|

시장보고서

상품코드

1628792

프랑스의 플라스틱 포장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)France Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

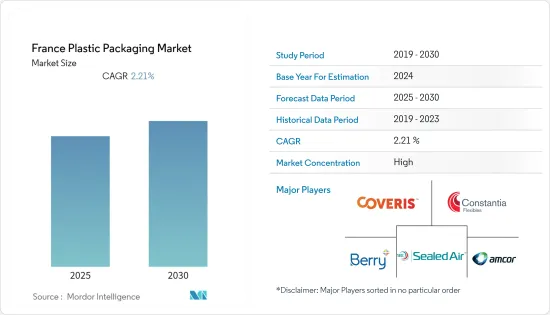

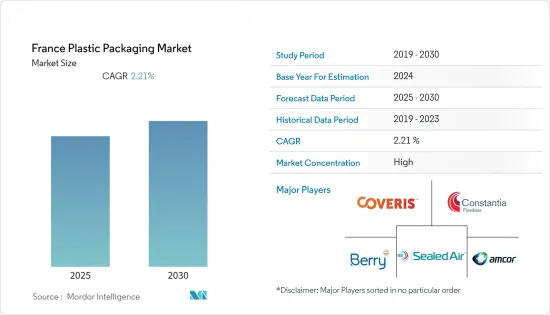

프랑스의 플라스틱 포장 시장은 예측 기간 동안 CAGR 2.21%를 기록할 것으로 예상됩니다.

주요 하이라이트

- 식품 포장에 경질 플라스틱을 사용하는 것은 이동성과 편의성을 추구하는 경향의 증가에 큰 영향을 받고 있습니다. 또한, PET 병의 사용은 이동 중 소비 증가와 부분 제어에 대한 수요 증가로 인해 PET 병의 사용이 증가하고 있습니다. 또한, 뜨거운 음료는 예측 기간 동안 연질 포장재 사용의 주요 견인차 역할을 계속할 것으로 보입니다. 여성 위생 제품에 대한 수요 증가는 예측 기간 동안 연질 포장의 성장을 촉진할 것으로 보입니다.

- 또한 국내 모든 산업에서 경질 플라스틱의 사용을 촉진하는 주요 특성은 저렴한 가격, 강인성, 휴대 성 및 가벼운 무게입니다. 연질 포장의 확대는 또한 저렴한 가격, 다양한 모양과 크기에 대한 적응성, 폐쇄의 용이성으로 인해 촉진되고 있습니다.

- 플라스틱 사용에 대한 국내 규제의 증가는 국내 플라스틱 포장 시장에 영향을 미칠 것으로 예상됩니다. 예를 들어, 2020년 12월 프랑스 의회 하원은 2040년 이후 모든 일회용 플라스틱 제품 및 포장을 금지하고 재사용 및 재활용을 강화하기 위한 일련의 조치를 통과시켰습니다. 여러 환경보호론자들은 2040년이라는 기한과 함께 플라스틱 컵, 접시, 식기, 수저, 빨대 사용을 2021년부터 폐지하는 목표가 당초 계획대로 2020년이 아닌 2021년부터 시행될 수 있도록 더 많은 속도를 내야 한다고 주장했습니다.

- 국내에서는 플라스틱 사용과 금지에 대한 환경이 혼재되어 있습니다. 2021년 10월 11일 환경부는 플라스틱 쓰레기를 줄이기 위해 2022년 1월부터 거의 모든 과일과 채소의 플라스틱 포장을 금지한다고 발표했습니다. 추정에 따르면, 과일과 채소의 37%가 포장된 상태로 판매되고 있으며, 이번 조치로 연간 10억 개 이상의 불필요한 플라스틱 포장재 생산이 중단될 것으로 예상됩니다.

- 또한 다양한 최종사용자 산업과 고객들 사이에서 플라스틱 사용에 대한 우려가 높아지는 것도 플라스틱 사용에 영향을 미치고 있습니다. 예를 들어, 국내 화장품 업체들은 업계의 플라스틱 문제를 해결하기 위해 노력하고 있으며, 이에 따라 대기업을 위한 지속가능한 솔루션을 개발하고 있습니다.

- 또한 최근 프랑스는 대부분의 과일과 채소의 플라스틱 포장을 금지했습니다. 올해 6월 말까지 방울토마토, 강낭콩, 복숭아의 플라스틱 포장이 금지됩니다. 엔다이브, 아스파라거스, 버섯, 특정 샐러드, 허브는 내년 말까지 플라스틱 포장으로 판매되지 않을 것이며, 2026년 6월까지 라즈베리, 딸기 및 기타 섬세한 베리류 판매에 플라스틱이 사용되지 않을 것입니다.

- COVID-19가 발생함에 따라 식음료 회사들은 코로나바이러스의 영향에 대응하기 위해 위험을 줄이고 준비하기 위한 대응책과 실질적인 계획을 수립했습니다. 이러한 계획에는 비즈니스의 모든 측면의 인력으로 구성된 다분야 위기 대응 팀을 구성하여 제시된 위험을 식별, 평가 및 관리하는 것이 포함되었습니다. 또한, 러시아-우크라이나 전쟁은 전체 포장 생태계에 영향을 미쳤습니다.

프랑스의 플라스틱 포장 시장 동향

경량 포장 채택 증가가 시장 성장을 견인할 가능성

- Custom-Pak의 플라스틱에서 대체재(종이 및 판지, 유리, 강철, 알루미늄, 섬유, 고무, 코르크 등)로의 교체가 미치는 영향에 대한 연구에 따르면 대체재는 평균 4.5 배 더 무겁습니다. 대체품은 같은 종류의 포장을 만들기 위해 더 많은 재료 생산량이 필요합니다.

- 산토리는 또한 더 많은 재활용 플라스틱을 조달하기 위해 폴리머를 단량체로 분해하여 음료수 병과 같은 새로운 경질 플라스틱 포장재로 쉽게 재사용할 수 있는 기술을 개발한 프랑스 신생 기업 카르비오스에 투자할 예정입니다. 또한 주요 유럽 시장에서 각국의 보증금 반환 제도 시행을 지원하기 위해 투자할 예정입니다. 또한, 해당 지역에서 플라스틱 포장이 100% 재활용 가능한 것으로 분류될 수 있도록 노력할 것입니다.

- 또한 모든 종류의 플라스틱 중에서 PET를 사용하는 것이 가장 가벼운 병과 용기를 만드는 데 도움이 될 것으로 생각되며, PETRA에 따르면 PET는 투명하고 강하고 가벼운 플라스틱으로 음료 및 식품 포장에 널리 사용되며, 특히 청량음료, 주스 및 물의 포장에 널리 사용됩니다. 널리 사용되고 있습니다. 영국에서 판매되는 탄산음료와 물의 1인용 병과 2리터 병은 거의 모두 PET로 만들어졌습니다.

- 플라스틱은 가볍고 튼튼하기 때문에 유리보다 운송에 더 적합합니다. 플라스틱 병과 용기의 운송은 유리보다 연료 소비가 적기 때문에 에너지 소비가 적고 이산화탄소 배출량이 적습니다.

- 또한 재활용 가능한 경량 플라스틱 포장 제품에 대한 수요 증가도 시장 개척에 기여하고 있습니다. 여러 포장업체들이 다양한 고객층을 확보하기 위해 경량 포장 제품을 도입하는 데 주력하고 있습니다. 예를 들어, 플라스틱 포장 솔루션 회사인 Greiner Packaging은 지난 2월, 3월 8일부터 10일까지 프랑스 렌에서 열리는 CFIA에 참가할 것이라고 발표했습니다. 라이너 패키징의 혁신적인 개발은 골판지와 플라스틱 조합의 재활용 가능성에 혁명을 일으키고 있습니다. 이전에는 폐기물이 올바르게 분리되어 있는지 확인하는 것은 전적으로 소비자의 역할에 의존했습니다. 그러나 K3(R)r100을 사용하면 골판지와 플라스틱 컵이 재활용 시설로 가는 도중에 자동으로 분리됩니다. 이는 재활용에 이상적인 포장 솔루션입니다.

- K3는 얇은 플라스틱 컵과 쉽게 제거할 수 있는 외부 골판지 랩이 결합되어 있습니다. 플라스틱은 식품을 보호하고 유통기한을 연장하며 음식물 쓰레기를 줄이기 때문에 식품에 가장 적합한 포장재입니다. 재활용이 가능할 뿐만 아니라, K3 컵 제조에 사용되는 플라스틱은 rPET와 같은 재활용 재료로 만들어질 수 있으며, K3 컵은 같은 크기의 직접 인쇄된 컵보다 최대 50% 더 많은 플라스틱을 절약할 수 있습니다.

- 또한 유로스타트에 따르면 지난해 프랑스의 플라스틱 포장재 생산량 지수는 99.1을 기록해 전년 대비 1.6 증가했다고 밝혔습니다. 전염병에서 크게 회복된 것은 프랑스에서 플라스틱 포장재에 대한 수요 증가를 나타내며, 경량 포장에 대한 선호도가 높아졌음을 의미합니다.

퍼스널케어는 큰 폭의 성장률 예상

- 이 지역의 사회 인구통계학적 변화는 화장품 및 관련 제품의 천연 성분 수요에 영향을 미칩니다. 이 지역의 고령화는 노화 방지와 같은 활성 특성을 가진 천연 성분에 대한 수요를 증가시키고 있습니다.

- 많은 스킨케어 브랜드가 치열한 경쟁에 직면하고 있으며, 포장 공급업체들은 브랜드에 편의성, 사용 편의성, 고급 기능을 제공하는 디자인 차별화 방법을 제공하고 있습니다. 스킨케어 제품 포장은 다양한 제품 형태와 포뮬러에 대응할 수 있도록 다양한 옵션을 제공하고 있습니다. 예를 들어, 나드 스킨케어는 플라스틱 및 기타 소재의 병, 튜브, 항아리, 스포이트를 사용합니다.

- 일부 브랜드는 다른 업계를 따라 소비자 재생 PET를 사용하여 일회용 플라스틱 소비를 줄이는 것을 선택했습니다. 예를 들어, 아베다는 현재 스킨케어 및 헤어스타일링 PET 병, 항아리, 사탕수수에서 추출한 바이오플라스틱의 85%를 100% 소비자 재생 PET를 사용하고 있습니다.

- 여러 정부 기관은 유럽 내 플라스틱 원료 가격 상승을 주요 원인으로 꼽고 있습니다. 현재 버진 플라스틱의 생산능력은 현재 파이프라인에 있으며, 이는 버진 수지의 가격을 낮추고 재활용 수지의 가격에도 압력을 가할 것으로 보입니다.

- 또한, 프랑스 뷰티 제품 제조업체들이 소셜 미디어를 통한 홍보 활동을 활발히 하는 것도 온라인을 통한 구매를 촉진하고 증가시키는 데에 일조하고 있습니다. 예를 들어, 프랑스 내 퍼스널케어 분야 온라인 쇼핑몰의 지난 1년간 매출 순위를 E-Commerce 연간 순매출액 순으로 정리한 자료가 있습니다. 지난해 프랑스의 퍼스널케어 및 뷰티 제품을 취급하는 다국적 소매업체 세포라(Sephora)는 프랑스에서 퍼스널케어 분야 제품을 판매해 2억 4,540만 달러의 매출을 올렸습니다. 온라인 쇼핑몰 Nocibe.fr은 1억 9,310만 달러의 매출로 2위를 차지했습니다.

- Sephora.fr은 지난해 8월 5억 명 이상의 방문자 수를 기록하며 프랑스 뷰티 및 퍼스널케어 제품 온라인 쇼핑몰 중 가장 높은 트래픽을 기록했으며, 2위는 독일 향수 및 화장품 회사 더글라스의 자회사인 Nocibe.fr로 3억 7천만 명이 방문함. 웹사이트 방문이 있었습니다. 각 브랜드의 제품 판매에는 다양한 플라스틱 포장 제품이 포함되어 있으며, 플라스틱 포장 제품에서 큰 매출을 창출하고 있습니다.

프랑스의 플라스틱 포장 산업 개요

프랑스의 플라스틱 포장 시장은 소수의 기업이 큰 점유율을 차지하고 있기 때문에 통합되어 있습니다. 프랑스 지역에서는 플라스틱 포장에 대한 수요가 크게 증가함에 따라 Amcor plc, Coveris Management GmbH, Berry Global Inc. International GmbH와 같은 주요 기업들이 존재하며 시장은 매우 집중되어 있습니다. 이들은 지속적으로 신제품을 개발하고 있으며, 이는 신규 진입 장벽이 되고 있습니다.

2023년 1월, 프랑스 라 제네테(La Genete)에 위치한 베리(Berry) 공장은 포장재의 재활용 가능성과 재활용 함량에 대한 신뢰할 수 있는 주장에 대한 수요를 충족시키기 위해 RecyClass 인증을 획득했습니다. 베리는 2030년까지 모든 플라스틱을 재활용 및 재사용할 수 있도록 하겠다는 EU의 목표를 달성하기 위해 선형 경제에서 순환 경제로 전환하기 위해 노력하고 있습니다. 이러한 순환 경제 발전을 위한 조치로 인해 모든 분야의 제조업체가 플라스틱 포장 솔루션에서 재활용 및 재생 재료의 사용을 공개하고 이를 증명하는 것이 점점 더 중요해지고 있습니다.

2022년 2월, 코벨리스는 프랑스 몽포콩에 위치한 시설에 투자했습니다. 최근 회사는 장비를 개선하고 산업용 수축 후드 및 스트레치 후드 생산을 늘리기 위해 압출기를 구입했습니다. 이번 투자는 재활용 및 재생 가능한 연포장재에 대한 수요 증가에 대응하기 위한 것입니다. 코벨리스의 5층 공압출 기술 압출기는 재활용 가능한 소재를 포함한 스트레치 후드 및 수축 후드 생산능력을 향상시키는 것을 목표로 합니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 가정과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업 밸류체인 분석

- 업계의 매력 - Porter's Five Forces 분석

- 공급 기업의 교섭력

- 소비자의 협상력

- 신규 참여업체의 위협

- 대체품의 위협

- 경쟁 기업 간의 경쟁 강도

- COVID-19의 시장에 대한 영향 평가

제5장 시장 역학

- 시장 성장 촉진요인

- 경량 포장 방법 채용 증가

- 친환경 포장과 재생 플라스틱 증가

- 시장 과제

- 원자재(플라스틱 수지) 가격 급등

- 정부 규제와 환경 문제

- 러시아·우크라이나 전쟁 시장에 대한 영향

- 세계의 플라스틱 포장 시장 개요

제6장 시장 세분화

- 포장 유형별

- 연질 플라스틱 포장

- 경질 플라스틱 포장

- 제품 유형별

- 보틀과 자

- 트레이·용기

- 파우치

- 백

- 필름·랩

- 기타 제품 유형

- 업계별

- 식품

- 음료

- 헬스케어

- 퍼스널케어와 가정용품

- 기타 최종사용자별

제7장 경쟁 구도

- 기업 개요

- Amcor Plc

- Coveris Management GmbH

- Berry Global Inc.

- Constantia Flexibles International GmbH

- Wipak Group

- Sonoco Products Company

- Sealed Air Corporation

- Tetra Laval International SA

- Silgan Holdings Inc.

- Industrial Packaging Solutions

제8장 투자 분석

제9장 시장 향후 전망

ksm 25.01.20The France Plastic Packaging Market is expected to register a CAGR of 2.21% during the forecast period.

Key Highlights

- The usage of rigid plastics in food packaging continues to be significantly influenced by the rising trend toward mobility and convenience. Additionally, the use of PET bottles is driven by the rise in on-the-go consumption and the demand for portion control. Further, hot beverages would continue to be the primary driver of flexible packaging material utilization during the projection period. Increased demand for feminine hygiene products would drive flexible packaging growth through the forecast period.

- Moreover, the main attributes driving the use of rigid plastics across industries in the country are their affordability, toughness, portability, and low weight. The expansion of flexible packaging is also driven by its affordability, adaptability to various forms and sizes, and simplicity of closing.

- The increasing regulations in the country against the use of plastic are anticipated to affect the market for plastic packaging in the country. For instance, in December 2020, the French Parliament's lower chamber passed a law to ban all single-use plastic products and packaging after 2040 and a raft of measures to ramp up reuse and recycling. Various environmentalists complained that the 2040 deadline, plus targets for ending the use of plastic cups, plates, cutlery, and straws, starting in 2021 instead of 2020, as initially planned, needs to be faster.

- The country has been witnessing a mixed environment for the use and ban of plastic. The environment ministry said on October 11, 2021, that France will ban plastic packaging for nearly all fruit and vegetables from January 2022 to reduce plastic waste. According to estimates, 37% of fruits and vegetables are sold packaged, and it is anticipated that the move will stop more than one billion unnecessary plastic packaging items from being produced annually.

- Further, the growing concerns regarding the use of plastics across various end-user industries and among their customers are affecting the use of plastics. For instance, the cosmetic vendors in the country are keen on tackling the industry's plastic problem; hence, they are developing sustainable solutions for major players.

- Moreover, recently, France banned plastic packaging for most fruits and vegetables. By the end of June this year, plastic packing for cherry tomatoes, green beans, and peaches will be prohibited. Endives, asparagus, mushrooms, certain salads, and herbs will no longer be sold in plastic packaging by the end of next year. By June 2026, plastic will no longer be used to market raspberries, strawberries, and other delicate berries.

- Owing to the COVID-19 outbreak, Food & Beverage companies developed response actions and practical plans to mitigate their risk and prepare to deal with the coronavirus's effects. These plans included establishing an interdisciplinary crisis response team of personnel from all aspects of the business to identify, assess, and manage the risk presented. Further, the Russia-Ukraine war had an impact on the overall packaging ecosystem.

France Plastic Packaging Market Trends

Increase in Adoption of Light-Weight Packaging may Drive the Market Growth

- Custom-Pak's study on the ramifications of replacing plastic with alternatives (such as paper and paperboard, glass, steel, aluminum, textile, rubber, and cork) found that substitutes are, on average, 4.5 times heavier. The alternatives require substantially more material output to create the same type of packaging.

- Suntory is also investing in Carbios, a French startup that developed the technology that breaks down polymers into monomers, making them easy to reuse in new rigid plastics packaging, such as drinks bottles, in order to source more recycled plastics. It will also invest in supporting the implementation of national deposit-return schemes across its key European markets. It will also work to ensure that its plastic packaging is classed as 100% recyclable in the region.

- Moreover, of all the types of plastic, it is believed that using PET will help manufacture the lightest bottle and containers. According to PETRA, PET is a clear, strong, and lightweight plastic that is widely used for packaging food and beverages, especially convenience-sized soft drinks, juices, and water. Virtually all single-serving and 2-liter bottles of carbonated soft drinks and water sold in the United Kingdom are made from PET.

- Plastic is lightweight and tough, making it much more suitable for transportation than glass. Shipping of plastic bottles and containers consumes less fuel than that of glass, expending less energy and leaving a smaller carbon footprint.

- Furthermore, the growing demand for recyclable, lightweight plastic packaging products contributes to the market's development. Several packaging companies are focusing on introducing light packaging products to gain a broad customer base. For instance, Greiner Packaging, a plastic packaging solution company, stated in February of last year that the company would participate in the CFIA in Rennes, France, from March 8-10. An innovative development from Greiner Packaging is revolutionizing the recyclability of cardboard-plastic combinations. Making sure that waste was sorted correctly used to be fully reliant on consumers playing their part. But now with K3(R) r100, the cardboard wrap and theplastic cup separate all by themselves on the way to the recycling facility. This makes the packaging solution ideal for recycling

- K3 combines a thin plastic cup with an easily removed exterior cardboard wrap. Because plastic protects, increases shelf life, and decreases food waste, it remains the best packaging material for food goods. In addition to being recyclable, the plastic used to produce K3 cups may also be made from recycled materials like rPET. The K3 cup can save up to 50% more plastic than a directly printed cup of the same size.

- Moreover, according to Eurostat, last year, the production volume index of the manufacture of plastic packing goods in France was recorded at 99.1, which increased by 1.6 units from the previous year. The significant recovery from the pandemic represents the increased demand for plastic packaging goods in the country, leading to the growing preference for lightweight packaging.

Personal Care is Expected to Witness Significant Growth Rates

- Socio-demographic changes in the region affect the demand for natural ingredients for cosmetics and related products. The region's aging population is increasing the demand for natural ingredients with active properties, such as anti-aging.

- Many skincare brands face increased competition, and the packaging suppliers provide brands with ways to differentiate designs that deliver convenience, ease of use, and advanced capabilities. A broad range of options is available for packaging skin care products to accommodate different product formats and formulations. For example, Nerd Skincare uses bottles, tubes, jars, and droppers in plastic and other materials.

- Some brands choose to reduce their single-use plastic consumption by using post-consumer recycled PET, following the suit of other industries. Aveda, for instance, is now using 100% post-consumer recycled PET in 85% of its skin care and hair styling PET bottles, jars, and bioplastic from sugarcane.

- Multiple government agencies cited that prices of plastic materials in Europe increased, with a significant contributor. With virgin plastics production capacity being in the current pipeline, this would place pressure on virgin resin prices downward and also on recycled resin prices.

- Also, the growing promotional activities of beauty product manufacturer in France through social media has boosted and increased purchasing through online websites. For example, the statistic presents a ranking of the top online stores in France in the personal care segment in the last year, sorted by annual net e-commerce sales. Last year, a significant market shareholding player, Sephora, a French multinational retailer of personal care and beauty products, generated USD 245.4 million via selling products from the personal care segment in France. The online store Nocibe.fr was ranked second with a revenue of USD 193.1 million.

- With more than five million visits in August last year, Sephora.fr garnered the highest traffic to its website among selected French online stores for beauty and personal care products. In second place came Nocibe.fr, a German perfume and cosmetics company Douglas subsidiary, with 3.7 million website visits. The brands' product sales include a wide range of plastic packaging products, generating significant sales from plastic packaging products.

France Plastic Packaging Industry Overview

The France Plastic Packaging Market is consolidated owing to a few players holding significant shares. As the demand for plastic packaging has been increasing significantly in the France region, the market is highly concentrated with the presence of major players like Amcor plc, Coveris Management GmbH, Berry Global Inc., Sealed Air Corporation, and Constantia Flexibles International GmbH, among others. The companies are involved in developing new products consistently, creating a barrier to new entrants.

In January 2023, the Berry factory in La Genete, France, received RecyClass certification to fulfill the demand for credible claims regarding recyclability and recycled content in packaging. The company is working to shift from a linear to a circular economy to meet the EU goal of having all plastic recyclable and reused by 2030. These measures to develop circularity make it more and more critical for manufacturers in all sectors to be open about recycling and using recycled material in their plastic packaging solutions and to prove it.

In February 2022, Coveris invested in its facilities in Montfaucon, France. Recently, the business bought an extruder to improve its equipment and increase the production of shrink and stretch hoods for industrial uses. The investment is meant to satisfy the rising demand for recyclable and recycled flexible packaging materials. The five-layer coextrusion technology extruder from Coveris is intended to boost the plant's capability for producing stretch and shrink hoods, including those made of recyclable materials.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Lightweight Packaging Methods

- 5.1.2 Increased Eco-friendly Packaging and Recycled Plastic

- 5.2 Market Challenges

- 5.2.1 High Price of Raw Material (Plastic Resin)

- 5.2.2 Government Regulations & Environmental Concerns

- 5.3 Impact of Russia-Ukraine War on the Market

- 5.4 Overview of the Global Plastic Packaging Market

6 MARKET SEGMENTATION

- 6.1 By Packaging Type

- 6.1.1 Flexible Plastic Packaging

- 6.1.2 Rigid Plastic Packaging

- 6.2 By Product Type

- 6.2.1 Bottles and Jars

- 6.2.2 Trays and containers

- 6.2.3 Pouches

- 6.2.4 Bags

- 6.2.5 Films & Wraps

- 6.2.6 Other Product Types

- 6.3 By End-User Vertical

- 6.3.1 Food

- 6.3.2 Beverage

- 6.3.3 Healthcare

- 6.3.4 Personal Care and Household

- 6.3.5 Other End-User Verticals

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Plc

- 7.1.2 Coveris Management GmbH

- 7.1.3 Berry Global Inc.

- 7.1.4 Constantia Flexibles International GmbH

- 7.1.5 Wipak Group

- 7.1.6 Sonoco Products Company

- 7.1.7 Sealed Air Corporation

- 7.1.8 Tetra Laval International SA

- 7.1.9 Silgan Holdings Inc.

- 7.1.10 Industrial Packaging Solutions