|

시장보고서

상품코드

1626313

라틴아메리카의 유리 포장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Latin America Glass Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

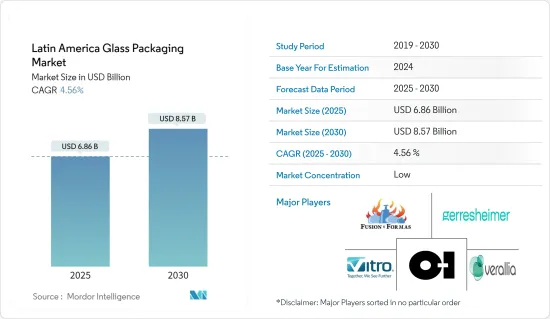

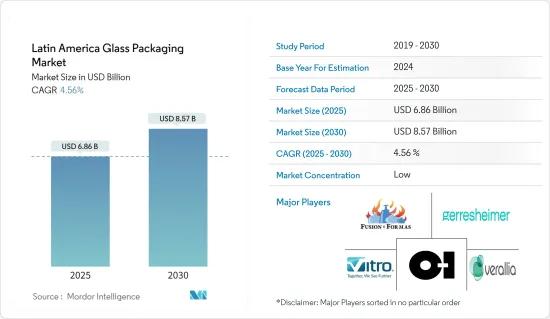

라틴아메리카의 유리 포장 시장 규모는 2025년 68억 6,000만 달러로 추정되며, 예측 기간(2025-2030년) 동안 4.56%의 CAGR로 2030년에는 85억 7,000만 달러에 달할 것으로 예상됩니다.

유리 포장은 건강, 맛, 환경 안전을 우선시하는 소비자에게 신뢰할 수 있는 선택입니다. 유리 포장은 제품의 신선도를 유지하고 보호할 수 있는 고급스러움으로 인정받고 있습니다. 또한, 친환경 제품에 대한 수요 증가와 음료 및 식품 시장의 호황은 유리 포장 시장의 성장을 촉진하고 있습니다.

주요 하이라이트

- 소비자들이 안전하고 건강한 포장에 대한 관심이 높아지면서 유리 포장은 여러 카테고리에서 성장세를 보이고 있습니다. 또한, 엠보싱, 성형, 예술적 마감과 같은 기술 혁신은 최종사용자에게 유리 포장의 매력을 증폭시키고 있습니다.

- 도시화, 소비자 선호도 변화, 음료 및 주류에 대한 수요 증가에 힘입어 점점 더 많은 제조업체들이 유리 포장을 채택하고 있습니다. 유엔에 따르면, 인구의 80%가 도시에 거주하는 라틴아메리카와 카리브해 국가들은 가장 도시화가 진행된 지역으로 꼽힙니다. 이러한 역학으로 인해 시장은 향후 몇 년 동안 완만한 성장세를 보일 것으로 보입니다.

- 유리는 다양한 제품의 포장재로 계속 선호되고 있지만, 플라스틱을 대체할 수 있는 플라스틱의 채택이 증가함에 따라 시장 성장에 어려움을 겪고 있습니다. 또한, 플라스틱의 안전성을 높이기 위한 플라스틱의 발전은 포장재로서 유리의 범위를 더욱 제한하고 있습니다.

- 최근 몇 년 동안 환경에 대한 인식이 높아지고 있습니다. 기업과 소비자 모두 자신의 선택이 지구에 어떤 영향을 미치는지 인식하고 있습니다. 동시에 정책 입안자들은 지속가능성에 대한 노력을 강화하기 위한 프레임워크를 만들고 결정을 내리고 있습니다. 그 결과, 지속가능성은 세계 이슈로 자리 잡았고, 사회, 경제, 정책 논의에 영향을 미치며 유리 포장에 대한 수요를 견인하고 있습니다.

- 시장은 또한 도전에 직면해 있습니다. 라틴아메리카의 일부 국가에서는 재활용 인프라가 미비하여 유리 폐기물의 수집 및 처리가 복잡합니다. 그 결과, 유리 폐기물은 매립이나 소각으로 처리되는 경우가 많습니다. 유리는 비용면에서 유리하고 다양한 용도로 사용되는 플라스틱과 같은 포장재와 경쟁하고 있습니다.

라틴아메리카의 유리 포장 시장 동향

음료 부문의 수요 증가가 시장을 견인할 것으로 예상

- 최근 몇 년 동안 라틴아메리카에서는 음료 출시와 판매가 증가하고 있습니다. 알코올 음료와 무알콜 음료의 유리 포장에 대한 수요가 증가함에 따라 각 회사는 브라질에 생산 기지를 설립하고 있습니다.

- 브라질 성인과 젊은 층이 일주일에 5일 이상 청량음료를 마시는 비율이 증가하고 있는 것은 브라질의 청량음료 수요 증가를 보여줍니다. 이러한 소비 증가는 청량음료 업계의 유리병 수요에 긍정적인 영향을 미칠 것으로 보입니다.

- 브라질 지역 통계 연구소에 따르면 2019년 증류주 및 기타 음료 제조 수익은 902.11달러였으며 2023년에는 9억 4,932만 달러에 달할 것으로 예상됩니다. 따라서 청량음료 소비가 증가함에 따라 소비자의 취향과 시장 수요를 충족시키기 위한 포장 옵션으로 유리병에 대한 수요도 그에 상응하게 증가할 것으로 예상됩니다.

- Glanbia Nutritionals에 따르면, 라틴아메리카에서 천연 에너지 증진 음료에 대한 수요가 증가하고 있습니다. 멕시코 소비자의 69%가 하루 종일 에너지를 지속시켜주는 제품에 관심을 보이고 있으며, 장시간 활력을 원하는 경향이 두드러지게 나타나고 있습니다.

- 또한, 더 건강하고 깨끗한 라벨을 가진 음료로 전환하는 추세는 라틴아메리카 기능성 음료의 전망을 형성하고 있습니다. 향후 주요 성장 분야는 '단백질+' 음료로, 설탕과 칼로리 없이 다양한 건강 성분을 함유한 단백질이 함유된 에너지 음료가 포함될 수 있습니다. 라틴아메리카 시장을 염두에 두고 있는 제조업체는 음료 혁신과 지역적 뉘앙스에 정통한 음료 원료 공급업체와 파트너십을 맺는 것이 가장 중요합니다.

멕시코는 견조한 시장 확대가 예상

- 멕시코의 포장 장비의 급속한 기술 성장과 바쁜 라이프스타일의 변화는 예측 기간 동안 시장 성장을 견인할 것으로 예상됩니다. 멕시코는 풍부한 천연 자원, 저렴한 노동력, 소비 지출 증가로 인해 외국 유리 포장 제조업체 및 기타 기업을 유치하고 있습니다.

- 국립통계지리원(INEGI)의 보고서에 따르면 멕시코의 콜라 음료 생산량이 증가하여 유리 포장에 대한 수요를 주도하고 있으며, 2023년 4월 콜라 음료 판매량은 11억 1,000만 리터에 육박하여 전월보다 증가하였다고 합니다. 이러한 판매량 급증은 음료 산업에서 생산량 증가에 대응하기 위해 유리 포장의 필요성을 강조하고 있습니다.

- 또한, 소규모 생산자들을 LaLa나 Alpura와 같은 대규모 협동조합이나 기업에 통합함으로써 효율성과 규모의 경제를 높일 수 있습니다. 이러한 액체 우유 생산의 증가는 유제품 부문에서 유리 포장에 대한 수요를 뒷받침할 것으로 예상됩니다. FAO와 미국 농무부에 따르면, 유제품 생산량 증가에 따라 액체 식품 생산량 확대에 대응하기 위해 유리 병을 포함한 포장재에 대한 수요가 증가할 것으로 예상되며, 낙농 작업의 효율성이 높아짐에 따라 유제품 업계에서 유리 병과 같은 포장 솔루션에 대한 수요가 증가할 것으로 예상됩니다.

- Consejo Regulador del Tequila에 따르면 2019년 테킬라 생산량은 351.7리터였습니다. 멕시코의 1인당 평균 순수 알코올 소비량은 4.9리터로 남성의 소비량이 여성의 소비량을 앞질렀습니다. 특히 18-29세 연령층이 1인당 7.6리터로 가장 많이 소비하는 것으로 나타났습니다.

- 또한 2023년 10월에는 코카콜라가 멕시코 Jujosdel Valle-Santa Clara 공장에서 유제품 및 주스 생산을 확대하기 위해 1억 3,300만 달러를 투자할 예정으로 유리 포장재 수요를 뒷받침할 것으로 예상됩니다. 생산량 증가에 따라 유제품 및 주스 제품 생산량 확대에 대응하기 위해 유리 병을 포함한 포장재에 대한 수요가 증가할 가능성이 높습니다. 이 투자는 특히 멕시코의 음료 부문의 성장을 의미하며, 이는 유리 포장에 대한 수요를 자극할 수 있습니다.

라틴아메리카의 유리 포장 산업 개요

라틴아메리카의 유리 포장 시장은 단편화되어 있으며, 다음과 같은 소수의 국내 및 해외 기업이 시장을 주도하고 있습니다. Vitro SAB de CV, Fusion y Formas SA de CV, Gerresheimer AG, Owens-Illinois Inc. 및 Verallia Group 등. 시장 점유율을 유지하기 위해 기업들은 지속적으로 혁신과 전략적 파트너십을 체결하고 있습니다.

- 2024년 7월 Vitro Glass Containers는 멕시코 Toluca 공장에 새로운 용광로를 완공하여 향수 및 주류 분야로의 생산능력을 50% 이상 증가시켰습니다. 이 새로운 용광로에 7,000만 달러를 투자하여 매일 230톤을 생산할 수 있게 되었습니다. 이번 업그레이드를 통해 비트로의 트루카 공장은 특히 화장품, 고급 주류 및 특수 품목을 겨냥한 세계 최대의 유리 용기 제조업체로 거듭나게 됩니다. 최첨단 기술로 제작된 이 용광로는 에너지 소비를 최적화하고 CO2 배출량을 크게 줄이는 것을 목표로 하고 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 가정과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 업계의 매력 - Porter's Five Forces 분석

- 신규 참여업체의 위협

- 구매자의 교섭력

- 공급 기업의 교섭력

- 대체품의 위협

- 경쟁 기업 간의 경쟁 강도

- 업계 생태계 분석

제5장 시장 역학

- 시장 성장 촉진요인

- 친환경 제품에 대한 수요 증가

- 식품 및 음료 시장 수요 증가

- 시장 성장 억제요인

- 운영 비용 상승

- 대체 제품(플라스틱) 사용 확대

제6장 시장 세분화

- 제품 유형별

- 보틀

- 바이알

- 앰플

- 자

- 기타 제품 유형

- 최종 이용 산업별

- 음료

- 주류

- 맥주·사이다

- 와인과 증류주

- 기타 주류

- 무알코올

- 탄산음료

- 우유

- 물

- 기타 비주류

- 식품

- 퍼스널케어와 화장품

- 헬스케어와 의약품

- 기타 최종 이용 산업

- 음료

- 국가별

- 브라질

- 멕시코

- 아르헨티나

제7장 경쟁 구도

- 기업 개요

- Corning Incorporated

- Heinz-Glas Gmbh & Co. KgaA

- Verallia Group

- Owens-Illinois Inc.

- Gerresheimer AG

- Fusion and Forms SA de CV

- Vitro SAB de CV

- Saverglass SAS

제8장 투자 분석

제9장 시장 전망

ksm 25.01.16The Latin America Glass Packaging Market size is estimated at USD 6.86 billion in 2025, and is expected to reach USD 8.57 billion by 2030, at a CAGR of 4.56% during the forecast period (2025-2030).

Glass packaging is a trusted choice for consumers prioritizing health, taste, and environmental safety. Glass packaging, valued for its premium nature, preserves product freshness and ensures protection. Additionally, the surging demand for eco-friendly products, coupled with a booming food and beverage market, propels the growth of the glass packaging market.

Key Highlights

- As consumers place a premium on safe and health-conscious packaging, glass packaging is experiencing growth across multiple categories. Furthermore, technological innovations, such as embossing, shaping, and artistic finishes, amplify the appeal of glass packaging for end users.

- Driven by urbanization, shifting consumer preferences, and rising demand for beverages and alcoholic drinks, manufacturers are increasingly turning to glass packaging solutions. The United Nations reports that with 80% of its population residing in cities, Latin America and the Caribbean stand out as the most urbanized regions. Given these dynamics, the market is set for moderate growth in the coming years.

- While glass continues to be the favored packaging material for a range of products, the rising adoption of plastics as a substitute poses a challenge to the market's growth. Moreover, plastic advancements for safer applications further limit the scope of glass as a packaging material.

- In recent years, environmental awareness has surged. Companies and consumers are increasingly mindful of how their choices impact the planet. Concurrently, policymakers are crafting frameworks and making decisions to bolster sustainability efforts. As a result, sustainability has firmly established itself on the global agenda, influencing societal, economic, and policy discussions and subsequently driving the demand for glass packaging.

- The market also faces challenges. Several Latin American nations need help with underdeveloped recycling infrastructures, which complicate the collection and processing of glass waste. Consequently, this often results in glass waste being diverted to landfills or incineration. Glass contends with packaging rivals like plastic, which frequently offer cost advantages and enjoy broader usage.

Latin America Glass Packaging Market Trends

Increasing Demand from the Beverages Segment is Expected to Drive the Market

- In Latin America, beverage launches and sales have risen over the past few years. The increasing demand for glass packaging from alcoholic and non-alcoholic beverages has drawn players to establish their manufacturing units in Brazil.

- The increase in the percentage of adults and young adults in Brazil consuming soft drinks five or more days per week, as reported by Ministerio daSaude, indicates an increasing demand for soft drinks in the country. This rise in consumption is likely to positively impact the demand for glass bottles in the soft drink industry.

- According to the Brazilian Institute of Geography and Statistics, the revenue from the manufacturing of spirits and other beverages in 2019 was USD 902.11 and reached USD 949.32 million in 2023. Therefore, as the consumption of soft drinks increases, there will likely be a corresponding increase in the demand for glass bottles as packaging options to meet consumer preferences and market demand.

- According to Glanbia Nutritionals, in Latin America, there is a rising demand for beverages that boost natural energy. A significant 69% of Mexican consumers express interest in products that sustain their energy throughout the day, underscoring the demand for prolonged vitality.

- Moreover, the ongoing shift toward healthier, clean-label choices is set to shape the functional beverage landscape in Latin America. Key growth areas on the horizon include "protein +" beverages, which encompass protein-infused energy drinks that can integrate a variety of healthy ingredients without sugar or calories. Partnering with a beverage ingredient supplier that is well-versed in beverage innovation and regional nuances is paramount for manufacturers eyeing the Latin American market.

Mexico is Expected to Witness Robust Expansion in the Market

- Rapid technological growth in packaging equipment and changing busy lifestyles in the country are anticipated to drive the market's growth during the forecast period. Mexico attracted foreign glass packaging makers and other companies owing to abundant natural resources, low-cost labor, and increasing consumer expenditure.

- The growing production of cola drinks in Mexico, as reported by the National Institute of Statistics and Geography (INEGI), is driving the demand for glass packaging. In April 2023, the sales volume of cola drinks totaled nearly 1.11 billion liters, marking an increase from the previous month. This surge in sales highlights the need for glass packaging to accommodate the rising production levels in the beverage industry.

- Additionally, integrating small-scale producers into larger cooperatives or companies, like LaLa and Alpura, enhances efficiency and economies of scale. This growth in fluid milk production is expected to support the demand for glass packaging in the dairy segment. With increased production levels, there will be a greater need for packaging materials, including glass bottles, to accommodate the expanded output of fluid milk. According to the FAO and the US Department of Agriculture, as dairy operations become more efficient, the demand for packaging solutions like glass bottles is expected to rise in the dairy industry.

- According to Consejo Regulador del Tequila, the production volume of tequila in 2019 was 351.7 liters. In Mexico, the average per capita consumption of pure alcohol stands at 4.9 liters, with men outpacing women in consumption. Notably, the 18-29 age group leads with a per capita consumption of 7.6 liters.

- Further, in October 2023, Coca-Cola's investment of USD 133 million to expand dairy and juice production at Jugosdel Valle-Santa Clara's plant in Jalisco, Mexico, is expected to support the demand for glass packaging. As production increases, there will likely be a corresponding need for packaging materials, including glass bottles, to accommodate the expanded output of dairy and juice products. This investment signals growth in the beverage sector, particularly in Mexico, which can stimulate demand for glass packaging.

Latin America Glass Packaging Industry Overview

The Latin American glass Packaging Market is fragmented, with few domestic and international players such as Vitro SAB de CV, Fusion y Formas SA de CV, Gerresheimer AG, Owens-Illinois Inc., and Verallia Group. To retain their market share, companies keep on innovating and entering into strategic partnerships.

- July 2024: Vitro Glass Containers completed the anniversary of a new furnace at its Toluca plant in Mexico, boosting its capacity to cater to the perfumery and liquor segments by over 50%. This USD 70 million investment in the new furnace is set to produce 230 tons daily. With this upgrade, Vitro's Toluca facility positions itself among the world's largest producers of glass containers, specifically targeting cosmetic products, premium liquors, and specialty items. The furnace, crafted with cutting-edge technology, aims to optimize energy consumption and significantly reduce CO2 emissions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Ecosystem Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Eco-friendly Products

- 5.1.2 Rising Demand from the Food and Beverage Market

- 5.2 Market Restraints

- 5.2.1 Rising Operational Costs

- 5.2.2 Growing Usage of Substitute Products (Plastic)

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Bottles

- 6.1.2 Vials

- 6.1.3 Ampoules

- 6.1.4 Jars

- 6.1.5 Other Product Type

- 6.2 By End-user Industry

- 6.2.1 Beverages

- 6.2.1.1 Alcoholic**

- 6.2.1.1.1 Beer and Cider

- 6.2.1.1.2 Wine and Spirit

- 6.2.1.1.3 Other Alcoholic Beverages

- 6.2.1.2 Non-Alcoholic**

- 6.2.1.2.1 Carbonated Soft Drinks

- 6.2.1.2.2 Milk

- 6.2.1.2.3 Water

- 6.2.1.2.4 Other Non-Alcoholic Beverages

- 6.2.2 Food

- 6.2.3 Personal Care and Cosmetics

- 6.2.4 Healthcare and Pharmaceutical

- 6.2.5 Other End-user Industries

- 6.2.1 Beverages

- 6.3 By Country

- 6.3.1 Brazil

- 6.3.2 Mexico

- 6.3.3 Argentina

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Corning Incorporated

- 7.1.2 Heinz-Glas Gmbh & Co. KgaA

- 7.1.3 Verallia Group

- 7.1.4 Owens-Illinois Inc.

- 7.1.5 Gerresheimer AG

- 7.1.6 Fusion and Forms SA de CV

- 7.1.7 Vitro SAB de CV

- 7.1.8 Saverglass SAS