|

시장보고서

상품코드

1630280

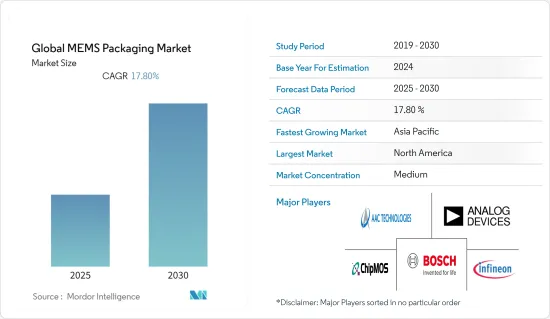

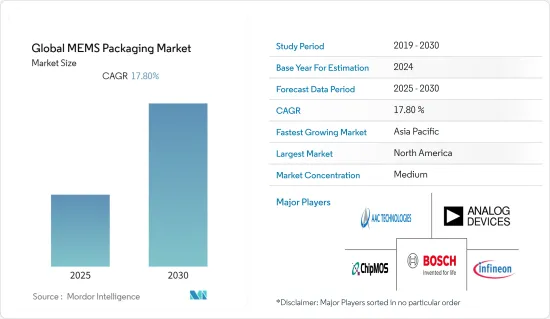

MEMS 패키징 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Global MEMS Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

세계 MEMS 패키징 시장은 예측 기간 동안 17.8%의 CAGR을 기록할 것으로 예상됩니다.

주요 하이라이트

- MEMS 패키징은 MEMS 장치의 용도가 크게 확대됨에 따라 MEMS 장치 패키징에서 MEMS 시스템 패키징으로 발전해 왔습니다. 혁신적이고 효율적인 패키징 기술은 새로운 패키징 재료와 마찬가지로 점점 더 중요해지고 있습니다.

- 최근 CMOS 호환 MEMS 제조 공정의 기술 개발로 인한 저온 웨이퍼 본딩 및 기타 단일 칩 집적은 MEMS 패키징 시장의 기술 혁신을 주도하고 있습니다. 또 다른 새로운 트렌드는 저비용 무연 반도체 패키징에 베어 웨이퍼 스택을 적용하는 것입니다. 이를 통해 대량 생산을 위한 저비용 소형 핀 패키징이 가능해졌습니다.

- MEMS의 채택이 증가하고 있는 것도 임베디드 다이 패키징 시장의 새로운 수요에 기여하고 있습니다. 이 기술은 이 시장에만 국한된 것은 아니지만, 높은 비용과 낮은 수율로 인해 틈새 애플리케이션으로 다양화되고 있지만, 향후 발전 가능성은 무궁무진하며, 블루투스 및 RF 모듈의 발전과 WiFi-6의 등장은 이 기술에 대한 투자를 더욱 가속화할 것으로 예상됩니다.

- MEMS 디바이스의 채택이 확대됨에 따라 MEMS 패키징 업체들은 이러한 디바이스의 효율성과 작동 성능을 향상시키기 위해 혁신적인 패키징 기술을 더욱 발전시키고 있습니다. 예를 들어, 반도체 제조 선도기업인 T-SMART는 2021년 열전대 센서용 이종 통합을 통한 새로운 MEMS 패키징 기술을 개발 중이라고 발표했습니다.

- 또한 IEEE에 따르면 MEMS 패키징은 MEMS 장치의 다양성과 많은 장치가 동시에 환경과 접촉하고 환경으로부터 보호해야 하기 때문에 IC 패키징보다 난이도가 높다고 합니다. 또한, 다이 취급, 다이 장착, 계면 장력, 아웃 가스 등 MEMS 패키징 내에도 문제가 있습니다. 이러한 새로운 MEMS 패키징의 도전과제는 시급한 연구 개발 노력이 필요합니다.

- 칩 산업에서 MEMS의 활용은 COVID-19 팬데믹에 대응하기 위해 전 세계 기술 기업들이 기술 혁신을 가속화하면서 크게 성장하고 있습니다. 초소형 디바이스에 대한 요구는 열화상 및 현장 검사 속도 향상부터 미세유체 기반 중합효소 연쇄 반응(PCR) 도구 및 SARS-CoV-2 검출 기술에 이르기까지 전자공학의 진보를 촉진하고 있습니다. 그러나 팬데믹은 제조업의 세계 공급망에 대한 인식을 변화시켰으며, 보다 지역화된 가치사슬과 지역화를 촉진하고 있습니다.

MEMS 패키징 시장 동향

스마트폰과 커넥티드 디바이스의 보급이 수요를 견인할 것으로 전망

- 스마트폰 사용자 수가 전 세계적으로 크게 증가하고 있습니다. 소비자들은 연결, 결제, 게임, 사진 촬영, GPS 등 스마트폰이 제공하는 다양한 기능에 접근하기 위해 스마트폰으로 전환하고 있습니다. 이러한 기능을 구현하기 위해 스마트폰의 하드웨어에 여러 센서가 내장되어 있기 때문에 스마트폰 사용자 증가는 조사 대상 시장의 성장에 긍정적인 영향을 미칠 것으로 예상됩니다.

- Ericsson Mobility Report에 따르면, 인도 내 스마트폰 가입자는 2020년 8억 1,000만 대에서 2026년 12억 대까지 확대될 것으로 예상됩니다. 농촌 지역이 인터넷 지원 휴대폰 판매를 주도하고 있으며, 인터넷 연결이 더욱 확산됨에 따라 스마트폰 수요는 증가할 것으로 예상됩니다.

- 또한, MEMS 디바이스는 소비자 전자제품 시장에도 혁명을 일으키고 있습니다. 모든 스마트폰과 태블릿에 탑재된 MEMS 마이크와 CMOS 이미지 센서를 결합하여 소비자 전자제품 제조업체들은 기존 기기를 스마트폰으로 쉽게 원격 제어할 수 있는 커넥티드 기기로 바꾸고 있습니다.

- 건강에 대한 인식이 높아지면서, 특히 COVID-19 사태 이후 센서를 사용하여 사용자의 생체 데이터를 추적하는 커넥티드 웨어러블 디바이스 시장을 주도하고 있으며, MEMS 디바이스는 이러한 디바이스에서 필수적인 역할을 하고 있기 때문에 수요 증가는 연구 시장에 긍정적인 영향을 미칠 것으로 예상됩니다. 영향을 미칠 것으로 예상됩니다. 예를 들어, CISCO Systems에 따르면, 2022년까지 전 세계 웨어러블 기기 수는 11억 대에 달할 것으로 예상됩니다.

북미 시장 점유율이 가장 큰 비중을 차지

- 북미는 전통적으로 세계 전자 산업의 주요 주주로, 그 이유는 높은 연구개발 능력, 인텔, 델 등 주요 반도체 및 하이테크 기업의 존재, 전자기기, IoT 및 첨단 자동차 기술의 높은 보급률 등 때문입니다. 예를 들어, 이 지역은 ADAS 지원 차량 및 자율 운송 솔루션 채택의 선구자 중 하나로 간주되며, Deutsche Bank에 따르면 미국의 ADAS 차량 생산량은 2021년까지 1,845만 대에 달할 것으로 예상됩니다.

- 자동차 제조업체들은 자동차에 고유한 기능을 추가하기 위해 MEMS 장치를 점점 더 많이 채택하고 있습니다. 예를 들어, MEMS 기반 LiDAR는 자율주행/무인자동차, 산업용 로봇, 무인항공기(UAV) 등을 대체하고 있으며, 2021년 9월 제너럴모터스(General Motors)는 2023년 생산을 위한 MEME 기반 LiDAR 공급업체로 Cepton을 선정했습니다. 제너럴모터스는 Cepton LiDAR를 사용하여 자동 긴급제동, 보행자 감지 등 ADAS 기능을 강화하고 향후 울트라 크루즈 시스템을 구현할 예정입니다.

- 각 업체들은 최신 센서 혁신에 주력하고 있으며, 혁신적인 제품으로 인정받고 있습니다. 예를 들어, 2022년 4월 북미 및 세계 반도체 조립 및 테스트 서비스 제공업체인 Unisem은 MEMS and SENSORS Technical Congress(MSTC)에서 MEMS Cavity Packages라는 프리젠테이션을 통해 Packaging Process Showdown을 수상하였습니다.

- 세계 칩 부족으로 인해 최근 지역 반도체 산업이 활성화되면서 북미 지역 정부는 반도체 및 관련 산업에 대한 투자를 늘릴 수밖에 없었습니다. 예를 들어, 캐나다 정부는 2022년 초에 2억 4,000만 달러를 투자하여 현지 연구자 및 기업과 협력하여 캐나다의 반도체 산업에서의 입지를 더욱 강화할 것을 약속했습니다. 이러한 사례는 조사 대상 시장의 성장에 유리한 시장 시나리오를 만들어 낼 것으로 예상됩니다.

- 또한, 스마트폰 및 소비자 전자제품은 MEMS 디바이스 수요를 주도하는 주요 산업 중 하나이며, 이는 이 지역의 패키징 서비스 수요에 긍정적인 영향을 미치고 있습니다. 예를 들어, 미국 소비자기술협회(CTA)에 따르면 2021년 미국 5G 스마트폰 출하량은 1억 6천만 대에 달할 것으로 예상됩니다.

MEMS 패키징 산업 개요

MEMS 패키징 시장은 경쟁이 치열합니다. 이 산업은 자본 집약적이기 때문에 시장의 주요 업체들은 다양한 제품 포트폴리오와 제품 개발로 우위를 점하고 있습니다. 벤더의 기술 혁신 능력은 R&D 투자에 크게 의존하고 있습니다. 또한, 자본 집약적인 산업 특성상 신규 진입자에게는 진입장벽이 되고 있습니다. ChipMos Technologies Inc., AAC Technologies, Bosch Sensortec GmbH, Infineon Technologies AG, Analog Devices, Inc. 등이 이 시장에서 활동하는 주요 업체로는 ChipMos Technologies Inc.

- 2022년 8월 - MEMS 기술 솔루션 제공 업체인 MEMSIC는 최초의 MEMS 6축 관성 센서(IMU) MIC6100HG를 출시했습니다. 이 제품은 3축 가속도계와 3축 자이로스코프를 통합하여 스마트 리모컨, 게임 컨트롤러 등 고감도 센싱을 통한 모션 감지 인터랙티브 시스템을 지원할 수 있습니다. 또한, MIC6100HG 6축 IMU 센서는 대용량 FIFO를 탑재하고 I2C/I3C/SPI 통신 모드를 지원하며, LGA 패키징 크기는 2.5x3x0.83mm, 데이터 출력 주파수는 2,200Hz입니다.

- 2022년 2월 - STMicroelectronics는 3세대 MEMS 센서를 발표했습니다. 이 새로운 센서는 스마트 산업, 소비자 모바일, 의료 및 소매 부문을 위해 성능과 기능을 한 단계 더 발전시킬 수 있도록 설계되었다고 회사 측은 밝혔습니다. 새롭게 출시된 LPS22DF 및 방수 LPS28DFW 기압 센서는 1.7μA에서 작동하고 절대 압력 정확도가 0.5hPa이며, 가장 작은 크기(2.0 x 2.0 x 0.74mm)를 자랑합니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 소개

- 조사 가정과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업의 매력 - Porter's Five Forces 분석

- 공급 기업의 교섭력

- 구매자의 교섭력

- 신규 참여업체의 위협

- 대체품의 위협

- 경쟁 기업 간의 경쟁 관계

- 기술 현황

- COVID-19의 시장에 대한 영향 평가

제5장 시장 역학

- 시장 성장 촉진요인

- 성장하는 스마트 자동차 시장

- 스마트폰 보급률과 커넥티드 디바이스 증가

- 산업의 센서 이용

- 시장 성장 억제요인

- 복잡한 제조 공정

제6장 시장 세분화

- 센서 유형별

- 관성 센서

- 광학 센서

- 환경 센서

- 초음파 센서

- RF MEMS

- 기타

- 최종사용자별

- 자동차

- 휴대폰

- 가전제품

- 의료 시스템

- 산업용

- 기타

- 지역별

- 북미

- 유럽

- 아시아태평양

- 기타

제7장 경쟁 구도

- 기업 개요

- ChipMos Technologies Inc.

- AAC Technologies Holdings Inc.

- Bosch Sensortec GmbH

- Infineon Technologies AG

- Analog Devices, Inc.

- Texas Instruments Incorporated.

- Taiwan Semiconductor Manufacturing Company Limited

- MEMSCAP S.A.

- Orbotech Ltd.

- TDK Corporation

- MEMSIC Semiconductor Co., Ltd

- STMicroelectronics

제8장 투자 분석

제9장 시장 향후 전망

ksm 25.01.23The Global MEMS Packaging Market is expected to register a CAGR of 17.8% during the forecast period.

Key Highlights

- MEMS packaging has evolved from packaging MEMS devices to packaging MEMS systems as the application of MEMS devices has expanded significantly. Innovative and efficient packaging technology is becoming increasingly important, as are new packaging materials.

- The recent technological development of CMOS-compatible MEMS manufacturing processes for low-temperature wafer bonding and other single-chip integration are among the driving innovations in the MEMS packaging market. Another emerging trend is the application of bare wafer stacks for low-cost lead-free semiconductor packages. This enables a low-cost, small-pin package for high-volume production.

- The increasing adoption of MEMS is also contributing to new demand in the embedded die packaging market. The technology is not unique to the market, but its high cost and low yields have diversified it into niche applications, but the potential for future development is immense. Advancements in Bluetooth and RF modules and the rise of WiFi-6 will likely accelerate investment in this technology further.

- The growing adoption of MEMS devices is also encouraging the MEMS packaging vendors to develop innovative packaging techniques further to enhance these devices' efficiency and operational performances. For instance, in 2021, T-SMART, a leading semiconductor manufacturing company, announced that it is working towards a new MEMS packaging technology based on Heterogeneous Integration for the thermopile sensor.

- Furthermore, according to IEEE, MEMS packaging is more challenging than IC packaging due to the diversity of MEMS devices and the need for many devices to be in contact with and protected from the environment simultaneously. In addition, there are also challenges within MEMS packaging, such as die handling, die attachment, interfacial tension, and outgassing. These new MEMS packaging challenges require urgent R&D efforts.

- The usage of MEMS in the chip industry has witnessed immense growth as technology companies around the world accelerated innovation in the fight against the COVID-19 pandemic. The need for tiny devices drives advances in electronics, ranging from thermal imaging and faster point-of-care testing to microfluidics-based polymerase chain reaction (PCR) tools and techniques to detect SARS-CoV-2. However, the pandemic has changed the perception of the global supply chain in manufacturing, where more localized value chains and regionalization have come into the picture.

MEMS Packaging Market Trends

Growing Adoption of Smartphones and Connected Devices is Expected to Drive the Demand

- The number of smartphone users is rising enormously worldwide. Consumers are switching to smartphones to access various functionality they offer, including connectivity, payment, gaming, photography, and GPS. As multiple sensors are integrated into the smartphone's hardware to enable such functionality, the growing number of smartphone users is expected to positively impact the studied market growth.

- According to Ericsson Mobility Report, smartphone subscription in India is expected to grow from 810 million in 2020 to 1.2 billion in 2026. With rural areas driving the sale of internet-enabled phones, demand for smartphones is expected to increase as Internet connectivity spreads further.

- Moreover, MEMS devices are also revolutionizing the consumer electronics market. Combining the MEMS microphones and CMOS image sensors found in all smartphones and tablets, the consumer electronic device manufacturing companies are turning the traditional devices into connected ones that can easily be remotely controlled through smartphones.

- The increasing health consciousness, especially after the outbreak of COVID-19, drives the market for connected wearable devices that use sensors to track users' biological data. As MEMS devices play an integral role in these devices, the increasing demand is expected to impact the studied market positively. For instance, according to CISCO Systems, the total number of wearable devices is expected to reach 1.1 billion globally by 2022.

North America to Hold Significant Market Share

- The North American region traditionally has been a major shareholder of the global electronics industry owing to factors such as higher R&D capabilities, the presence of some of the biggest semiconductor and tech companies such as Intel, Dell, etc., along with higher penetration of electronic devices, IoT, and advanced automotive technologies. For instance, the region is considered one of the pioneers in adopting ADAS-enabled vehicles and autonomous transportation solutions. According to Deutsche Bank, ADAS vehicle production in the US is expected to grow to 18.45 million by 2021.

- Automotive companies are increasingly adopting MEMS devices to add unique functionality to their vehicles. For instance, MEMS-based LiDARs were an alternative to autonomous/driverless cars, industrial robots, UAVs, etc.; in September 2021, General Motors selected Cepton for the supply of MEME-based LiDAR for 2023 production. General Motor is expected to use the Cepton LiDAR to enhance ADAS capabilities for automatic emergency braking and pedestrian detection and to enable its upcoming Ultra Cruise system.

- Companies are also focused on innovating the latest sensors and are receiving recognition for their innovative products. For instance, in April 2022, Unisem, a North American and global semiconductor assembly and test services provider, won the Packaging Process Showdown at MEMS and SENSORS Technical Congress (MSTC) for its presentation, MEMS Cavity Packages.

- The recent push to the local semiconductor industry amid the global chip shortage has forced the governments in the North American region to increase their investment in the semiconductor and related industries. For instance, through a USD 240 million investment in early 2022, the government Canadian government has committed to work with local researchers and companies to strengthen Canada's position in the industryfurther. Such instances are expected to create a favorable market scenario for the growth of the studied market.

- Furthermore, the smartphone and consumer electronics also are among the leading industries driving the demand for MEMS devices which n turn is positively impacting the demand for packaging services in the region. For instance, according to the Consumer Technology Association (CTA), the 5G smartphone shipments in the United States was expected to reach 106 million in 2021.

MEMS Packaging Industry Overview

The MEMS packaging market is moderately competitive. As the industry is capital intensive, major vendors in the market are banking on diverse product portfolios and product development to gain an edge. The innovation capabilities of the vendors are highly dependent on their R&D investments. Additionally, the industry's capital-intensive nature poses an entry barrier to new entrants. Some key players operating in the market are ChipMos Technologies Inc., AAC Technologies, Bosch Sensortec GmbH, Infineon Technologies AG, and Analog Devices, Inc., among others.

- August 2022 - MEMSIC, a leading MEMS technology solution provider, releases the first MEMS 6-axis inertial sensor (IMU) MIC6100HG. The product integrates a 3-axis accelerometer and a 3-axis gyroscope, which can support motion-sensing interactive systems such as smart remote controls and game controllers with sensitive sensing. Additionally, the MIC6100HG 6-axis IMU sensor has a large FIFO and supports I2C/I3C/SPI communication mode. The LGA package size is 2.5x3x0.83mm, and the data output frequency is 2200Hz.

- February 2022 - STMicroelectronics introduced its third generation of MEMS sensors. According to the company, the new sensors are designed to enable the next leap in performance and features for smart industries, consumer mobiles, healthcare, and retail sectors. The newly launched LPS22DF and waterproof LPS28DFW barometric pressure sensors, which operate from 1.7µA and have absolute pressure accuracy of 0.5hPa and are packed in one of the smallest footprints (2.0 x 2.0 x 0.74mm).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Smart Automotive Market

- 5.1.2 Increasing Smart Phone Adoption Rate & Connected Devices

- 5.1.3 Sensor Usage in Industries

- 5.2 Market Restraints

- 5.2.1 Complex Manufacturing Process

6 MARKET SEGMENTATION

- 6.1 By Sensor Type

- 6.1.1 Inertial Sensors

- 6.1.2 Optical Sensors

- 6.1.3 Environmental Sensors

- 6.1.4 Ultrasonic Sensors

- 6.1.5 RF MEMS

- 6.1.6 Others

- 6.2 By End User

- 6.2.1 Automotive

- 6.2.2 Mobile Phones

- 6.2.3 Consumer Electronics

- 6.2.4 Medical Systems

- 6.2.5 Industrial

- 6.2.6 Others

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ChipMos Technologies Inc.

- 7.1.2 AAC Technologies Holdings Inc.

- 7.1.3 Bosch Sensortec GmbH

- 7.1.4 Infineon Technologies AG

- 7.1.5 Analog Devices, Inc.

- 7.1.6 Texas Instruments Incorporated.

- 7.1.7 Taiwan Semiconductor Manufacturing Company Limited

- 7.1.8 MEMSCAP S.A.

- 7.1.9 Orbotech Ltd.

- 7.1.10 TDK Corporation

- 7.1.11 MEMSIC Semiconductor Co., Ltd

- 7.1.12 STMicroelectronics