africa

- 6.2.6 Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Advantest Corporation

- 7.1.2 Tokyo Electron Limited

- 7.1.3 Teradyne Inc.

- 7.1.4 Cohu Inc.

- 7.1.5 HCT Co. Ltd

- 7.1.6 Tokyo Seimitsu Co. Ltd

- 7.1.7 National Instruments

- 7.1.8 Astronics Corporation

- 7.1.9 TESEC Inc.

- 7.1.10 Chroma ATE Inc.