|

시장보고서

상품코드

1626298

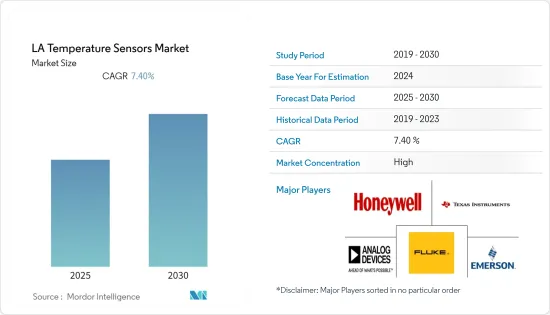

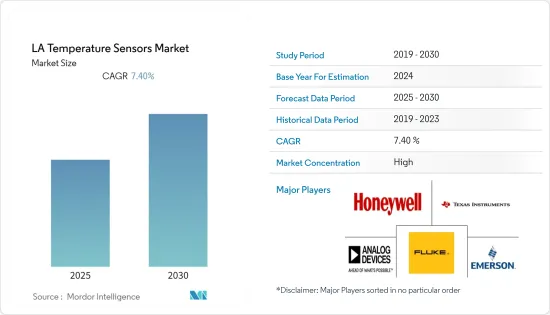

라틴아메리카의 온도 센서 : 시장 점유율 분석, 산업 동향, 통계 및 성장 예측(2025-2030년)LA Temperature Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

라틴아메리카의 온도 센서 시장은 예측 기간 동안 CAGR 7.4%를 나타낼 것으로 예상됩니다.

주요 하이라이트

- 라틴아메리카는 가전, 석유 및 가스, 발전, 항공우주, 자동차 등 다양한 산업에서 스마트 기술을 채택하고 추진하는 주요 국가 중 하나입니다.

- Associacao Nacional dos Fabricantes de Veiculos Automotores(ANFAVEA)에 따르면 2020년 2월 현재 7,500대 이상의 하이브리드 및 전기자동차가 유통되고 있습니다. 전기자동차는 온도 센서를 많이 활용하고 있으며, 자동차 부문은 온도 센서의 국내 최대 사용자 중 하나입니다.

- 멕시코는 이 지역의 다른 국가들 중에서도 전통적으로 압도적인 석유 생산국이며, 향후 10년간 세계 생산량에 300만 BPD를 추가할 수 있는 잠재력을 가진 세계의 새로운 석유 프론티어 국가로 여겨지고 있습니다.

- 온도 센서는 코로나19와의 싸움에서 쉽게 사용되었으며, 2020년 5월 브라질 주세리노 쿠비체크 공항은 국내선 출발 시 체온 센서 시스템을 도입한다고 발표했습니다. 이 시스템은 한 번에 30명의 체온을 측정하고 정상 체온과 다른 열원을 구별할 수 있습니다.

라틴아메리카의 온도 센서 시장 동향

자동차 산업이 급격한 성장세를 보이고 있습니다.

- 이 지역의 자동차 산업은 온도 센서의 중요한 사용자입니다. 자율주행차 분야에 집중하는 인텔과 같은 기업들이 멕시코에 투자하고 있습니다. 멕시코의 전기자동차 판매량은 두 자릿수 증가율을 보이고 있지만, 전기자동차 수요는 하이브리드 자동차보다 더디게 성장하고 있습니다.

- 국립통계지리원(INEGI)이 발표한 데이터에 따르면, 2019년 1월부터 2020년 2월까지 멕시코 자동차 딜러들은 353대의 전동화 차량을 판매한 것으로 나타났습니다.

- 또한 국가전기에너지국(ANEEL)은 2030년까지 전기자동차의 수가 21만 2,000대까지 증가할 것으로 예상하고 있습니다. 전기자동차는 온도 센서를 많이 사용하기 때문에 자동차 산업은 국내 최고의 온도 센서 사용자가되었습니다.

- 그러나 Asociacion de Fabricantes de Automotores(ADEFA)의 데이터에 따르면 아르헨티나 자동차 산업의 상황은 수요 감소로 인해 상당히 어려운 상황임. 수요 감소에 따라 아르헨티나 자동차 산업 공급업체 3곳이 공장 폐쇄(2020년 7월)를 발표하고 브라질로 이전을 계획하고 있습니다. 이는 아르헨티나 자동차 산업에서 온도 센서의 사용을 방해할 것으로 예상됩니다.

브라질이 가장 높은 시장 점유율을 차지

- 중남미 최대 국가인 브라질은 가전, 석유 및 가스, 발전, 항공우주, 자동차 등 다양한 산업에서 스마트 기술 도입 및 보급에 힘쓰고 있는 주요 국가 중 하나입니다.

- 영국 런던에 본사를 둔 석유 및 가스 회사 BP PLC는 브라질이 향후 5년간 석유 부문에 약 220억 달러 상당의 투자를 유치할 수 있을 것으로 추정하고 있습니다. 그 결과 생산량은 2025년까지 약 370만 BPD까지 증가할 것으로 예상됩니다. 따라서 새로운 프로젝트를 통한 확장 가능성도 있습니다. 이러한 통계는 이 분야에서 온도 센서에 대한 수요가 증가하고 있음을 보여줍니다.

- 이 나라에는 가장 유명한 대표 기업인 Embraer가 있으며, 이 회사는 현재 세계 3위의 민간, 군용 및 임원용 항공기 제조업체입니다. BCI Aerospace에 따르면, 항공우주산업은 향후 몇 년동안 연간 5-6%의 성장 기회를 가질 것으로 예상되며, 이는 남반구에서 가장 큰 산업으로 성장하고 있습니다.

- 브라질은 스마트시티 개발에서도 큰 성과를 거두었습니다. 예를 들어, 브라질은 플래닛 스마트 시티(Planet Smart City)가 개발할 예정인 새로운 저비용 스마트 시티인 나탈(Natal)을 출범시켰습니다. 이 도시는 170헥타르의 부지에 개발되며 약 15만 명이 거주할 예정입니다. 이 도시는 해비택스(Habitax)와의 제휴를 통해 개발될 예정입니다. 이러한 개발로 인해 온도 센서를 포함한 센서 시스템의 이용이 증가할 것으로 예상됩니다.

라틴아메리카의 온도 센서 산업 개요

라틴아메리카의 온도 센서 시장은 경쟁이 치열하고 여러 대기업으로 구성되어 있습니다. 시장 점유율 측면에서 현재 몇몇 대기업이 시장을 독점하고 있습니다. 시장 점유율이 높은 이들 대기업들은 해외로 고객 기반을 확대하는 데 주력하고 있습니다. 이들 기업은 시장 점유율을 확대하고 수익성을 높이기 위해 전략적 공동 이니셔티브를 활용하고 있습니다.

- 2021년 6월 - ISO 9001:2015 인증을 획득하고 50년 이상 온도 변화에 민감한 제품의 무결성을 보호하는 스마트 솔루션을 개발 및 제공하는 세계 기업 콜드체인 테크놀로지스(Cold Chain Technologies)가 라틴아메리카에 진출한다고 발표했습니다. 발표했습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- COVID-19의 업계에 대한 영향 평가

- 시장 성장 촉진요인

- 인더스트리 4.0으로 고속 공장 자동화 성장

- 소비자 일렉트로닉스 웨어러블 수요 증가

- 시장 성장 억제요인

- 원재료 가격 변동

- 밸류체인 분석

- 업계의 매력 - Porter의 Five Forces 분석

- 공급 기업의 교섭력

- 바이어의 교섭력

- 신규 진출업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 세분화

- 유형별

- 유선

- 무선

- 기술별

- 적외선

- 열전대

- 저항 온도 검출기

- 서미스터

- 온도 트랜스미터

- 광섬유

- 기타

- 최종사용자 산업별

- 화학제품 및 석유화학제품

- 석유 및 가스

- 금속 및 광업

- 발전

- 식품 및 음료

- 자동차

- 의료

- 항공우주·군

- 가전

- 기타 최종사용자 산업

- 국가별

- 브라질

- 멕시코

- 기타 라틴아메리카

제6장 경쟁 구도

- 기업 개요

- Siemens AG

- Panasonic Corporation

- Texas Instruments Incorporated

- Honeywell International Inc.

- ABB Ltd

- Analog Devices Inc.

- Fluke Process Instruments

- Emerson Electric Company

- STMicroelectronics

- Microchip Technology Incorporated

- NXP Semiconductors NV

- GE Sensing & Inspection Technologies GmbH

- Robert Bosch GmbH

- Gunther GmbH Temperaturmesstechnik

- TE Connectivity Ltd

- Denso Corporation

- Omron Corporatio

- FLIR Systems

- Thermometris

- Maxim Integrated Products

- Kongsberg Gruppen

제7장 투자 분석

제82장 시장의 미래

LSH 25.01.15The LA Temperature Sensors Market is expected to register a CAGR of 7.4% during the forecast period.

Key Highlights

- Latin America is one of the leading adopters and promoters of smart technology in various industries, such as consumer electronics, oil, gas, power generation, aerospace, and automotive.

- According to the Associacao Nacional dos Fabricantes de Veiculos Automotores (ANFAVEA), As of February 2020, there are more than 7,500 hybrid and electric vehicles in circulation. Electric vehicles significantly utilize temperature sensors, making the automotive sector one of the country's prominent users of temperature sensors.

- Among other countries in the region, Mexico has traditionally been the dominant producer of oil and is being considered the world's new oil frontier with a potential to add three Million BPD to the global output during the next decade.

- Temperature sensors were readily used in combat against covid-19. In May 2020, the Juscelino Kubitschek Airport in Brazil announced the implementation of a body-heat sensor system for domestic departures. The system measures the temperature of 30 people at a time and can differentiate normal body temperatures from other sources of heat.

Latin America Temperature Sensors Market Trends

Automotive Industry to Show Significant Growth

- The automotive sector of the region is a significant user of temperature sensors. Companies such as Intel, which are focusing on the autonomous vehicle space, are investing in Mexico. The sales of electrified vehicles in the country have increased at a two-digit pace, although the demand for electric cars is growing slower than that of hybrid units.

- According to the data made available by the National Institute of Statistics and Geography (INEGI), auto dealers in Mexico sold 353 electrified vehicles between January 2019 and February 2020.

- Moreover, The National Agency of Electric Energy (ANEEL) suggests that the number of electric vehicles is expected to rise to 212,000 by 2030. Electric vehicles significantly utilize temperature sensors, making the automotive sector one of the country's prominent users of temperature sensors.

- However, the state of the automotive industry in Argentina has been quite challenging due to the decreasing demand, according to data from Asociacion de Fabricantes de Automotores (ADEFA). In response to the decline in demand, three supplier companies of the automotive industry in Argentina have announced the closure of factories (July 2020), with plans of migrating to Brazil. This is expected to hamper the usage of temperature sensors in the automotive sector of Argentina.

Brazil to Hold the Highest Market Share

- Brazil, the largest country in the Latin American region, is one of the leading countries involved in adopting and promoting smart technology in various industries, such as consumer electronics, oil, gas, power generation, aerospace, and automotive.

- BP PLC, an oil and gas firm based out of London, United Kingdom, estimates that Brazil could attract about USD 22 billion worth of investment in the oil sector in each of the next five years. Owing to this, the production is expected to increase to around 3.7 Million BPD by 2025. This has been providing the scope for expansion, possibly in new projects. Such statistics highlight the rising demand for temperature sensors in the sector.

- The country is home to the most prominent representative company named Embraer, a firm that is currently the third-major manufacturer of commercial, military, and executive aircraft in the world. This places the country's aerospace industry as the largest in the Southern Hemisphere. According to BCI Aerospace, the aerospace industry has potential opportunities for annual growth of 5-6% over the next few years.

- Brazil has also been witnessing significant development of smart cities. For instance, Brazil launched a new low-cost smart city, Natal, which is expected to be developed by Planet Smart City. The city is expected to be developed in 170 hectares and to house around 150,000 people. The city is to be developed in partnership with Habitax. Such developments are expected to increase the usage of sensor systems, including temperature sensors.

Latin America Temperature Sensors Industry Overview

The Latin America Temperature Sensor market is competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. These major players with a prominent share in the market are focusing on expanding their customer base across foreign countries. These companies are leveraging on strategic collaborative initiatives to increase their market share and increase their profitability.

- June 2021 - Cold Chain Technologies, an ISO 9001:2015 certified global provider with more than 50 years of developing and delivering smart solutions that protect the integrity of temperature-sensitive products, announced an extensive expansion into Latin America.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Assessment of Impact of COVID-19 on the Industry

- 4.3 Market Drivers

- 4.3.1 Growth in Industry 4.0 & Rapid Factory Automation

- 4.3.2 Increasing Demand for Wearable in Consumer Electronics

- 4.4 Market Restraints

- 4.4.1 Fluctuation in Raw Material Prices

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Wired

- 5.1.2 Wireless

- 5.2 By Technology

- 5.2.1 Infrared

- 5.2.2 Thermocouple

- 5.2.3 Resistance Temperature Detector

- 5.2.4 Thermistor

- 5.2.5 Temperature Transmitter

- 5.2.6 Fiber Optic

- 5.2.7 Others

- 5.3 By End-user Industry

- 5.3.1 Chemical and Petrochemical

- 5.3.2 Oil and Gas

- 5.3.3 Metal and Mining

- 5.3.4 Power Generation

- 5.3.5 Food and Beverage

- 5.3.6 Automotive

- 5.3.7 Medical

- 5.3.8 Aerospace and Military

- 5.3.9 Consumer Electronics

- 5.3.10 Other End-user Industries

- 5.4 By Country

- 5.4.1 Brazil

- 5.4.2 Mexico

- 5.4.3 Rest of Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Siemens AG

- 6.1.2 Panasonic Corporation

- 6.1.3 Texas Instruments Incorporated

- 6.1.4 Honeywell International Inc.

- 6.1.5 ABB Ltd

- 6.1.6 Analog Devices Inc.

- 6.1.7 Fluke Process Instruments

- 6.1.8 Emerson Electric Company

- 6.1.9 STMicroelectronics

- 6.1.10 Microchip Technology Incorporated

- 6.1.11 NXP Semiconductors NV

- 6.1.12 GE Sensing & Inspection Technologies GmbH

- 6.1.13 Robert Bosch GmbH

- 6.1.14 Gunther GmbH Temperaturmesstechnik

- 6.1.15 TE Connectivity Ltd

- 6.1.16 Denso Corporation

- 6.1.17 Omron Corporatio

- 6.1.18 FLIR Systems

- 6.1.19 Thermometris

- 6.1.20 Maxim Integrated Products

- 6.1.21 Kongsberg Gruppen